The Price of Solana: Why it Fluctuates and What Traders Can Learn

Solana's price has varied greatly in the past, making traders feel both excited and cautious.

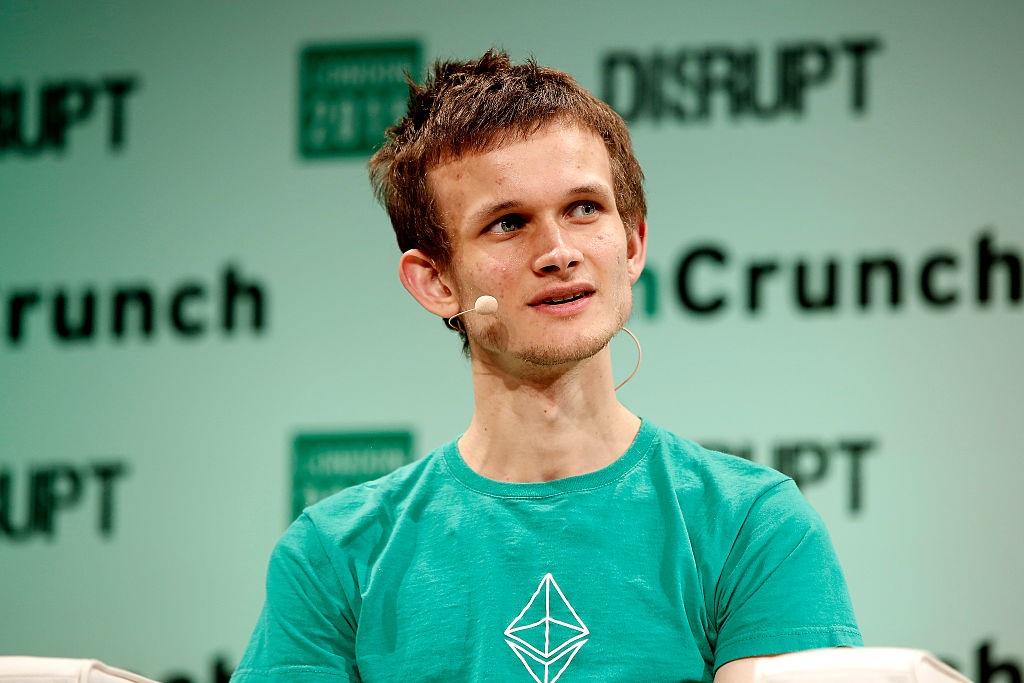

Come here for the latest crypto price predictions and developments in blockchain technology, new cryptocurrencies, and trends affecting established coins like Bitcoin, Ethereum, Ripple, Litecoin, Dogecoin, and more.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.