Intel Corp

Latest Intel Corp News and Updates

Understanding AMD’s PC Market Growth Strategy

Advanced Micro Devices (AMD) is set to launch its Ryzen desktop processors on March 2, 2017.

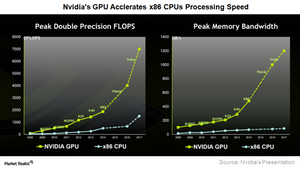

What’s Nvidia’s GPU Strategy for 2017 and 2018?

Nvidia (NVDA) has reported strong growth in fiscal 2017, thanks to Pascal GPUs.

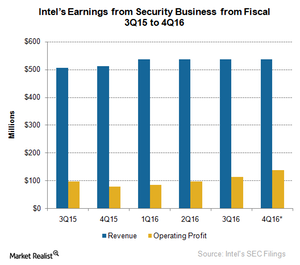

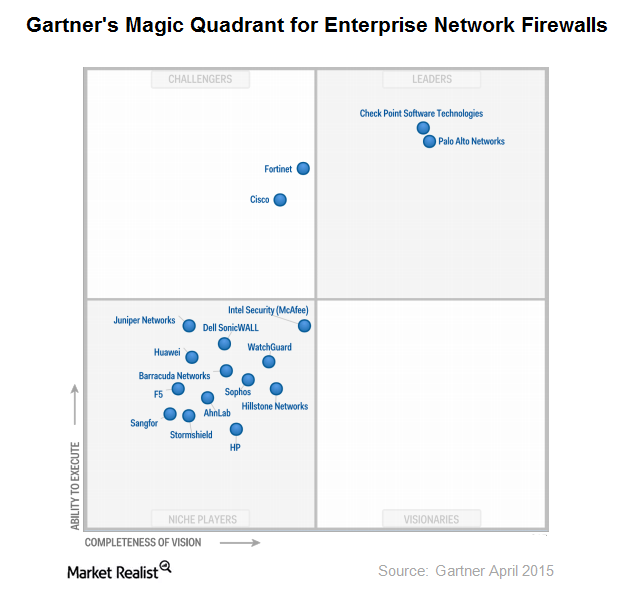

What Does Intel Security Group Have to Offer before Spin-Off?

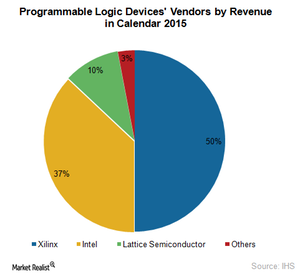

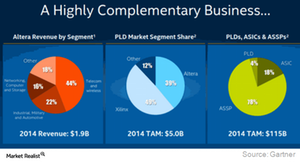

Intel (INTC) is falling behind Xilinx (XLNX) in the programmable solutions market.

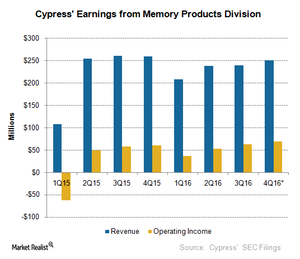

Cypress Depends on Memory Business to Improve Profits

Cypress Semiconductor (CY) is becoming a complete embedded solutions provider.

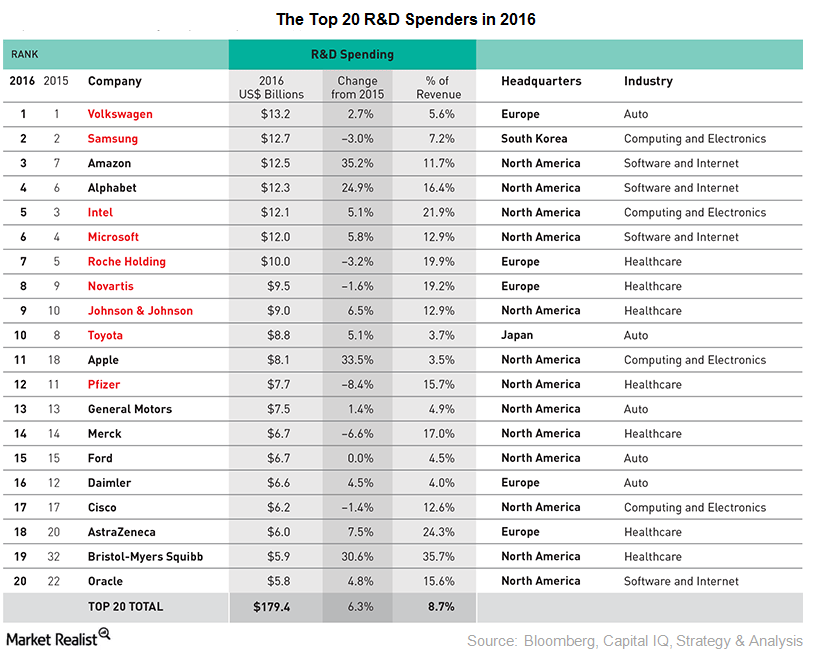

Why IBM Needs to Spend on Research and Development

IBM (IBM) spends ~6% of its annual revenue on R&D (research and development). In 2016, IBM spent $5.4 billion on R&D

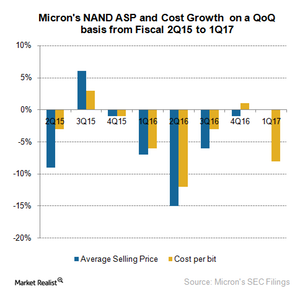

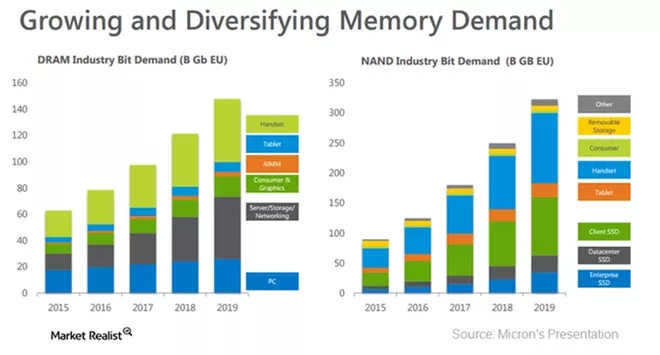

Is Supply Shortage in the NAND Market Good for Micron?

Micron expects the NAND industry’s supply to rise 38.0%–42.0% in 2017 as the transition to 3D brings technological challenges for manufacturers.

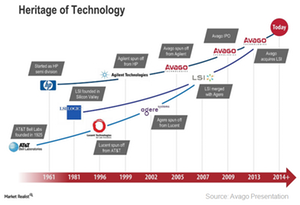

Does Consolidation in the FPGA Market Make Xilinx an Acquisition Target?

In the past, analysts have named Broadcom (AVGO), Qualcomm (QCOM), and Texas Instruments (TXN) as potential bidders for Xilinx.

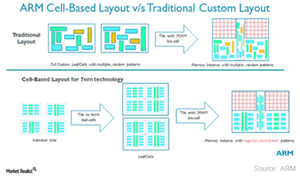

Xilinx Prepares Gears up with ARM’s IP

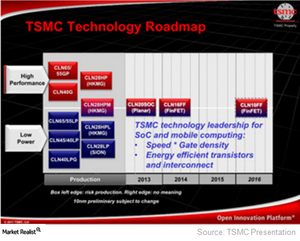

Xilinx (XLNX) is moving ahead of Intel (INTC), not only in FPGA (field programmable gate array) adoption but also in technology node.

How Does Xilinx Plan to Change the Future of Data Center with FPGAs?

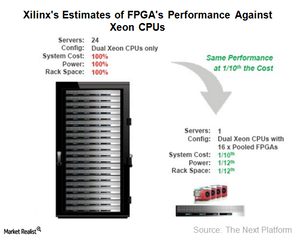

Xilinx believes that FPGAs (field programmable gate arrays) can bring more power savings than GPUs while delivering same computing performance.

How Is Intel Placed among Competitors in the IoT Space?

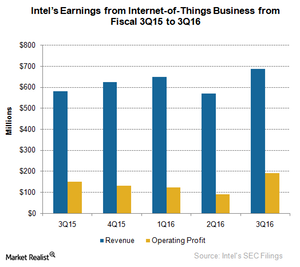

Intel’s IoT group revenues grew 19% year-over-year to $689 million in fiscal 3Q16, driven by strong demand from retail, video, and transportation.

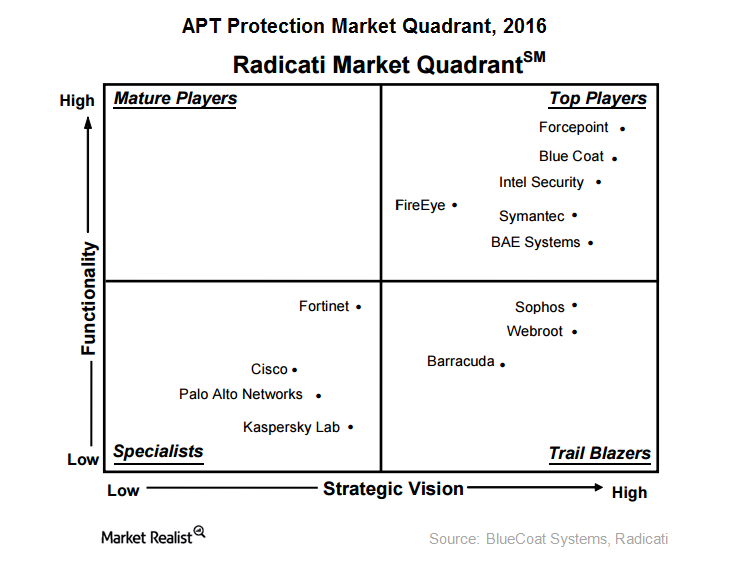

Why FireEye’s Leadership in APT Could Benefit Its Investors

An increase in cyberattacks, the proliferation of IoT, and the increasing requirement to deploy advanced security solutions should drive growth in the APT space.

What Is Intel’s Strategy behind Its Foundry Model?

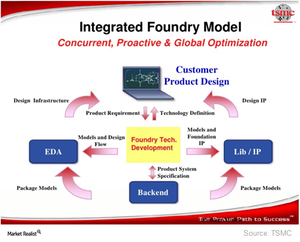

In fiscal 3Q16, Intel (INTC) partnered with ARM Holdings (ARMH) to provide foundry services for ARM-based chips. Intel announced another foundry partnership with Spreadtrum, but it did not identify the products that would be manufactured.

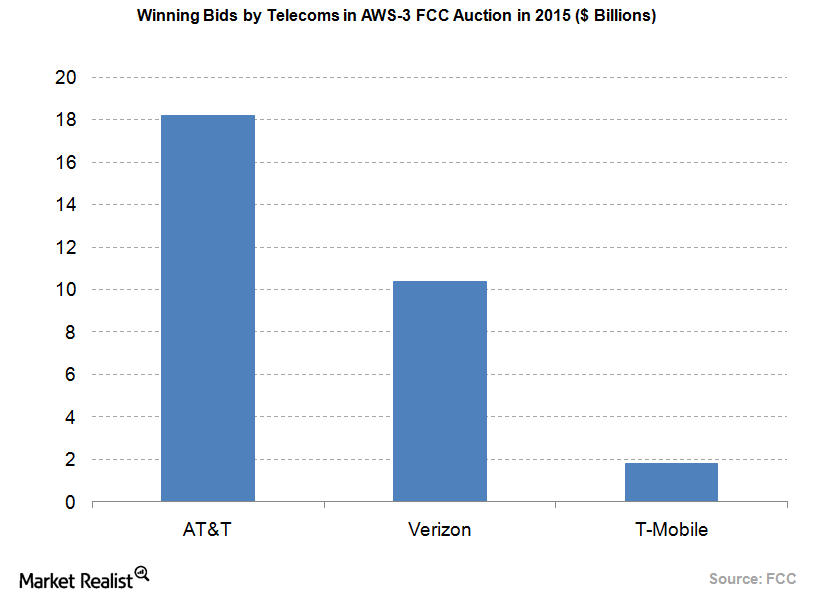

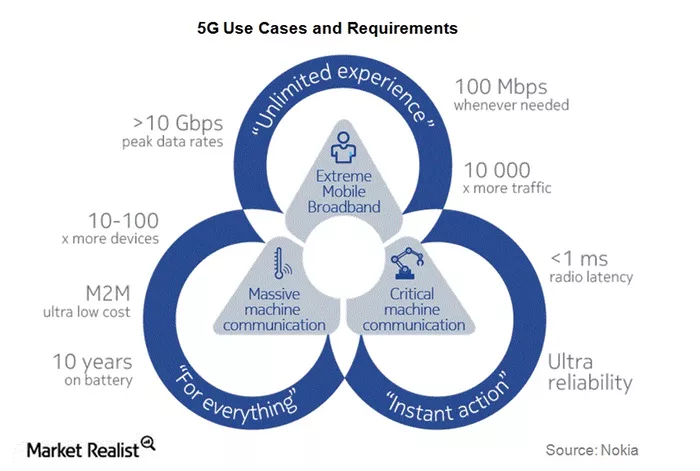

What’s Giving Verizon a Competitive Advantage in 5G Technology?

Verizon considers 5G to be a game changer. It also believes that 5G implementation will save costs for the company.

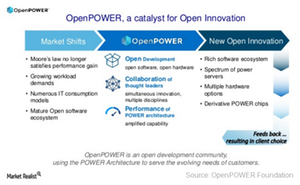

How Will IBM Compete with Intel in the Data Center Space?

In 2013, IBM decided to make its technology available to third parties and launched the OpenPower Foundation.

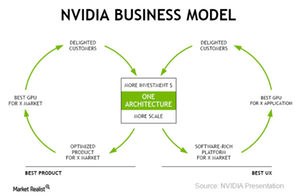

Nvidia’s Journey from a Startup to the Fastest-Growing Company

Nvidia (NVDA) is currently in a strong position with little competition to its GPU technology. However, it is at risk of entering into a price war with AMD (AMD), which might affect NVDA’s margins.

Broadcom: A Product of Several Mergers and Acquisitions

Mergers and acquisitions aren’t new for Broadcom. It has a history of successful M&As, and the most recent Avago-Broadcom merger is its biggest deal to date.

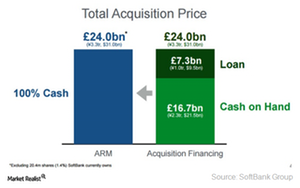

Inside the Key Financials Involved in the SoftBank-ARM Deal

In the biggest YTD semiconductor acquisition of 2016, SoftBank has offered to acquire UK-based designer ARM for a cash consideration of $32 billion.

Who Are the Major Players Targeting the 5G Space?

In March 2016, Cisco (CSCO) announced that it would collaborate with Ericsson (ERIC) and Intel (INTC) to develop the industry’s first 5G (fifth generation) router.

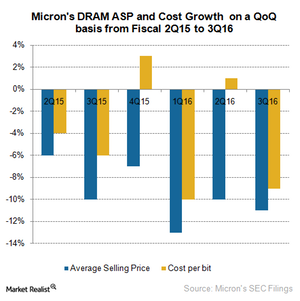

Falling DRAM Prices Reduce Micron’s DRAM Margin

The overall DRAM market is slowing and despite this, Micron increased its exposure in this space from 54% in fiscal 2Q16 to 60% in fiscal 3Q16.

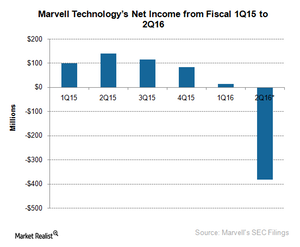

Marvell Hit by Several Internal and External Challenges

Marvell, a supplier of silicon solutions for storage, cloud infrastructure, IoT connectivity, and multimedia, has been making news for all the wrong reasons.

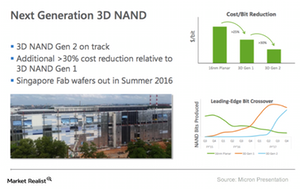

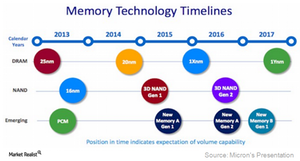

What the Investments of Micron and Other Suppliers in 3D NAND Capacity Could Mean

Micron is moving a step further and developing 3D NAND Generation 2 technology. It expects to bring this into production in fiscal 2Q17.

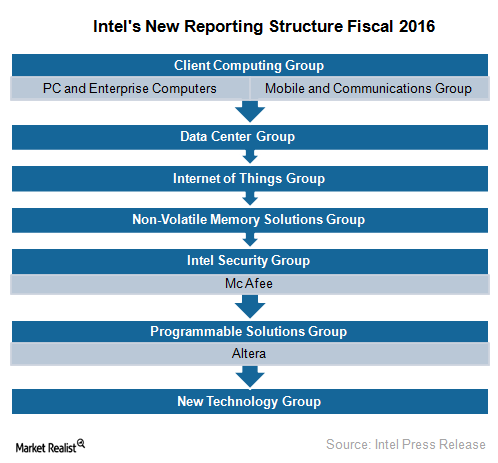

Intel Is a Blend of Acquisitions, Joint Ventures, and Organic Growth

Intel’s acquisitions mostly revolve around vertical integration where it integrates the acquired company’s technology into its microprocessors.

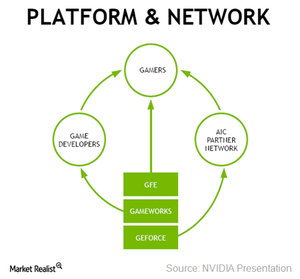

NVIDIA’s Strategy to Reach Out to a Larger User Base

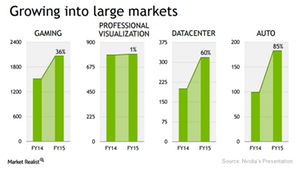

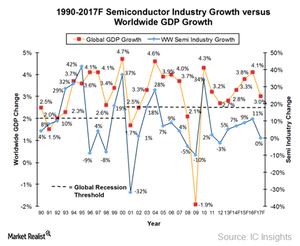

NVIDIA (NVDA) reported a 7% year-over-year revenue growth in 2015, a time when the semiconductor industry revenues fell by 2.3% YoY. At its 2016 Investor Conference, NVIDIA’s executives highlighted the company’s growth opportunities in terms of geography and new technology.

TSMC Has Accelerated Advanced Technology Development

TSMC is currently ramping up production of its 16nm technology. It expects to complete it by the end of fiscal 2Q16.

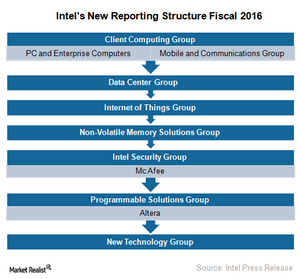

A Look at Intel’s New Reporting Structure

Intel is expanding its product portfolio to offer a comprehensive solution to its cloud customers such as Microsoft (MSFT).

NVIDIA Upgrades Its GPU Portfolio to Capitalize on Future Trends

NVIDIA (NVDA), a popular name among PC gamers, made news at the GTC (GPU Technology Conference) 2016 from April 4 to 7, 2016.

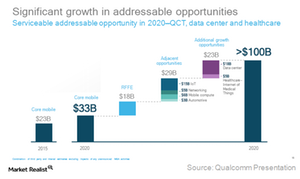

Qualcomm Is Targeting a $100 Billion Market by 2020

Qualcomm (QCOM) has stated that its total SAM (serviceable addressable market) is expected to grow from $23 billion in 2015 to about $100 billion in 2020.

Understanding Resilient Systems: IBM’s Latest Acquisition in the Security Space

Resilient Systems, a heavy hitter in the cybersecurity space, is best known for its “incident response” platform and is IBM’s most recent acquisition.

Gauging the Impact of the Microchip-Atmel Merger on Atmel Shareholders

On September 20, 2015, Dialog Semiconductor agreed to buy Atmel for ~$4.6 billion. But in December, Microchip made a competing bid of nearly $3.6 billion.

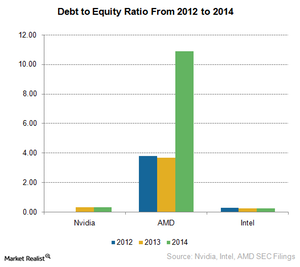

How Is Nvidia’s Capital Structure Compared to Its Rivals’?

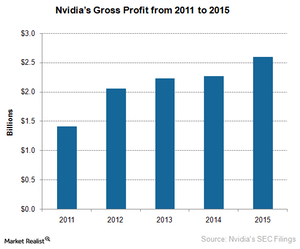

Nvidia’s free cash flow to net income ratio indicates that it has a strong capital structure to withstand headwinds and bear significant capital expenditure.

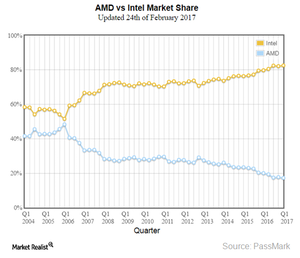

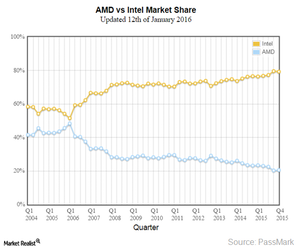

Intel and AMD’s Duopoly in the PC Processor and Server Market

AMD and Intel seem to have a duopoly in the PC processor and server market, with Intel accounting for more than 80% share in the PC processor space and a 99% share in the server space.

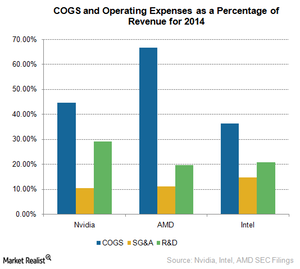

Is Nvidia’s Cost Structure Favorable for Investors?

Nvidia’s cost of goods sold is around 40% of its revenue, whereas Advanced Micro Devices’ COGS is more than 65%. Intel’s (INTC) COGS is below 40%.

What External Risks Pose Threats to Nvidia?

Any defects found in Nvidia’s products would incur significant costs. Greater risks would arise if a defect were found after commercial shipment had begun.

What Risks Does a Limited Customer Base Pose for Nvidia?

Nvidia is looking to diversify its revenue stream by targeting customers in the automotive market. In fiscal 3Q16, its revenue from automotive rose 52% YoY.

Micron’s Technology Roadmap for 2016 and 2017

Micron’s technology transition will slow down the output and revenue in the short term. The company will be able to meet advanced memory products’ needs.

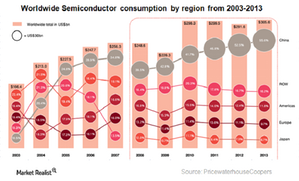

The Macro Trends that Affect the Global Semiconductor Industry

Consumer trends directly impact the semiconductor industry. For instance, consumers shifted from PC to mobile, negatively impacting Intel’s revenue.

Intel Finalizes Altera Acquisition, Right on Schedule

Intel (INTC) completed its acquisition of Altera on December 28, 2015, for $16.7 billion. The Altera acquisition will make Intel the second largest semiconductor supplier after Texas Instruments.

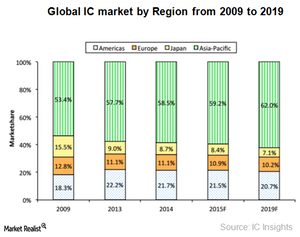

Germany to Drive Growth in European Semiconductor Industry

Despite growth in Europe’s semiconductor industry, it’s unlikely to grow as fast as its Asian counterparts. The EC launched its “10/100/20” strategy in 2013.

DRAM Prices Fall Due to Weak Demand

DDR4 (double data rate 4) has been consistently gaining market share in overall DRAM (dynamic random access memory) production.

With SanDisk Purchase, Western Digital Will Pass Samsung in SSD

With the action on the acquisition front, including the SanDisk acquisition, Western Digital is geared up to increase and enhance its presence in the SSD arena.

Why Western Digital May Want to Acquire SanDisk

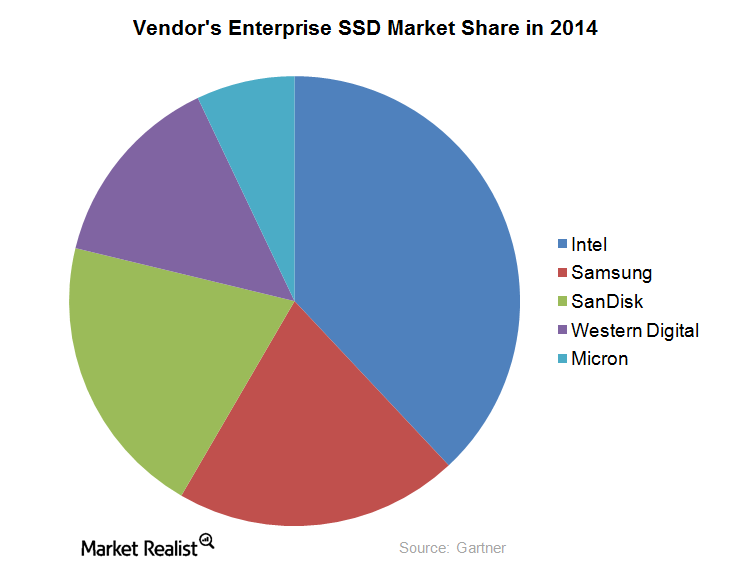

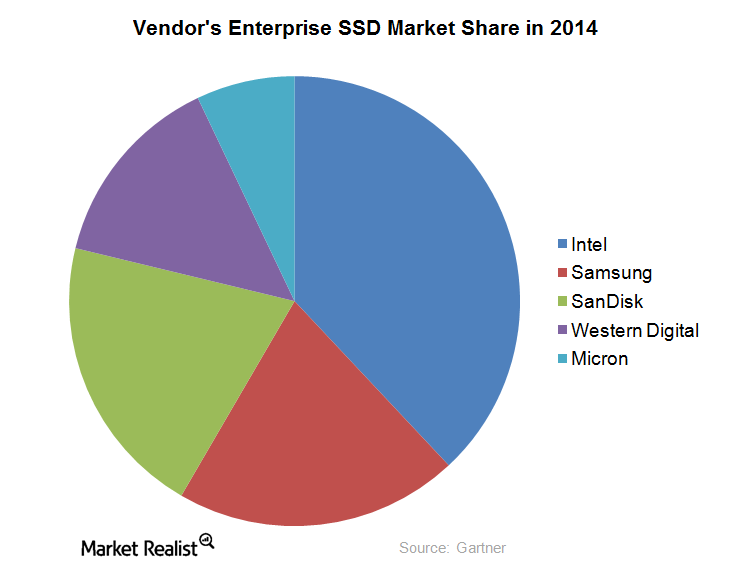

Western Digital (WDC) and Micron (MU) held 10.2% and 5.1% of the market share, respectively, in the enterprise SSD space.

Micron’s Clients and Relationships at a Glance

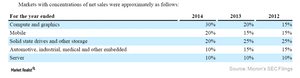

Micron largely caters to PC and storage manufacturers. Hewlett-Packard (HPQ), Intel Corporation (INTC) and Kingston account for ~30% of Micron’s net sales.

Micron’s Manufacturing Base in the US and Overseas

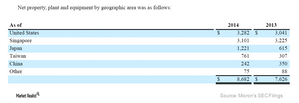

Micron controls costs by developing a manufacturing base in countries where manufacturing costs are low, but it manufactures most of its chips in the US.

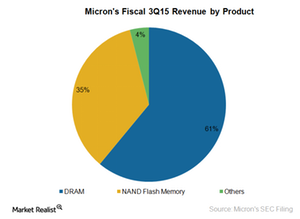

Micron’s Product Portfolio at a Glance: Must-Knows

Micron expanded its product portfolio from 64-kilobit DRAM chips in 1980 to NAND Flash Memory devices in 2004, to SSDs in 2007, to NOR Flash Memory in 2011.

Alliance for Open Media: Netflix, Google, and Amazon Team Up

The Alliance for Open Media aims to develop video formats that have no royalty costs. The nature of the business makes royalty payments significant for companies like Apple and Google.

Rumors Strong about Sale of HP’s TippingPoint

HP is considering the sale of its TippingPoint business. Some private equity firms have shown interest in TippingPoint, valuing the business in the range of $200–$300 million.

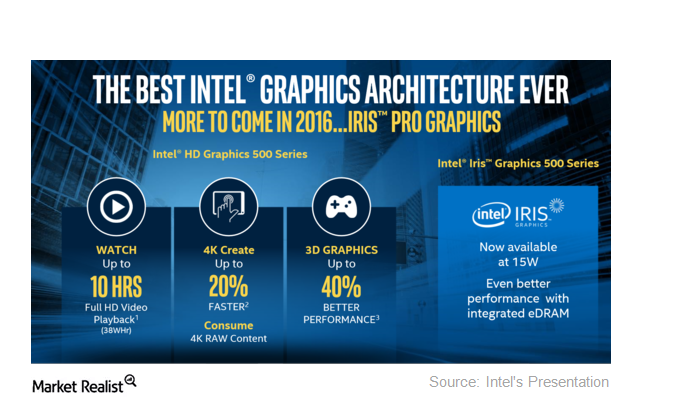

Intel’s Skylake a New Lifeline for the PC Market?

Intel’s Skylake will offer new wireless charging and data transfer for a wire-free computing environment. Thus, Intel’s Skylake should help the PC market.

China Emerges as New Competition in Semiconductor Industry

China is looking to reduce its dependence on foreign technology. Its government plans to invest up to $161 billion over the next decade to promote domestic chip manufacturers.

Why Did Japan’s Semiconductor Industry Fall?

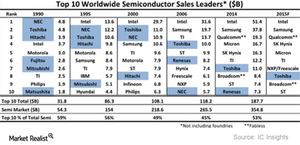

In 1990, Japan led the semiconductor industry, with six companies named in the top ten semiconductor sales leaders. In 2014, only two companies made the list.

South Korea: Second Largest Global Semiconductor Manufacturer

After memory chips, LEDs comprise the second most produced semiconductor products in South Korea. The country accounts for ~13% of the global LED market.