Anuradha Garg

Anuradha Garg has worked at Market Realist since 2014, and her equity research experience spans more than 11 years. She has an MBA in finance from a premier Indian college. Prior to joining Market Realist, she worked with HSBC for three years, where she used to cover UK business services companies and African cement, sugar, and telecom companies. She has also worked with Fidelity Investments as a buy-side analyst handling diverse sectors of Australian mining & mining services, Australian REITs, and China discretionary consumer space.

At Market Realist, her research focus has spanned various sectors. She started with basic materials, particularly precious metals and iron ore. She also covered hedge fund managers’ holdings. Her current research focus is on US auto stocks, including electric vehicle companies and ride-sharing firms.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Anuradha Garg

Will Workhorse Stock’s Winning Streak Continue?

Lately, Workhorse (NASDAQ:WKHS) stock has been on an unprecedented winning streak. The stock rose for 11 consecutive days as of July 2.

Are NIO and Tesla Defying the Downtrend in China’s NEV Market?

NIO and Tesla seem to be defying the overall downtrend in the Chinese NEV market with their rising sales in June. They have been gained ground in China.

Can Focusing on Quality Place NIO above Tesla in China?

Tesla is going all out to increase its market share in China. However, to win there, Tesla has to compete with the likes of NIO.

NIO’s Battery Swap Technology Might Be a Game-Changer

To flourish, any business needs to have an edge or a unique proposition. NIO (NYSE:NIO) might have an edge in battery swap technology.

Baillie Gifford Thinks NIO Stock Could Be Worth More

One of Baillie Gifford’s big bets among EVs is on NIO (NYSE:NIO) stock. Baillie Gifford is also one of the largest Tesla (NASDAQ:TSLA) investors.

Goldman Sachs and Morgan Stanley Downgrade Tesla Stock

Tesla’s stock price has been on a brilliant run lately. Tesla has gained 123% year-to-date. On June 10, the stock close above the $1,000 per share level.

Goldman Sachs and Gundlach See Upside in Gold Prices

Gundlach is bullish on gold. He expects the metal to reach new highs. His bullishness for gold also stems from his bearishness for the US dollar.

Record High Tesla Price: More Upside on China Growth Story?

Tesla (NASDAQ:TSLA) sold 11,095 Model 3 cars in China in May, as reported by Reuters. The company sold about a third of the cars in April or 3,635 vehicles.

Musk Might Consider Another Stock Offering for Tesla

Tesla raised over $2 billion through equity issuance in February. On February 13, Tesla stock closed with gains after it announced the capital raise.

Ford Mustang Mach-E to Get Tesla-Like OTAs

Ford announced that it will provide OTA updates for the Mustang Mach-E. The updates will be similar to the OTA that Tesla pioneered for its vehicles.

Gold Prices: Undervaluation, Smart Money Piles Up

Since March, gold prices are on a tear due to uncertainty surrounding COVID-19. The SPDR Gold Shares has seen gains of 16.2% since March 18.

Why Is David Einhorn Skeptical about Tesla’s Financials?

David Einhorn has locked horns again with Elon Musk. He asked several questions related to the company’s first-quarter financials.

Can Tesla Create a New Market with the Cybertruck?

Tesla’s (TSLA) electric pickup truck, also known as the Cybertruck, has been one of the most polarizing vehicles recently unveiled.

Forget Tesla Pre-Orders, the Ford Mach-E Has Sold Out

Ford unveiled its first all-electric SUV, the Mustang Mach-E, last month. The unveiling marks another step toward ramping up in the electric vehicle space.

US Pickup Trucks: Competition Will only Intensify

Pickup trucks and SUVs have maintained the allure of the US auto sector while the sector is sluggish. Consumers are dumping sedans for pickup trucks

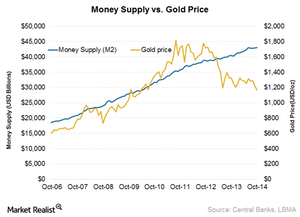

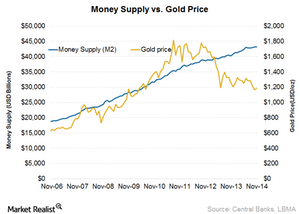

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.

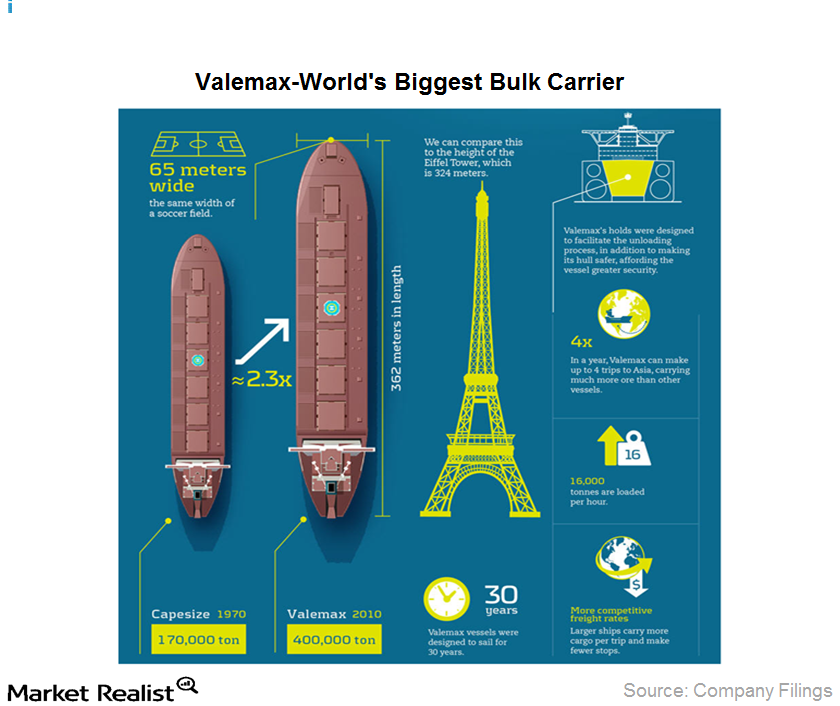

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

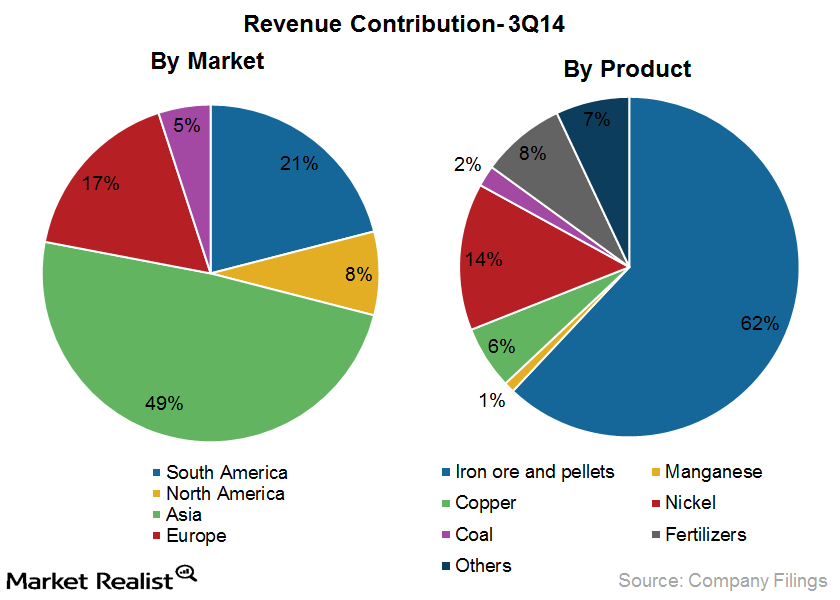

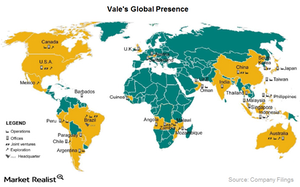

Vale SA: Overview of the world’s largest iron ore company

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

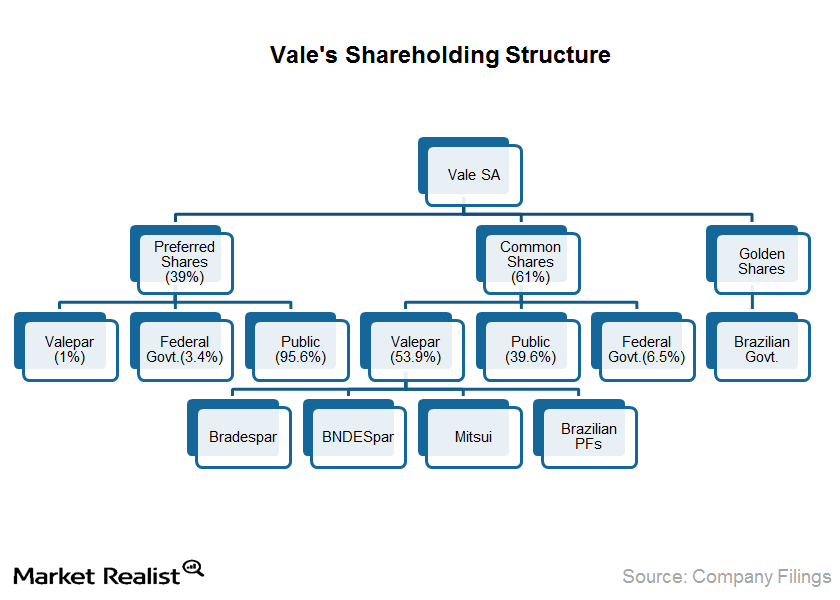

The implications of the Vale SA ownership structure

Although there hasn’t been any recent cause for concern, and the government doesn’t interfere in the day-to-day workings of Vale, there’s always a risk that the company could be pushed into pursuing objectives that aren’t in the best interests of all shareholders.

Vale SA: Top-quality iron ore and pellets

Vale SA (VALE) is the world’s largest producer of iron ore and pellets. Pellets are manufactured by gathering together the powder generated during the ore extraction process.

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

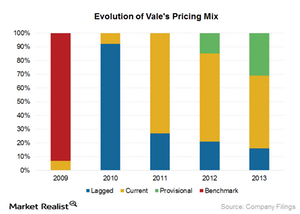

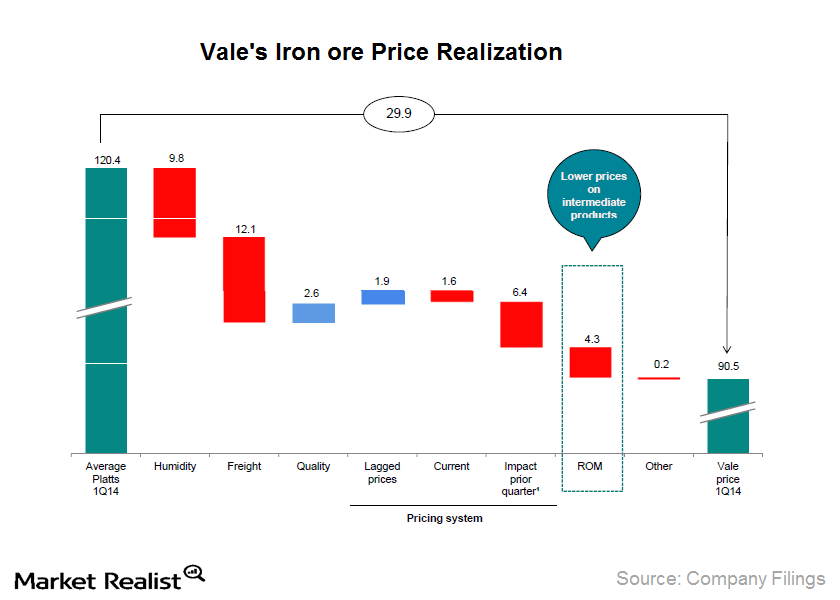

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

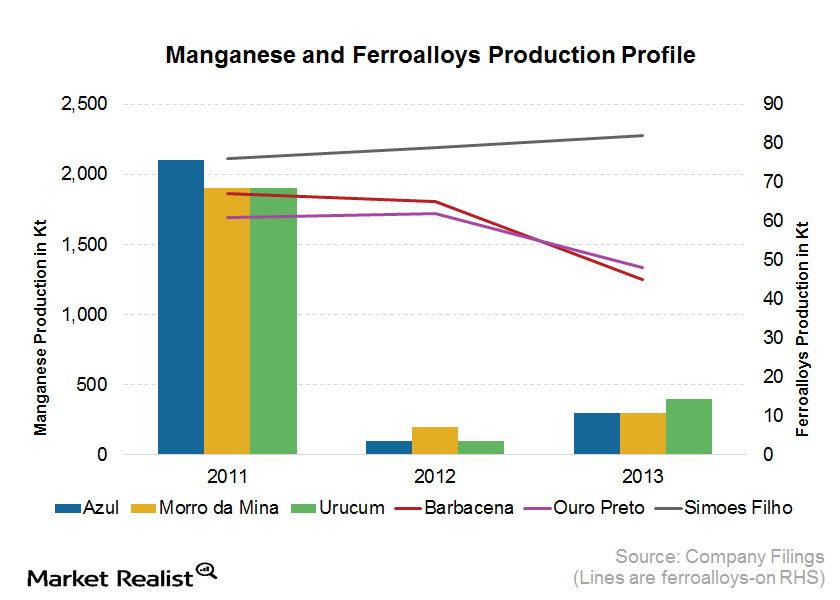

Vale SA in the manganese and ferroalloys business

Vale SA is the largest manganese producer in Brazil, accounting for roughly 70% of the country’s market. The Azul Mine in Para is responsible for 80% of its output.Materials Key gold indicators that you should keep an eye on

You should analyze these gold indicators together since many of them are interrelated. They show the direction of gold prices and gold-backed ETFs.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.Materials Key things to look out for when you invest in junior gold stocks

The junior mining space is very risky, given very limited options in terms of mines and their involvement in early stages. So it’s very important to identify the right junior stock.

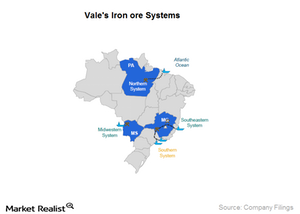

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.

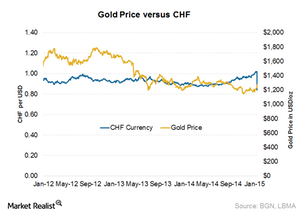

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

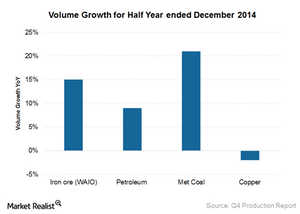

BHP reports mixed production results and maintains its guidance

Overall, BHP reported mixed 2Q15 results. It recorded a 9% production increase during the December 2014 half-year.

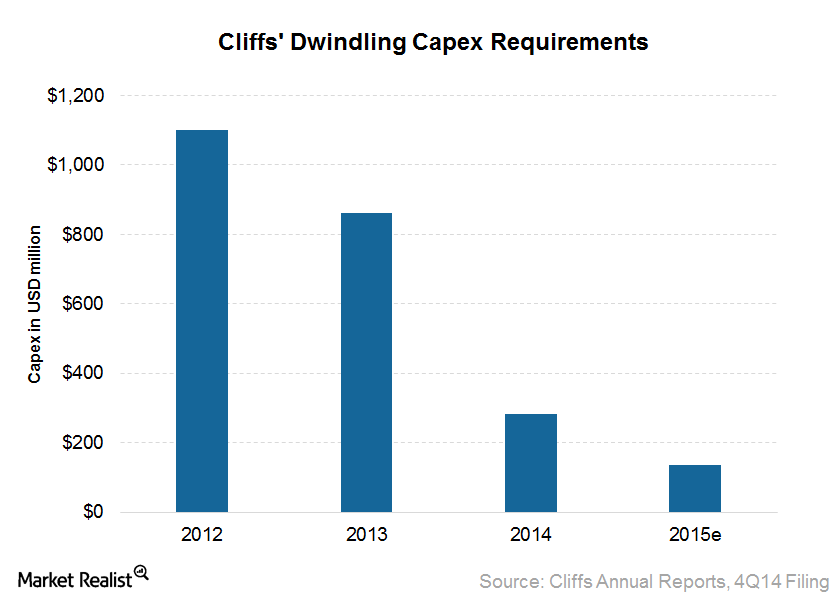

Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.

Global money supply and its link to gold

The gold price increase kept pace with the global money supply until recently. The relationship between the two appears to have broken.

Why Tesla Chose Germany for Its European Gigafactory

In its Q3 results, Tesla said it would announce the location of its European Gigafactory before the end of this year. It fulfilled that promise yesterday.

Can Tesla and Musk Pull Off an Electric Pickup Truck?

Yesterday in a tweet, Elon Musk announced the unveiling of Tesla’s electric pickup truck. But will he keep his promise this time?

Tesla’s Marketing Plan Aims to Lead China’s EV Market

Tesla plans to double the number of repair and maintenance shops in China. It also plans to add about 100 charging stations in China.

NIO Rose Due to Self-Driving Collaboration with Mobileye

NIO plans to enter the self-driving market. A partnership with Intel’s Mobileye boosted the stock by more than 25% today.

Will Uber Face an Extended Sell-Off on a Bad Q3?

Uber is scheduled to report its third-quarter earnings results on November 4 after the market closes. Analysts expect it to report $3.7 billion in revenue.

Tesla’s Real Competition: Automakers or Mega-Tech?

Tesla (TSLA) stock has been polarizing like no other. Analysts and investors have very strong views about the stock on either side.

Ford and GM Split Over Siding with Trump

Automakers have effectively split in their support of a particular set of emission regulations, pitting large automakers Ford and GM against one another.

Could Ford’s Electric SUV Take On the Tesla Model Y?

Ford is set to unveil its “Mustang-inspired” crossover SUV, the Mach-E, on November 17. The company is positioning it against the Tesla Model Y.

Ford’s Q3 Earnings: Updates for Investors to Watch

Ford (F) is scheduled to report its third-quarter results on Wednesday after the market close. The stock has increased 21.4% year-to-date.

China’s Auto Market Slowdown Deepens—Ford, GM Reel

China, the world’s largest auto market, is faltering like never before. September was the 15th month of annual car sales decline for the company.

China’s De-Dollarization amid Trade War: Gold’s Upside?

China continued buying gold for the tenth consecutive month in September. The country also continued its de-dollarization bid.

Is Tesla Giving ICE Makers a Run for Their Money?

Tesla (TSLA) changed the EV (electric vehicle) game in the US. Ford (F) and General Motors (GM) ventured into EVs as a way to cut emissions.

Tesla: Are Analysts’ Demand Concerns Justified?

Tesla’s Q3 deliveries came in at 97,000 on Wednesday, beating its record of 95,200 in Q2. Its stock fell 5% in after-hours trading after this report.

How Tesla Plans to Lead in the EV Race in China

Citing Piper Jaffray, CNBC reported on September 26 that Tesla’s China deliveries were up more than 175% year-over-year in the third quarter.

Tesla V10: Do Other Cars Feel Like ‘Owning a Horse?’

On September 26, Tesla (TSLA) rolled out its version 10 software update—its biggest software update ever—which customers were eagerly awaiting.

Can Tesla Boost Its Financials by Learning from Amazon?

Elon Musk seems serious about addressing Tesla’s (TSLA) logistics issues, and is considering taking inspiration from Amazon’s (AMZN) delivery model.

Rivian: Is Amazon’s Order Bad News for Tesla?

Amazon placed a bulk order for 100,000 electric delivery vans from Rivian. Amazon plans to phase out its current diesel vehicles in a systematic manner.

MS: Model Y, Pickup Truck to Drive Tesla’s Market Share

Yesterday, Morgan Stanley analyst Adam Jonas provided his thoughts on Tesla while maintaining his rating and target price on its stock.

Gundlach Discussed the Fed, Trade Deal, and Gold

Gundlach thinks that we’ve already seen a bottom in interest rates for 2019. US Treasury yields have been hitting lows in 2019.