What Are the Sources to Obtain Economic Moats?

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that […]

Oct. 29 2019, Updated 11:36 p.m. ET

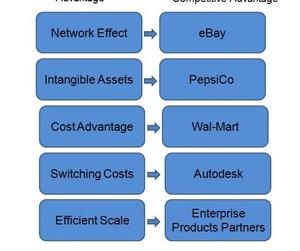

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that can give companies economic moats, and which are viewed as sources of sustainable competitive advantages: 1) Network Effect 2) Intangible Assets 3) Cost Advantage; 4) Switching Costs; and 5) Efficient Scale. Here we explore the concept of “Cost Advantage.”

Market Realist

What is an economic moat?

As part of its fundamental approach to investing, Morningstar assists investors in determining and selecting companies with economic moats. Coined and popularized by Warren Buffett, the term “economic moat” explains a business’s ability to achieve a competitive edge over its competitors in the same industry.

Furthermore, to assist investors in choosing moat companies (VFC) (LB), Morningstar assigns one of three economic ratings to companies: none, narrow, and wide.

To attain this competitive advantage and to obtain either a “narrow” or “wide” economic rating, a business has to fulfill two major requirements as identified by Morningstar. The firm must earn above-average returns and also protect the long-term returns from crumbling.

The chart above shows examples of companies that have obtained a competitive advantage. eBay (EBAY) acquired a “wide” economic rating from Morningstar with its network effect, and Pepsico (PEP) garnered a “wide” rating with its competitive advantage of intangible assets. Walmart (WMT) has a “wide” rating from Morningstar because of cost advantage.

Main idea of obtaining an economic moat

The main idea of a company receiving an economic moat is to stay ahead of the competition and protect its long-term profits. A company can achieve this with a low-cost advantage such as obtaining raw materials at a cheaper cost. The company can also use intangible assets like patents and licenses to prevent duplication of products and services.

A company can obtain a competitive advantage and gain profit in the short run. However, to achieve an economic moat, it must sustain the higher returns over a longer period while creating long-term value for its shareholders.

In this series, we’ll focus on one of the sources of obtaining a sustainable competitive advantage—cost leadership. With the example of four companies, we’ll explore how cost leadership helped these companies achieve economic moats.