Anuradha Garg

Anuradha Garg has worked at Market Realist since 2014, and her equity research experience spans more than 11 years. She has an MBA in finance from a premier Indian college. Prior to joining Market Realist, she worked with HSBC for three years, where she used to cover UK business services companies and African cement, sugar, and telecom companies. She has also worked with Fidelity Investments as a buy-side analyst handling diverse sectors of Australian mining & mining services, Australian REITs, and China discretionary consumer space.

At Market Realist, her research focus has spanned various sectors. She started with basic materials, particularly precious metals and iron ore. She also covered hedge fund managers’ holdings. Her current research focus is on US auto stocks, including electric vehicle companies and ride-sharing firms.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Anuradha Garg

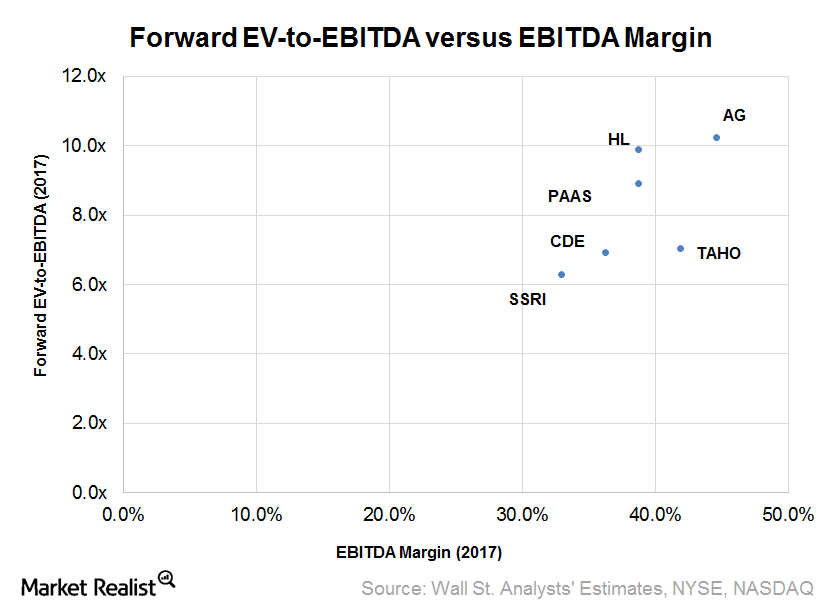

Analyzing Silver Miners’ Relative Valuations

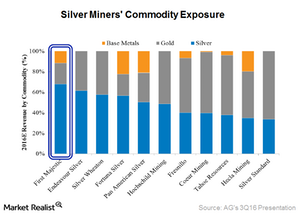

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

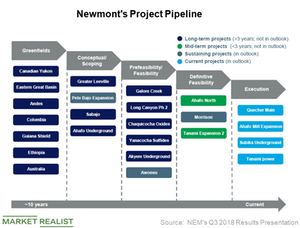

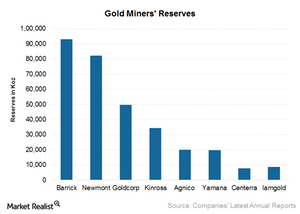

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

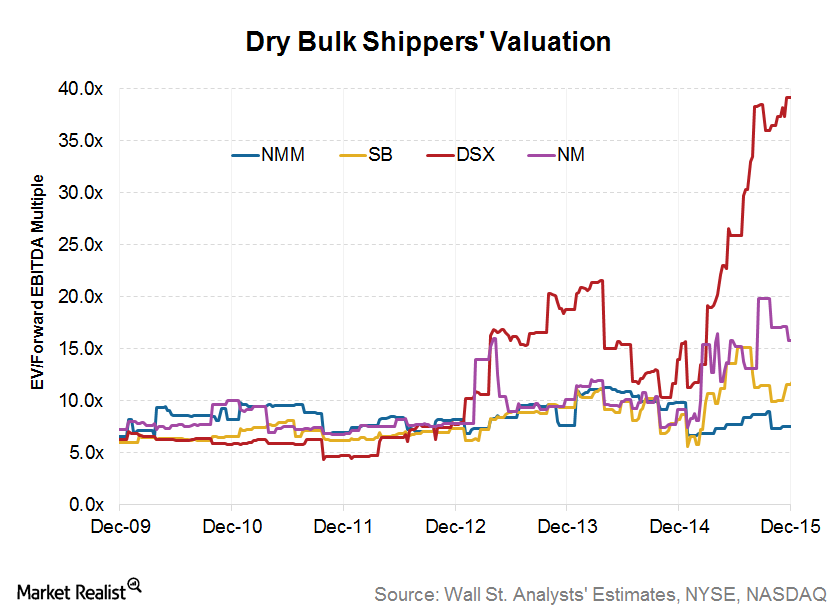

The Relative Valuation of Dry Bulk Companies

Diana Shipping is proactively investing in vessels to take advantage of the current low point for vessel valuation, and it can most likely outlast a prolonged downturn. So its valuation appears more or less full.

Can Renault’s Bigger Electric Car Take Tesla Head-On?

Bloomberg reported on October 8 that Renault (RNLSY) was mulling a new all-electric car. It’s expected to be bigger than its best-selling Zoe.

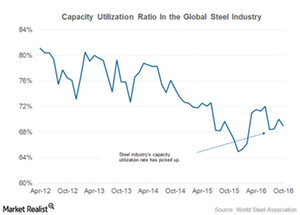

Why the Outlook for US Steel Prices Is Bright beyond 4Q17

While US steel prices rose to a high of $660 per ton in March 2017, they fell to $580 per ton in June.

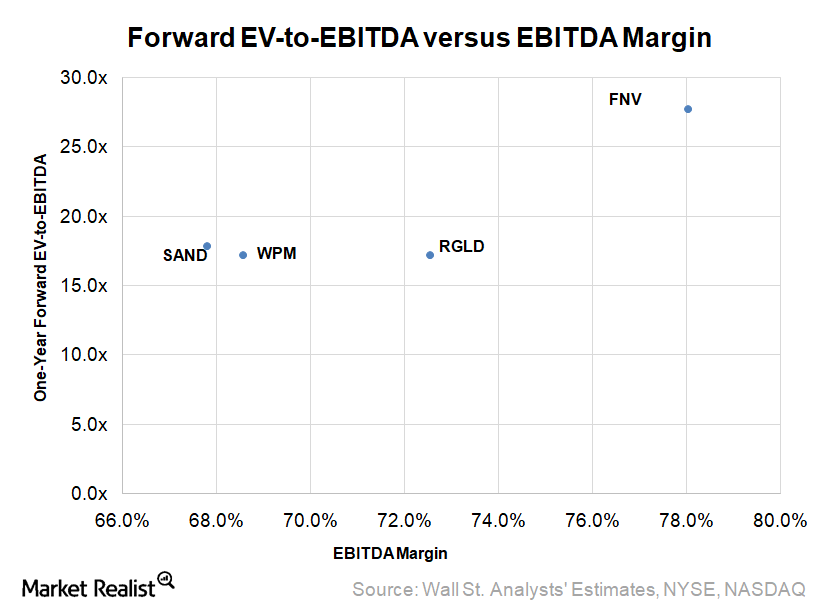

Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.Materials Must-know: Why US debt to GDP and gold price move together

Debt to gross domestic product (or GDP) is the ratio that shows how much a country owes versus how much it earns. Investors use this ratio to measure a country’s ability to make future payments on its debt. This impacts the country’s borrowing costs and government bond yields.

Goldman Sachs Upgrades NIO, More Analysts Might Turn Around

Goldman Sachs upgraded NIO (NYSE:NIO) stock on Tuesday. Notably, NIO received its third upgrade in less than a month. Will more analysts turn around?

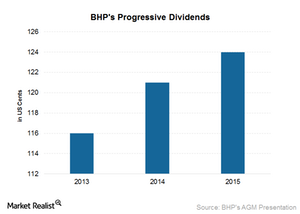

Can BHP Maintain Its Dividends in 2016?

BHP Billiton is facing pressure in all the commodity businesses it’s involved in. At spot prices, free cash flow doesn’t cover the company’s dividends.

Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

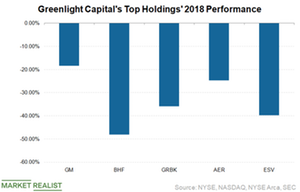

The Biggest Detractors for Einhorn’s Greenlight in 2018

Overall, in 2018, the most significant contributors to Greenlight Capital’s gains included Micron Technology (MU) and Twitter (TWTR).

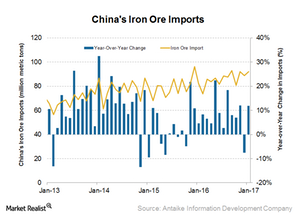

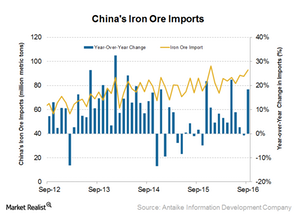

What China’s High Iron Ore Imports Suggest

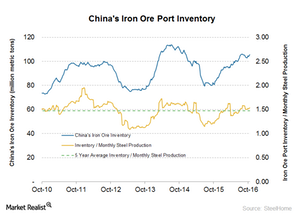

China imported 92 million tons of iron ore in January 2017—a growth of 12.0% YoY and 3.4% month-over-month.

How Are Pensions Funded?

Pension funds are plans that provide retirement income to employees. How are pensions funded?

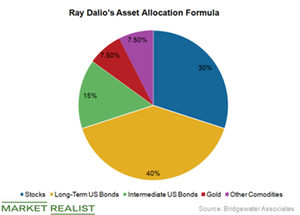

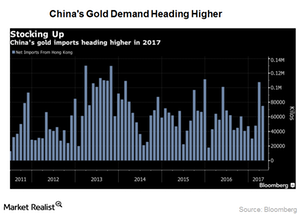

Ray Dalio Increased His Bets on Gold during Q1

Ray Dalio increased Bridgewater Associates’ stake in the SPDR Gold Shares (GLD) and the iShares Gold Trust ETF (IAU).

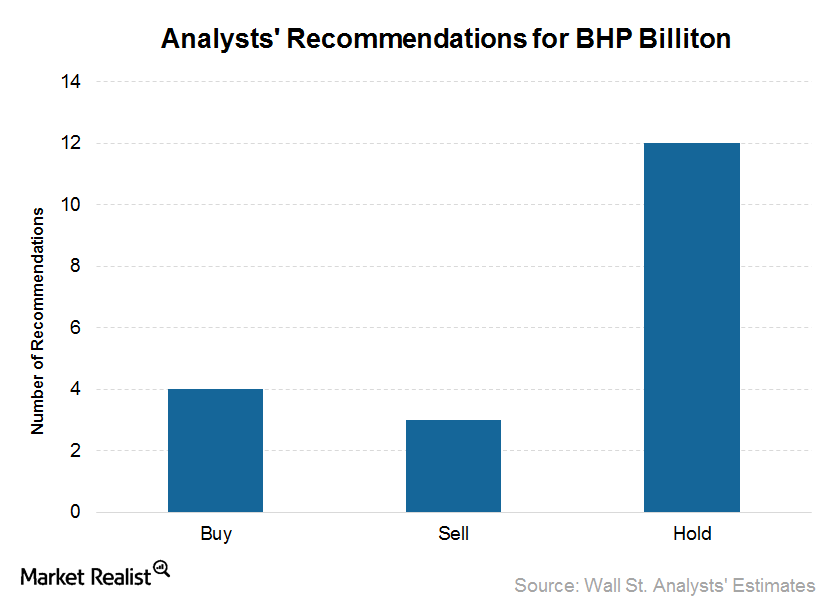

Inside BHP Billiton’s Recent Upgrades and Downgrades

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

Nikola Stock: Sentiment Play or a Real Game-Changer?

Nikola stock hasn’t been able to catch a break since its NASDAQ debut on June 4. The stock has increased by more than 136%.

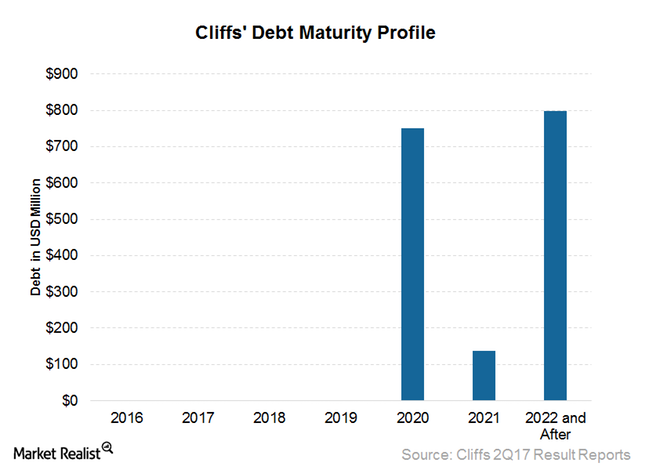

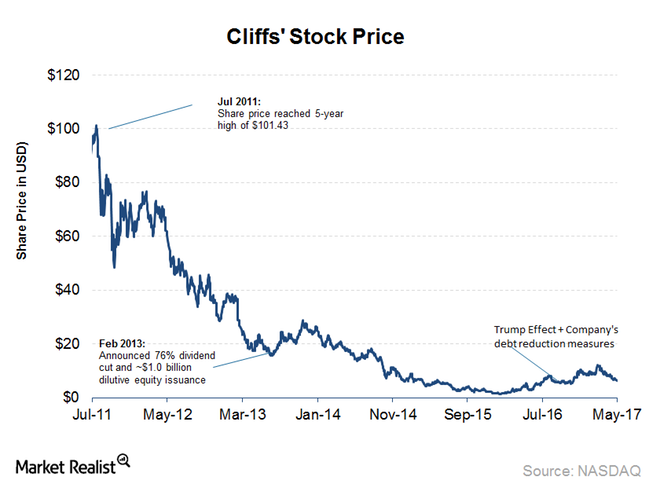

What Cliffs Natural Resources’ Debt Tender Offer Means

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

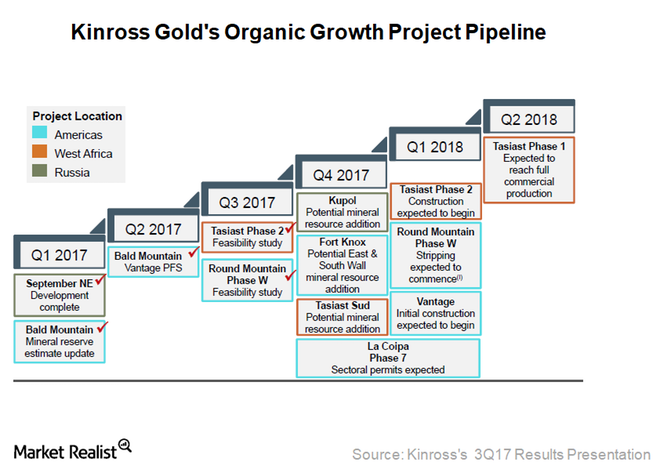

Here’s What Might Help Kinross Gold Outperform in 2018

Apart from royalty and streaming companies, Kinross Gold (KGC) is one of the best-performing miners (GDX) (RING) in 2017.

What to Expect from Cliffs Natural Resources’ 2Q17 Earnings

In this series, we’ll see what investors could expect from Cliffs Natural Resources’ (CLF) 2Q17 earnings report. CLF stock has gained 23% in the last 15 trading days.

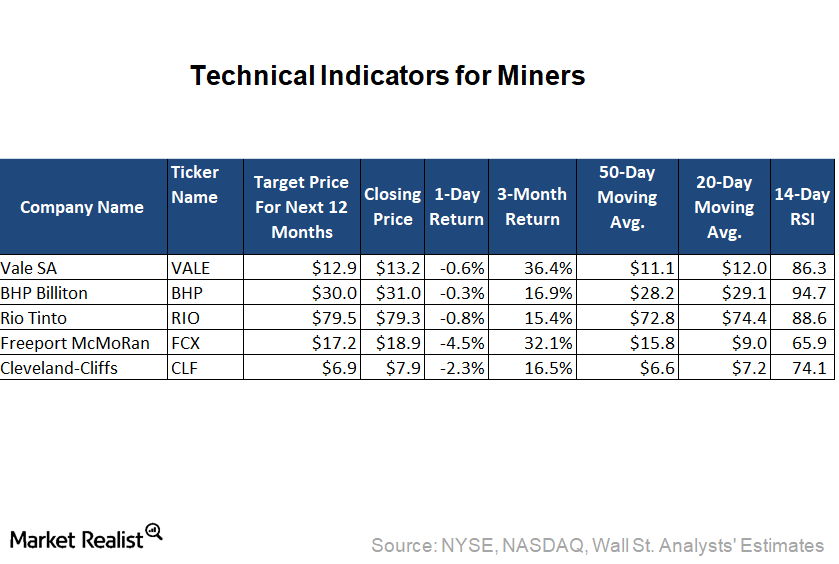

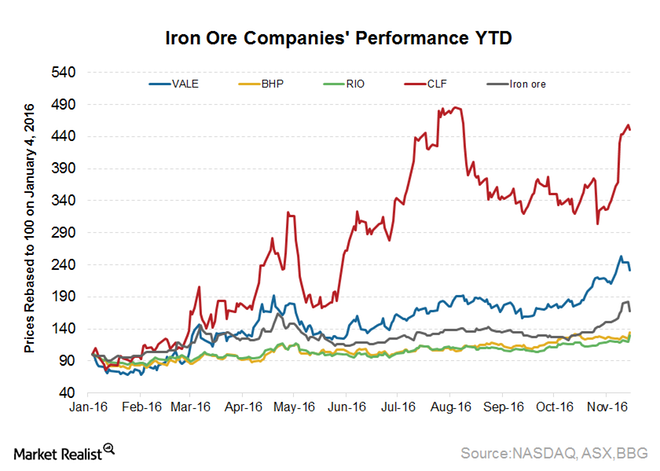

Is the Pullback in Iron Ore Miners Based on Technical Indicators?

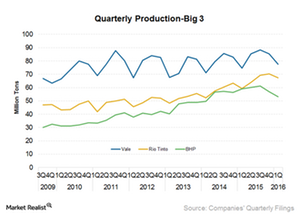

Among the stocks under review in this series, Vale SA (VALE) has given the highest trailing-three-month return of 36.4%, while Rio Tinto (RIO) has generated the lowest return of 15.4%.

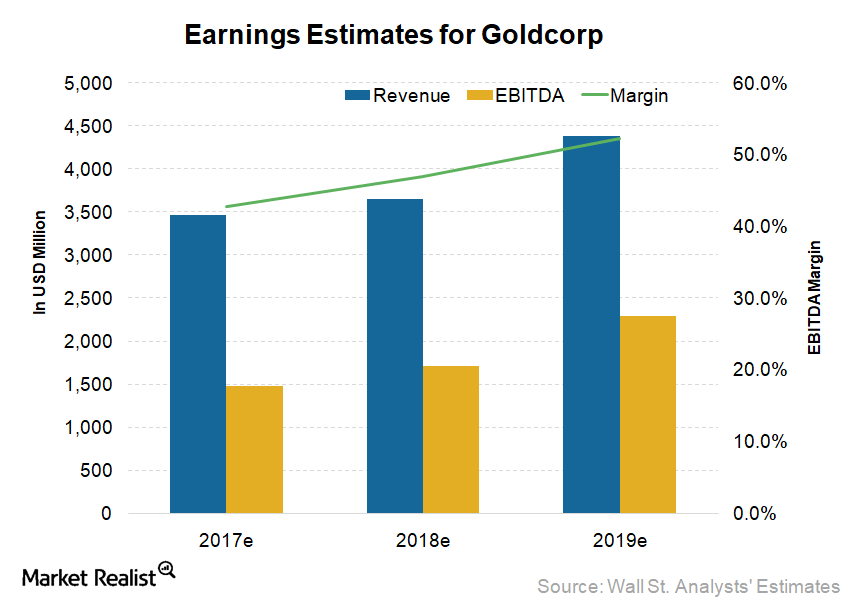

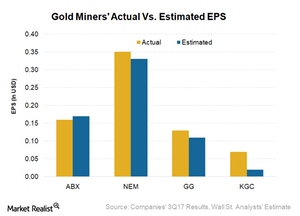

Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

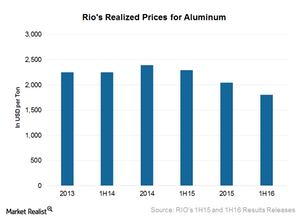

Rio’s Aluminum Division Didn’t Bow to Commodity Price Pressures

Rio Tinto’s (RIO) Aluminum division contributed 19% of its 1H16 underlying EBITDA (or earnings before interest, tax, depreciation, and amortization).

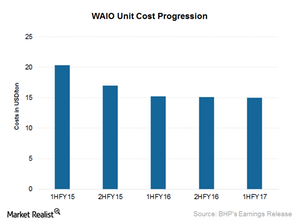

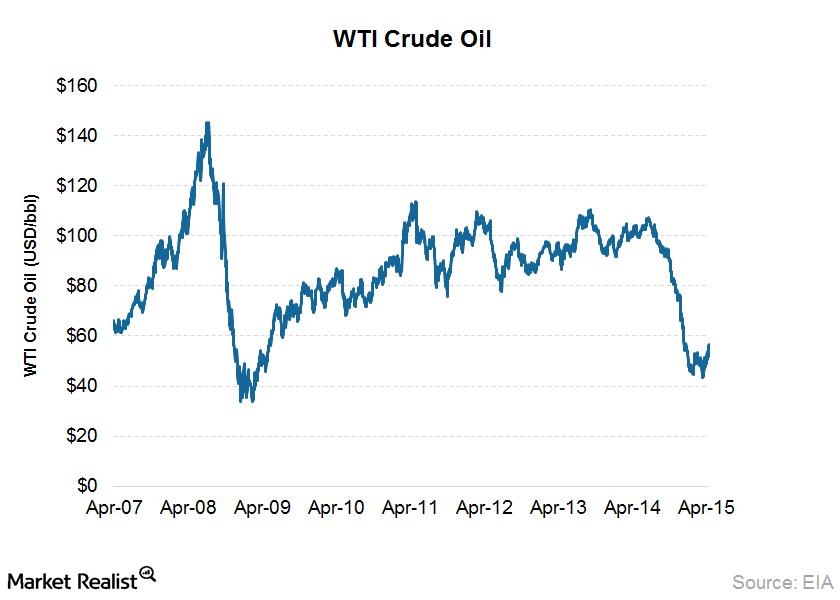

This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

Why Rio Tinto Believes Iron Ore Prices Can Sustain

According to Bloomberg, Rio Tinto CFO Chris Lynch has suggested that iron ore prices will not collapse, as many expect.

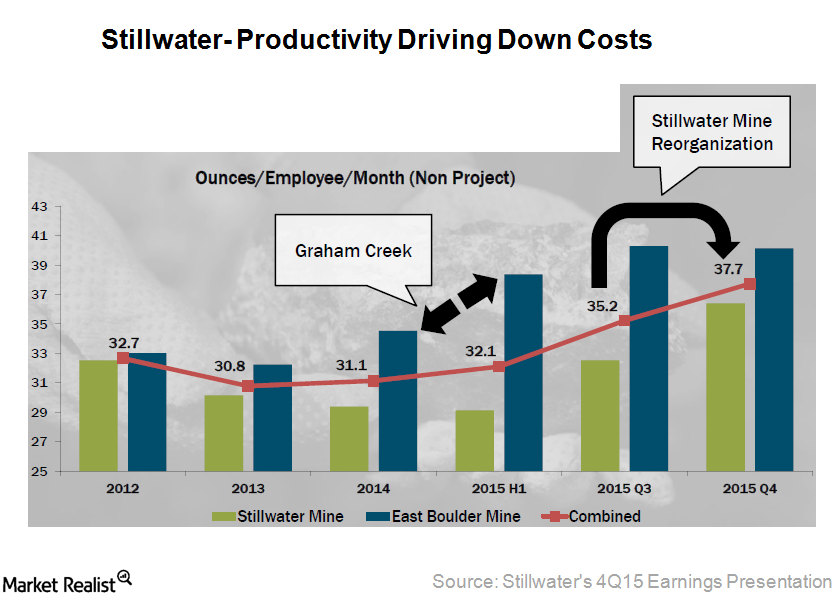

How Is Stillwater Cutting Costs to Stay Ahead of Platinum Prices?

Stillwater Mining (SWC) has seen a significant increase in recovery rates, which is one of the best in the PGM (platinum group metals) industry.

Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

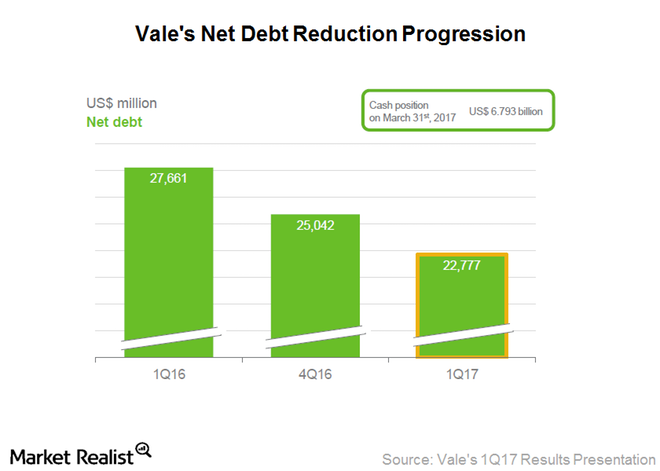

Can Vale SA Reverse Its 2Q17 Performance in 2017?

While Vale SA outperformed peers including Rio Tinto (RIO) and BHP Billiton by rising 24.7% in 1Q17, its performance deteriorated significantly in 2Q17.

Tesla Model Y: Could It Be the Real ICE-Killer?

Tesla achieved a surprise profit in Q3. During its Q3 earnings call, CEO Elon Musk noted that its Model Y could outsell its Models S, X, and 3 combined.

How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

Foreign Exchange and Fuel Tailwinds Could Help Newmont in 1Q15

Investors should watch out for any tailwinds or headwinds that could impact Newmont’s costs in 1Q15.

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

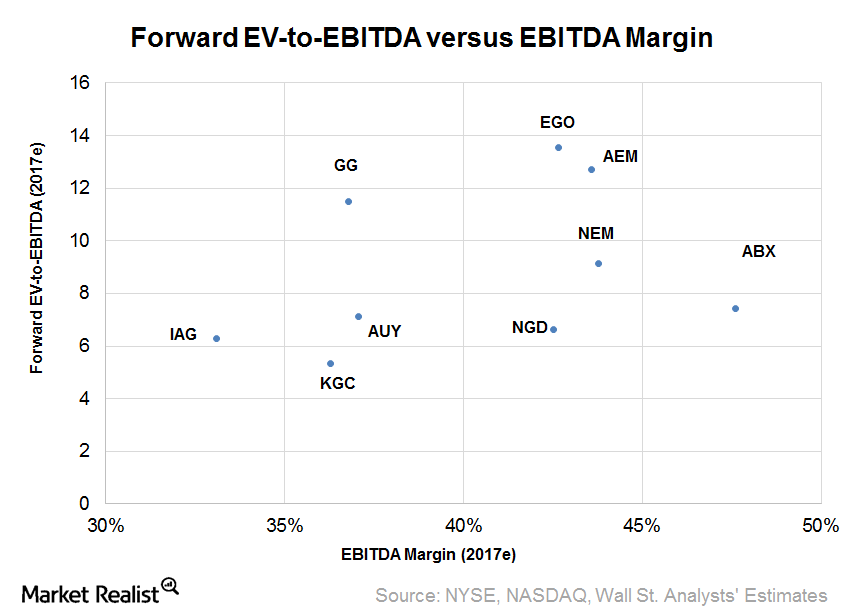

Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

NIO, TSLA, and WKHS: Are EV Stocks the Pot Stocks of 2020?

Amid the global pandemic and somber mood elsewhere, 2020 has been incredible for EV stocks. Their gains have beat the benchmark indices.

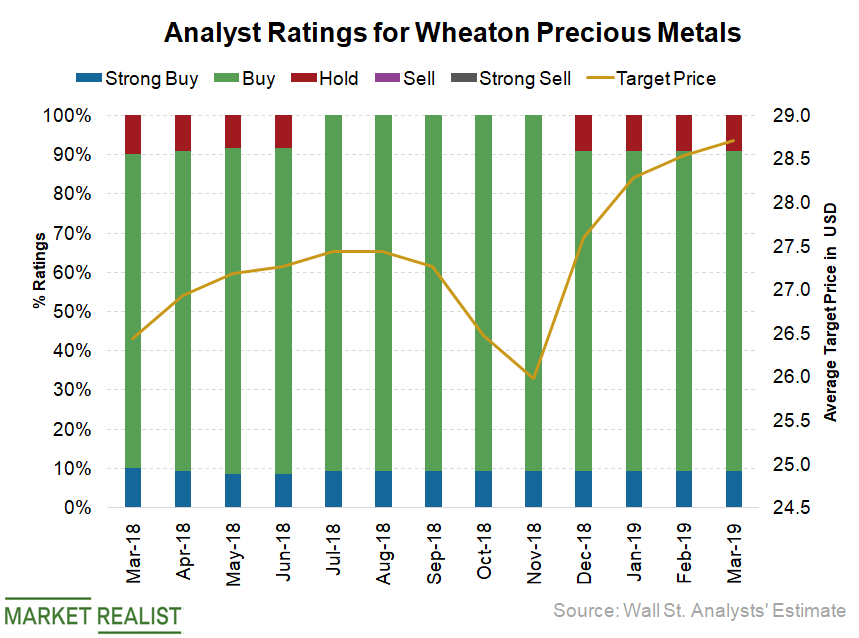

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

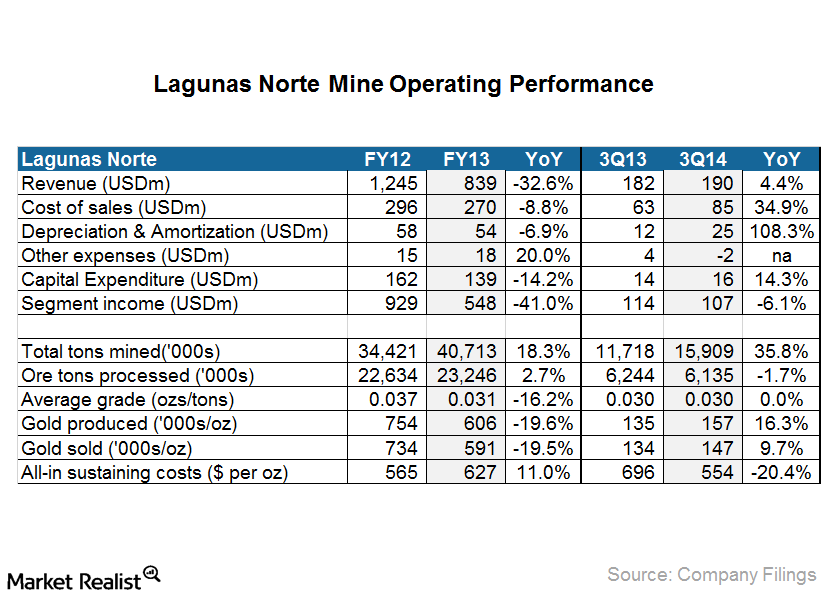

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Which Silver Miners Offer Diversified Exposure to Commodities?

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

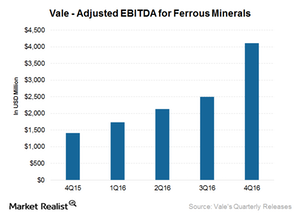

How Vale Reacted to Higher Iron Ore Prices in 4Q16

Iron ore price realization In 4Q16, Vale’s (VALE) ferrous division accounted for ~85.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals came in at $4.1 billion, which was $1.6 billion higher than 3Q16. Higher realized prices and higher sales volumes led to these rises. The CFR […]

Must Know: An Overview of Kinross Gold Corp.

In this series, we’ll analyze the various business aspects of Kinross Gold. We’ll also look at various key drivers that impact Kinross’s investors.Materials Why are iron ore futures downward sloping?

“Backwardation” occurs when futures contracts trade below the spot price, and the futures curve begins to downward slope. This means that the market expects further decline in iron ore prices based on current indicators and fundamentals.

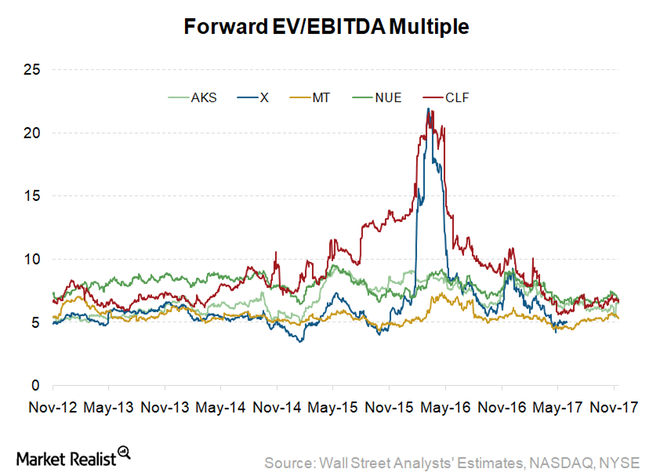

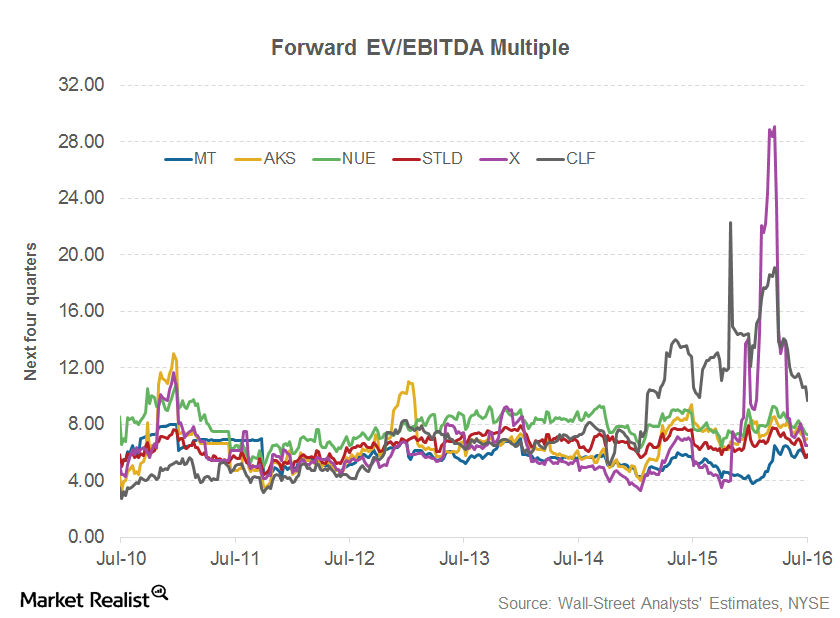

These Factors Could Affect CLF’s Valuation

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last five-year average multiples.Materials Why gold and the US dollar have an inverse relationship

Gold and the U.S. dollar were associated when the gold standard was being used. During this time, the value of a unit of currency was tied to the specific amount of gold. The gold standard was used from 1900 to 1971. The separation was made in 1971. The U.S. dollar and gold were freed. They could be valued based on supply and demand.

Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

Could There Be More Upside to Cliffs Natural Resources’ Valuation?

For companies in cyclical industries such as steel and mining, the EV-to-EBITDA multiple is the preferred valuation metric.

What Led Robust Chinese Iron Ore Imports despite Contrary Views

Contrary to what was suggested by many market participants, the iron ore imports by China increased in September 2016 instead of declining.

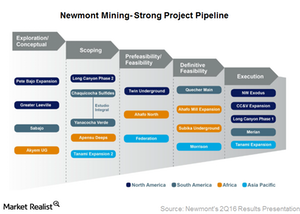

Newmont’s Project Pipeline: On Track and On Budget

Newmont Mining (NEM) has five projects in final stages, all of which will start production either this year or next.

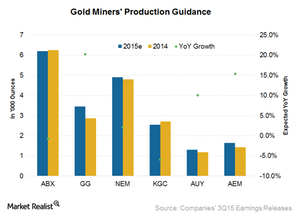

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

Does 2018 Bode Well for US Steel Prices?

Steel prices are the major driver of steelmakers’ earnings and revenues. So it’s important for steel investors and Cleveland-Cliffs (CLF) investors to track the trend in steel prices.

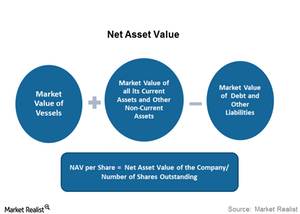

How Does Net Asset Value Measure Navios Maritime’s Valuation?

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities.