Intel Corp

Latest Intel Corp News and Updates

What Intel’s New Crypto Mining Chip Can Do for Blockchain Technology

Intel just launched its new Bitcoin (BTC) mining chip, a small element that could make a huge difference in the state of blockchain technology.

Intel's Mobileye Self-Driving Unit Plans to Go Public

Self-driving system manufacturer Mobileye plans to go public after a recent filing. Why did Intel purchase Mobileye in the first place?

Intel's New Ohio Facility Could Be the World's Biggest Chip Factory

Intel has chosen New Albany, Ohio, as the location for its new multi-billion dollar chip manufacturing plant. Here are all of the details about the new plant.

Pat Gelsinger Signed a Massive Deal When He Became Intel's CEO

The new Ohio facilities planned are quite an accomplishment for Intel CEO Pat Gelsinger, who took the helm in February 2021. What's Gelsinger’s net worth?

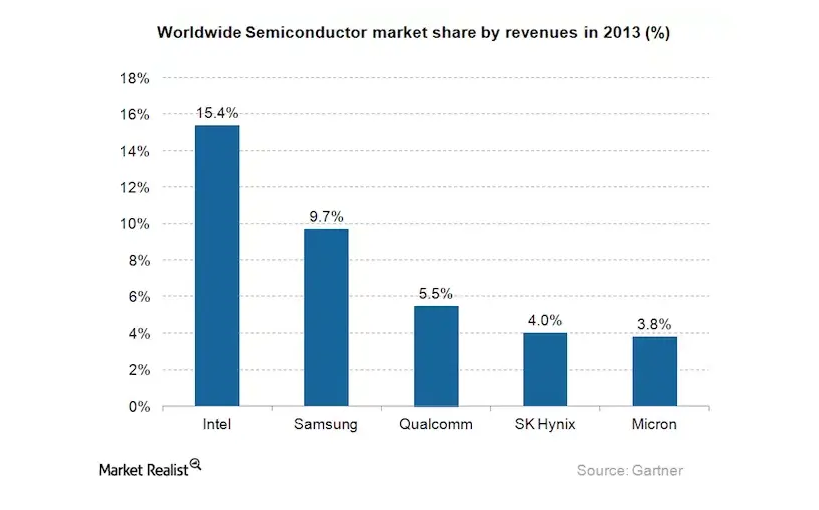

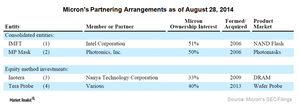

Overview: Micron Technology business segments

According to information technology research company Gartner, Micron held tenth position in the worldwide semiconductor market in 2012.

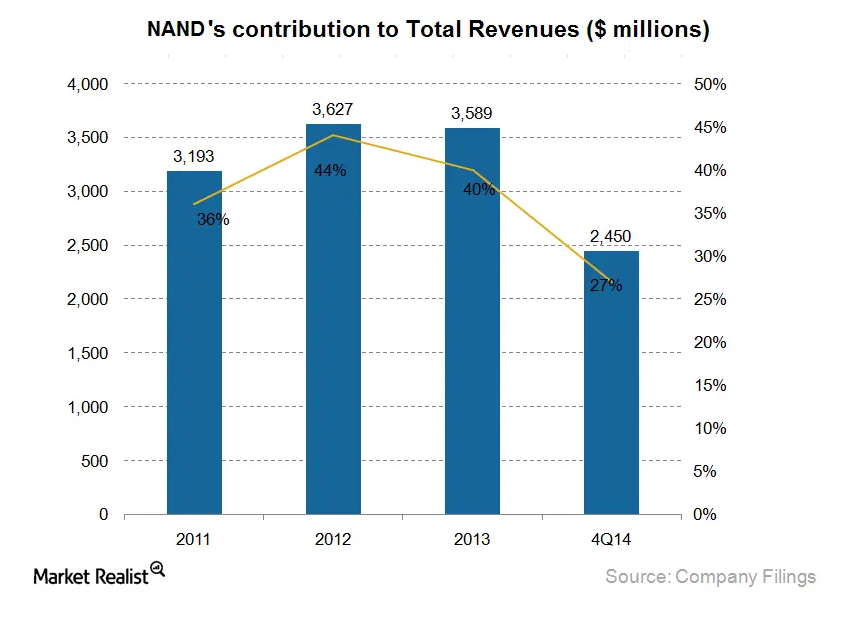

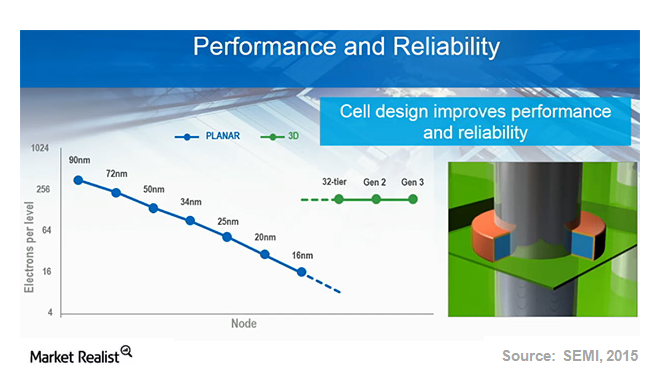

Why Micron’s NAND is an important business segment

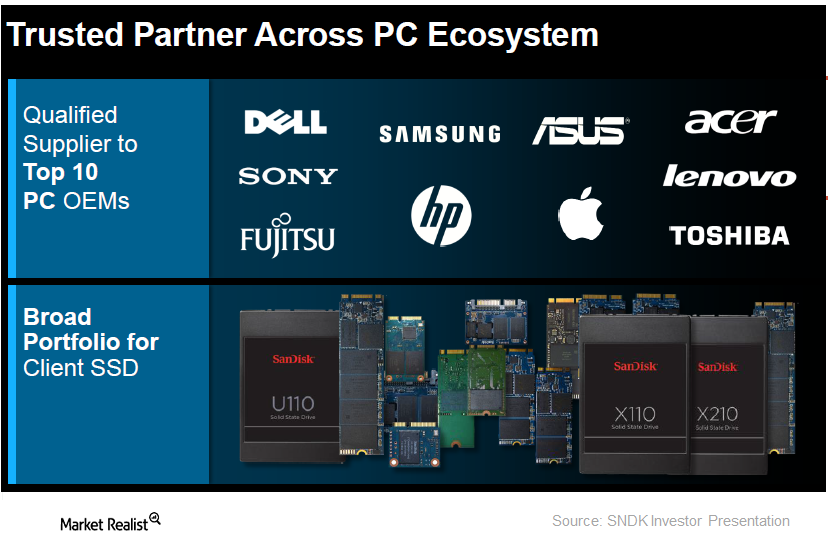

These products offer higher performance, reduced power consumption, and better reliability when compared to traditional hard disk drives. This explains the product’s popularity and rapid proliferation as a data storage medium.

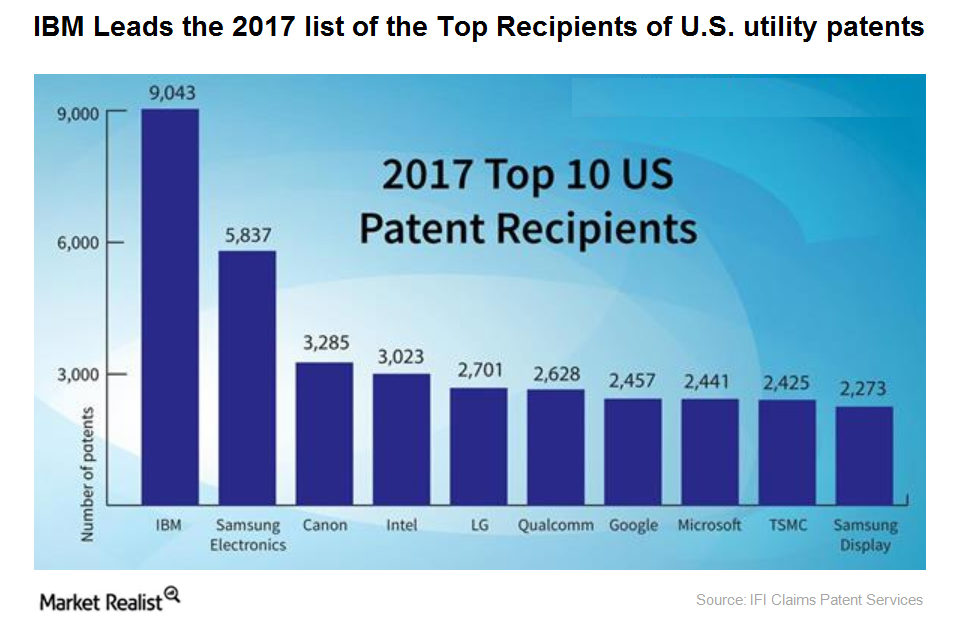

IBM Led Peers in Patents in 2017

Earlier in the series, we discussed IBM’s improved position in the cloud space due to its prowess in the hybrid cloud space.

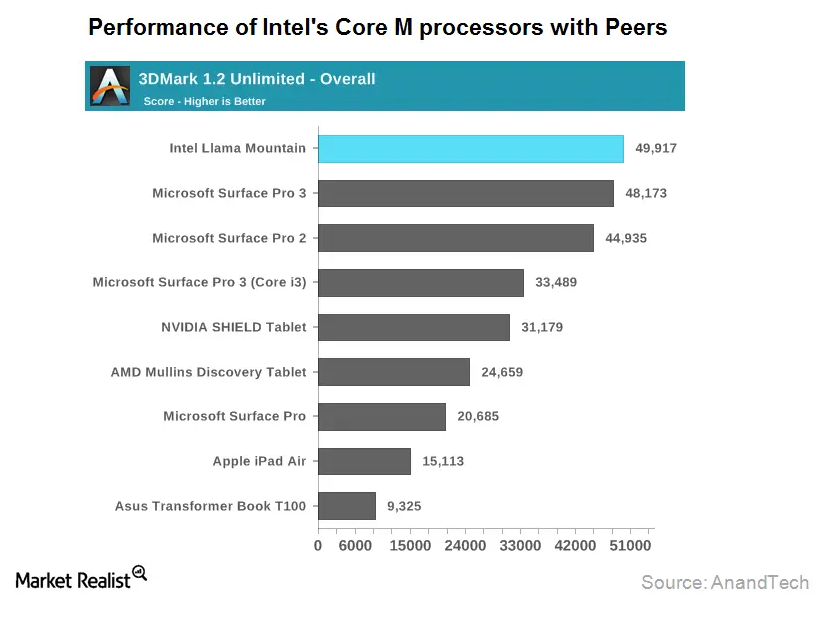

Why Intel’s tablet segment could get a boost from its Core M

Intel Core M processors, or Lama Mountain, are expected to be available by the end of October 2014. They should lead to more design wins for Intel.

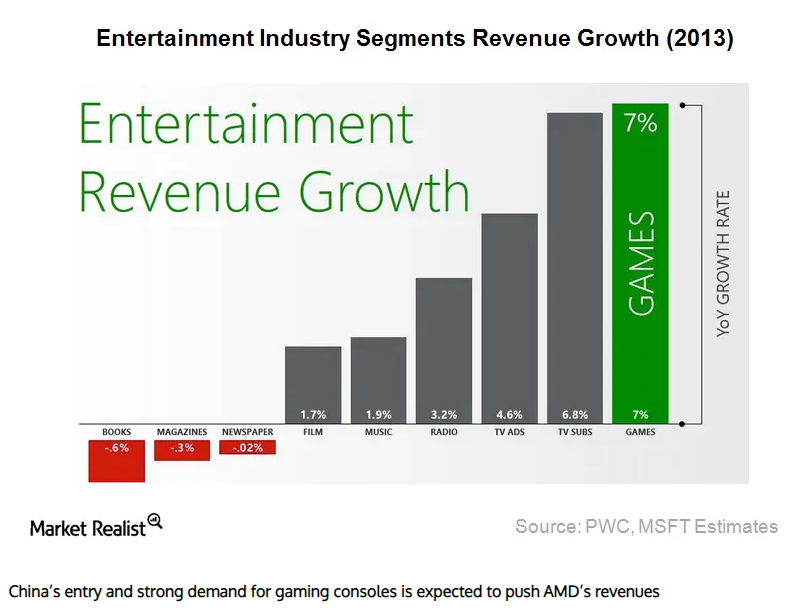

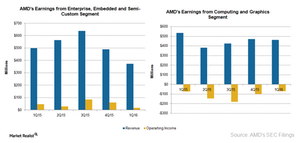

AMD’s semi-custom is a high growth market

AMD (AMD) provides customized silicon chip solutions to original equipment manufacturers (or OEMs). The chip solutions are found in a variety of products. They help product development.

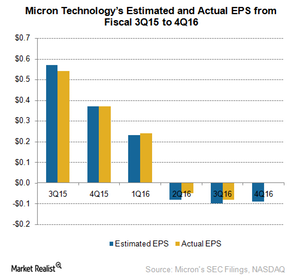

Micron’s Ability to Return to Profit Hindered by Market Forces

All market forces are in favor of Micron Technology (MU) and are likely to drive the company’s revenue up 10% sequentially in fiscal 4Q16.

Why Competition Is Heating up for NVIDIA in the AI Space

Many companies are shifting their focus toward AI, which has been increasing the competition for NVIDIA (NVDA).

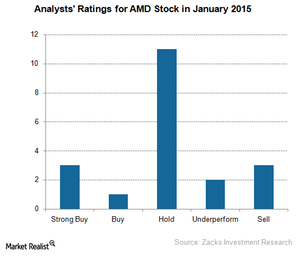

What Do Analysts Think about AMD Stock?

AMD stock has a consensus rating of “hold” and an annual price target of $2.43. The most bullish estimate is $5.00. The most bearish estimate is $1.50.

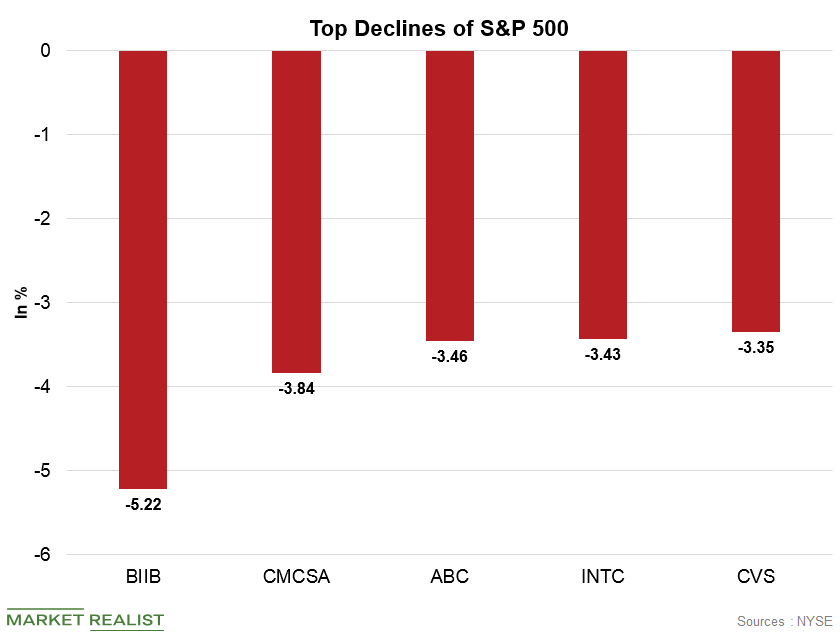

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

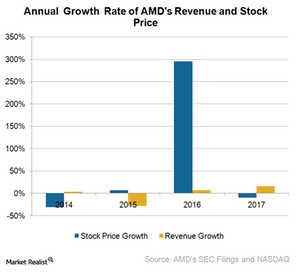

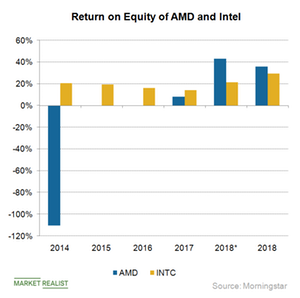

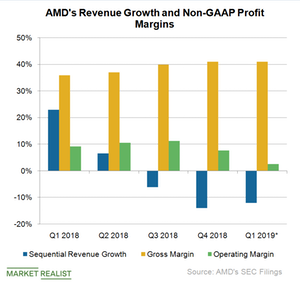

Where AMD Stands Today in the Tech Transition

Calendar 2017 was a turnaround year for Advanced Micro Devices (AMD) as it moved from losses to profits.

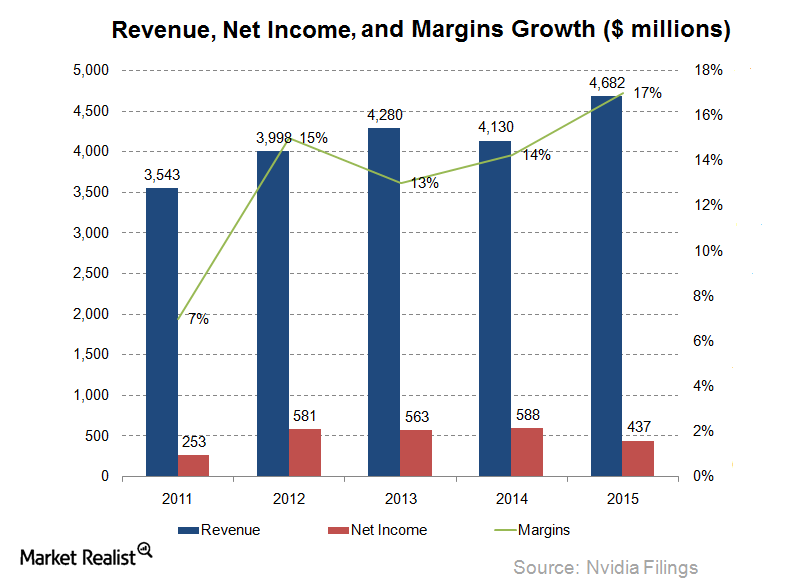

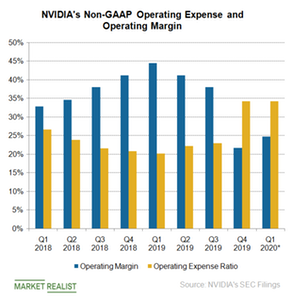

What margins, financials say about Nvidia’s growth prospects

PC gaming and accelerated computing played strong roles in the expansion of margins for Nvidia.

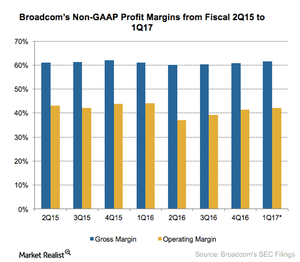

How Broadcom’s Acquisitions Could Improve Its Profitability

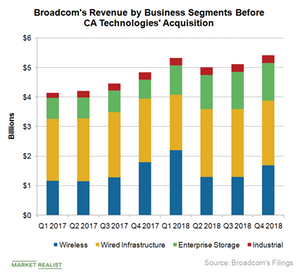

Broadcom’s profitability In the previous part of this series, we saw that Broadcom (AVGO) is likely to witness seasonal revenue decline as demand in its wireless segment, its second largest, falls. While revenue depends significantly on external factors such as customer demand, the pricing environment, and competition, profitability depends on internal factors such as cost control and product […]

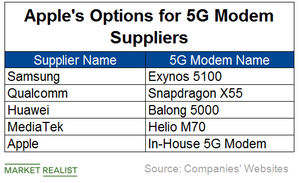

5G Technology: The Main Driver of Qualcomm and Apple’s Settlement

Apple (AAPL) is the second-largest handset maker in the world after Samsung (SSNLF), and it earns more than 60% of its revenue from iPhones.

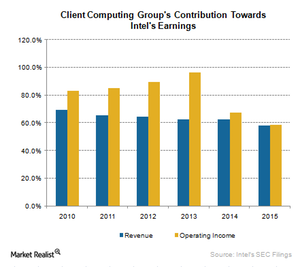

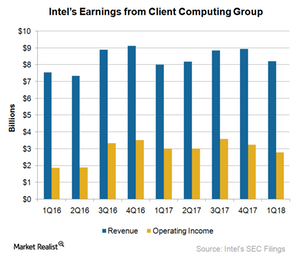

Slowing PC Shipments Hit Intel’s Earnings

As the PC demand slowed, Intel started reducing its exposure in the CCG segment.

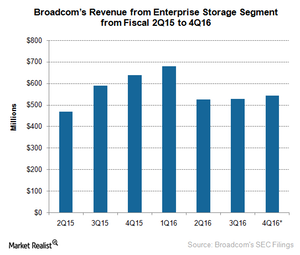

What Are Broadcom’s Plans for Its Enterprise Storage Business?

Broadcom’s latest acquisition of Brocade should double the size of its Enterprise Storage segment, which currently accounts for 13% of its revenue.

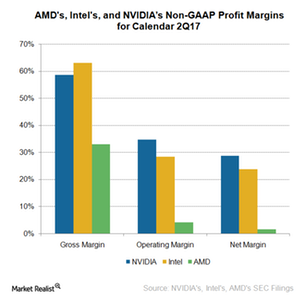

Where NVIDIA’s Margins Stand next to Those of Intel and AMD

NVIDIA’s profit margins NVIDIA (NVDA) has been increasing its revenue while controlling its expenses, resulting in improved profitability and a high free cash flow of up to 20% of its total revenues. Gross margin NVIDIA’s non-GAAP (generally accepted accounting principles) gross margin fell 90 basis points from 59.7% in fiscal 1Q18 to 58.6% in fiscal 2Q18 […]

AQR Capital increases stake in Intel

Intel generated ~$5.7 billion in cash from operations. The company paid quarterly dividends of $1.1 billion and repurchased 122 million shares for $4.2 billion.

Micron Targets 3D NAND to Raise Its Visibility in the NAND Space

Micron (MU) in its fiscal 3Q15 presentation stated that it plans to start volume production of 3D NAND by the end of 2015.

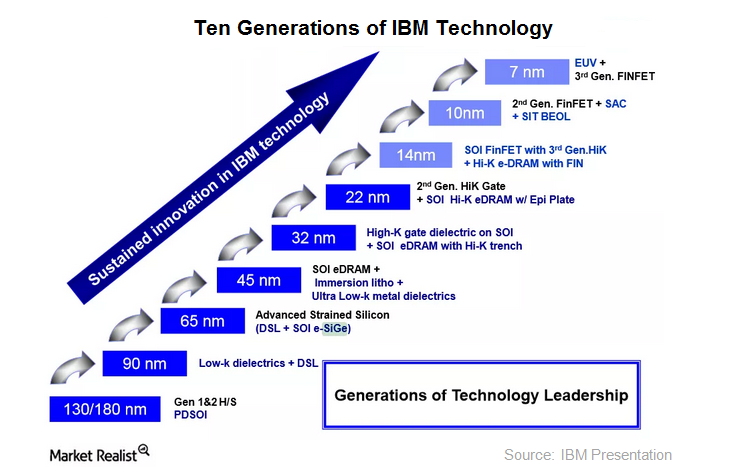

Why Have IBM’s 7-nm Chips Created Such Excitement?

With the development of 7-nm chips, IBM has surpassed Intel, which is still working on 10-nm chips.

NVIDIA Broadens Software Stack to Maximize Data Center Returns

NVIDIA (NVDA) has differentiated itself from other computing accelerator companies like Xilinx (XLNX) and Intel’s (INTC) Altera by transitioning to being an accelerated computing platform company.

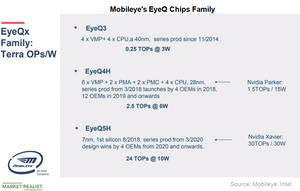

Progress Report: Intel’s Mobileye Business

Mobileye reported 37% year-over-year growth in the company’s second-quarter revenues as the adoption of its ADAS solutions increased.

How Will AMD’s Price Strategy Impact its Earnings?

In fiscal 1Q16, Advanced Micro Devices reported strong guidance for fiscal 2Q16, whereas behemoths Intel and Qualcomm reported weak guidance.

Why AMD entered into a partnership with Synopsys

In September 2014, AMD (AMD) and Synopsys (SNPS) entered into a multi-year agreement. The partnership will give AMD access to a range of Synopsys’ intellectual property.

Will AMD’s Lisa Su Step Up as Intel’s Next CEO?

Intel’s (INTC) next CEO is a hot topic in the tech sector. Rumors suggest that the company plans to announce its new CEO before its fourth quarter of 2018 earnings release on January 24.

NVIDIA’s Operating Expenses Exceed Its Operating Profits

NVIDIA’s non-GAAP operating expenses increased 3% sequentially to $755 million in fiscal 2019’s fourth quarter as the company continued to invest in gaming, data centers, and automotive.

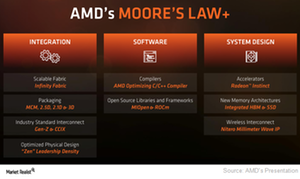

Chart in Focus: AMD’s Moore’s Law Plus Concept

AMD developed the concept of Moore’s Law Plus to drive future innovation.

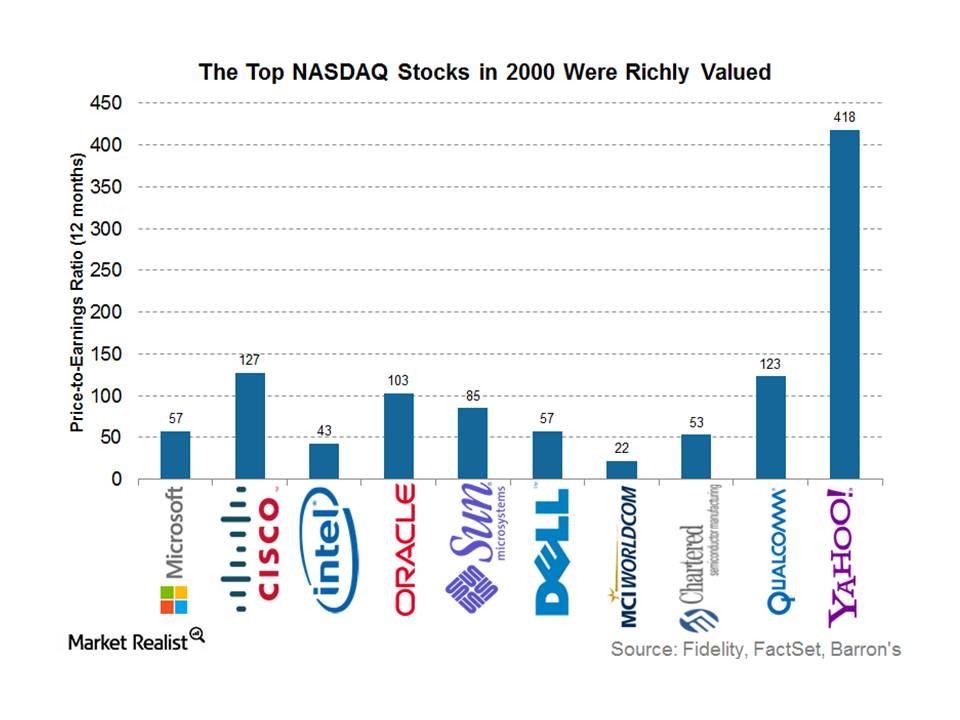

Dotcom Bubble 2.0? We Don’t Think So!

Although tech stocks have been buoyant in 2015, we don’t think that this means the advent of dotcom bubble 2.0. There are some key differences.

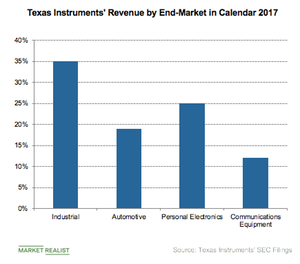

These Are Texas Instruments’ Future Growth Drivers

Texas Instruments (TXN) reported strong fiscal Q2 2018 revenue, and forecast slower-than-usual revenue growth for the third quarter as it increases its exposure to the more stable industrial and automotive markets.

What Efficiency Ratios Say about AMD’s Management

In 2018, AMD increased its capital spending by 44% to $163 million and net income by 400% to $514 million, resulting in a stronger efficiency ratio.

JAT Capital Eliminates Exposure to SanDisk Corporation

JAT Capital sold its position in SanDisk Corporation (SNDK) in 4Q14. The position had represented 1.2% of the fund’s third-quarter portfolio.

AMD Stock Rises on Intel’s Troubles

AMD stock has hit a 12-year high, rising 182% year-to-date. In contrast, the Market Vectors Semiconductor ETF (SMH) has risen 6.7% YTD.

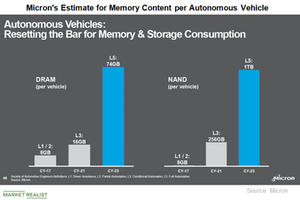

How Big Is the Autonomous Vehicle Opportunity for Micron?

The entire auto supply chain is working on developing the car of the future—the SDC (self-driving car), which is essentially a data center on wheels.

What Drove Broadcom’s Fiscal 2018 Revenue?

Broadcom (AVGO) has grown its business organically and through acquisitions.

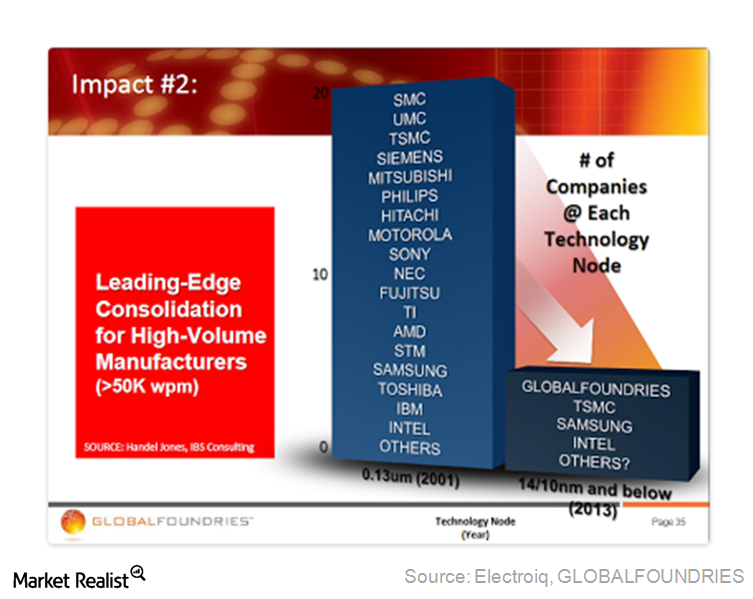

What Makes Micron a Key Player in Semiconductor Manufacturing?

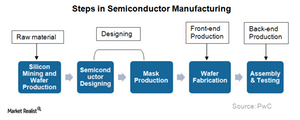

Semiconductor manufacturing is complex and involves design, fabrication, assembly, and testing. Building a fab requires investments of $3–4 billion.

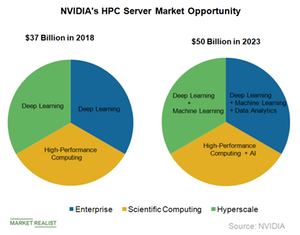

How NVIDIA Increased Data Center Revenue Ninefold in Three Years

NVIDIA’s data center business rose from just $340 million in 2015 to $3 billion in 2018.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

Intel’s CPU Supply Shortage to Negatively Impact Supply Chain

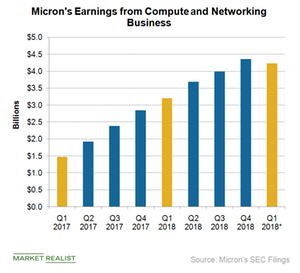

Micron expects its revenues to fall 4.0% sequentially to $8.1 billion at the midpoint in the fiscal first quarter of 2019, which ends on November 30.

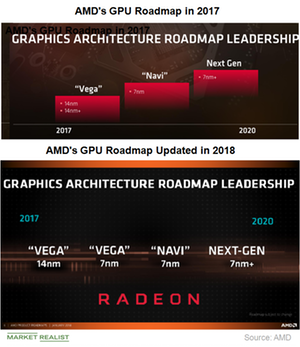

AMD Revises Original 2017 GPU Roadmap

Advanced Micro Devices (AMD) is progressing well in the CPU (central processing unit) market and might even overtake Intel (INTC) in manufacturing node technology.

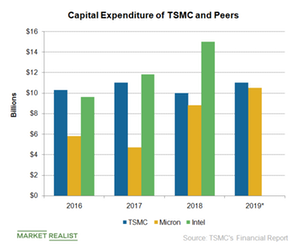

Advanced Nodes Increase TSMC’s Capital Expenditure

In the first three quarters of 2018, TSMC spent $6.7 billion in capital expenditure and is expected to spend $3.3 billion in the fourth quarter as it ramps up 7-nm production.

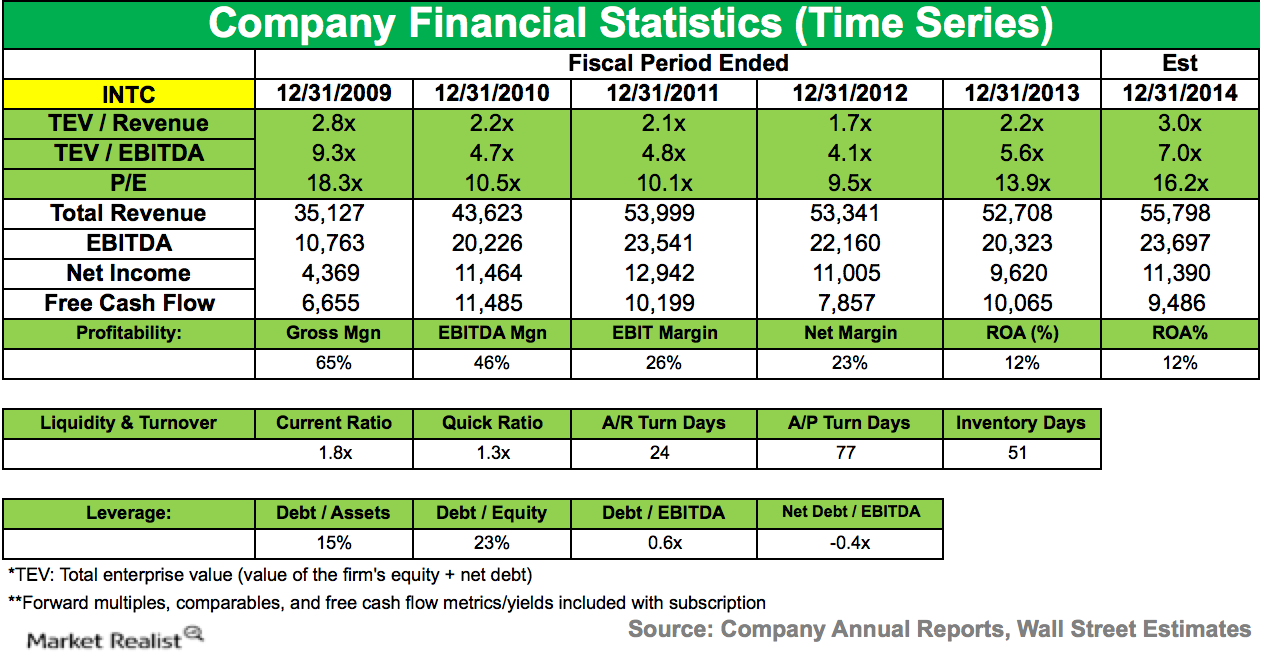

A Look at Intel’s Operating Efficiency

Intel’s (INTC) gross margin is declining, as the delay in volume production of the 10-nanometer process node has increased its production cost.

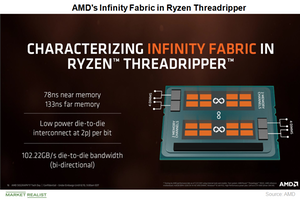

AMD’s Infinity Fabric Technology inside Ryzen Threadripper Two

Advanced Micro Devices (AMD) is using Infinity Fabric to leverage its Zen cores across low, mid, and high-end PC and server CPUs (central processing units).

An Instructive Rundown of Micron’s Business Strategies

Two business strategies that Micron can use to beat competition include innovating processes that reduce costs and developing next-generation products.

Why “big data” and IoT are important to Intel’s growth

In March 2014, Intel (INTC) announced that it invested $740 million in Cloudera—in return for an 18% stake ownership in the company.

Can Operating Leverage Keep AMD Profitable despite Weak Revenue?

In the fourth quarter of 2018, AMD’s operating expense rose 9.5% sequentially.

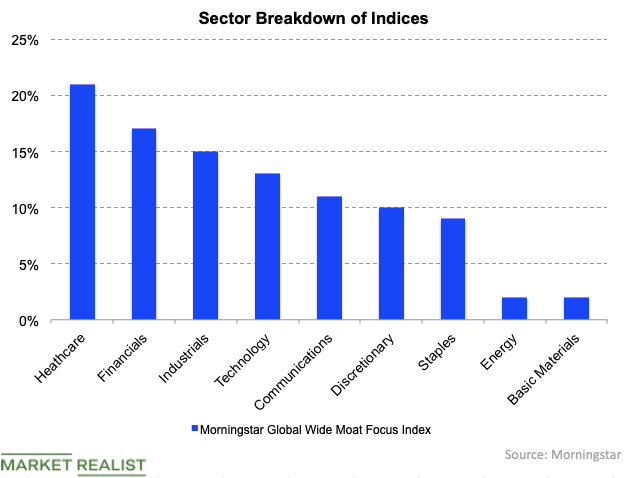

How to Invest in Global Wide Moat Stocks

The Morningstar Global Wide Moat Focus Index has global exposure, unlike the Morningstar International Moat Index (MOTI).

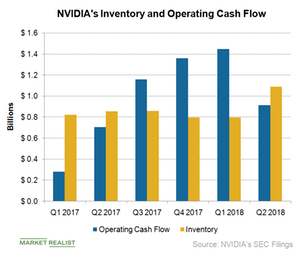

NVIDIA’s Curiously High Inventory Levels

After enjoying windfall gains from the crypto boom, NVIDIA (NVDA) has seen its profits normalize.