Phalguni Soni

Phalguni is a retail analyst at Market Realist. Phalguni has had 9 years’ experience in Canada, Dubai, and India, and has worked in Analyst roles at Great Canadian Gaming Corp., Dubai World, Lusight Research, TradeBriefs, and Global Education Management Systems. Phalguni has completed the CFA program. She received a degree in Commerce from the University of Calcutta and was placed at the top of her class.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Phalguni Soni

Competitive Forces: Why Walmart Dominates The Grocery Industry

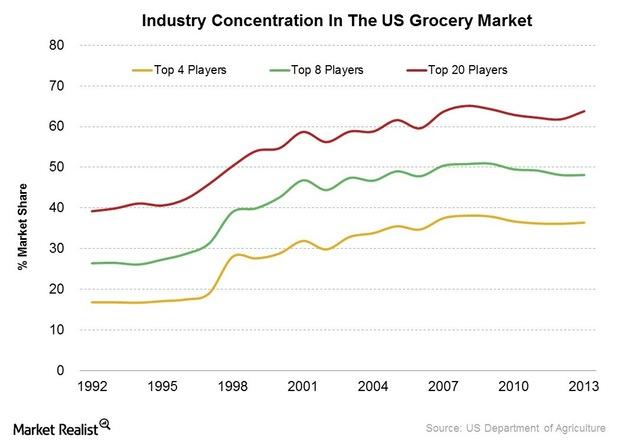

Walmart’s largest merchandising category is groceries. According to the USDA, Walmart was the largest seller of grocery items in the US in 2013.

Managing Walmart’s Supply Chain – Cross-Docking and Other Tools

Cross-docking is an inventory management system. Walmart made it popular. Cross-docking can lower the time required to transport merchandise.

What The Supercenter Format Contributes To Walmart

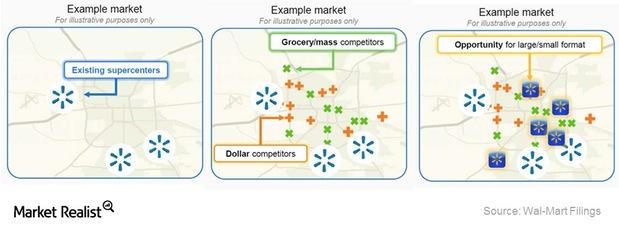

Walmart (WMT) has been concentrating on expanding the store count of its larger supercenter format. A supercenter averages ~179,000 square feet in size.

Walmart: When Big-Box Retail Embraces Small

Walmart (WMT) operates retail (XRT) and wholesale stores. The stores are located in the US and 26 other countries around the world.

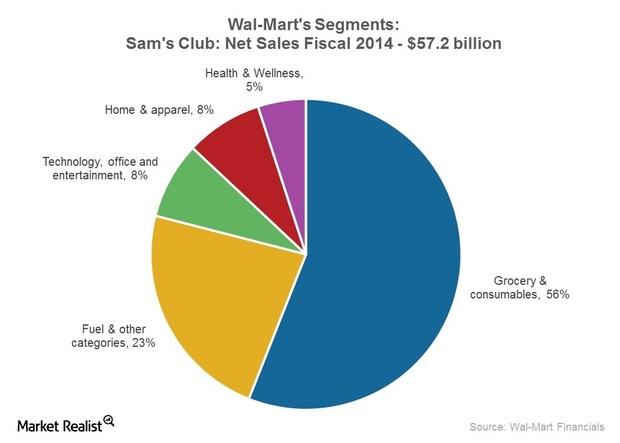

Walmart’s Sam’s Club Segment: Positioning For The Next Level

Walmart’s Sam’s Club segment consists of membership-only club warehouse retail operations. Members include both business owners and individual consumers.

Who’s The Greatest Retailer Of Them All? – Walmart

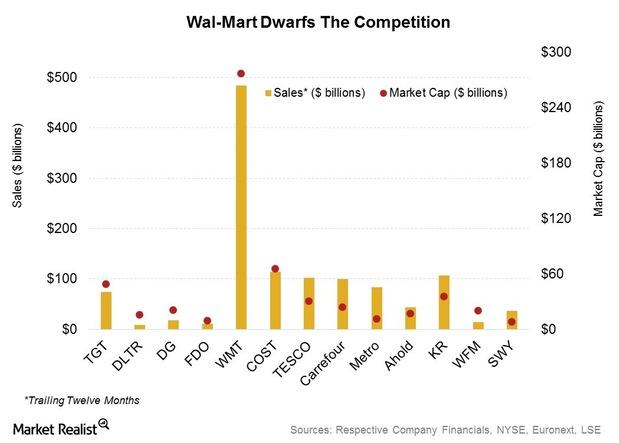

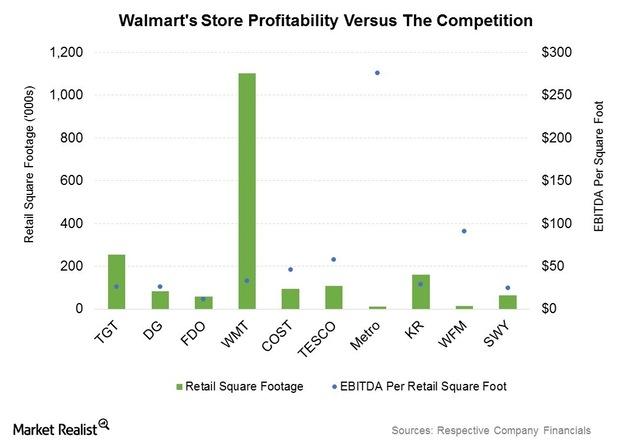

Walmart is among a select group of global retailers (XRT) (RTH) competing in a variety of store formats. However, Walmart dwarfs all of the other companies.

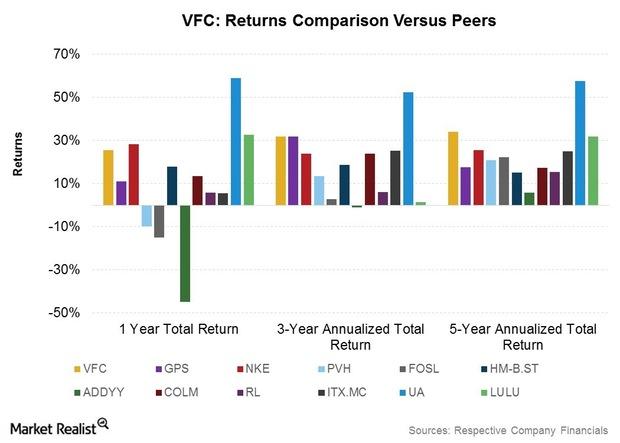

Shareholder Returns Analysis: Where VF Corp. Trumps Competitors

VFC’s total annualized returns to shareholders appear among the most consistent within its peer group for one-year, three-year, and five-year time periods.

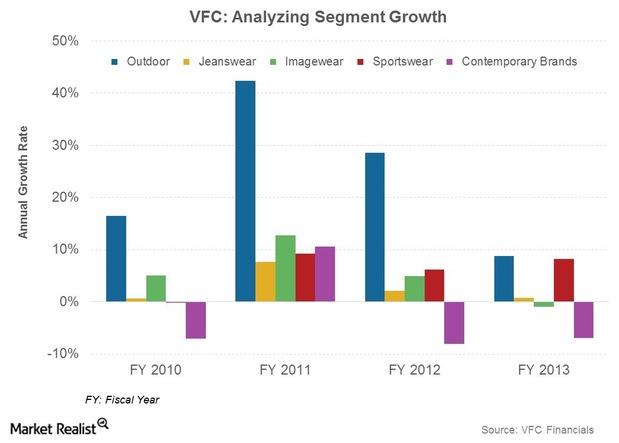

Making It To VF Corp.’s $2-Billion Brand Club

The North Face became VFC’s first brand to achieve $2 billion in sales in 2013. Timberland revenues are expected to come in at ~$1.7 billion in 2014.

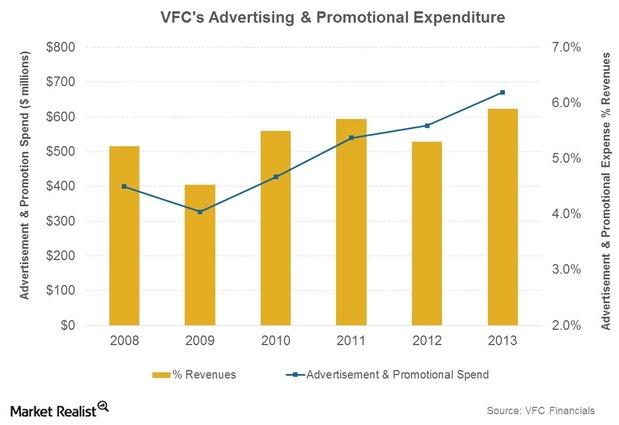

Discovering VF Corp.’s Marketing Edge

VFC’s marketing dollars are designed to get the most returns from its stores, other retailers (wholesale customers), and its e-commerce websites.

VF Corp.’s Location, Manufacturing, And Supply Chain Advantages

VFC manufactures ~27% of its products in facilities operated by the company. The company owns 28 manufacturing facilities.

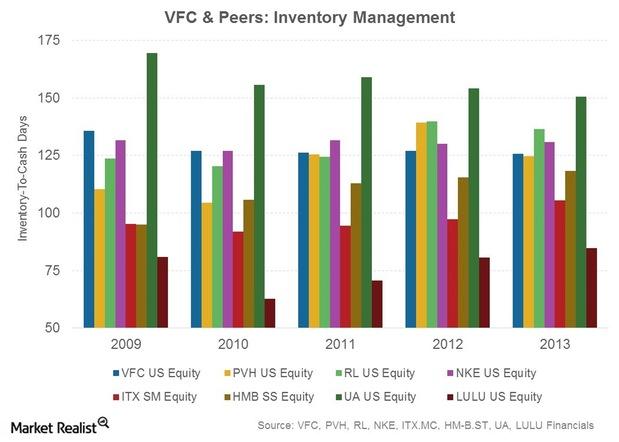

Inventory Management Is Critical Zone For VF Corp. And Its Peers

For fashion and apparel firms, inventory management, or tracking inventory levels, is critical. Inventory levels signify whether products are in demand or not.

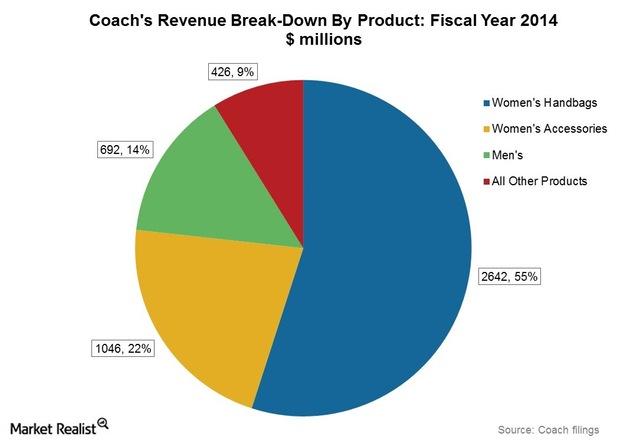

Design And Brand Positioning: Recent Changes At Coach

At Coach (COH), products are conceptualized by its New York-based design team. The team also directs the design of all Coach products.

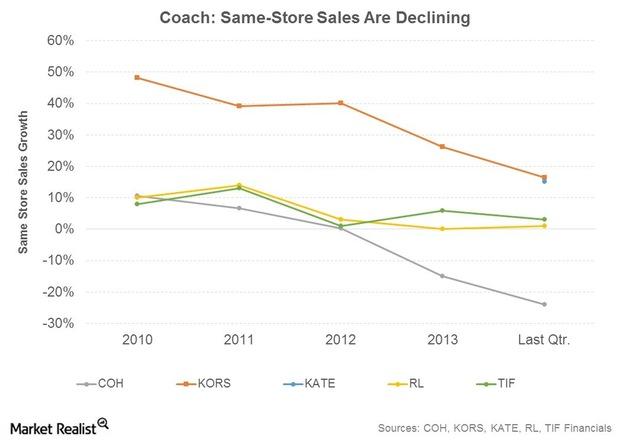

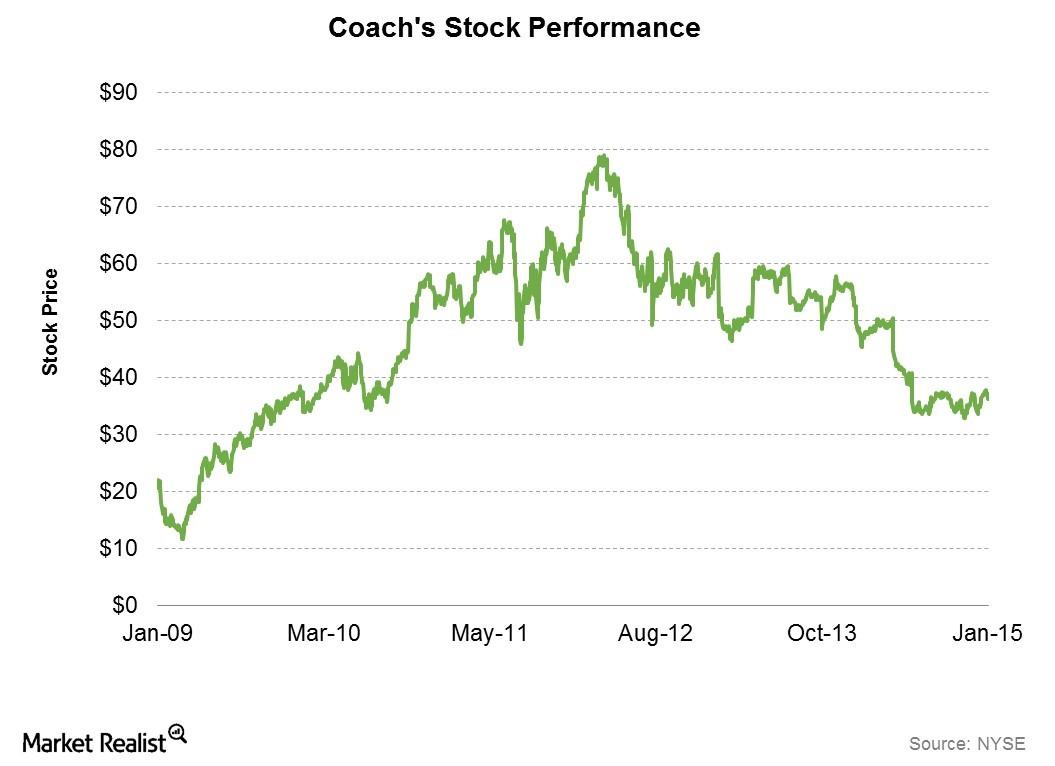

Purse Wars: Coach Seeing Fierce Competition For Market Share

Competition is fierce in all of the affordable luxury industry. And, there are many players, including KORS and KATE.

Coach’s Pricing Strategies And Target Market

Coach’s pricing is lower than other luxury brands. This appeals to HENRYs, or high-earners, not rich yet, among other markets.

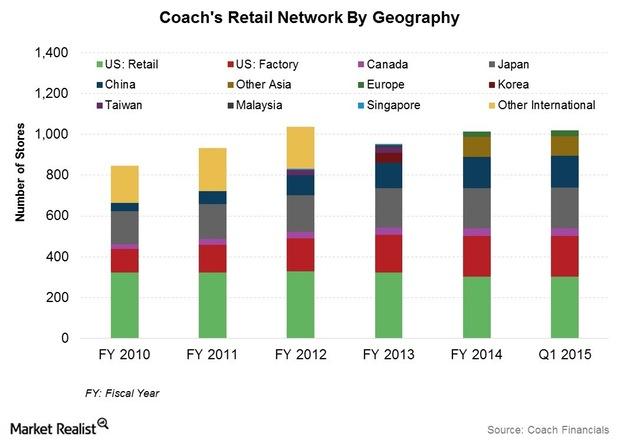

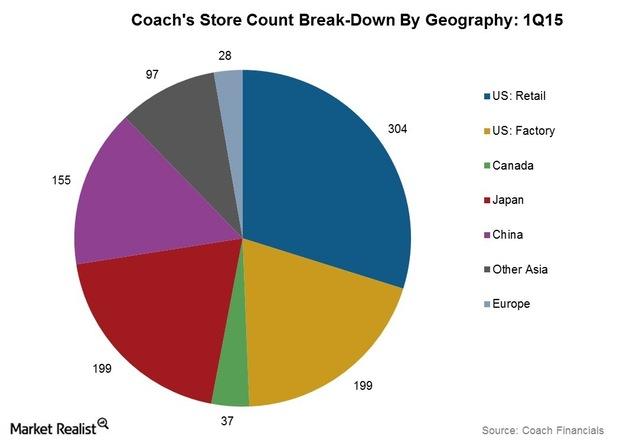

Selling Channels: How Coach Products Reach Customers

Coach, Inc. (COH) distributes products through wholesale and direct-to-customer channels. It runs wholesale shops-within-shops at major department stores.

Coach’s Supply Chain And Manufacturing Model

Although the manufacturing process is outsourced, Coach tries to keep a grip on the manufacturing process from design to production.

An Introduction To Luxury Brand Pioneer Coach

Coach is a well-known premium fashion brand. In recent years, Coach has faced increasing competition from newer entrants in the affordable luxury market.

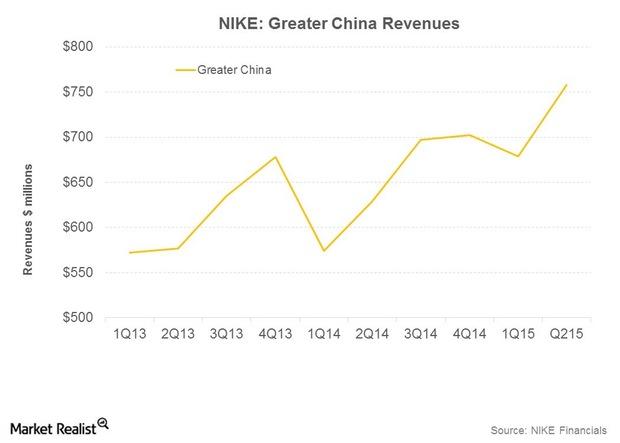

NIKE in Greater China: Strategies That Work

NIKE holds the #1 position for both apparel and footwear in China among sportswear rivals. It plans to leverage the value of its brand among consumers.

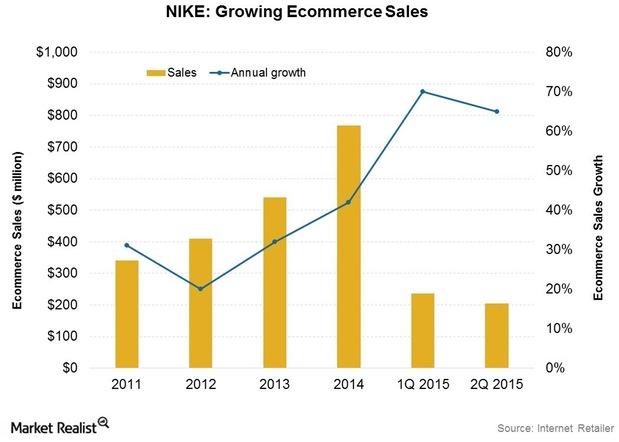

E-commerce: A Critical Growth Driver At NIKE

NIKE plans to grow DTC revenues to $8 billion by fiscal 2017, including e-commerce revenues of $2 billion. E-commerce grew 65% in 2Q15 to ~$205 million.

SWOT Analysis: Balancing Under Armour’s Strengths And Weaknesses

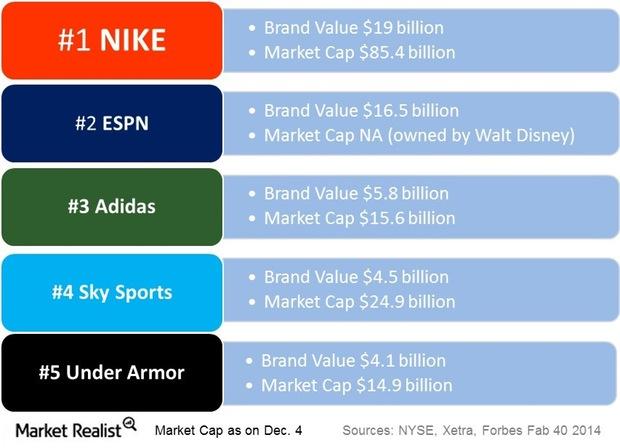

How strong is Under Armour’s business model? In the next parts of this series, you’ll read a SWOT analysis—looking at strengths, weaknesses, opportunities, and threats—of Under Armour, Inc. (UA). We’ll also compare the company to rival firms, the overall market, and the consumer discretionary (XLY) sector. In this part, we’ll cover the firm’s key strengths and weaknesses. […]

Headwinds And Tailwinds For Lululemon Revenues This Year

Lululemon Athletica announced an increase of 10.4% in its revenues to $419.4 million in the third quarter of fiscal 2015 compared to $379.9 million in 3Q14.

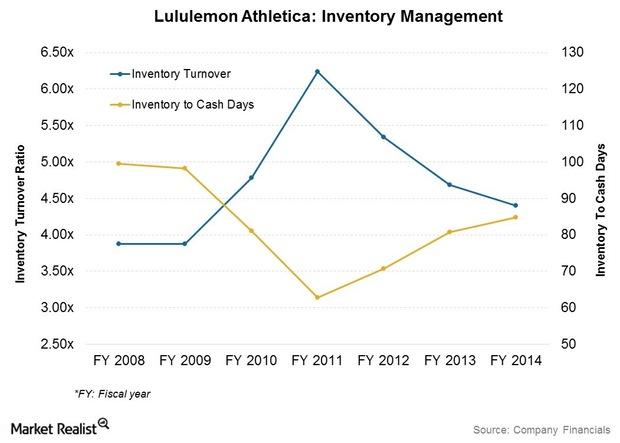

Lululemon’s Retail Inventory Management Strategies Are Crucial

These changes should lower future inventory levels and probably result in higher inventory turnover and lower inventory-to-cash days.

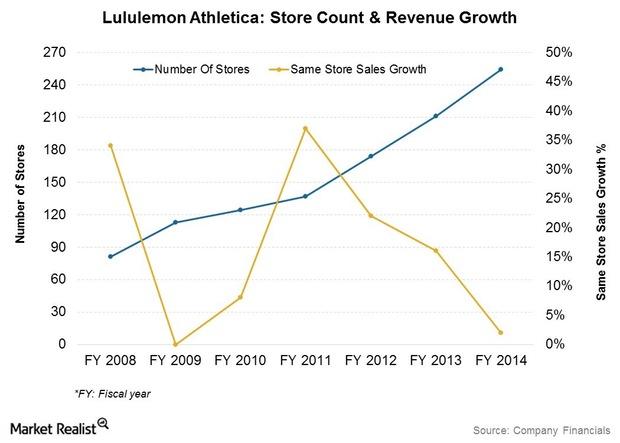

Why Lululemon Is Looking At A Global Store Footprint

LULU’s global store count was estimated at 289 at the end of 3Q15. Stores are company-owned, with most located in the US (201) and Canada (57).

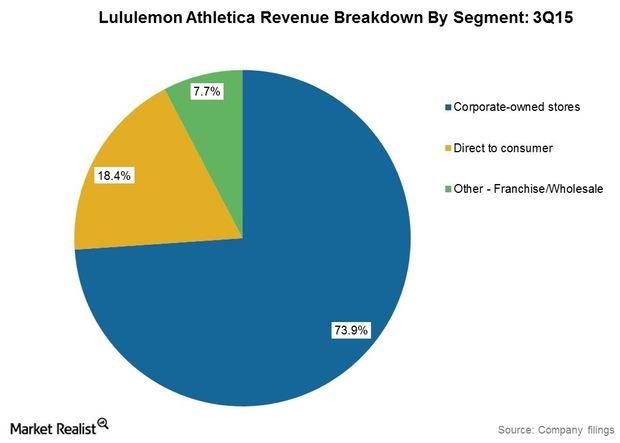

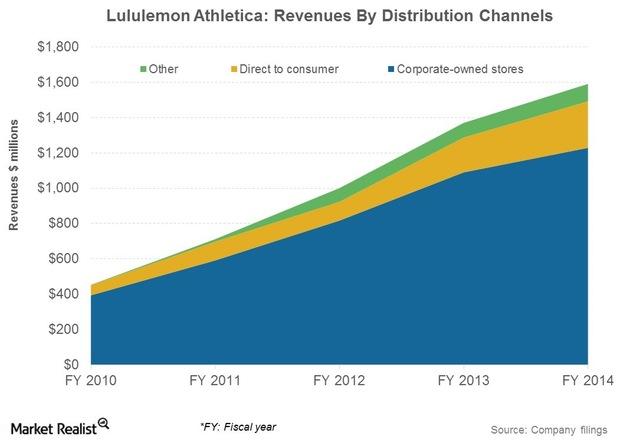

Why Lululemon’s Distribution Channels Are A Competitive Advantage

LULU’s sale through wholesale channels is much lower than its competitors VF Corporation, NIKE, and Under Armour. This is why LULU’s margins are higher.

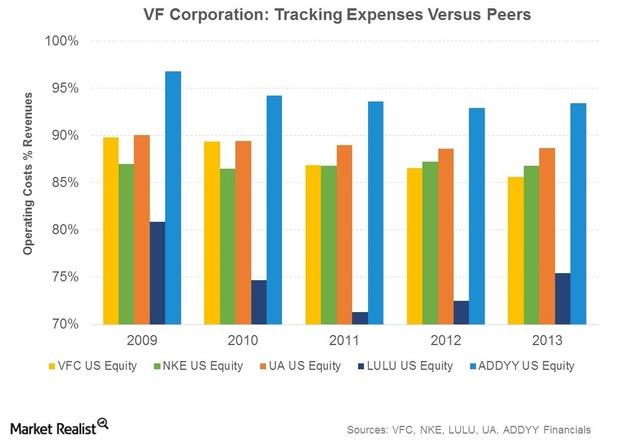

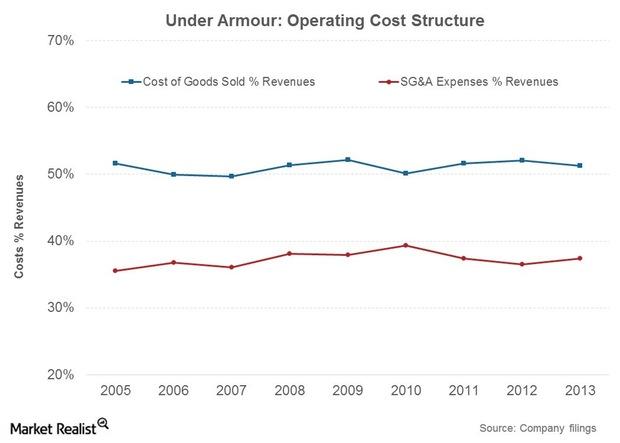

Under Armour’s Cost Profile And Outlook

Under Armour, Inc.’s cost of goods sold margins have been fairly steady over the years. SG&A costs are likely to trend higher in the near to medium term.

Lululemon Supplier, Manufacturer, And Distribution Overview

Manufacturer base: There were about 35 manufacturers producing the company’s products as of the fiscal year ending February 2, 2014.

Lululemon Builds Brands Through Unique Marketing Strategies

For relatively new companies competing in an industry with many players, building a well-recognized and reputed brand is essential.

Overview: Lululemon’s Target Market And Product Assortment

Major product lines include fitness pants, shorts, tops and jackets. It also has a range of fitness-related accessories like bags, socks, and yoga mats.

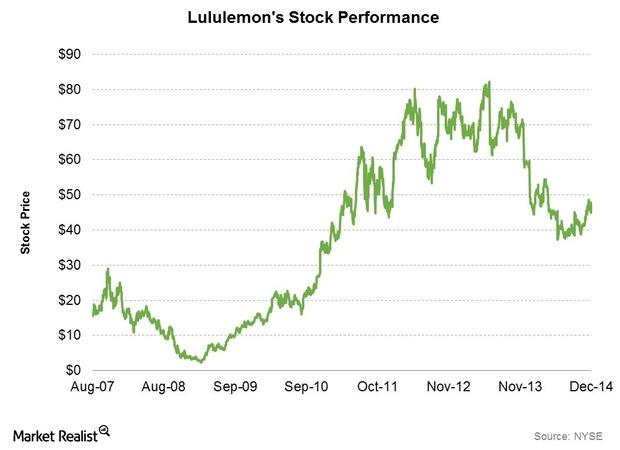

Lululemon Attempts To Reinvigorate Its Interrupted Growth Model

In this series, we’ll provide an overview of Lululemon Athletica, its financials (including its latest quarterly results), and its strategies.

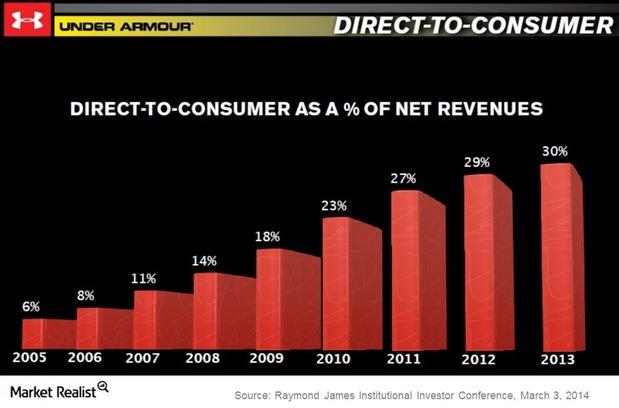

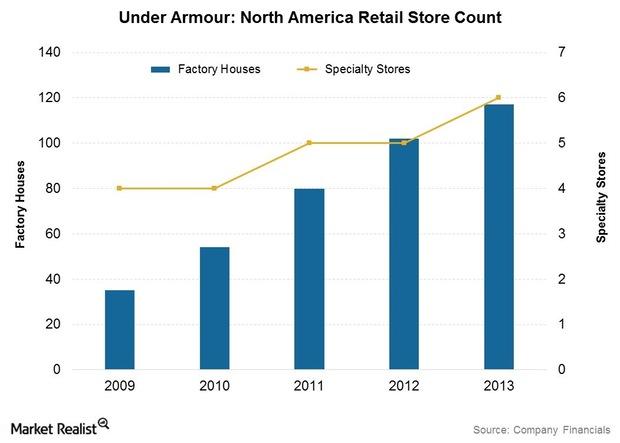

Under Armour revenues and retail presence

Wholesales represented 68% of Under Armour revenues in 2013. As a category, however, DTC sales have increased steadily over the years.

Porter’s 5 Forces: Under Armour And The Sportswear Industry

Porter’s 5 Forces, developed by Harvard Business professor M. Porter, is a model of analysis used to gauge the level of competition within an industry.

The Cogs In The Under Armour Supply Chain

Under Armour: Sourcing, manufacturing, and distribution decisions Under Armour, Inc. (UA) manufactures virtually nothing in-house. Production is outsourced to third-party manufacturers overseas. This is common practice in the apparel industry among companies including the The Gap, Inc. (GPS) and Fossil, Inc. (FOSL). These companies are held by the Consumer Discretionary Select Sector SPDR ETF (XLY), as are United Armour, or […]

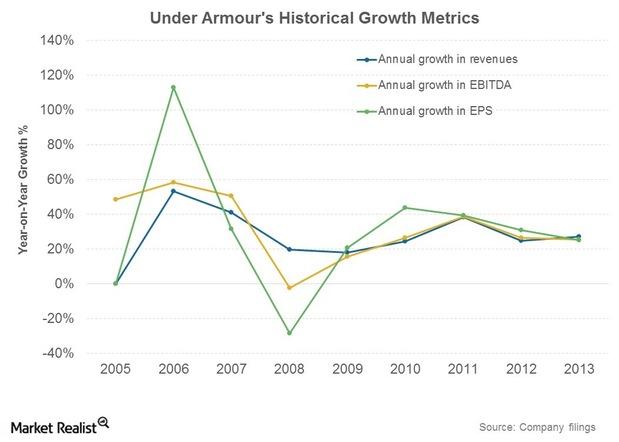

Understanding The Under Armour Growth Story

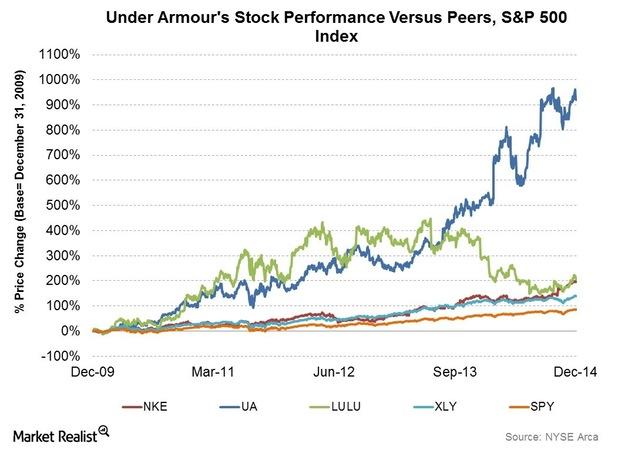

Under Armour’s stock price growth has been phenomenal—up by over 10x in the last five years. This dwarfs the ~200% increase seen by market leader NIKE.Financials What are the risks associated with short-term wholesale funding?

Short-term wholesale funding refers to a bank’s use of short-term deposits from other financial intermediaries—like pension funds and money market mutual funds. It uses the short-term deposits to invest in longer-term assets—like loans to businesses. Using these short-term funds to invest in longer-term assets causes a timing mismatch between assets and liabilities.Technology & Communications Must-know: Analyzing the market structure of the telecom sector

Despite the presence of a number of players, the sheer size of Verizon and AT&T gives the market structure a duopolistic character—smaller players like Sprint (S) and T-Mobile (TMUS) haven’t been able to match the larger players for size, resources, and scale.Technology & Communications Why New York’s Manufacturing Survey may mean upbeat tech earnings

Even though the current conditions index reached a four-year high, survey respondents were less optimistic over future business conditions.Healthcare Why-high-yield issuers coast on “drive-by” and “add-on” deals

DaVita HealthCare Partners (DVA) and Tenet Healthcare (THC) were among the more prominent HY debt issuers in the week ending June 13.Technology & Communications The latest word in telecom: Can SoftBank swing a T-Mobile deal?

Masayoshi Son, Chairman and CEO of SoftBank Corp. (SFTBF) and chairman of Sprint (S), has been pushing for more consolidation in the telecom sector in the U.S.