Trump Sues Justice Department for $230 Million, Says He Has Final Say

Trump and his past lawyers are in positions that could approve the payout. The situation is unprecedented.

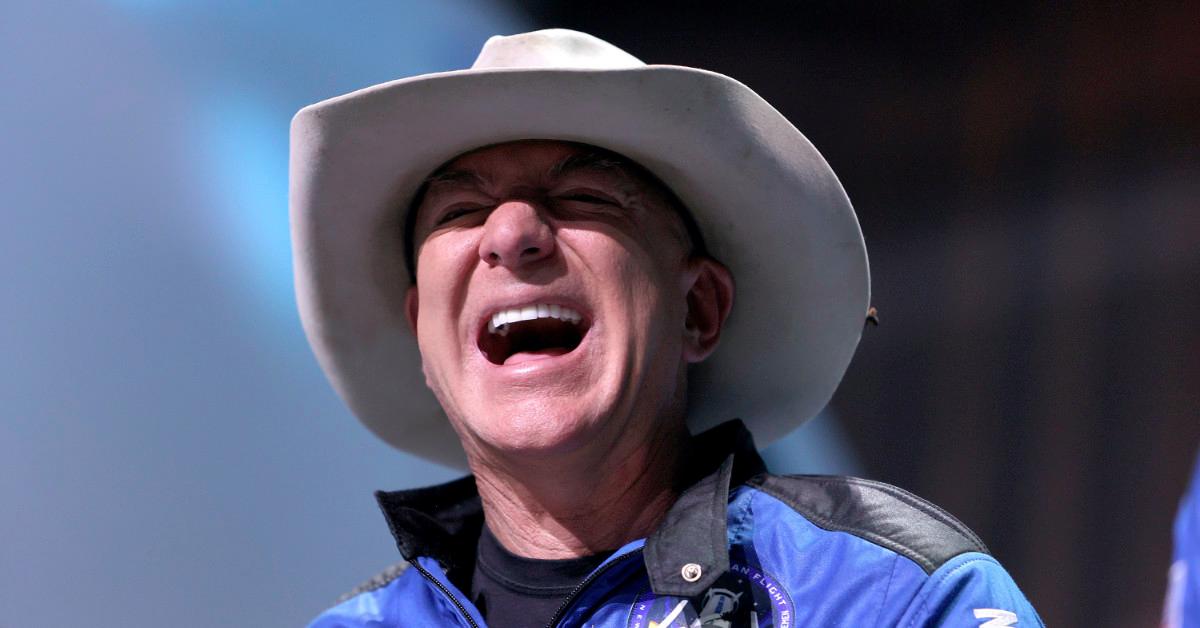

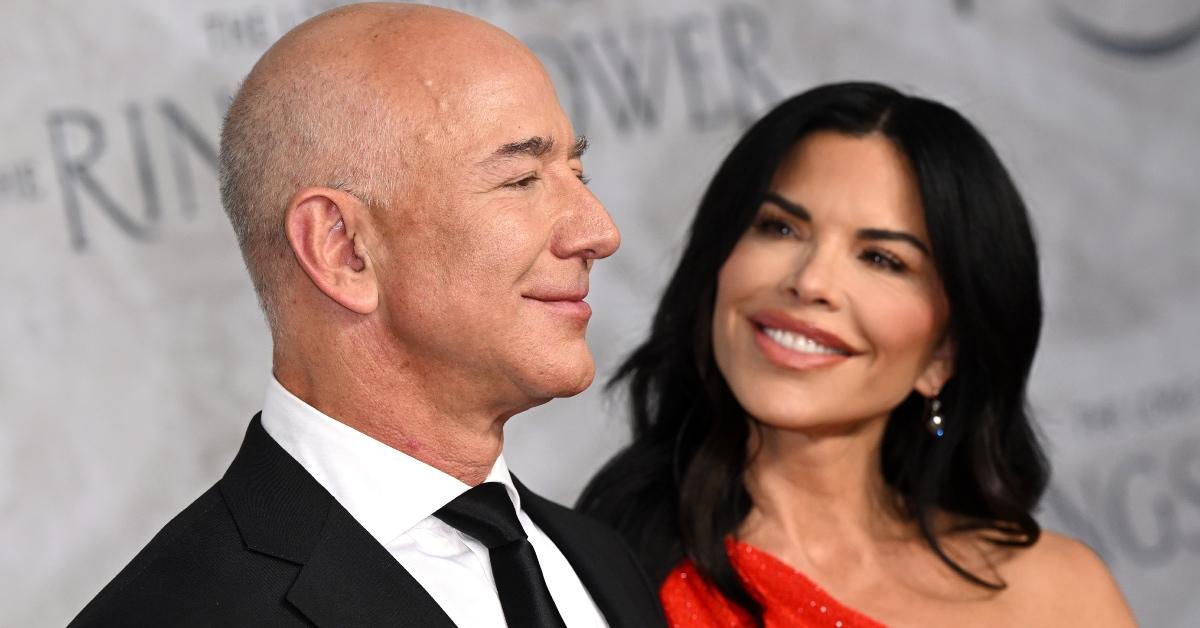

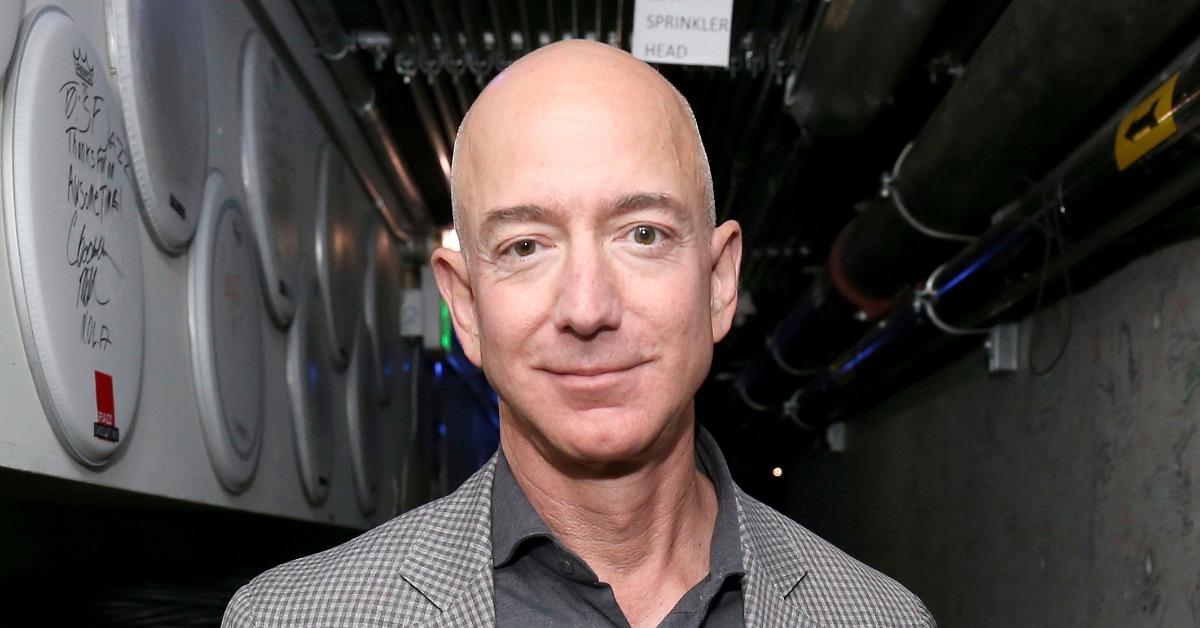

News and in-depth articles about billionaires like Elon Musk, Warren Buffett, Jeff Bezos, and more.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.