Coca-Cola Co

Latest Coca-Cola Co News and Updates

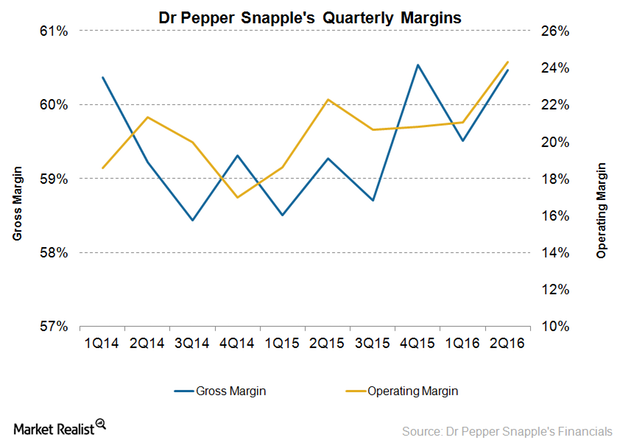

What Led Dr Pepper Snapple’s Margin Expansion in 2Q16?

Dr Pepper Snapple’s (DPS) gross margins increased by 120 basis points to 60.5% in 2Q16 on a YoY (year-over-year) basis.

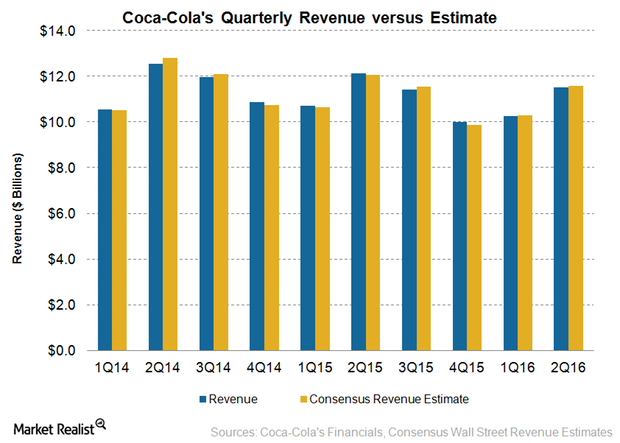

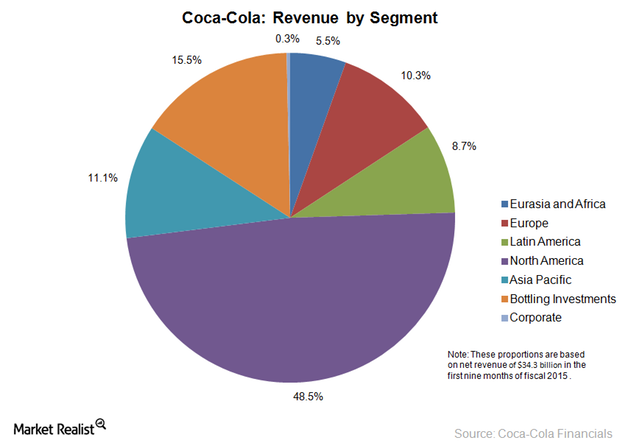

Coca-Cola’s 2Q16 Revenue Fell Due to Headwinds

Coca-Cola generated revenue of $11.5 billion in fiscal 2Q16 ending July 1, 2016. It missed analysts’ consensus revenue estimate of $11.6 billion.

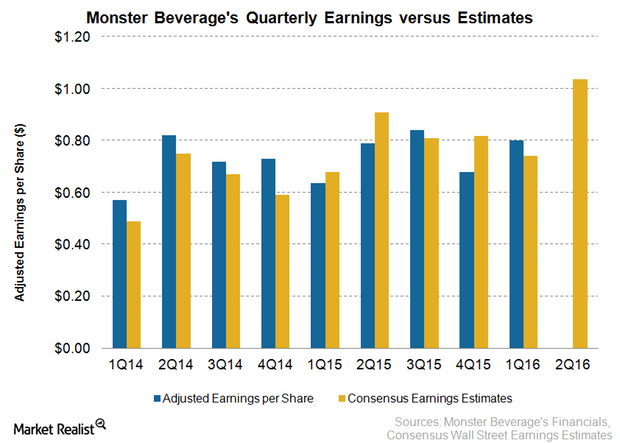

What Will Drive Monster Beverage’s 2Q16 Earnings Growth?

Monster Beverage (MNST) impressed its investors with a 26% growth in its 1Q16 EPS (earnings per share), excluding the impact of one-time items.

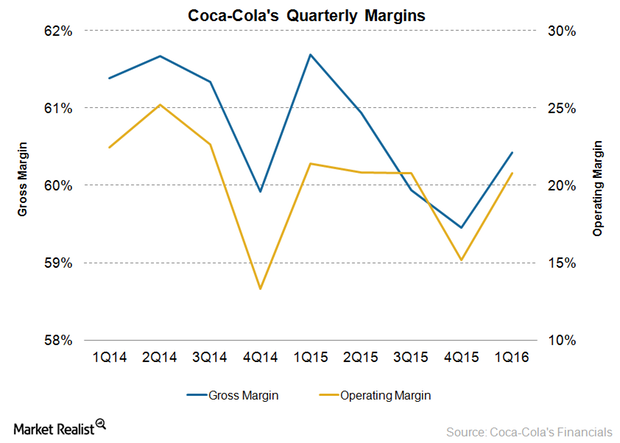

Can Productivity Measures Help Coca-Cola’s Margins in 2Q16?

Coca-Cola’s (KO) margins contracted in 1Q16 due to the impact of adverse currency fluctuations and structural headwinds.

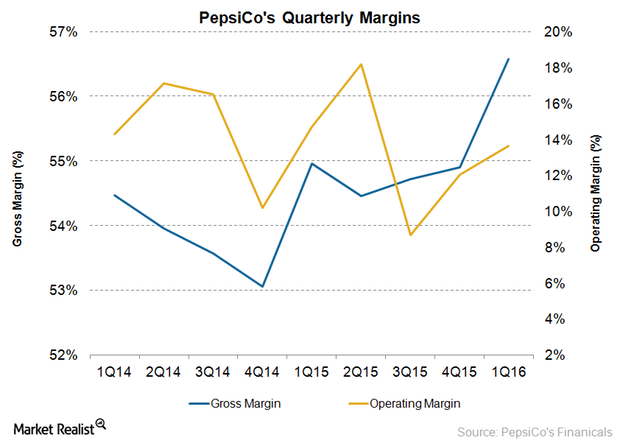

What Drove PepsiCo’s Margin Expansion in 2Q16?

PepsiCo’s gross margin expanded to 55.6% in 2Q16 from 54.5% in 2Q15.

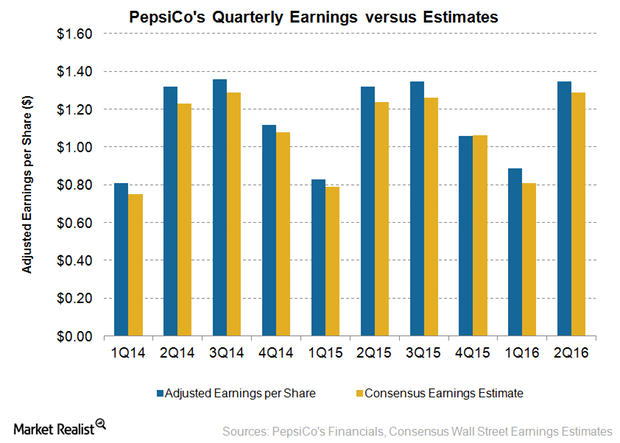

PepsiCo’s 2Q16 Earnings Rise on Improved Margins

Leading snack and beverage maker PepsiCo (PEP) delivered adjusted EPS (earnings per share) of $1.35 in 2Q16 ended June 11, 2016.

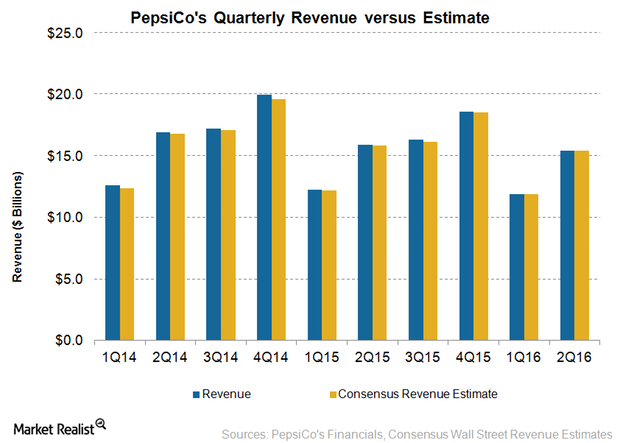

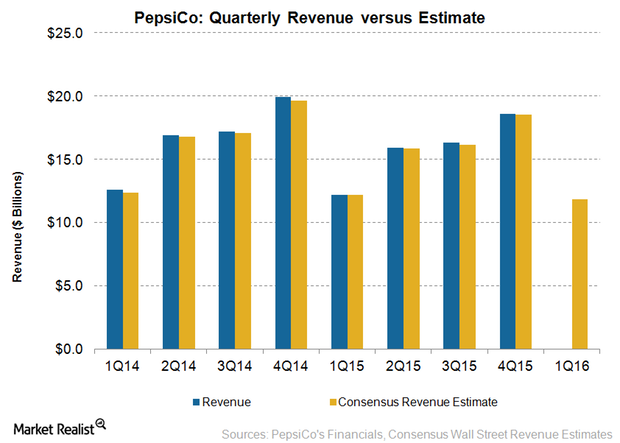

What Dragged down PepsiCo’s 2Q16 Revenue?

PepsiCo’s (PEP) revenue declined by 3.3% in 2Q16 ended June 11, 2016.

Coca-Cola Expands Its Still Portfolio with a Stake in Aloe Gloe

Coca-Cola’s Venturing & Emerging Brands unit has acquired a minority stake in the certified organic, non-GMO, and gluten-free drink Aloe Gloe.

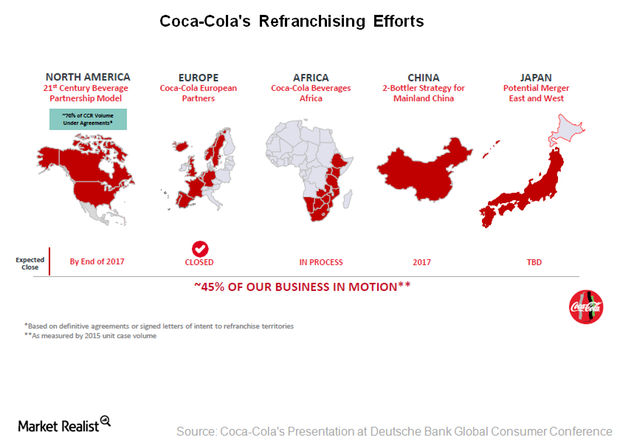

How Coca-Cola’s Refranchising Efforts Will Transform the Company

On June 15, the Coca-Cola Company (KO) announced a letter of intent to refranchise territories in most of the Memphis, Tennessee, market unit.

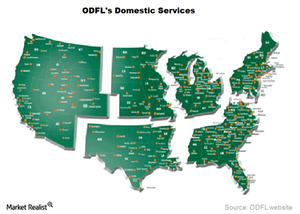

Understanding Old Dominion Freight Line’s Domestic Services

Old Dominion Freight Line has 224 shipping service centers and 32 transfer points. ODFL serves nine major regions and thousands of direct points in the US.

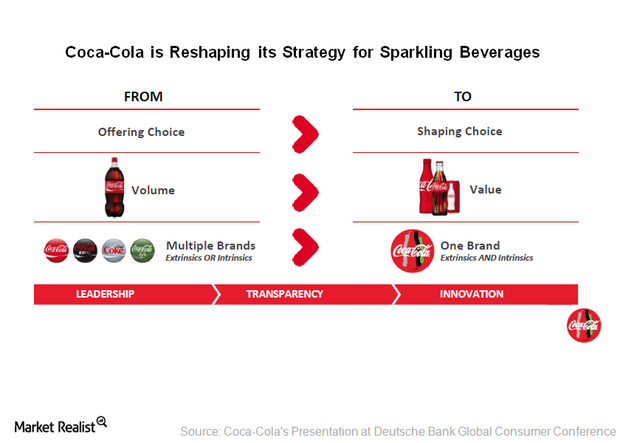

How Coca-Cola Is Reshaping Its Strategy for Sparkling Beverages

Coca-Cola is now changing its approach from offering beverage choices to consumers to shaping their choices.

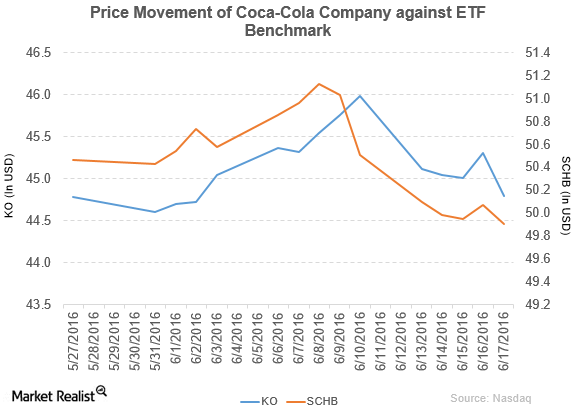

Why Did The Coca-Cola Company Fall on June 17?

The Coca-Cola Company (KO) has a market cap of $192.8 billion. It fell by 1.2% to close at $44.79 per share on June 17, 2016.

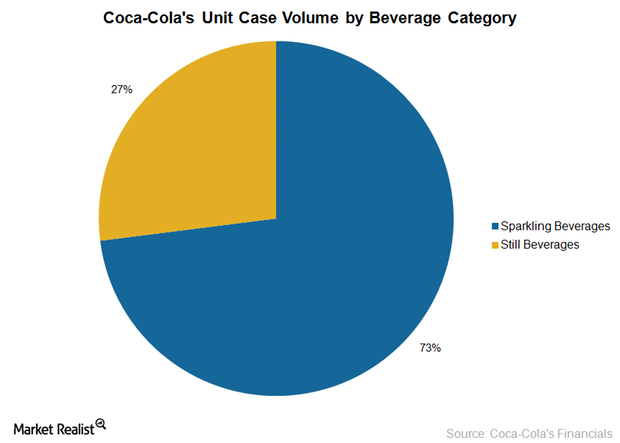

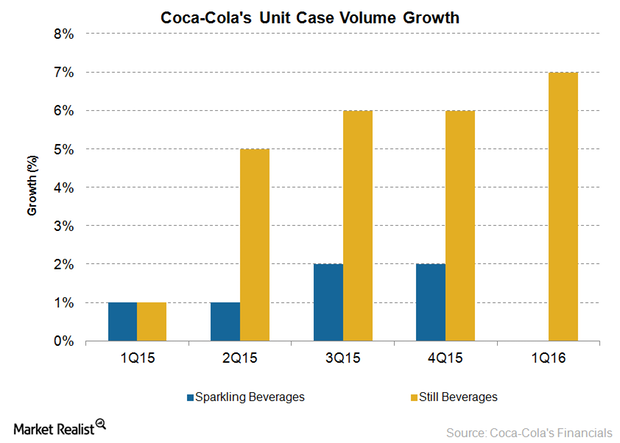

Why Coca-Cola Is Focusing on Still Beverages

In January 2016, Coca-Cola announced the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

PepsiCo’s Non-Carbonated Beverages Sparkle in 1Q16

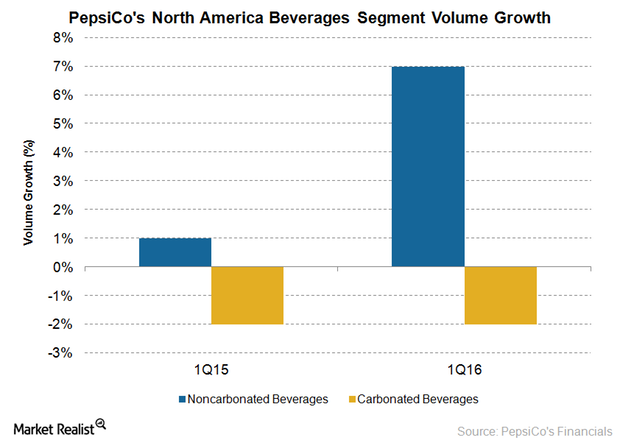

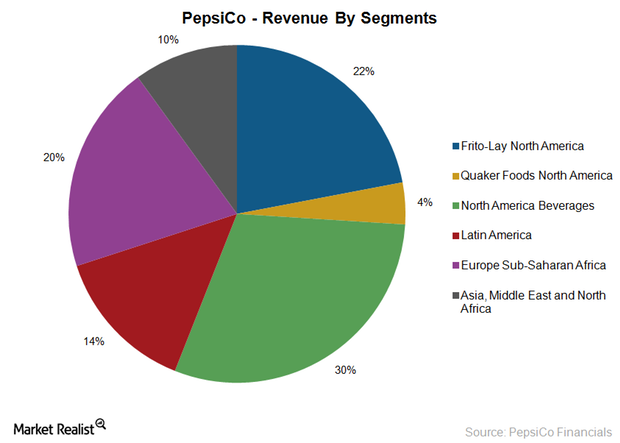

In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit.

Why Analysts Expect PepsiCo’s Revenue to Decline in Fiscal 1Q16

On April 18, PepsiCo is scheduled to announce its results for fiscal 1Q16. PepsiCo’s revenue has declined in each of the past five consecutive quarters.

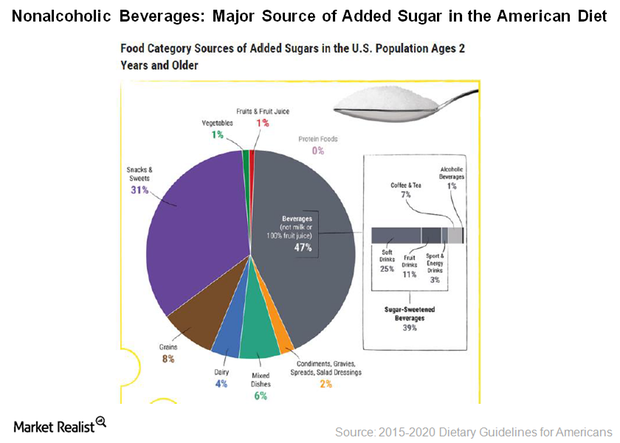

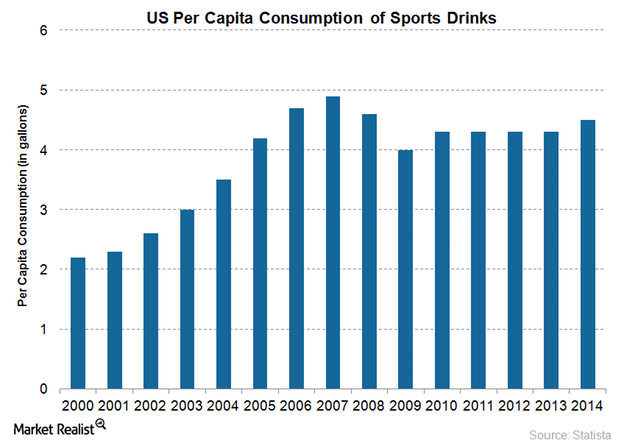

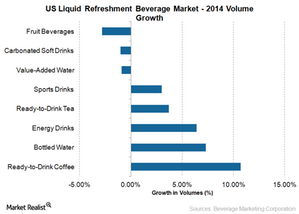

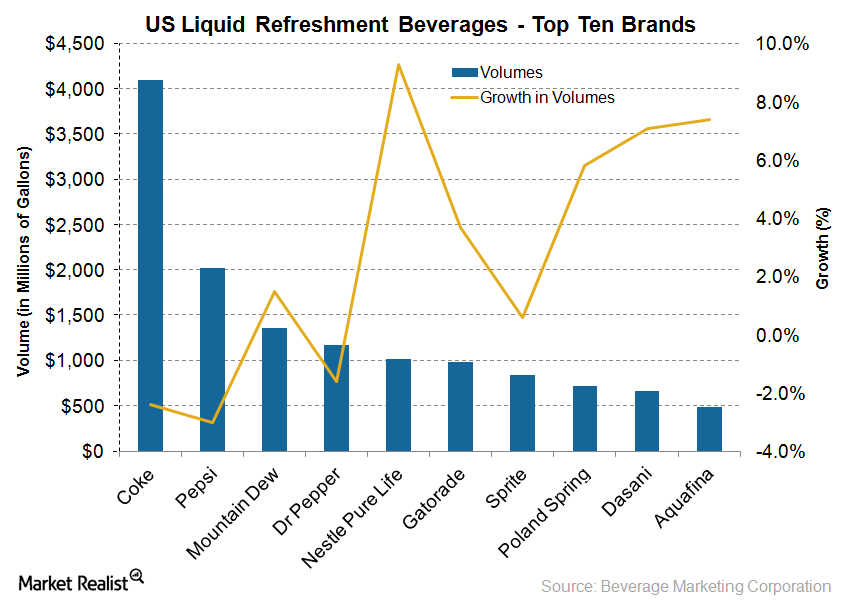

An Insight into Sport Drinks’ Positioning in the US Beverage Market

Sports drinks are considered a healthier choice than traditional soda beverages, and they contain less sugar than traditional soda beverages.

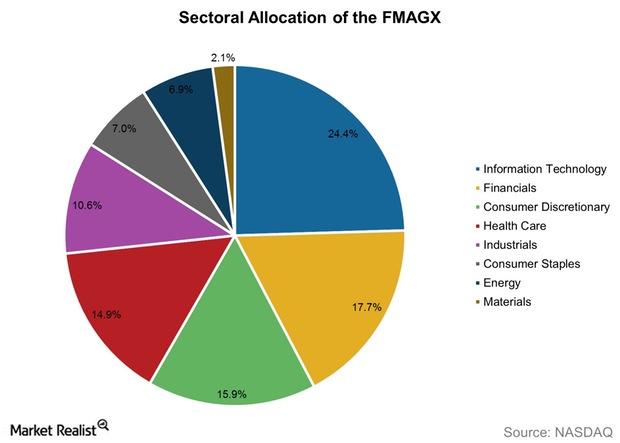

Need-to-Know Facts about the Fidelity Magellan Fund

The Fidelity Magellan Fund (FMAGX) invests primarily in common stocks of US and foreign issuers. It invests in either growth stocks, value stocks, or both.

Coca-Cola Strengthened Presence in Africa with Stake in Chi

Beverage giant Coca-Cola (KO) has expanded its presence in Africa with the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

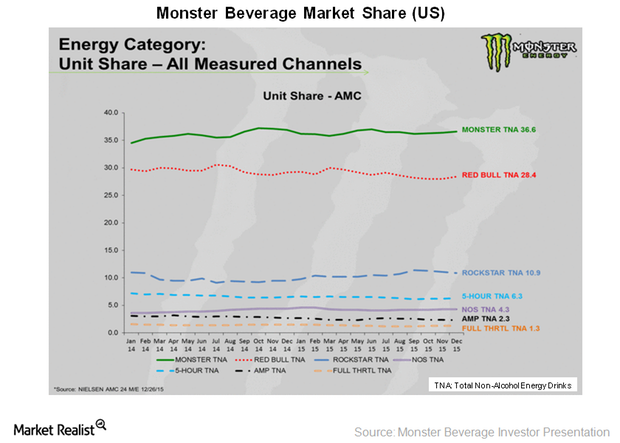

Are Strategic Brands Boosting Monster Beverage’s Sales?

According to Nielsen’s data, for the period ending December 26, 2015, the Monster Beverage brand held a 36.6% share of the US energy drink market in terms of unit sales.

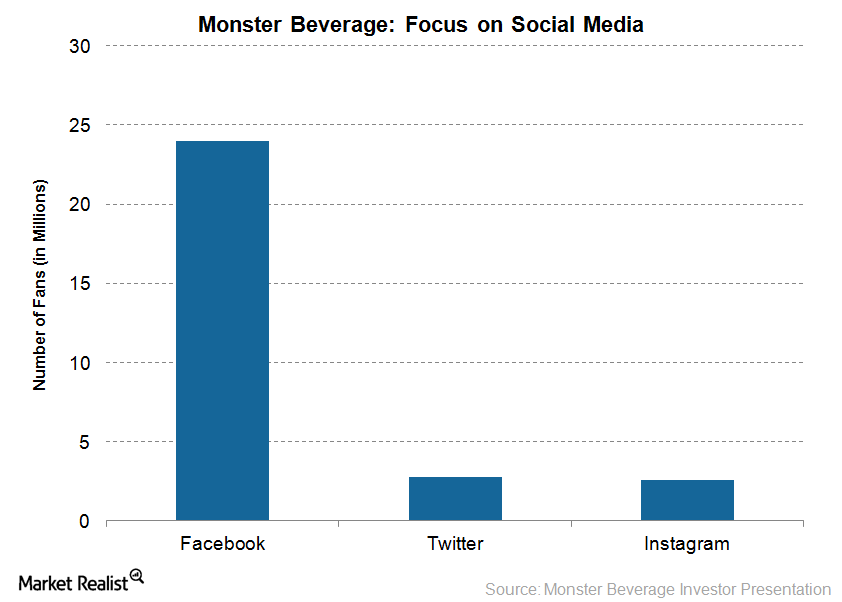

Monster Beverage Increases Its Advertising Efforts

Monster Beverage enjoys huge popularity on social media. It has 24 million fans on Facebook (FB), 2.8 million fans on Twitter (TWTR), and 2.6 million fans on Instagram.

Is Ferrari the World’s Most Recognizable Brand?

In an annual study conducted in 2013 by Brand Finance, Ferrari stood as the world’s most popular and instantly recognizable global brand.

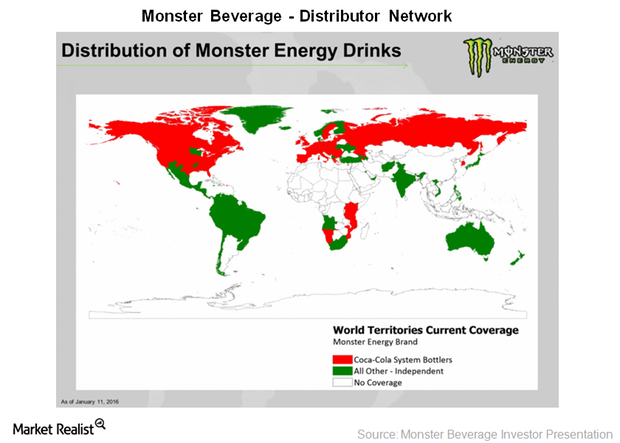

Monster Beverage Provides an Update on Distribution Transition

In its 3Q15 conference call, Monster Beverage disclosed an agreement with Coca-Cola HBC (Hellenic Bottling Company) that will apply across 28 countries.

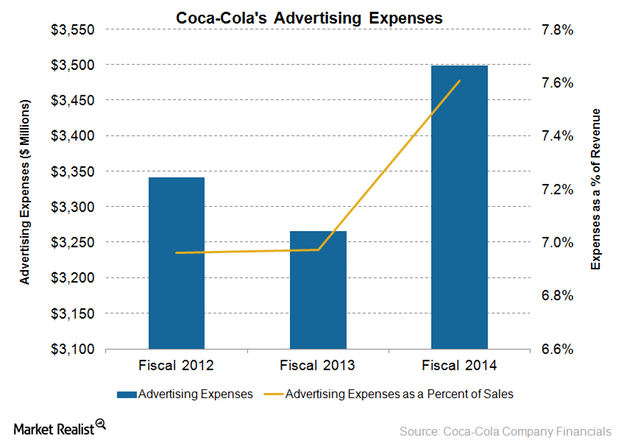

Understanding Coca-Cola’s New Marketing Efforts

Coca-Cola (KO) is using its productivity savings to ramp up its media investments.

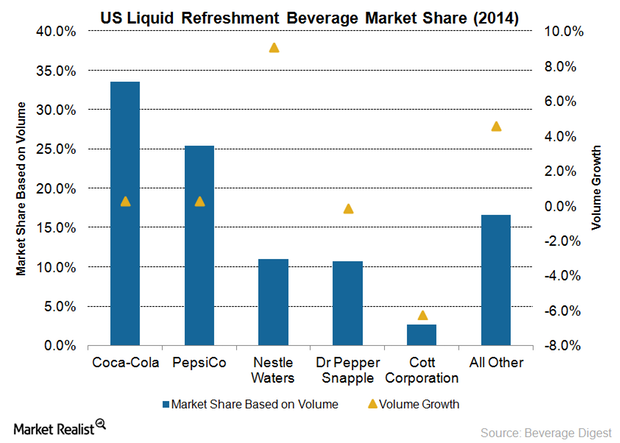

Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

PepsiCo’s Strategy for Its UK Business

PepsiCo’s strategy for its UK business involves continued investment in its core brands across snacks and beverages, including Walkers, Tropicana, Naked, Quaker, and Pepsi.

Dr Pepper Reaches for Sports Drinks with BodyArmor

On August 12, 2015, Dr Pepper Snapple announced that it purchased an 11.7% stake in BA Sports Nutrition, the company that owns BodyArmor.

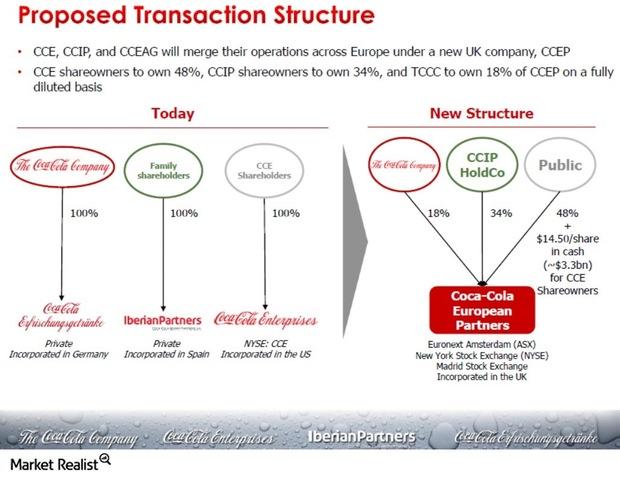

Coca-Cola Bottler Merger: Analyzing the Deal’s Economics

The new company, Coca-Cola European Partners PLC (or CCEP), would be based in the United Kindgom with CCE, CCIP, and The Coca-Cola Company (KO) holding 48%, 34%, and 18% of shares, respectively.

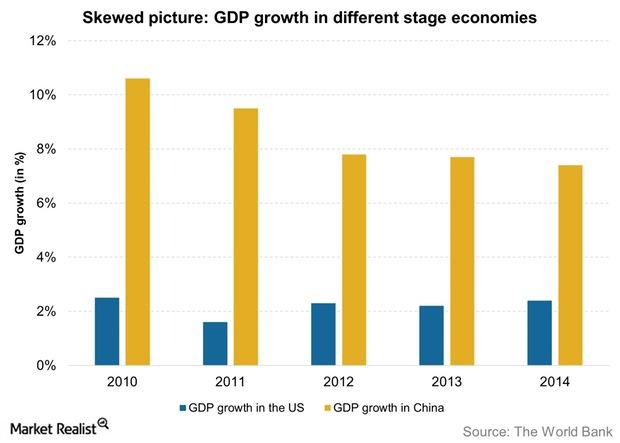

Economic Growth: Why Is It Important?

Economic growth can be considered among the most crucial indicators that are released. It indicates the growth in economic output.

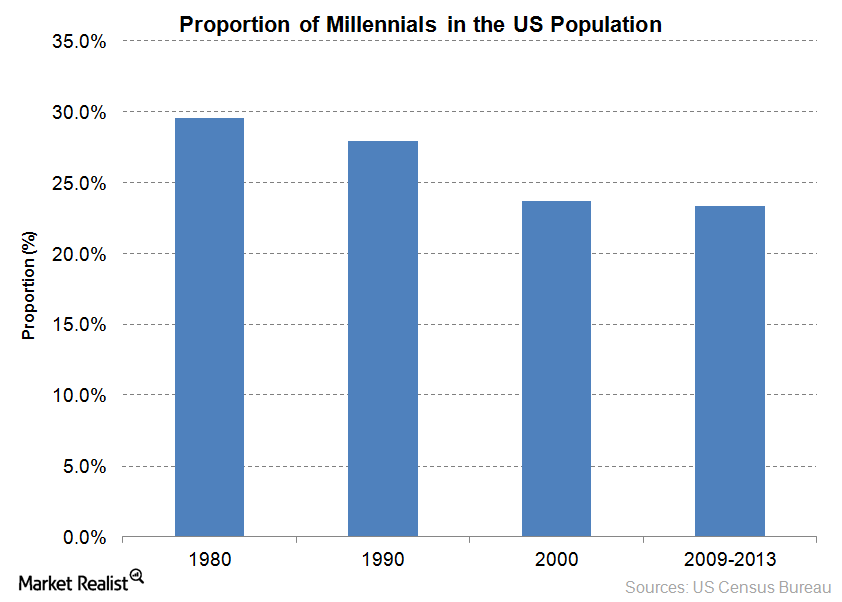

Why Are Millennials a Key Demographic for Monster Beverage?

Millennials are the key consumers of energy drinks and shots. Monster Beverage specifically targets this tech-savvy demographic in its advertisements.

Are Parents Driving Energy Drink Sales in the US?

As shocking as it may sound, a higher proportion of US households with children are consuming more energy drinks—compared to those without children.

Energy Drinks Continue to Thrive despite Controversies

Two-thirds of energy drink consumers are concerned about the negative effects of energy drinks and shots, but this doesn’t stop them from consuming the drinks.

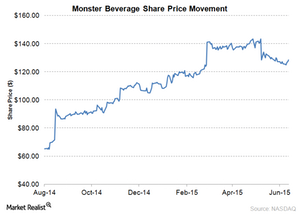

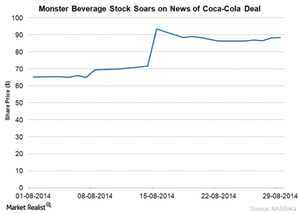

Monster Gets More Energy in Strategic Partnership with Coca-Cola

On June 12, Coca-Cola and Monster Beverage completed a strategic partnership. Coca-Cola purchased 16.7% in Monster for $2.2 billion. That day, Monster Beverage shares rose 1.0%, and Coca-Cola’s fell 0.3%.

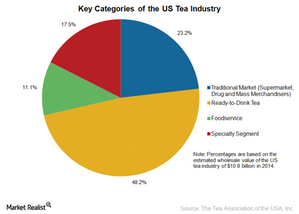

What Are the Key Categories in the US Tea Industry?

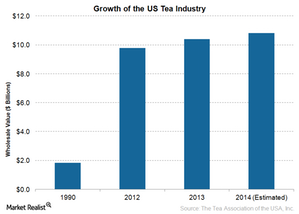

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014.

The Growing Demand for Tea in the US

Though the per capita consumption of tea in the US is low compared to other countries, the growth in tea consumption in recent years has been impressive.

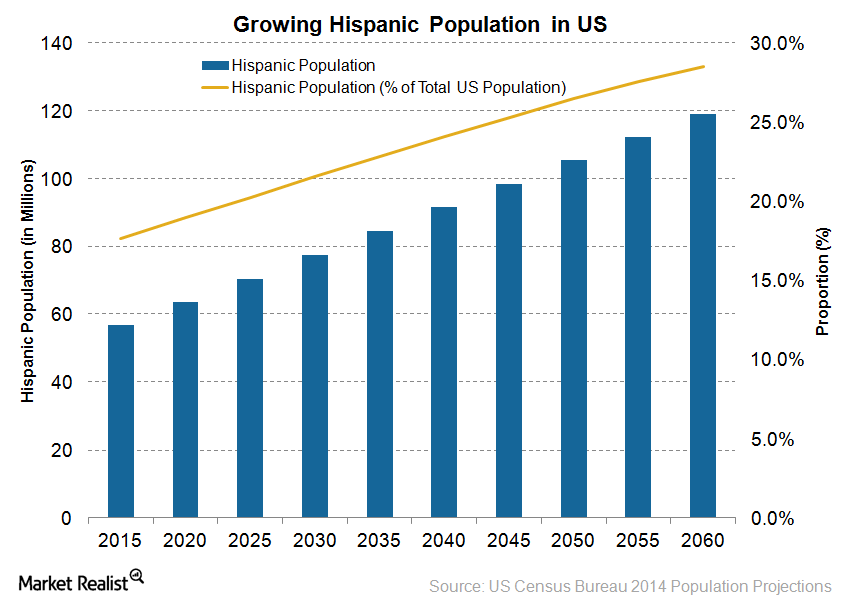

Why PepsiCo and Its Peers Are Focusing on Hispanics in 2015

PepsiCo (PEP) and peers like Coca-Cola and Dr Pepper Snapple have been developing several products based on the tastes and preferences of Hispanics.

Gatorade by PepsiCo: Still Athletic at 50

Gatorade is celebrating its 50th anniversary this year. It’s one of PepsiCo’s $22-billion brands, generating more than $1.0 billion in annual retail sales.

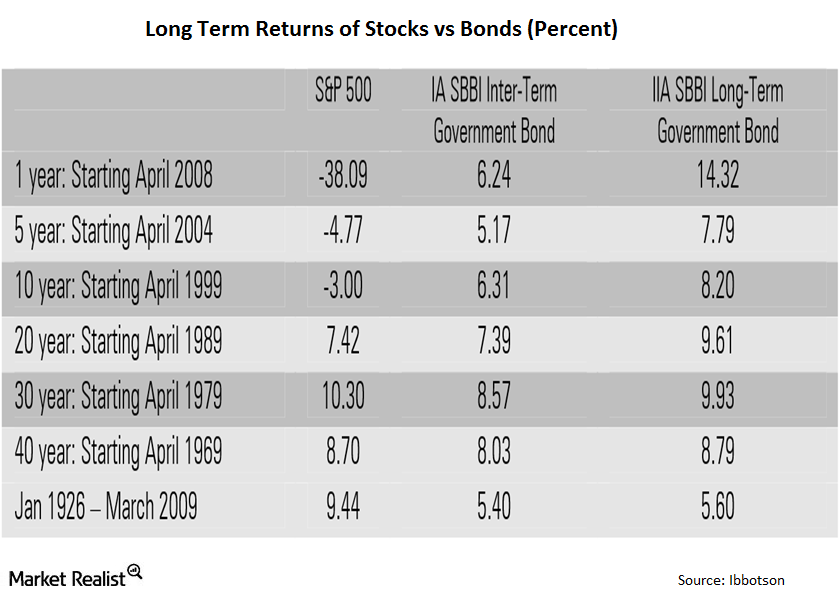

Stocks Beat Bonds over the Long Run By a Big Margin

The majority of investors believe bonds are safer than stocks. The main reason is that bonds pay regular interest.

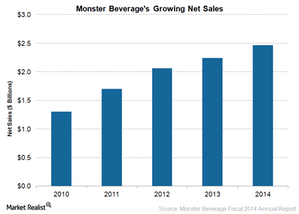

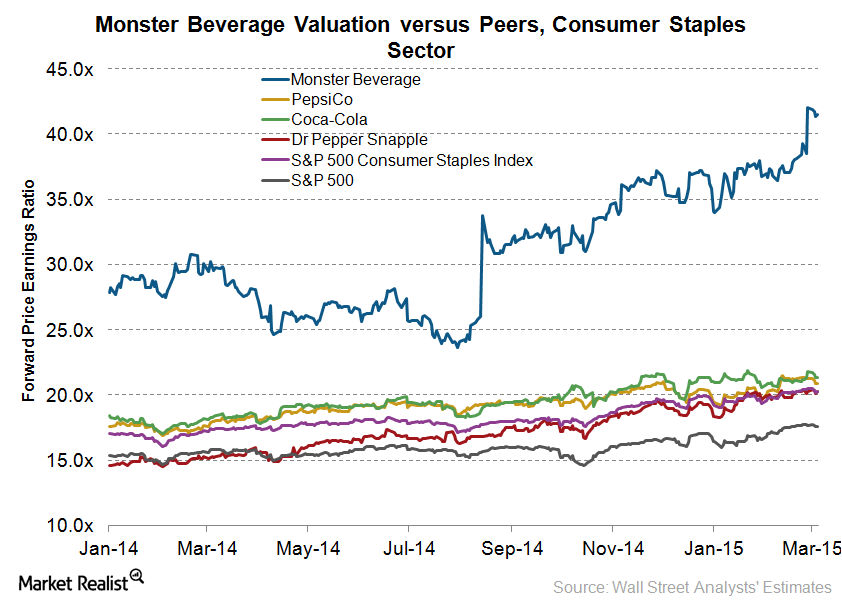

Monster Beverage’s stock outperforms peers

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.

Monster Beverage and Coca-Cola: A landmark partnership

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

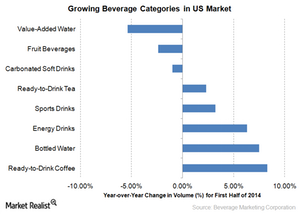

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

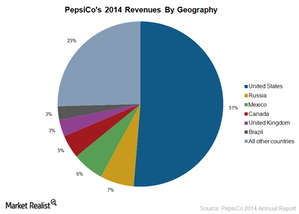

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

How PepsiCo’s focus on innovation is reaping rewards

PepsiCo’s focus on innovation includes Pepsi Spire 5.0 equipment, which allows consumers to create about 1,000 beverage combinations using a 32-inch touchscreen.

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.

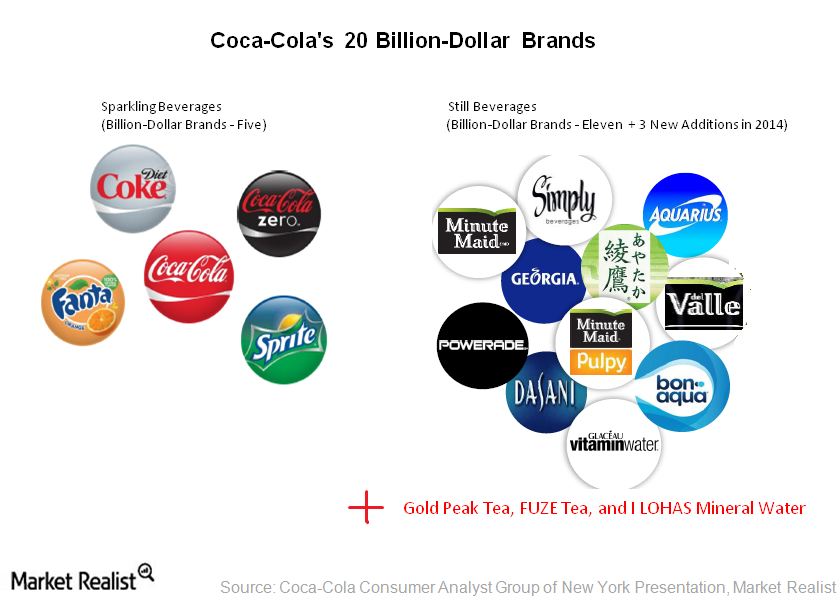

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

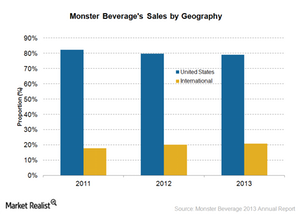

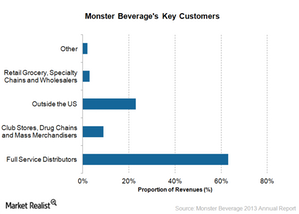

Why Monster Beverage’s international business is growing

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

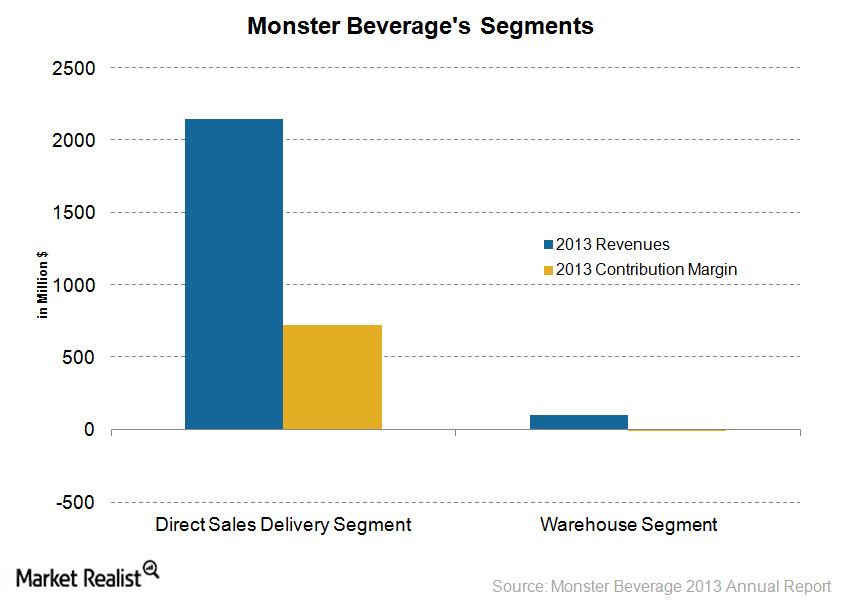

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.