Why Is Congress Probing Crypto Exchanges? Fraud Prevention at the Center

A U.S. congressional committee has inquired into the fraud-prevention strategies at crypto exchanges like Coinbase, FTX, and more.

Aug. 31 2022, Published 2:58 p.m. ET

Investors may be in the red on their cryptocurrency investments due to ongoing downturns in the market, but those aren’t the only losses occurring in the crypto space. As of August 19, hackers have already stolen $1.9 billion in crypto assets so far this year, a 37-percent jump year over year.

Now, a U.S. congressional committee is probing major crypto exchanges to find out what precautions the companies are taking to protect user assets. Crypto regulations remain in a gray area and, without federal guidelines, investor protection rests on the shoulders of the exchanges themselves.

U.S. congressional committee sends letters to crypto exchanges

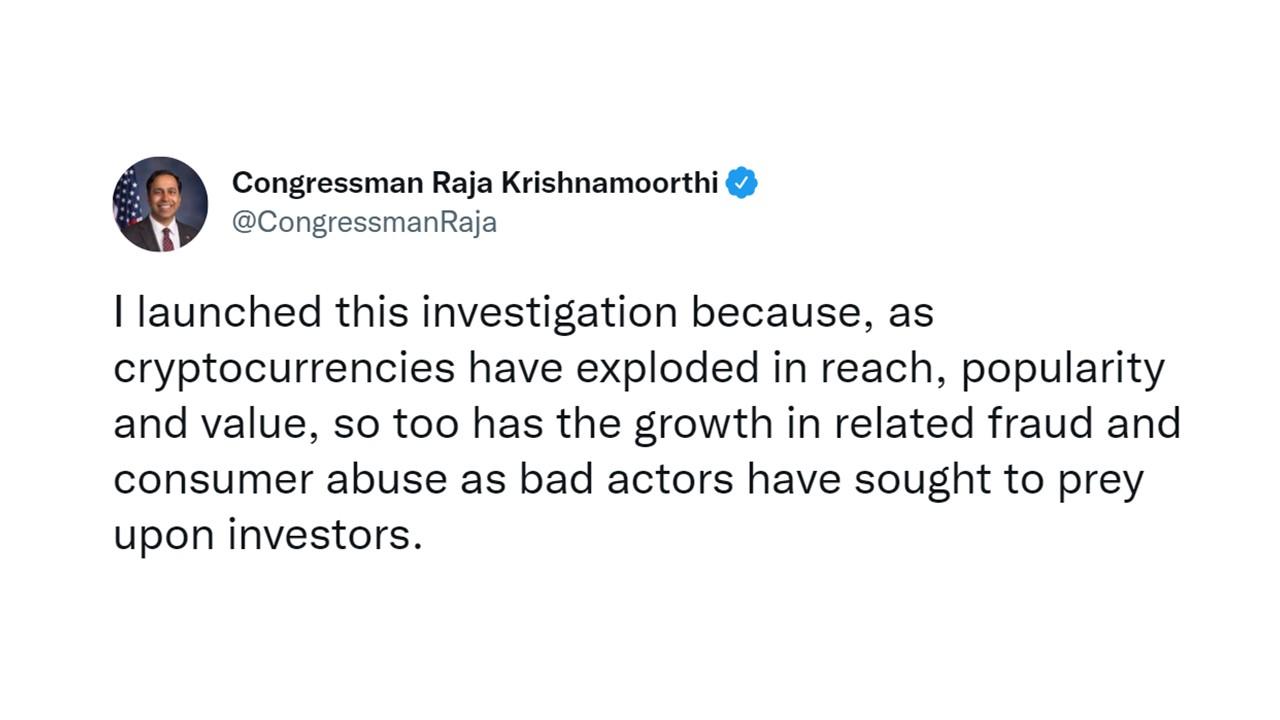

Rep. Raja Krishnamoorthi (D-Ill.), Chair of the Subcommittee on Economic and Consumer Policy, sent letters out to major crypto exchanges to determine what security measures the companies are taking to protect users. A letter requesting information on company practices went to Binance.US, Coinbase, FTX, Kraken, and KuCoin.

Krishnamoorthi wrote, “As stories of skyrocketing prices and overnight riches have attracted both professional and amateur investors to cryptocurrencies, scammers have cashed in. The lack of a central authority to flag suspicious transactions in many situations, the irreversibility of transactions, and the limited understanding many consumers and investors have of the underlying technology make cryptocurrency a preferred transaction method for scammers.”

For these reasons, Krishnamoorthi says he’s “concerned about the growth of fraud and consumer abuse linked to cryptocurrencies.”

Fraud plays a big role in the crypto landscape

The U.S. Department of the Treasury on August 8 announced sanctions against Tornado Cash, citing the platform’s prevalence in money laundering markets. According to the Treasury, more than $7 billion worth of crypto assets had been laundered through Tornado Cash since 2019.

This story sets the stage for a larger uncertainty of crypto security. In March, hackers made off with $615 million worth of crypto. Last year, SQUID coin (based off the notorious South Korean TV show Squid Game) convinced investors to pile in before pulling the rug. Even news outlets had covered SQUID, ultimately inviting investors straight into a scam.

Given all this and more, the committee’s interest in the matter makes sense. What are major crypto exchanges doing to protect users from fraud? The answer could outline forthcoming regulation from the government, which has long had its eye on the blockchain landscape.

As Congress probes crypto firms, what’s next?

Congress has set a deadline of September 12 for Coinbase, FTX, Kraken, KuCoin, and Binance.US to send all crypto fraud documents from 2009 and later. Once the committee receives the documents, it may use the information to impose regulations on the crypto market.

Regulators remain undecided on where crypto assets fall under the current delineations (Krishnamoorthi asked for experts’ opinions on whether crypto assets are “commodities, securities, or both”).

In short, any forthcoming regulation will take a substantial amount of deliberation. However, if regulators remain hyper-focused, those regulations could come sooner rather than later.