Coca-Cola Co

Latest Coca-Cola Co News and Updates

The CEO of Coca-Cola, James Quincey, Commands a Hefty Salary

Coca-Cola CEO James Quincey earns a huge salary after he helped to reverse the company's decline. What is his net worth?

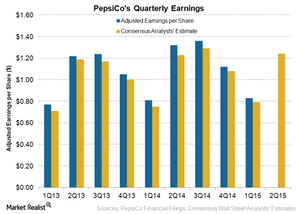

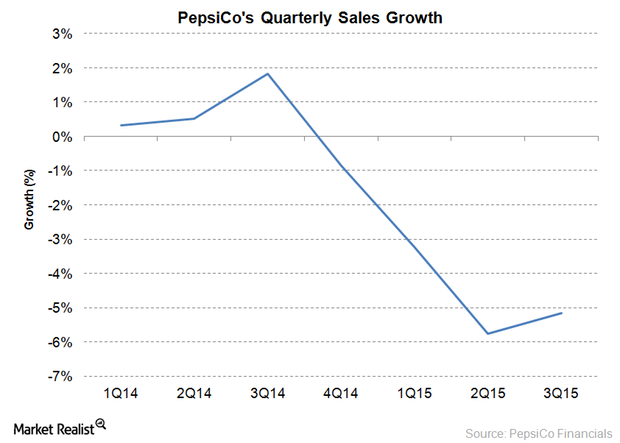

Will PepsiCo’s Earnings Stay Ahead of Wall Street in 2Q15?

PepsiCo expects currency headwinds to impact its fiscal 2015 core EPS by 11% compared to its previous estimate of 7%. It expects currency headwinds to drag down EPS in 2Q15 by 12%.

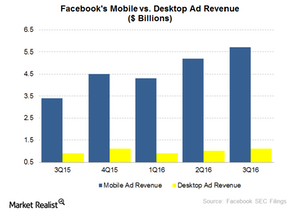

Eyes Are on Instagram as Facebook Reports 4Q16 Earnings

As Facebook (FB) reports its 4Q16 results, all eyes are on the company’s mobile revenue. FB has begun taking steps to monetize its other mobile properties such as Instagram.

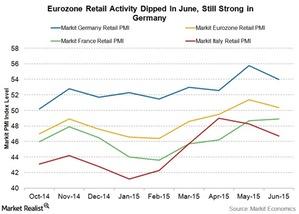

Eurozone Retail Activity Dipped In June, HEDJ Down 2.32%

The Eurozone’s Retail PMI (purchasing managers’ index) dipped to 50.4 in June from the 51.4 recorded in May.

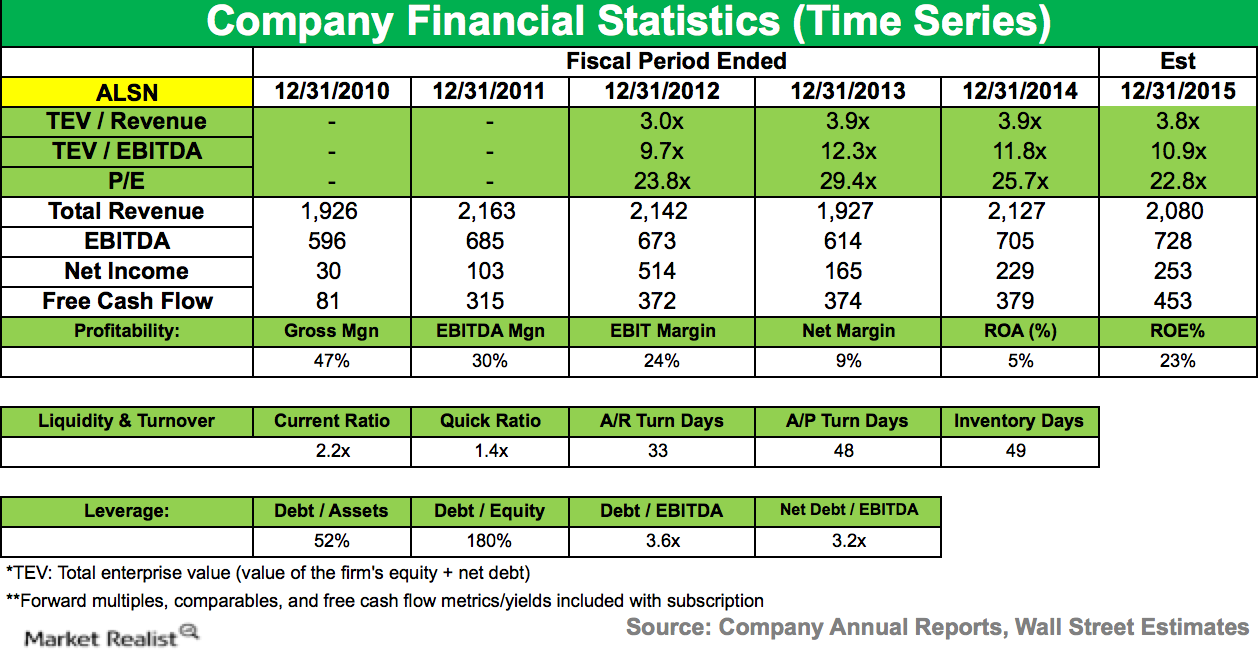

ValueAct Capital Ups Its Stake in Allison Transmission Holding

Allison Transmission Holding and its subsidiaries design and manufacture commercial and defense fully automatic transmissions.

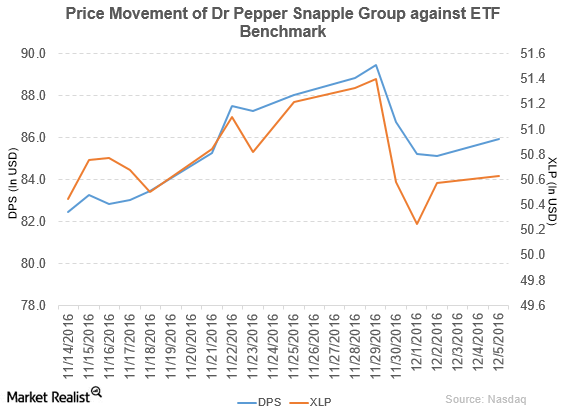

Why Did Moody’s Rate Dr Pepper Snapple Senior Notes as Baa1?

Dr Pepper Snapple Group (DPS) declared a quarterly dividend of $0.53 per share on its common stock. This dividend will be paid on January 5, 2017, to shareholders of record on December 13, 2016.

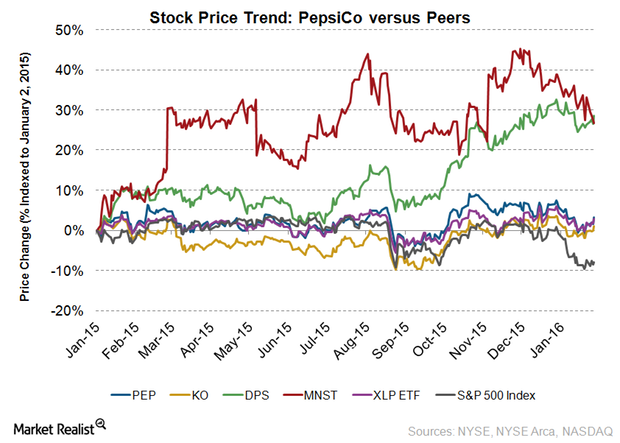

Can PepsiCo’s Stock Pick Up Momentum in 2016?

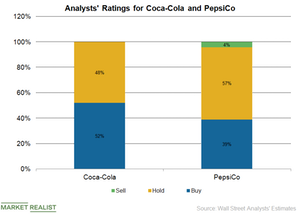

As of January 28, about 59% (or 17) analysts out of 29 analysts, have a “buy” recommendation for PepsiCo and 12 analysts have a “hold” recommendation. None of the analysts have a sell recommendation.

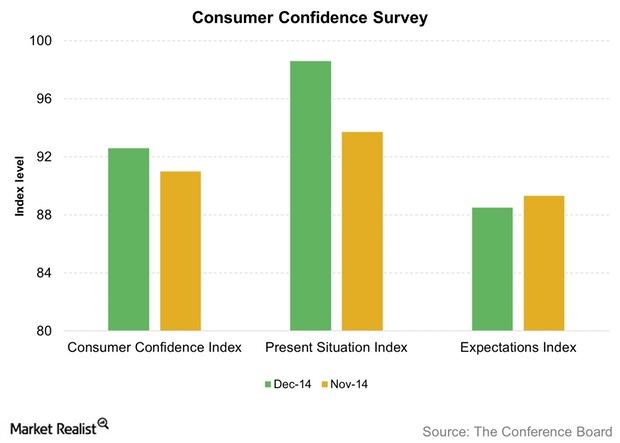

Why did consumers’ confidence rise in December?

The Board’s Consumer Confidence Index rose to 92.6 in December—compared to 91 in November. For November, the index was revised from an initially reported value of 88.7.

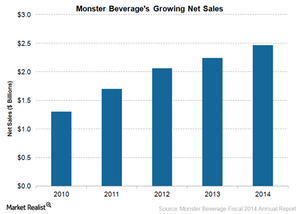

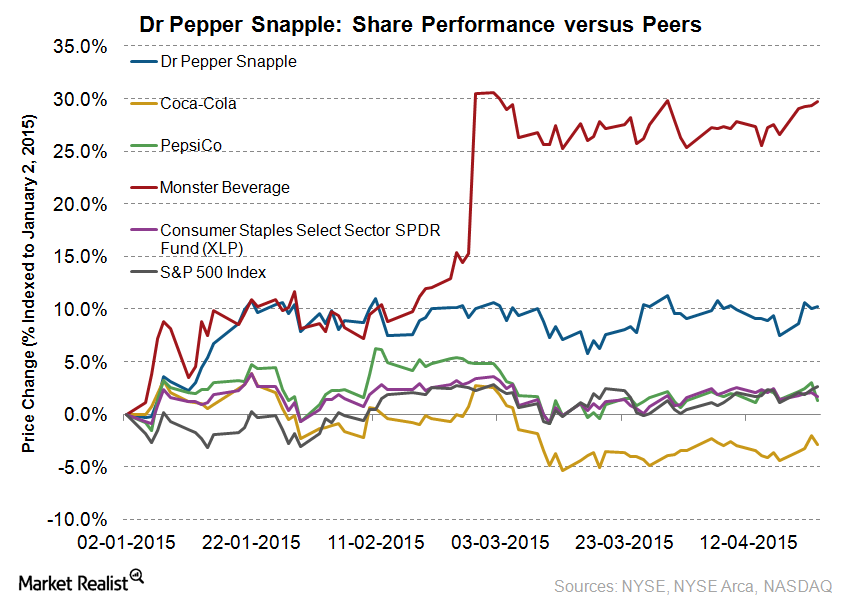

Coca-Cola Deal Gives Monster Beverage Yet Another Boost

In 2014, Monster Beverage’s net sales increased by 9.7% to $2.5 billion, with 21.7% of its net sales from outside the United States.

Maverick Capital Decreases Position in Allison Transmission

Allison Transmission and its subsidiaries design and manufacture commercial and defense fully automatic transmissions. In 4Q14, net sales grew 11% to $544 million.

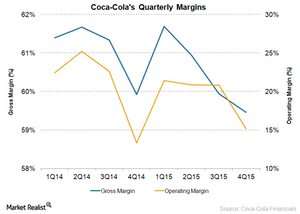

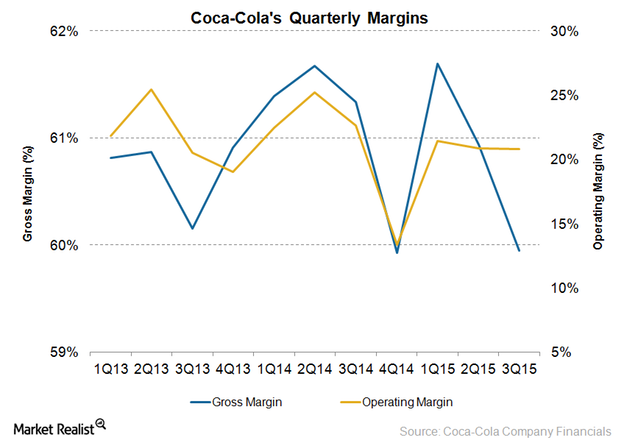

Coca-Cola’s 4Q15 Operating Margin Rose on Productivity Measures

Coca-Cola’s operating margin improved significantly to 15.2% in 4Q15 from 13.3% in the comparable quarter of the previous year.

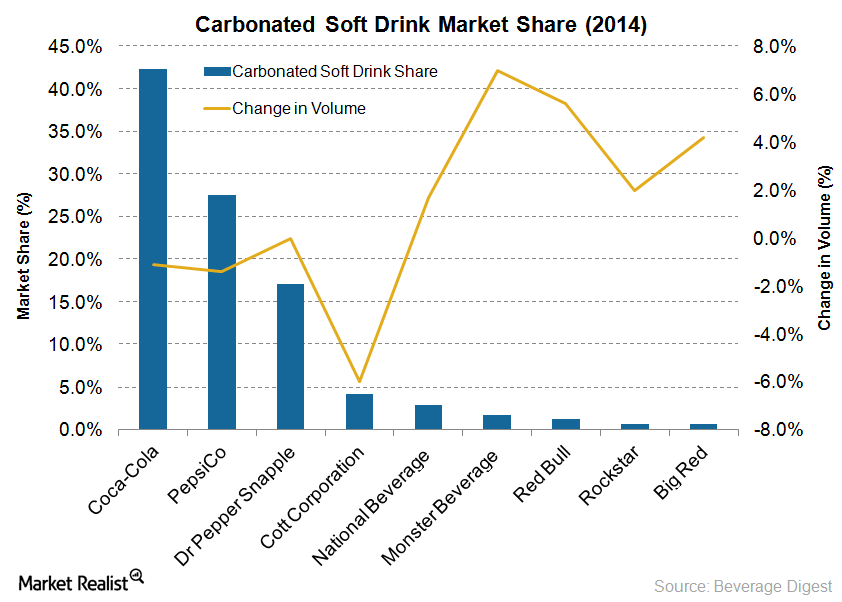

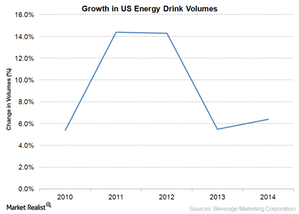

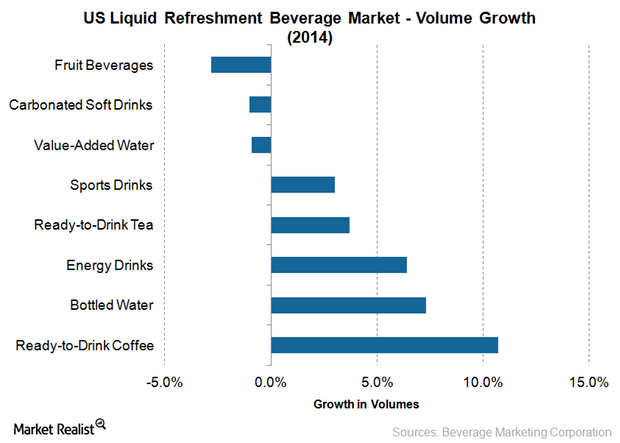

Energy Drinks Outperform Soda Drinks in Case-Volume Growth

An interesting development in the energy drinks industry is Monster Beverage’s strategic deal with Coca-Cola. The deal will expand Monster Beverage’s product line-up.

How PepsiCo Is Planning to Diversify Its Soft Drink Business

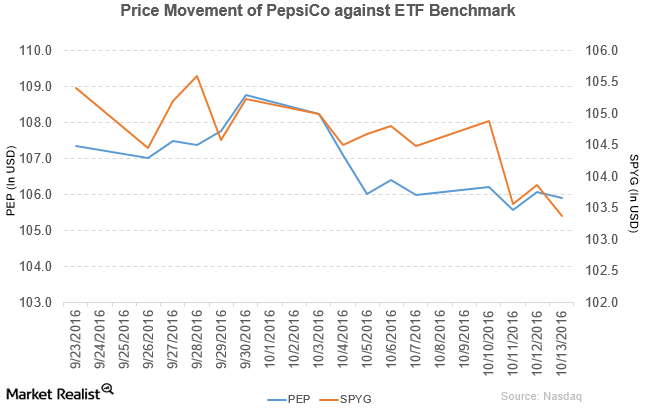

PepsiCo (PEP) has a market cap of $152.5 billion. It fell 0.15% to close at $105.92 per share on October 13, 2016.

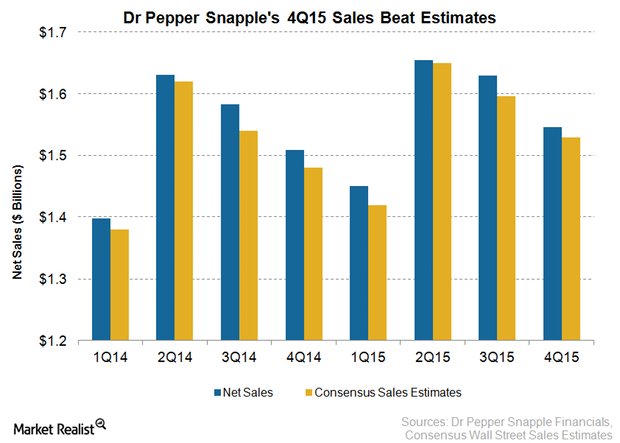

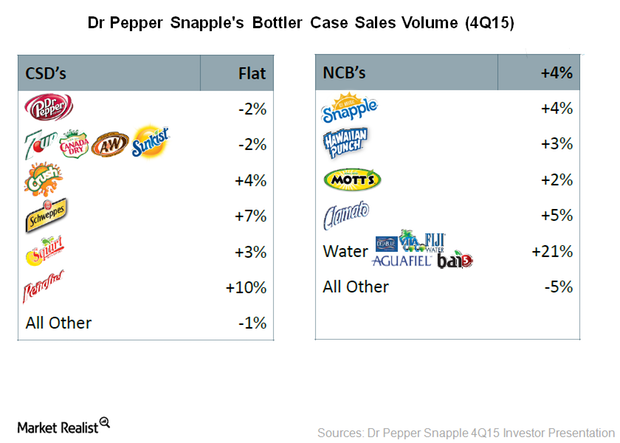

Key Drivers of Dr Pepper Snapple’s 4Q15 Sales

Dr Pepper Snapple reported sales of nearly $1.6 billion in 4Q15, beating the consensus Wall Street analyst estimate of $1.53 billion.

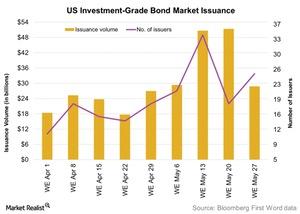

Investment-Grade Corporate Bonds’ Issuance Fell Last Week

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016.

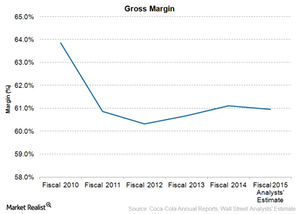

Coca-Cola’s Productivity Program to Improve 2015 Margins

Coca-Cola’s productivity program aims for annualized savings of $3 billion by 2019. The company will reinvest these savings in incremental media spending.

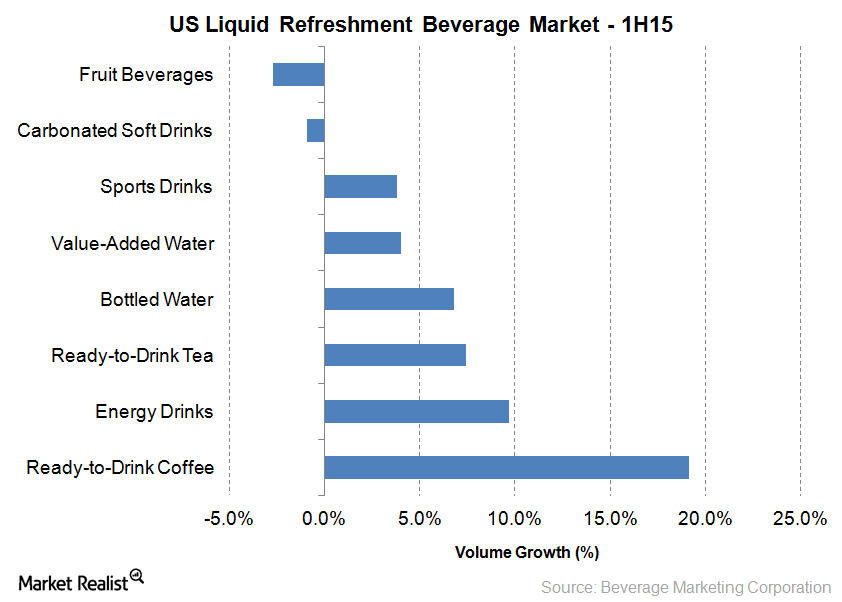

An Overview of the US Nonalcoholic Beverage Industry

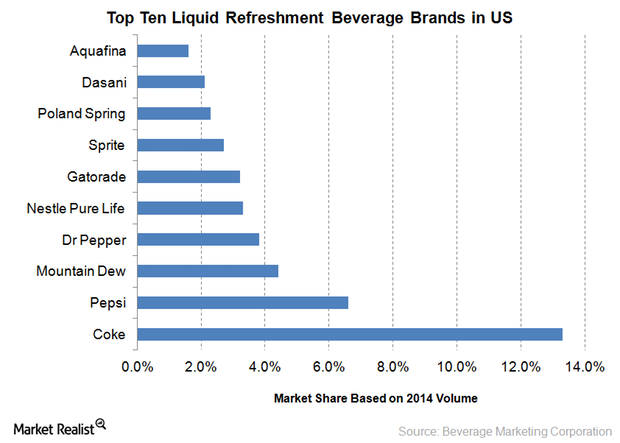

The US nonalcoholic beverage market comprises categories like carbonated soft drinks, ready-to-drink tea and coffee, bottled water, sports drinks, and energy drinks.

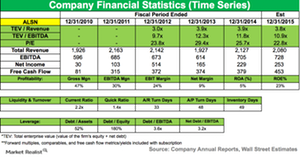

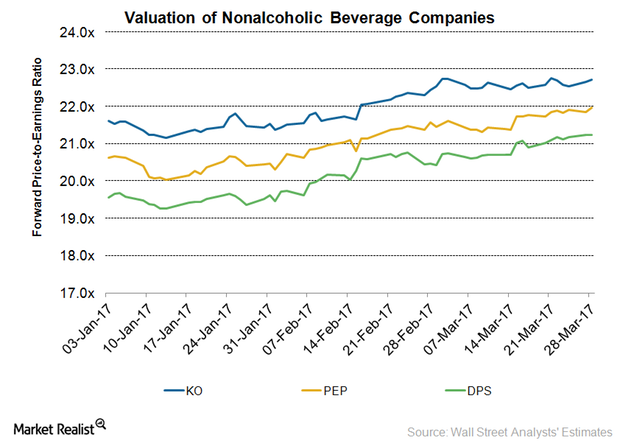

Coca-Cola, PepsiCo, Dr Pepper Snapple: A Valuation Showdown?

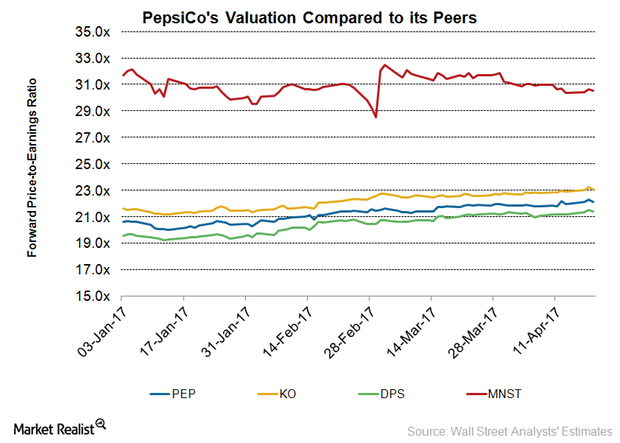

As of March 28, Coca-Cola and PepsiCo were trading at 12-month forward PE multiples of 22.7x and 22.0x, respectively.

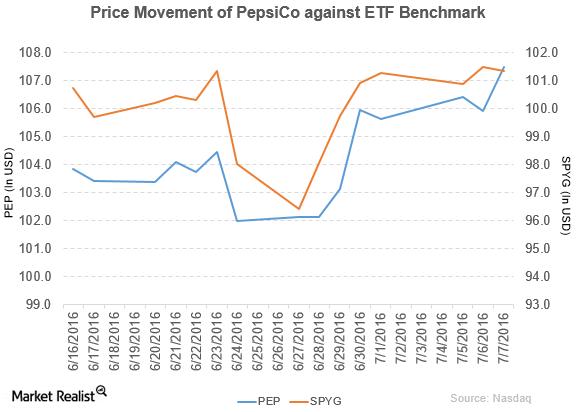

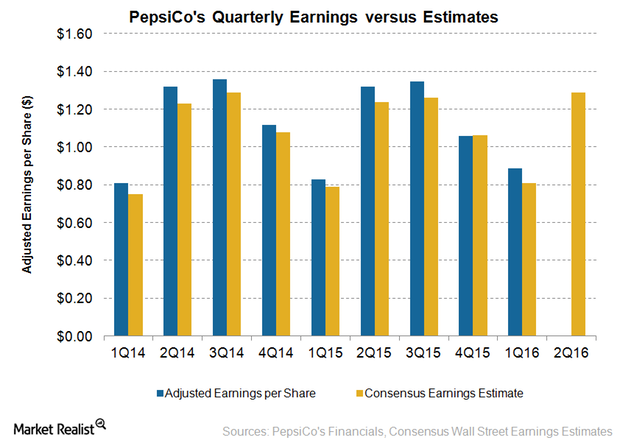

How Did PepsiCo’s 2Q16 Earnings Turn Out?

PepsiCo rose by 1.5% to close at $107.49 per share on July 7. Its weekly, monthly, and YTD price movements were 4.2%, 4.9%, and 9.2% that day.

New York Is Gearing Up for PepsiCo’s Kola House this Spring

PepsiCo is getting ready to launch Kola House, its first hospitality venture, at its flagship location in New York City’s Meatpacking District. The first Kola House, which will operate as a kola bar, restaurant, lounge, and event space, is expected to open this spring.

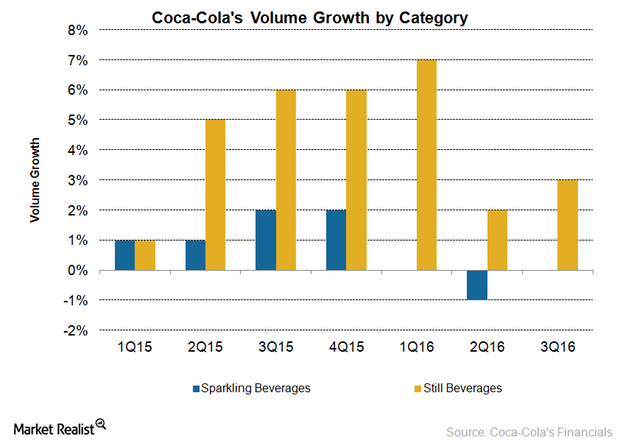

Coca-Cola’s Growth Strategy for Soda and Still Beverages

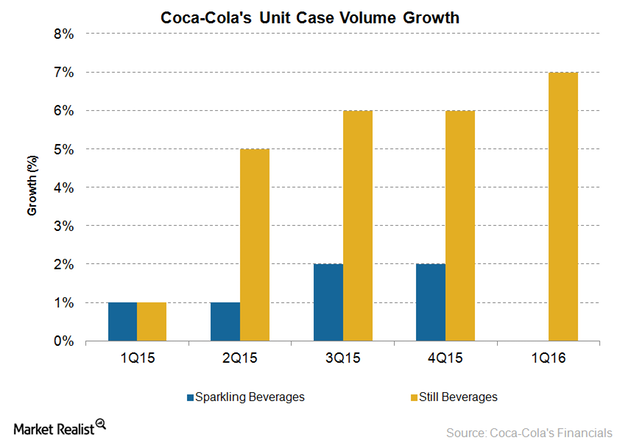

Coca-Cola’s (KO) overall unit case volume rose 1% in 3Q16. The company’s soda or sparkling beverage unit case volumes were flat in 3Q16 on a YoY basis.

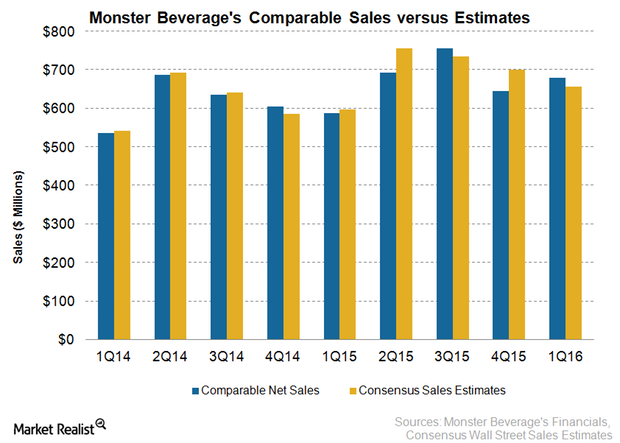

Monster’s 1Q16 Sales Benefit from Strategic Deal with Coca-Cola

Monster Beverage’s (MNST) net sales in 1Q16 ended March 31, 2016, were $680.2 million, ahead of the consensus analyst sales estimate of $656.9 million.

Coca-Cola and PepsiCo: Analysts’ Recommendations

On December 13, PepsiCo (PEP) stock rose 1.2%. UBS initiated coverage with a “neutral” rating and a target price of $123.

Mintel Forecasts Strong Growth in the US Energy Drink Market

The US energy drink and shots market grew by 56% between 2009 and 2014, even though the category was entangled in litigation and had negative publicity.

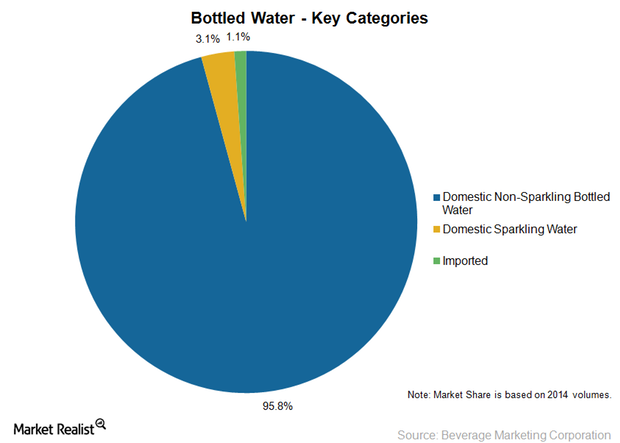

Non-Sparkling Water Is the Largest Bottled Water Segment in the US

The domestic non-sparkling bottled water category is the largest segment of bottled water in the US.

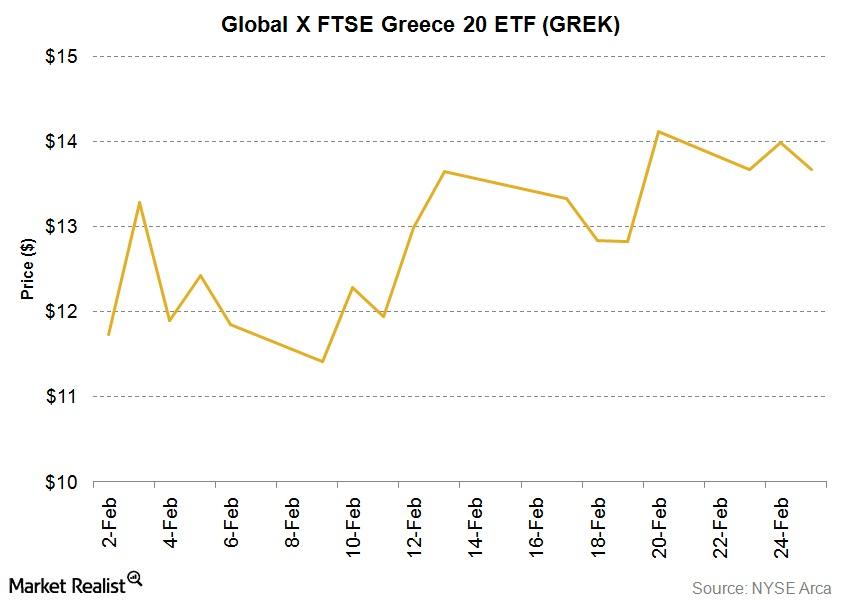

Eurozone grants bailout extension to Greece

Europe-tracking ETFs gained significantly from February 19 to February 24, when the bailout extension to Greece was approved.

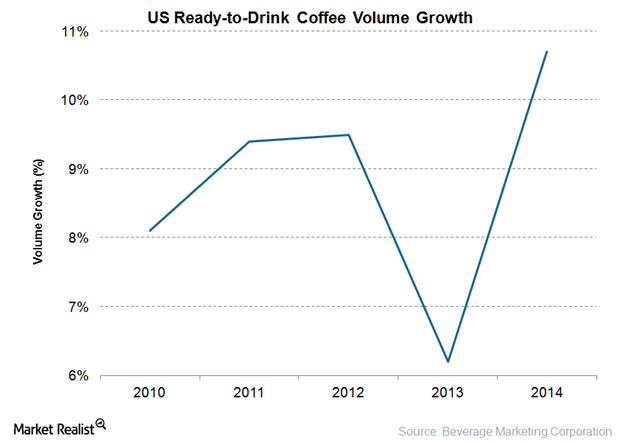

Why Ready-to-Drink Coffee Is Gaining Popularity with US Consumers

Coffee lovers in the United States are boosting ready-to-drink coffee volumes.

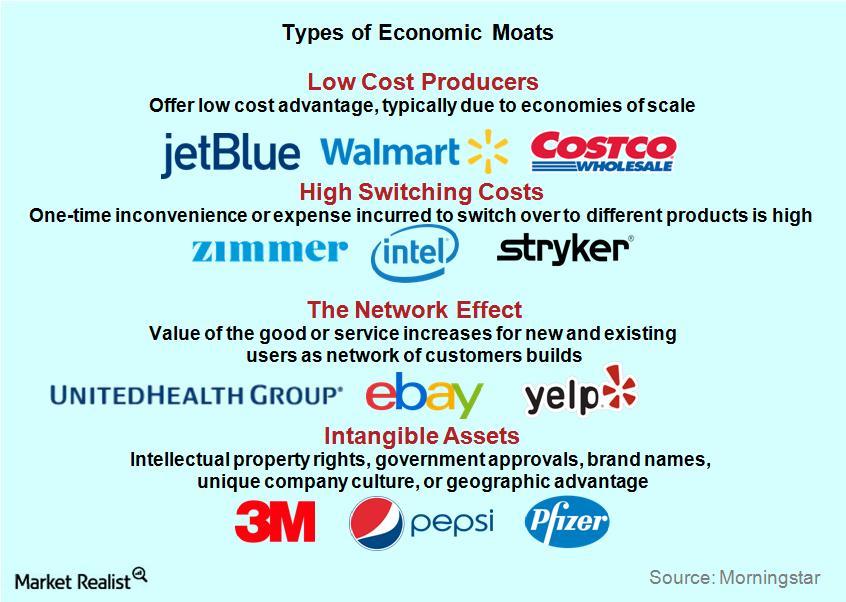

The Ins and Outs of Moat Investing

Stock selection, a cornerstone of the moat investment philosophy, has driven much of the recent success of the Morningstar® Wide Moat Focus Index.

Coca-Cola’s 2015 Productivity Initiatives: A Closer Look at Costs

Coca-Cola has been aggressively implementing productivity initiatives to offset the impact of sluggish soda volumes and macro challenges in key markets.

PepsiCo Announced Its CEO Succession Plan

On August 6, PepsiCo (PEP) announced its CEO succession plan. Long-term CEO Indra Nooyi will step down effective October 3.

The Growing Emphasis of Coca-Cola and Peers on Still Beverages

Another plant-based beverage acquisition made by Coca-Cola was that of Xiamen Culiangwang Beverage Technology Company in 2015.

US Soda Update: Case Volumes Decline for the Tenth Straight Year

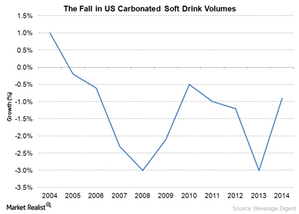

Carbonated soft drink volumes dropped to 8.8 billion 192-ounce cases in 2014. This is the tenth straight year of decline.

PepsiCo’s Valuation ahead of 1Q17 Results

As of April 19, PepsiCo (PEP) was trading at a 12-month forward PE (price-to-earnings) ratio of 22.1x.

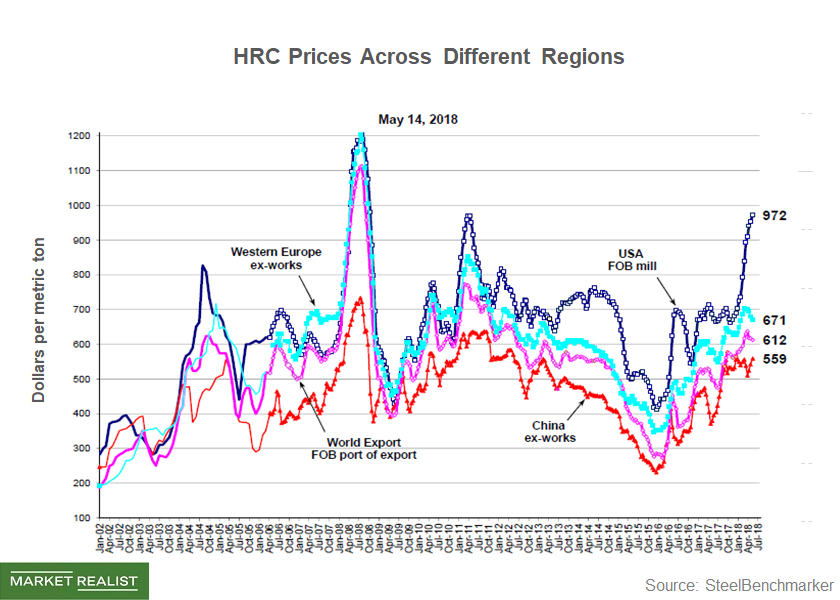

Is President Trump Robbing Peter to Pay Paul?

While higher steel prices benefit US steel producers, they raise input costs for downstream manufacturers.

Cannabis 2.0: Aurora Cannabis Gears Up for Edibles Market

Cannabis 2.0 legalization will take place in Canada next month. Cannabis players are gearing up to expand in the edibles market.

Innovation and Marketing Fuel Dr Pepper Snapple’s Future Growth

Dr Pepper Snapple is creating more visibility for its products by associating with popular movies. It expects its marketing spend to be ~7.6% of net sales in 2015.

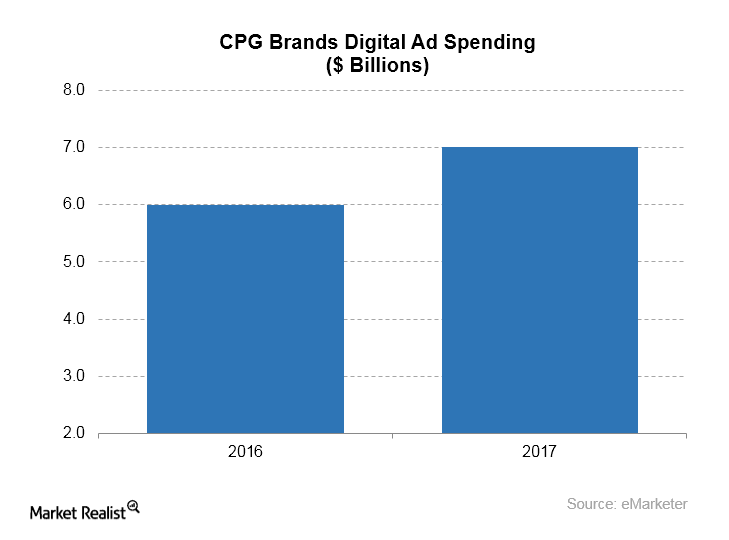

What Are the Trends in Facebook’s Largest Advertising Category?

Business intelligence firm eMarketer estimates that CPG brands spent more than $7.0 billion on digital advertising in 2017, compared with $6.0 billion in 2016.

Did Dr Pepper Snapple’s Non-Carbonated Beverages Call the Shots in 4Q15?

Dr Pepper Snapple (DPS) saw higher volume growth in non-carbonated beverages in all the quarters of fiscal 2015 compared to CSDs.

PepsiCo Aims to Revive Soda Volumes with Crystal Pepsi

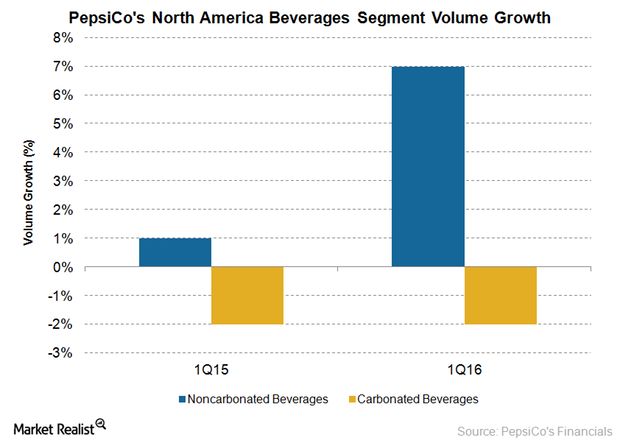

Carbonated soft drinks have been losing their fizz as more and more consumers are opting for healthier beverage options.

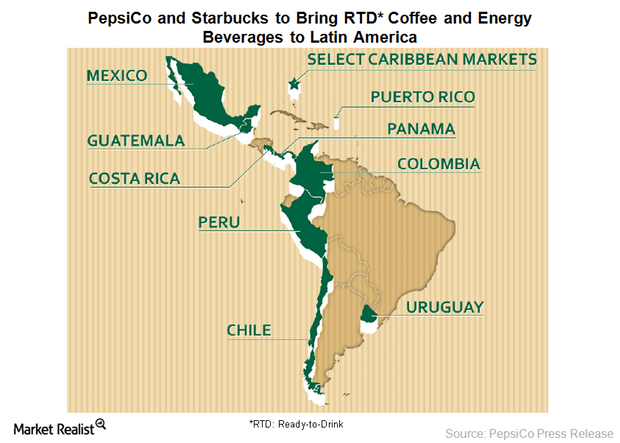

PepsiCo Partners with Starbucks to Seek Growth in Latin America

In 2016, PepsiCo and Starbucks will distribute Starbucks’s ready-to-drink, or RTD, coffee and energy beverages in select Latin American markets.

Coca-Cola Is Open to Inorganic Growth in Still Beverages

Coca-Cola has a dominant presence in the sparkling beverages market, but it’s the still beverage space that has huge growth prospects.

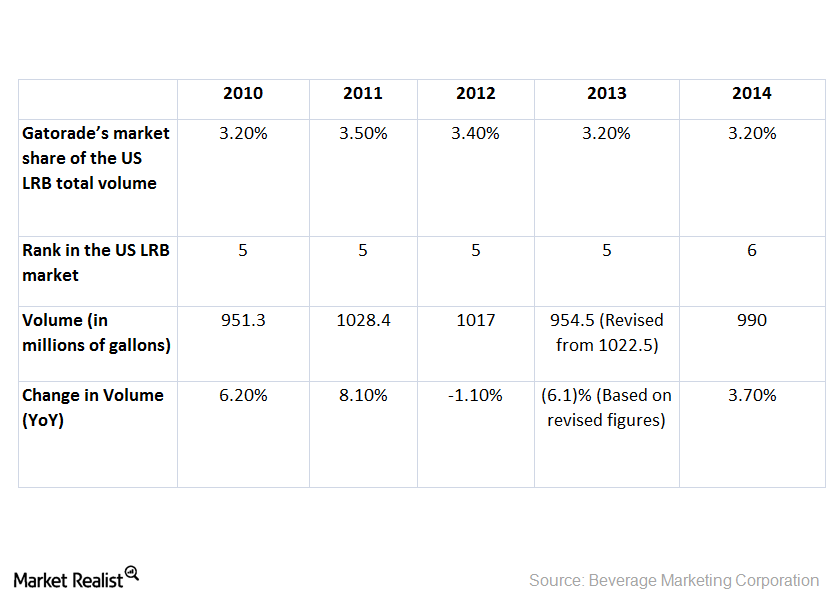

Gatorade’s Position in the Sports Beverage Market

Gatorade’s position and volumes have been impacted by rising competition. It has also felt the effect of the popularity of bottled water, ready-to-drink tea, coffee, and energy drinks.

What Do Analysts Expect from PepsiCo’s 2Q16 Earnings?

PepsiCo’s (PEP) performance in recent quarters has been under pressure due to currency headwinds and weakness in carbonated soft drink volumes.

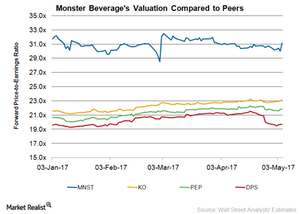

Monster Beverage’s Valuation: Impact of 1Q17 Results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

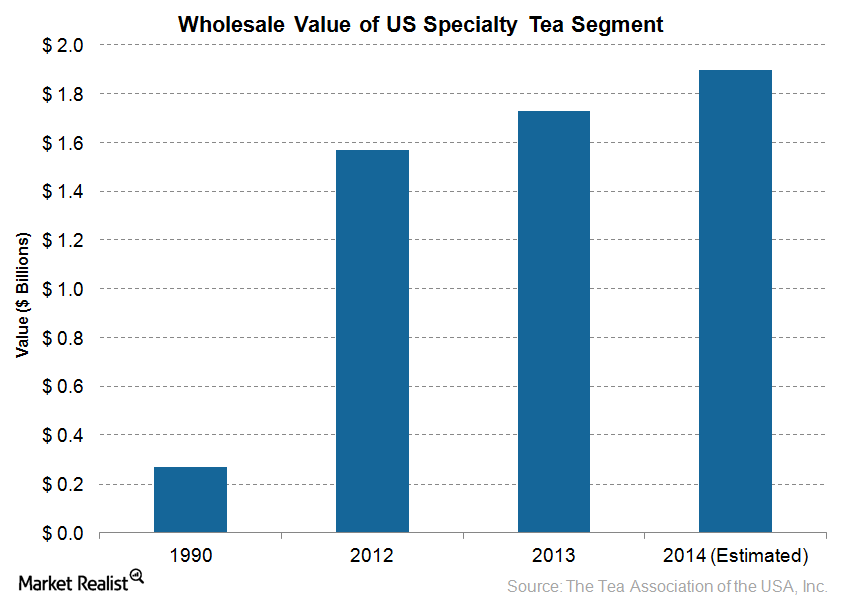

What’s So Special About Specialty Tea?

According to the Tea Association of the USA, the specialty tea segment wholesale value increased to an estimated $1.9 billion in 2014, up 9.8% from 2013.

Dr Pepper’s Prospects in Other Non-Carbonated Beverages

Dr Pepper Snapple adopted a strong strategy by acquiring an 11.7% stake in BodyArmor. But it could grow more in other non-carbonated beverage categories.Company & Industry Overviews Understanding Coca-Cola’s business segments

Overall, in 2013, still beverages performed better than sparkling beverages across all the segments except for Europe. Sparkling beverage volumes have been declining over the past few years.

PepsiCo: A Must-Know Overview of the Consumer Giant

Leading consumer staples company PepsiCo manufactures and distributes food and beverage products in over 200 countries

How to Make Money with Dividend Investing

If you’re an income investor, I’ve got a strategy for you. Dividend investing is a time-tested way to grow your account over the long haul.

PepsiCo Beats Q2 Estimates, Strong Snacks Sales amid COVID-19

PepsiCo’s global snack business helped offset the weakness in the company’s beverage business. The snack business delivered organic revenue growth of 5%.