L Brands Inc

Latest L Brands Inc News and Updates

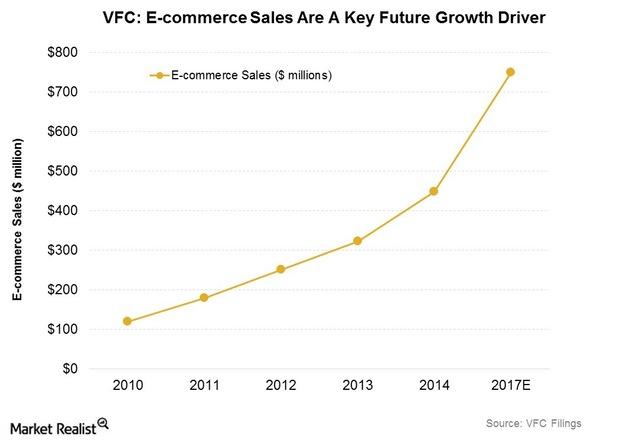

Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

Nike’s Fastest-Growing Demographic Segments

The women and young athletes demographic segments saw the greatest sales traction in fiscal 2015 for Nike.

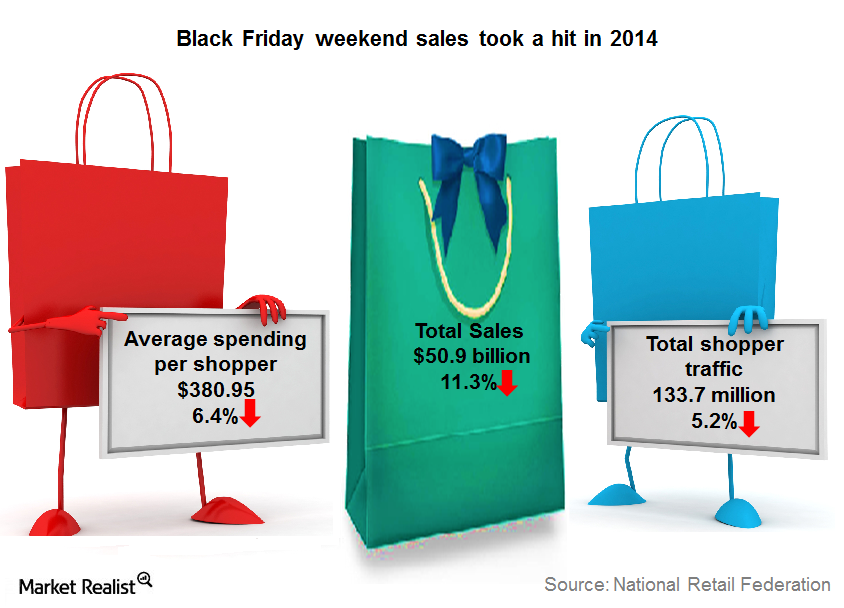

Santa Could Yet Bring Cheer To Holiday Retail Sales

We think the final tally for holiday retail sales could differ from the gloomy picture some of the initial estimates had painted.

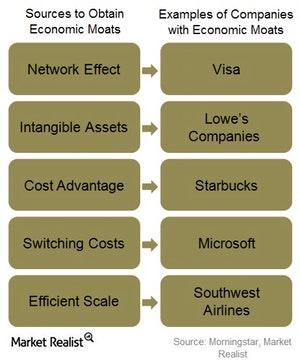

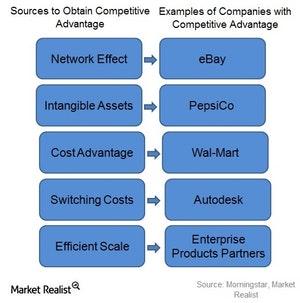

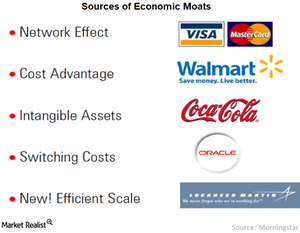

The Idea behind Economic Moats

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. she

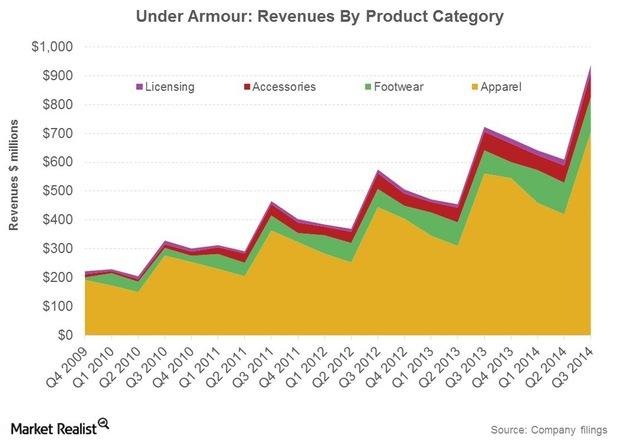

Under Armour: The Nature Of Its Business, Product Portfolio

UA’s product, marketing, and sales teams each play an active role in the design process. This collaboration helps control brand and product consistency.

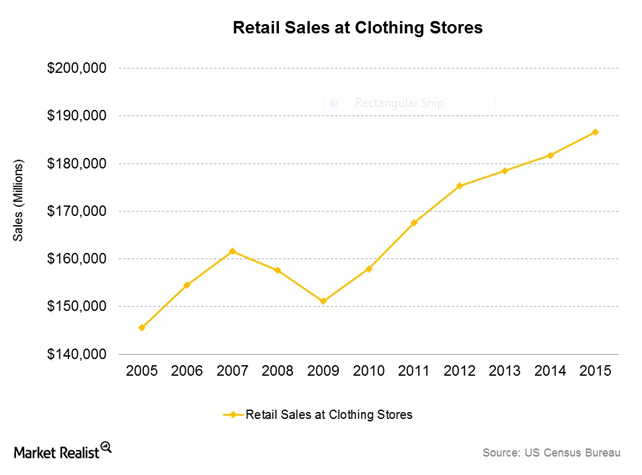

How Has Athleisurewear Boom Impacted the US Apparel Industry?

The growth rate in activewear or athleisurewear has outpaced the overall clothing market, with a double-digit CAGR over the past five years.

What Are the Sources to Obtain Economic Moats?

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that […]

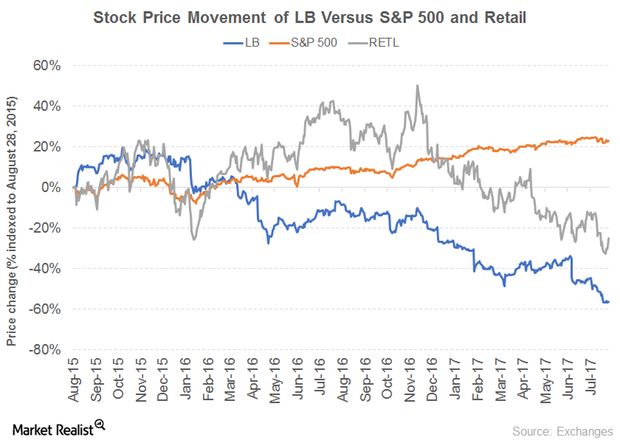

Here’s Why L Brands’ Dividend Yield Is Rising

Reasons behind L Brands’ growing yield Specialty fashion retailer L Brands (LB) saw its sales slow between 2013 and 2016. The company recorded revenue growth of 3.5% in 2016, compared with 6% in 2015. The growth was driven by the Victoria’s Secret and Bath & Body Works segments. Whereas its operating income grew 12% in 2015, it […]

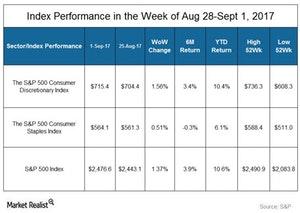

Analyzing the Consumer Sector’s Performance Last Week

On September 1, General Motors (GM) released its August sales report. In August, US retail sales recorded 275,552 vehicles—7.5% higher YoY.

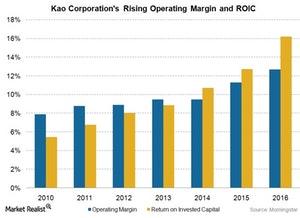

Kao Corporation: What’s Sharpening Its Competitive Edge?

Kao Corporation has become the largest branded and packaged goods company in Japan and the second-largest company in the cosmetics category.

How to Identify Economic Moats

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.

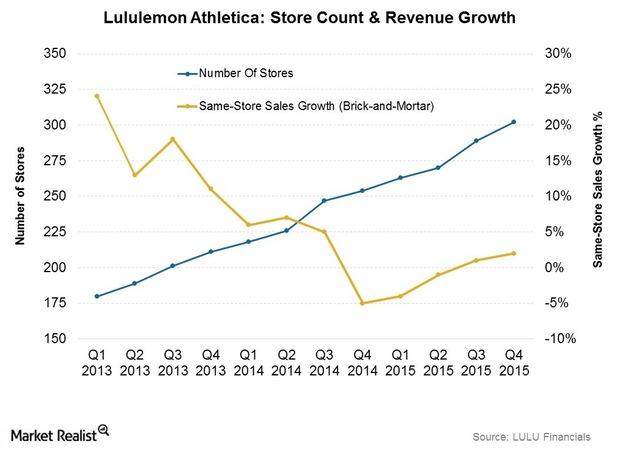

Why Store Expansion is a Critical Driver for Lululemon Athletica

Despite having negative comps in 1H15, Lululemon’s revenue growth for its physical stores was positive at 9.7% year-over-year in fiscal 2015.

Headwinds And Tailwinds For Lululemon Revenues This Year

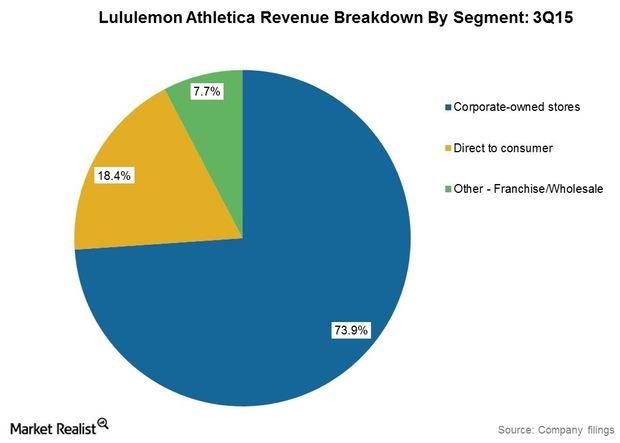

Lululemon Athletica announced an increase of 10.4% in its revenues to $419.4 million in the third quarter of fiscal 2015 compared to $379.9 million in 3Q14.

Overview: Lululemon’s Target Market And Product Assortment

Major product lines include fitness pants, shorts, tops and jackets. It also has a range of fitness-related accessories like bags, socks, and yoga mats.