PepsiCo Inc

Latest PepsiCo Inc News and Updates

Coca-Cola Expands Its Still Portfolio with a Stake in Aloe Gloe

Coca-Cola’s Venturing & Emerging Brands unit has acquired a minority stake in the certified organic, non-GMO, and gluten-free drink Aloe Gloe.

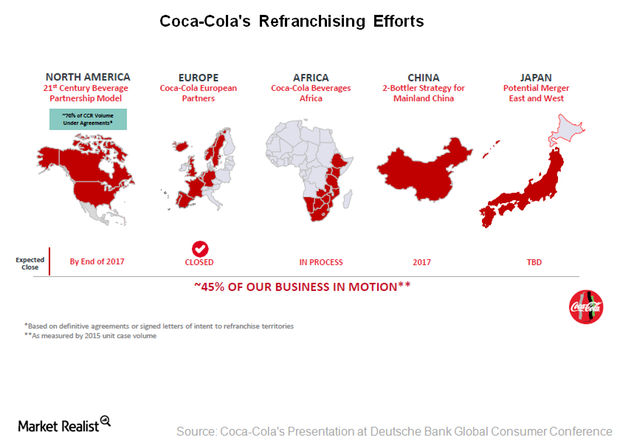

How Coca-Cola’s Refranchising Efforts Will Transform the Company

On June 15, the Coca-Cola Company (KO) announced a letter of intent to refranchise territories in most of the Memphis, Tennessee, market unit.

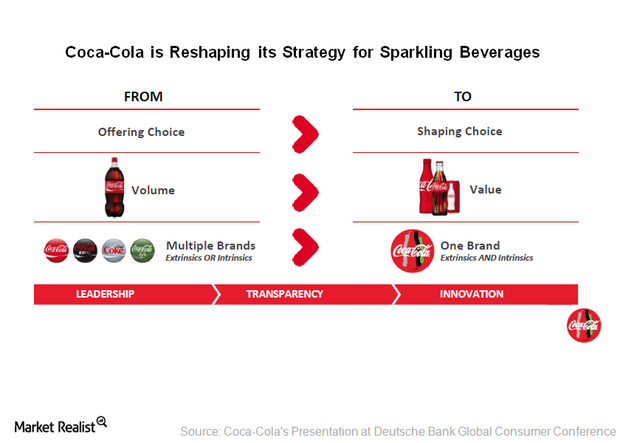

How Coca-Cola Is Reshaping Its Strategy for Sparkling Beverages

Coca-Cola is now changing its approach from offering beverage choices to consumers to shaping their choices.

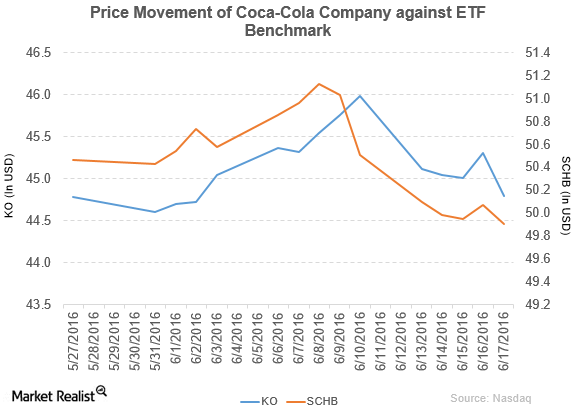

Why Did The Coca-Cola Company Fall on June 17?

The Coca-Cola Company (KO) has a market cap of $192.8 billion. It fell by 1.2% to close at $44.79 per share on June 17, 2016.

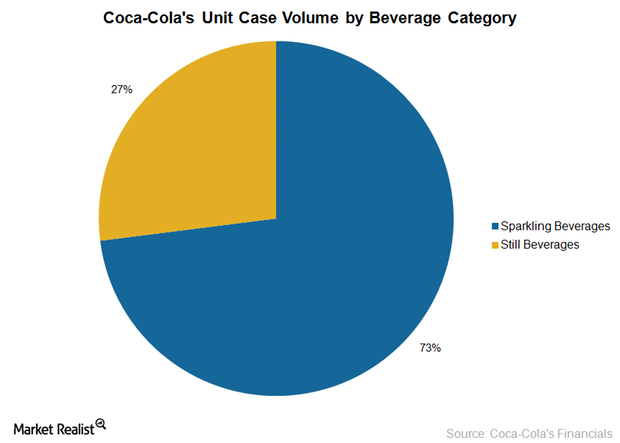

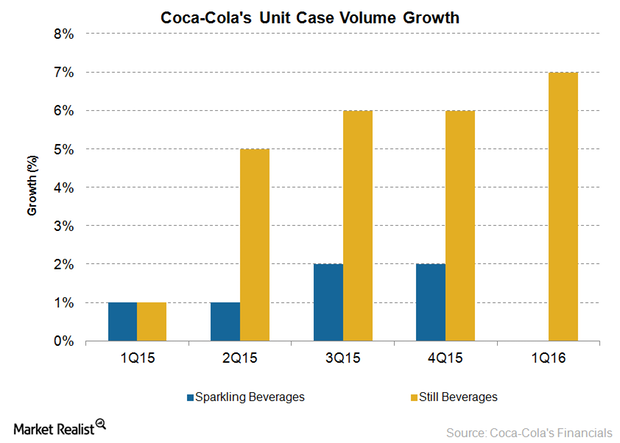

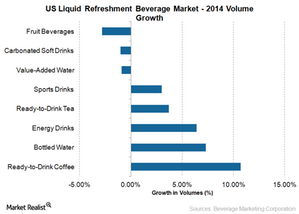

Why Coca-Cola Is Focusing on Still Beverages

In January 2016, Coca-Cola announced the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

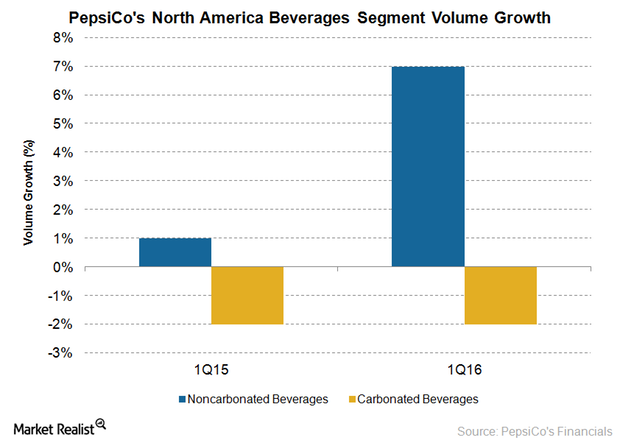

PepsiCo’s Non-Carbonated Beverages Sparkle in 1Q16

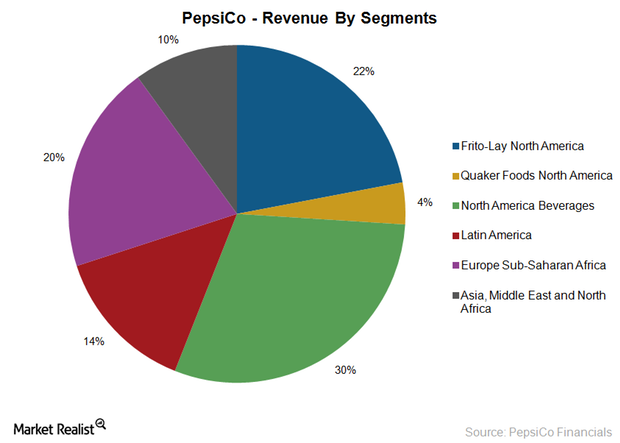

In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit.

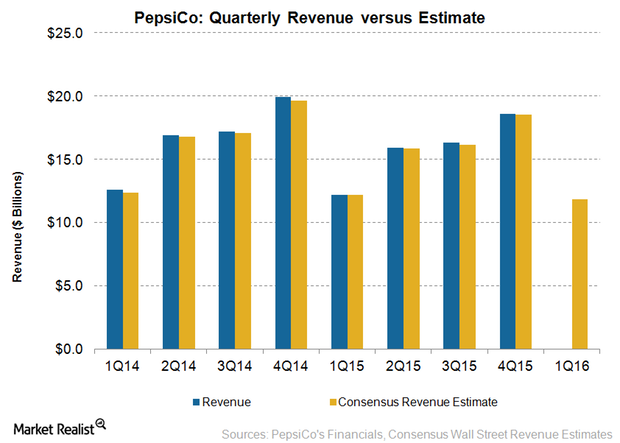

Why Analysts Expect PepsiCo’s Revenue to Decline in Fiscal 1Q16

On April 18, PepsiCo is scheduled to announce its results for fiscal 1Q16. PepsiCo’s revenue has declined in each of the past five consecutive quarters.

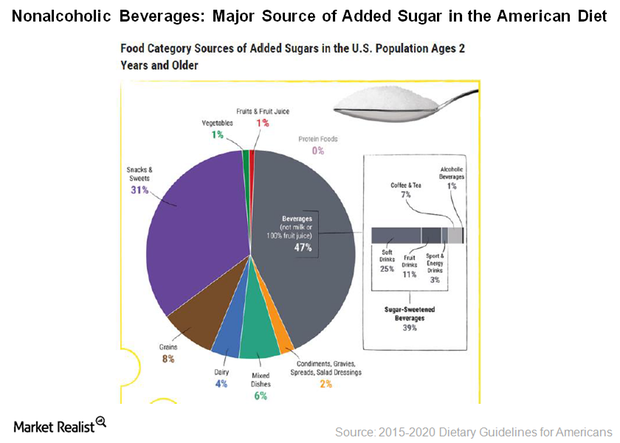

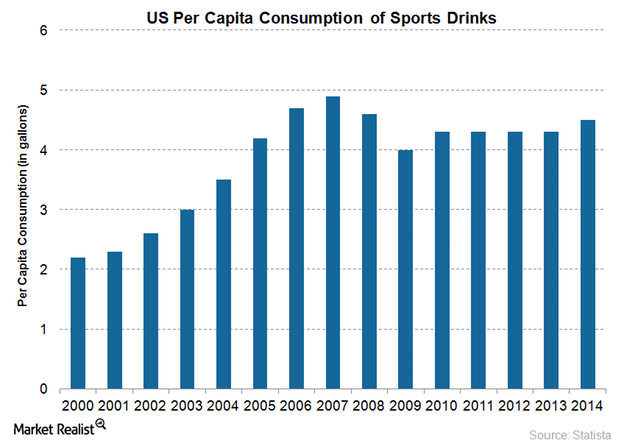

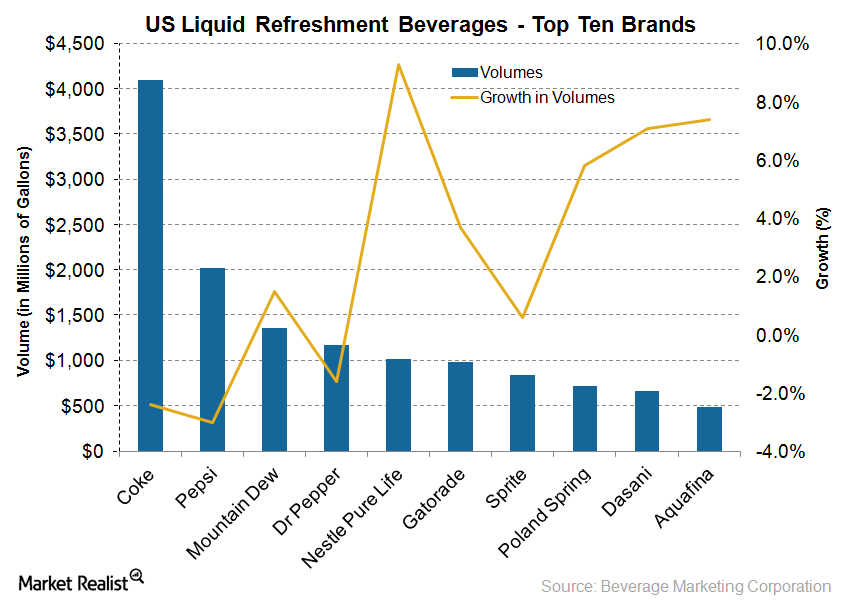

An Insight into Sport Drinks’ Positioning in the US Beverage Market

Sports drinks are considered a healthier choice than traditional soda beverages, and they contain less sugar than traditional soda beverages.

Coca-Cola Strengthened Presence in Africa with Stake in Chi

Beverage giant Coca-Cola (KO) has expanded its presence in Africa with the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

Are Strategic Brands Boosting Monster Beverage’s Sales?

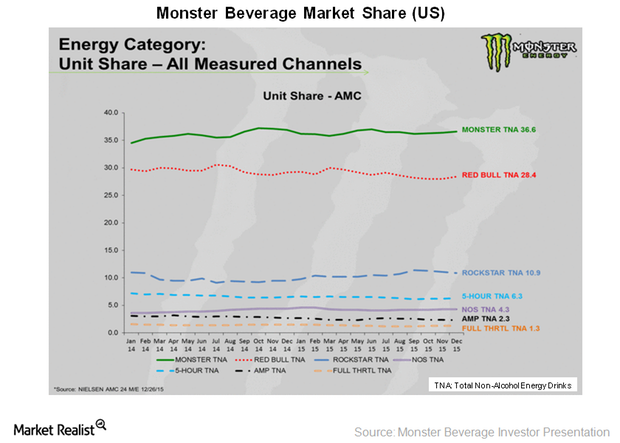

According to Nielsen’s data, for the period ending December 26, 2015, the Monster Beverage brand held a 36.6% share of the US energy drink market in terms of unit sales.

Monster Beverage Increases Its Advertising Efforts

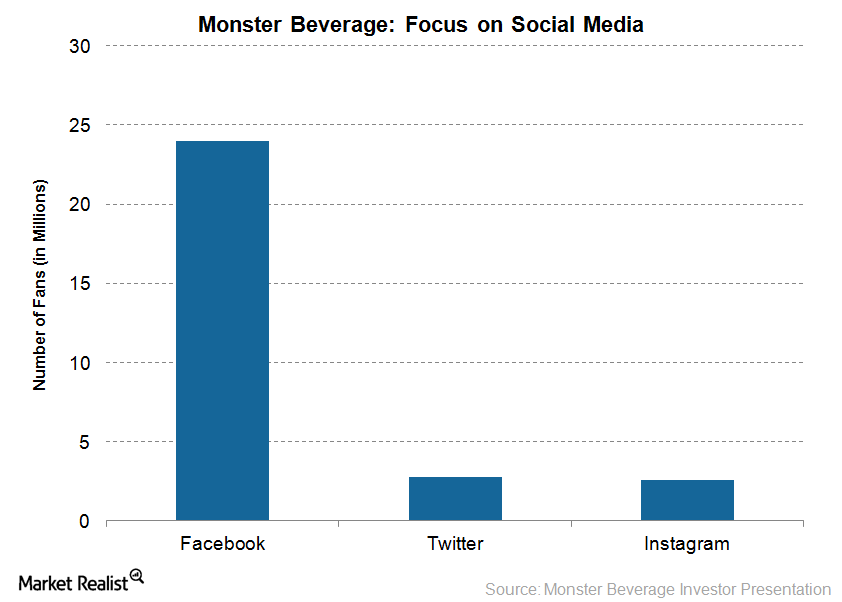

Monster Beverage enjoys huge popularity on social media. It has 24 million fans on Facebook (FB), 2.8 million fans on Twitter (TWTR), and 2.6 million fans on Instagram.

Monster Beverage Provides an Update on Distribution Transition

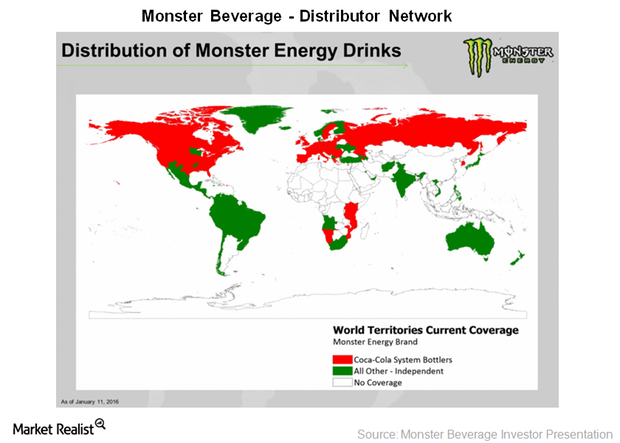

In its 3Q15 conference call, Monster Beverage disclosed an agreement with Coca-Cola HBC (Hellenic Bottling Company) that will apply across 28 countries.

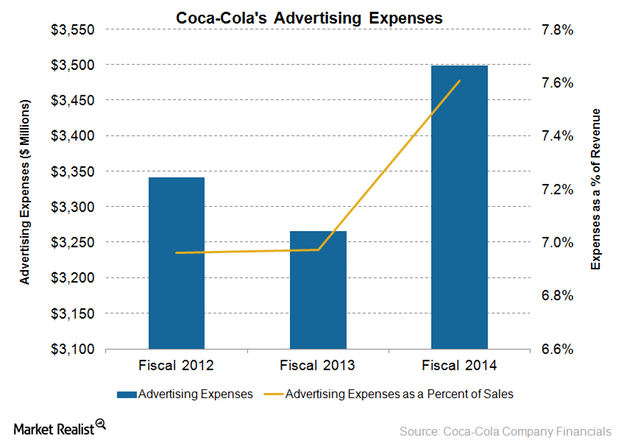

Understanding Coca-Cola’s New Marketing Efforts

Coca-Cola (KO) is using its productivity savings to ramp up its media investments.

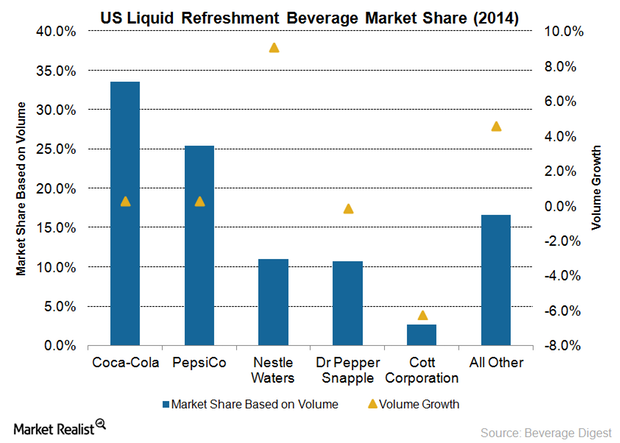

Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

PepsiCo’s Strategy for Its UK Business

PepsiCo’s strategy for its UK business involves continued investment in its core brands across snacks and beverages, including Walkers, Tropicana, Naked, Quaker, and Pepsi.

Dr Pepper Reaches for Sports Drinks with BodyArmor

On August 12, 2015, Dr Pepper Snapple announced that it purchased an 11.7% stake in BA Sports Nutrition, the company that owns BodyArmor.

Coca-Cola Bottler Merger: Analyzing the Deal’s Economics

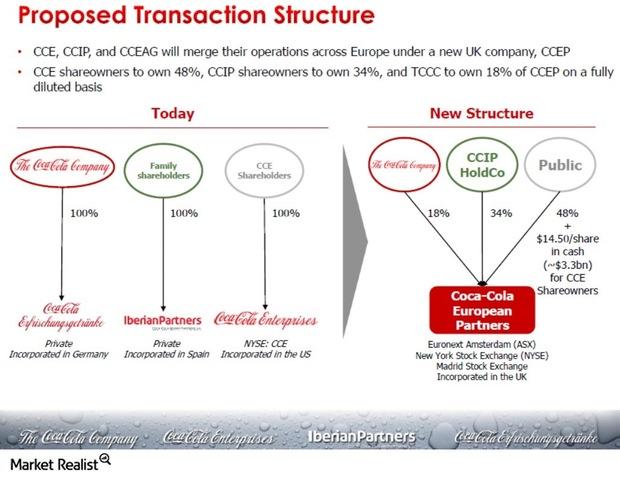

The new company, Coca-Cola European Partners PLC (or CCEP), would be based in the United Kindgom with CCE, CCIP, and The Coca-Cola Company (KO) holding 48%, 34%, and 18% of shares, respectively.

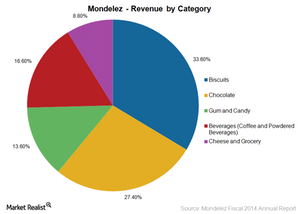

The Rationale behind the Sale of Mondelez’s Coffee Business

The primary reason behind the sale of Mondelez’s coffee business was so Mondelez could focus more on its core snack food business.

Why Are Millennials a Key Demographic for Monster Beverage?

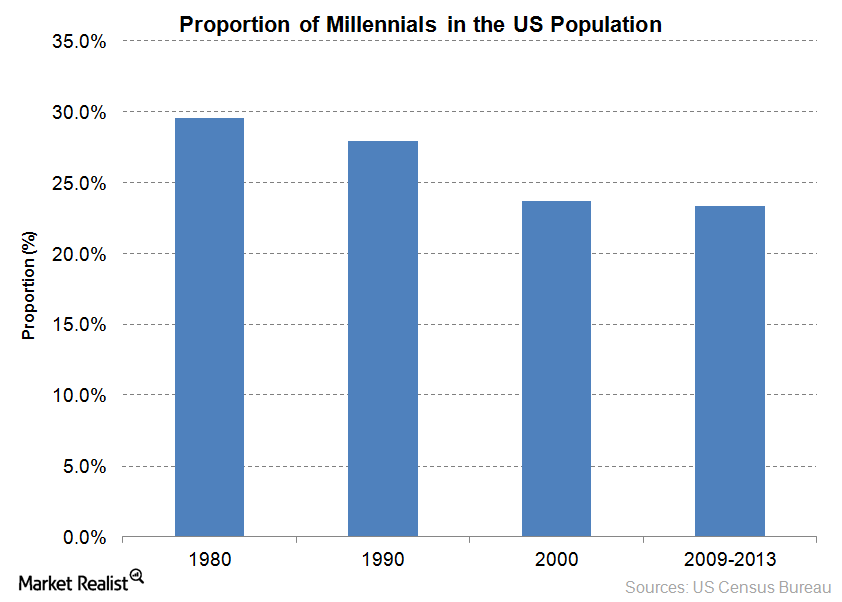

Millennials are the key consumers of energy drinks and shots. Monster Beverage specifically targets this tech-savvy demographic in its advertisements.

Are Parents Driving Energy Drink Sales in the US?

As shocking as it may sound, a higher proportion of US households with children are consuming more energy drinks—compared to those without children.

Energy Drinks Continue to Thrive despite Controversies

Two-thirds of energy drink consumers are concerned about the negative effects of energy drinks and shots, but this doesn’t stop them from consuming the drinks.

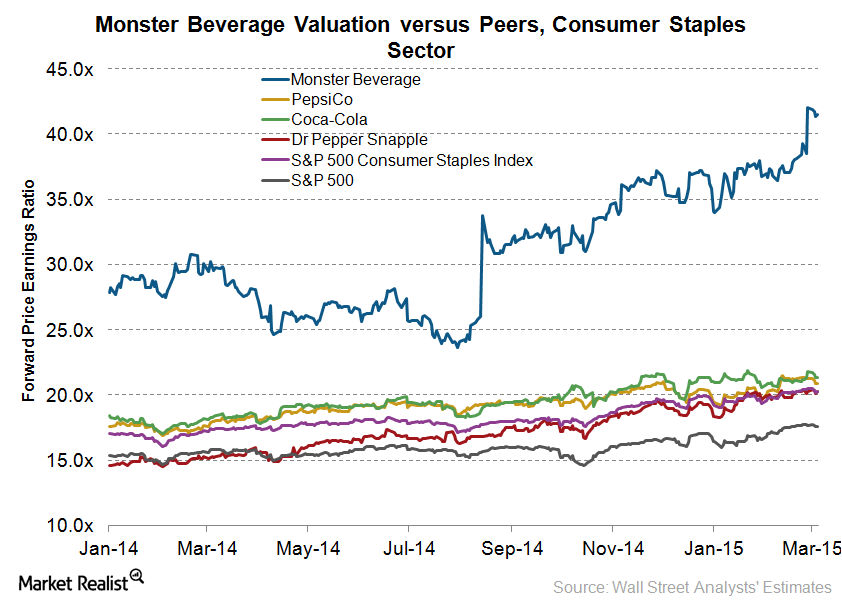

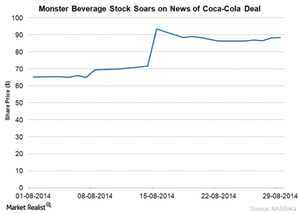

Monster Gets More Energy in Strategic Partnership with Coca-Cola

On June 12, Coca-Cola and Monster Beverage completed a strategic partnership. Coca-Cola purchased 16.7% in Monster for $2.2 billion. That day, Monster Beverage shares rose 1.0%, and Coca-Cola’s fell 0.3%.

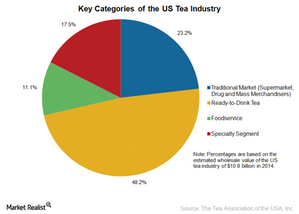

What Are the Key Categories in the US Tea Industry?

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014.

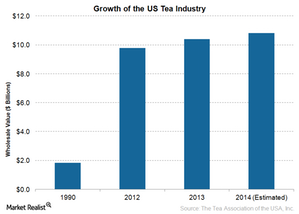

The Growing Demand for Tea in the US

Though the per capita consumption of tea in the US is low compared to other countries, the growth in tea consumption in recent years has been impressive.

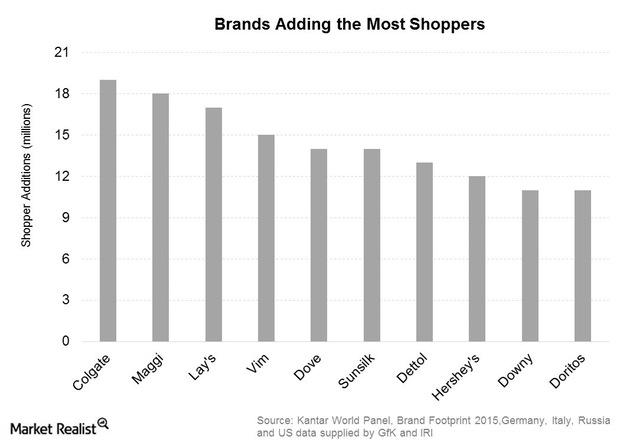

Procter & Gamble’s Downy: World’s Fastest-Growing Brand

According to Kantar World Panel’s Brand Footprint 2015 report, Procter & Gamble’s (PG) fabric softener Downy was the fastest-growing brand in 2014.

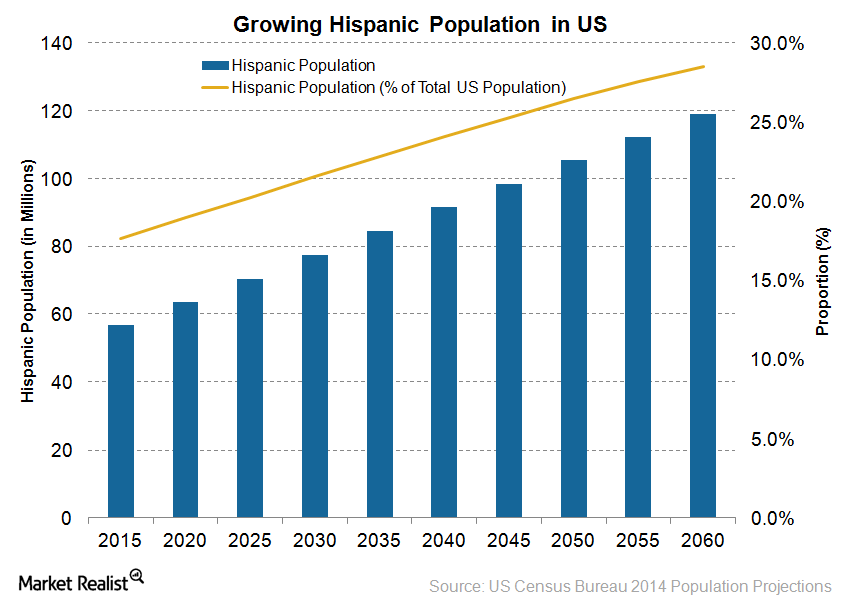

Why PepsiCo and Its Peers Are Focusing on Hispanics in 2015

PepsiCo (PEP) and peers like Coca-Cola and Dr Pepper Snapple have been developing several products based on the tastes and preferences of Hispanics.

Gatorade by PepsiCo: Still Athletic at 50

Gatorade is celebrating its 50th anniversary this year. It’s one of PepsiCo’s $22-billion brands, generating more than $1.0 billion in annual retail sales.

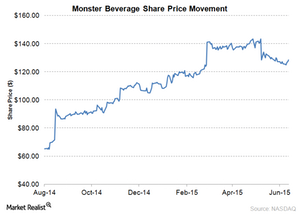

Monster Beverage’s stock outperforms peers

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.

Monster Beverage and Coca-Cola: A landmark partnership

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

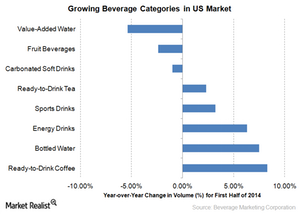

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

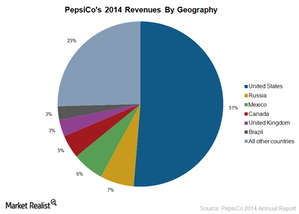

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

How PepsiCo’s focus on innovation is reaping rewards

PepsiCo’s focus on innovation includes Pepsi Spire 5.0 equipment, which allows consumers to create about 1,000 beverage combinations using a 32-inch touchscreen.

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

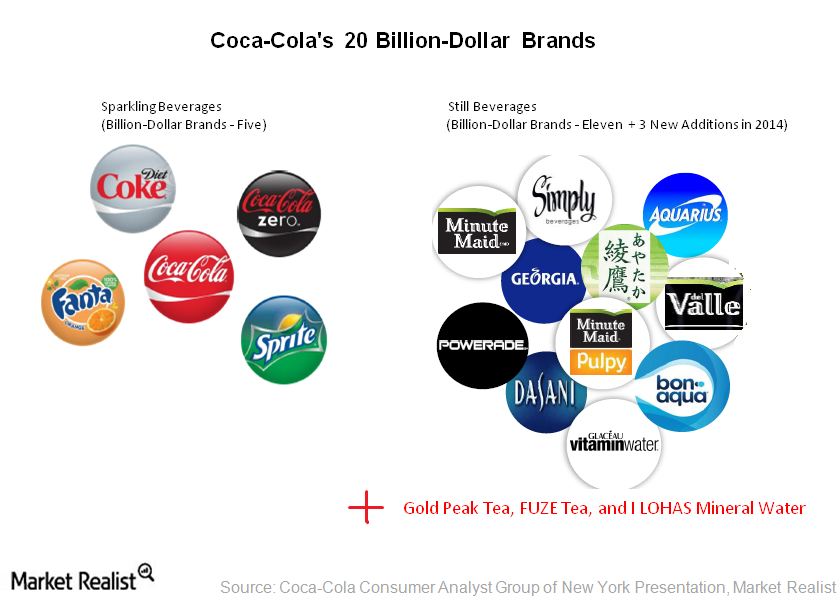

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

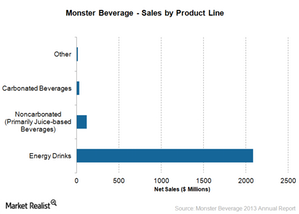

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

Why Monster Beverage’s international business is growing

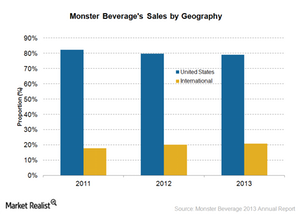

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

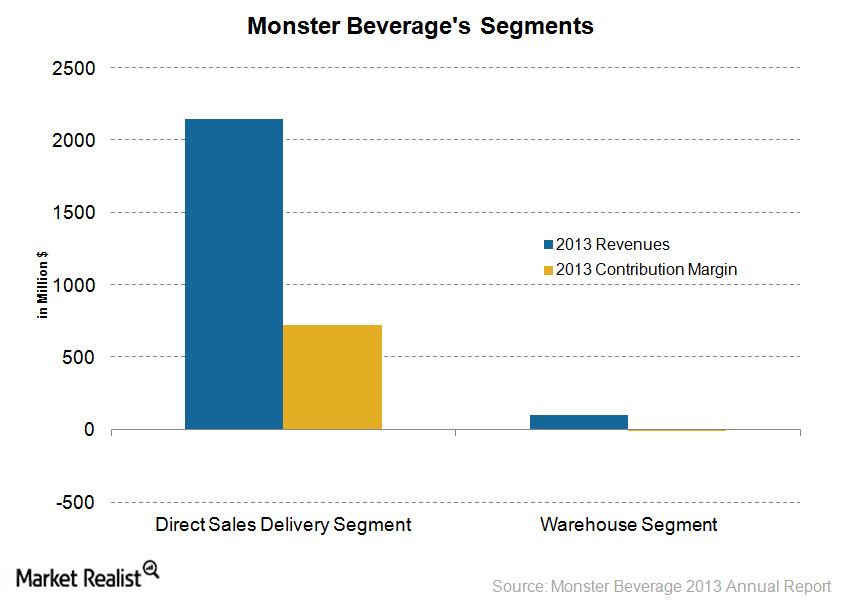

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

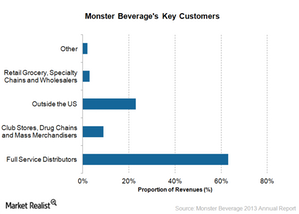

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.

Monster Beverage’s extensive line of energy drinks

Monster Beverage Corporation (MNST) emerged as a leader in energy drinks. It has a 14% market share in the world’s energy drink market.

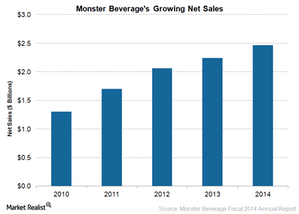

An overview of Monster Beverage Corporation

Monster Beverage Corporation (MNST) is based in California. It manufactures alternative beverages. It sold over 10 billion energy drinks in the past 12 years.

What are Dr Pepper Snapple’s growth strategies?

Dr Pepper Snapple plans to grow into new categories by leveraging its distribution agreements for third-party brands such as Vita Coco coconut water.

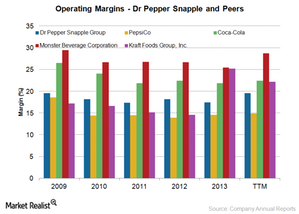

Dr Pepper Snapple makes efforts to improve profitability

Dr Pepper Snapple implemented its rapid continuous improvement (or RCI) in 2011 to simplify processes and address distribution and the availability gap.

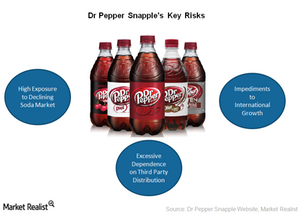

What are Dr Pepper Snapple’s major risks?

Dr Pepper Snapple faces major risks like significant reliance on carbonated soft drinks, limited international growth, and excessive reliance on third-party distribution.

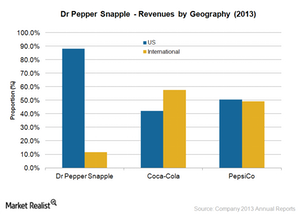

Why international expansion is vital for Dr Pepper Snapple

The carbonated soft drink volumes in North America have been continually declining. This makes it important for Dr Pepper Snapple to grow beyond its US operations.

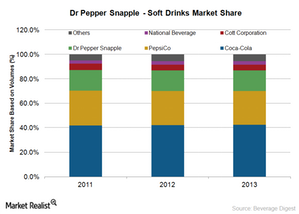

Dr Pepper Snapple is pitted against the soda behemoths

In 2013, Coca-Cola had 42.4% of the market share in the US carbonated soft drink category. PepsiCo had 27.7% and Dr Pepper Snapple 16.9% of the market share.

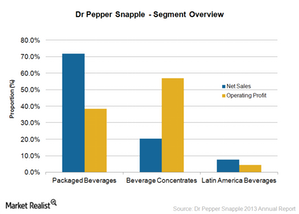

Understanding Dr Pepper Snapple’s revenue streams

Dr Pepper Snapple derives its revenues from the sale of carbonated soft drinks and noncarbonated beverages like ready-to-drink tea, juices, and mixers.

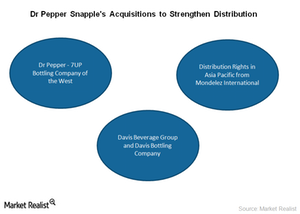

Dr Pepper Snapple strengthens its distribution network

Dr Pepper Snapple is continually strengthening its position as a major beverage company by acquiring regional bottling companies and distribution rights.

Understanding Dr Pepper Snapple’s route to market

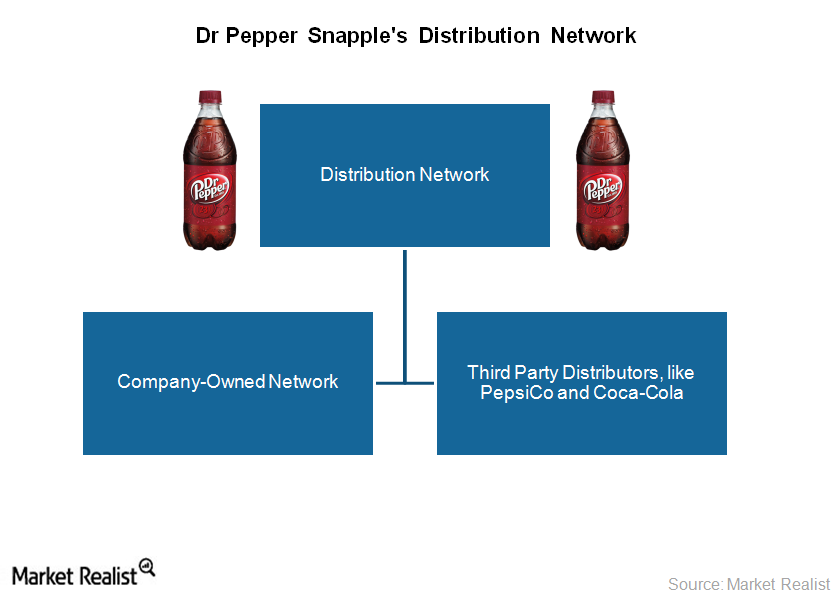

Dr Pepper Snapple’ beverages reach consumers through the company’s own distribution network, third-party distributors, and direct delivery to customers’ warehouses.

Dr Pepper Snapple targets key demographics in advertising campaigns

Dr Pepper Snapple is targeting Hispanics and Millennials in its advertising. By 2020, Hispanics will make up 19% of the US population. Millenials represents 24%.