Navios Maritime Partners L.P.

Latest Navios Maritime Partners L.P. News and Updates

What Do Fundamental Bulk Shipping Indicators Say?

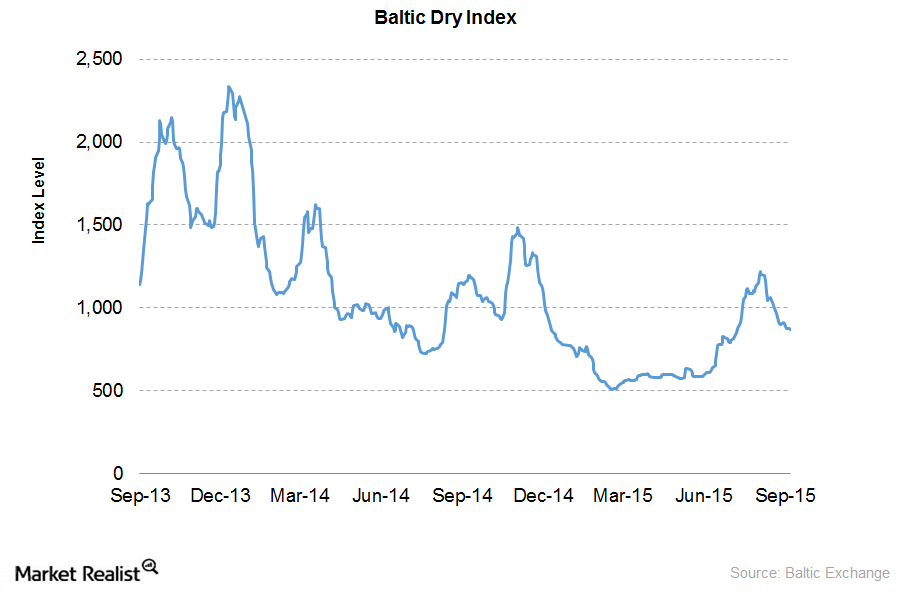

The BDI (Baltic Dry Index) is a leading indicator for the bulk shipping industry. It’s a measure of the cost of shipping major bulk commodities on a number of shipping routes.Industrials We just need decent ship orders for dry bulk shippers to recover

Managers remain optimistic From September 13 to 20, ship orders for Capesize vessels fell by 0.25%, from 10.53% to 10.28%, as a share of the existing number of ships. Orders for Panamax improved from 15.34% of existing ships to 15.87%, while those for Supramax were up slightly, rising 0.04% to 4.64%. Analysts use a percent […]

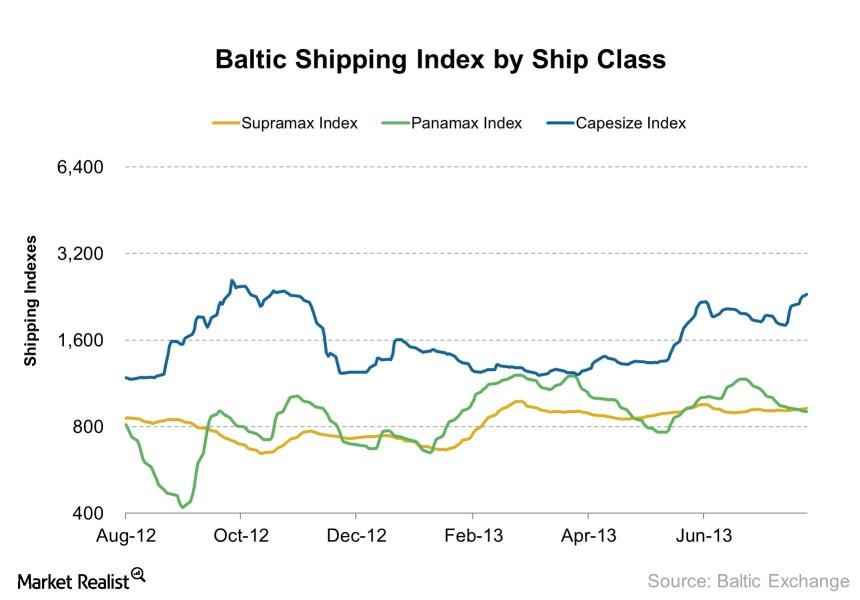

Why shipping rates for Capesize vessels continue to outperform

Investors can look forward to higher Capesize rates during the second half of this year compared to the first half, which is positive for dry bulk shippers.

Shipping stocks rise as Capesize rates approach $20,000

From August 23 to 30, shipping rates for Panamax, Supramax, and Capesize vessels stood relatively unchanged.

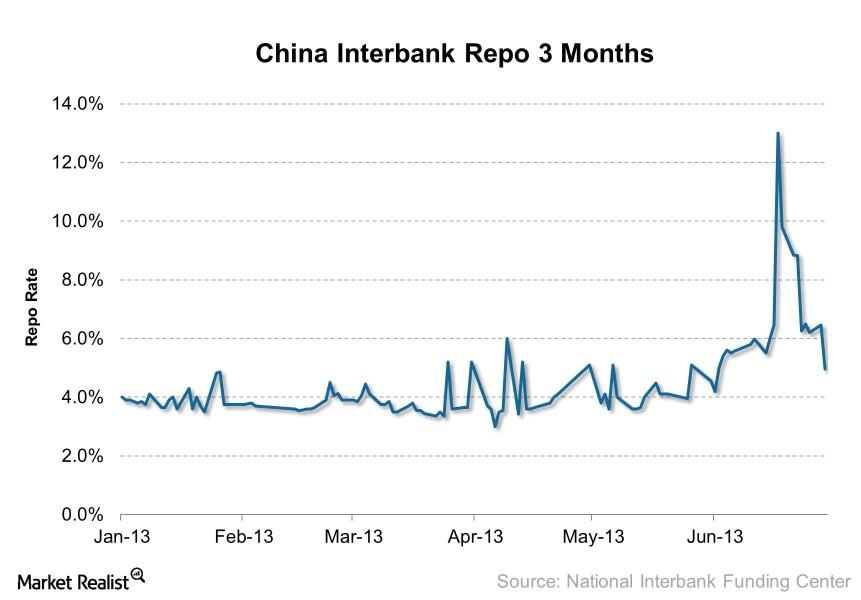

China’s interbank lending rate falls below 6.0%, positive for dry bulk shipping?

Update to Must-know: Shipping companies hit by China’s financial woes The impact of China’s financial industry The financial industry is an essential part of any economy. Without a stable financial system—one that supplies liquidity to businesses and individuals and bridges the gap between savers and borrowers—an economy can’t function as efficiently and productively as it […]

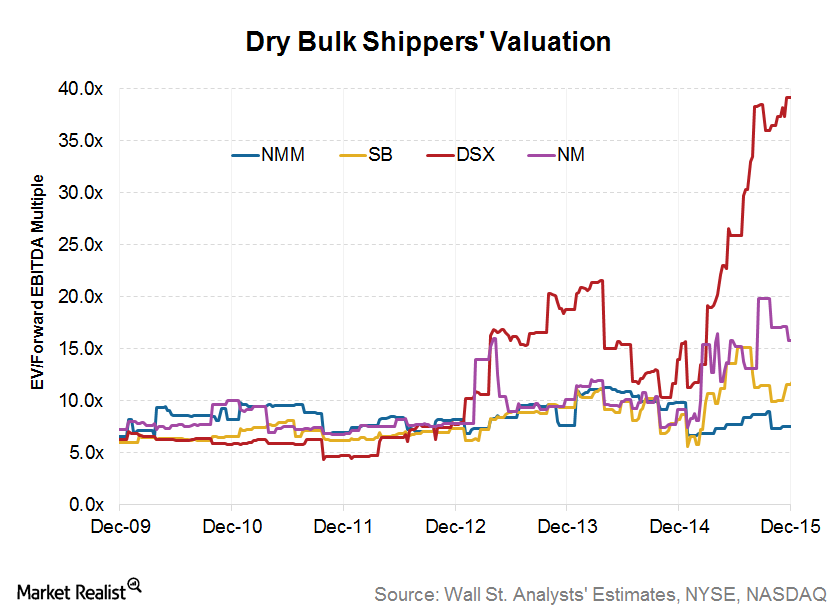

The Relative Valuation of Dry Bulk Companies

Diana Shipping is proactively investing in vessels to take advantage of the current low point for vessel valuation, and it can most likely outlast a prolonged downturn. So its valuation appears more or less full.

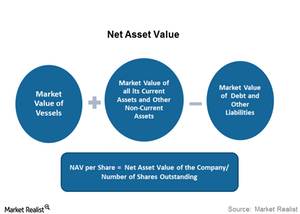

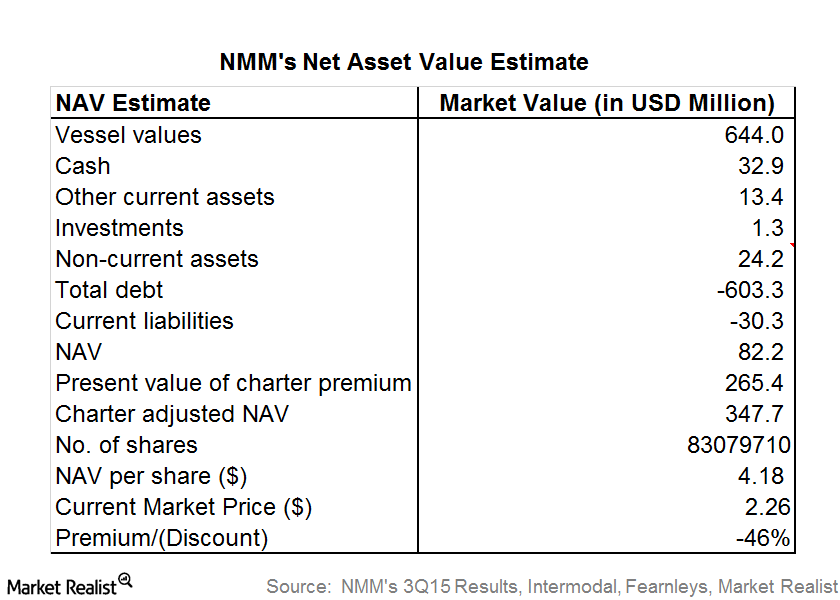

How Does Net Asset Value Measure Navios Maritime’s Valuation?

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities.Industrials Lower dry bulk ship supply growth is a catalyst for higher rates

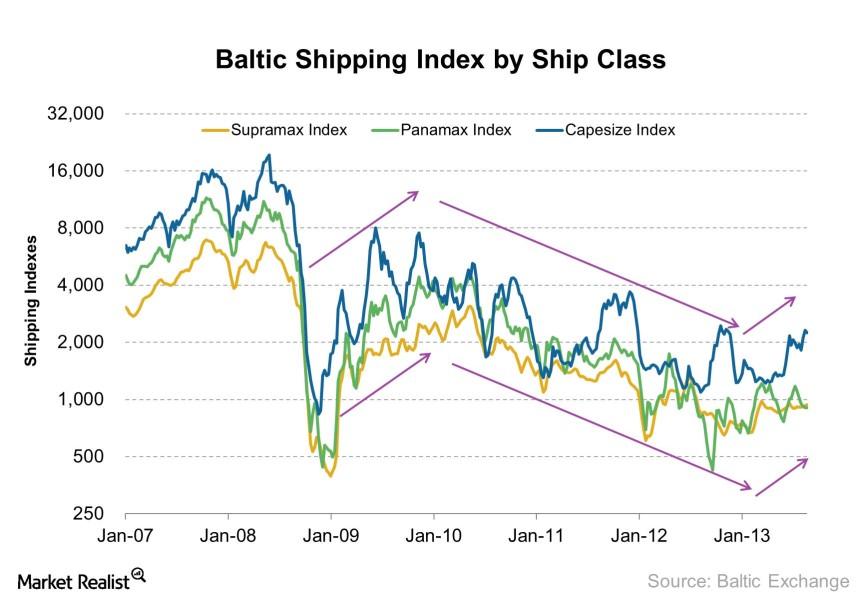

Why is capacity important? Analysts evaluate capacity growth to see whether it will exceed demand growth, instead of solely relying on indicators such as ship orders and ship prices that reflect managers’ perspective of future supply and demand dynamics. When capacity grows faster than demand, competition rises among individual shipping firms as they try to […]

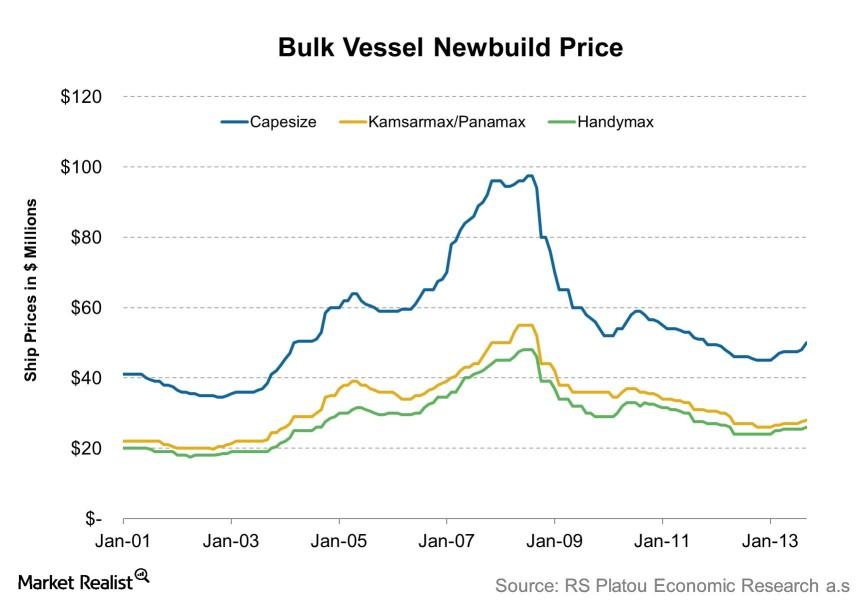

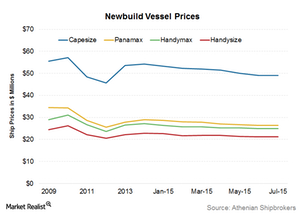

Higher new build prices mean higher dry bulk shipping share prices

What new build prices reflect The prices of new builds are useful indicators that reflect the dry bulk shipping industry’s future fundamental outlook. New prices often rise because of higher orders for ships. Usually, this is the result of managements’ speculation that future shipping rates (which can increase or stay the same from the current […]

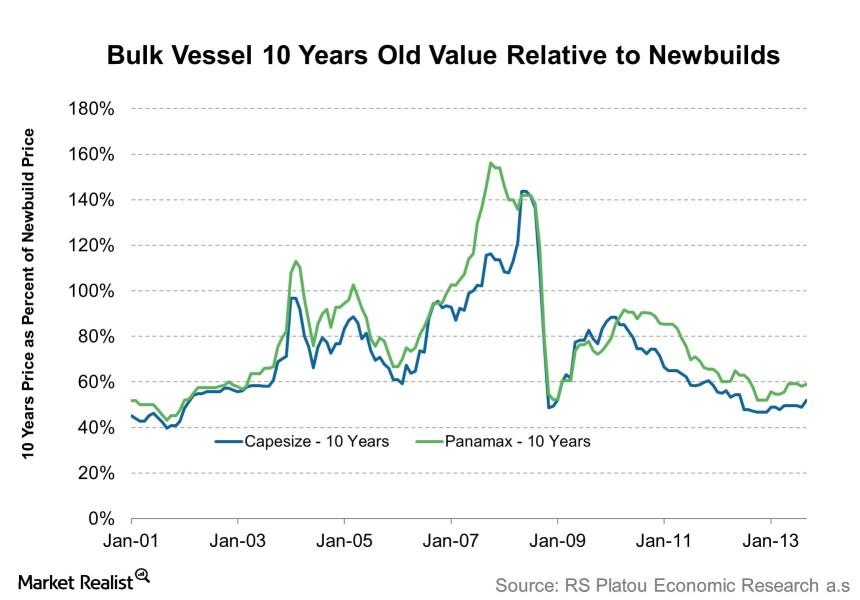

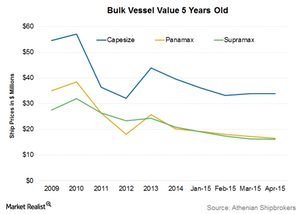

Why second-hand ship values suggest dry bulk shares will climb

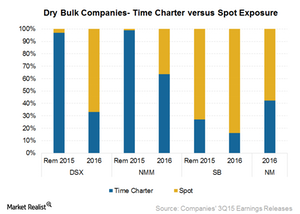

The significance of second-hand ship values The prices of older vessels are another indicator that reflects the fundamentals of shipping companies. Because these vessels are sold and bought in the secondary market, it doesn’t take as long for the buyer to receive these vessels. So price movements in older vessels often reflect nearer-term fundamental outlook […]Financials Why should you understand spot exposure and contract coverage?

There are two main types of contracts in the dry bulk shipping industry, spot charter contracts and time charter contracts.

Investing in dry bulk shipping: A must-read overview

This series covers key suppliers of various commodities in the seaborne market as well as indicators pertaining to economic and industry fundamentals.

CEO profile: Navios Holdings’ Angeliki Frangou helps NM and NMM

Angeliki Frangou has been Navios Maritime Holdings Inc.’s chairman and CEO since August 25, 2005.

How Does NMM’s Stock Compare with Its Adjusted Net Asset Value?

Navios Maritime Partners’ adjusted NAV (net asset value) shows that it is currently trading at a 46% discount to its NAV.

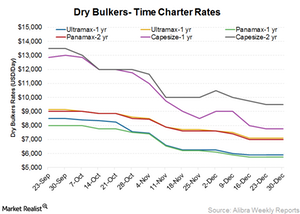

Dry Bulk Time Charter Rates Paint a Grim Picture

Time charter rates for dry bulk vessels have fallen considerably over the last few months. Capesize one-year rates have fallen by 40% in the last three months to $7,750 per day.

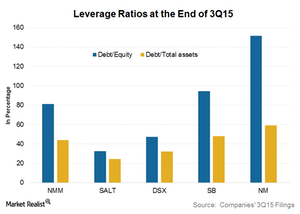

An Analysis of Financial Leverage for Dry Bulk Companies

Scorpio Bulkers (SALT) has the lowest financial leverage with debt-to-assets of 31.8% and debt-to-equity of 42.6% as of September 30, 2015. But this doesn’t give the full picture.

How Are Dry Bulk Companies Changing Their Chartering Strategies?

Navios Maritime Partners (NMM) and Diana Shipping (DSX) have a chartering strategy to charter the bulk of their vessels for the long term, thus holding high fixed-rate exposure.

Newbuild Vessel Prices Remained Steady in July

Newbuild vessel prices for all of the ship sizes remained constant in July 2015—compared to June 2015—according to data from Athenian Shipbrokers.

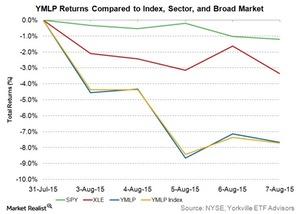

Why Did the YMLP ETF Fall Last Week?

The Yorkville High Income MLP ETF (YMLP) dropped 7.69% in the week ended August 7. The broad-market SPDR S&P 500 ETF (SPY) dropped 1.2%.

Secondhand Vessel Prices Continue to Fall

Secondhand vessels are delivered faster than newbuilds. As a result, secondhand vessels represent more of the short to medium-term outlook.

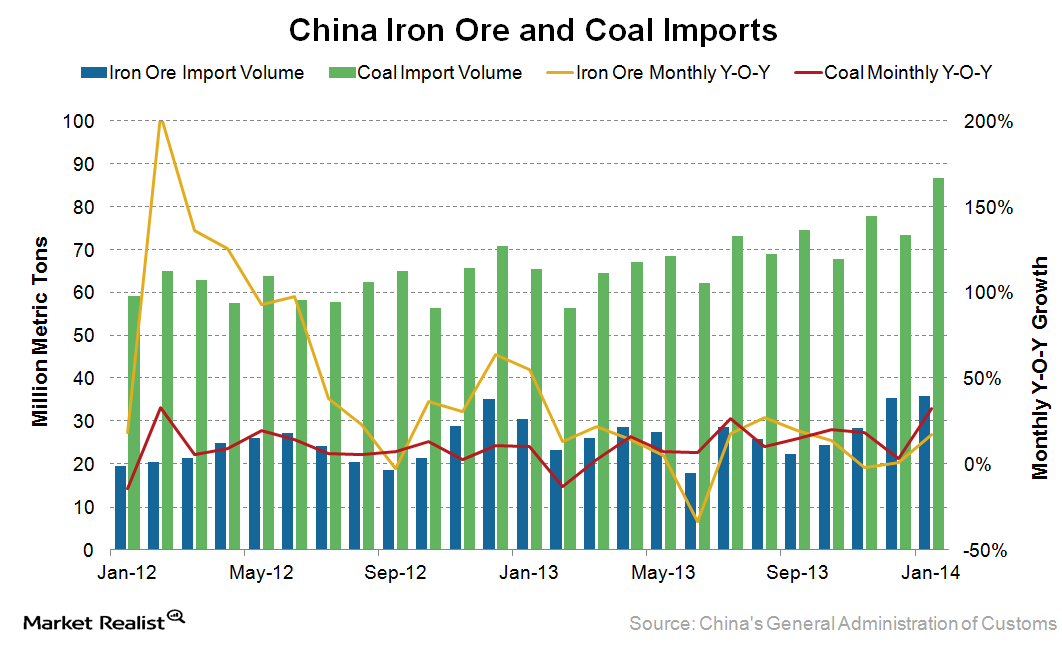

Why China saw high growth in iron ore and coal imports in January

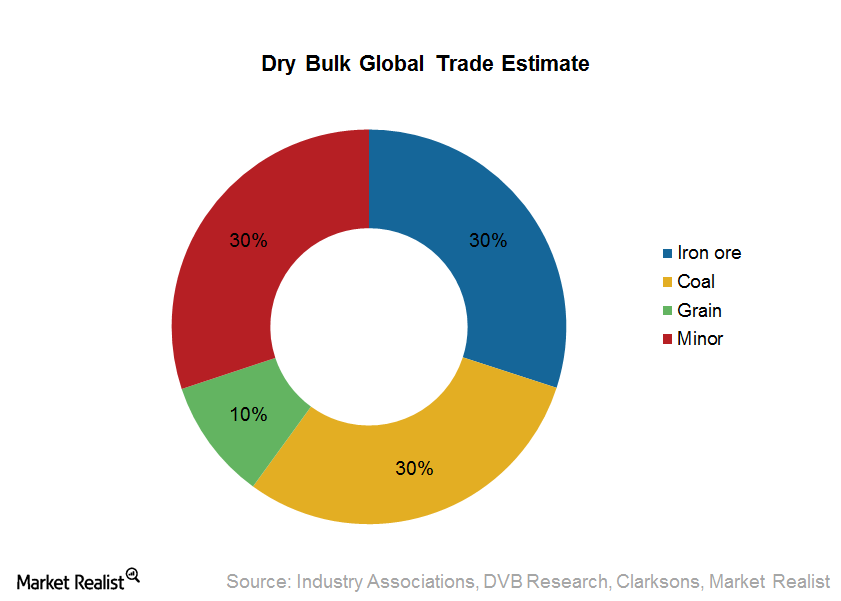

China’s iron ore and coal imports are key factors that drive shipping rates. Iron ore and coal each account for nearly 30% of the world’s dry bulk trade volume.