Intel Corp

Latest Intel Corp News and Updates

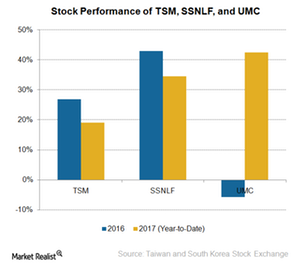

Who’s Betting on Foundries like TSM and SSNLF?

The performance of SME suppliers is a bellwether for the overall semiconductor industry’s outlook because these serve foundries and IDMs.

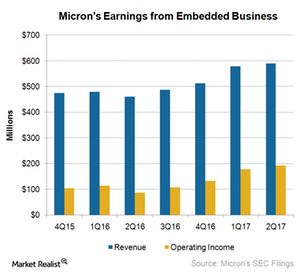

What’s the Role of Embedded Business in Micron’s Future Growth?

Micron’s EBU revenue rose 19% sequentially to $700 million in fiscal 3Q17 driven by high demand for its products across consumer, industrial, and automotive markets.

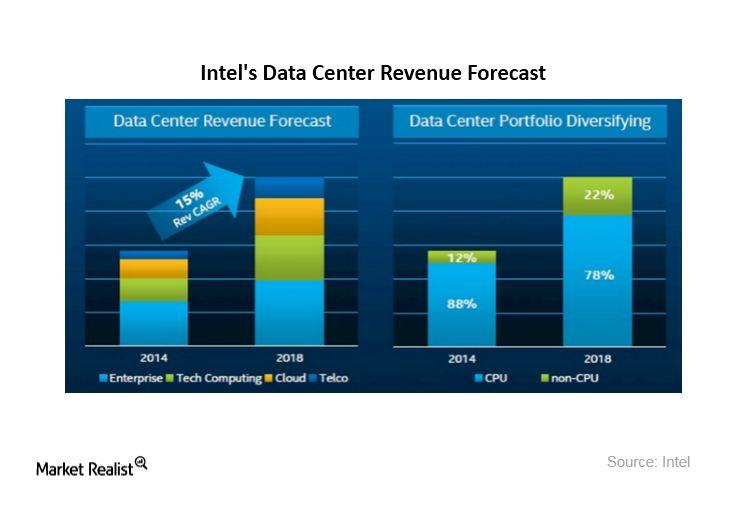

AMD Takes On Intel in the Data Center Processor Market

Intel controls more than 99% of the data center chip market.

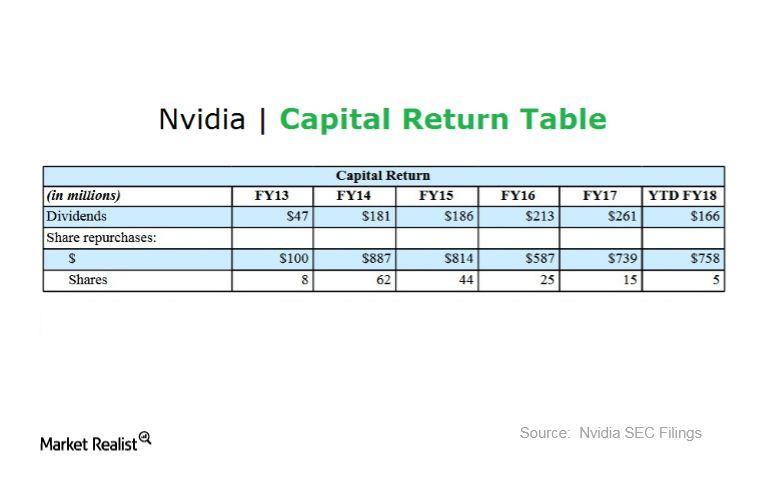

What It Means to Be a Nvidia Shareholder

In the first half of fiscal 2018 or fiscal 1H18, Nvidia distributed $166 million in dividends and repurchased shares worth $758 million.

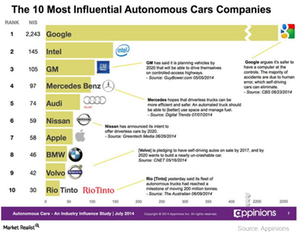

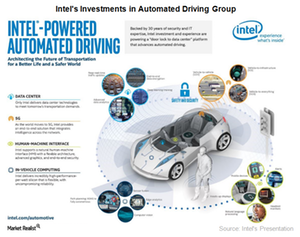

Where Intel Really Stands in the Autonomous Vehicle Market

Intel (INTC) is looking to become a complete technology solutions provider for automakers who want to enter the autonomous driving space.

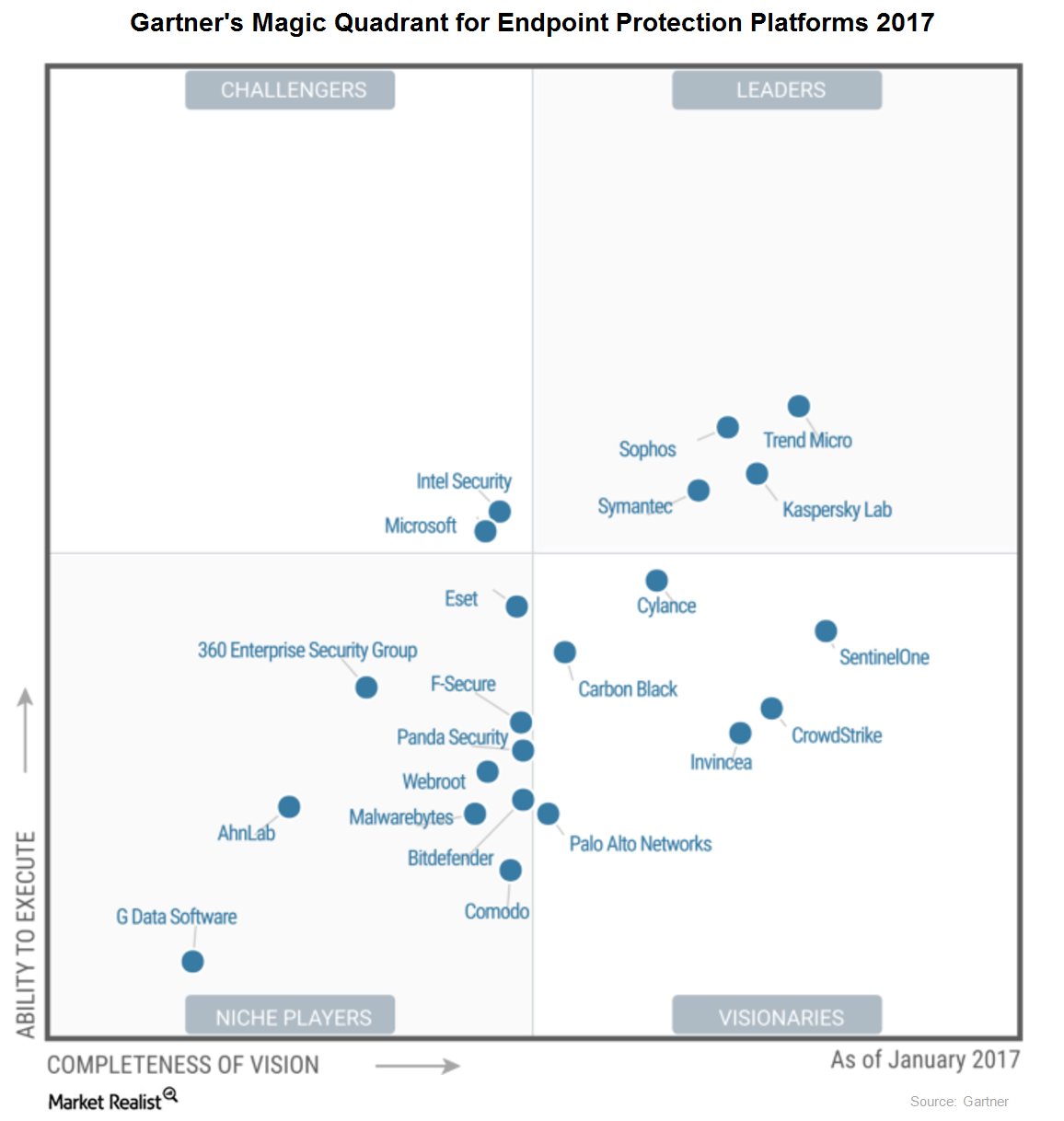

Why Symantec’s Enterprise Security Segment Is Inclined toward the Cloud

In late May 2017, Microsoft (MSFT) acquired Hexadite to strengthen its position in the cybersecurity space.

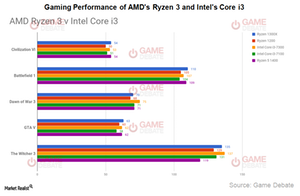

How AMD’s Ryzen 3 and Intel’s Core i3 Stack Up

Advanced Micro Devices (AMD) recently released its Ryzen 3 series for the budget PC (personal computer) segment.

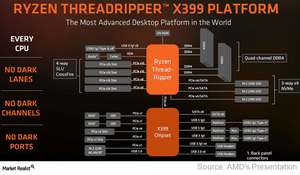

What Differentiates AMD’s Threadripper from Competition?

Advanced Micro Devices (AMD) has upped the core count of consumer CPUs (central processing unit) from the maximum of ten cores to 16 cores.

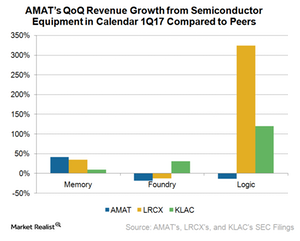

Is AMAT Losing Market Share to Lam Research and KLA-Tencor?

The emergence of the IoT (Internet of Things), self-driving cars, AR/VR (augmented/virtual reality), and AI (artificial intelligence) is driving demand for logic and memory chips.

Could NVIDIA’s Revenue Growth Result in a Higher Profit Margin?

For fiscal 2Q18, analysts expect NVIDIA to report earnings per share of $0.78, which marks a sequential decline of 8.2%.

Have Intel and Procter & Gamble Been Able to Increase Dividends?

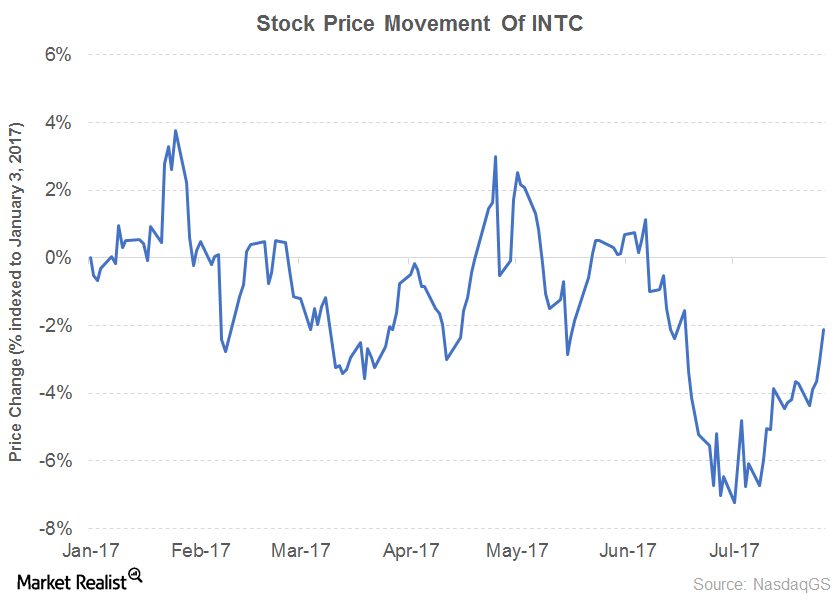

Intel (INTC) released its 2Q17 results on July 27, 2017. The company’s revenue and EPS for the first half of 2017 rose 8.5% and 72.0%, respectively.

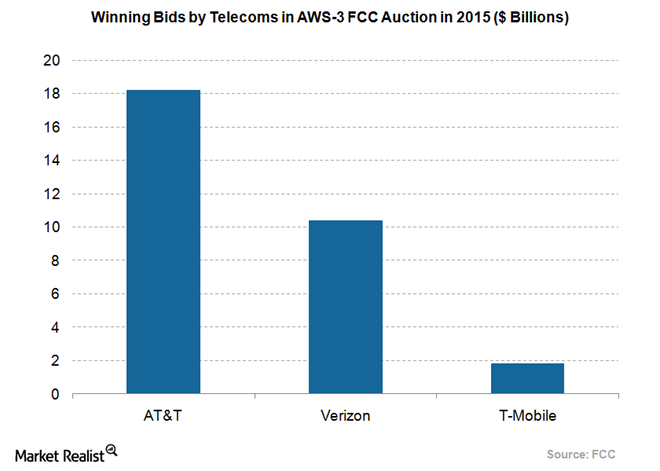

Chart in Focus: A Look at Verizon’s 5G Plans

Many wireless carriers are currently opting for 5G (fifth-generation) technology for network reliability and higher speeds.

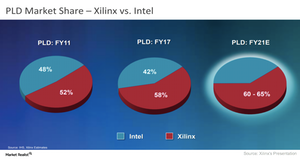

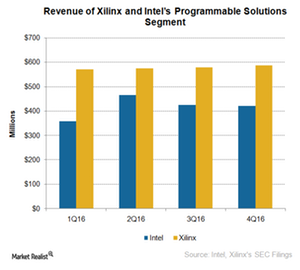

Xilinx versus Intel—A Competition of Scale and Technology

If Intel is not able to compete with Xilinx in terms of technology, it can compete in terms of price.

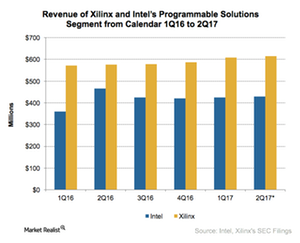

What’s Going on in Intel’s Programmable Solutions Group?

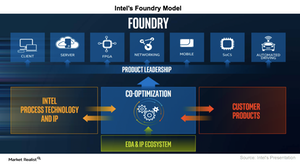

Intel is offering a full spectrum of AI solutions and several accelerators. The company’s journey in accelerated computing began with its acquisition of Altera in 2015.

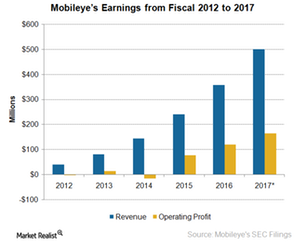

How the Acquisition of Mobileye Could Affect Intel’s Earnings

Intel (INTC) is acquiring Mobileye (MBLY) for $15.3 billion in order to grow in the autonomous vehicle market.

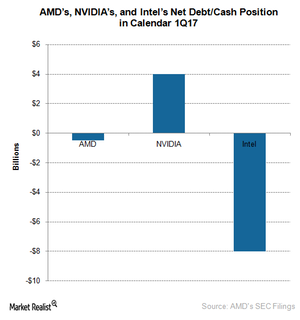

A Look at AMD’s Target Capital Structure

AMD’s target capital structure is to maintain a cash balance of up to $1.0 billion. Any amount above this figure would be used to repay debt, which currently stands at $1.5 billion.

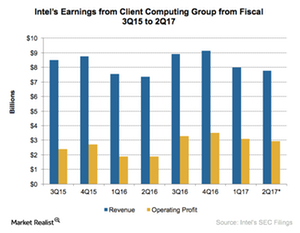

What’s Going on with Intel’s Client Computing Group?

Intel (INTC) is currently going through a phase of slow growth, which is threatening its top position in the semiconductor industry.

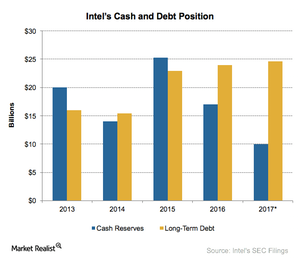

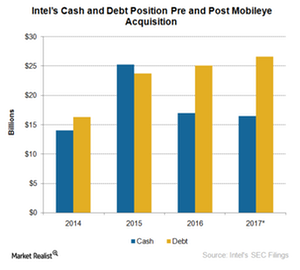

Should Investors Be Concerned about Intel’s Leverage?

Intel has long-term debt of $24 billion against cash reserves of $17 billion, resulting in net debt of $7 billion.

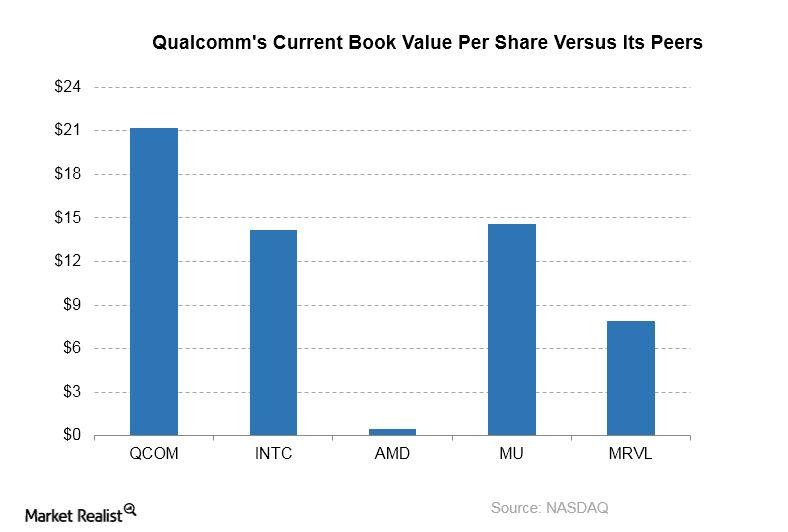

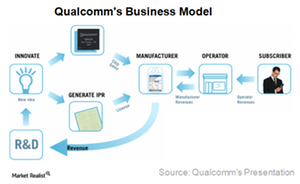

A Look at Qualcomm’s Valuation

Inside Qualcomm’s price and valuation multiples Qualcomm’s (QCOM) book value per share in 2016 was ~$21.20, compared with the expected book value per share of ~$20.60 in 2017. Qualcomm shares are trading at price-to-book value of ~2.7x. In comparison, Intel’s (INTC), Advanced Micro Devices’ (AMD), Micron Technology’s (MU), and Marvell Technology’s (MRVL) book values per […]

AMD Plans to Expand Radeon Vega GPU Lineup beyond Gaming

Advanced Micro Devices (AMD) has entered the high-performance GPU market with the launch of its Vega architecture.

AMD’s Ryzen Threadripper Challenges Intel in the Ultra-Premium PC Market

In response to AMD’s Threadripper, Intel announced an 18-core, 36-thread i9 processor for the very high-end market at the Computex Taipei show in Taiwan.

What Institutional Investors Think about Micron Technology

Currently, institutional investors own 81.1% and insiders own 0.69% of the total outstanding shares of Micron.

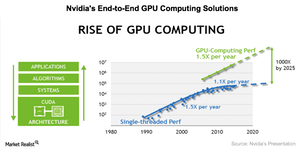

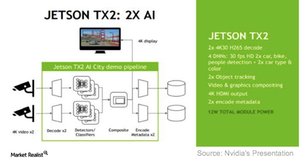

NVIDIA’s GPU-Accelerated Computing on the Rise

NVIDIA recently unveiled its unveiled its next-generation Volta GPU (graphics processing unit). In this series, we’ll look at the various growth opportunities NVIDIA is looking at to tap into GPU-accelerated computing.

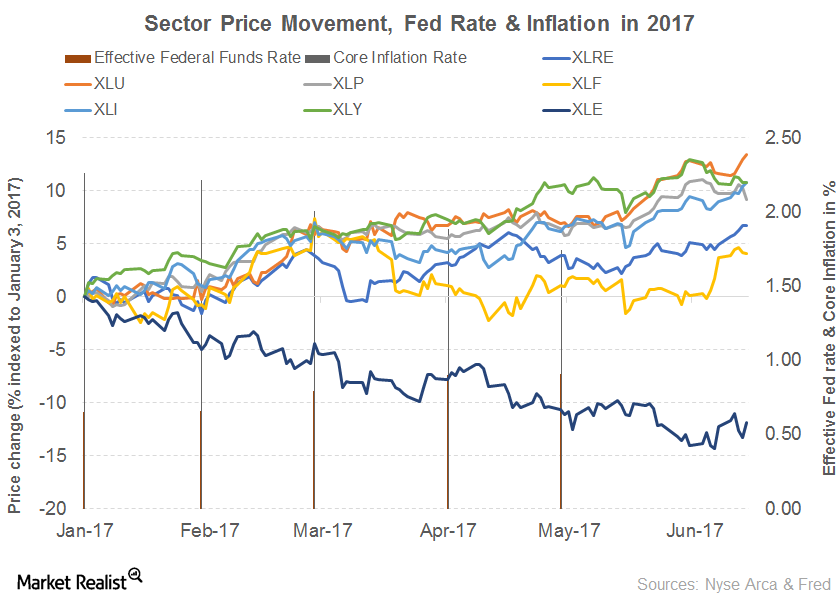

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

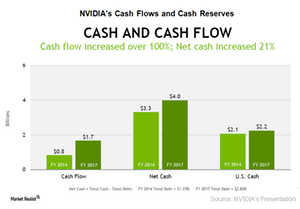

What NVIDIA’s Cash Position Says about Its Financial Health

NVIDIA’s operating cash flow fell 8.7% year-over-year to $282 million in fiscal 1Q18 as its revenues were hit by seasonal weakness. Its accounts receivables increased 87% YoY.

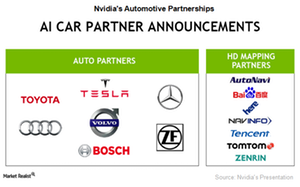

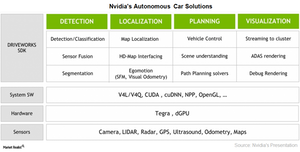

NVIDIA’s Strategy to Boost the Adoption of Autonomous Cars

NVIDIA is partnering with auto suppliers like Bosch, truck companies like PACCAR, and mid-tier carmakers like Toyota (TM) to increase the adoption of AI car platforms.

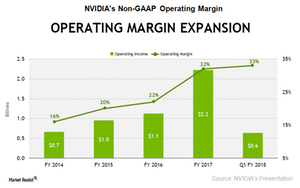

How Is Software Related to NVIDIA’s Operating Margin?

NVIDIA’s operating margin of 33% surpassed Intel’s (INTC) operating margin of 26% in 1Q17.

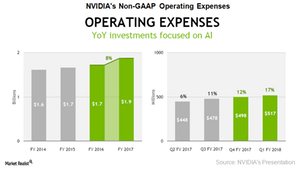

Why NVIDIA Is Increasing Its Operating Expenses in Fiscal 2018

NVIDIA’s non-GAAP operating expenses rose 17% year-over-year to $517 million in fiscal 1Q18. NVDA expects to increase its operating expenses to $530 million in fiscal 2Q18.

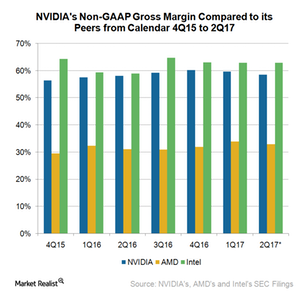

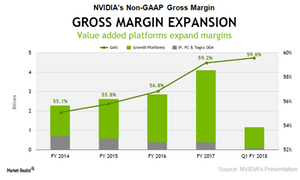

Factors That Could Drive NVIDIA’s Gross Margin in Fiscal 2018

NVIDIA’s non-GAAP gross margin improved from 57.5% in fiscal 1Q17 to 59.6% in fiscal 1Q18.

Why the Apple-Qualcomm Licensing Dispute Is Turning Nasty

In 2017, Apple sued Qualcomm for unfair licensing practices, accusing it of charging unfair royalties for “technologies they have nothing to do with.”

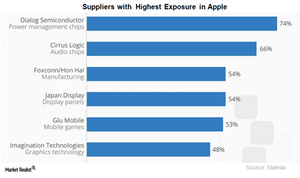

How Suppliers Are Reacting to Apple’s Dual-Sourcing Strategy

Apple (AAPL) sources its components from at least two suppliers in order to reduce risk and have negotiation strength.

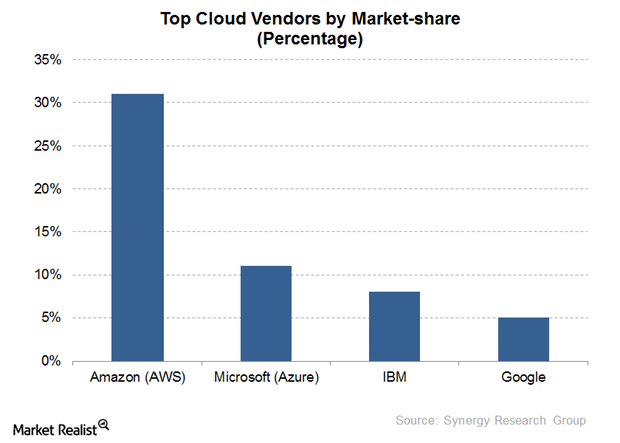

Qualcomm and Microsoft Join Hands to Challenge Intel

Microsoft has already agreed to partner with Qualcomm to develop server chips.

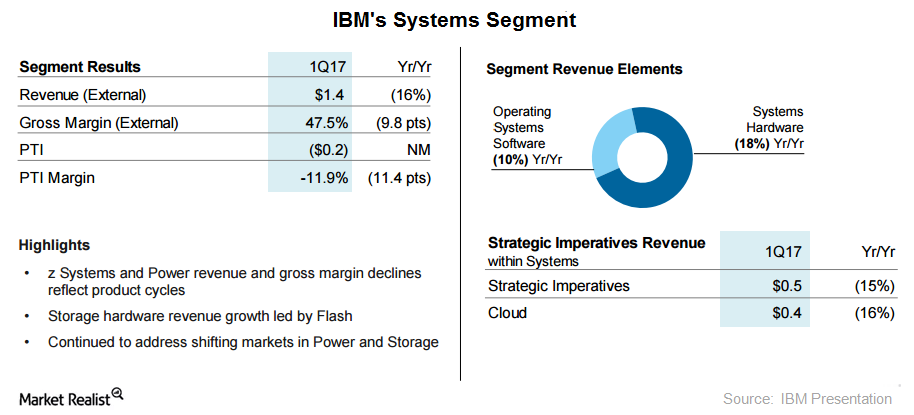

How IBM’s Systems Segment Has Been Performing

In this part of the series, let’s see how IBM’s (IBM) Systems segment performed in 1Q17. The Systems segment includes systems hardware and OS (operating system) software.

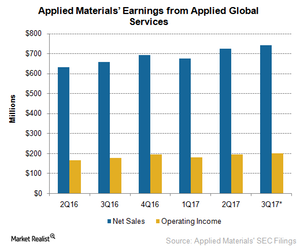

Applied Global Services Stabilizes Applied Materials’ Earnings

Applied Materials’ Applied Global Services segment Applied Materials’ (AMAT) Semiconductor Systems segment has seen strong growth as chipmakers transition to new material-intensive 3D NAND technology and 10-nm (nanometer) and 8-nm process nodes. The chipmakers may take some time to ramp up new technology and improve yield rates. Applied Materials’ AGS (Applied Global Services) team works in sync with […]

What Will Drive NVIDIA’s Professional Visualization Segment?

NVIDIA (NVDA) is developing products to support AI (artificial intelligence) adoption in the data center, embedded devices, and automotive spaces.

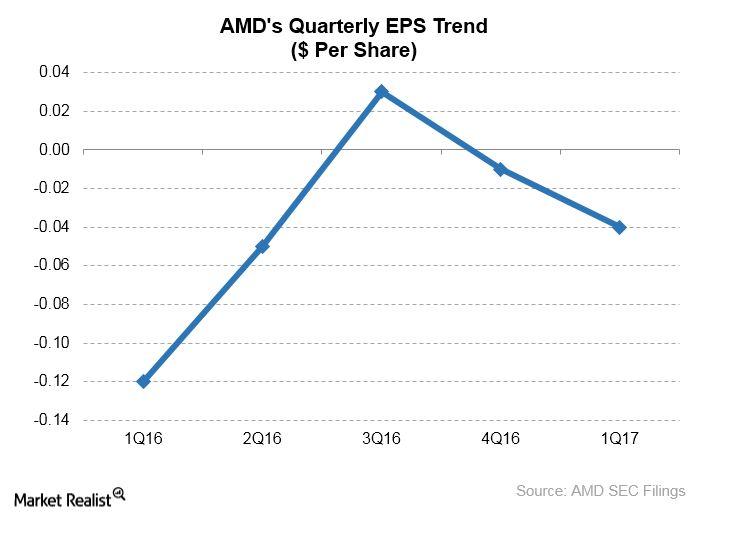

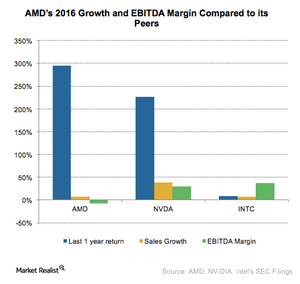

Are Advanced Micro Devices’ Innovations Paying Off?

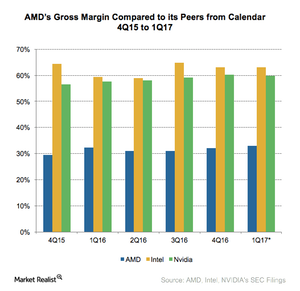

AMD’s 1Q17 revenues rose 18% to $984 million, which was in line with the consensus estimate.

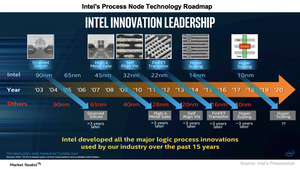

Behind Intel’s Foundry Business

Intel’s process leadership is seemingly unbeatable. Its upcoming 10nm (nanometer) node will contain double the number of transistors compared to Samsung’s and TSMC’s 10nm nodes.

Will Intel Continue to Benefit from Moore’s Law?

Intel’s (INTC) gross margin hasn’t improved much over the last two years because it’s been manufacturing chips on the same 14nm (nanometer) node since 2014.

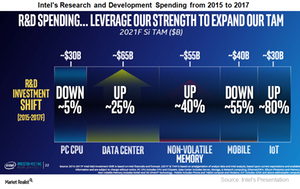

Behind Intel’s Transition into a Data-Centric Company

2017 started off slow for Intel (INTC) as it transitioned from being a PC-centric (personal computer) company to a data-centric company.

Why Is AMD’s Gross Margin Lower than Its Rivals’?

Advanced Micro Devices (AMD) is looking to improve its gross margin by entering the high-end market and ramping up Global Foundries’ (or GF) 14nm (nanometer) process node.

Why Did Goldman Sachs Downgrade AMD to a ‘Sell’?

Advanced Micro Devices (AMD) is growing beyond the game console market toward PC (personal computers), virtual reality, and data center technology with its new Ryzen CPUs.

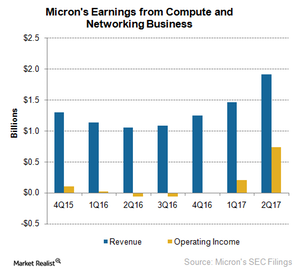

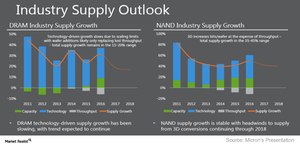

Inside Micron’s CNBU: Key Growth Drivers

The emergence of the data economy is creating new growth drivers for Micron Technology (MU) in every end market.

How Micron Technology Could Benefit from an Early Transition to 3D NAND

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

Could Intel Make the Mobileye Integration a Success?

Intel is looking to mitigate the integration risk by integrating its Automated Driving Group with Mobileye instead of integrating Mobileye into its business.

Intel’s History of Failed M&As: The Cause and the Impact

Intel (INTC) missed out on the mobile revolution, so now it’s trying to catch up, investing in areas such as autonomous cars and artificial intelligence.

Is Intel Taking a Huge Risk by Acquiring Mobileye?

The key risk Intel faces with the Mobileye acquisition is that Mobileye could fail to create an autonomous driving solution in time.

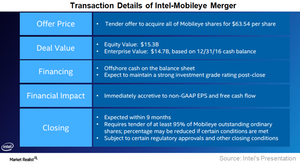

How the Mobileye Acquisition Could Impact Intel’s Earnings

Intel (INTC) is acquiring Mobileye (MBLY) for a hefty premium compared to MBLY’s earnings.

What You Need to Know about the Intel-Mobileye Merger

Analysts are criticizing the Intel-Mobileye deal. They think the acquisition price is too high and the synergies from the merger are too low.

Why Nvidia Stock Is Falling despite Strong Growth Ahead

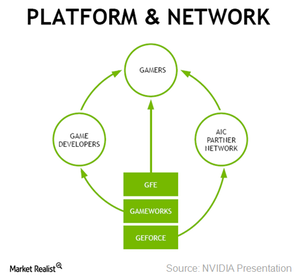

Nvidia’s (NVDA) move from GPUs to a GPU platform-based business model contributed to its exceptional growth in fiscal 2017. Nvidia’s earnings touched new highs as its revenues rose 38% year-over-year.

Where Is Intel Channeling Its Research and Development Efforts?

Intel (INTC) is in the midst of a major transformation, which makes Intel the top semiconductor R&D (research and development) spender in the world.