Phalguni Soni

Phalguni is a retail analyst at Market Realist. Phalguni has had 9 years’ experience in Canada, Dubai, and India, and has worked in Analyst roles at Great Canadian Gaming Corp., Dubai World, Lusight Research, TradeBriefs, and Global Education Management Systems. Phalguni has completed the CFA program. She received a degree in Commerce from the University of Calcutta and was placed at the top of her class.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Phalguni Soni

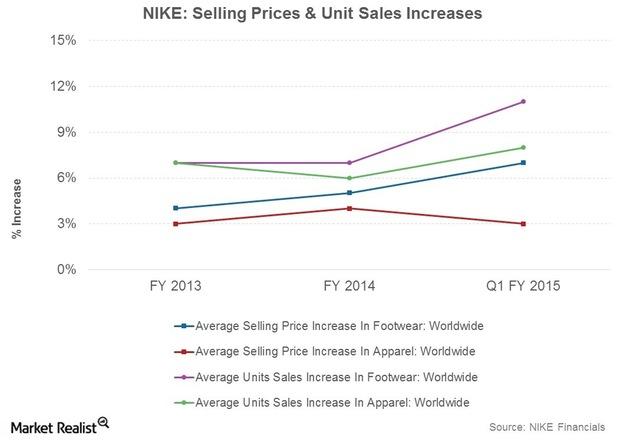

Understanding NIKE’s Pricing Power And Premium Products Tilt

Innovation and strong consumer demand enable NIKE to add more premium products to its portfolio. But its price-hiking strategies may not work everywhere.

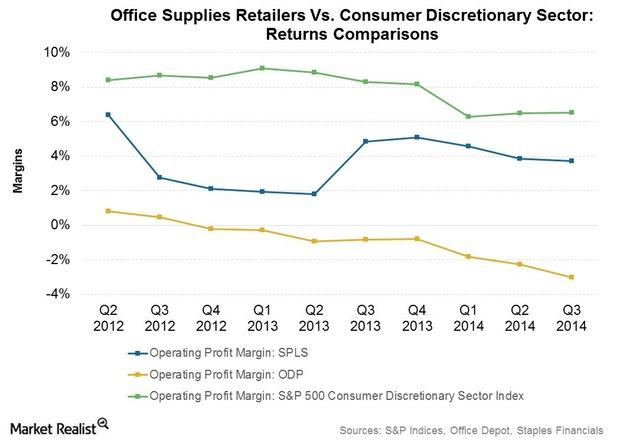

Staples And Office Depot—Market Leaders In A Changing Industry

Staples (SPLS) and Office Depot (ODP) are facing a challenging business environment. Their core product category is office supplies. Revenues are declining for office supplies.

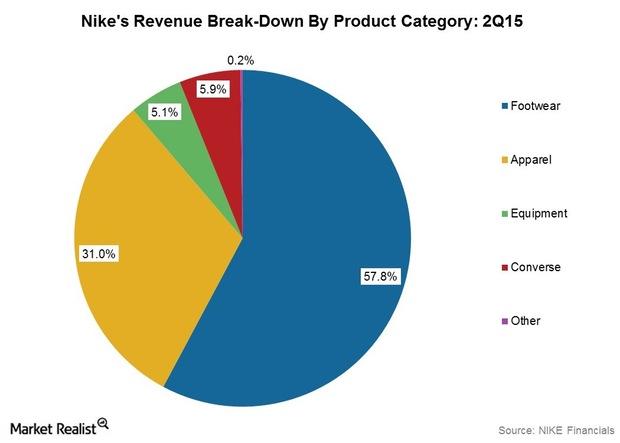

Market Share Gain Spurs NIKE’s North American Footwear Revenues

In the US, in 2014 year-to-date, NIKE, Converse, and the Jordan brands combined accounted for over 60% of market share in athletic footwear.

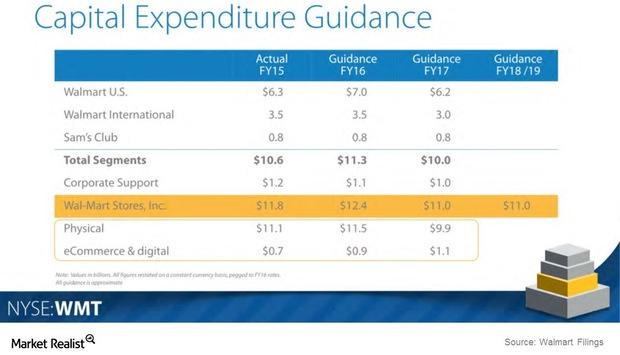

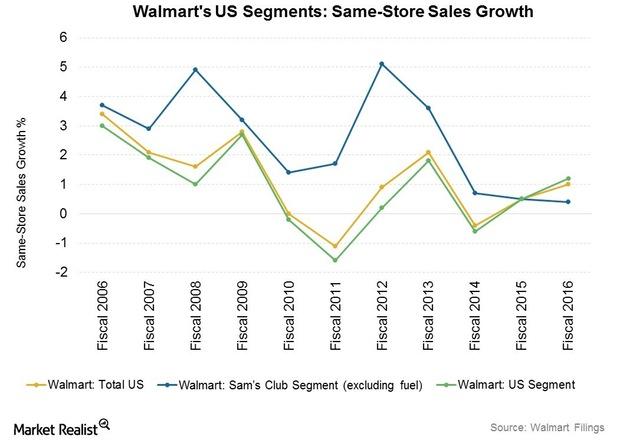

Walmart Lowers Capital Expenditure Projections

Walmart has updated its capital expenditure projections for fiscal 2016. It expects to spend $12.4 billion in fiscal 2016, in the middle of the $11.6–$12.9 billion guidance range provided earlier.

What’s Shaping Consumer Spending Trends at Walmart Stores?

The average store-only shopper spends ~$1,400 per year at Walmart, while the online-only shopper spends ~$200.

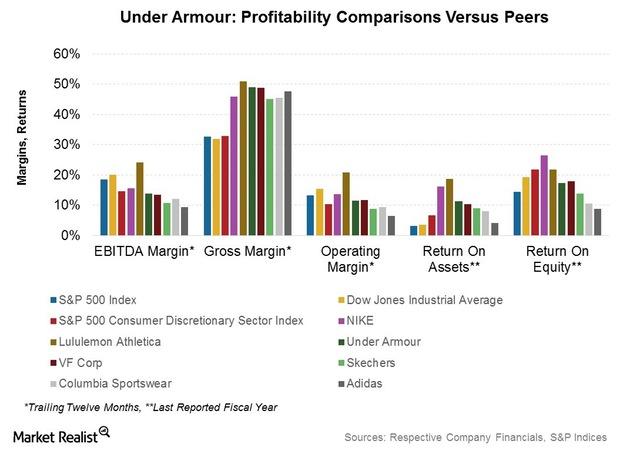

Key Drivers Impacting Under Armour’s Future Financial Performance

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe.

Lowe’s Retail and Pro Customers: Who Accounts for More Sales?

The retail customer accounts for about 70% of Lowe’s sales. However, retail customers account for about two-thirds of Home Depot’s (HD) customer base.

Which International Opportunities Is Lowe’s Betting On?

Lowe’s (LOW) operates stores in the select international markets of Canada and Mexico.Financials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

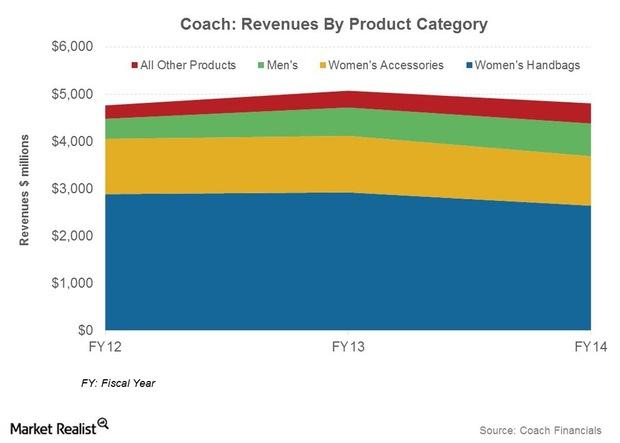

Coach: Bagging The Affordable Luxury Business

Coach’s main product assortment includes luxury accessories, ready-to-wear apparel, watches and jewelry, and other items.

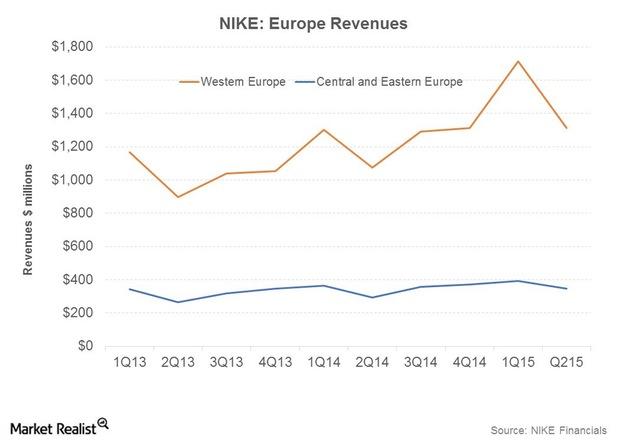

NIKE Defies Macro Headwinds In Europe

NIKE is in the midst of transforming the Western Europe market. It’s looking to improve profitability by increasing the premium on its brand.

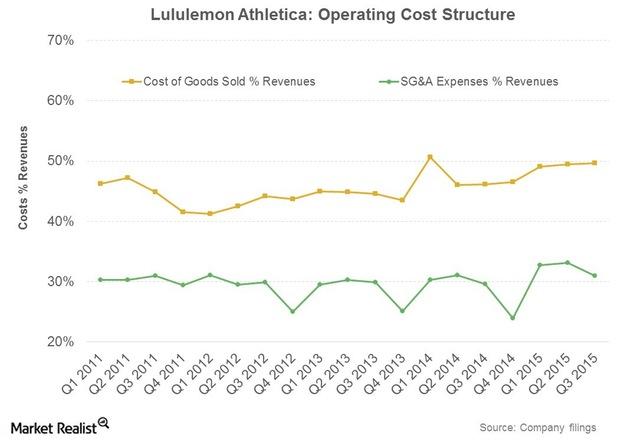

Why Lululemon’s Profit Margins Are Trumping The Company’s Peers’

LULU’s gross profit margin slipped from 55.7% in fiscal 2013 to 52.8% in fiscal 2014. The company’s operating profit margin slipped from 27.5% to 24.6%.

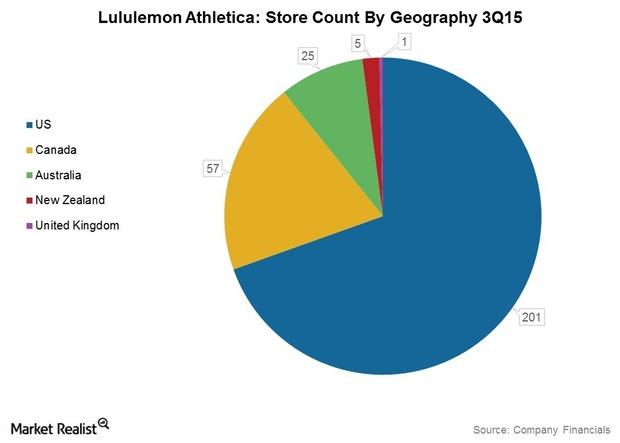

Analyzing Lululemon’s Revenues By Geographical Segment

The company grew its revenues at a compound annual growth rate of more than 35% over the past five years to come in at $1.6 billion in fiscal 2014.

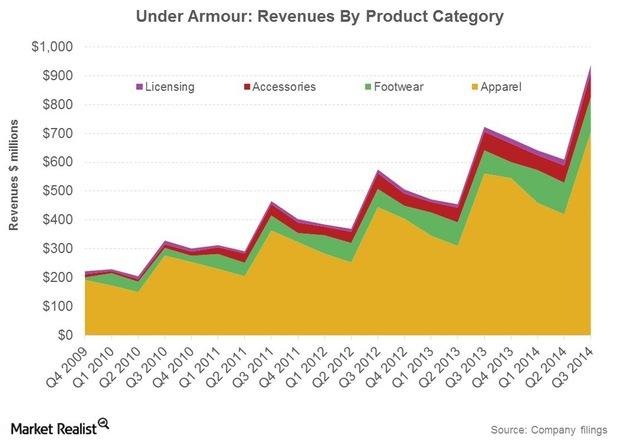

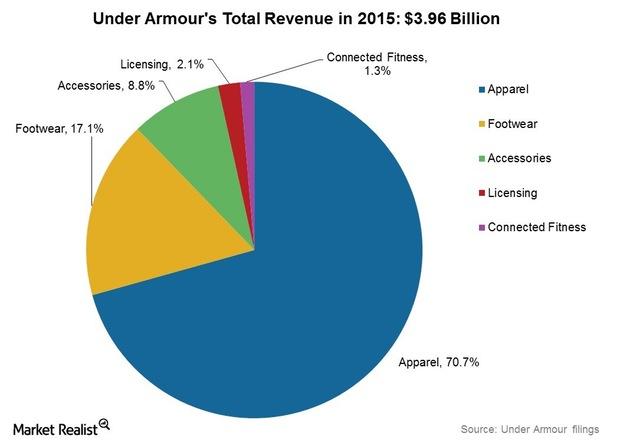

Under Armour: The Nature Of Its Business, Product Portfolio

UA’s product, marketing, and sales teams each play an active role in the design process. This collaboration helps control brand and product consistency.Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials Why credit upgrades and downgrades affect bond returns

A ratings upgrade or downgrade has a direct impact on fixed income yields, and therefore directly affects bond prices.Financials Why we need to relook at the consumer in this week’s releases

This week is full of indicators, with most of them being measures of national-level economic activity.Financials Key drivers affecting investment-grade bond funds flows

Bond yields and prices move in opposite directions. As a result, returns on high-quality corporate bonds were positive. This year, demand for U.S. investment-grade debt benefited from geopolitical tensions overseas and economic growth fears in the first quarter. This raised prices and lowered yields on high-quality corporate bonds.Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.Financials Why Treasury auctions impact investors and financial markets

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.Financials Must-know: What caused the Greek, Irish, and Spanish debt issues?

Tourism revenues—a key revenue component for all these countries—declined substantially because foreign tourists stayed away during the aftermath of the Great Recession. Key industries were also affected—notably cyclical industries like shipping.

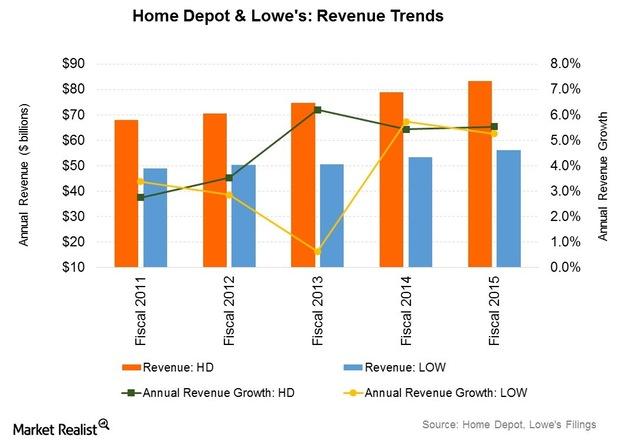

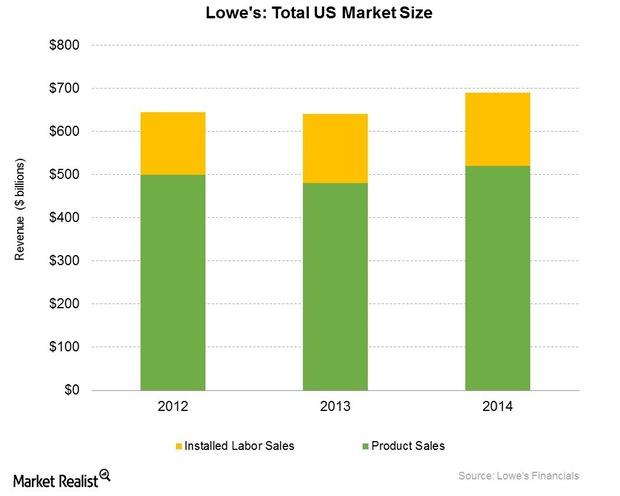

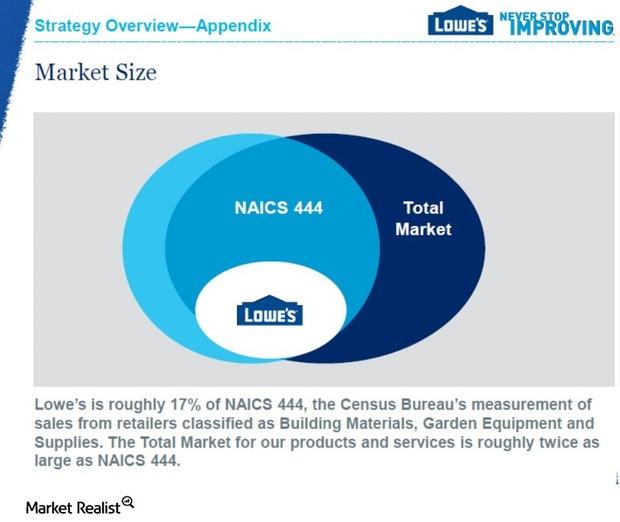

Why Home Depot and Lowe’s Are Leaders in Home Improvement Retail

Lowe’s (LOW) operates in the home improvement retail industry. The company competes with a number of retail and wholesale players.

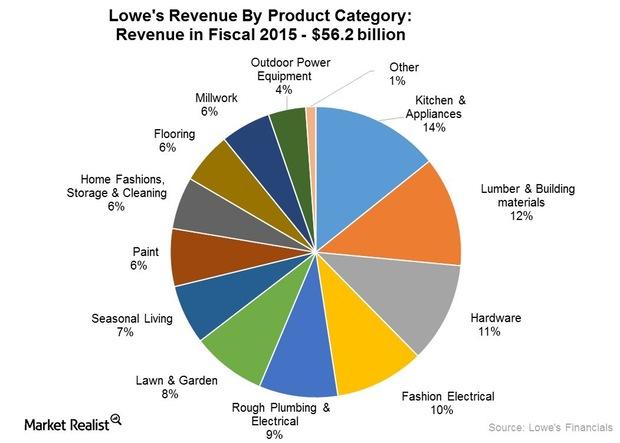

Porter’s 5 Forces: Lowe’s Position in a Competitive Industry

Lowe’s (LOW) operates in the home improvement industry where most products, especially building materials, are largely standardized and undifferentiated.

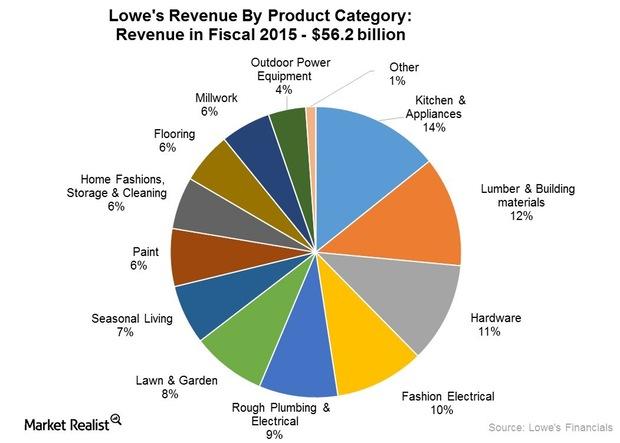

Analyzing Lowe’s Merchandise and Services Assortment

Lowe’s sources its merchandise from over 7,000 suppliers with no supplier accounting for more than 6% of sales.

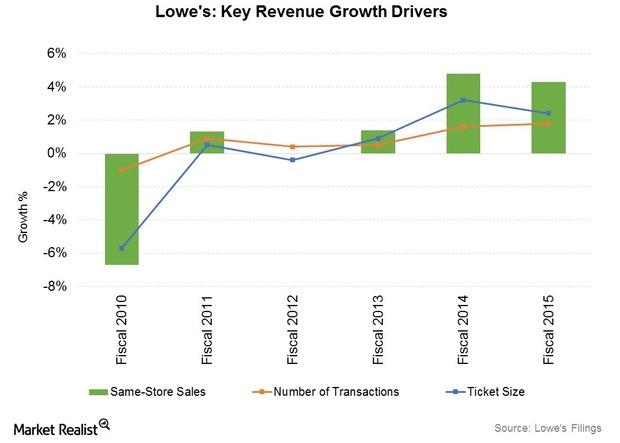

What’s Driving Sequential Same-Store Sales Growth for Lowe’s?

Lowe’s (LOW) has reported a positive trend in comparable store sales (XRT) for the past ten quarters.

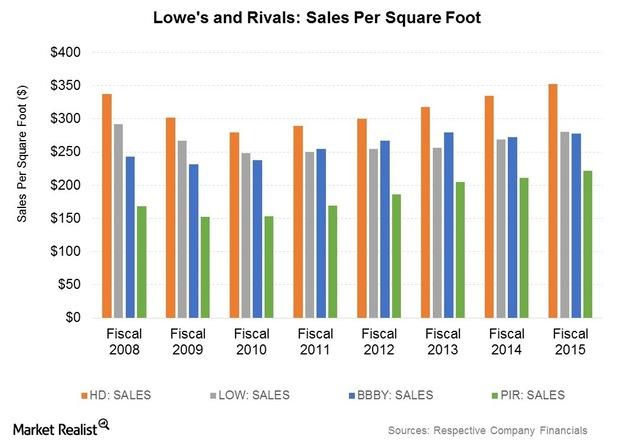

Why Lowe’s Store Productivity Is Growing Faster than Home Depot’s

One of the ways retailers can track their store performance is via productivity measures like sales and profitability per retail square foot.

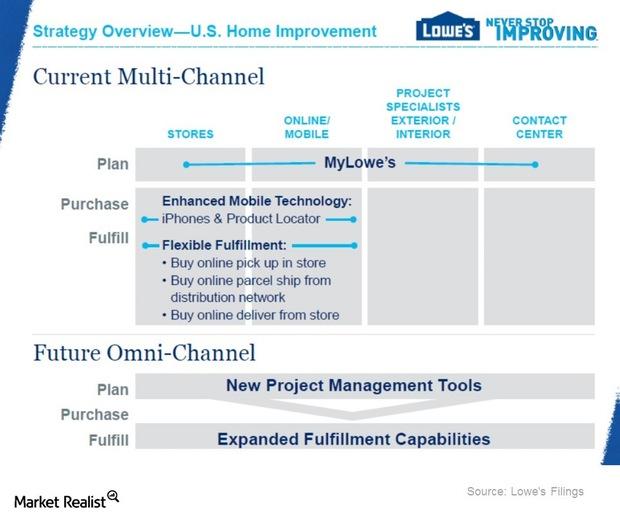

How Lowe’s Is Leveraging Its Omni-Channel Opportunity

Going omni-channel makes natural sense for both Lowe’s and Home Depot. Both retailers have a massive store network in the US, which can double as strategic fulfillment centers.

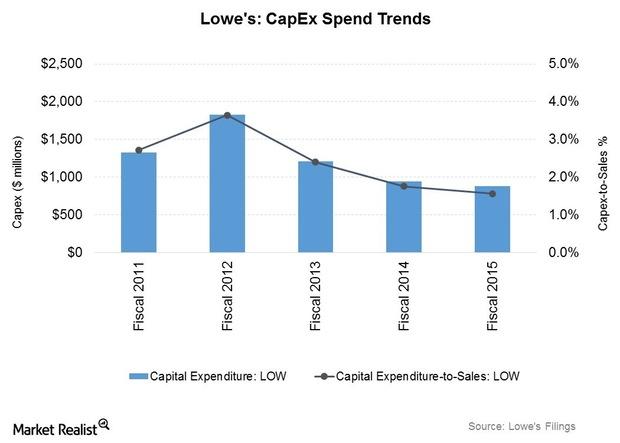

How Lowe’s Is Allocating Its Capital Expenditure Budget

Historically, a large percentage of Lowe’s (LOW) capital expenditure (or capex) has been spent on new store rollouts.

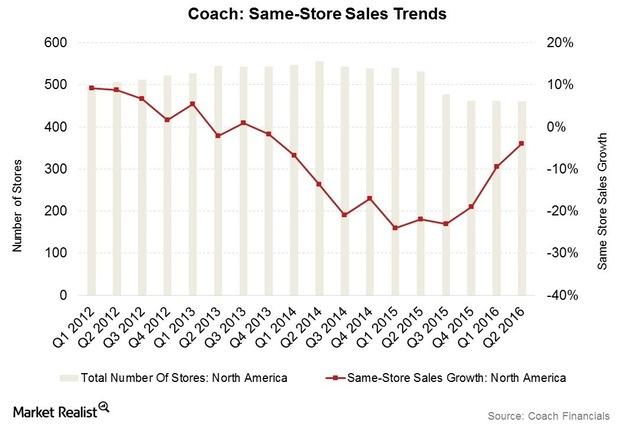

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

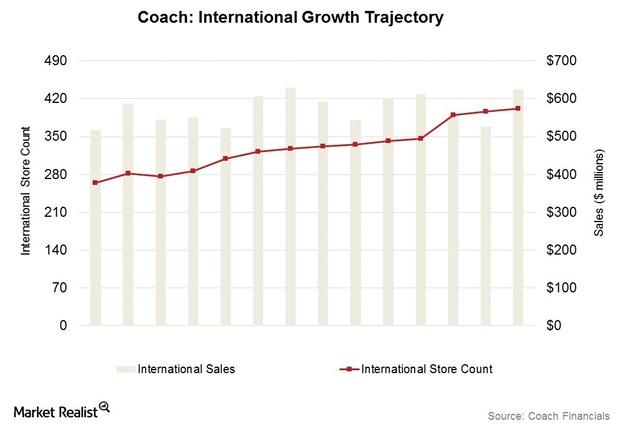

Coach’s Overseas Sales: What Do They Mean for Luxury Brands?

Sales trends for luxury brands may continue to grow in Europe due to monetary expansion and the weak euro.

Under Armour Partners with IBM and SAP to Widen Connected Fitness Potential

Under Armour’s revenues from its Connected Fitness initiative came in at $53 million in 2015, which was up from $19 million in 2014.

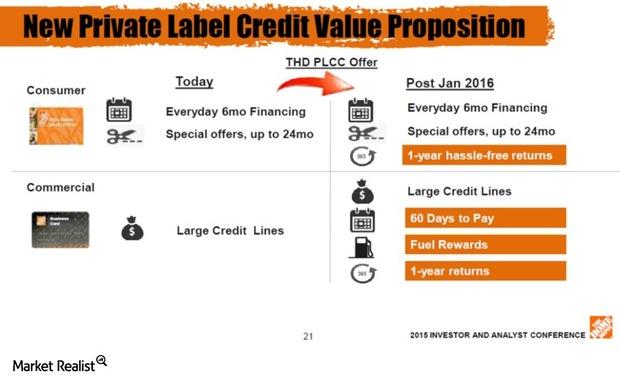

How Home Depot Is Leveraging the Pro Customer Opportunity

Driving growth from sales to pro customers is a key growth opportunity for the world’s largest home improvement retailer.

How Home Depot Drives Membership Loyalty With Pro Customers

The Home Depot’s (HD) focus on the pro customer allows the retailer to compete in the installations market and the product demand the services create.

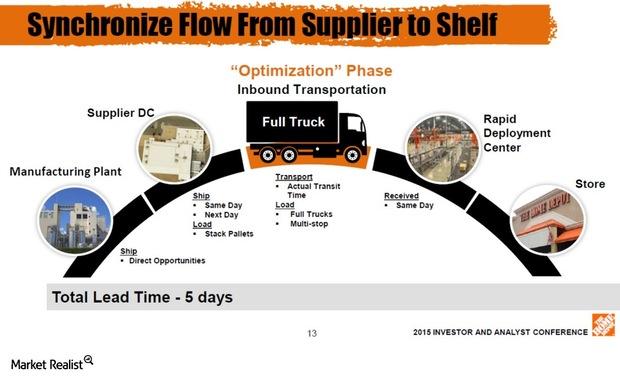

Supply Chain Sync: HD’s New Tool to Optimize Inventory Flow

Supply chain sync aims to optimize the logistics of moving products along the supply chain in the shortest and most cost-effective manner.

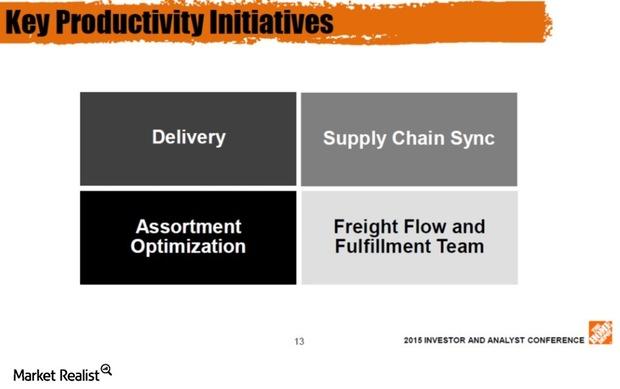

Productivity Enhancements: How Home Depot Is Trimming the Fat

Productivity enhancements resulted in improved profitability margins for the world’s number one retailer.

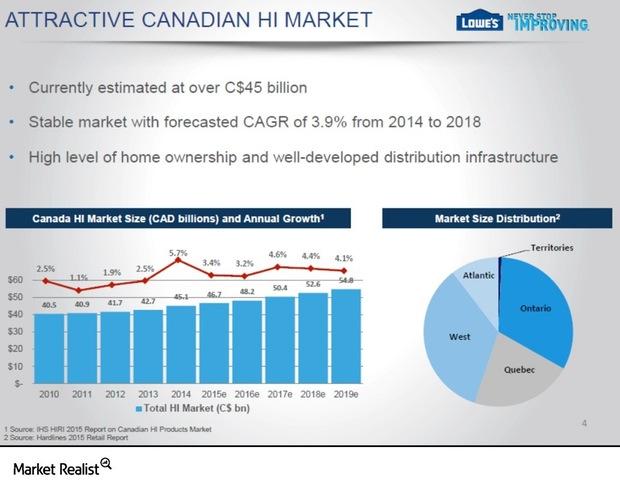

Market Share Play: Lowe’s Bid to Gain Scale in Canada with Rona

The Rona (RON.TO) acquisition should give Lowe’s (LOW) a market-leading position in Canada’s home improvement market, estimated at over $45 billion Canadian.

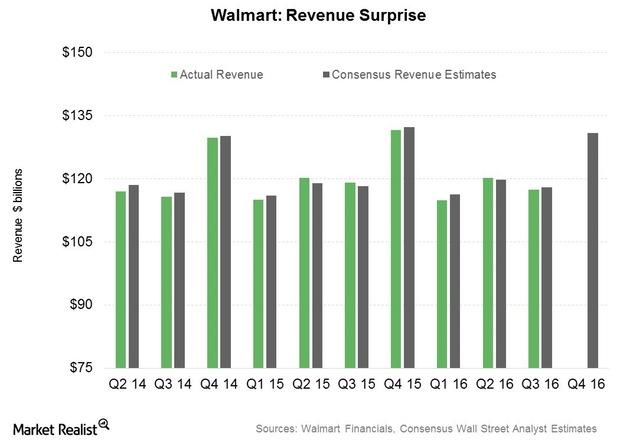

Why Foreign Currency Headwinds Have Hurt Walmart in Fiscal 2016

Adverse foreign currency movements due to an appreciating US dollar have reduced Walmart’s top line by $12.3 billion in the last three quarters.

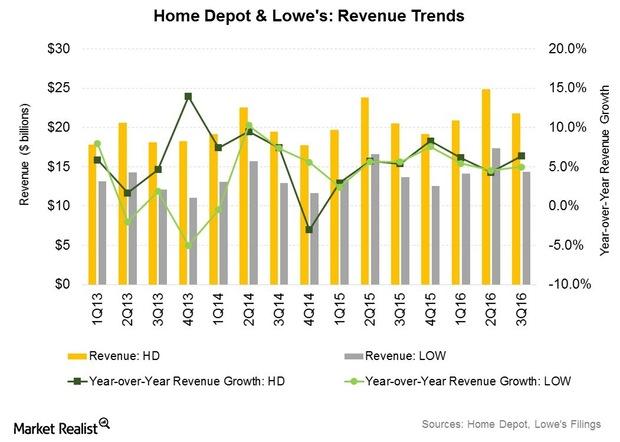

Analyzing Lowe’s YTD Sales Performance in Fiscal 2016

Lowe’s sales performance and growth in fiscal 2016 have been robust so far, with net sales rising by 4.9% and same-store sales rising by 4.6%.

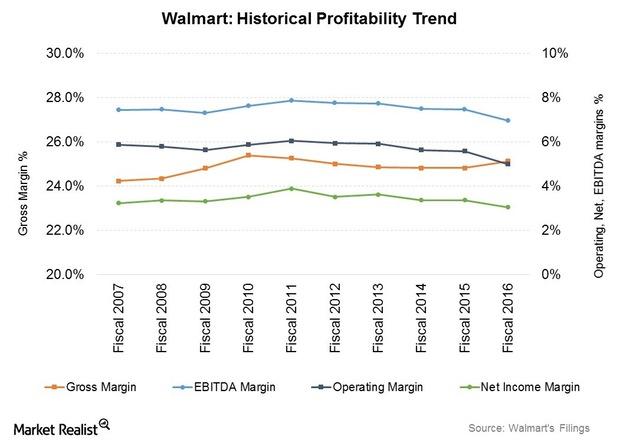

How Has Walmart’s Profitability Dip Affected Its Outlook?

Walmart’s reported operating income margin declined from 5.6% in fiscal 2015 to 5.0% in fiscal 2016.

How Walmart Is Looking to Offset Future Operating Cost Headwinds

Wage costs are expected to be a headwind for Walmart. On February 20, Walmart made the second round of wage increases for over 1.2 million staff.

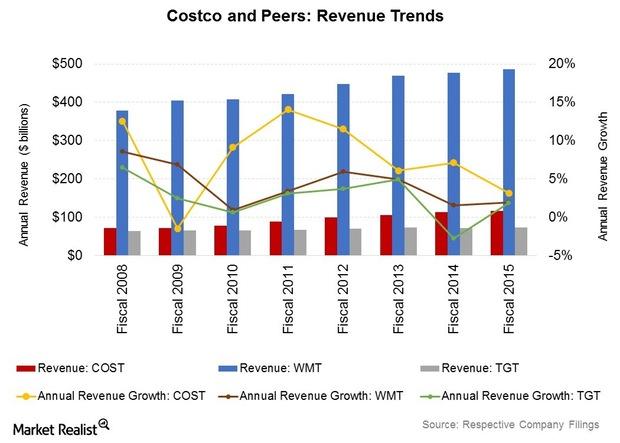

Costco’s Revenue Growth Likely to Moderate in Fiscal 2Q16

Costco posted record results for fiscal 2015. Revenue grew by 3.2% to $116.2 billion, and net income rose by 15.5% to $2.4 billion.

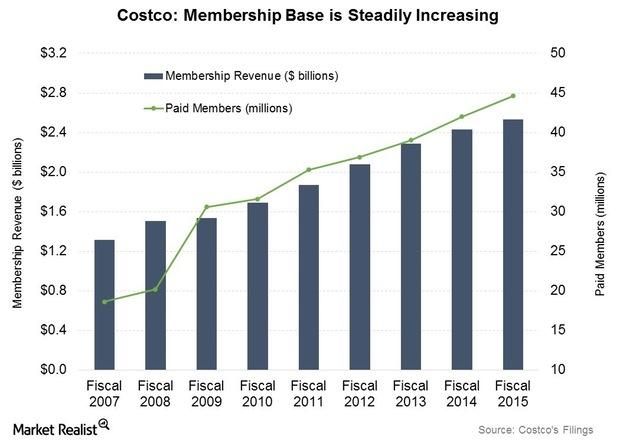

What’s Driving Record Membership Loyalty at Costco?

Costco has been able to steadily increase the renewal rate in the US and Canada from 88% in fiscal 2010 to 91% in fiscal 1Q16.

Kirkland Signature: Costco’s Key Differentiator in Fiscal 2Q16?

Costco has seen traffic growth averaging 4.3% per year in the period between fiscal 2009 and fiscal 2015. In fiscal 1Q16, club traffic rose by 3.5% YoY.

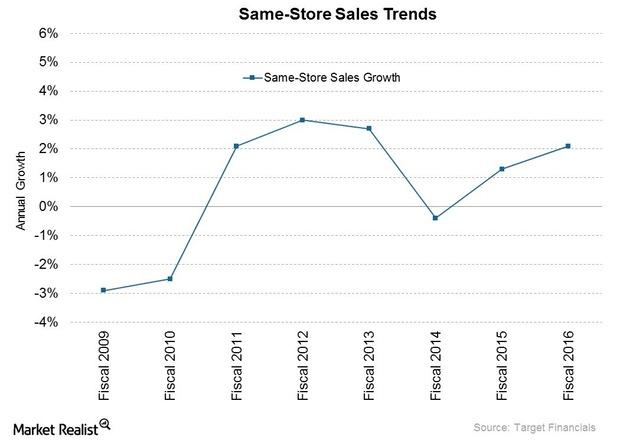

Analyzing Target’s Same-Store Sales Growth in Fiscal 2016

Target had upbeat revenue performance in fiscal 4Q16 and 2016. Store traffic was up by 1.3% YoY in fiscal 2016, trending in positive territory in all four quarters of the year.

What Can We Expect from Nike’s Wholesale Channel in Fiscal 3Q16?

The wholesale channel is the largest channel for Nike’s (NKE) sales.

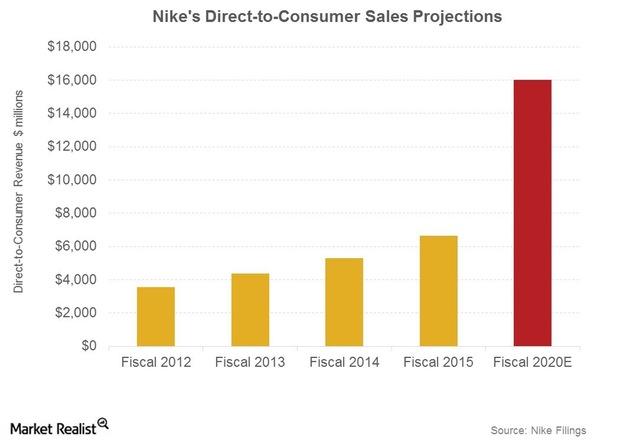

Why Is Nike Focusing on the Direct-To-Consumer Channel?

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores.

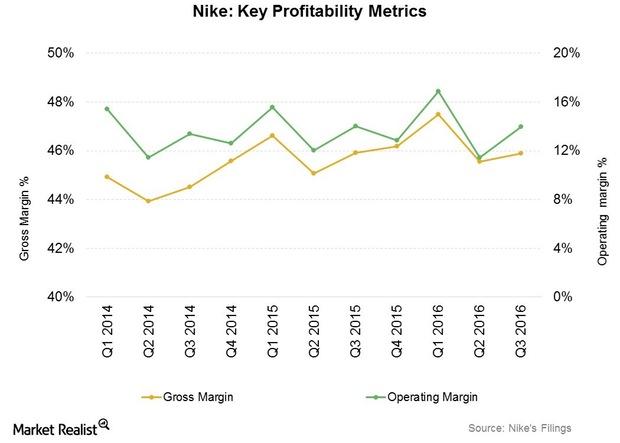

How Nike Has Sustained Profitability despite Headwinds

Nike’s profitability in fiscal 3Q16 was helped by better-than-average performance in North America and Greater China, two of its most profitable segments.