How Does Net Asset Value Measure Navios Maritime’s Valuation?

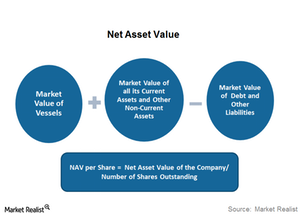

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities.

Nov. 20 2020, Updated 11:35 a.m. ET

What is net asset value?

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities. It is based on the same concept as net worth for individuals. Where the current market values of assets and liabilities differ significantly from the book value, the current values are considered for NAV. When the future cash flow streams are negative or non-existent, analysts often use NAV to value companies whose major value lies in the physically held assets. NAV is usually quoted on a per share basis.

Why use NAV for Navios Maritime Partners?

Being an MLP (master limited partnership), Navios Maritime Partners (NMM) usually trades based on its dividend yield. However, due to its increasing spot rate exposure and older fleet against the backdrop of deteriorating industry fundamentals, the net-asset-based valuation is better to get the sense of its floor valuation.

When there are no cash flows and negative earnings, the use of discounted cash flow or multiple-based valuations is meaningless. In such cases, NAV can be used as a floor valuation.

The current outlook for the dry bulk sector (SEA) is bleak, with vessel values deteriorating day by day. This has led to a significant divergence between the book values and the market values of assets. It is therefore important to get a current assessment of the worth of assets and liabilities. This liquidation value is equal to what remains after all assets have been sold and all liabilities have been paid.

Therefore, in an industry downturn such as the one we’re seeing now, NAV can give a reasonable assessment of the worth of dry bulk companies stocks such as Diana Shipping (DSX), Ship Finance International (SFL), Safe Bulkers (SB), and Navios Maritime Holdings. SFL forms 3.3% of SEA’s holdings. The SPDR Metals and Mining ETF (XME) provides exposure to the metals and mining space. In this series, we’ll analyze the NAV for Navios Partners to see where it trades compared with its asset valuation.