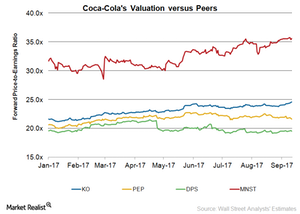

Where Coca-Cola’s Valuations Stand Compared to Its Peers

Coca-Cola’s valuation multiple is currently higher than PepsiCo (PEP) and Dr Pepper Snapple (DPS) but lower than Monster Beverage (MNST).

Sept. 18 2017, Updated 7:38 a.m. ET

12-month forward PE

On September 13, Coca-Cola (KO) was trading at a 12-month forward PE (price-to-earnings) ratio of 24.6x. The company’s valuation multiple has risen 2.8% since its 2Q17 results were announced on July 26.

Coca-Cola surpassed analysts’ revenue and earnings estimates for 2Q17. However, Coca-Cola’s revenues declined for the ninth consecutive quarter in 2Q17.

Valuation of peer group

Coca-Cola’s valuation multiple is currently higher than PepsiCo (PEP) and Dr Pepper Snapple (DPS) but lower than Monster Beverage (MNST). On September 13, PepsiCo and Dr Pepper Snapple were trading at 12-month forward price-to-earnings (or PE) multiples of 21.6x and 19.5x, respectively.

Monster Beverage’s forward valuation multiple was 35.6x. Coca-Cola has a 16.7% stake in Monster Beverage.

Coca-Cola’s valuation multiple is also higher than the S&P 500 Index, which was trading at a 12-month forward PE of 18.1x on September 13.

Growth expectations

The 12-month forward PE is influenced by several factors, including growth expectations. Currently, analysts expect Coca-Cola’s revenues to decline 16.3% to $35.0 billion in 2017. Structural headwinds mainly related to the refranchising of the company’s bottling operations are expected to impact the company’s top-line growth this year.

Excluding one-time items, analysts expect the company’s adjusted EPS (earnings per share) to fall 0.6% to $1.90 in 2017.

Coca-Cola’s guidance issued in July 2017 indicates organic revenue growth of 3.0% in 2017. The company expects its adjusted EPS growth to reach the -2.0% to flat range from $1.91 in 2016.

Let us look at analysts’ recommendations for Coca-Cola stock in the final part of this series.