First Trust Consumer Discretionary AlphaDEX Fund

Latest First Trust Consumer Discretionary AlphaDEX Fund News and Updates

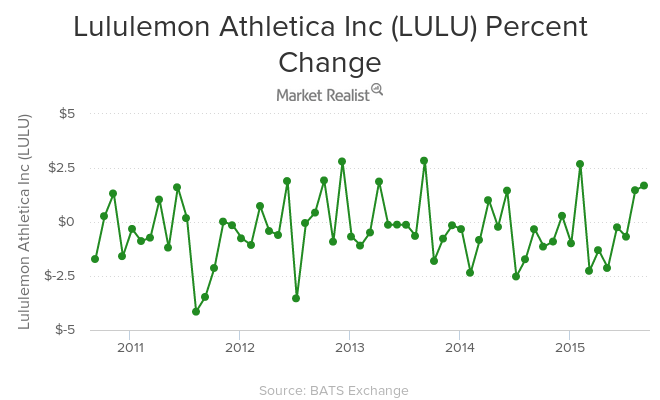

Lululemon: The Outliers Affecting LULU’s Stock Price Movement

On June 11, Lululemon Athletica (LULU) filed a shelf prospectus with the US Securities and Exchange Commission (or SEC).

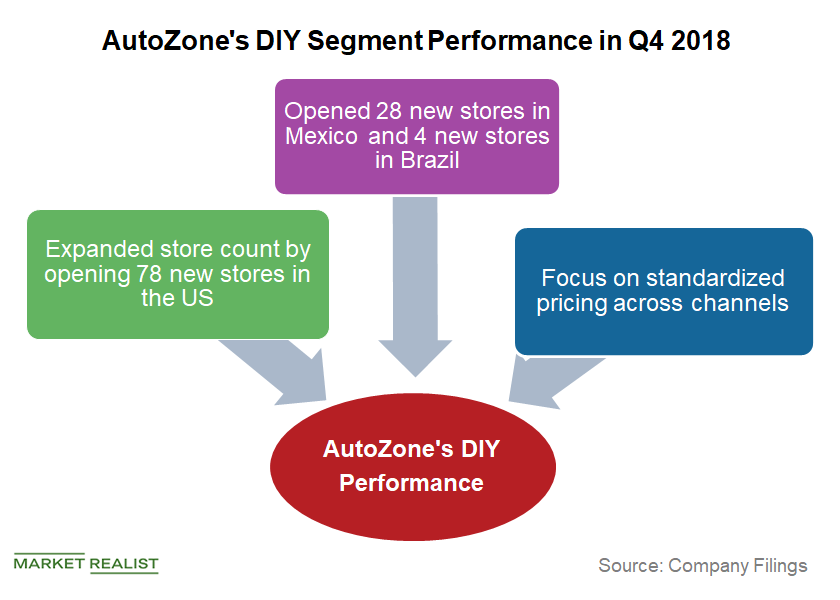

How AutoZone’s DIY Segment Performed in Fiscal Q4 2018

In the second half of fiscal 2018, AutoZone’s management decided to discontinue aggressive promotional discounts for its ship-to-home sales.

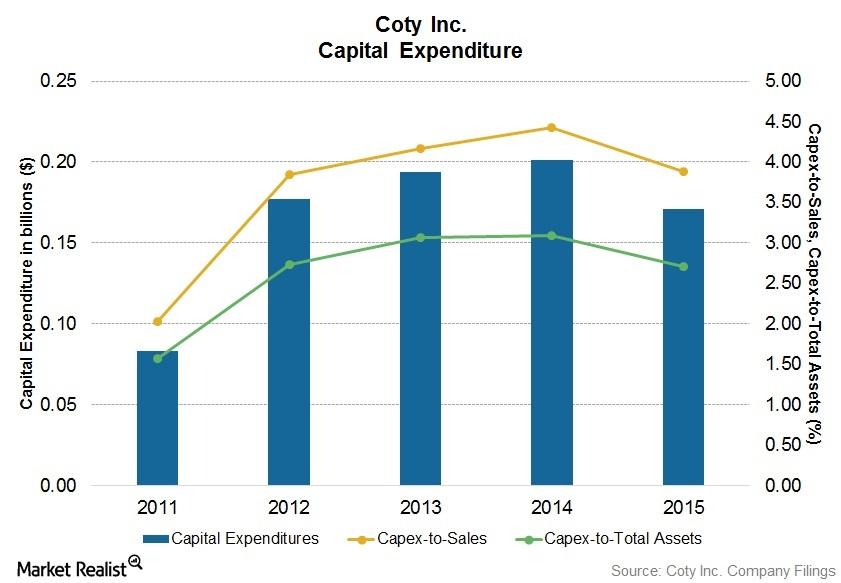

Why Coty’s Capital Expenditure Could Rise

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014.

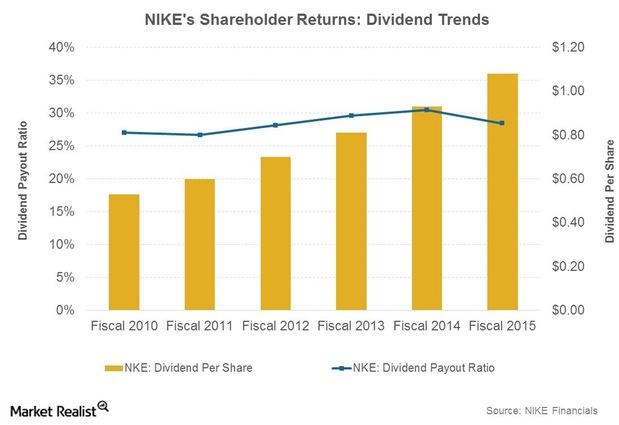

Nike: 5-Year Returns Targets for Shareholders

At its 2015 Investor Day held on September 14, Nike briefed the financial community on its targets for generating value for shareholders.

Nike’s Fastest-Growing Demographic Segments

The women and young athletes demographic segments saw the greatest sales traction in fiscal 2015 for Nike.

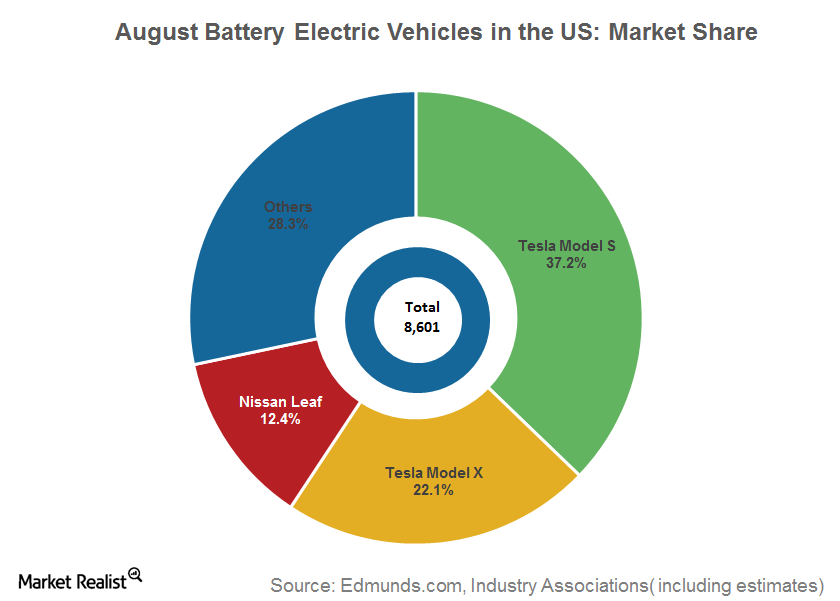

Here’s How Tesla Has Changed Perceptions about Electric Vehicles

A few years ago, Tesla Motors showcased the true potential of EVs with its Roadster, Model S, and Model X.

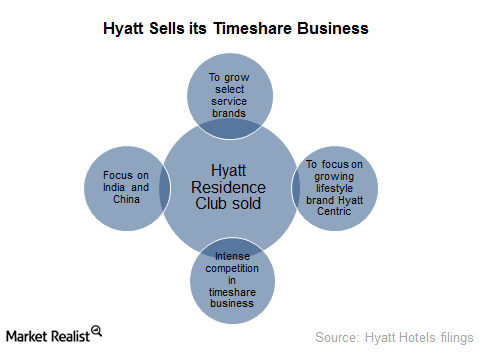

Why Did Hyatt Sell Its Vacation Ownership Segment?

Hyatt is focusing on increasing its presence to under-penetrated markets. The company believes that its presence in emerging markets such as India and China is essential for its growth.

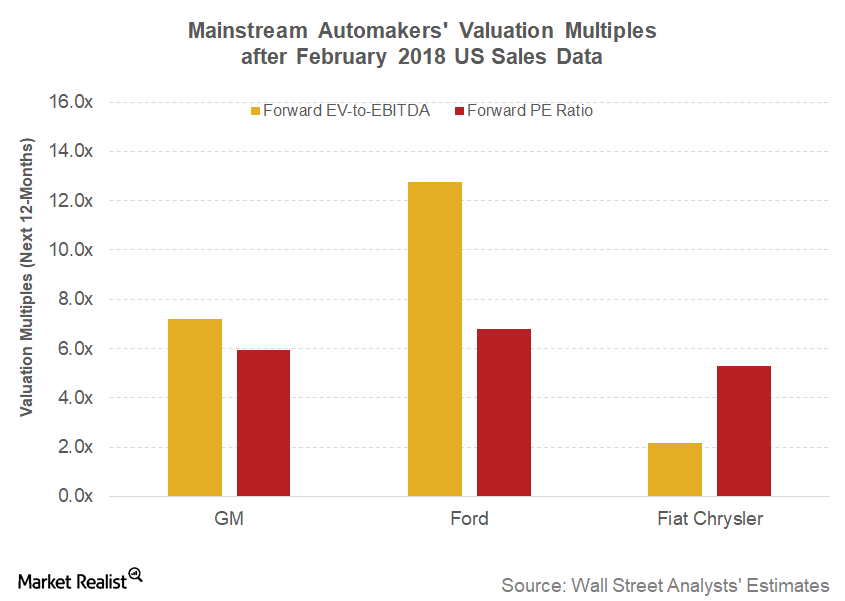

How US Auto Companies’ Valuation Multiples Look in March 2018

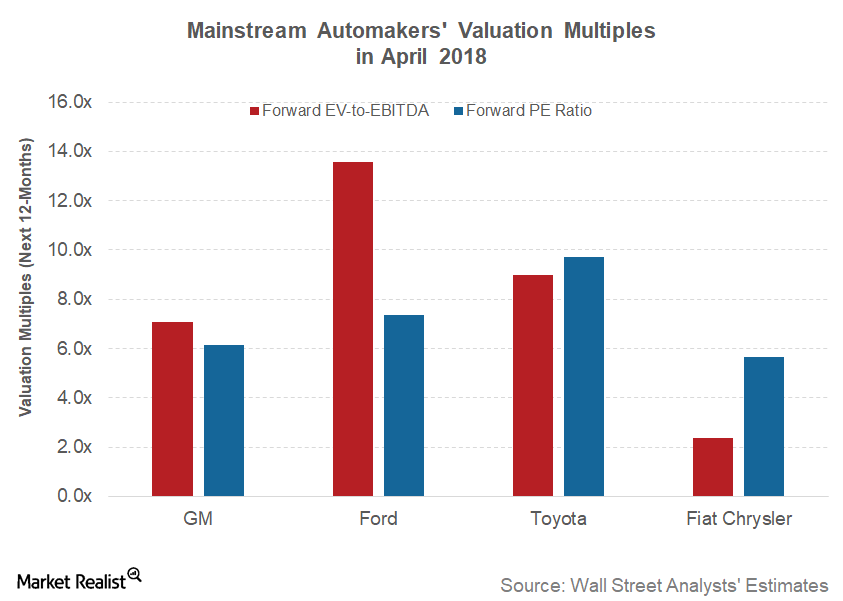

On March 8, 2018, GM’s EV-to-EBITDA was 7.2x, much lower than its direct competitor Ford’s multiple of 12.8x.

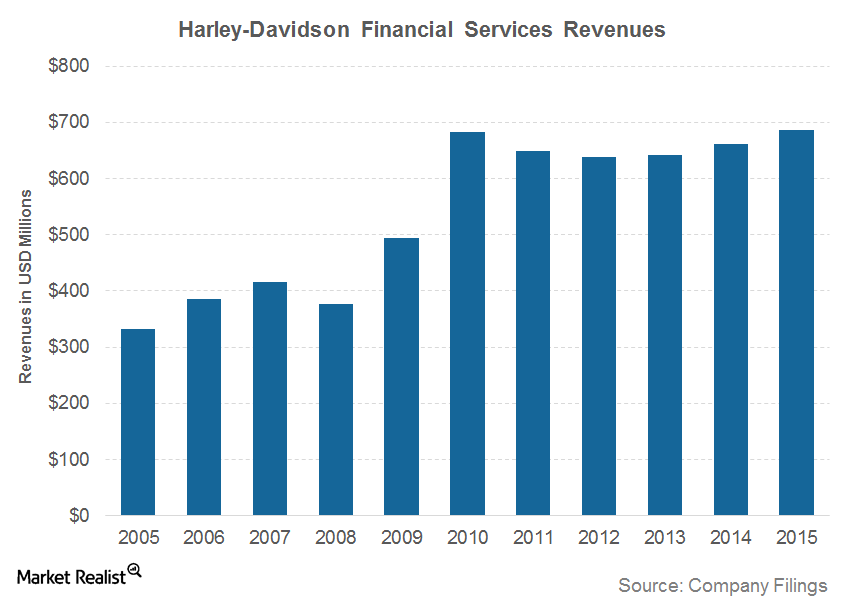

How Harley-Davidson’s Financial Services Complement Its Core Business

Under its retail financial services, Harley-Davidson Financial Services primarily provides installment lending for the purchase of new and used Harley-Davidson motorcycles.

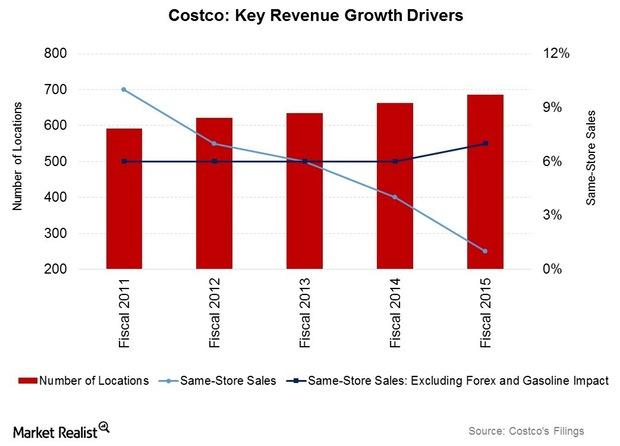

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

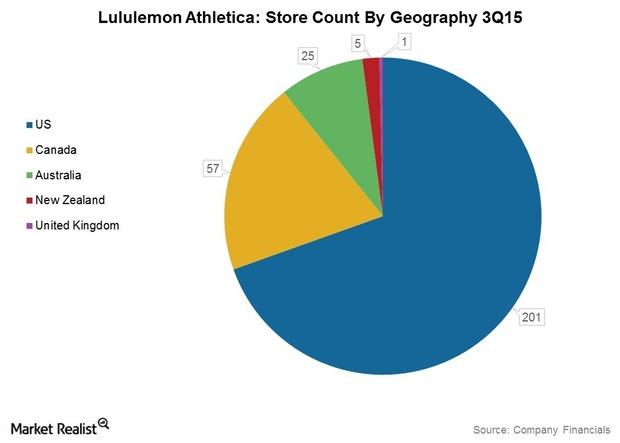

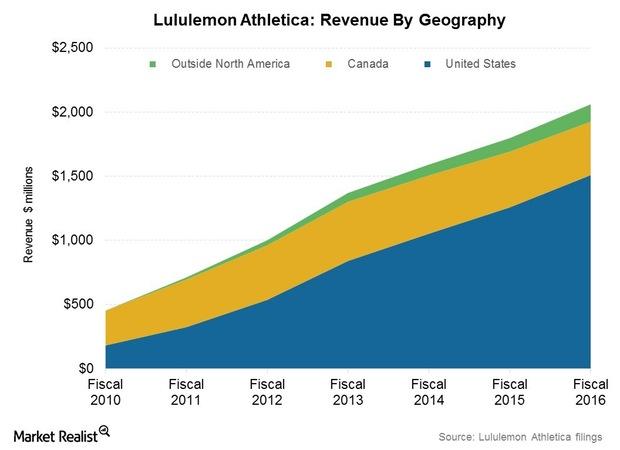

Analyzing Lululemon’s Revenues By Geographical Segment

The company grew its revenues at a compound annual growth rate of more than 35% over the past five years to come in at $1.6 billion in fiscal 2014.

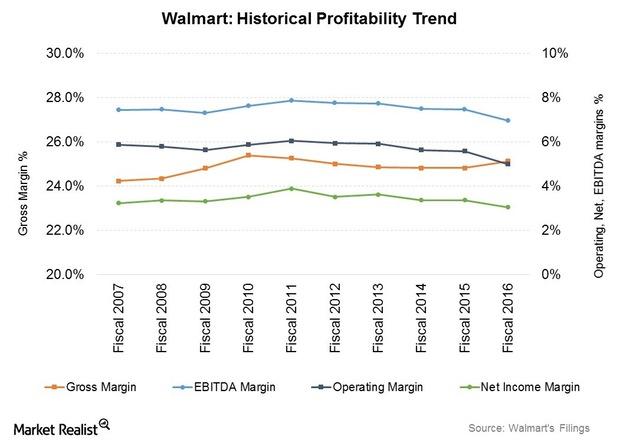

How Walmart Is Looking to Offset Future Operating Cost Headwinds

Wage costs are expected to be a headwind for Walmart. On February 20, Walmart made the second round of wage increases for over 1.2 million staff.

What’s Driving Record Membership Loyalty at Costco?

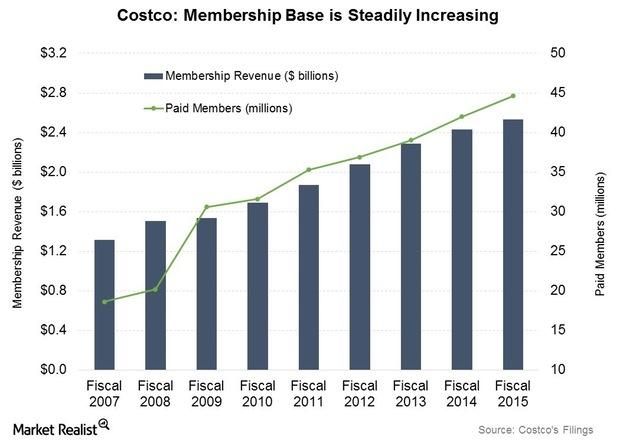

Costco has been able to steadily increase the renewal rate in the US and Canada from 88% in fiscal 2010 to 91% in fiscal 1Q16.

Analyzing Target’s Same-Store Sales Growth in Fiscal 2016

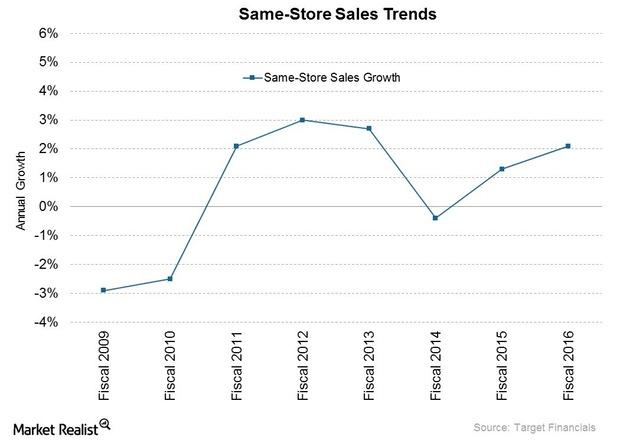

Target had upbeat revenue performance in fiscal 4Q16 and 2016. Store traffic was up by 1.3% YoY in fiscal 2016, trending in positive territory in all four quarters of the year.

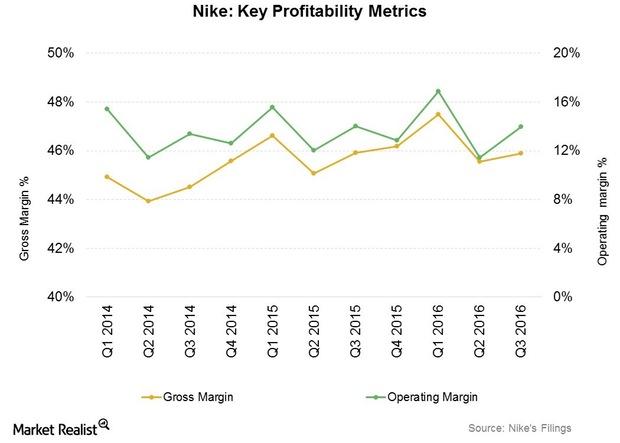

How Nike Has Sustained Profitability despite Headwinds

Nike’s profitability in fiscal 3Q16 was helped by better-than-average performance in North America and Greater China, two of its most profitable segments.

Five-Year Plan: Lululemon’s Long-Term Vision and Goals

Over the next five years, Lululemon Athletica (LULU) is aiming to double its revenue to $4 billion with an expected mid-single-digit growth rate in store comps.

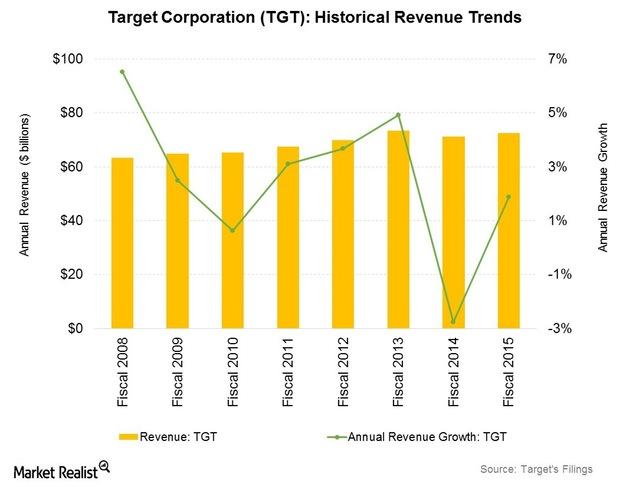

How Does Target’s Historical Sales Growth Compare to Its Peers’?

Target opened 15 new stores in fiscal 2016. Its same-store sales rose 2.1%, with customer traffic at stores up 1.3%.

Skechers: Achieving Growth through Diverse Product Development

Since the launch of its first line in 1992, Skechers has diversified into several new lines, targeting different demographics and different activities.

How Does Skechers Manage Its Inventory and Distribution?

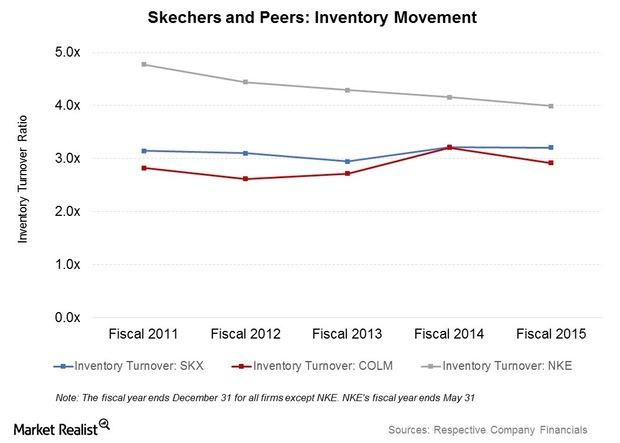

In recent years, Skechers has reported improved working capital metrics. The company’s inventory turnover (or ITR) rose from 2.9x in 2013 to 3.2x in 2015.

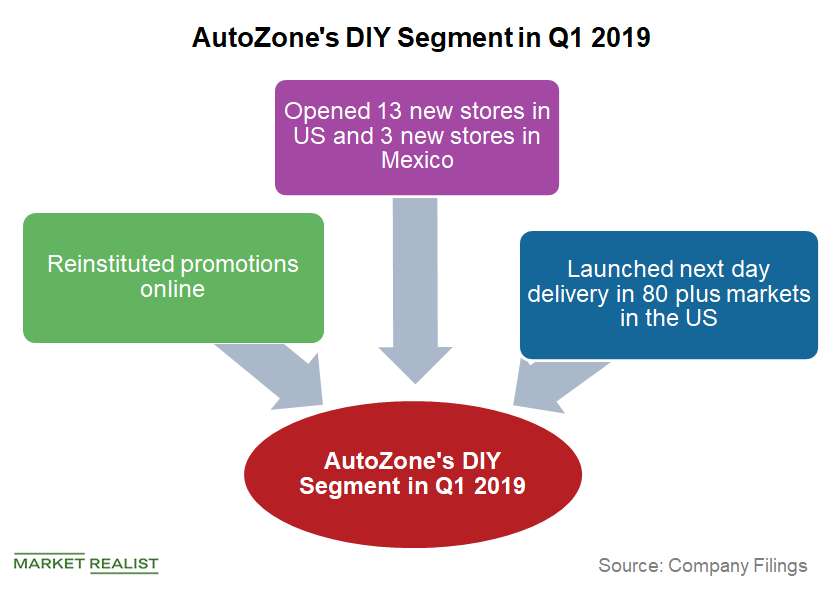

Did AutoZone Resume Its Promotional Strategy in Q1 2019?

AutoZone’s performance is mainly divided into two business segments: DIY (do it yourself), or Retail, and DIFM (do it for me), or Commercial.

Is Ferrari’s Growth in China Enough to Please Investors?

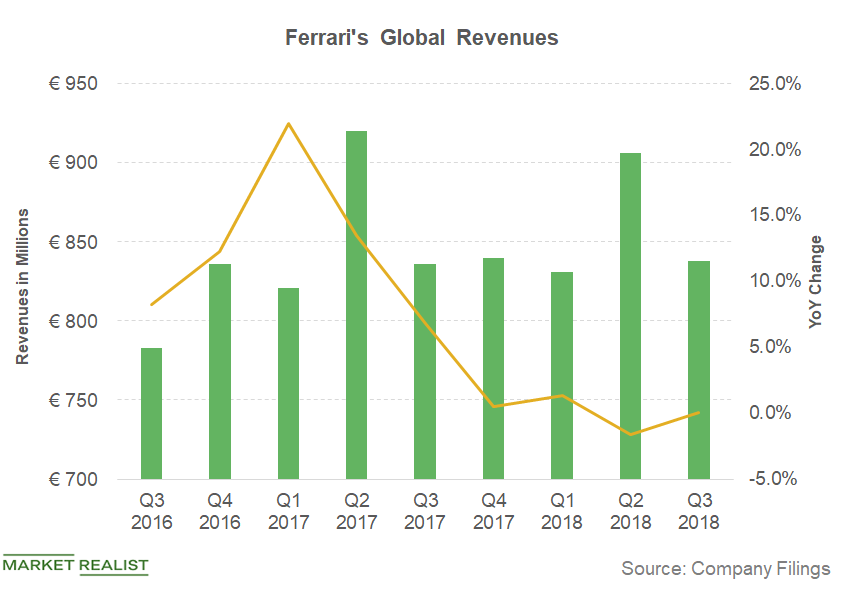

In the third quarter, Ferrari (RACE) reported net revenue of 838 million euros, or ~$956 million.

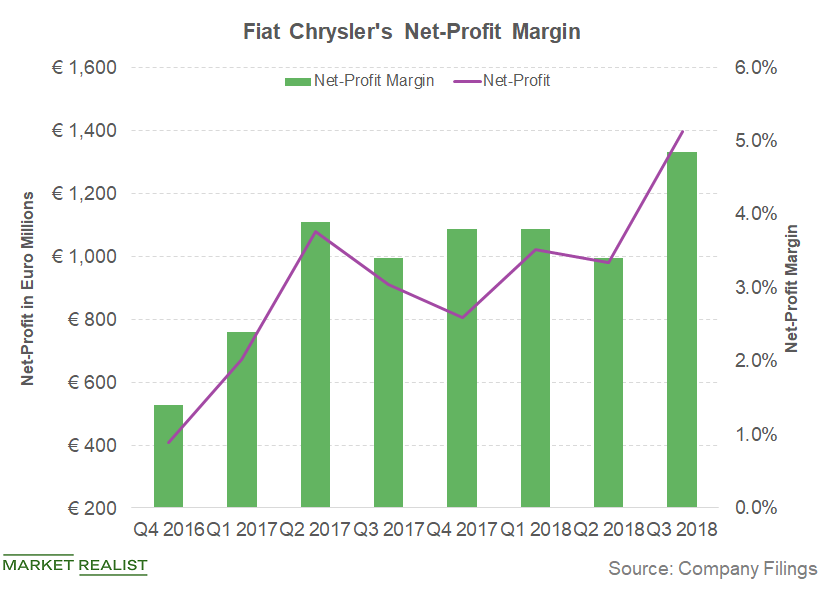

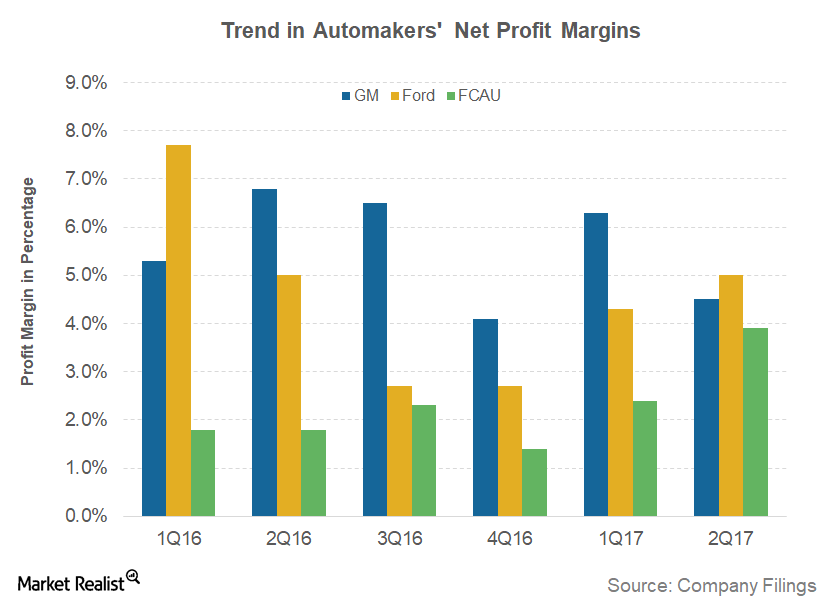

What Helped Fiat Chrysler Expand Its Profit Margin in Q3 2018?

A couple of years quarters ago, FCAU had a bad reputation for having the lowest profit margins among legacy automakers (FXD).

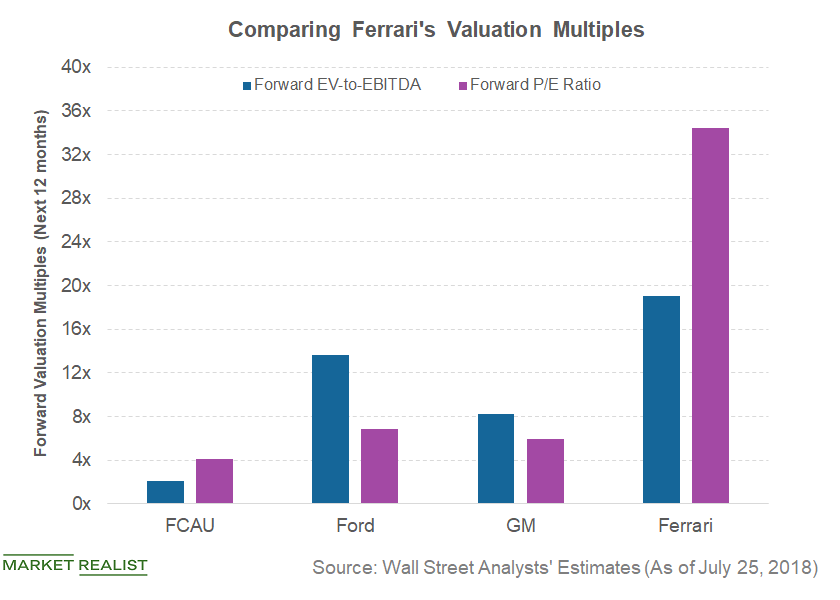

How Ferrari’s Valuation Looks before Its Q2 2018 Earnings Event

On July 25, Ferrari’s (RACE) forward EV-to-EBITDA multiple was 19.0x.

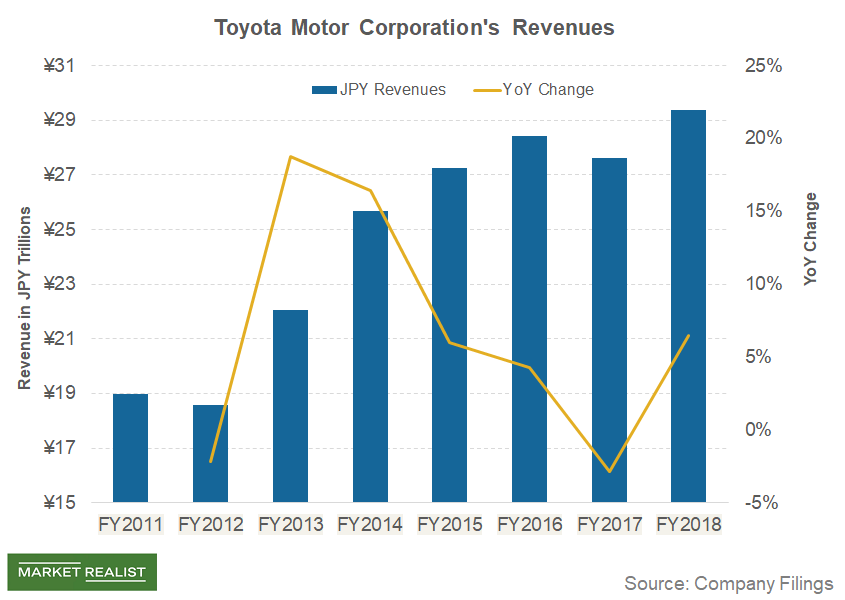

What Factors Boosted Toyota’s Fiscal 2018 Revenue?

In 2017, Toyota Motor (TM) was the third-largest automaker by volume in the world after Renault-Nissan Alliance and Volkswagen (VLKAY).

Comparing Auto Industry Valuation Multiples

In the auto sector, valuation multiples are used by investors to compare companies that are similar in size or business.

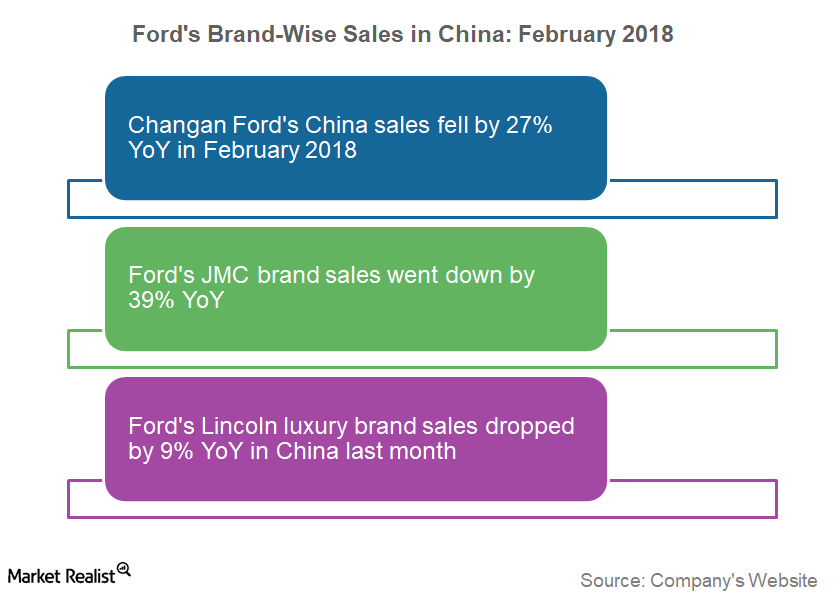

How Ford’s Key Brands Performed in China in February 2018

In 4Q17, Ford Motor Company’s (F) Asia-Pacific region’s revenue rose 11% YoY (year-over-year).

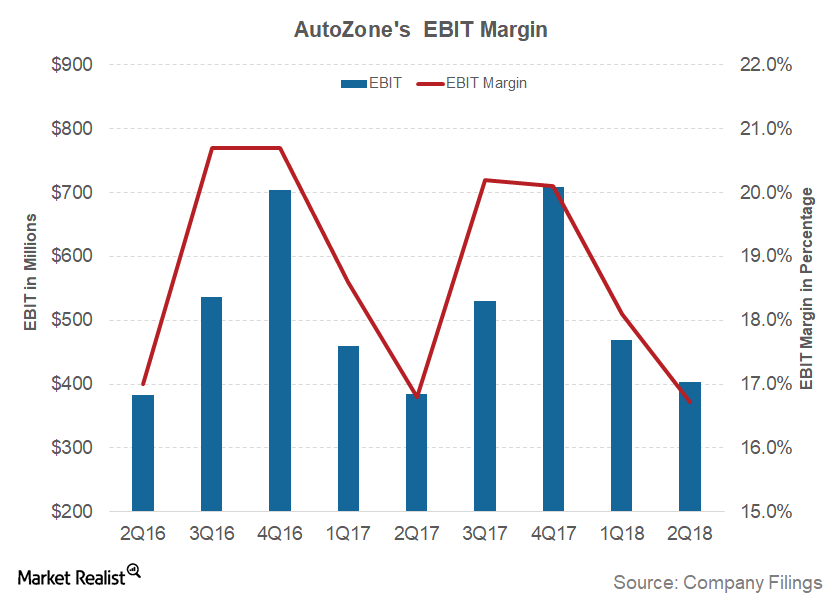

Why AutoZone’s Profit Margin Failed to Impress in Fiscal 2Q18

AutoZone’s 2Q18 earnings Previously, we looked at how AutoZone’s (AZO) key business segments fared in 2Q18. The company’s focus on improving parts availability and the in-store experience continued to drive growth. AZO’s commercial and online retail business traffic grew during the quarter. Let’s find out how these factors affected AutoZone’s profitability in 2Q18. Profit margin in 2Q18 […]

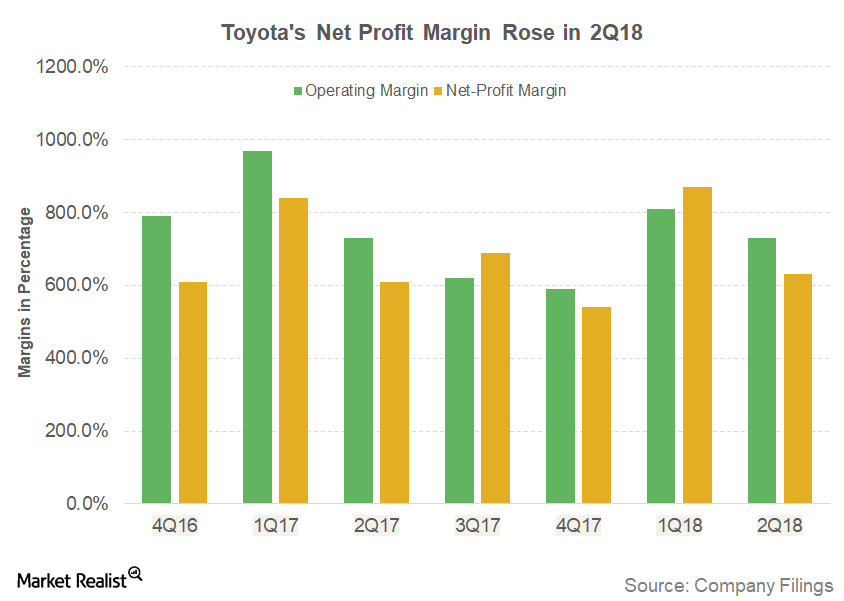

How Toyota’s Profit Margins Trended in Fiscal 2Q18

In fiscal 2Q18, Toyota reported a flat operating margin of 7.3% compared to 7.3% in the same quarter the previous year.

Comparing Mainstream Automakers’ 2Q17 Profit Margins

In 2Q17, General Motors’ (GM) adjusted EBIT (earnings before interest and taxes) stood at 3.7 billion. The company’s EBIT margin was 10.0% for the quarter.

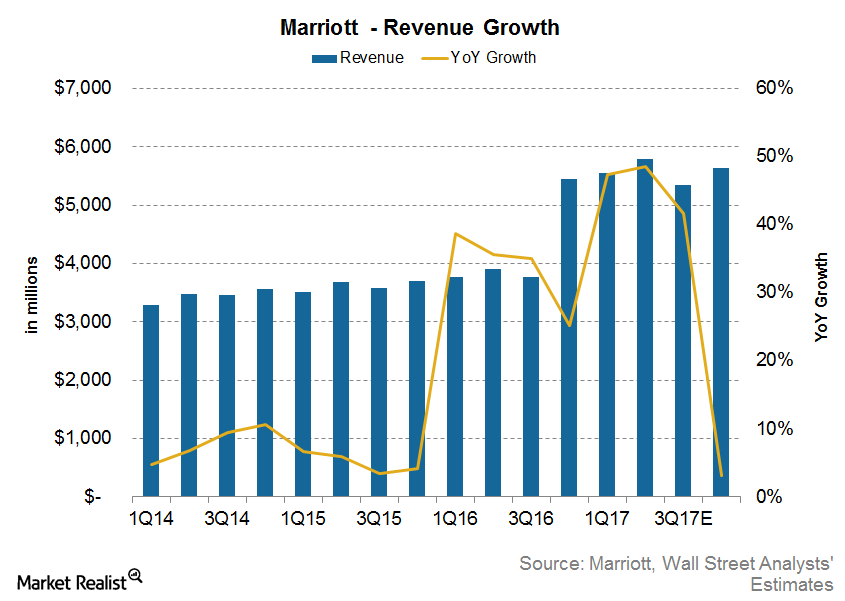

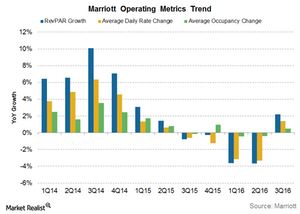

Marriott’s Revenue Is Now Expected to Go This Way in 2017

In 2Q17, Marriott’s revenues grew 49% YoY to $5.8 billion, compared with $3.9 billion in 2Q16, due to higher fee revenues and RevPAR and room growth.

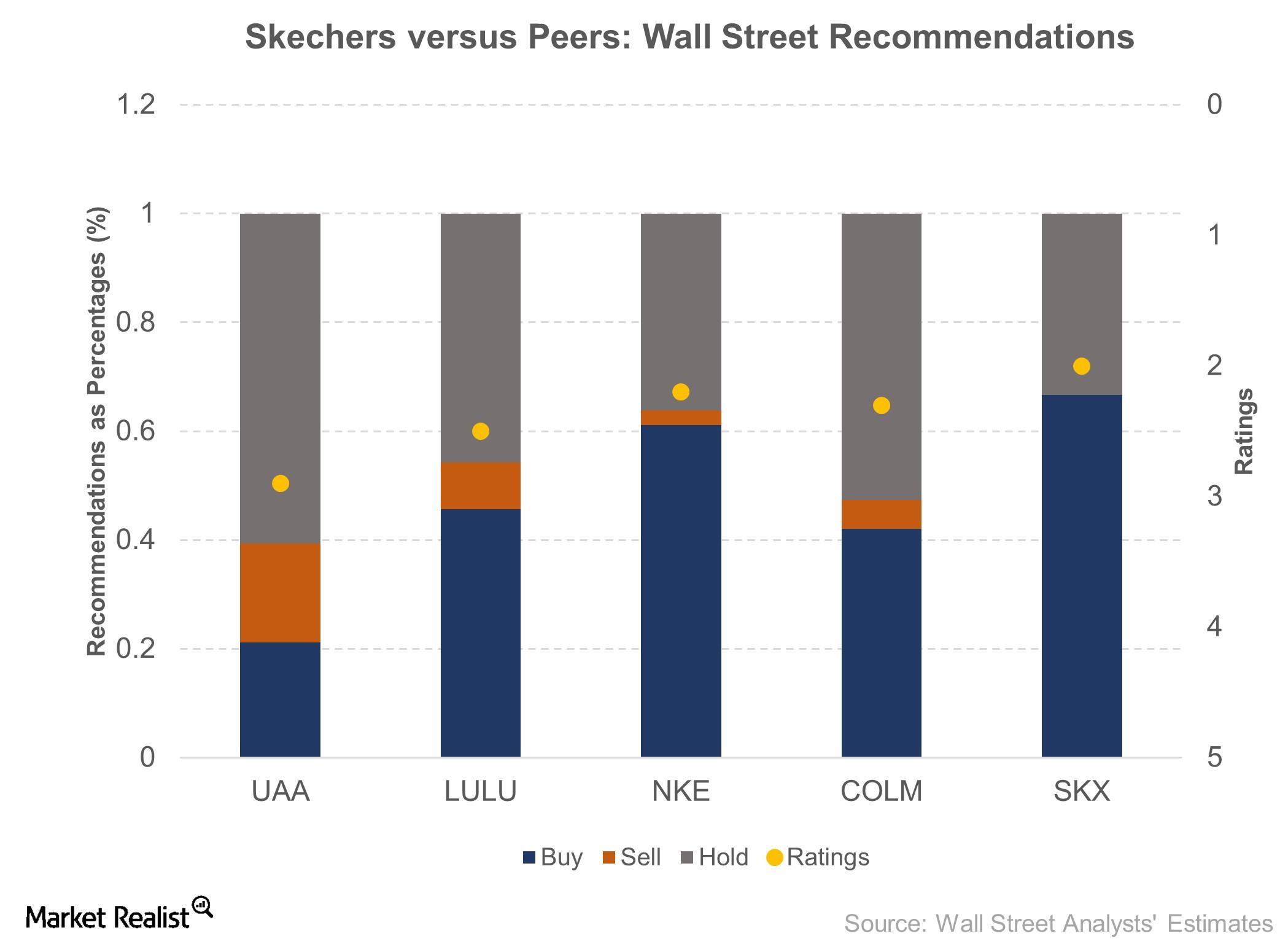

Discussing Wall Street’s View on Skechers

Skechers (SKX) is covered by 12 Wall Street analysts who jointly rate the company as a 2 on a scale of 1 (“strong buy”) to 5 (“sell”).

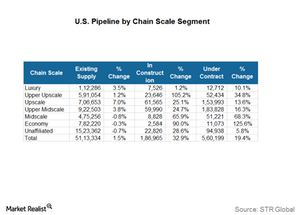

Why Hotel Investors Should Follow Construction Pipeline Data

According to STR Global’s US Construction Pipeline Report for January 2017, rooms under contract rose 16.1% to reach 576,000 rooms in 4,763 hotel properties.

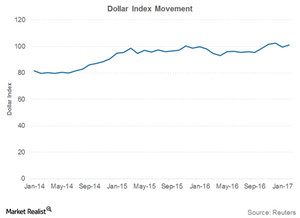

What a Strong US Dollar Means for the US Hotel Industry

The strength of the US dollar measured against currencies that are widely used in international trade is measured by the Trade Weighted Dollar Index.

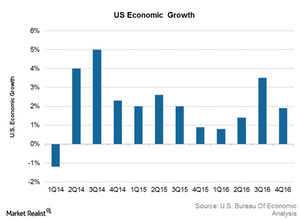

Why Economic Growth Is Important for the US Hotel Industry

A booming economy allows people to spend money on discretionary items such as air travel, so hotel revenues are higher during economic growth and lower during economic contraction.

What Do Marriott’s Key Metrics Suggest ahead of 4Q16 Results?

For 3Q16, Marriott and Starwood Hotels & Resorts together added 17,600 rooms, taking the total to 4,554 properties and 777,000 timeshare resorts.

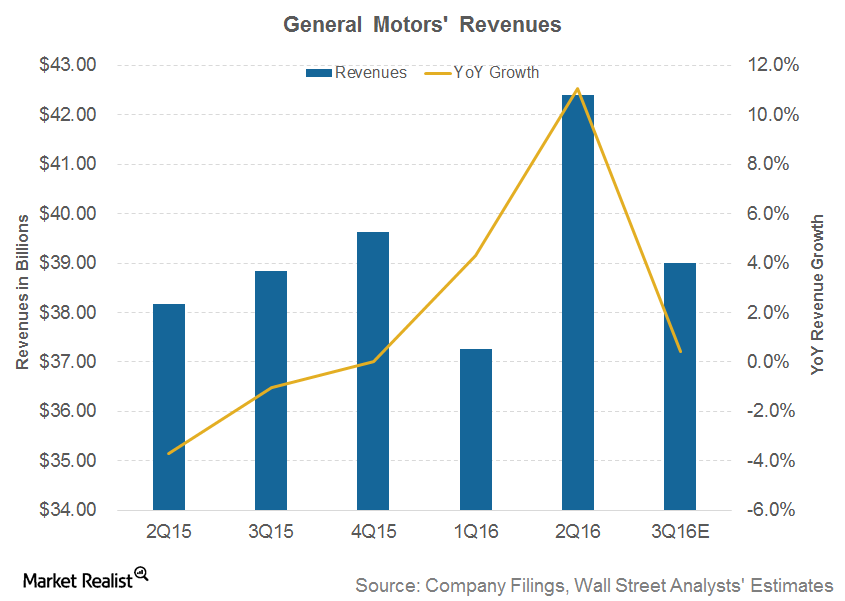

What Drove General Motors’ Revenues Higher in 2Q16?

In 2Q16, General Motors’ (GM) revenues came in at $42.4 billion. This reflects an increase of 11.1% over $38.2 billion in the corresponding quarter of the previous year.

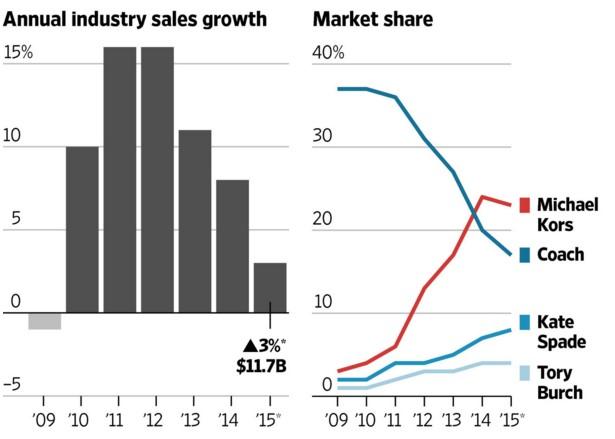

How Is Kate Spade Positioned in the American Affordable Luxury Segment?

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

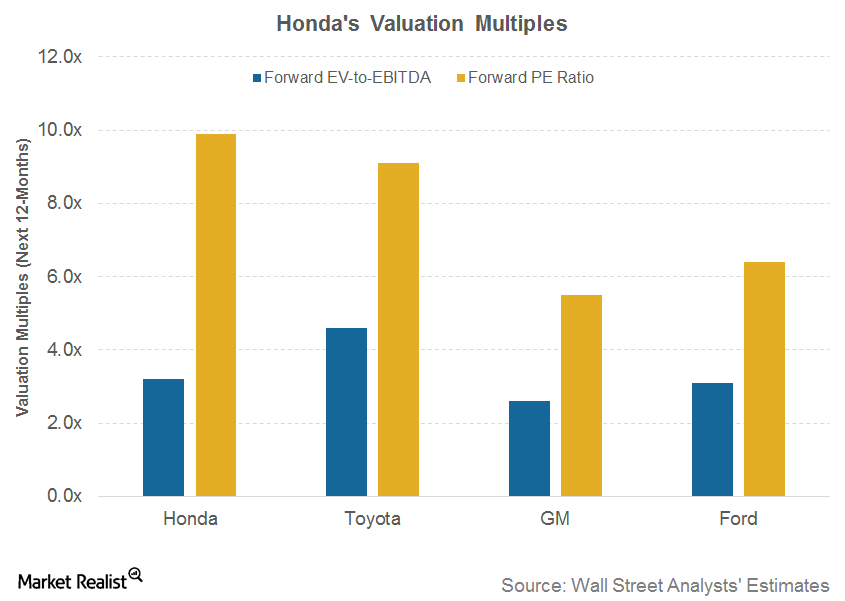

An Investor’s Guide to Honda’s Valuation

On June 10, 2016, Honda had a forward EV-to-EBITDA multiple of 3.2x for the next 12 months.

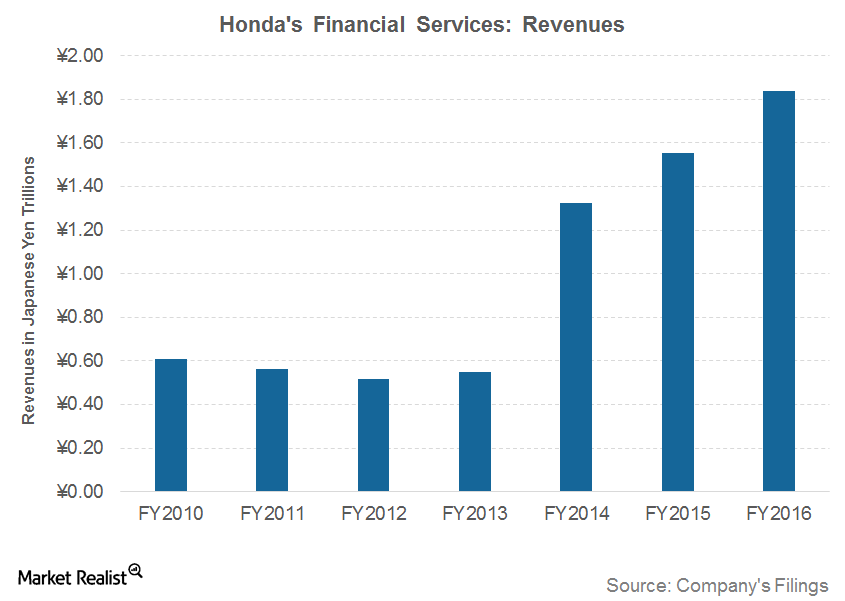

Understanding Honda’s Financial Services Business

In fiscal 2016, Honda’s Financial Services’s net revenues stood at 1.8 trillion Japanese yen. This is 18% higher than its fiscal 2015 revenues of 1.5 trillion yen.

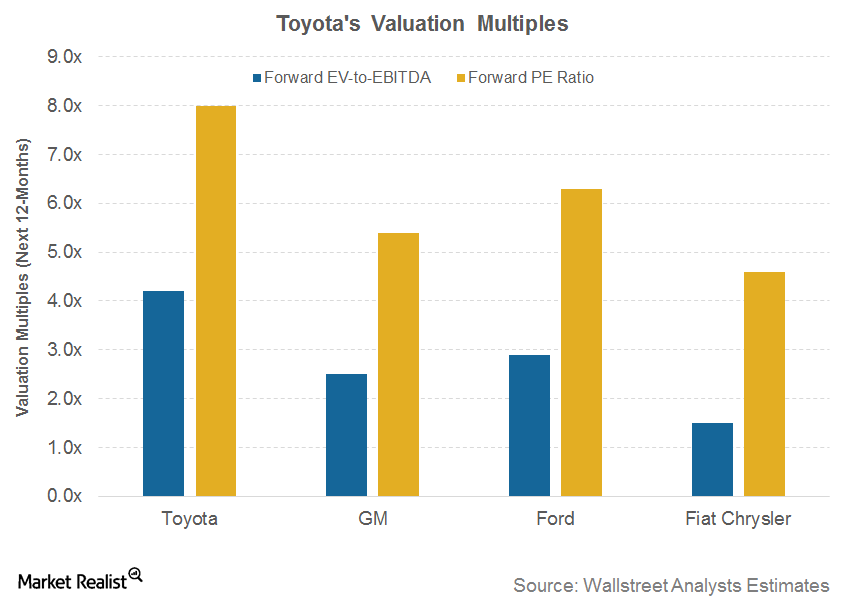

An Investor’s Guide to Toyota’s Valuation

On May 23, 2016, Toyota’s forward PE ratio, based on earnings forecasts for the next 12 months, stood at 8.0x, also much higher than Ford’s 6.2x and GM’s 5.3x.

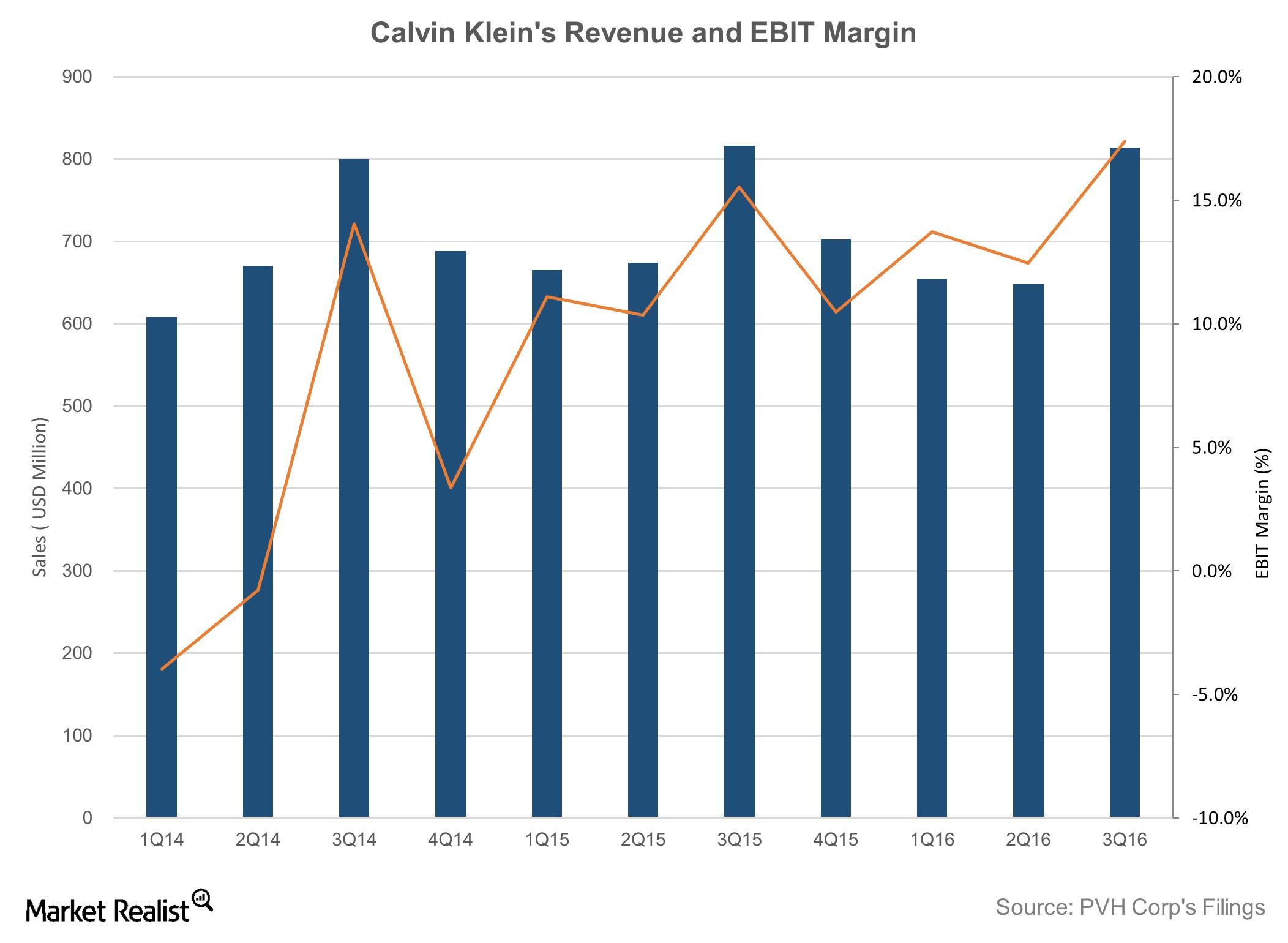

PVH Corp: Why Calvin Klein’s Still Strong Despite Harsh Conditions

Calvin Klein in fiscal 3Q15 PVH Corp’s (PVH) Calvin Klein business recorded strong performance despite several macroeconomic headwinds. On a constant-currency basis, revenue was up 7% compared to the third quarter of the previous year. Including the $58 million negative impact of foreign currency translation, the segment’s revenue was down 0.3%. Revenue in the Calvin […]

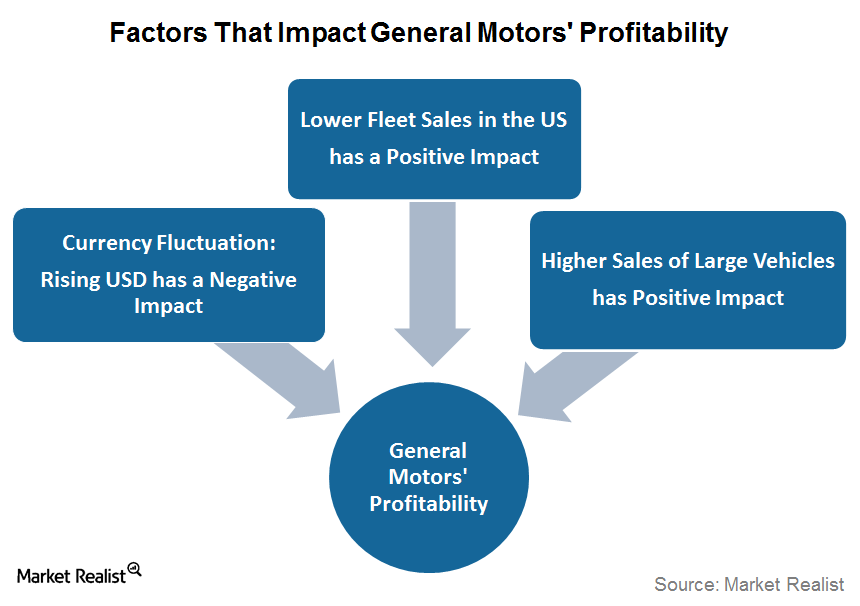

What Factors Are Affecting General Motors’ Profitability?

According to 2015 sales volume, General Motors is the largest US automaker and the third-largest automaker globally.

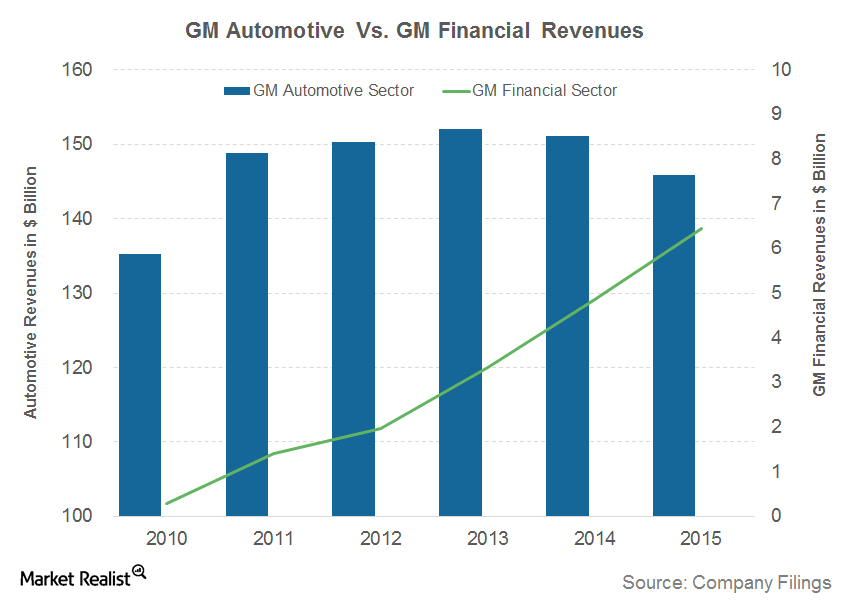

How GM Helps Customers Buy Vehicles through GM Financial

To encourage people to purchase its vehicles, General Motors provides automotive financing services through GM Financial Company.

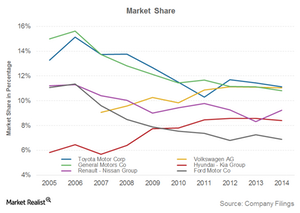

Why Has Ford’s Global Market Share Fallen in the Last Decade?

Ford’s market share fell from 11.1% in 2005 to ~7% in 2015, mostly due to competition outside North America and strength in the commercial vehicle segment.

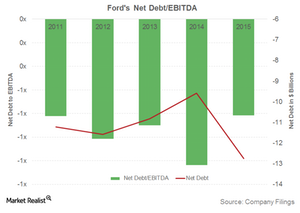

Analyzing Ford Motor Company’s Leverage Position

Ford uses a high amount of financial leverage. At the end of 2015, 70.4% of Ford’s capital structure was made up of debt, while 29.6% was made up of equity.

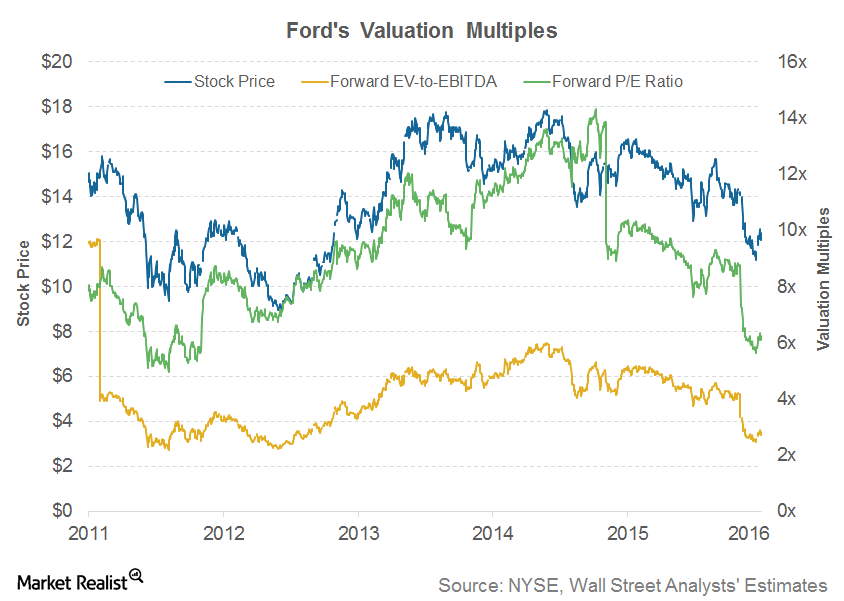

An Investor’s Guide to Ford’s Valuation

Ford’s valuation multiples are in a negative trend. This could be because of the concern that US auto sales may have already peaked last year.

What Are Lowe’s Opportunities and Key Threats?

The greatest opportunity for Lowe’s (LOW) perhaps lies in fully leveraging the omni-channel (XLY) model.

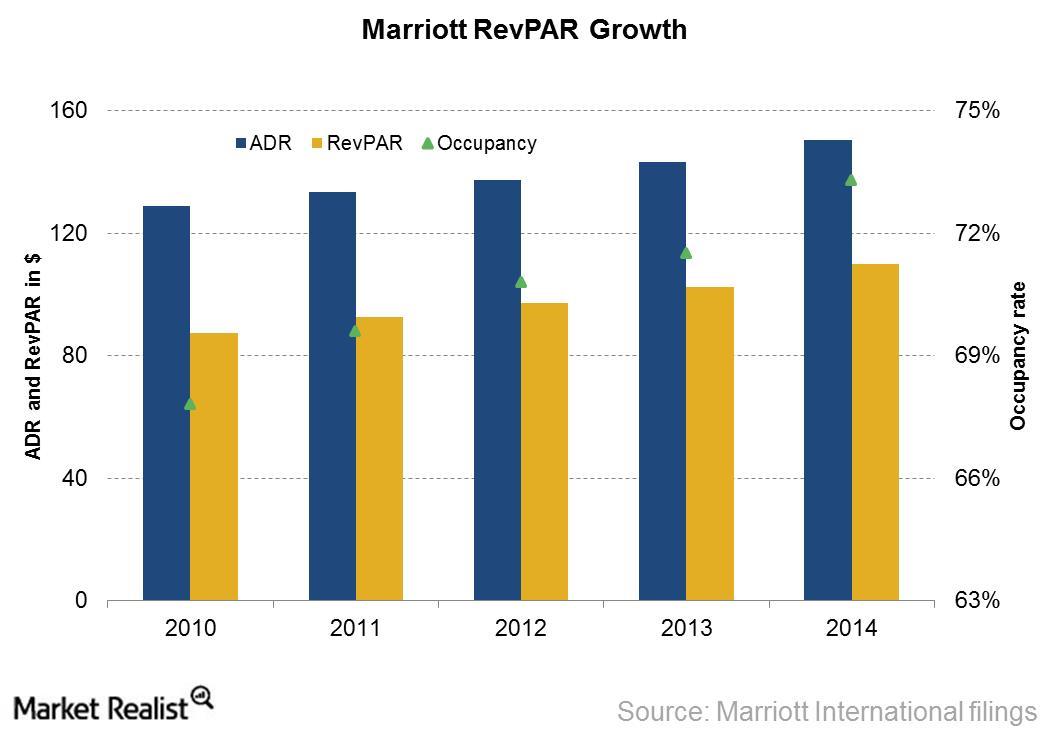

Industry-Wide Demand Growth Drives Marriott International’s RevPAR

Marriott International saw strong increases in RevPAR—from $87 to $110—between 2010 and 2014.

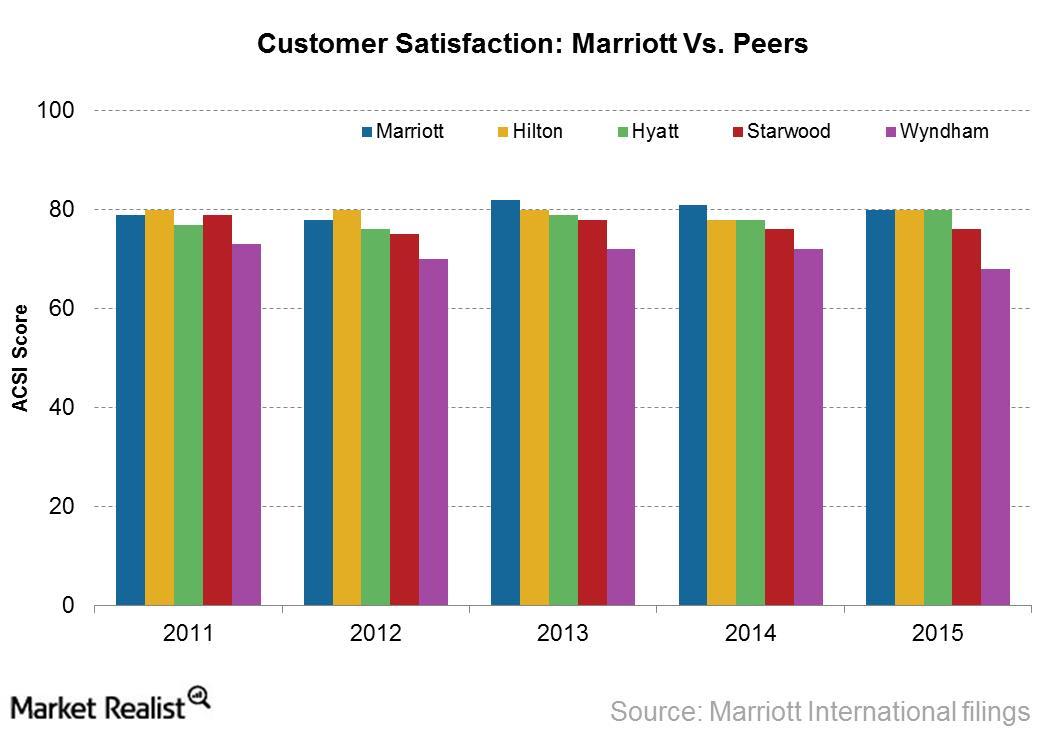

Marriott International in the Eyes of Customers: Outside Looking In

In 2015, Marriott topped the ACSI survey with a score of 80. It also topped the survey in 2014 and 2013, with scores of 83 and 81, respectively.

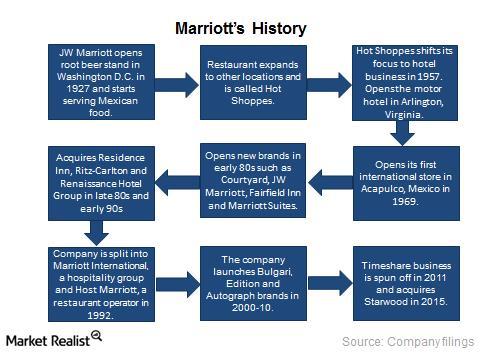

Introducing Marriott International: Your Key Company Overview

Marriott International is known for its wide range of budget and luxury hotels. Its acquisition of Starwood will make it the world’s largest hotel chain.