Ship Finance International Ltd

Latest Ship Finance International Ltd News and Updates

Weekly tanker digest: Have fundamentals changed? (Part 4)

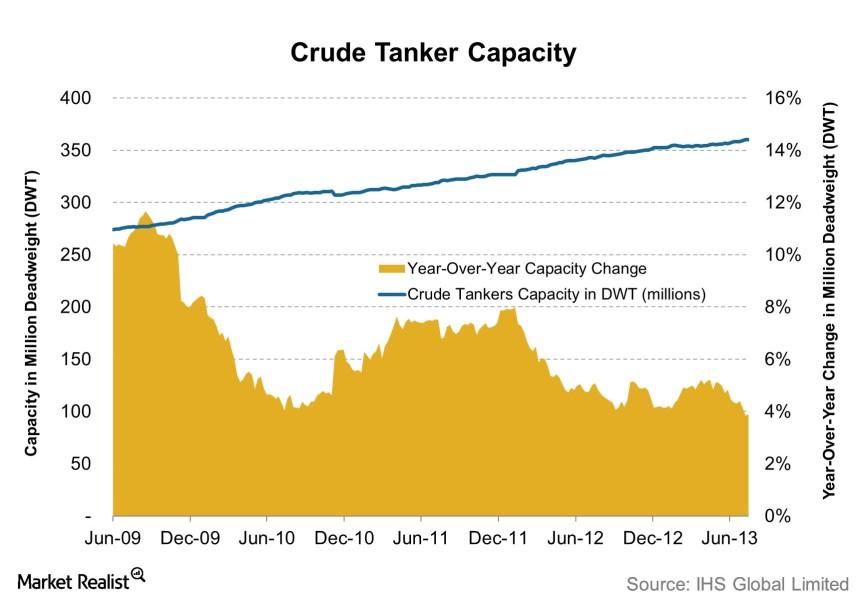

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]

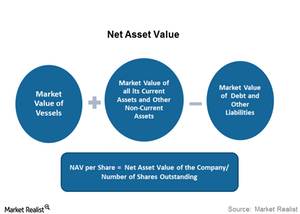

How Does Net Asset Value Measure Navios Maritime’s Valuation?

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities.