PepsiCo Inc

Latest PepsiCo Inc News and Updates

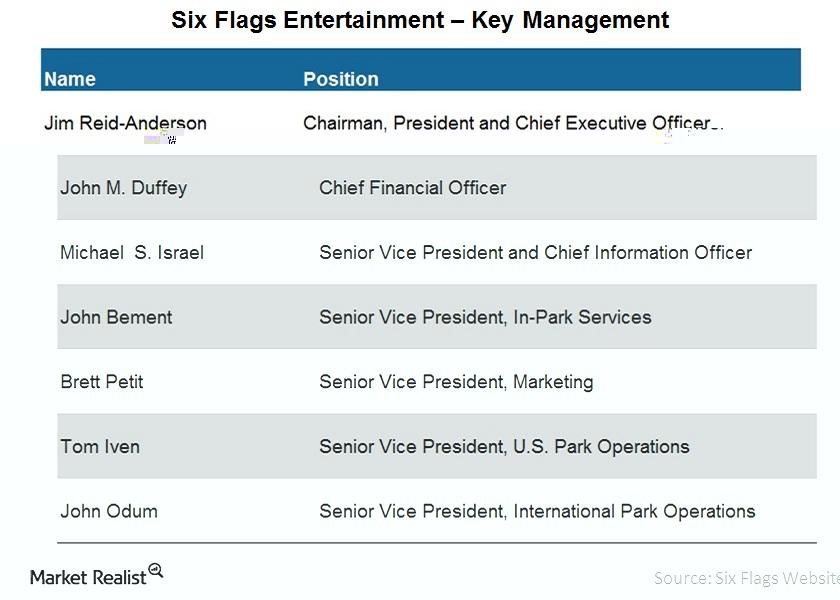

A brief overview of Six Flags’ management

Six Flags’ management plays a vital role in shaping the company and leading it in the desired direction. This article reviews three management positions.

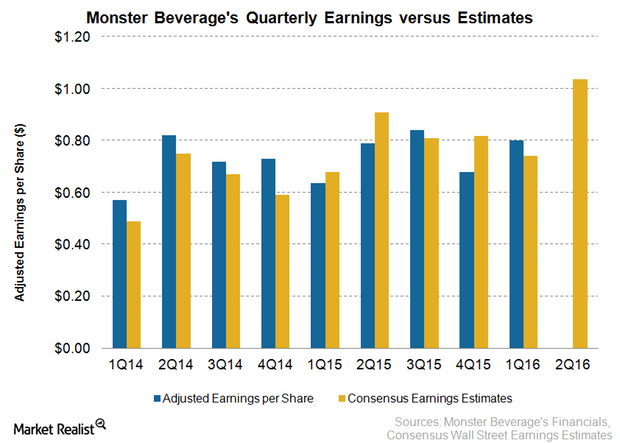

Monster Beverage Beats Wall Street’s Q3 Estimates

Monster Beverage (MNST) stock was up 3% as of 1:48 PM ET today after the leading energy drink maker beat analysts’ earnings estimates.

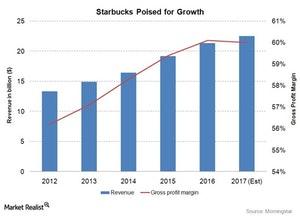

How Starbucks Obtained a Wide Economic Moat Rating

Cost Advantage in Action: Four Case Studies of Moat Companies To demonstrate the power of cost advantages in creating economic moats, we highlight four moat companies: U.S. based Starbucks and Compass Mineral, and international moat companies: Kao (Japan) and Ramsay Health Care (Australia). Starbucks Corp (SBUX US) boasts a “wide economic moat” rating from Morningstar from […]

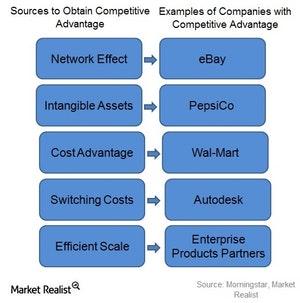

What Are the Sources to Obtain Economic Moats?

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that […]

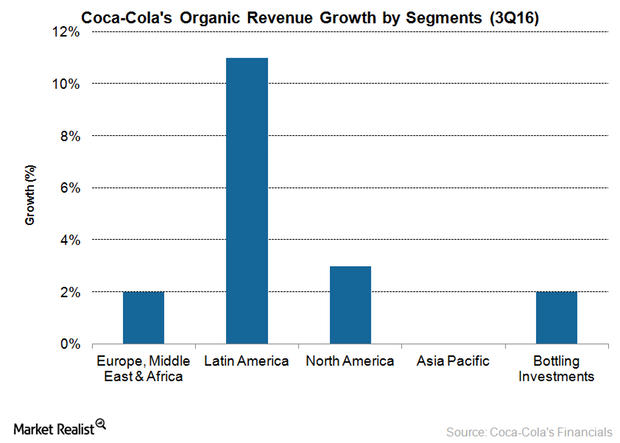

Coca-Cola Earnings: Increased Sales Drove Its Stock

Coca-Cola had an impressive sales performance in the third quarter. The company’s third-quarter revenues benefited from higher organic sales.

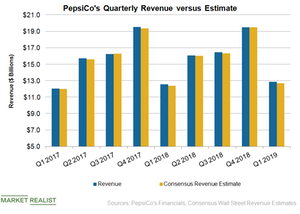

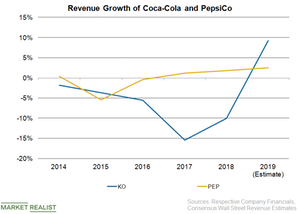

What Factors Are Likely to Drive PepsiCo’s Revenue in 2019?

PepsiCo’s revenue rose 1.8% to $64.7 billion in 2018. Excluding the impact of structural items and currency fluctuations, the company’s revenue rose 3.7% on an organic basis in 2018. Its revenue rose 2.6% to $12.9 billion in the first quarter.

Coca-Cola Stock Rose Due to Revenue Outlook and Q2 Results

On Tuesday, Coca-Cola (KO) stock rose 5.7% as of 10:48 AM ET. The company announced strong second-quarter results and raised its fiscal revenue outlook.

PepsiCo’s Q2 Results Impressed Investors

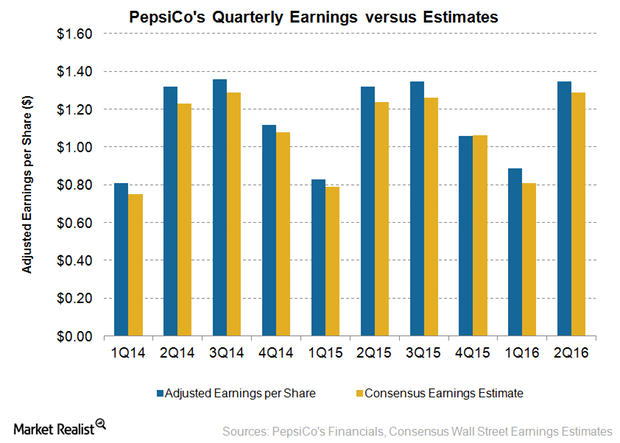

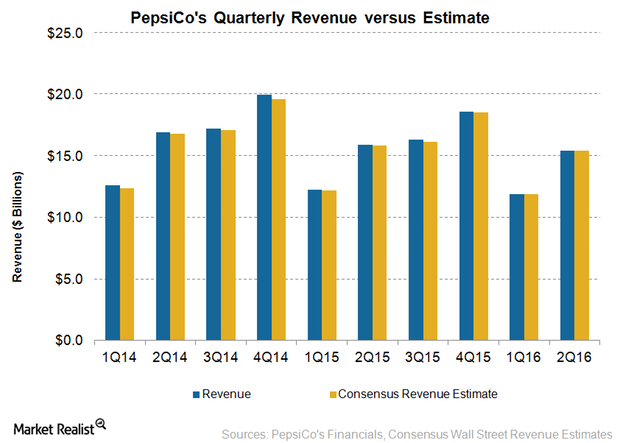

PepsiCo’s Q2 results impressed investors once again. The company’s Q2 revenue grew 2.2% to $16.45 billion and was slightly ahead of analysts’ forecast of $16.43 billion.

Coca-Cola Stock Rises on Impressive Q1 Results

Coca-Cola (KO) impressed investors with better-than-expected revenue and earnings for the first quarter.

PepsiCo’s Frito-Lay North America Segment Continues to Impress

PepsiCo (PEP) reported impressive first-quarter earnings results today. Its revenue rose 2.6% on a reported basis to $12.88 billion in the quarter.

Will Coca-Cola and PepsiCo’s Revenue Pick Up in 2019?

Coca-Cola’s (KO) revenue declined for the sixth consecutive year in 2018 on a reported basis. The decline in the soda giant’s revenue in recent years reflects the impact of currency headwinds and the refranchising of its bottling operations.

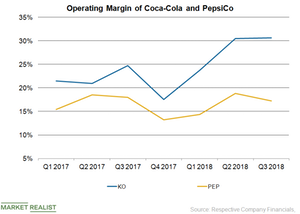

Can Coca-Cola and PepsiCo Improve Margins amid Rising Costs?

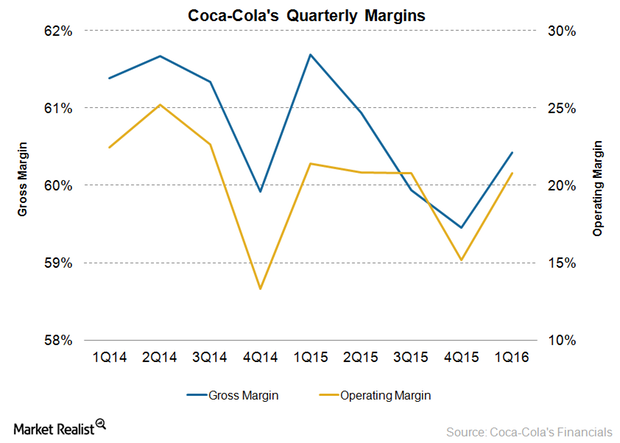

Coca-Cola’s (KO) decision to refranchise its bottling operations has helped it transform into a capital-light business.

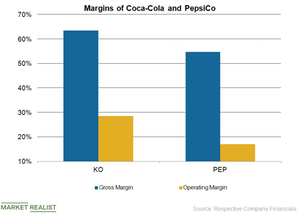

Coca-Cola and PepsiCo: Who’s Delivering Better Margins?

Coca-Cola (KO) has outperformed PepsiCo (PEP) by generating a better gross and operating margin in the first nine months of 2018.

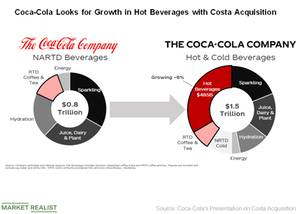

Can Coca-Cola and Its Peers Benefit from Strategic Acquisitions?

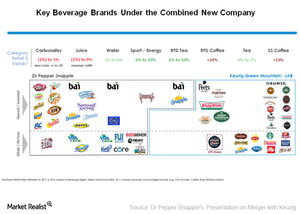

The nonalcoholic beverage space saw some major deals in 2018. Dr Pepper Snapple merged with Keurig Green Mountain to form Keurig Dr Pepper (KDP).

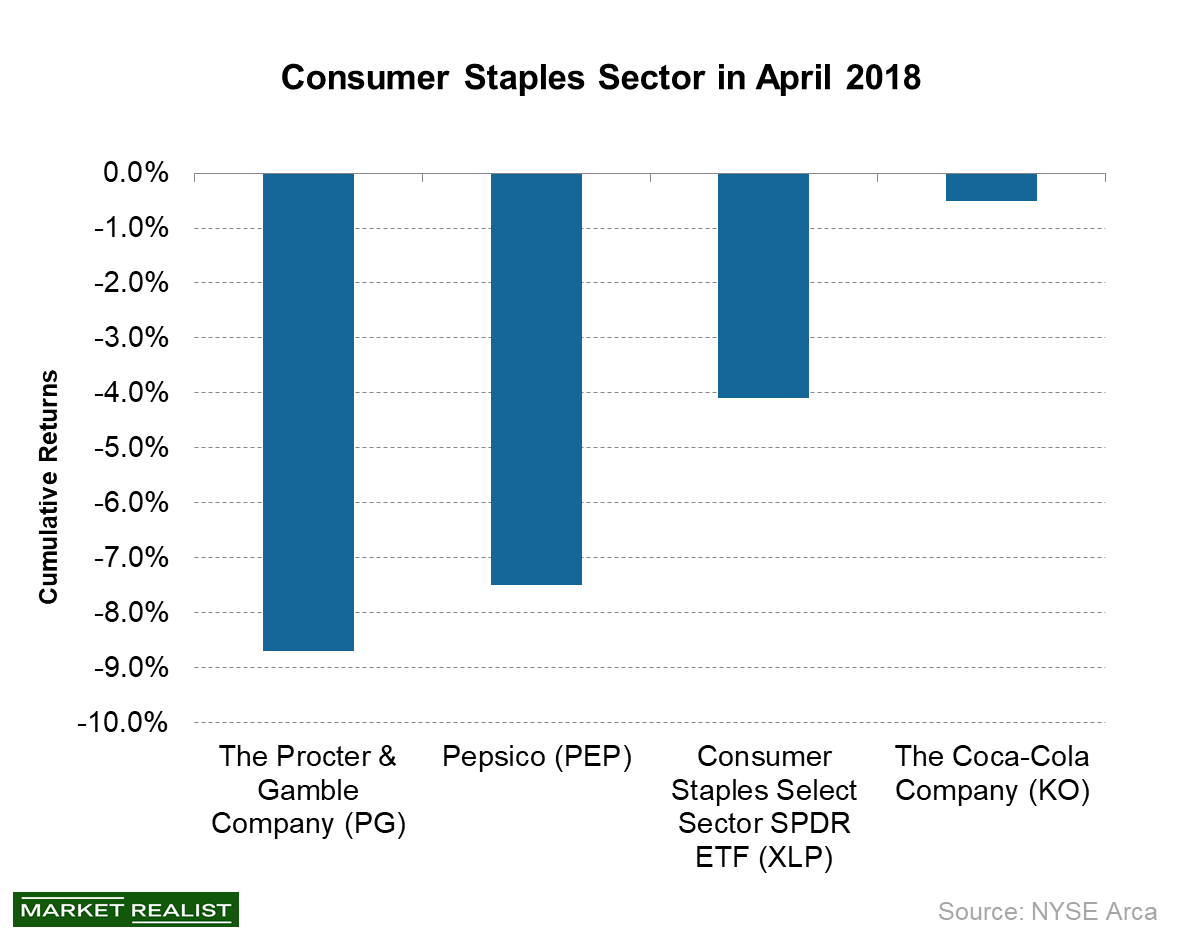

Is Higher Inflation Hurting the Consumer Staples Sector?

The consumer staples sector is an important sector in the S&P 500 Index (SPY).

What Synergies Could the Dr Pepper Snapple–Keurig Merger Create?

Extensive portfolio Keurig Dr Pepper, the new company to be formed by the proposed merger between Dr Pepper Snapple (DPS) and Keurig Green Mountain, is to have an extensive portfolio of hot and cold beverages. The combined company is expected to have a portfolio of 125 owned, licensed, allied, and partner brands, including Dr Pepper, 7 Up, […]

Hain Celestial Pursues an Accretive Acquisition Strategy

Hain Celestial (HAIN) has solidified its position over the years by making numerous acquisitions in both US and overseas markets.

How Coca-Cola’s Innovations Could Improve Its Revenue

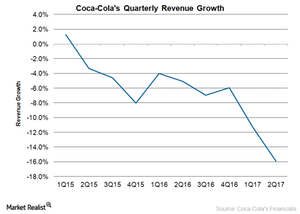

Coca-Cola’s (KO) revenue has declined for ten straight quarters. The decline has been due to several factors, including a weakness in soda volumes.

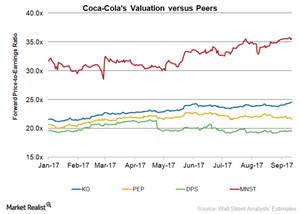

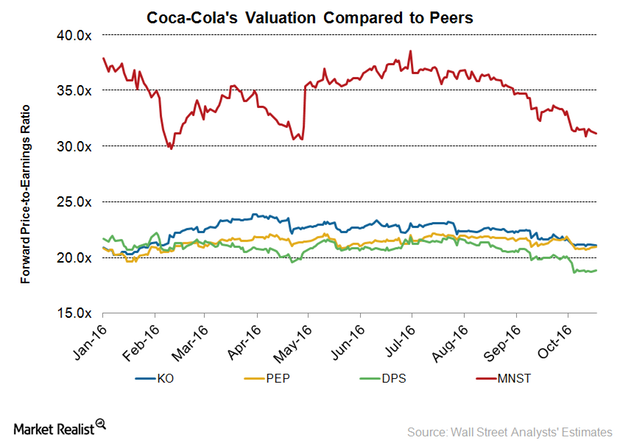

Where Coca-Cola’s Valuations Stand Compared to Its Peers

Coca-Cola’s valuation multiple is currently higher than PepsiCo (PEP) and Dr Pepper Snapple (DPS) but lower than Monster Beverage (MNST).

Chart in Focus: Coca-Cola’s Revenue Growth Strategies

Coca-Cola’s (KO) top line has reflected persistent weakness over the past few quarters.

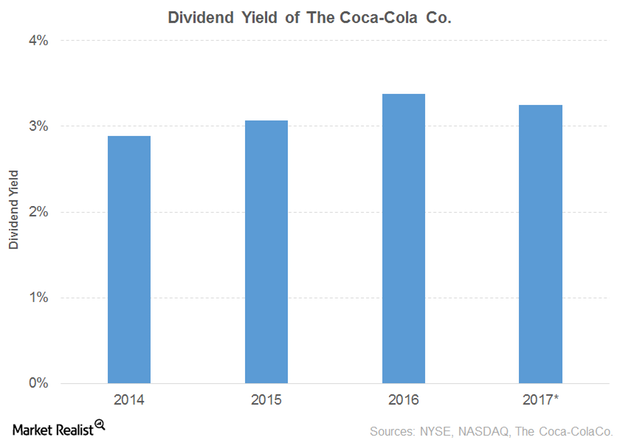

A Look at Coca-Cola’s Dividend Yield

Coca-Cola (KO) recorded a fall of 6.0% in its 2016 net operating revenues due to a decline in its Third Party and Intersegment segments.

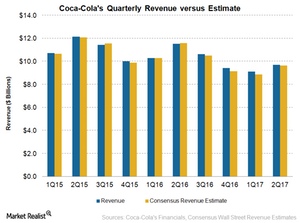

Key Drivers behind Coca-Cola’s 2Q17 Organic Revenue Growth

Coca-Cola (KO) generated revenue of $9.7 billion in 2Q17, exceeding the consensus analysts’ revenue estimate by 0.5%.

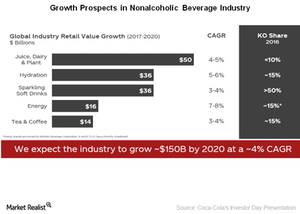

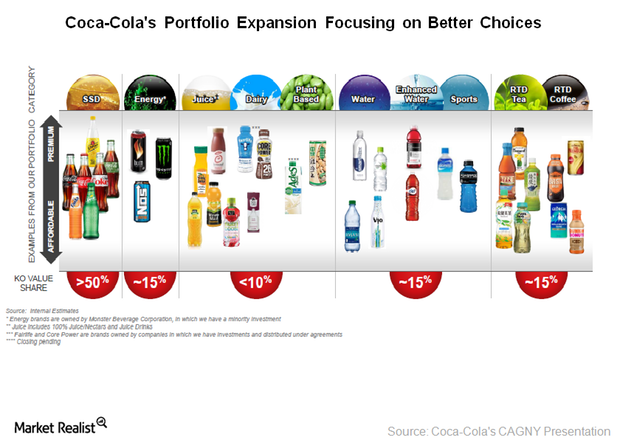

Coca-Cola and PepsiCo by Portfolio: A Better Choice Strategy

Nonalcoholic beverage companies see tremendous opportunities in the better-for-you product categories.

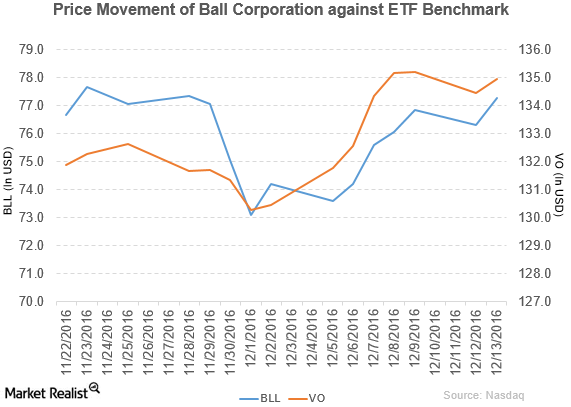

What’s the Latest News on Ball Corporation?

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15.

Coca-Cola Announces Its Expansion Plans

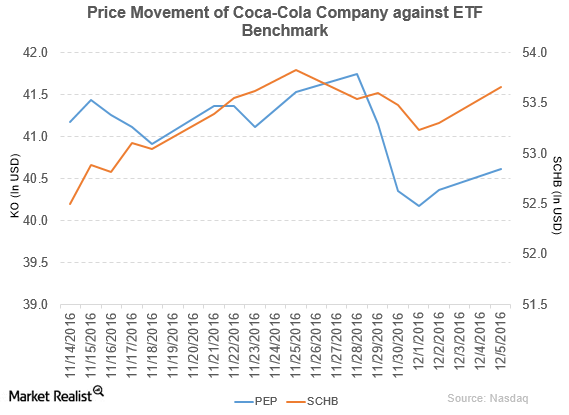

Coca-Cola’s net income and EPS fell to $1.0 million and $0.24, respectively, in 3Q16, compared to $1.4 million and $0.33 in 3Q15.

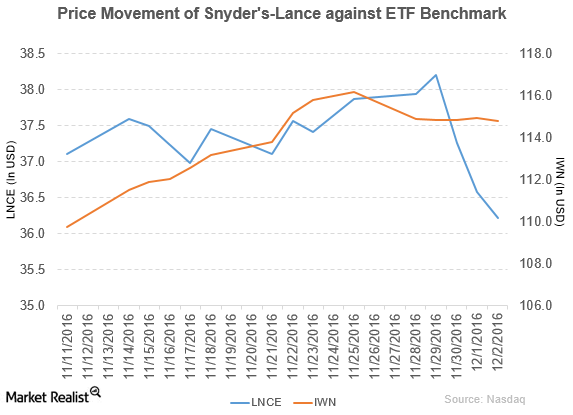

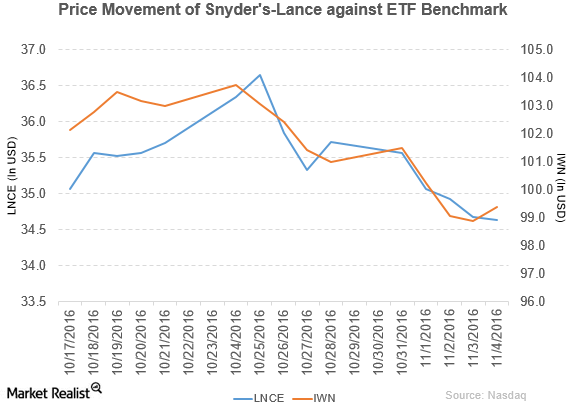

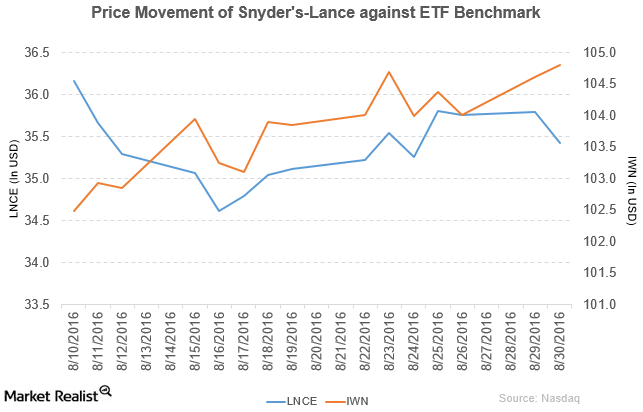

Snyder’s-Lance Plans to Sell Diamond of California

Snyder’s-Lance (LNCE) fell 4.4% to close at $36.22 per share during the fifth week of November 2016.

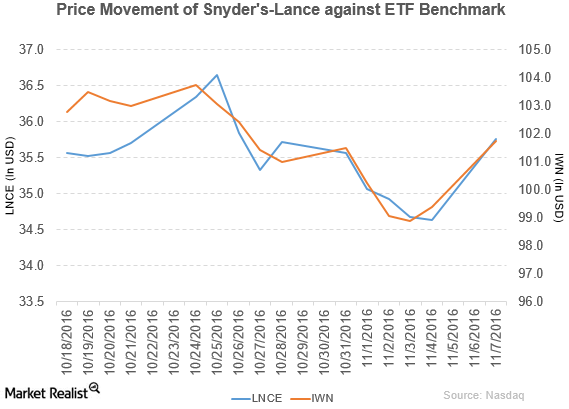

How Did Snyder’s-Lance Perform in 3Q16?

Price movement Snyder’s-Lance (LNCE) has a market cap of $3.5 billion. It rose 3.2% to close at $35.76 per share on November 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.53%, 4.4%, and 5.8%, respectively, on the same day. LNCE is trading 1.2% above its 20-day moving average, 3.1% above […]

Snyder’s-Lance Declares Dividend of $0.16 per Share

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell 0.12% to close at $34.64 per share on November 4, 2016.

Coca-Cola’s Developed Markets Performance in 3Q16

In 3Q16, only Coca-Cola’s North America and Asia-Pacific segments reported growth in net revenues.

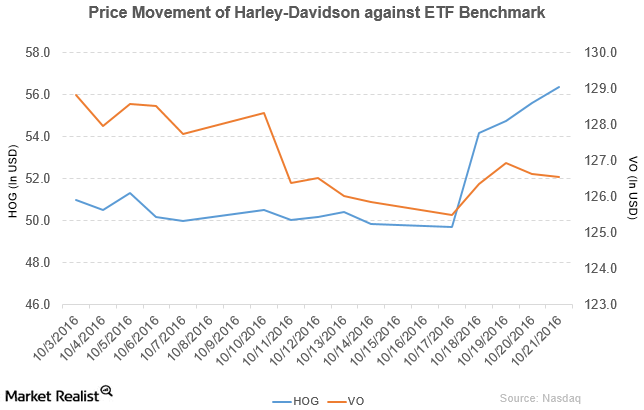

A Look at Harley-Davidson’s 3Q16 Performance

Price movement Harley-Davidson (HOG) rose 13.1% to close at $56.37 per share during the third week of October 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 13.1%, 8.5%, and 27.2%, respectively, as of October 21. HOG is trading 9.2% above its 20-day moving average, 8.1% above its 50-day moving average, and […]

Analyzing Coca-Cola’s Valuation ahead of Q3 Earnings

12-month forward PE In this article, we’ll discuss Coca-Cola’s (KO) valuation using the 12-month forward PE (price-to-earnings) ratio. As of October 17, Coca-Cola was trading at a 12-month forward PE of 21.1x. The company is trading below its YTD (year-to-date) average forward PE of 22.4x. Peers’ valuation As of October 17, nonalcoholic beverage companies PepsiCo […]

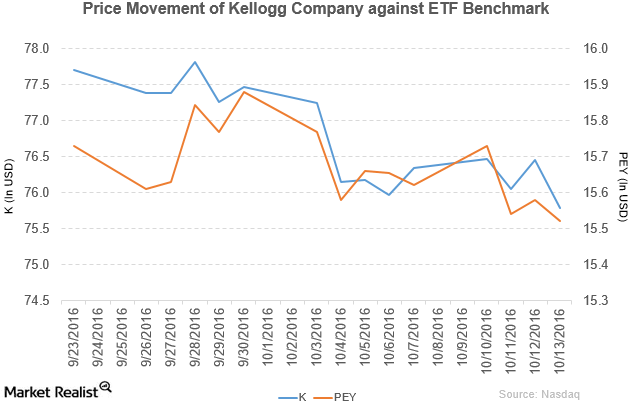

How Are Those Cheerios Sales Going? Kellogg’s Earnings in Focus

Kellogg (K) has a market cap of $26.4 billion. It fell 0.89% to close at $75.78 per share on October 13, 2016.

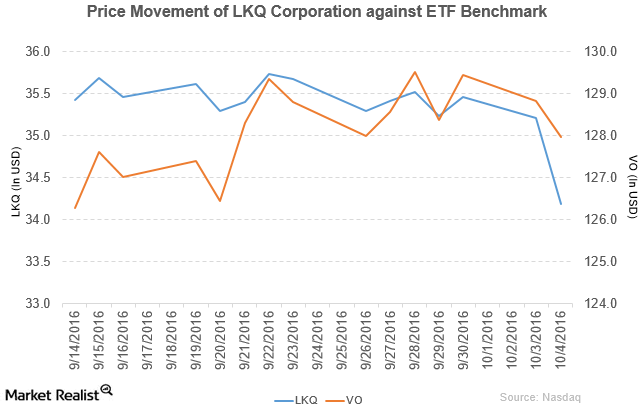

LKQ Announced New Acquisition to Expand Its Presence in the UK

LKQ Corporation (LKQ) reported 2Q16 revenue of $2.5 billion, a rise of 38.9% compared to revenue of $1.8 billion in 2Q15.

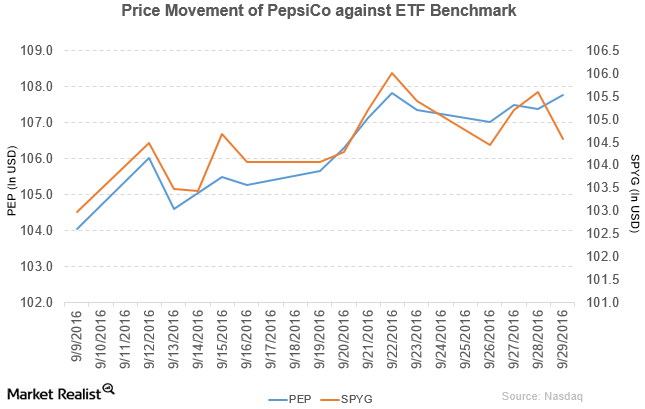

How Did PepsiCo Perform in 3Q16?

Price movement PepsiCo (PEP) has a market cap of $155.1 billion. It rose 0.35% to close at $107.76 per share on September 29, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -0.06%, 1.2%, and 10.2%, respectively, on the same day. PEP is trading 1.2% above its 20-day moving average, 0.57% above […]

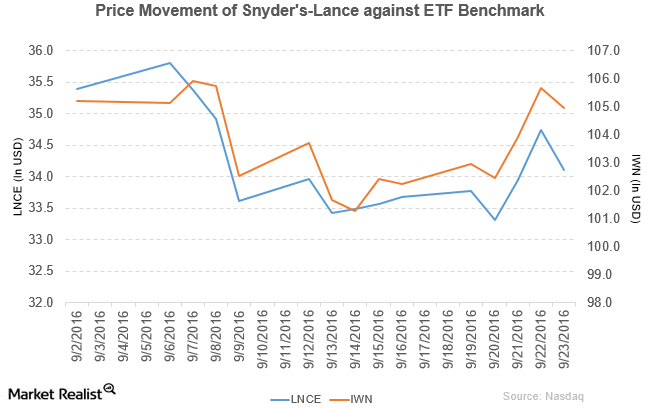

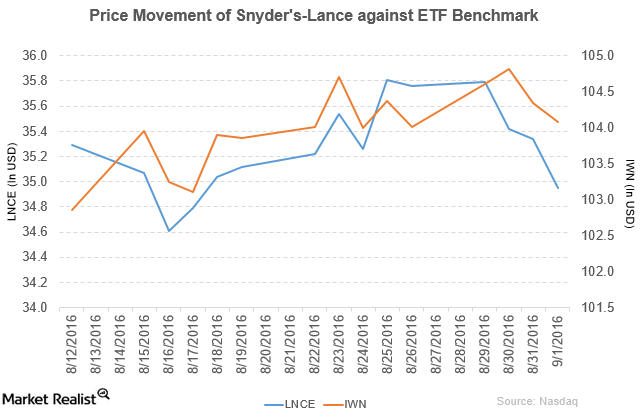

Snyder’s-Lance Appoints Pease as Executive Vice President

Price movement Snyder’s-Lance (LNCE) has a market cap of $3.3 billion. It fell 1.8% to close at $34.10 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.3%, -3.3%, and 0.92%, respectively, on the same day. LNCE is trading 1.5% below its 20-day moving average, 1.8% below […]

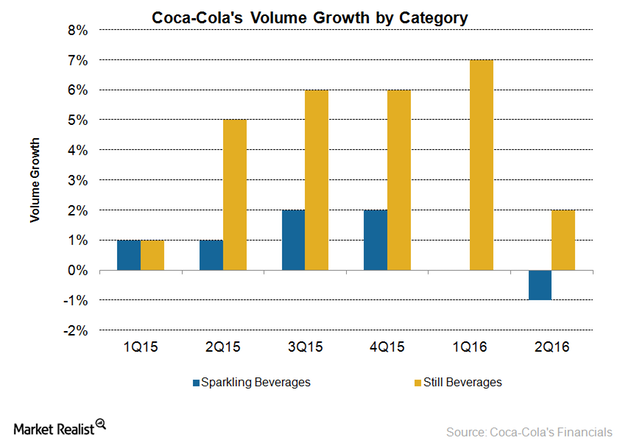

Coca-Cola Keeps Its Focus on Still Beverages for Future Growth

Coca-Cola’s (KO) still beverage volumes have seen higher growth compared to sparkling or soda beverages.

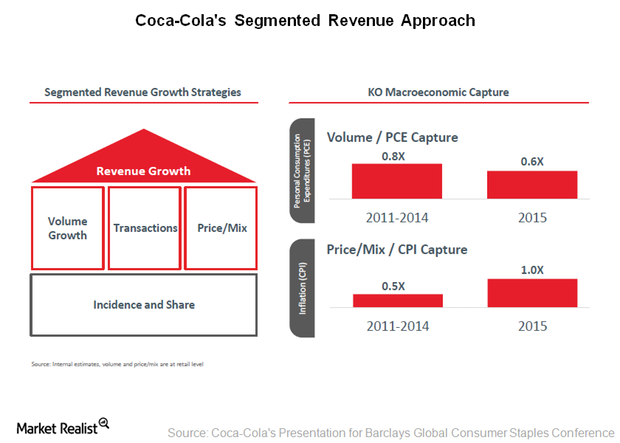

Is Coca-Cola’s Segmented Revenue Approach Working?

Coca-Cola has a dominant position in the US market. However, US soda volumes have been declining for more than a decade.

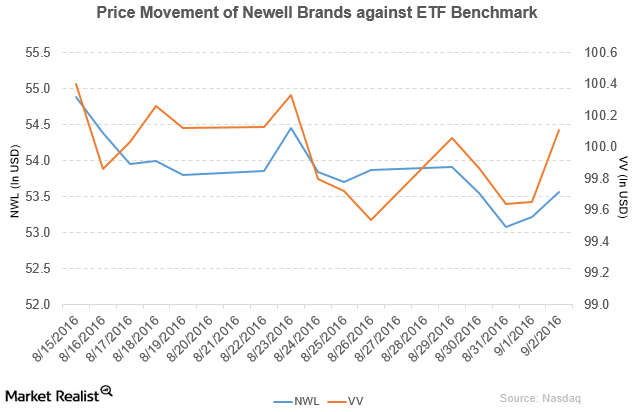

Newell Brands Makes Changes in Its Management

NWL fell by 0.20% to close at $53.57 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -0.20%, 0.90%, and 23.1%.

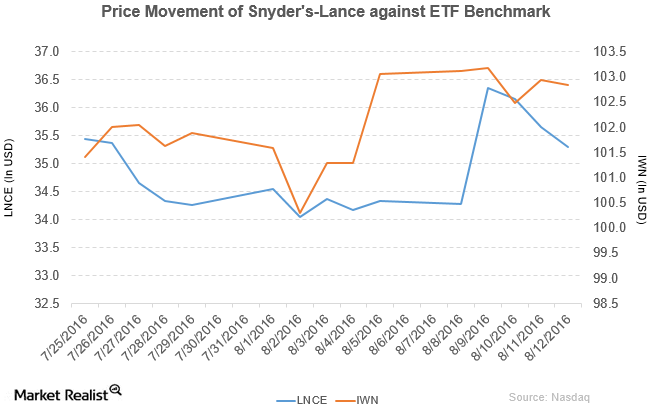

Snyder’s-Lance Acquired Metcalfe’s Skinny to Expand Its Business

Snyder’s-Lance fell by 1.1% to close at $34.95 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -2.4%, 2.2%, and 3.4%.

Why Did Snyder’s-Lance Recall Some of Its Products?

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell by 1.0% to close at $35.42 per share on August 30, 2016.

Why Does Janus Think Inflation Is on the Rise?

In the “Janus Market GPS,” the team had outlined its belief that a low unemployment rate signaled tighter labor market conditions.

Analyzing Snyder’s-Lance Performance in 2Q16

Snyder’s-Lance rose by 2.8% and closed at $35.29 per share during the second week of August 2016. It reported fiscal 2Q16 net revenue of $609.5 million.

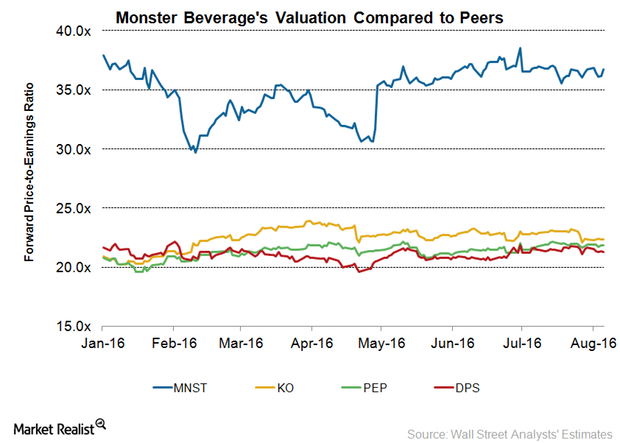

How 2Q16 Results Impacted Monster Beverage’s Valuation

As of August 5, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings) ratio of 36.8x.

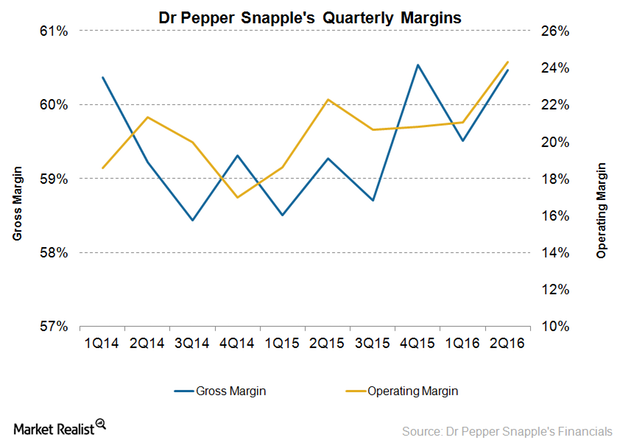

What Led Dr Pepper Snapple’s Margin Expansion in 2Q16?

Dr Pepper Snapple’s (DPS) gross margins increased by 120 basis points to 60.5% in 2Q16 on a YoY (year-over-year) basis.

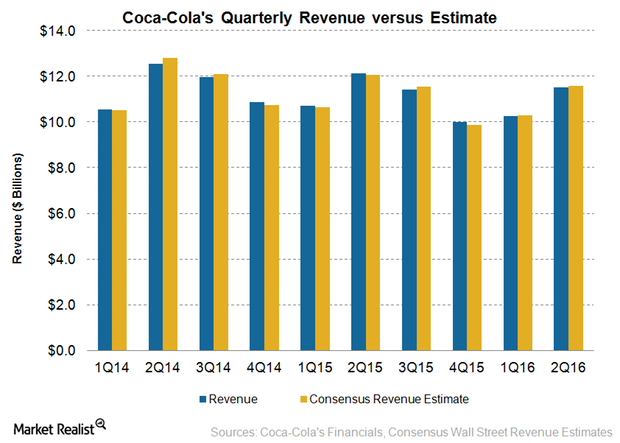

Coca-Cola’s 2Q16 Revenue Fell Due to Headwinds

Coca-Cola generated revenue of $11.5 billion in fiscal 2Q16 ending July 1, 2016. It missed analysts’ consensus revenue estimate of $11.6 billion.

What Will Drive Monster Beverage’s 2Q16 Earnings Growth?

Monster Beverage (MNST) impressed its investors with a 26% growth in its 1Q16 EPS (earnings per share), excluding the impact of one-time items.

Can Productivity Measures Help Coca-Cola’s Margins in 2Q16?

Coca-Cola’s (KO) margins contracted in 1Q16 due to the impact of adverse currency fluctuations and structural headwinds.

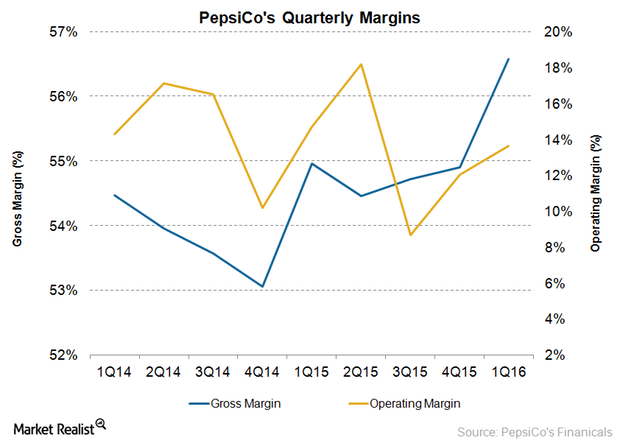

What Drove PepsiCo’s Margin Expansion in 2Q16?

PepsiCo’s gross margin expanded to 55.6% in 2Q16 from 54.5% in 2Q15.

PepsiCo’s 2Q16 Earnings Rise on Improved Margins

Leading snack and beverage maker PepsiCo (PEP) delivered adjusted EPS (earnings per share) of $1.35 in 2Q16 ended June 11, 2016.

What Dragged down PepsiCo’s 2Q16 Revenue?

PepsiCo’s (PEP) revenue declined by 3.3% in 2Q16 ended June 11, 2016.