PepsiCo Inc

Latest PepsiCo Inc News and Updates

Indra Nooyi: Former PepsiCo CEO and Top Female Executive Still Earns Millions

Indra Nooyi was the CEO of PepsiCo for 12 years. What's Nooyi’s net worth? How did she become one of the top female business executives?

Pepsi Launches 'Pepsi Mic Drop' Genesis NFT—How to Get on the Waitlist

Pepsi has joined the list of brands and entities creating their brand-inspired NFTs with its "Pepsi Mic Drop" genesis collection. How can you join the waitlist?

These Popular Products Are Made on Israeli Settlements

You might own or have tried many of these products, but did you know they were produced on Israel-occupied Palestinian land?

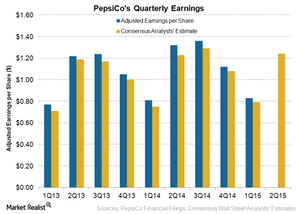

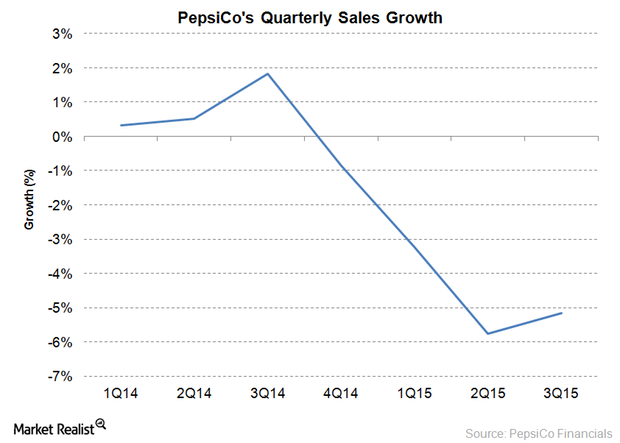

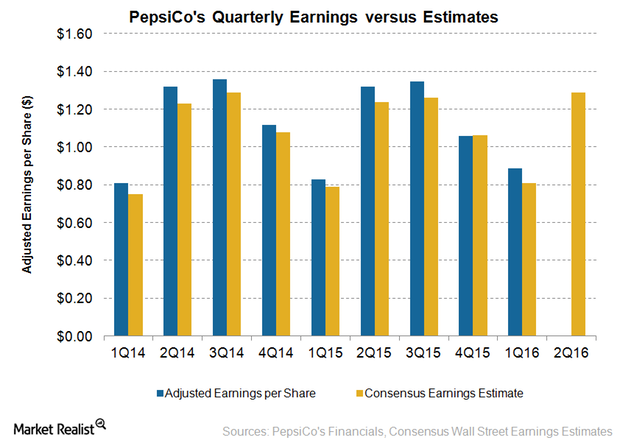

Will PepsiCo’s Earnings Stay Ahead of Wall Street in 2Q15?

PepsiCo expects currency headwinds to impact its fiscal 2015 core EPS by 11% compared to its previous estimate of 7%. It expects currency headwinds to drag down EPS in 2Q15 by 12%.

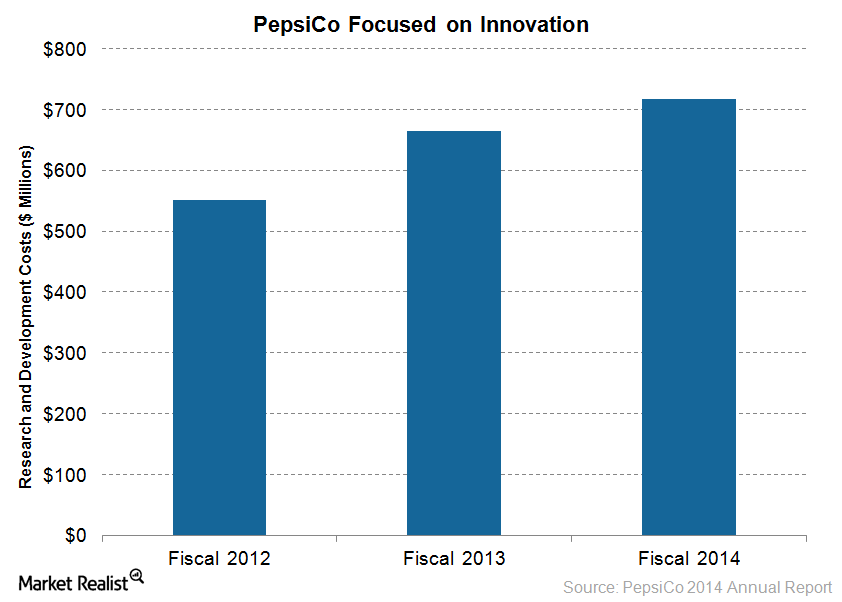

Why Innovation Should Drive PepsiCo’s 2015 Revenue

In April 2015, PepsiCo (PEP) launched two new protein-packed snack mixes under its Cracker Jack’D food brand.

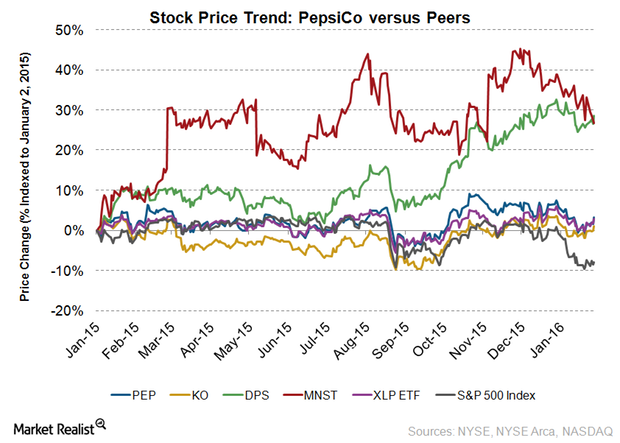

Can PepsiCo’s Stock Pick Up Momentum in 2016?

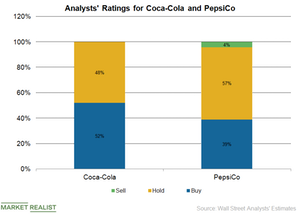

As of January 28, about 59% (or 17) analysts out of 29 analysts, have a “buy” recommendation for PepsiCo and 12 analysts have a “hold” recommendation. None of the analysts have a sell recommendation.

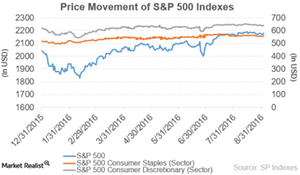

Your Outliers in the Consumer Space: 5th Week of August

By the end of August, the S&P Consumer Staples had outperformed the S&P Consumer Discretionary and SPY with respective returns of 0.89%, -0.18%, and 0.50%.

Coca-Cola Deal Gives Monster Beverage Yet Another Boost

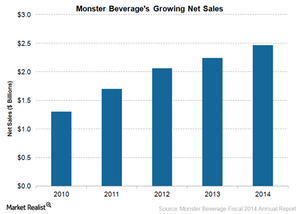

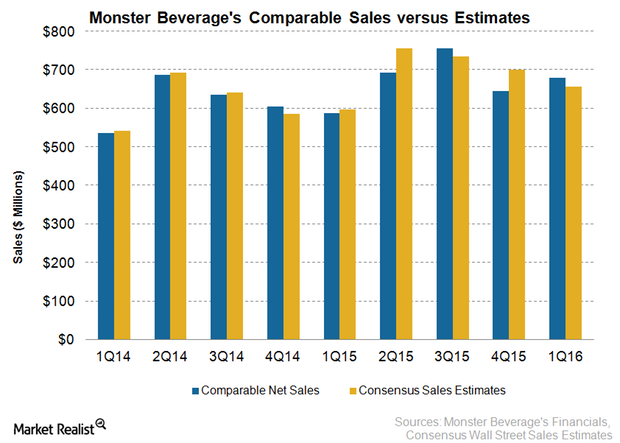

In 2014, Monster Beverage’s net sales increased by 9.7% to $2.5 billion, with 21.7% of its net sales from outside the United States.

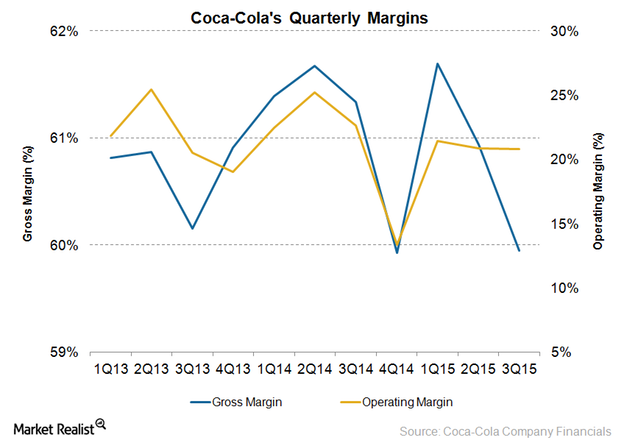

Coca-Cola’s 4Q15 Operating Margin Rose on Productivity Measures

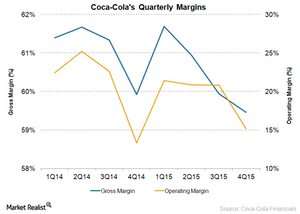

Coca-Cola’s operating margin improved significantly to 15.2% in 4Q15 from 13.3% in the comparable quarter of the previous year.

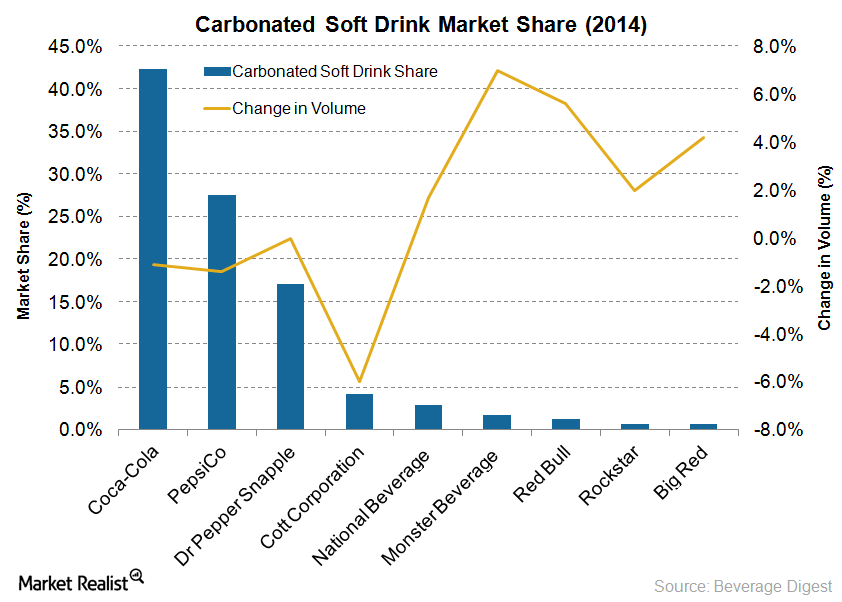

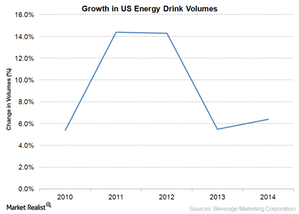

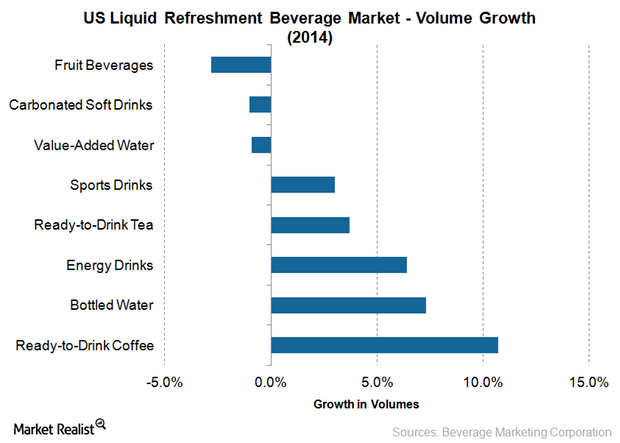

Energy Drinks Outperform Soda Drinks in Case-Volume Growth

An interesting development in the energy drinks industry is Monster Beverage’s strategic deal with Coca-Cola. The deal will expand Monster Beverage’s product line-up.

How PepsiCo Is Planning to Diversify Its Soft Drink Business

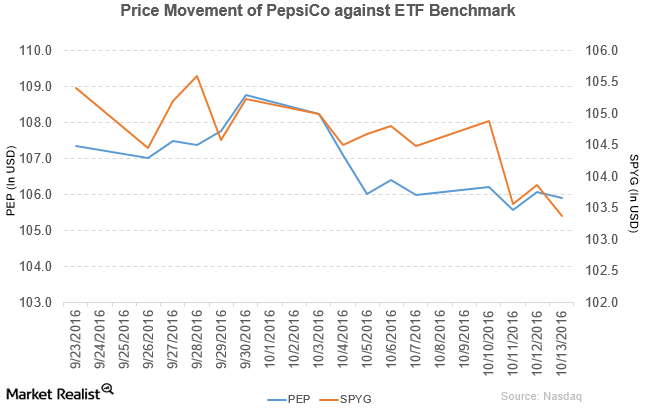

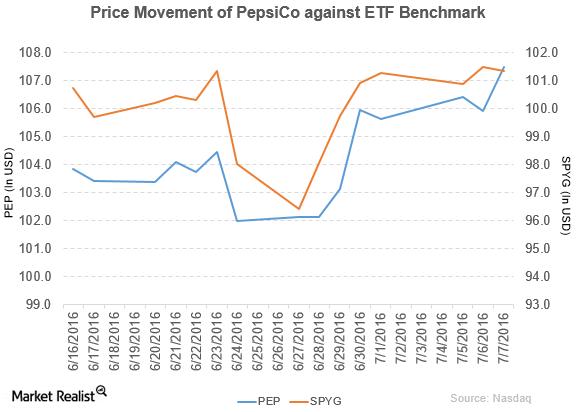

PepsiCo (PEP) has a market cap of $152.5 billion. It fell 0.15% to close at $105.92 per share on October 13, 2016.

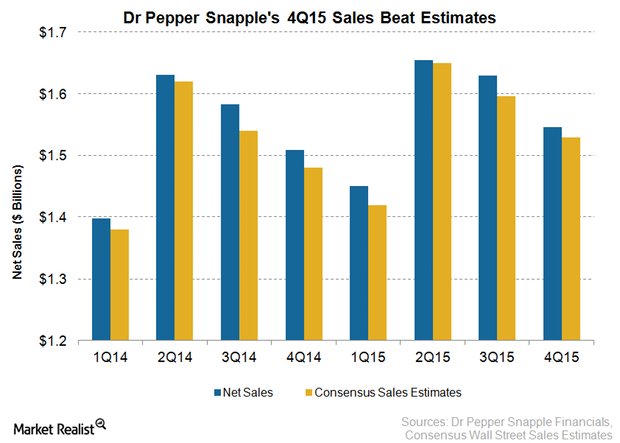

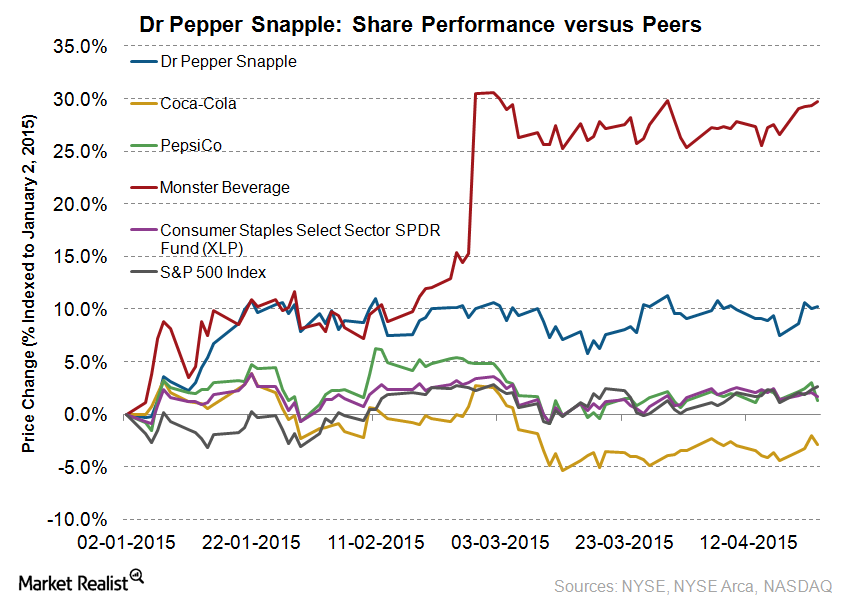

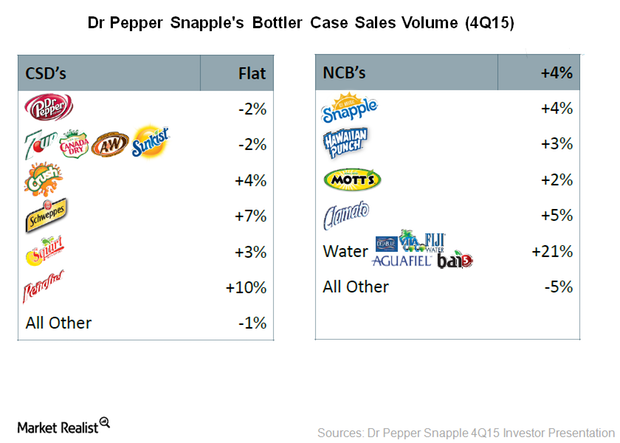

Key Drivers of Dr Pepper Snapple’s 4Q15 Sales

Dr Pepper Snapple reported sales of nearly $1.6 billion in 4Q15, beating the consensus Wall Street analyst estimate of $1.53 billion.

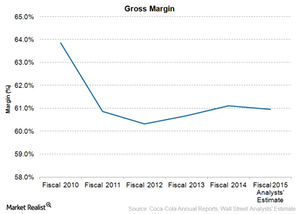

Coca-Cola’s Productivity Program to Improve 2015 Margins

Coca-Cola’s productivity program aims for annualized savings of $3 billion by 2019. The company will reinvest these savings in incremental media spending.

An Overview of the US Nonalcoholic Beverage Industry

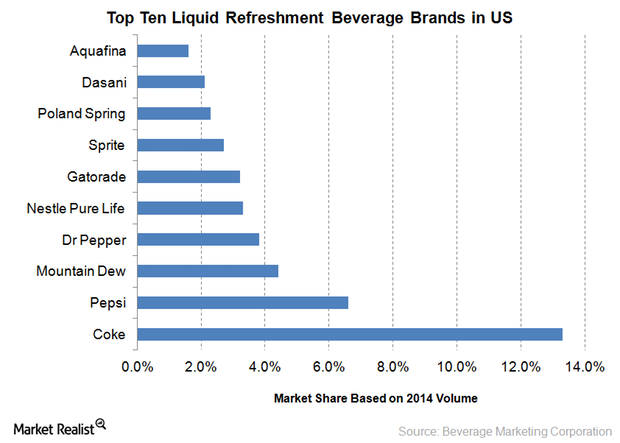

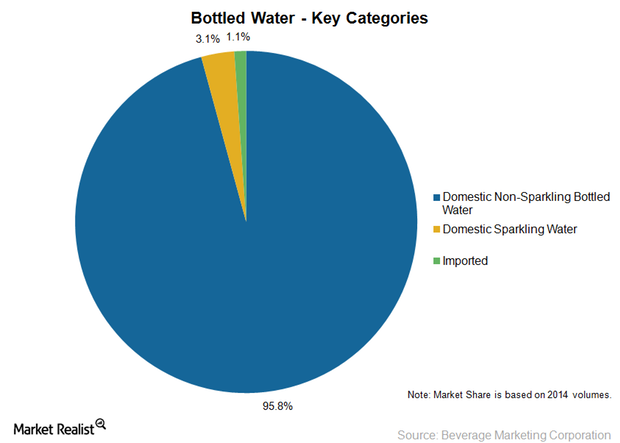

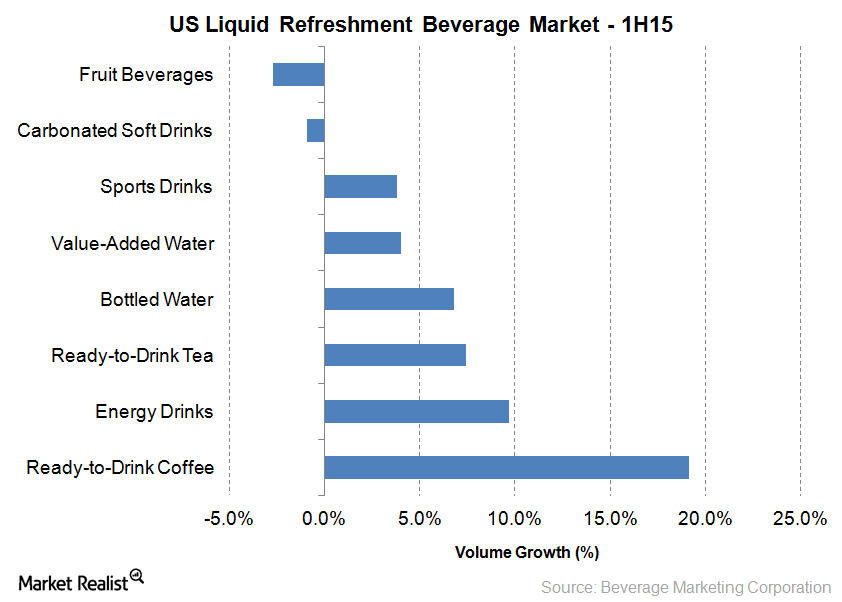

The US nonalcoholic beverage market comprises categories like carbonated soft drinks, ready-to-drink tea and coffee, bottled water, sports drinks, and energy drinks.

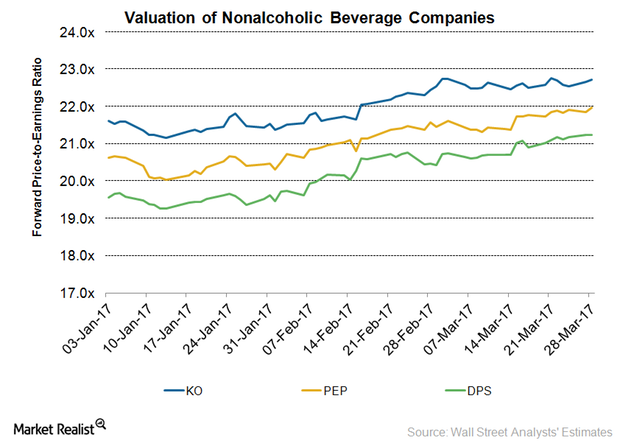

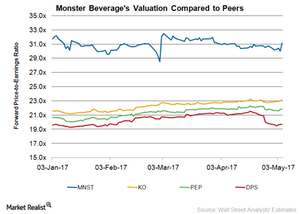

Coca-Cola, PepsiCo, Dr Pepper Snapple: A Valuation Showdown?

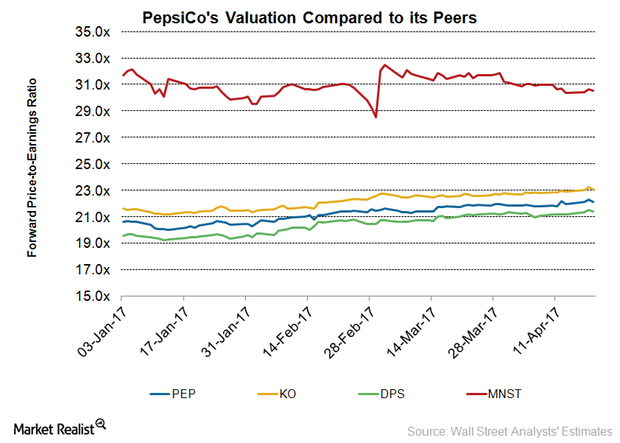

As of March 28, Coca-Cola and PepsiCo were trading at 12-month forward PE multiples of 22.7x and 22.0x, respectively.

How Did PepsiCo’s 2Q16 Earnings Turn Out?

PepsiCo rose by 1.5% to close at $107.49 per share on July 7. Its weekly, monthly, and YTD price movements were 4.2%, 4.9%, and 9.2% that day.

New York Is Gearing Up for PepsiCo’s Kola House this Spring

PepsiCo is getting ready to launch Kola House, its first hospitality venture, at its flagship location in New York City’s Meatpacking District. The first Kola House, which will operate as a kola bar, restaurant, lounge, and event space, is expected to open this spring.

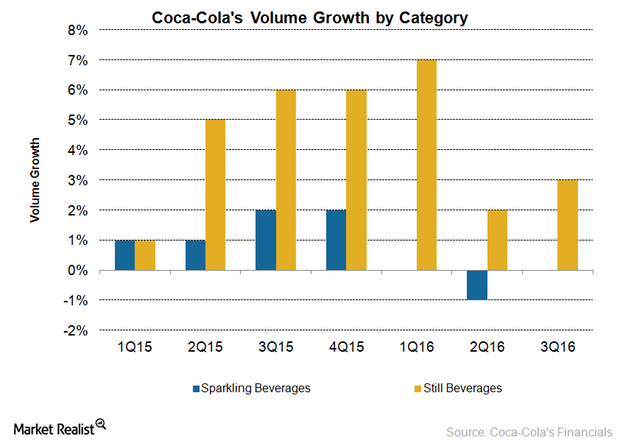

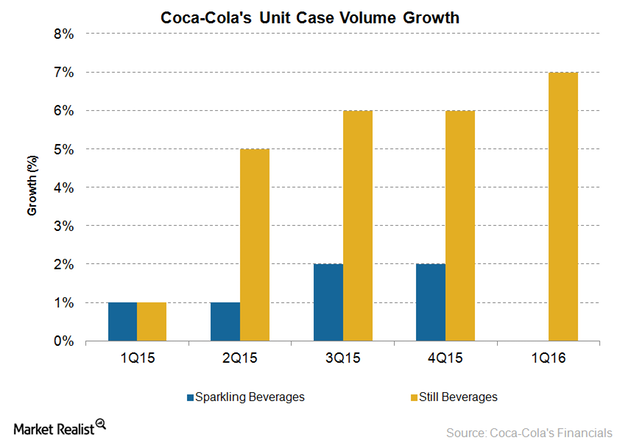

Coca-Cola’s Growth Strategy for Soda and Still Beverages

Coca-Cola’s (KO) overall unit case volume rose 1% in 3Q16. The company’s soda or sparkling beverage unit case volumes were flat in 3Q16 on a YoY basis.

Monster’s 1Q16 Sales Benefit from Strategic Deal with Coca-Cola

Monster Beverage’s (MNST) net sales in 1Q16 ended March 31, 2016, were $680.2 million, ahead of the consensus analyst sales estimate of $656.9 million.

Coca-Cola and PepsiCo: Analysts’ Recommendations

On December 13, PepsiCo (PEP) stock rose 1.2%. UBS initiated coverage with a “neutral” rating and a target price of $123.

Mintel Forecasts Strong Growth in the US Energy Drink Market

The US energy drink and shots market grew by 56% between 2009 and 2014, even though the category was entangled in litigation and had negative publicity.

Non-Sparkling Water Is the Largest Bottled Water Segment in the US

The domestic non-sparkling bottled water category is the largest segment of bottled water in the US.

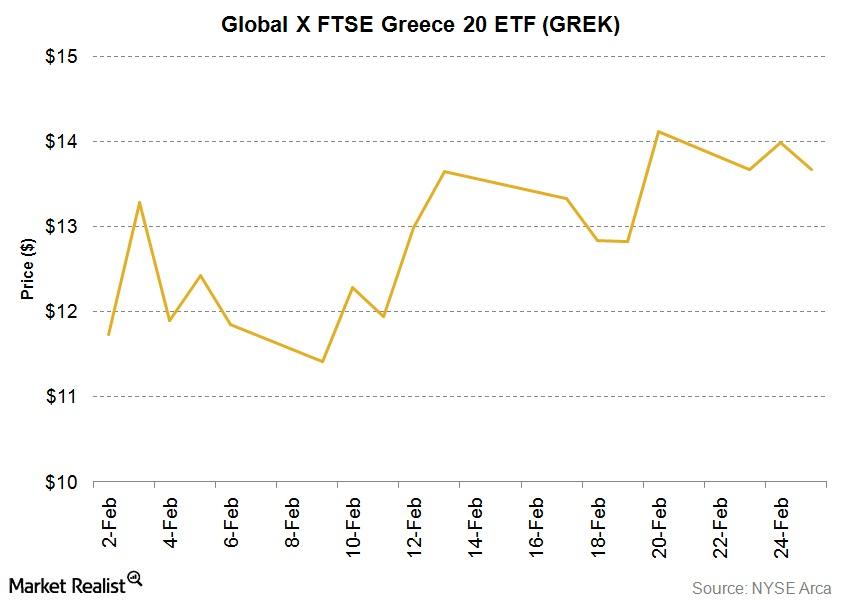

Eurozone grants bailout extension to Greece

Europe-tracking ETFs gained significantly from February 19 to February 24, when the bailout extension to Greece was approved.

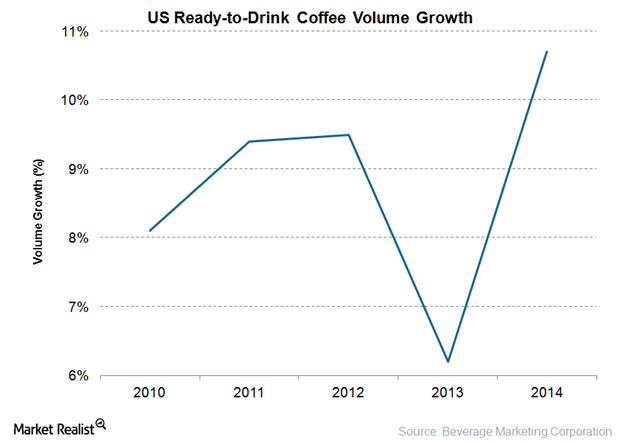

Why Ready-to-Drink Coffee Is Gaining Popularity with US Consumers

Coffee lovers in the United States are boosting ready-to-drink coffee volumes.

Coca-Cola’s 2015 Productivity Initiatives: A Closer Look at Costs

Coca-Cola has been aggressively implementing productivity initiatives to offset the impact of sluggish soda volumes and macro challenges in key markets.

PepsiCo Announced Its CEO Succession Plan

On August 6, PepsiCo (PEP) announced its CEO succession plan. Long-term CEO Indra Nooyi will step down effective October 3.

The Growing Emphasis of Coca-Cola and Peers on Still Beverages

Another plant-based beverage acquisition made by Coca-Cola was that of Xiamen Culiangwang Beverage Technology Company in 2015.

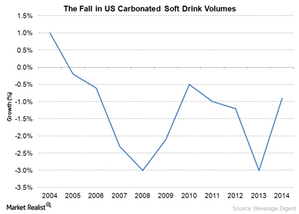

US Soda Update: Case Volumes Decline for the Tenth Straight Year

Carbonated soft drink volumes dropped to 8.8 billion 192-ounce cases in 2014. This is the tenth straight year of decline.

PepsiCo’s Valuation ahead of 1Q17 Results

As of April 19, PepsiCo (PEP) was trading at a 12-month forward PE (price-to-earnings) ratio of 22.1x.

Innovation and Marketing Fuel Dr Pepper Snapple’s Future Growth

Dr Pepper Snapple is creating more visibility for its products by associating with popular movies. It expects its marketing spend to be ~7.6% of net sales in 2015.

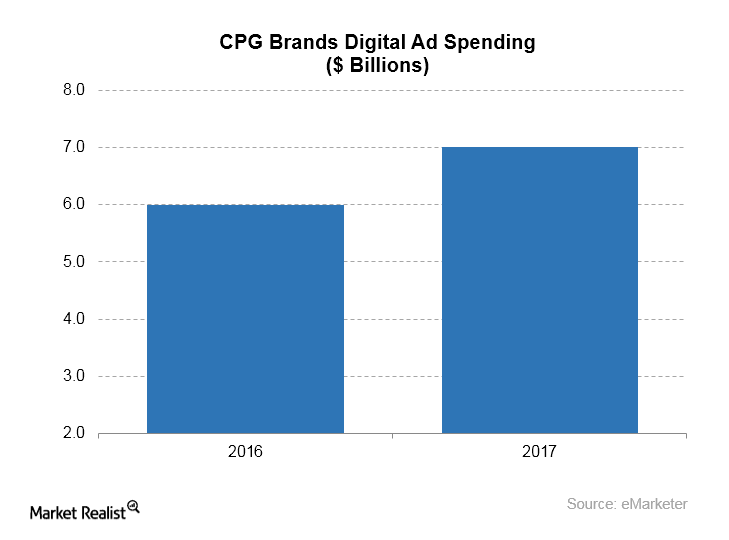

What Are the Trends in Facebook’s Largest Advertising Category?

Business intelligence firm eMarketer estimates that CPG brands spent more than $7.0 billion on digital advertising in 2017, compared with $6.0 billion in 2016.

Did Dr Pepper Snapple’s Non-Carbonated Beverages Call the Shots in 4Q15?

Dr Pepper Snapple (DPS) saw higher volume growth in non-carbonated beverages in all the quarters of fiscal 2015 compared to CSDs.

Women CEOs: 5 Names You Should Know

Of all the Fortune 500 companies, only 5% have women CEOs. We rounded up five of the biggest names investors should know. Here’s why.

PepsiCo Aims to Revive Soda Volumes with Crystal Pepsi

Carbonated soft drinks have been losing their fizz as more and more consumers are opting for healthier beverage options.

PepsiCo Partners with Starbucks to Seek Growth in Latin America

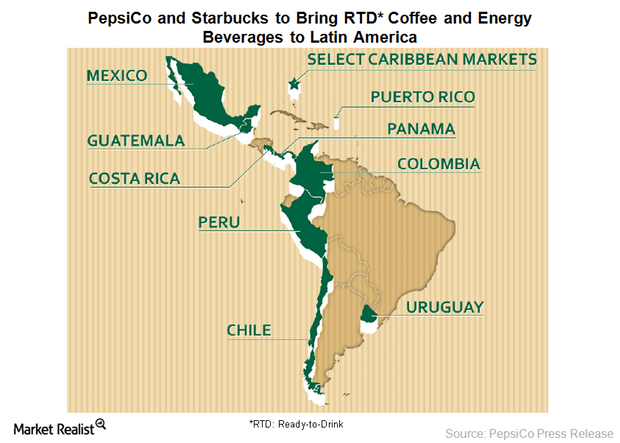

In 2016, PepsiCo and Starbucks will distribute Starbucks’s ready-to-drink, or RTD, coffee and energy beverages in select Latin American markets.

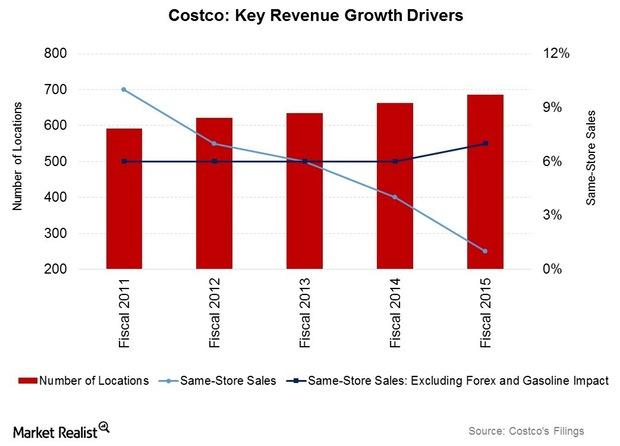

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Coca-Cola Is Open to Inorganic Growth in Still Beverages

Coca-Cola has a dominant presence in the sparkling beverages market, but it’s the still beverage space that has huge growth prospects.

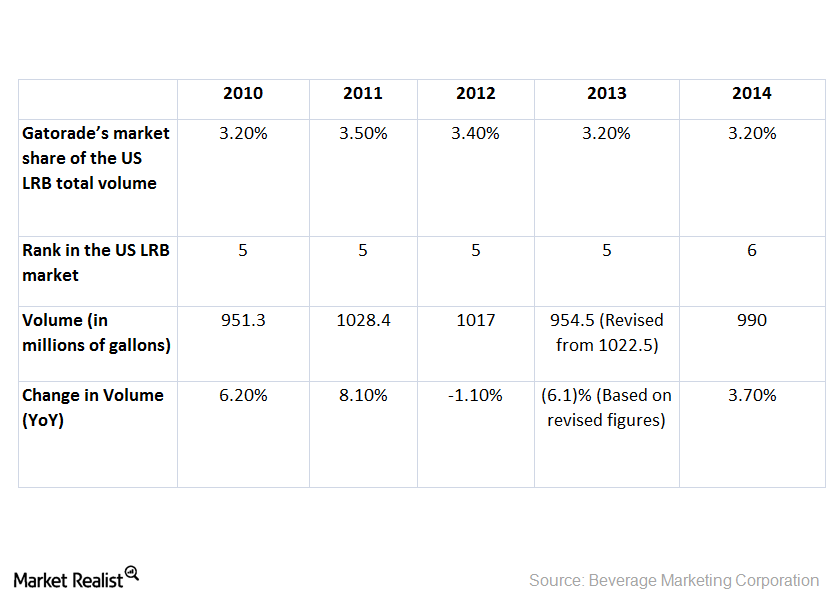

Gatorade’s Position in the Sports Beverage Market

Gatorade’s position and volumes have been impacted by rising competition. It has also felt the effect of the popularity of bottled water, ready-to-drink tea, coffee, and energy drinks.

What Do Analysts Expect from PepsiCo’s 2Q16 Earnings?

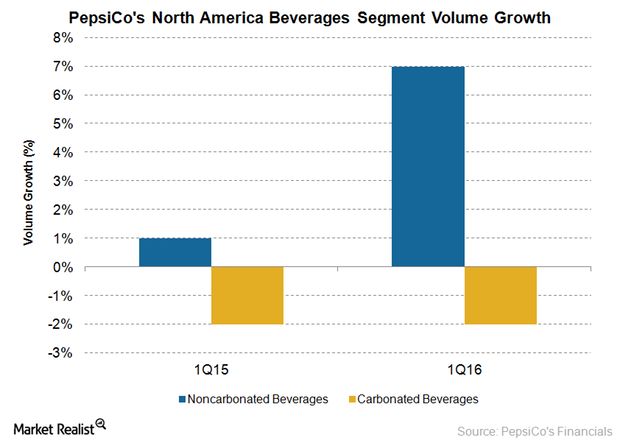

PepsiCo’s (PEP) performance in recent quarters has been under pressure due to currency headwinds and weakness in carbonated soft drink volumes.

Monster Beverage’s Valuation: Impact of 1Q17 Results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

Dr Pepper’s Prospects in Other Non-Carbonated Beverages

Dr Pepper Snapple adopted a strong strategy by acquiring an 11.7% stake in BodyArmor. But it could grow more in other non-carbonated beverage categories.Company & Industry Overviews Understanding Coca-Cola’s business segments

Overall, in 2013, still beverages performed better than sparkling beverages across all the segments except for Europe. Sparkling beverage volumes have been declining over the past few years.

Is PepsiCo Stock a Good Buy at These Prices?

So far, PepsiCo has outperformed Coca-Cola this year. Will the outperformance continue and is PepsiCo stock a good buy at these prices?

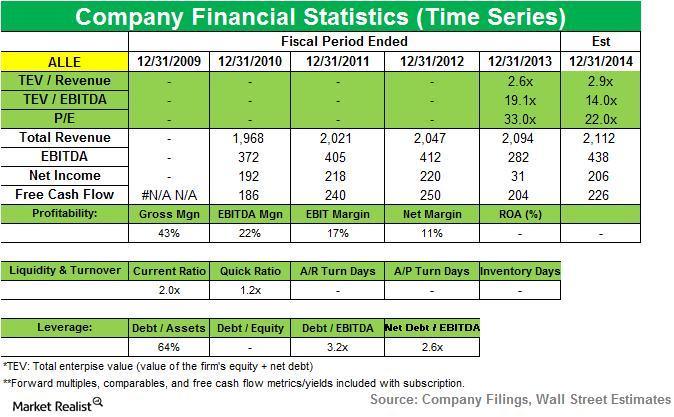

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

PepsiCo: A Must-Know Overview of the Consumer Giant

Leading consumer staples company PepsiCo manufactures and distributes food and beverage products in over 200 countries

PepsiCo Seeks Energy with Rockstar Acquisition

PepsiCo (NYSE:PEP) is gearing up to capture growth in the energy drinks market by acquiring Rockstar Energy Beverages for $3.85 billion.

Will Coca-Cola Post Strong Q4 Earnings?

Coca-Cola will report its earnings for the fourth quarter of fiscal 2019 on Friday before the market opens. Analysts have a positive outlook for the stock.

How Did PepsiCo and Coca-Cola Perform in 2019?

While PepsiCo and Coca-Cola have been facing increased competition, the stocks of both companies have risen in 2019. We’ll see why in this article.

Understanding PepsiCo’s Business Segments and More

PepsiCo (PEP) is one of two beverage-industry behemoths. We break down everything investors should know about the stock and the business.Financials Must-know investment pledges to India from Fortune 500 CEOs

The group spoke about how these companies and India could benefit from investment flow into the country. Modi sought investment pledges from many of these CEOs, who were impressed with what India had to offer.