These Are Texas Instruments’ Future Growth Drivers

Texas Instruments (TXN) reported strong fiscal Q2 2018 revenue, and forecast slower-than-usual revenue growth for the third quarter as it increases its exposure to the more stable industrial and automotive markets.

Nov. 20 2020, Updated 5:03 p.m. ET

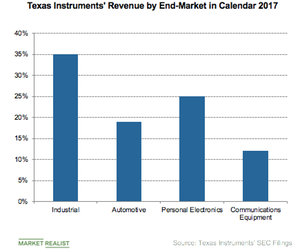

Texas Instruments’ revenue by end market

Texas Instruments (TXN) reported strong fiscal Q2 2018 revenue, and forecast slower-than-usual revenue growth for the third quarter as it increases its exposure to the more stable industrial and automotive markets. This shift is reducing the company’s exposure to Apple (AAPL), mitigating the seasonality arising from the smartphone segment.

Industrial and automotive

Texas Instruments is increasing its exposure to the industrial and automotive markets, as they deliver broad-based and diverse revenue growth. The company caters to 14 industrial sectors and five automotive sectors. Because of its diverse nature, any decline in one sector is usually offset by growth in another sector, bringing stable growth.

As the world moves toward a data economy, the industrial and automotive sectors are becoming automated, increasing devices’ silicon content. Chip giant Intel (INTC), which has recognized this content increase as an opportunity, has therefore acquired Mobileye to accelerate its growth in the autonomous vehicle space.

Enterprise Systems

Texas Instruments is also seeing growth in the enterprise system segment as corporates and cloud companies invest in data center infrastructure. This investment is benefitting Intel’s data center segment, which has been reporting double-digit YoY (year-over-year) revenue growth over the past three quarters.

Communication equipment

Texas Instruments has been witnessing weakness in the communication equipment market as 4G (fourth-generation) infrastructure investments decline. However, the company expects this segment to pick up when 5G (fifth-generation) deployment begins, which could happen as early as next year. TSMC (TSM) is also witnessing weakness in the communications space, prompting it to focus on high-performance computing.

Personal electronics

Texas Instruments’ personal electronics revenue grew by low single digits YoY in Q2 2018 as production increases by some customers were offset by declines by others. One of these customers was Apple, which cut its iPhone X production in the second quarter. Texas Instruments is boosting its revenue through diversification. Next, we’ll see how the company is increasing its profitability.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!