Anuradha Garg

Anuradha Garg has worked at Market Realist since 2014, and her equity research experience spans more than 11 years. She has an MBA in finance from a premier Indian college. Prior to joining Market Realist, she worked with HSBC for three years, where she used to cover UK business services companies and African cement, sugar, and telecom companies. She has also worked with Fidelity Investments as a buy-side analyst handling diverse sectors of Australian mining & mining services, Australian REITs, and China discretionary consumer space.

At Market Realist, her research focus has spanned various sectors. She started with basic materials, particularly precious metals and iron ore. She also covered hedge fund managers’ holdings. Her current research focus is on US auto stocks, including electric vehicle companies and ride-sharing firms.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Anuradha Garg

Alex Karp Really Does Work Out of a New Hampshire Barn

Alex Karp works out of his New Hampshire barn even though his company based out of Palo Alto, Calf. Why did he choose this setup?

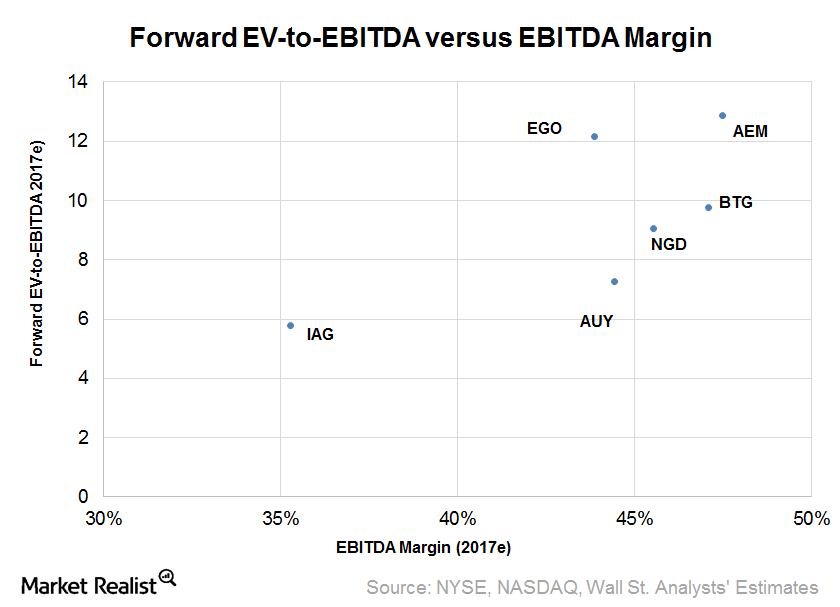

What Could Drive IAMGOLD Corp.’s Valuation Going Forward?

IAG stock could continue to gain traction due to its high operational leverage, at least as long as the upward trend in gold prices continues.

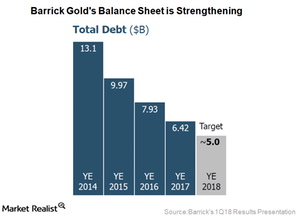

Barrick Gold Won’t Sell More Assets to Reduce Debt

Investors have been punishing Barrick Gold (ABX) and other gold miners for a long time due to their high debt.

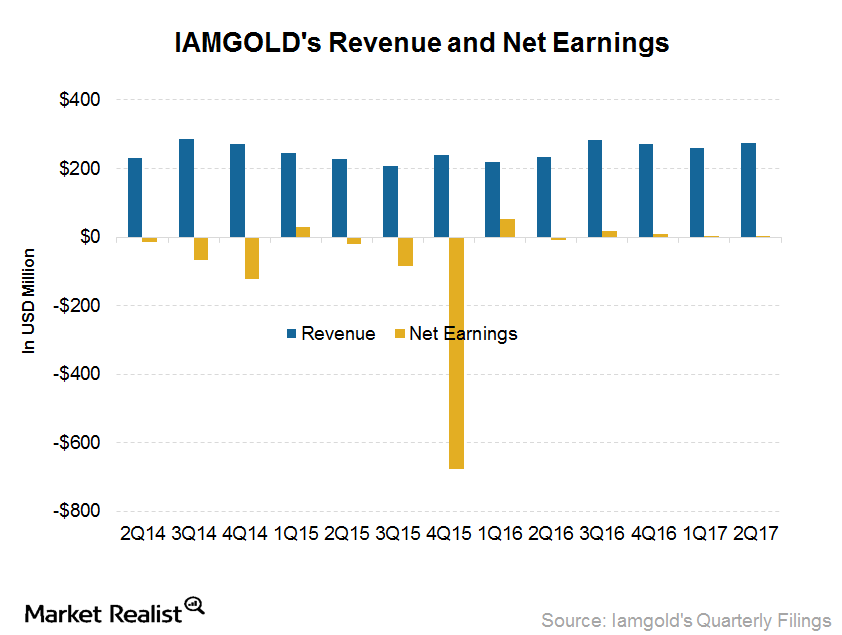

Understanding IAMGOLD’s 2Q17 Earnings Highlights

IAMGOLD’s (IAG) 2Q17 production was 223,000 ounces of gold—growth of 26,000 ounces or 13% year-over-year (or YoY).

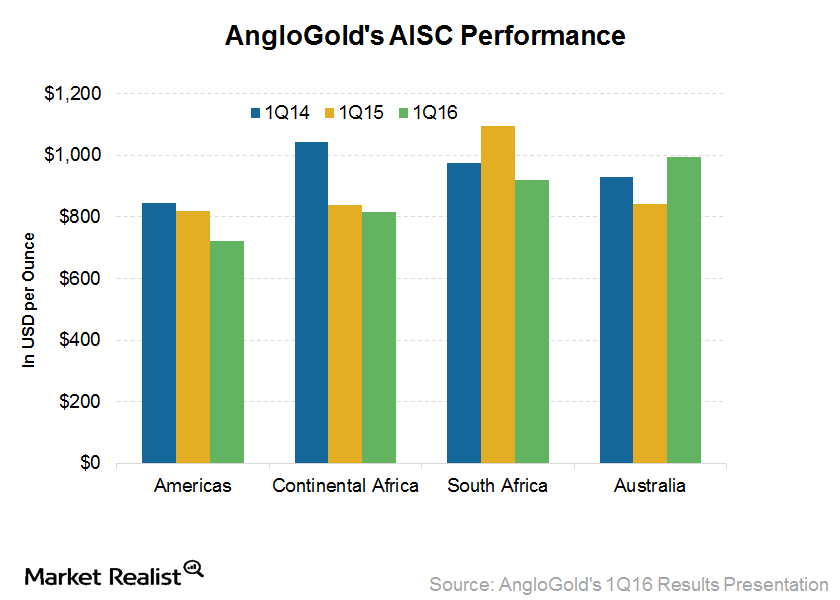

How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

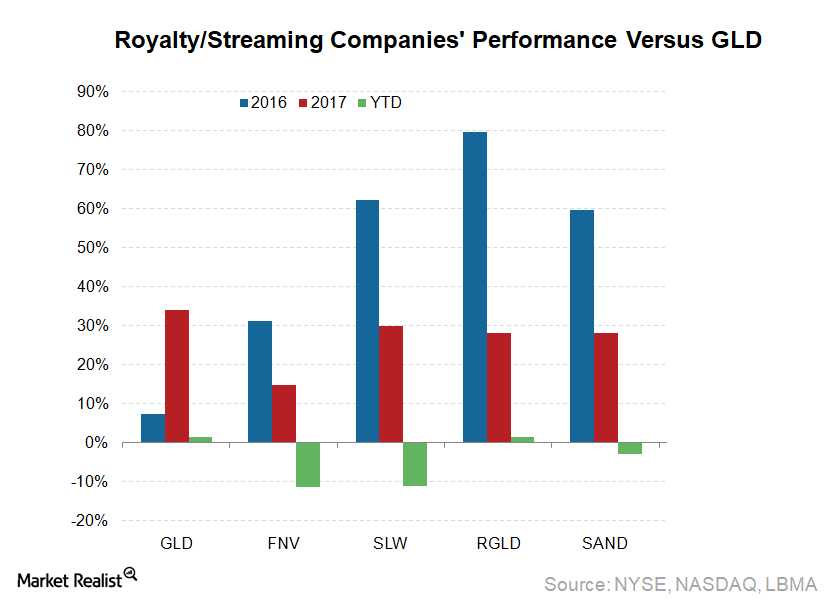

Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

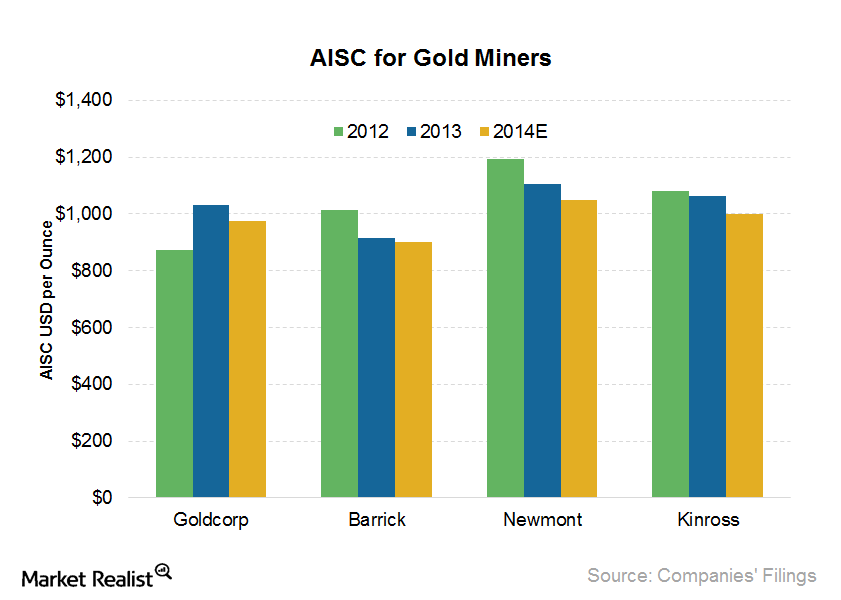

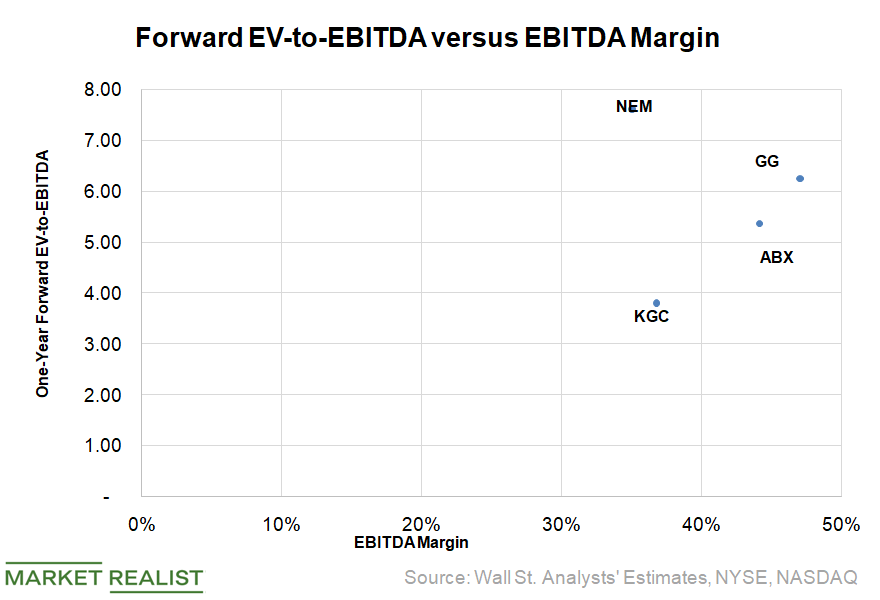

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

US Businesses Push Back against Trump’s Tariffs

Farmers for Free Trade’s campaign was rolled out on September 12 with the slogan “Tariffs Hurt the Heartland.”

Key Insights from Goldcorp’s 3Q17 Earnings

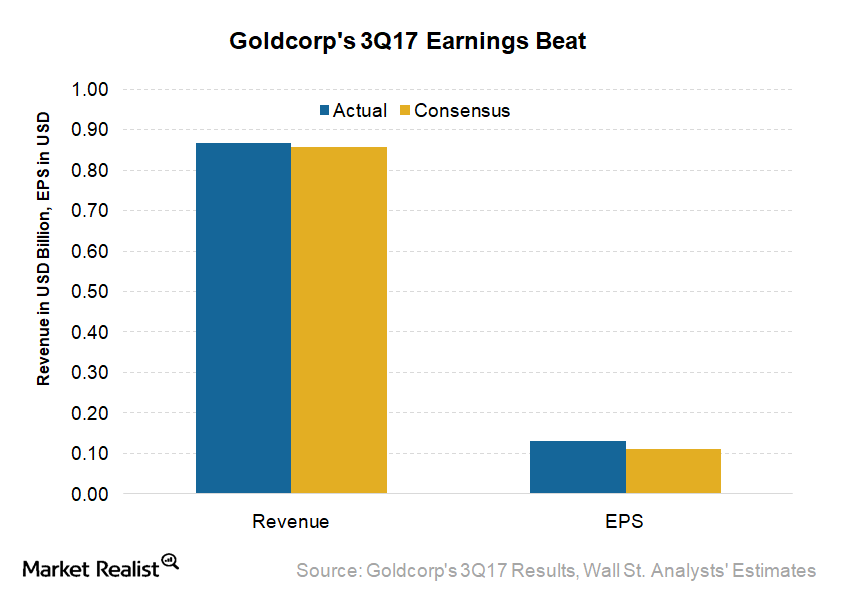

Goldcorp (GG) reported its 3Q17 results after the market closed on October 25, 2017. It reported EPS (earnings per share) of $0.13, which beat analysts’ expectations by $0.02.

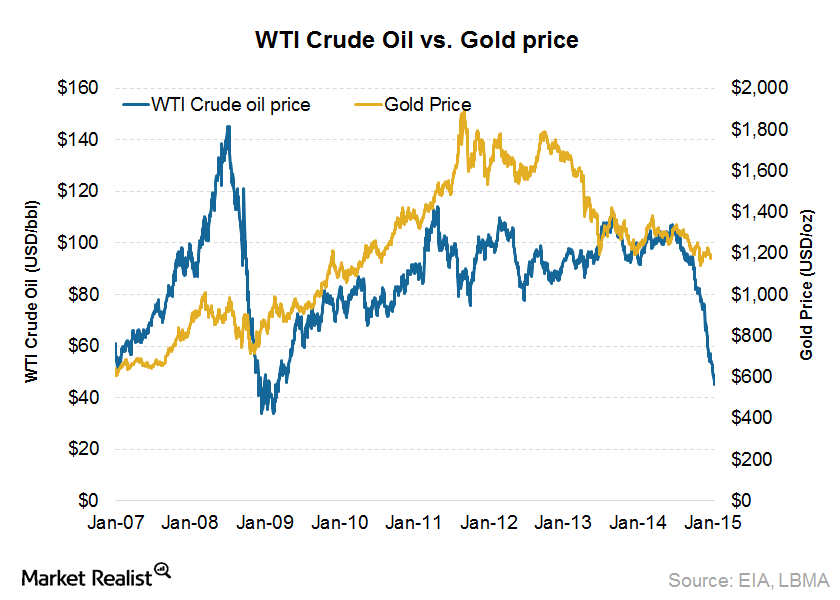

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

Assessing variables that drive the outlook for gold prices

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

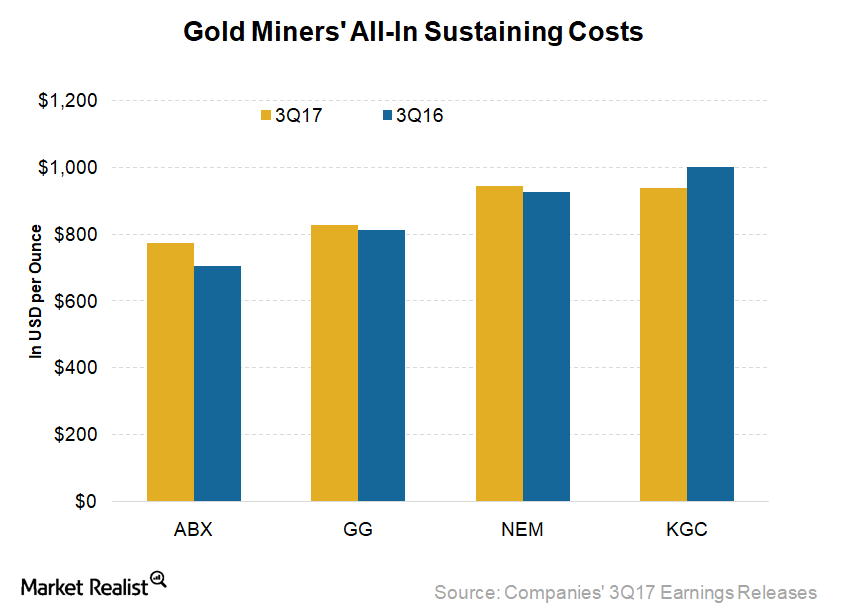

These Gold Miners Surprised Us with Unit Costs in 3Q17

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

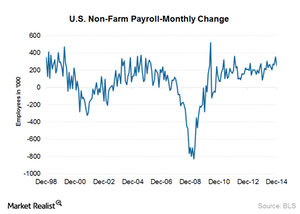

How US labor conditions impact gold investors

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.Materials Why the demerger of non-core assets makes sense for BHP

BHP had been contemplating whether to sell the non-core assets or go for a demerger. Finally, the company decided in favor of a demerger on August 15. The proposed company will likely have assets in the range of $12–$20 billion.Materials Lagunas Norte: Increasing Barrick’s cost per unit

Lower ore grade increases the amount of waste stripping required—in order to extract some volume of ore—as a result of mining more tons of waste.Materials Why did the Cliff’s share price rally?

Iron ore prices are down 19% year-over-year (or YoY) and coal prices are down 30% YoY—volumes were also down YoY, but the stock rallied 7% in a single trading session the next day of the earnings call and up 3% the subsequent trading day.

Which Gold Miners Could Offer Valuation Upsides after Q2 2018?

The average ratio of the NYSE Arca Gold Miners Index and the S&P 500 Index (SPY) is 0.18 compared to the ten-year average of 0.68.

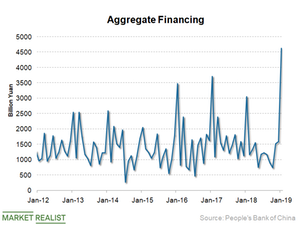

Can China Manage Growth without Fueling a Debt Crisis?

While there is no denying that China (FXI) needs stimulus measures to kickstart its slowing economy, any propping up needs to be done in a way to avoid another debt-fueled crisis.

How Is Atlassian Faring Versus Other Work-From-Home Stocks?

Due to the increasing work-from-home trend amid the COVID-19 pandemic, Atlassian stock has gained in 2020. How are the company's competitors doing?

Jared Bernstein, Key Economist on Biden's CEA Team

Joe Biden has included Jared Bernstein on his economic team. How will Bernstein help the Biden administration? What experience does he have?

What Would Delisting Mean for Chinese Stocks and Investors?

The House of Representatives is making a move that could lead to eventually delisting Chinese companies. What happens when a stock gets delisted?

Why Is HP Ink Out of Stock?

HP, which makes PCs and printers, has seen sudden growth amid the COVID-19 pandemic. Can HP stock sustain the growth?

When Will DoorDash Go Public and Should You Buy It?

DoorDash revealed the IPO pricing on Nov. 30, which was higher than expected. So, when is DoorDash’s IPO date and what is the pricing?

What Is Dave Ramsey's 401(k) and Life Insurance Advice?

Many people look up to Dave Ramsey, a radio host and financial expert, for financial advice. What does he recommend for a 401(k) and life insurance??

Sundial Growers Stock Got a Boost from Merger News

Sundial Growers stock received a significant boost on merger news. How likely is the company’s merger?

When Is Mark Cuban and Palihapitiya-Backed Metromile Insurance Going Public?

Metromile Insurance, a digital auto insurance company, is going public through the SPAC route. When is its IPO date?

Why Is Parler, the Advocate of “Free Speech,” Banning Users?

Parler, the social media platform, markets itself as advocate of “free speech.” Then why is it banning users?

What Is Bill Gates’ Net Worth and Where Does He Invest?

Bill Gates, the co-founder of Microsoft, is currently the third-richest person in the world. What is his net worth?

How Did Leon Cooperman Become a Billionaire?

Leon Cooperman, a billionaire investor, wasn’t always rich. How did he obtain his wealth?

When Is the Butterfly Network SPAC IPO Date?

Butterfly Network, a digital health company, is about to go public through a SPAC IPO. When is its IPO date?

Who Owns DoorDash?

DoorDash is expected to go public soon. What does the company do and who owns it?

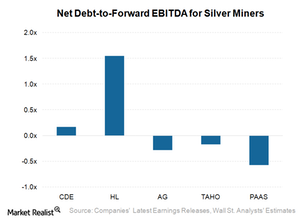

Behind Silver Miners’ Debt Repayment Capacities

Silver companies try to maintain an optimal level of debt-to-equity to lower their costs of capital and maintain an optimum level of risk-reward for shareholders.

NIO Stock at $10: Is It Closer than It Seems?

NIO (NYSE:NIO) stock’s recent performance has been very impressive. The stock has gained close to 74% in the last eight trading days.

Goldman Sachs Warns of Impending Market Crash

Goldman Sachs (GS) thinks that the risk of a market crash is the highest since the financial crisis.

Which Positions Did Einhorn Increase and Reduce in Q1?

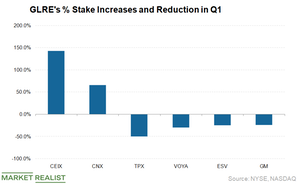

David Einhorn’s Greenlight Capital’s (GLRE) largest stake increase in percentage terms was in Consol Energy (CEIX), in which GLRE increased its stake by 142.9% in the first quarter.

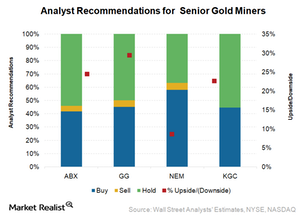

Which Senior Gold Miners Are Analysts Betting On?

As a group, the average gains of North American senior gold miners (GDX) (RING) have been muted.

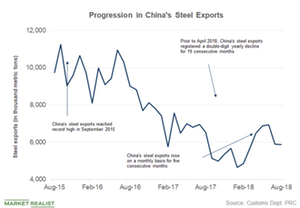

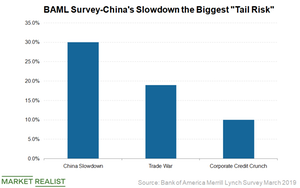

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

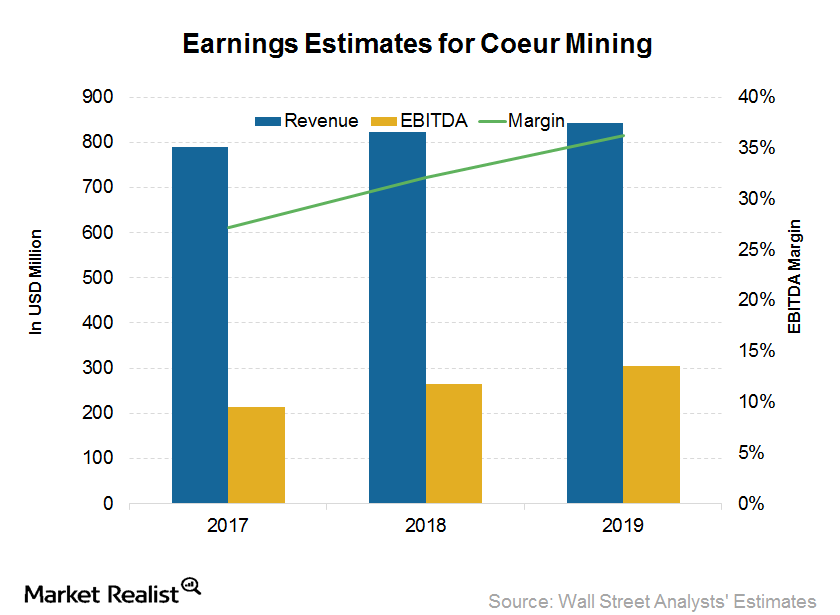

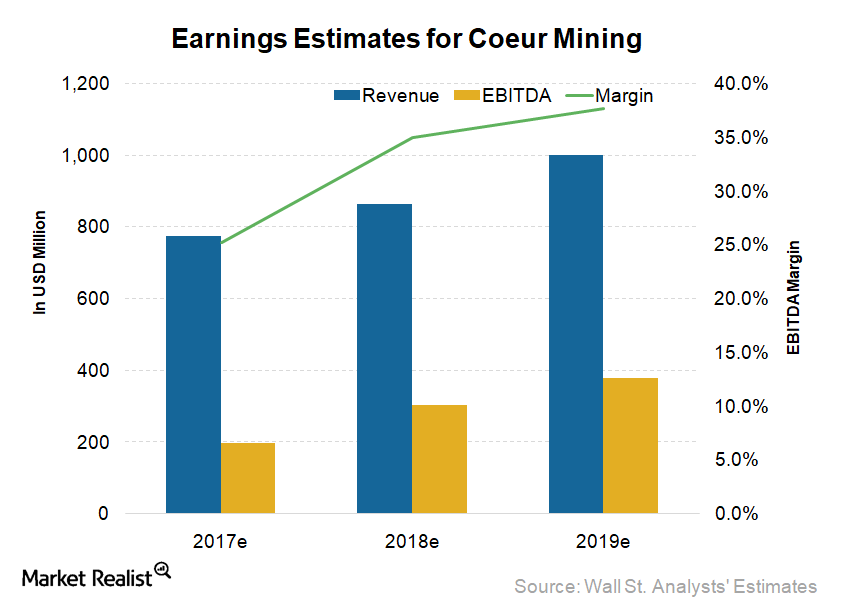

Analysts Are Optimistic about Coeur Mining

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]Materials Why an increase in real interest rates makes gold lose its sheen

Gold doesn’t give any returns besides appreciation. Appreciation doesn’t always happen. As a result, gold has to compete against assets that yield something. When the return on the alternate assets begins to rise, the demand for gold falls. In a scenario where the real interest rates are rising continuously, the demand for gold—as an investment—will start falling.

Why NIO Stock Might Remain Overbought for a While

NIO (NYSE:NIO) stock has risen for four consecutive weeks. The stock has netted a return of 94% to its investors in less than a month.

Strong Economy and a Rate Cut: Can Trump Have It Both Ways?

Today, President Donald Trump told reporters, “Our country’s doing unbelievably well economically.”

NIO Stock: Pullback or Progress after 4 Straight Weekly Gains?

NIO (NYSE:NIO) stock has gained 83% year-to-date. Notably, 92% of the gains have come in since May 28—the day it announced its first-quarter results.

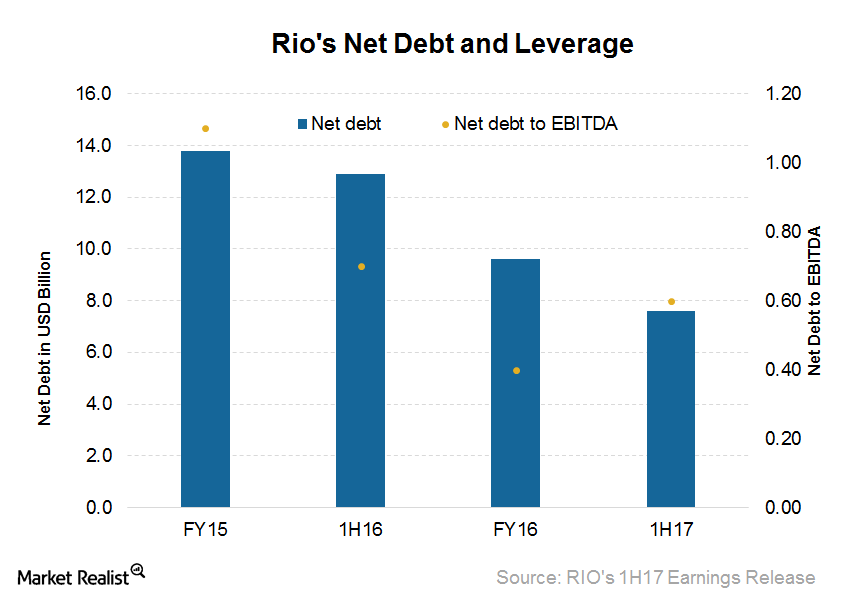

What Rio Tinto’s Balance Sheet Means for Future Growth

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

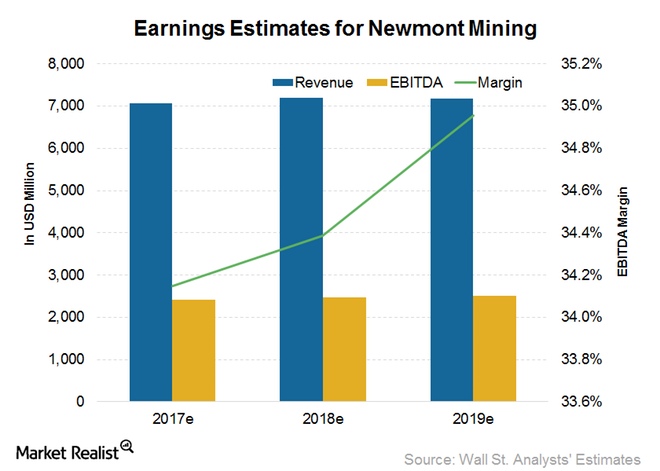

Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

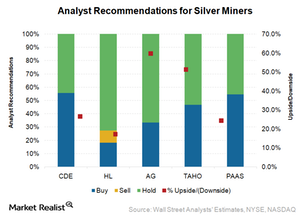

How the Ratings and Potential Upsides for Silver Miners Look Today

The performances of precious metal miners with substantial exposure to silver have been disappointing in 2017. As a group, they’ve returned just 0.9% YTD.

The Market Sentiment for Coeur Mining as 4Q17 Begins

CDE stock has risen 2.6% year-to-date. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

Will Analysts’ Actions Catch Up with NIO’s Stock Price?

NIO’s stock price has run up substantially in about a month. As a result, Wall Street analysts’ target prices have a lot of catching up to do.

Is NIO’s Profitability Close Enough for a Bullish Bet?

A whopping 86% of NIO’s YTD gains have come since May 22. Record deliveries, strong guidance, and analysts’ positive sentiment helped the rally.

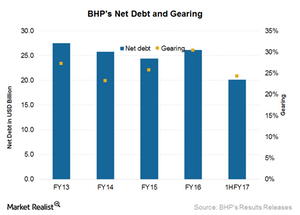

BHP’s Balance Sheet: The 2017 Outlook

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.