Anuradha Garg

Anuradha Garg has worked at Market Realist since 2014, and her equity research experience spans more than 11 years. She has an MBA in finance from a premier Indian college. Prior to joining Market Realist, she worked with HSBC for three years, where she used to cover UK business services companies and African cement, sugar, and telecom companies. She has also worked with Fidelity Investments as a buy-side analyst handling diverse sectors of Australian mining & mining services, Australian REITs, and China discretionary consumer space.

At Market Realist, her research focus has spanned various sectors. She started with basic materials, particularly precious metals and iron ore. She also covered hedge fund managers’ holdings. Her current research focus is on US auto stocks, including electric vehicle companies and ride-sharing firms.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Anuradha Garg

Tesla Gigafactory 3: A Step Closer to Model 3 Production

Tesla (TSLA) is one step closer to producing China-made Tesla Model 3s through its China Gigafactory, also known as its Gigafactory 3.

How Musk is Trying to Address Tesla’s Service Issues

Tesla (TSLA) seems to have realized how important service centers and customer experience are to its sales, especially in the wake of service issues.

New Rivian Investment: Could It Be the Real Tesla Killer?

Yesterday, electric truck maker Rivian revealed that it had landed an investment of $350 million from automotive services company Cox Automotive.

China’s NEV Sales Drop Again: Effects on Tesla, NIO

In addition to China’s passenger vehicle sales, its sales of NEVs (new energy vehicle) also fell for the second straight month in August.

Could the Tesla Model 3 Disrupt the UK EV Space?

Another piece of information that lent optimism to Tesla bulls came out yesterday: its Model 3 became the third-best-selling car in the UK in August.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Could Tesla’s China Gigafactory Be Its Secret Weapon?

As the trade war escalates, one thing that could make a difference for Tesla is its Gigafactory 3 in China. Its construction pace has been impressive.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Why Elon Musk Doesn’t Need to Be Tesla’s CEO

On Thursday, James Anderson of Baillie Gifford did an interview with Manager Magazin. Anderson discussed why he thinks Tesla could work without Musk.

Why Ron Baron Remains a Firm Long-Term Tesla Bull

Tesla (TSLA) bull and billionaire founder of Baron Capital, Ron Baron, talked to CNBC today about his long-term investment in TSLA stock.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Tesla Model 3 Ranked ‘Best Electric Car,’ Musk Approves

According to YouTube’s most noted auto reviewers, Tesla’s Model 3 is the “best electric car” available today. Tesla produces 5,000 Model 3 units per week.

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

Morgan Stanley Sees Ford’s Dip as a ‘Buying Opportunity’

Yesterday, Morgan Stanley upgraded Ford Motor Company stock from “equal weight” to “overweight” and increased its target price.

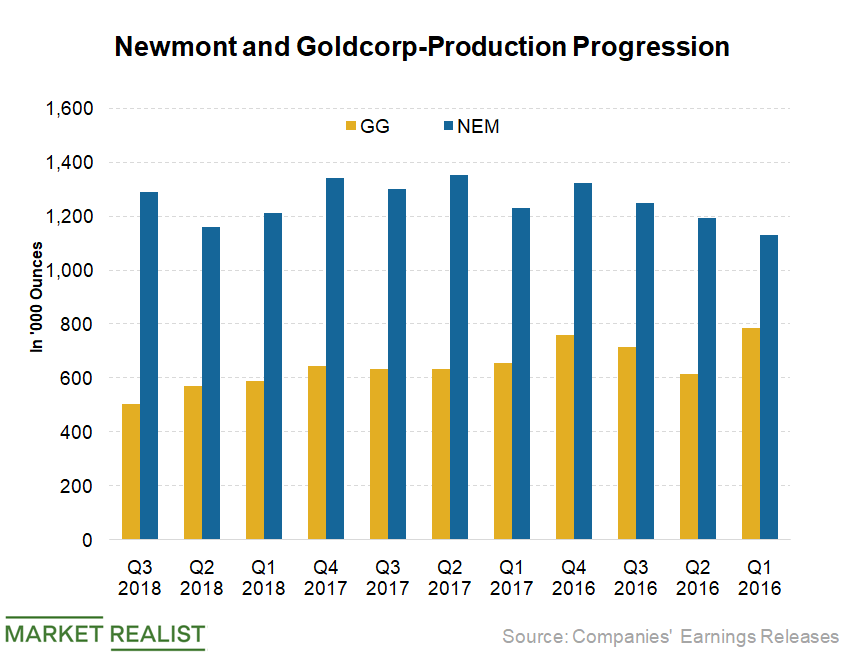

What Synergies Does Newmont Expect from Merger with Goldcorp?

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger.

Morgan Stanley Is Skeptical about the S&P 500’s Upside

Morgan Stanley doesn’t believe the S&P 500’s current breakout above 3,000 will last. It also doesn’t expect Fed rate cuts to rekindle growth.

Trade War: Trump’s Advisers Think It’s a ‘Prosperity Killer’

President Trump’s advisers want him to focus on strengthening the economy, even if he has to ease up a little on his trade war rhetoric.

Why Ray Dalio’s Bridgewater Is Underperforming in 2019

Pure Alpha, the flagship fund of Ray Dalio’s Bridgewater Associates, fell 4.9% in the first half, the Financial Times reported.

Dalio and Buffett: What to Do When Stocks Get Battered

As we face a market downturn, market veteran Ray Dalio has valuable advice.

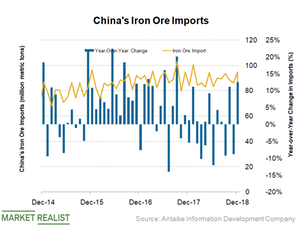

China’s Iron Ore Imports Drop, Will Prices Stay Elevated?

Falling iron ore imports China consumes more than 70% of seaborne-traded iron ore. As a result, iron ore investors should track China’s demand and outlook. Today, China released its trade data for June. China’s iron ore imports were 75.18 million tons in June—9.7% lower YoY (year-over-year) and 10.2% lower month-over-month. In June, China’s imports fell […]

Will Trump Favor Tariffs or Bullish Stock Markets at the G20?

It might not take much for Trump to at least reach a truce in the ongoing trade war with China. All eyes are on the Trump-Xi meeting on the sidelines of the G20 summit, scheduled for tomorrow.

Gold and Miners: To Buy or to Hold?

Since lower interest rate expectations, a weakening US dollar, and geopolitical factors pushed gold above its long-term resistance of $1,350 per ounce, technical factors seem to have taken over.

Why Jeffrey Gundlach Likes Gold

During DoubleLine’s investor webcast on June 13, Jeffrey Gundlach said, “I am certainly long gold.” His call on gold is based on his expectation that the US dollar (UUP) will finish lower this year.

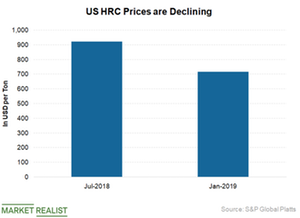

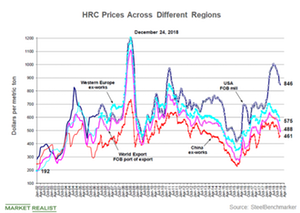

Why CLF’s CEO Sees a Big Upswing in US Steel Prices Soon

Cleveland-Cliffs’ (CLF) CEO, Lourenco Goncalves, believes that US steel prices should see a big upswing in the next few months.

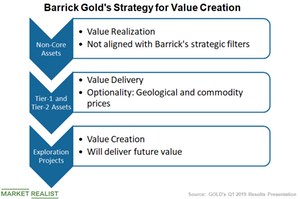

Barrick Gold’s Strategy for Creating Shareholder Value

The Barrick Gold (GOLD) and Randgold Resources combined company intends to achieve sector-leading (GDX) (JNUG) returns.

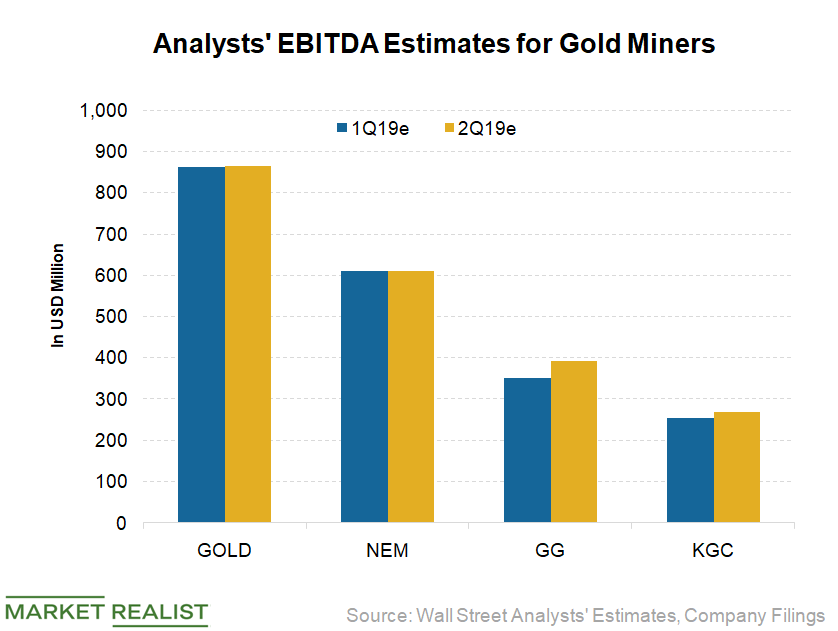

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

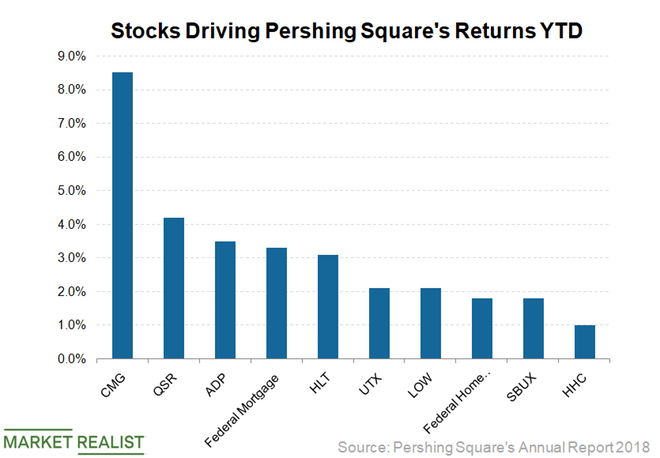

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

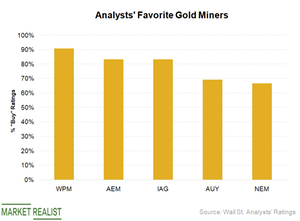

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

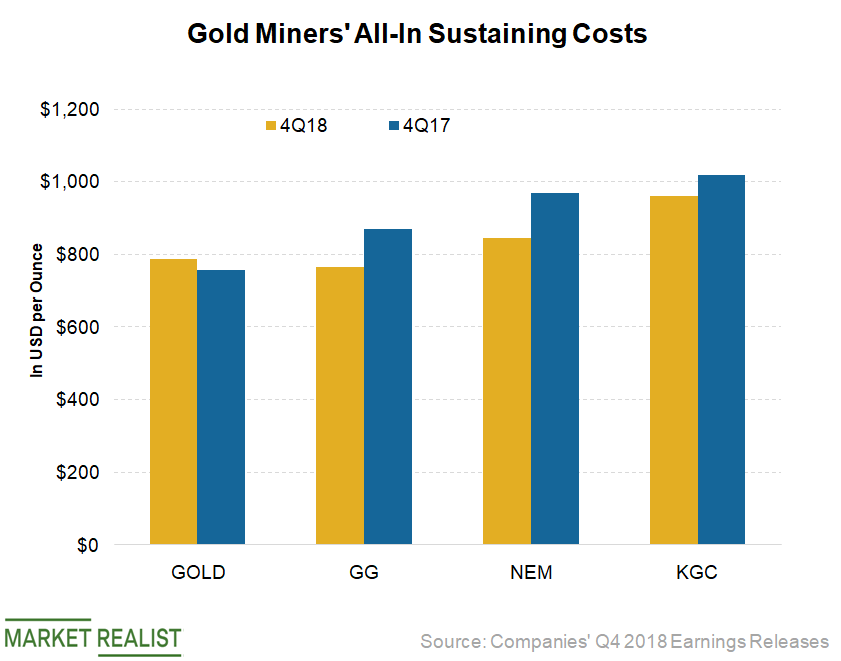

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

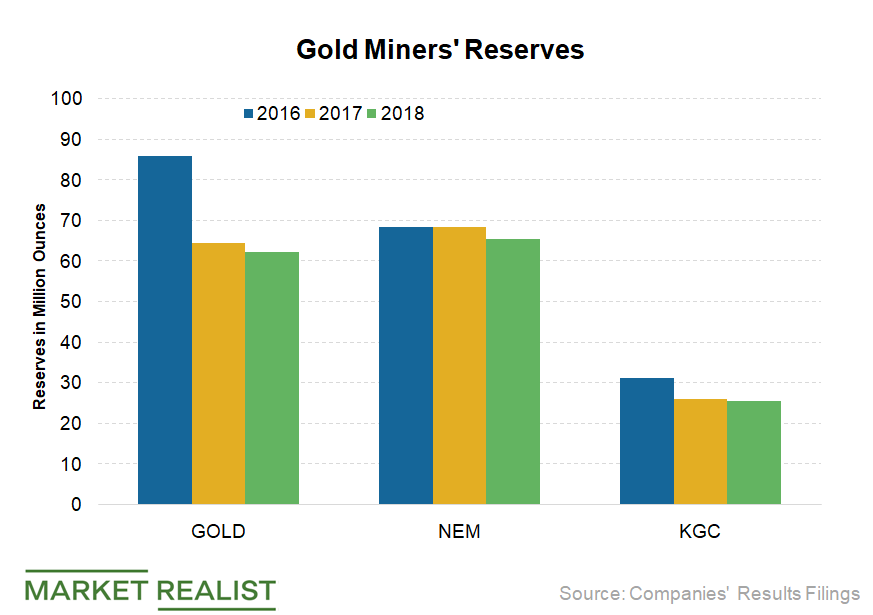

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

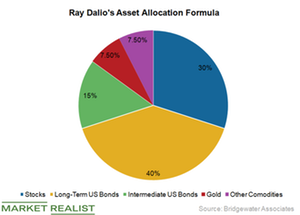

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

Is Cleveland Cliffs’ HBI Plant an ‘Underappreciated’ Opportunity?

After Cleveland-Cliffs’s (CLF) debt repayment concerns were taken care of, it started refocusing on growth.

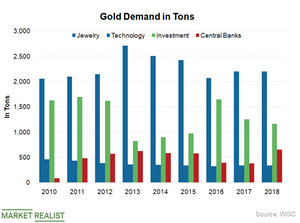

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.

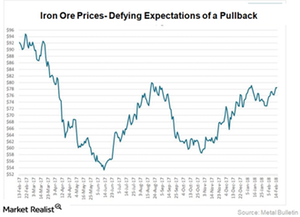

What China’s Steel Price Trends Could Mean for Iron Ore Miners

Bumper margins prompted Chinese steel mills to continue increasing their output.

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

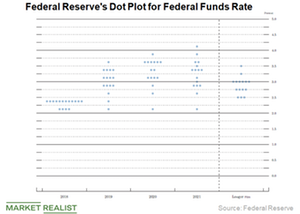

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

Q4 2018 Started on a High Note for Gold

During the third quarter, gold’s price fell ~5%, dipping below the psychologically important level of $1,200 per ounce it touched in August.

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Why Seaborne Iron Ore Prices Might Not Impact Cleveland-Cliffs Much

Iron ore prices showed a lot of volatility in 2017, which is continuing well into 2018.

How US Steel Import Tariffs Could Affect Cleveland-Cliffs in 2018

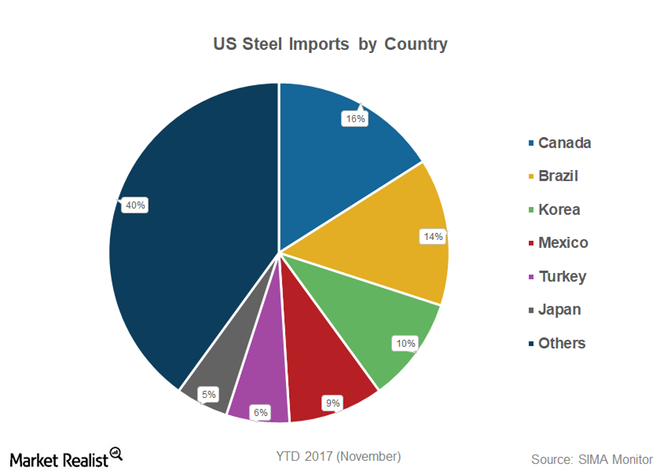

US steelmakers (SLX) were facing an onslaught of increasing steel imports into the US, which impacted their capacity utilization and pricing power negatively.

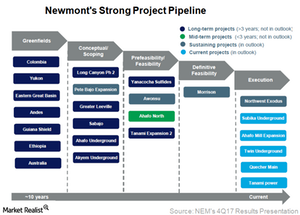

Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

Cleveland-Cliffs Stock Rises on Tariff Recommendations

On February 16, 2018, the US Department of Commerce released its recommendations for the Section 232 probe into steel and aluminum imports.

Iron Ore: China’s Property Market Shows Signs of Weakness

It’s vital for iron ore investors to track movements in the Chinese real estate market (TAO). This sector constitutes more than 50% of the total steel consumed in the country.

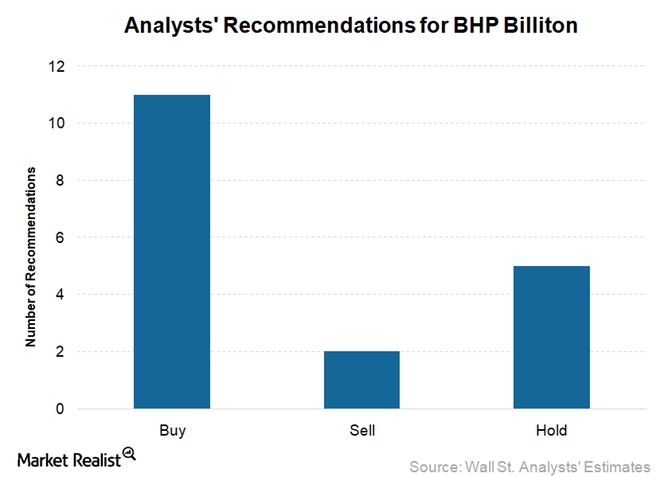

BHP Billiton: Recent Wall Street Upgrades and Downgrades

Of the 18 Wall Street analysts currently covering the BHP Billiton’s (BHP) stock, 61% rate it as a “buy,” 28% recommend a “hold,” and the remaining 11% have a “sell” recommendation on the stock.

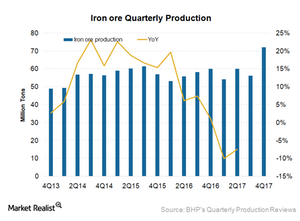

BHP Billiton Outlook: Iron Ore Volumes Flat

Iron ore (PICK) volumes are key to BHP Billiton’s (BHP) revenues and earnings as iron ore is the single largest commodity produced by the company.

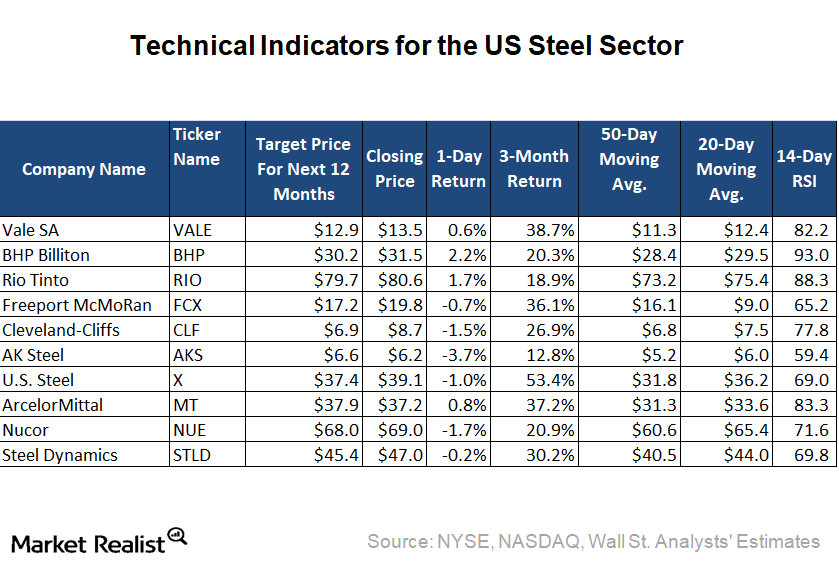

What Technical Indicators Say about Cliffs and Peers

Based on its January 12, 2018, closing price, Cleveland-Cliffs is trading ~28% above its 50-day moving average and 15.4% above its 20-day moving average.

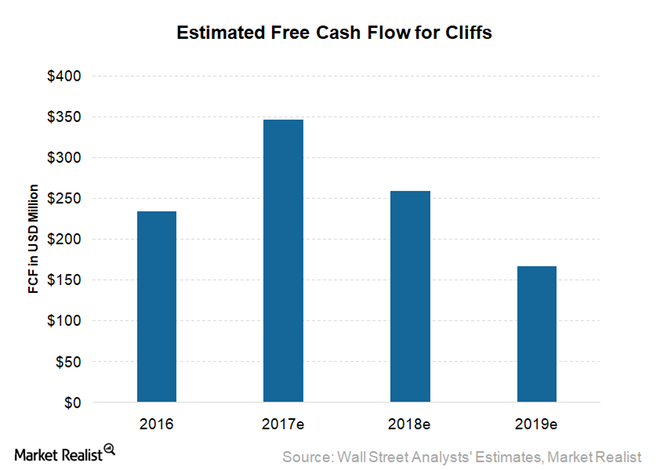

These Factors Could Lead to Upside to CLF’s Free Cash Flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years.