Procter & Gamble’s Downy: World’s Fastest-Growing Brand

According to Kantar World Panel’s Brand Footprint 2015 report, Procter & Gamble’s (PG) fabric softener Downy was the fastest-growing brand in 2014.

June 1 2015, Updated 1:06 p.m. ET

Downy is the fastest-growing brand

According to Kantar World Panel’s Brand Footprint 2015 report, Procter & Gamble’s (PG) fabric softener Downy was the fastest-growing brand in 2014. It was the fastest-growing brand for the second year in a row. Downy clocked the highest growth in CRPs (Consumer Reach Points). It added 11 million shoppers.

Downy’s growth was primarily fueled by emerging markets, with newer products like Downy Unstopables. Its marketing campaigns, using HBO’s (TWX) Game of Thrones theme and digital campaigns, like #Hugmore, contributed to its growth, according to the report. Procter & Gamble also cross-sells Downy with Tide, its top ten brand in terms of CRPs—refer to Part 1 in this series. The Downy Infusions variant allows consumers to create their own fabric softener fragrance. It also creates customer interest in the brand.

PepsiCo and Unilever have more brands in the top ten

PepsiCo (PEP) with four brands—Lay’s, Mountain Dew, Doritos, and Cheetos—had the most number of brands in the fastest-growing brand rankings. Three of Unilever’s (UL) brands were also featured in the top ten—Vim, Lifebuoy, and Sunsilk.

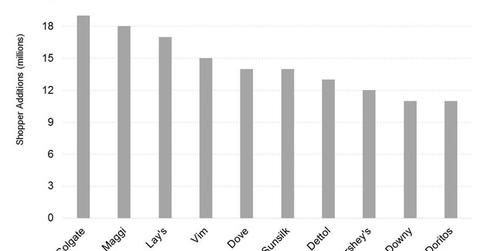

Colgate adds the most shoppers

Colgate-Palmolive’s (CL) Colgate was the fastest-growing brand in 2014, in terms of shopper additions. The brand added 19 million shoppers. Its CRPs rose 3%. Colgate had 87% penetration in India. It also added most of its new shoppers in the country. Refer to Part 2 for more on Colgate’s strategies in India.

Maggi, Lay’s, Hershey’s (HSY), and Dove were also featured among the brands that added the most shoppers last year. Adapting to local preferences was a key element that drove brand growth.

PepsiCo’s growth flavors

PepsiCo has been intent on diversifying away from carbonated soft drinks to snacks as the former category has been losing fizz in developed markets. The growth in the three snack brands came about globally. The company has also been adapting its snack and beverage portfolio to include the local population’s demographic requirements.

The iShares Core S&P 500 ETF (IVV) provides exposure to Procter & Gamble, Colgate-Palmolive, PepsiCo, and Hershey’s. Together, they account for 2.3% of the holdings of IVV.