Guggenheim Shipping ETF

Latest Guggenheim Shipping ETF News and Updates

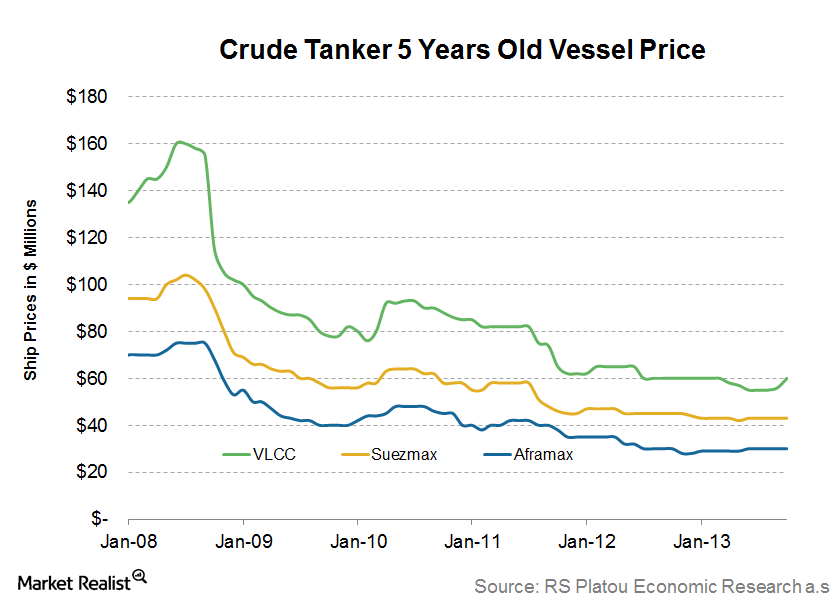

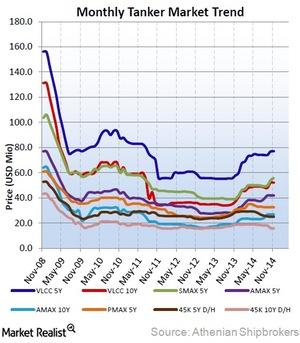

Why current secondhand oil tanker values suggest a mixed outlook

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

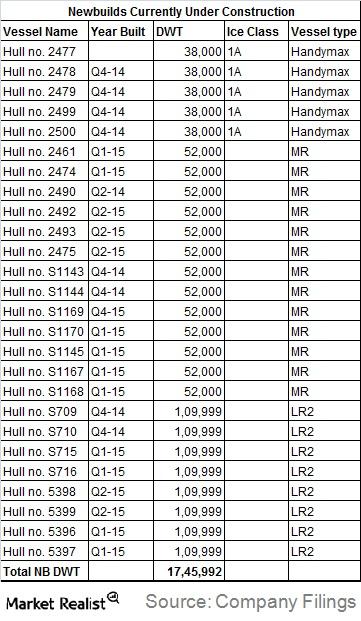

Scorpio Tankers adopts a shift in charter mix

For the third quarter of 2014, the charter hire expense increased $1.1 million to $32.9 million, from $31.9 million in the year ago quarter.

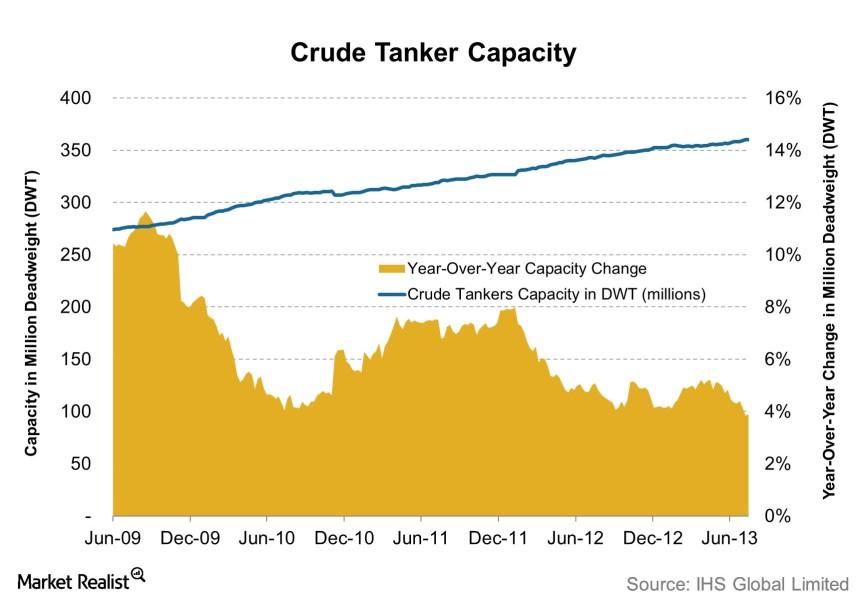

Weekly tanker digest: Have fundamentals changed? (Part 4)

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]Energy & Utilities Why Frontline is on the verge of bankruptcy

Industry analysts suggest that investors should avoid Frontline because of the bankruptcy risk. Currently, the company is facing bankruptcy. This is led by the $190 million bond that’s due in April 2015.

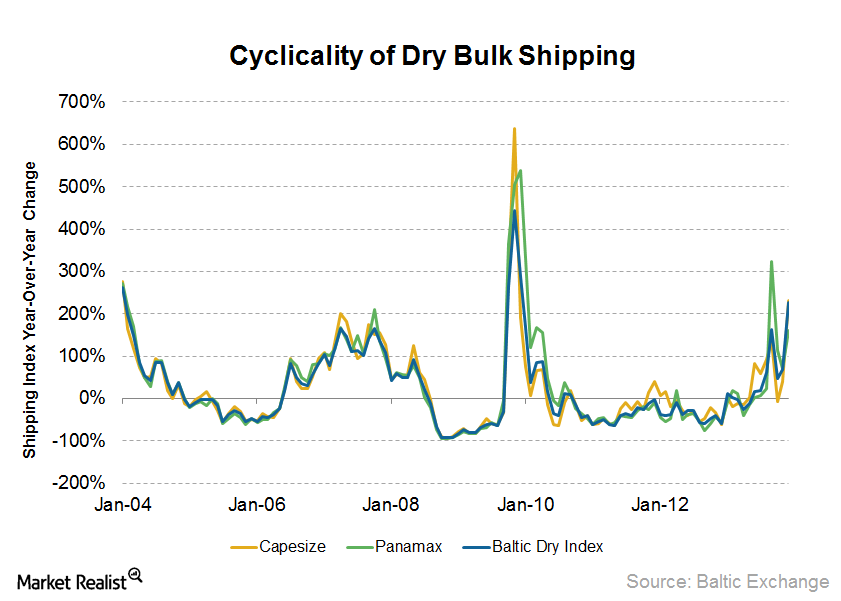

Recommendation: Capitalize on dry bulk shipping’s cyclical waves

The dry bulk shipping industry is cyclical mainly due to economic or business cycles as well as a long lead time between the placement of orders and the delivery of new vessels.

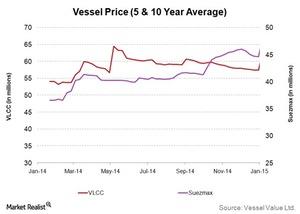

Five-year and ten-year VLCC prices increase

With faster deliveries and employment of vessels, secondhand vessels tend to reflect industry participants’ expectations for medium-term fundamentals.Energy & Utilities 5-year-old and 10-year-old VLCC prices stay at consistent levels

Since secondhand vessels can be delivered within a few months, they tend to reflect industry participants’ expectations for medium-term fundamentals and rates, unlike newbuilds, for which two years of delivery time is mandatory.

5- and 10-year VLCC and Suezmax weekly prices on the run-up

Weekly vessel values have been on the rise, with positive week-over-week and significant year-over-year growth.

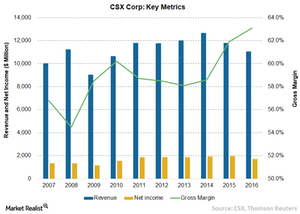

CSX Corporation Has a Wide Economic Moat

To demonstrate the power of efficient scale in creating economic moats, we highlight four companies: U.S.-based wide moats CSX Corporation and UPS, and international narrow moats Telefonica SA (Spain) and CapitaLand Commercial (Singapore).

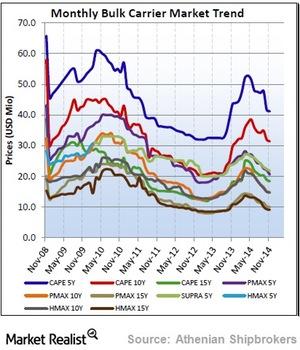

5-year and 10-year ship prices for dry bulk companies

Vessel prices are very close to bottom levels that occurred back in the period from December 2012 to January 2013.Energy & Utilities Liquefaction capacity is key to liquefied natural gas carriers

Whether more proposals will get approval and more liquefaction capacity will come online will depend on the economic feasibility of the liquefaction plants.Energy & Utilities A guide to liquefied natural gas carriers and key shipping costs

While there are a few different types of LNG vessels, the two dominant containment systems, Moss (nicknamed “dinosaur egg”) and Membrane systems are employed today.Energy & Utilities Investing in liquefied natural gas carriers: The future of natural gas

Global energy demand will continue to increase, driven by population growth and improved standards of living. At the same time, emphasis on sustainability becomes more critical.

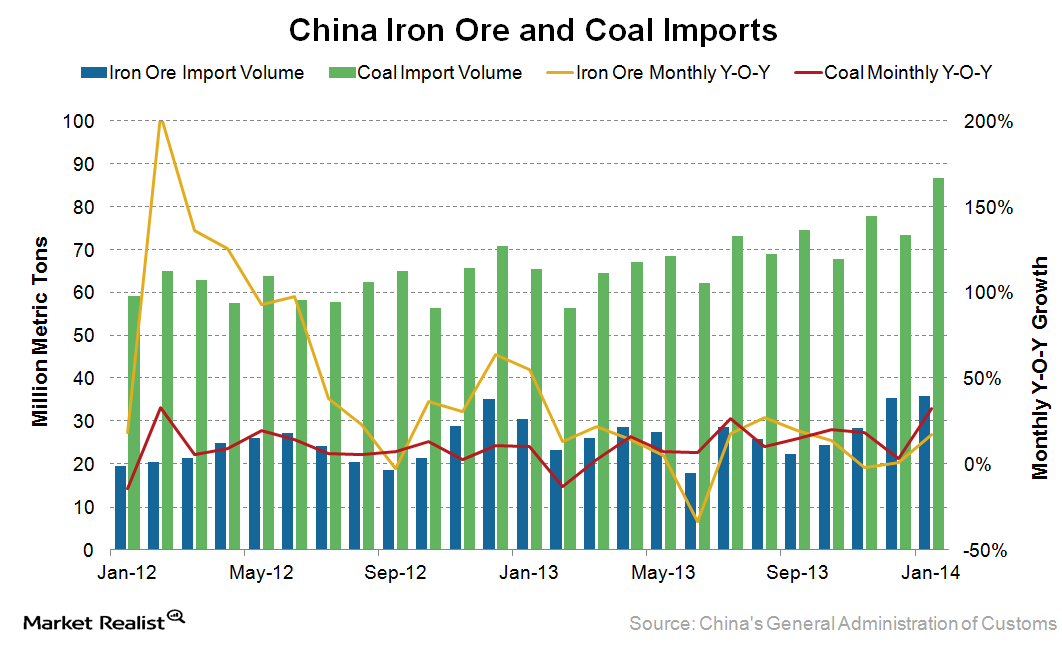

Why China saw high growth in iron ore and coal imports in January

China’s iron ore and coal imports are key factors that drive shipping rates. Iron ore and coal each account for nearly 30% of the world’s dry bulk trade volume.