Phalguni Soni

Phalguni is a retail analyst at Market Realist. Phalguni has had 9 years’ experience in Canada, Dubai, and India, and has worked in Analyst roles at Great Canadian Gaming Corp., Dubai World, Lusight Research, TradeBriefs, and Global Education Management Systems. Phalguni has completed the CFA program. She received a degree in Commerce from the University of Calcutta and was placed at the top of her class.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Phalguni Soni

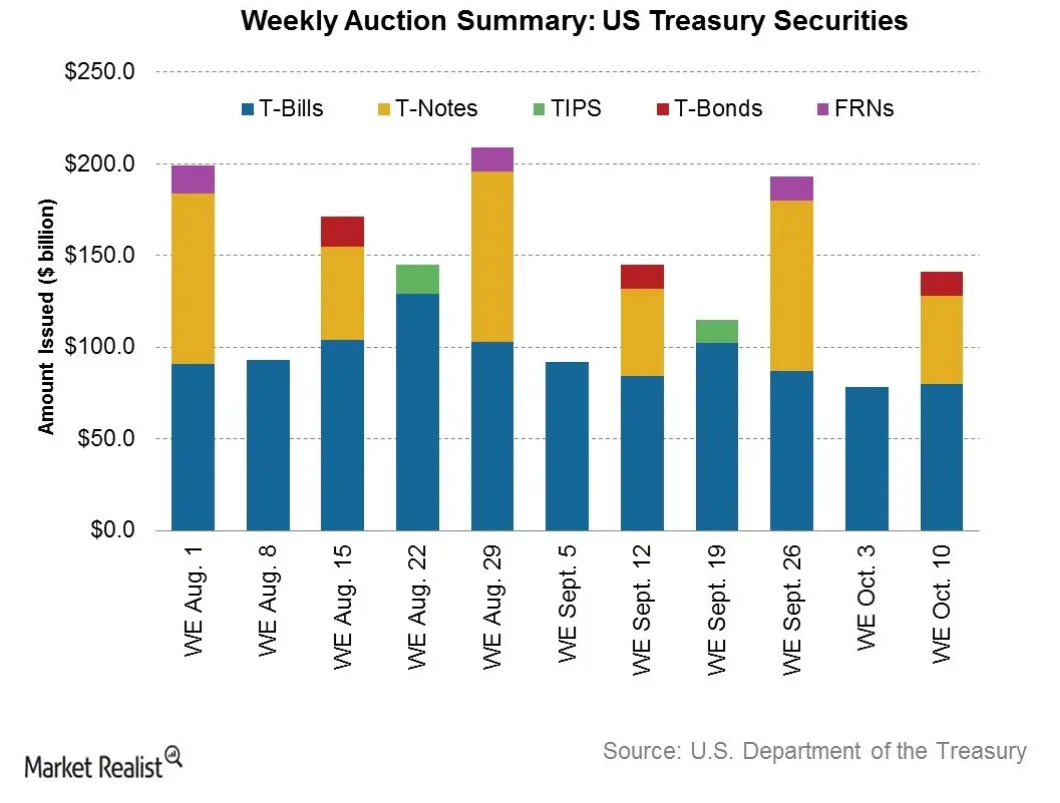

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.

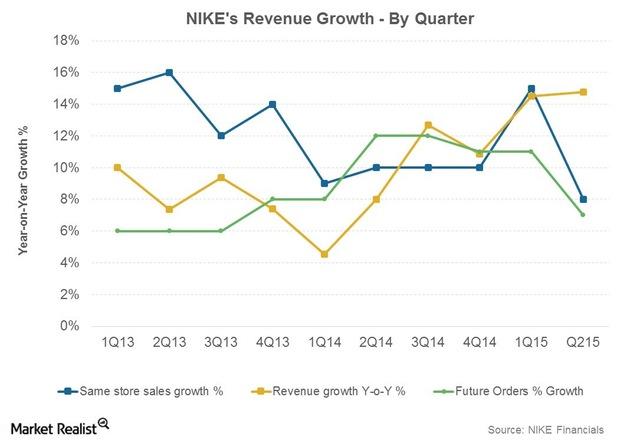

Analyzing the Prospects of Nike’s Geographic Segments

Most of Nike’s (NKE) incremental revenue was recorded in its North America market, Nike’s largest geographical segment.

Where NIKE And Under Armour Win In The Market Share Stakes

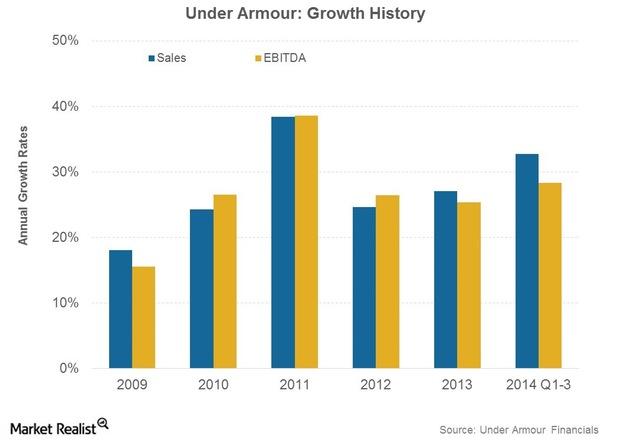

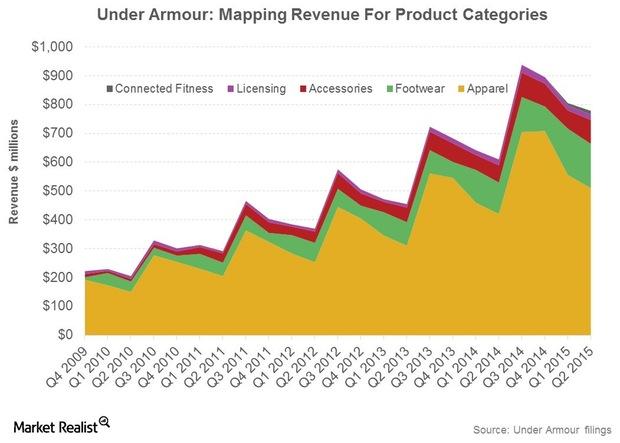

Under Armour’s share of the apparel market rose from 14% to 16%, year-over-year, in the first nine months of 2014.

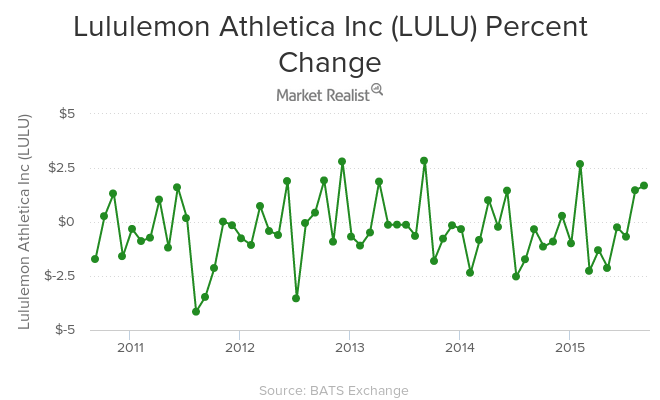

Lululemon: The Outliers Affecting LULU’s Stock Price Movement

On June 11, Lululemon Athletica (LULU) filed a shelf prospectus with the US Securities and Exchange Commission (or SEC).Industrials Can manufacturing activity in the northeast increase the pace?

The Philadelphia Fed will release the results of its Business Outlook Survey for June, on Thursday, June 19.

How Markets Are Pricing Under Armour Stock

Markets expect the strong growth trend to continue, and value Under Armour stock higher than the overall market and comparable firms.Industrials March manufacturing releases are critical in assessing a recovery

The Purchasing Managers Manufacturing Index (or PMI) is based on a monthly survey of selected companies that provide an advanced indication of what’s really happening in the private-sector economy.

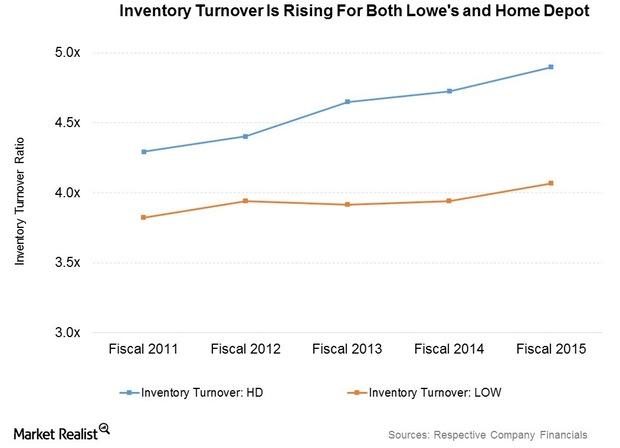

What Are Lowe’s Supply Chain and Inventory Management Policies?

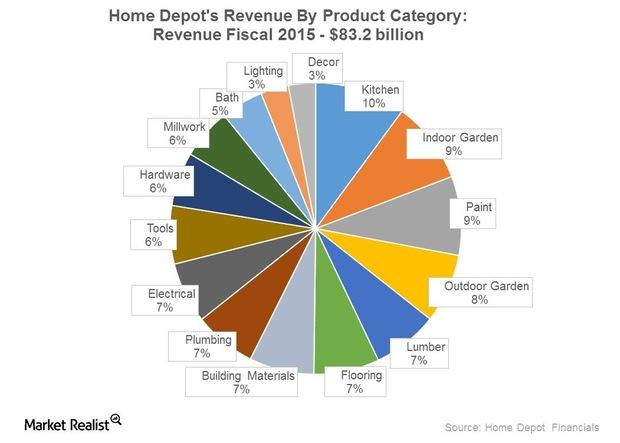

Lowe’s inventory turnover came in at 4.1x in fiscal 2015 compared to 4.9x for Home Depot (HD).

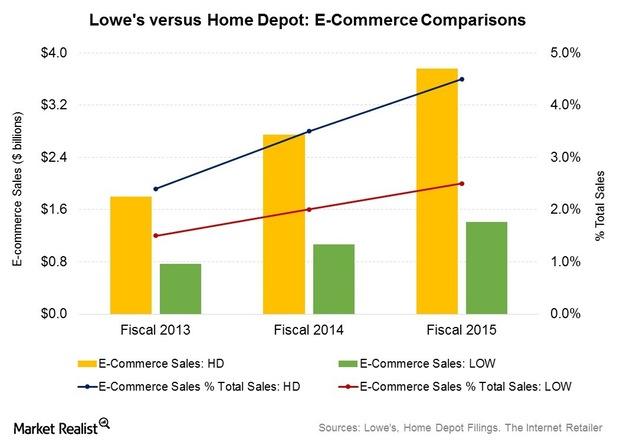

How Does Lowe’s E-Commerce Performance Compare to Rivals?

Lowe’s (LOW) derived about 2.5% of its sales from the e-commerce channel, or an estimated $1.4 billion, in fiscal 2015.

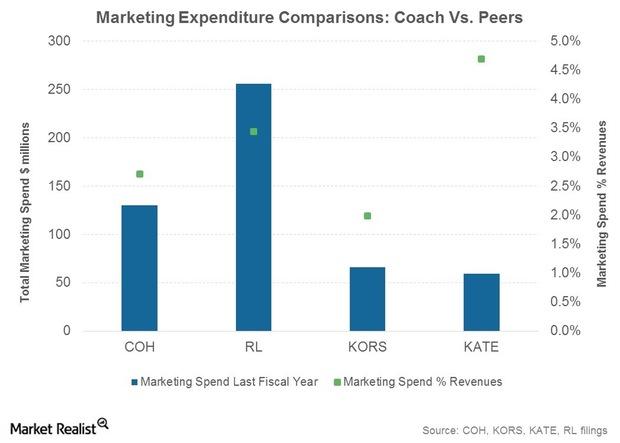

Understanding Coach’s Marketing Strategies

To support its direct marketing initiatives, Coach has a database of 24 million households in North America and 10 million in Asia.

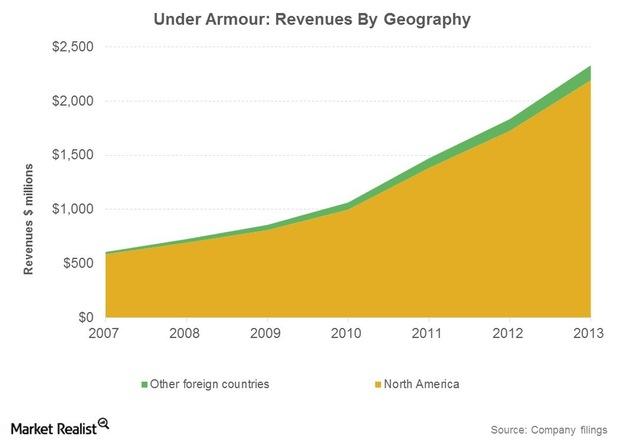

Can Under Armour’s Growth Model Cope With These Threats?

Key threats to the company include higher labor costs and greater regulation. After the Bangladesh factory tragedy, stricter regulations can be expected.

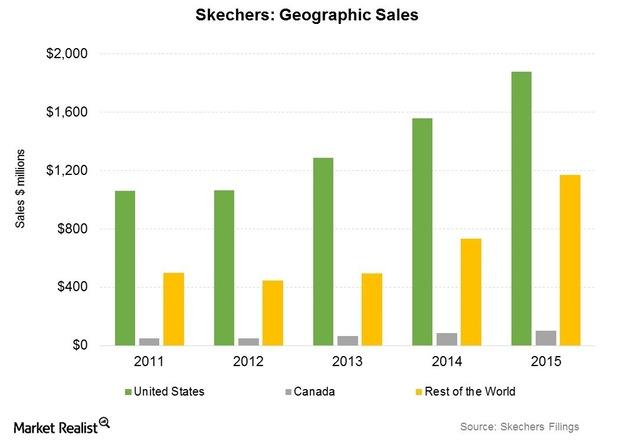

Why Skechers Is Thriving in a Competitive Footwear Market

Skechers grabbed the number two spot in the US footwear market last year. The company’s brands were also ranked number one in walking and work footwear.

Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

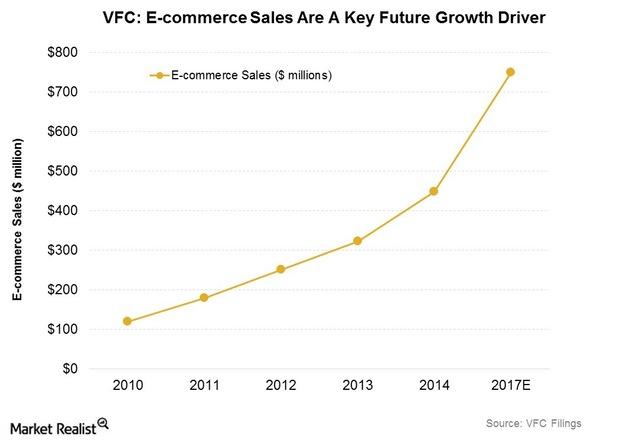

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

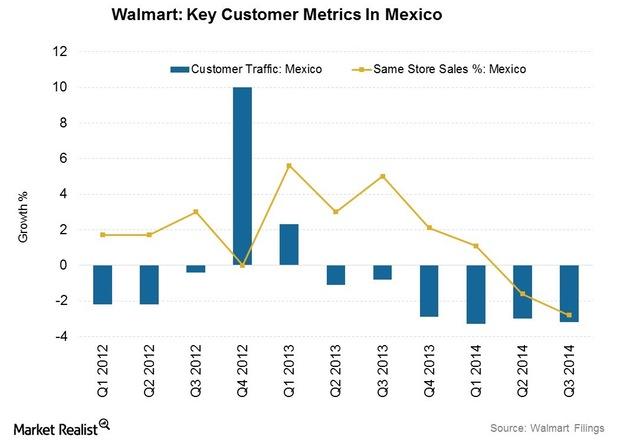

Walmex – Walmart’s Recent Initiatives In Mexico

Walmex also looking at higher sales through the e-commerce channel. It launched e-commerce in Mexico in 2013. The growth has been moderate.Financials Must-know: Why did the Indian rupee free-fall in 2013?

India’s current account deficit rose to 4.8% of GDP in 2012–2013, largely financed through hot money flows, and exceeded the government’s target level of 2.5% to 3% of GDP.

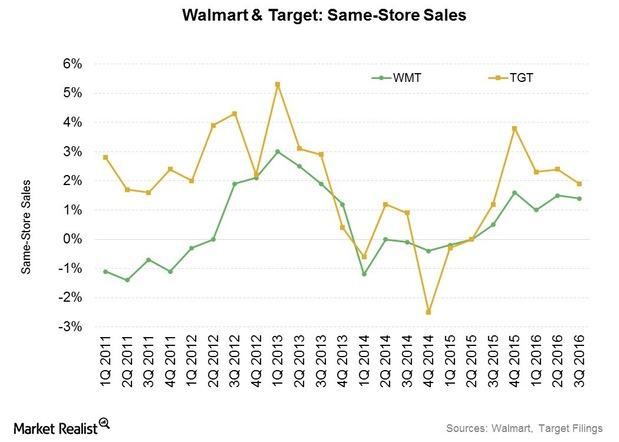

Why Walmart and Target Saw Same-Store Sales Growth in 3Q16

Same-store sales growth came in at 1.5% in 3Q16 for Walmart US compared to 0.4% in 3Q15. Target’s (TGT) same-store sales grew 1.9% in 3Q16, driven by both higher traffic and transaction size.

Skechers’ China Sales Rise: What’s the Growth Outlook?

China has been an important element in Skechers’ success in international markets. Sales from China rose to $220 million in 2015 from $86 million in 2014.

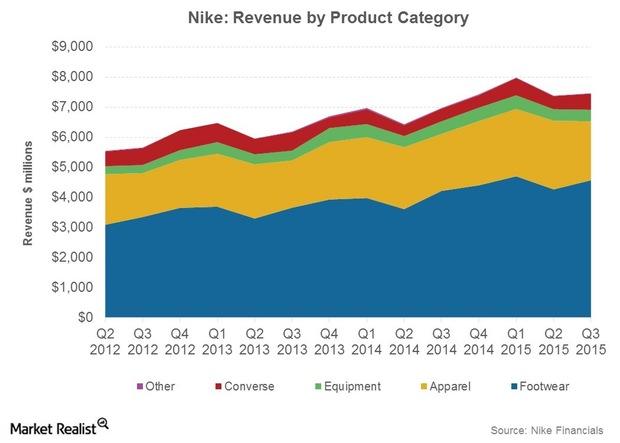

Nike Market Share Gets the High Score in Activewear

UA’s market share came in at 6%, and ADDYY’s came in at 3%. Hanes (HBI) took 3% of the market in 1Q15 .Nike (NKE) was the market leader for activewear overall.

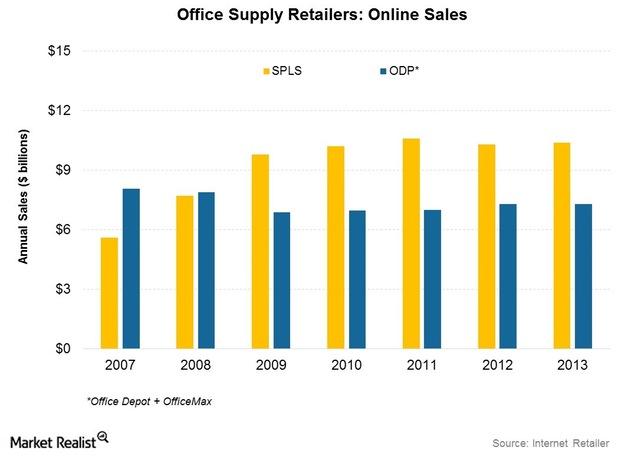

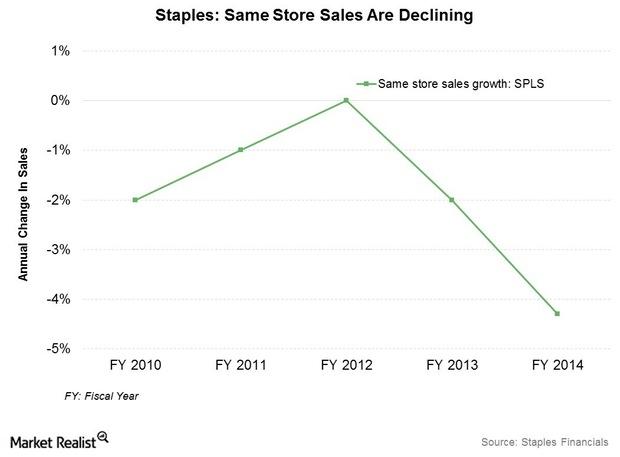

Why Online Sales Are A Competitive Advantage For Staples

The growth in ODP and OMX’s combined sales fell—compared to Staples. They were ~143% of SPLS’s sales in 2007. This is just over $8 billion. That fell to $7.3 billion in 2013.

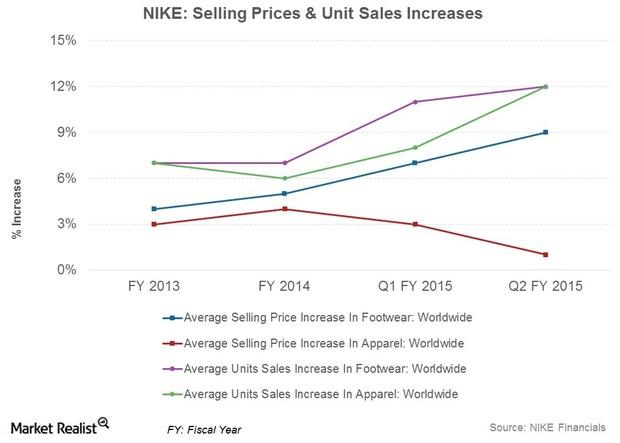

Why Nike Is Able To Sell More Products At Higher Prices

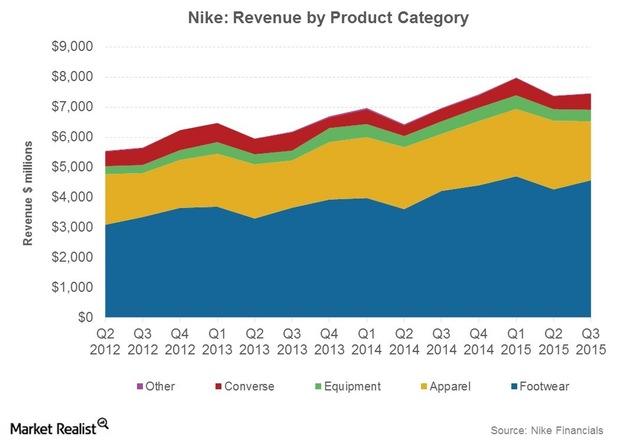

Revenue gains for Nike (NKE) in 1H15 were broad-based. Sales rose for almost all key product categories, with the notable exception of the golf category.Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

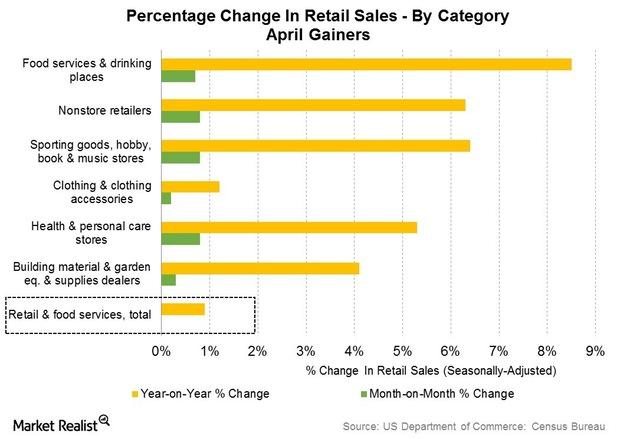

The 6 Positive Things about April’s Retail Sales Report

The advance retail sales report for April 2015 was on the whole, mixed. The mixed readings in the retail sales report brought about indifferent reactions from markets.

Why Lowe’s Is Trying Hard to Woo Professional Customers

A professional customer is one who’s looking for products to complete projects for other customers.

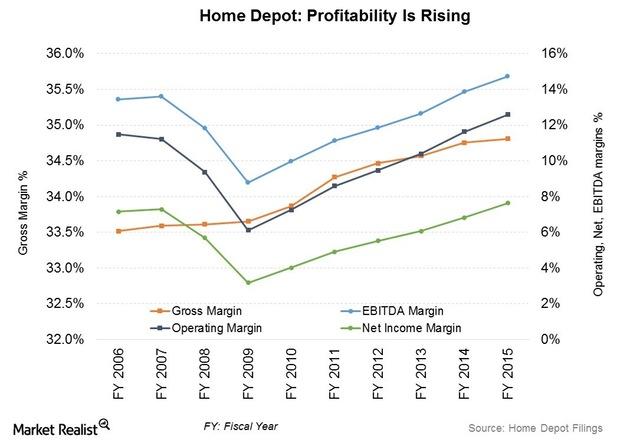

Home Depot: Margins Up on Higher Sales, Lower Expenses

Home Depot’s margins are ahead of those reported by the number-two home improvement (XHB) (ITB) retailer, Lowe’s (LOW), over the past twelve months.

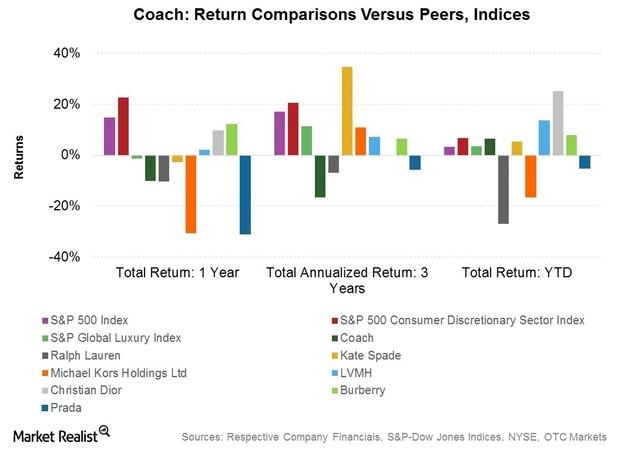

Opportunities and Challenges for Coach

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

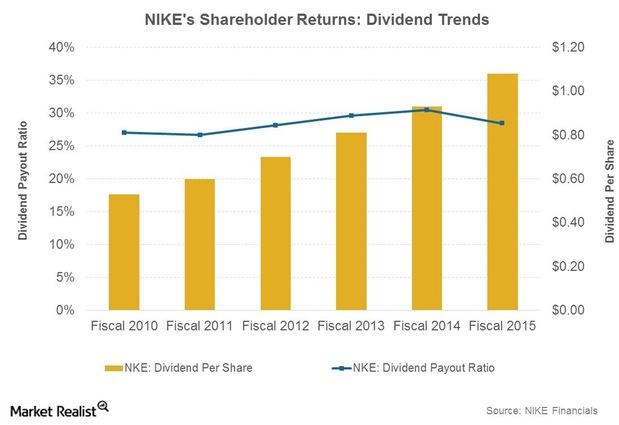

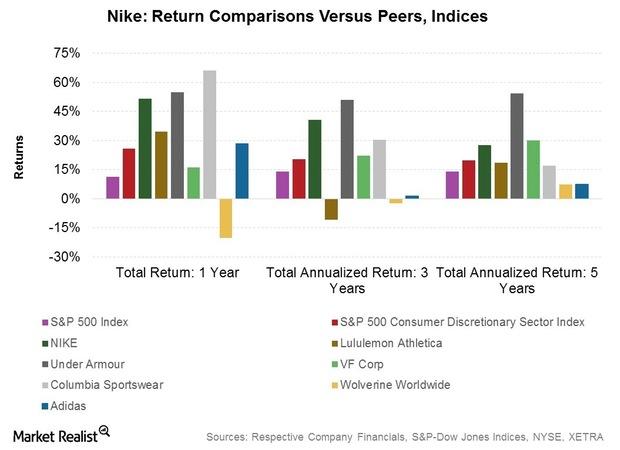

Nike: 5-Year Returns Targets for Shareholders

At its 2015 Investor Day held on September 14, Nike briefed the financial community on its targets for generating value for shareholders.

Office Supplies Retail: Regulation, Competition, And Consolidation

There aren’t many large brick-and-mortar players left in the market. The industry faced stiff competition from online retailers like Amazon (AMZN).Technology & Communications Why you should know the key differences between job reports

Few economic releases elicit as much reaction from both the stock (IVV) and bond (BND) markets as the employment reports issued by Automatic Data Processing (ADP) and the Bureau of Labor Statistics (the BLS).

Analysis: Nike’s 5-Year Roadmap to Grow Sales

Nike holds the top position in athletic footwear and athletic apparel. It’s apparel and footwear sales were $8.6 billion and $18.3 billion, respectively, in fiscal 2015.

Nike’s Fastest-Growing Demographic Segments

The women and young athletes demographic segments saw the greatest sales traction in fiscal 2015 for Nike.

Key Risks and Opportunities for Home Depot’s Multichannel Model

The Home Depot believes in educating less wired up vendors about the inherent opportunities in e-commerce. This will lead to higher sales, a win-win for both parties.

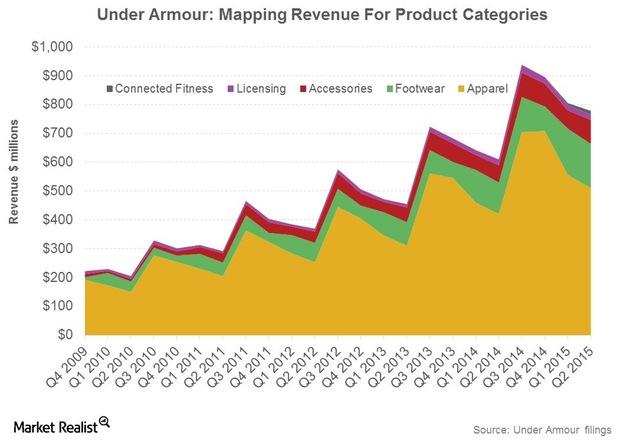

Under Armour’s Fitness App Platform Is the World’s Largest

Late last year and in early 2015, Under Armour acquired Endomondo and MyFitnessPal. Its fitness app user platform became the largest in the world.

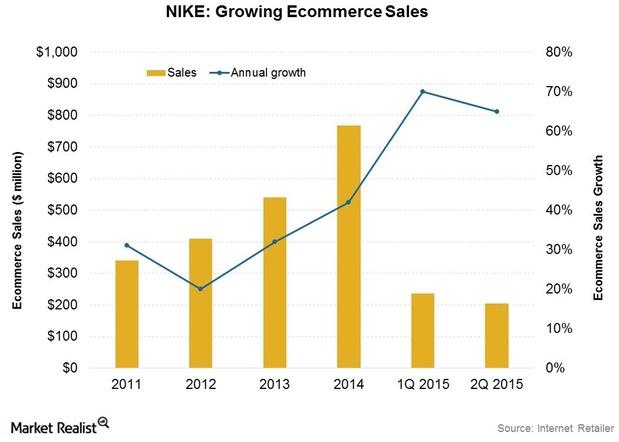

Why Nike Is Able to Turn a Profit in E-Commerce

The Nike+ Training Club clocked ~17 million downloads by 1Q15. The app is now available in 18 languages, creating the framework for a global community.

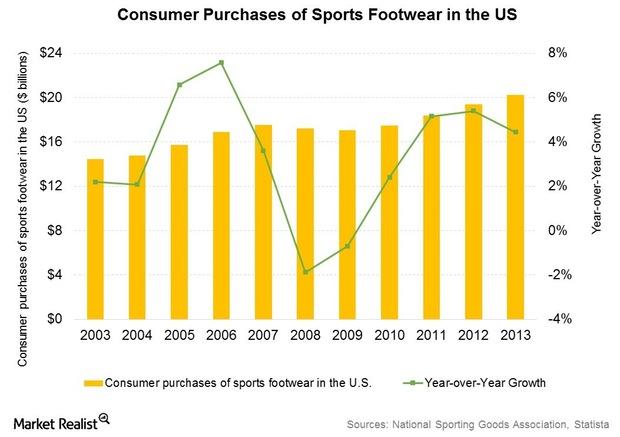

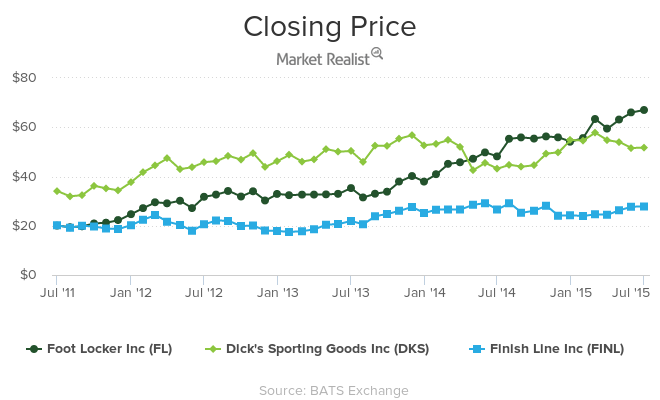

Nike Still Dominates Athletic Footwear in 1Q15

US dollar sales of athletic footwear rose 8% in the first quarter of 2015. Nike was the most dominant brand by far with a market share of 62%.

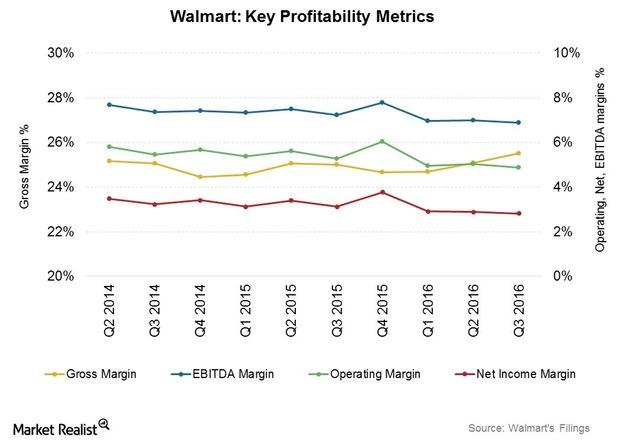

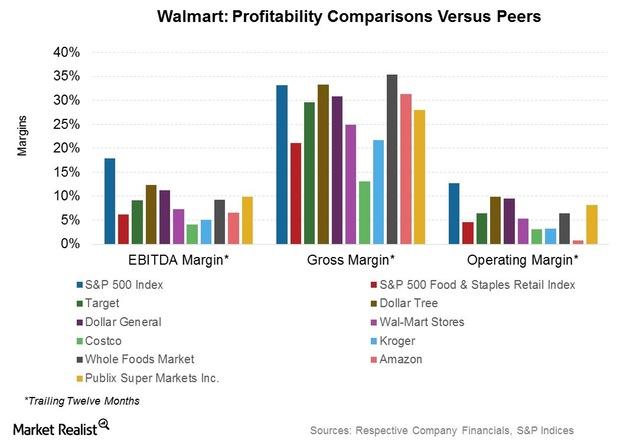

When Can You Expect Walmart’s Profitability Margins to Stabilize?

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016.

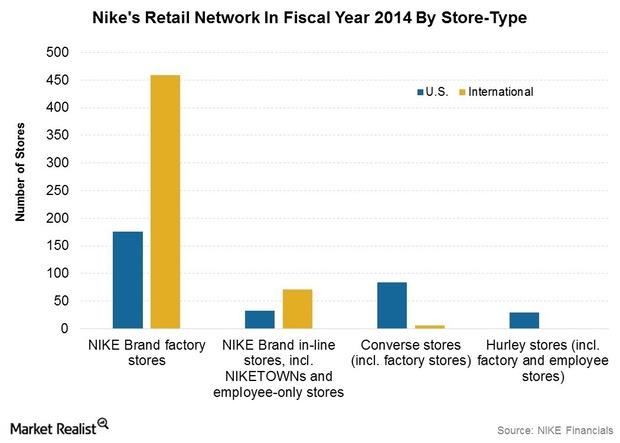

NIKE Scores Big Leveraging E-commerce, Retail Channels

The company is widening its retail footprint and growing e-commerce sales. NIKE’s store count stood at 858 stores at the end of fiscal 2014.Financials Financial intermediation, systemic risks, and “too big to fail”

When financial intermediaries allocate funds, they assess the risks and returns that come from various risky claims. Intermediaries help allocate resources and risks throughout the economy. Financial intermediation can result in concentrated risks. The risks increase the financial system’s fragile state. These risks are called systemic risks.

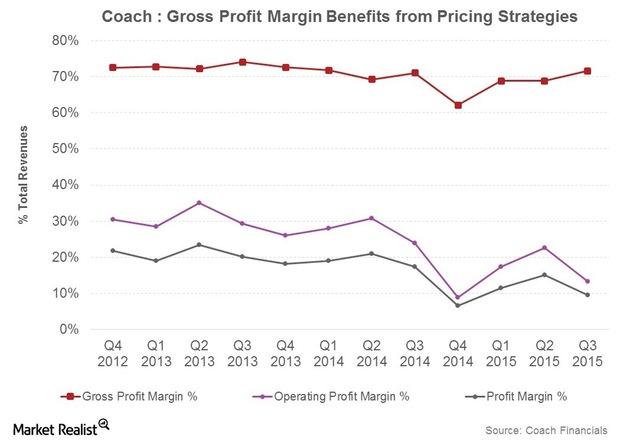

Coach’s Pricing Strategies Benefit Its Margins

Coach’s gross margin expanded to 71.6% in 3Q15 from 71.1% in 3Q14. Coach reduced the frequency of its in-store and online promotions, which should boost its margins.Financials Risks you should know before investing in international bond funds

In this article, we’ll discuss some of the risks an investor must consider before investing in international bonds. Some of these risks are unique to this asset class.

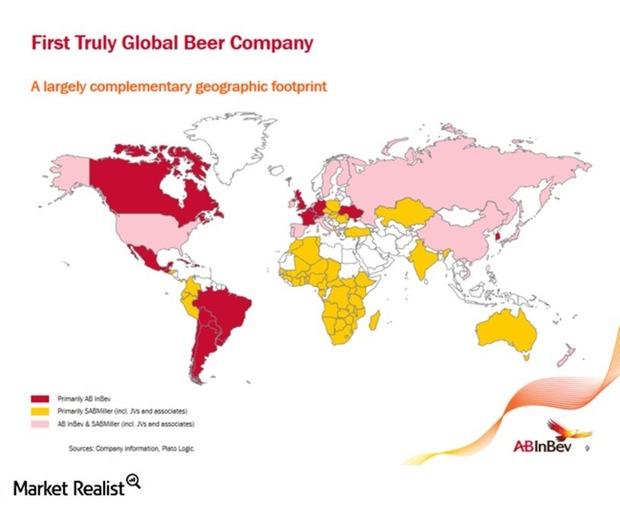

Anheuser-Busch InBev Bids for SABMiller: Analysis

On October 7, Anheuser-Busch InBev announced a formal cash bid of 42.2 pounds per share to SABMiller’s board. This was the third offer rejected by SABMiller.

Nike’s Outlook: Category Offense All the Way

Consensus Wall Street analyst estimates project Nike’s adjusted diluted EPS to be $3.58 in fiscal 2015, an increase of 19.7% over the previous year.

Why Skechers Is Expanding Distribution in Key Overseas Markets

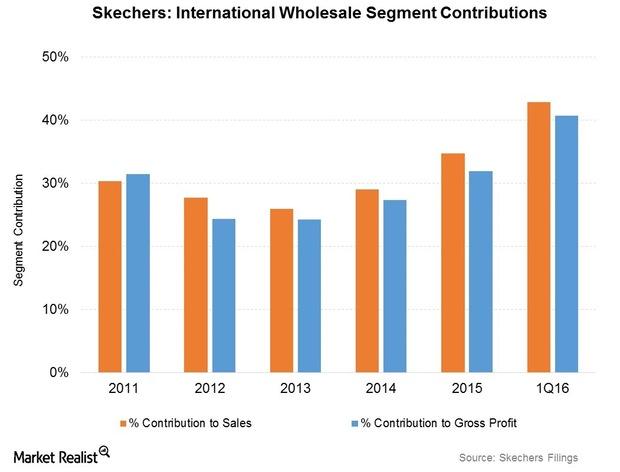

Skechers (SKX) products are sold in about 160 countries. The company’s international wholesale segment was its fastest-growing segment from 2011 to 2015.

How Walmart Is Gaining—and Losing—Market Share in Key Overseas Markets

Walmart’s international segment posted sales of $123.4 billion in fiscal 2016, down 9.4% YoY. In constant currency terms, the segment’s sales were up 3.2%.

Under Armour: The ARMOURY and Its Wholesale Strategic Importance

The ARMOURY stores will cater to the premium segment of the market. They’ll also feature UA product exclusives and occasional visits from star athletes.

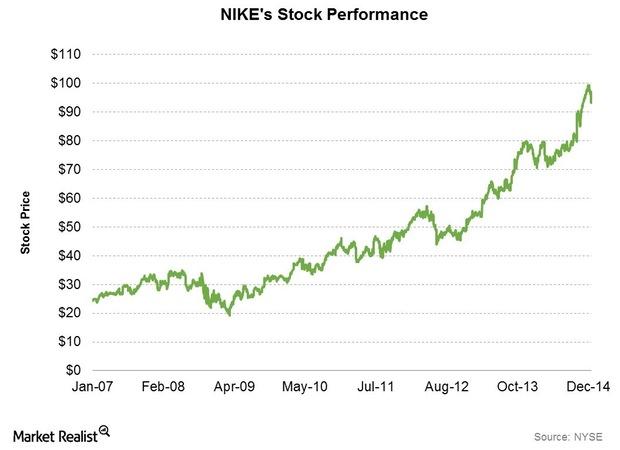

The Growth Factors Spiking NIKE Revenues And Earnings

In this series, we’ll analyze the results of the past quarter and the reasons why NIKE continues to outperform.

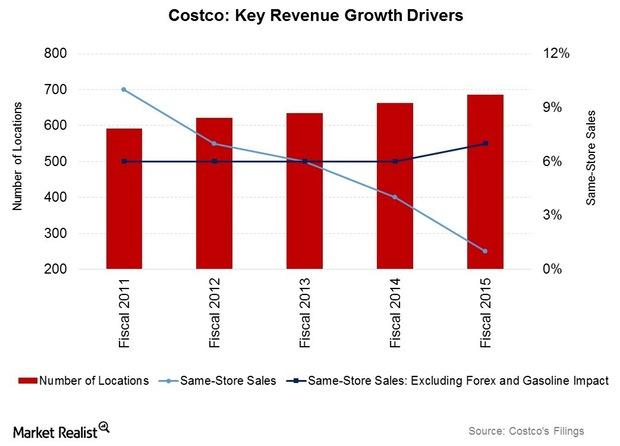

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Walmart’s Strategic Business Priorities and Their Impact

Walmart’s strategic priorities include building omni-channel capabilities, growing its top line faster, focusing on core assets and capital discipline, and generating stronger shareholder returns.

Walmart’s Key Challenges In Its Business Environment

The NLRB filed a complaint last January. It accused Walmart of violating labor laws. The NLRB claims that the retailer acted against workers who joined unions.

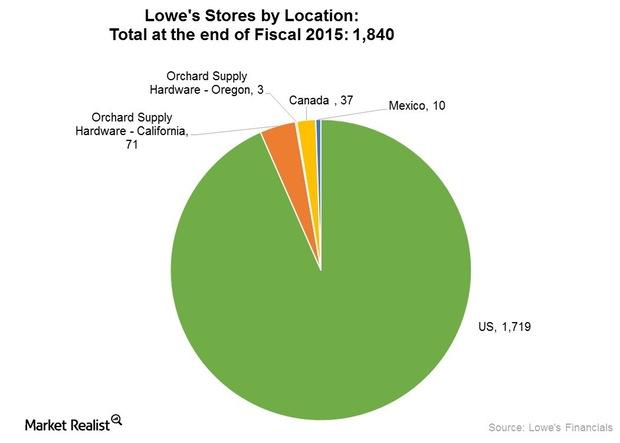

Why Lowe’s Bought Orchard Supply and Is Eyeing Smaller Stores

Lowe’s is also experimenting with the idea of rolling out other smaller format stores like City Center stores in other under-penetrated and high-density urban areas in the US.

Under Armour’s Footwear Business versus Skechers and New Balance

Primarily an apparel player, Under Armour (UA) has stepped up its pace in entering new footwear categories.