Phalguni Soni

Phalguni is a retail analyst at Market Realist. Phalguni has had 9 years’ experience in Canada, Dubai, and India, and has worked in Analyst roles at Great Canadian Gaming Corp., Dubai World, Lusight Research, TradeBriefs, and Global Education Management Systems. Phalguni has completed the CFA program. She received a degree in Commerce from the University of Calcutta and was placed at the top of her class.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Phalguni Soni

Why Lululemon Athletica Expects Stronger Sales in Fiscal 4Q16

Growth company Lululemon Athletica (LULU) has revised its fourth quarter (fiscal 4Q16) and full-year (fiscal 2016) revenue guidance upwards.

Lululemon’s Revenue Spikes in Fiscal 2016: What’s Driving Sales?

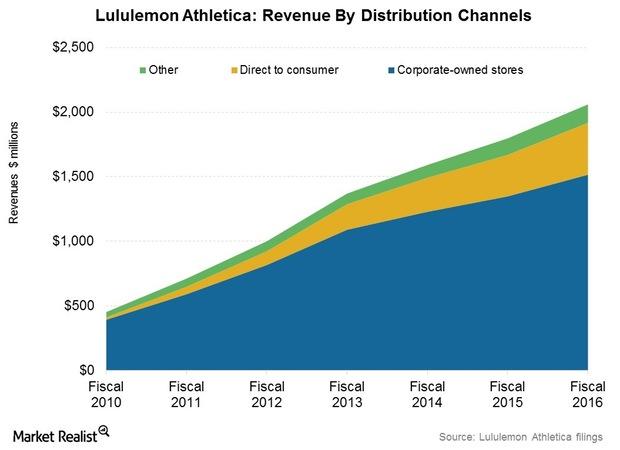

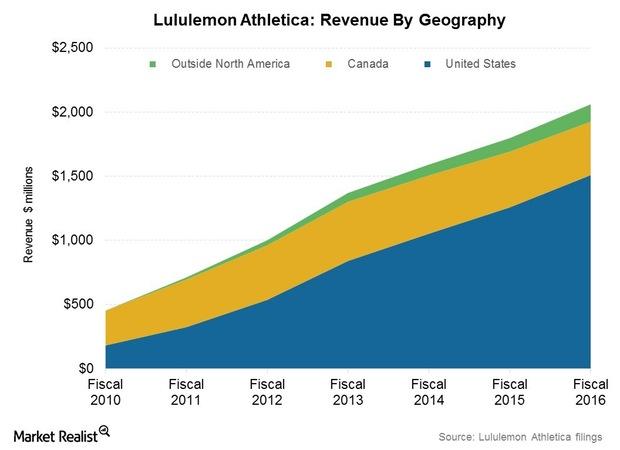

Lululemon Athletica’s (LULU) revenue grew by 14.7% year-over-year to $2.1 billion, a new milestone for the company. In fiscal 4Q16, Lululemon’s sales grew 16.8% to $704 million.

E-Commerce: A High-Growth Business for Lululemon Athletica

E-commerce was one of the reasons Lululemon Athletica (LULU) had an upbeat performance in fiscal 2016. It posted e-commerce sales of almost $402 million, a 25% increase year-over-year.

Five-Year Plan: Lululemon’s Long-Term Vision and Goals

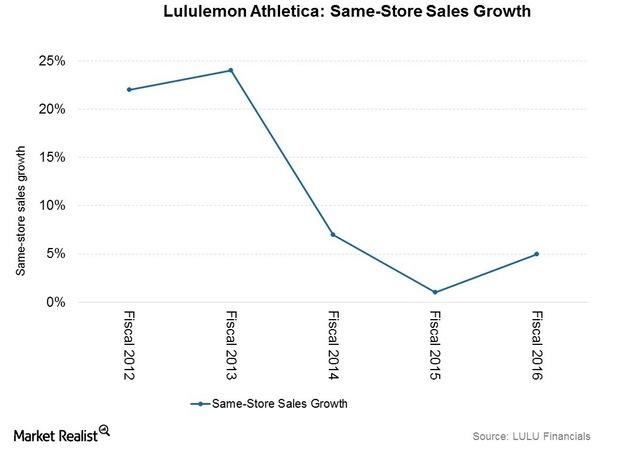

Over the next five years, Lululemon Athletica (LULU) is aiming to double its revenue to $4 billion with an expected mid-single-digit growth rate in store comps.

Porter’s 5 Forces: Analyzing Target’s Competitive Positioning

It’s relatively easy to open a competing business like Target’s, though it’s harder to do it on the scale that the retailer presently enjoys.

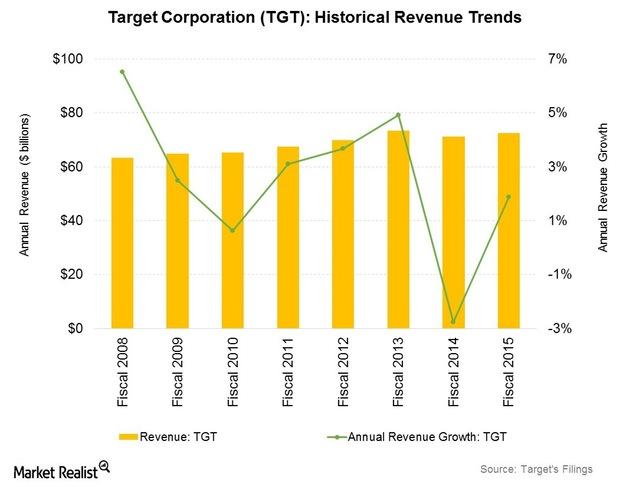

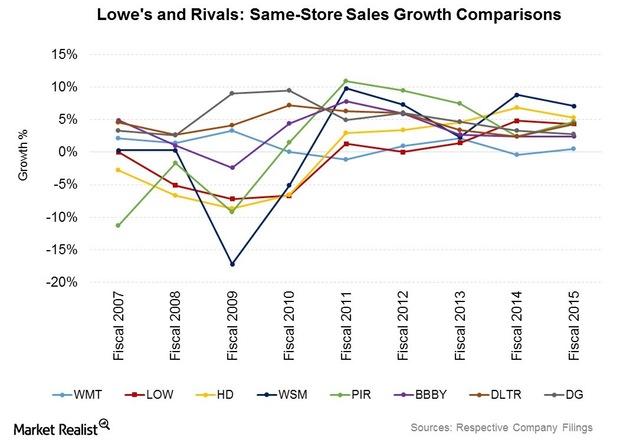

How Does Target’s Historical Sales Growth Compare to Its Peers’?

Target opened 15 new stores in fiscal 2016. Its same-store sales rose 2.1%, with customer traffic at stores up 1.3%.

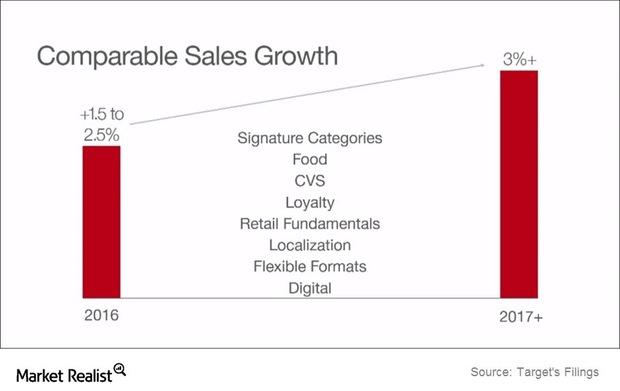

Why Target Is Focusing on Its Signature Categories to Drive Sales

Target has identified four signature categories it’s concentrating on to provide higher store and web traffic and sales: Baby, Style, Wellness, and Kids.

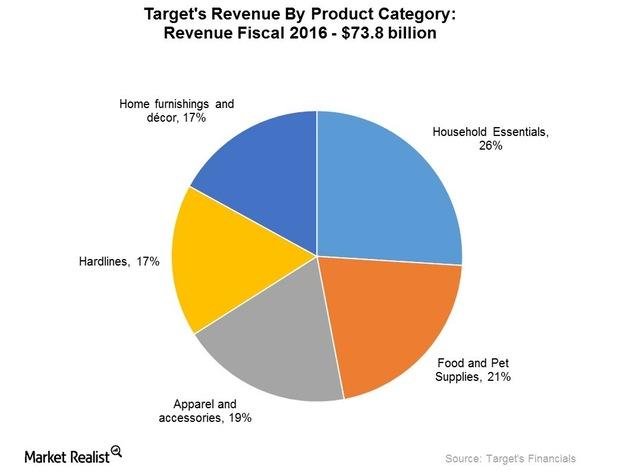

Merchandise Mix: Which Categories Are Performing Best at Target?

In fiscal 2016, Target’s (TGT) performance was upbeat for all merchandise categories with the exception of hardlines.

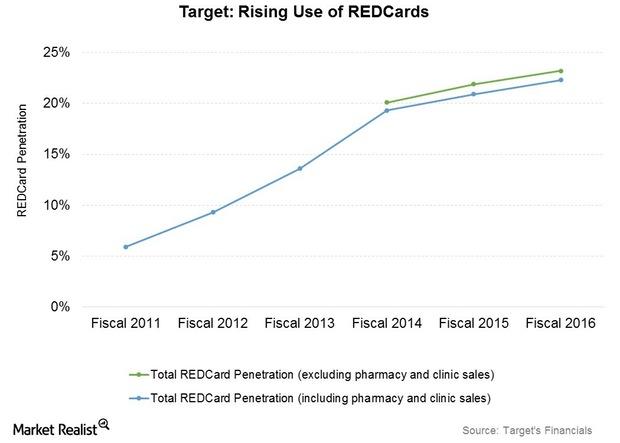

How the REDCard and Cartwheel Programs Affect Target’s Sales

Target (TGT) has several marketing programs designed to attract higher store (XRT) (RTH) traffic and higher customer loyalty.

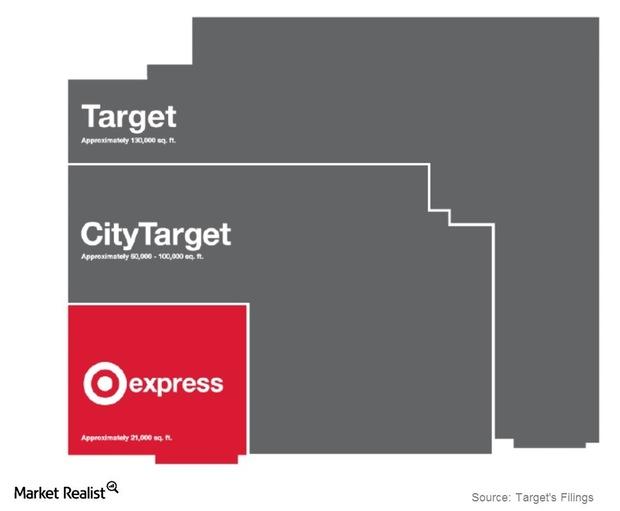

Why Target Is Looking at Flexible Format Stores in the US Market

Target operates 1,792 stores in the United States under multiple store formats. Its merchandise assortment differs by store, store location, and store size.

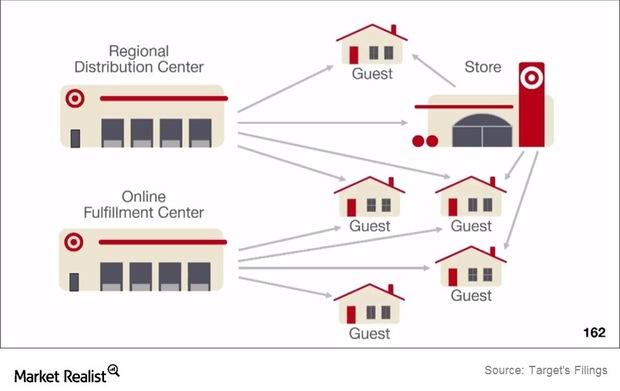

Why Target Is Ramping up on Supply Chain and Digital Investments

Target (TGT) has been making improvements in its supply chain to cope with the additional demand posed by e-commerce and omni-channel retailing (RTH).

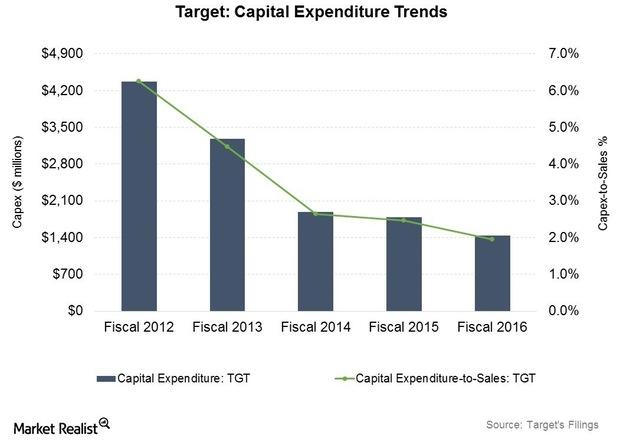

Where Is Target Spending the Bulk of Its Capital Expenditure?

Target (TGT) spent $1.4 billion on capital expenditure in fiscal 2016, representing about 2% of sales.

Can Target Make the Most of Its Opportunities?

Target’s flexible and smaller format stores could prove a cost-effective and capital-efficient way for it to reach customers in new markets.

Target’s Strengths and Weaknesses Are Balanced

Target’s business model has been tested over several economic cycles. Even during the recession in 2008–2009, it managed to raise its dividend per share.

What Drove Under Armour’s 30% Revenue Jump in 1Q16?

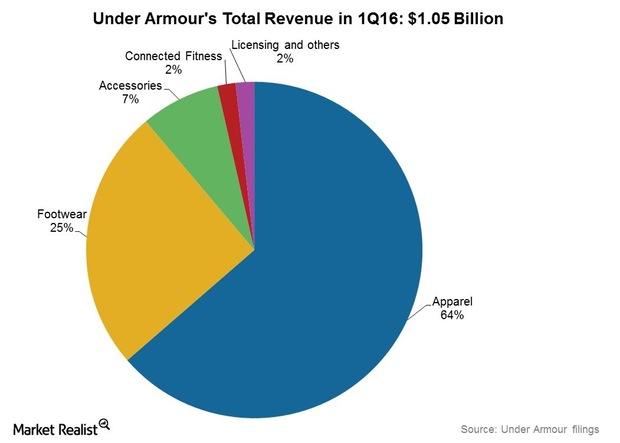

Under Armour (UA) grew revenue by 30% to $1.05 billion in 1Q16. This was the company’s 24th straight quarter of more than 20% growth in its top line.

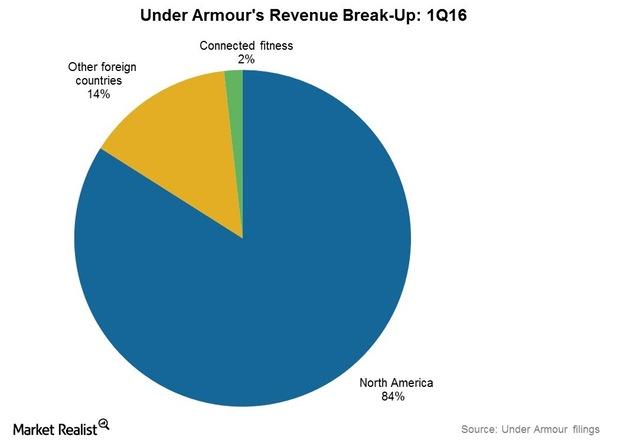

What Led to Under Armour’s Massive International Growth in 1Q16?

Under Armour’s (UA) international sales grew 55.6% to almost $150 million in 1Q16. Sales growth in overseas markets came in at 64.6% in currency-neutral terms.

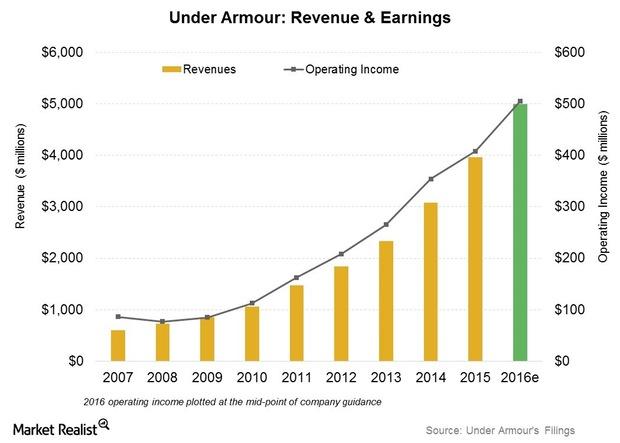

How Much Has Under Armour Increased Revenue Guidance?

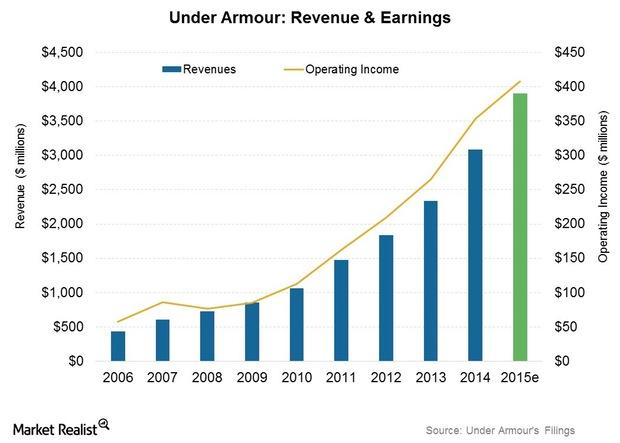

Under Armour raised the higher end of its 2016 operating income estimate to $503 million–$507 million, implying a growth rate of 23.1%–24.1% over 2015.

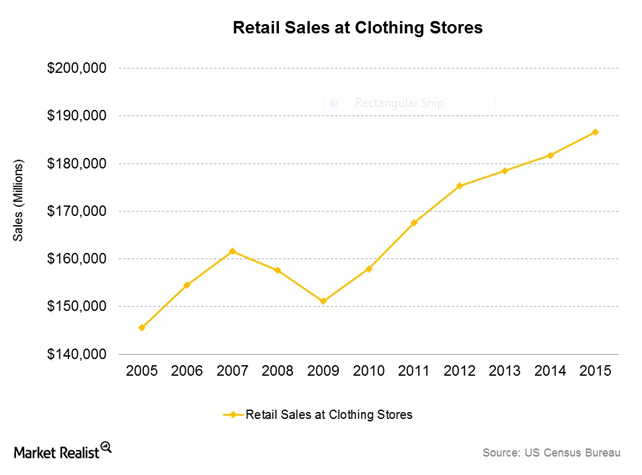

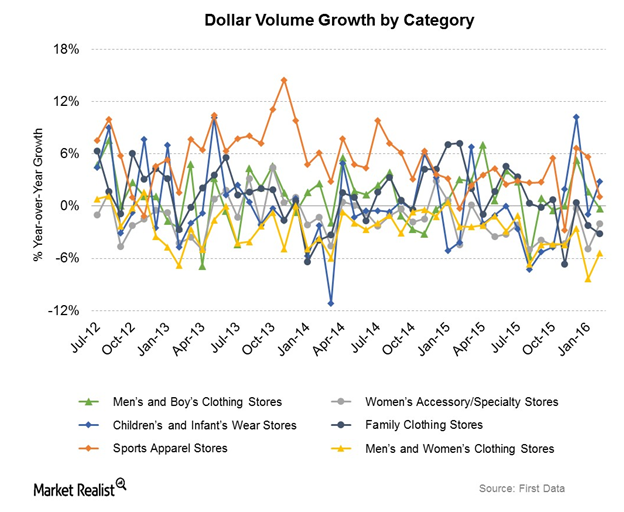

How Has Athleisurewear Boom Impacted the US Apparel Industry?

The growth rate in activewear or athleisurewear has outpaced the overall clothing market, with a double-digit CAGR over the past five years.

Athleisurewear Giants: Which Companies Dominate Activewear?

The athleisurewear category has had a boost from higher interest in physical well-being globally and by increased participation by women in sports and other fitness activities.

Is Walmart’s Supercenter Format Its Most Successful Retail Foray?

Supercenters are more likely to double as fulfillment centers as Walmart widens its omni-channel capabilities. They are likely to provide the company with economies of distribution.

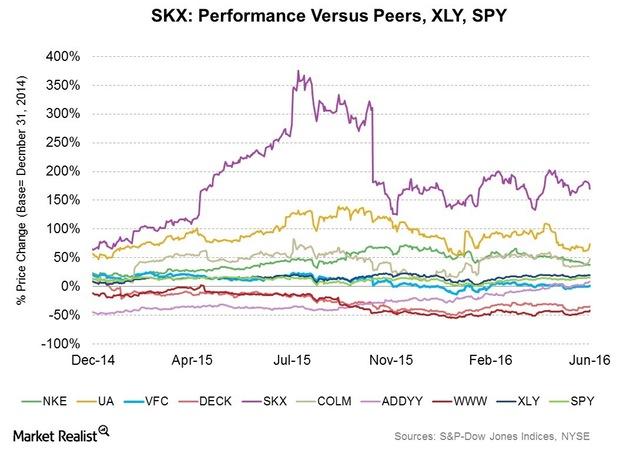

Skechers: Achieving Growth through Diverse Product Development

Since the launch of its first line in 1992, Skechers has diversified into several new lines, targeting different demographics and different activities.

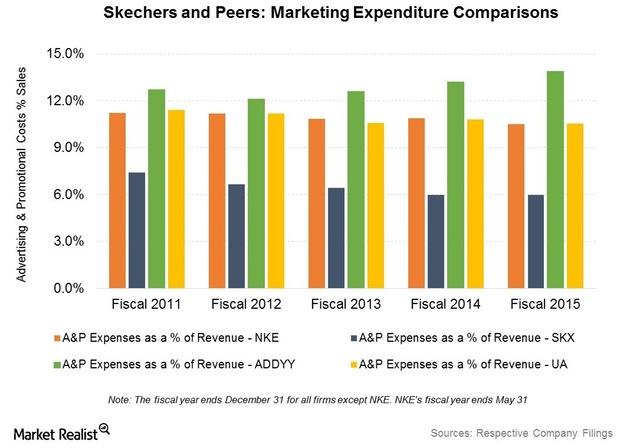

Marketing and Branding: How Skechers Sells Its Footwear Products

To maintain its market share and drive sales, Skechers spends considerable time and effort in marketing activities to promote its footwear globally.

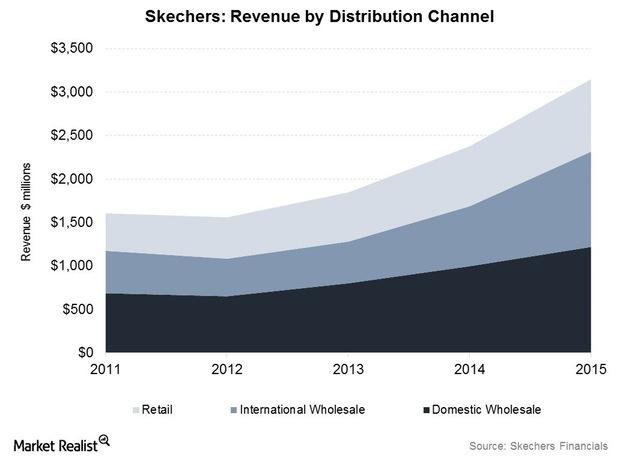

How Skechers Sells Its Products to Its Customers

In 2015, Skechers became the second-largest footwear company in the United States, trailing global market leader Nike (NKE).

Skechers Footwear: Design, Sourcing, and Manufacturing Overview

Skechers designs footwear with its own in-house design team. However, it doesn’t own or operate any factories in which to conduct its manufacturing.

How Does Skechers Manage Its Inventory and Distribution?

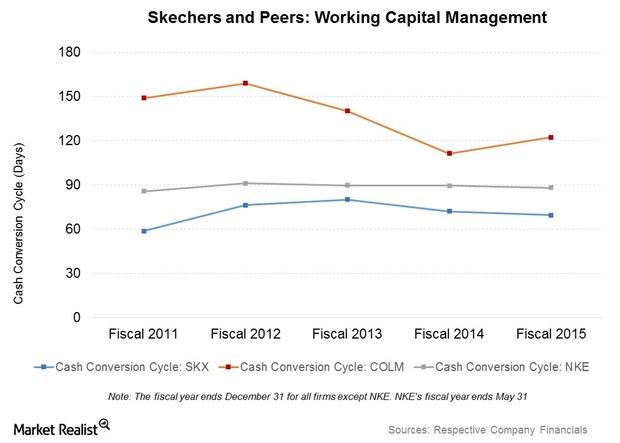

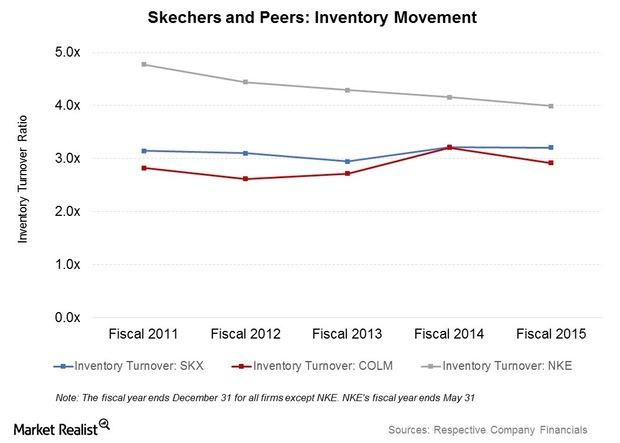

In recent years, Skechers has reported improved working capital metrics. The company’s inventory turnover (or ITR) rose from 2.9x in 2013 to 3.2x in 2015.

Comparing Skechers’ Strengths and Weaknesses

Skechers is quickly establishing its presence in international markets. It made $3.1 billion in sales in 2015, of which 40.4% stemmed from overseas markets.

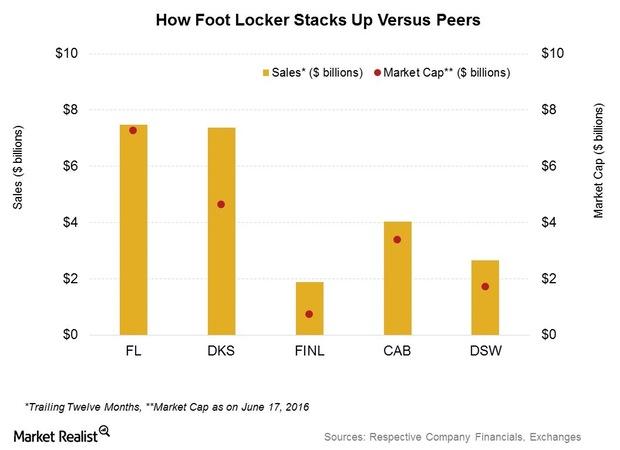

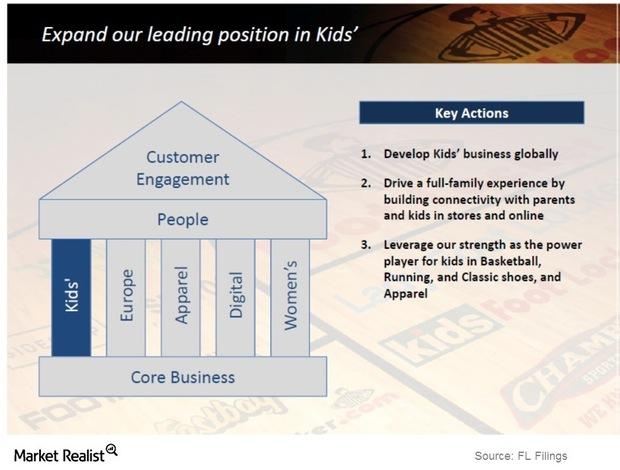

Porter’s Five Forces: What’s Foot Locker’s Industry Position?

In this part, we’ll look at industry forces affecting sporting goods retailers. We’ll also look at Foot Locker’s competitive positioning based on Porter’s Five Forces

Competitive Forces Shaping Foot Locker, Sporting Goods Retailers

It’s easy for customers to switch between sporting goods retailers. Specialty retailers (XRT) compete on product exclusives, assortment, price points, and customer experience.

Retail Footprint: Why Foot Locker Operates Multiple Store Formats

Foot Locker is primarily a mall-based athletic goods specialty retailer. The company operates several store formats, depending on the product, customer demographic, and geography.

Fleet of Foot? Foot Locker’s Fastest-Growing Sales Segments

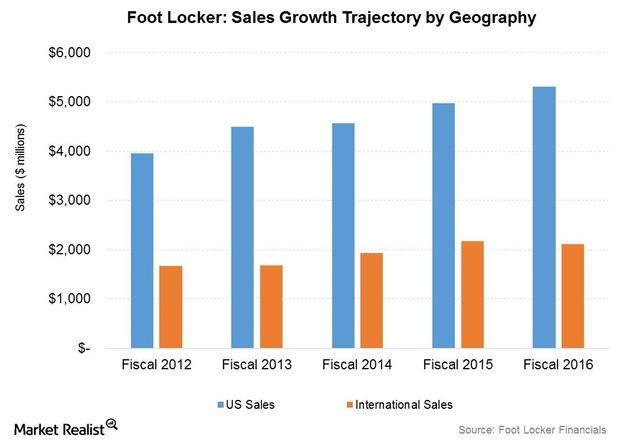

In fiscal 2016, Foot Locker made $5.3 billion in US sales, representing 71.6% of its total revenue. In contrast, international revenue came in at $2.1 billion.

Foot Locker’s e-Commerce Sales Growth: Potential and Prospects

Foot Locker (FL) operates several e-commerce websites under the Foot Locker and other store banners. It reports e-commerce sales under the direct-to-customer segment.

Why Is Foot Locker Eyeing Higher Growth in Europe?

Foot Locker (FL) made about 28.4% of its sales, or $2.1 billion, from outside the United States in fiscal 2016.

Analyzing the Cogs in Foot Locker’s Supply Chain

Foot Locker’s distribution and supply chain includes five distribution centers around the world. It owns two of them and leases three.

How Foot Locker Has Stepped Up Inventory Management Efforts

In recent quarters, Foot Locker (FL) has made inventory management a priority. The retailer is targeting faster inventory turns.

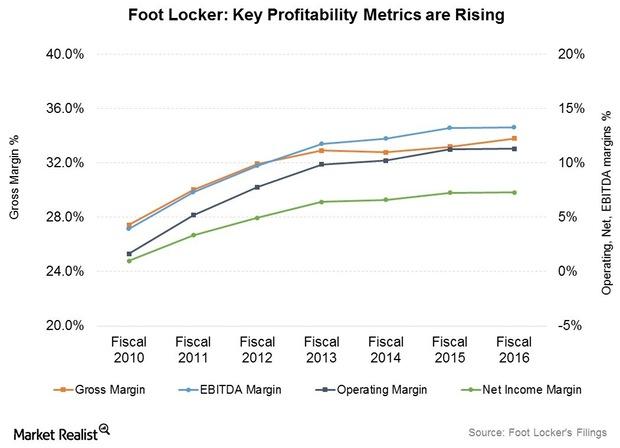

A Look at Foot Locker’s Cost Structure, Expanding Profitability

As part of its long-term plan, Foot Locker (FL) has been concentrating on enhancing its profitability margins and focusing on store remodels and improved service and product assortment.

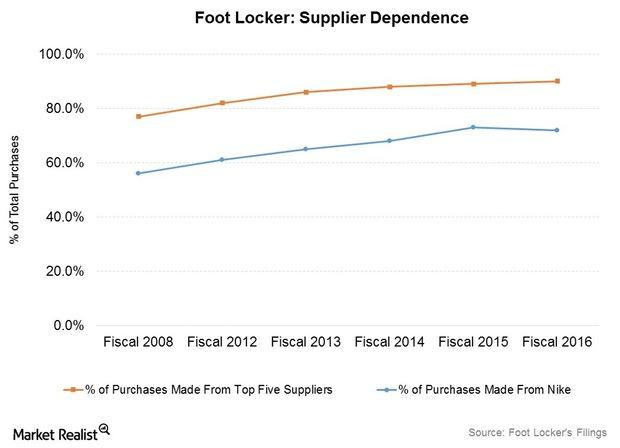

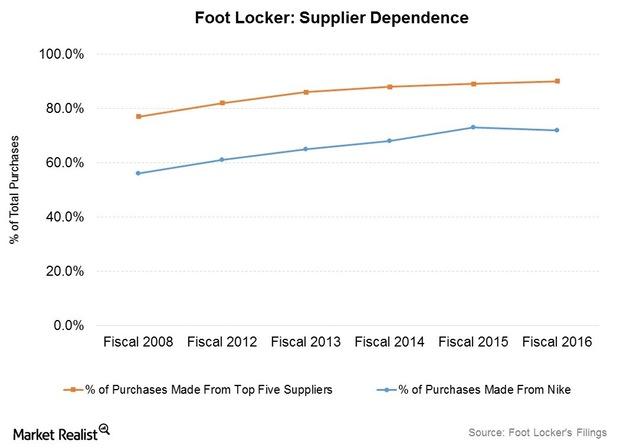

A Look at Foot Locker’s Key Strengths and Weaknesses

Foot Locker (FL) has several key strengths. It’s the largest specialty retailer (XRT) of sporting goods in terms of US store count.

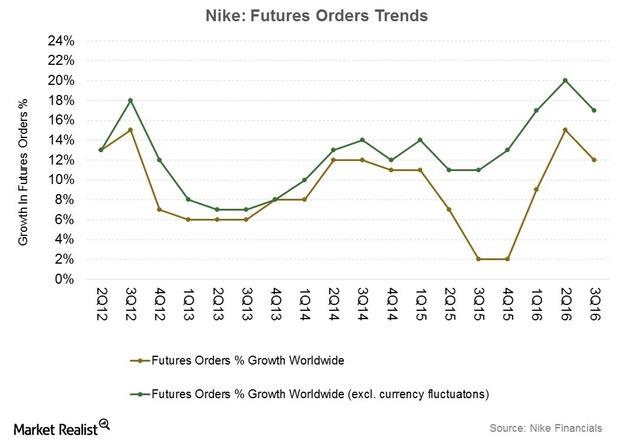

The Catalysts Powering Nike’s Growth Performance in Fiscal 2016

Nike (NKE) is expected to post sales of $8.3 billion in fiscal 4Q16, an increase of 6.4% year-over-year, according to the Wall Street analysts’ consensus.

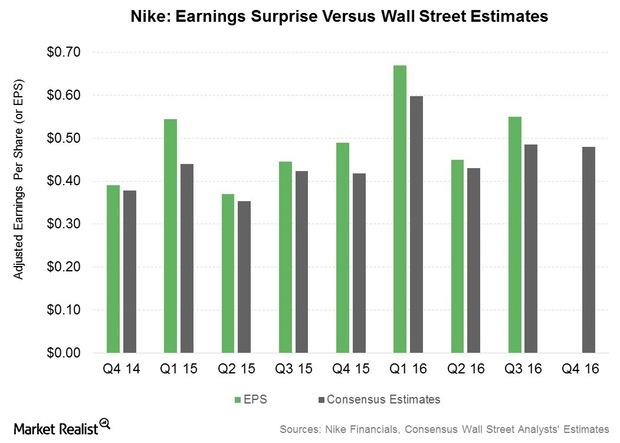

The Earnings Outlook for Nike in Fiscal 4Q16

After posting adjusted EPS growth rates exceeding 20% in the first three quarters of fiscal 2016, the earnings expectations for Nike (NKE) in the fourth quarter are modest.Financials How to measure your portfolio’s interest rate risk with convexity

Portfolio durations differ from key rate durations, as even though the durations of two portfolios may match, both portfolios may differ in the maturity profiles of the bonds they comprise, which will result in differing key rate durations.Financials Must-know variants in developed market international bond funds

International bond funds like the Vanguard Total International Bond Index ETF (BNDX) can have various investment styles determined by their stated choice of bond investments.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.

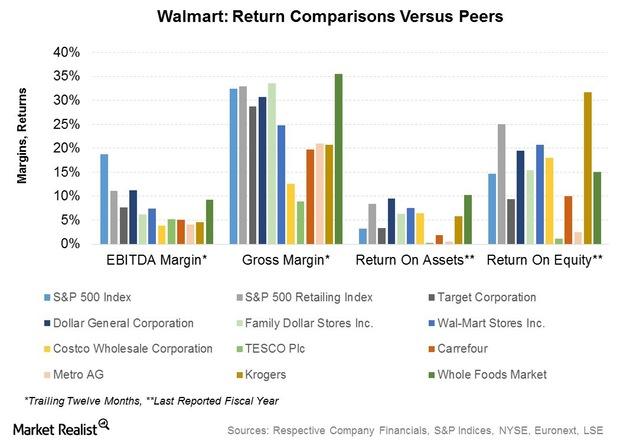

Analyzing Walmart’s Cost Structure With US And Overseas Firms

Margins in the food and staples (XLP) retail segment are slender. It’s important for Walmart (WMT) to keep a tight grip on the cost structure.Financials Richard Fisher explains why excess reserves can create velocity

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.

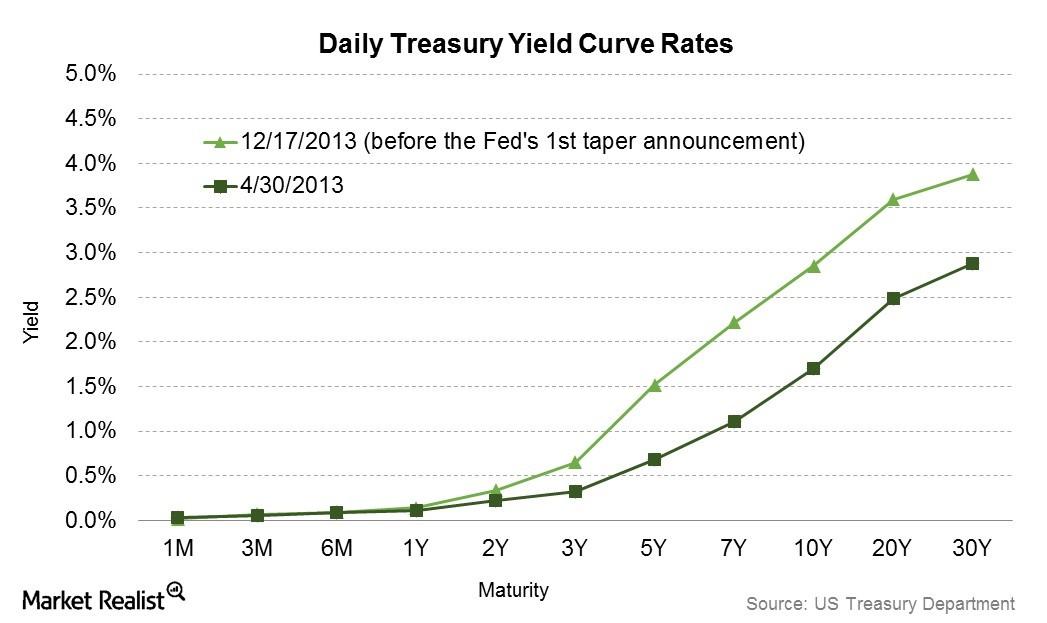

How do interest rate expectations impact financial markets?

The inflation and interest rate expectations of consumers and firms are important variables determining bond prices.Financials Issuers like Wells Fargo and Verizon take advantage of low yields

Major deals included debt issues by Wells Fargo (WFC), Baidu, AT&T, and Verizon (VZ).Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

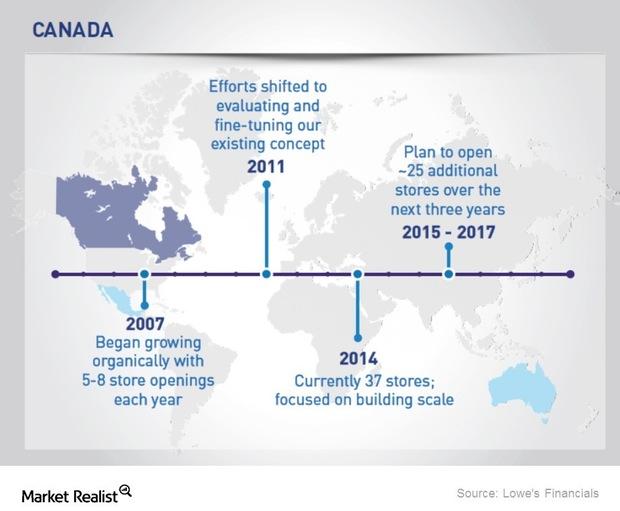

What Are Lowe’s Opportunities and Key Threats?

The greatest opportunity for Lowe’s (LOW) perhaps lies in fully leveraging the omni-channel (XLY) model.

What Are Lowe’s Strengths and Weaknesses?

Lowe’s (LOW) is one of the largest and oldest big box retailers around. It’s been publicly listed since 1961.

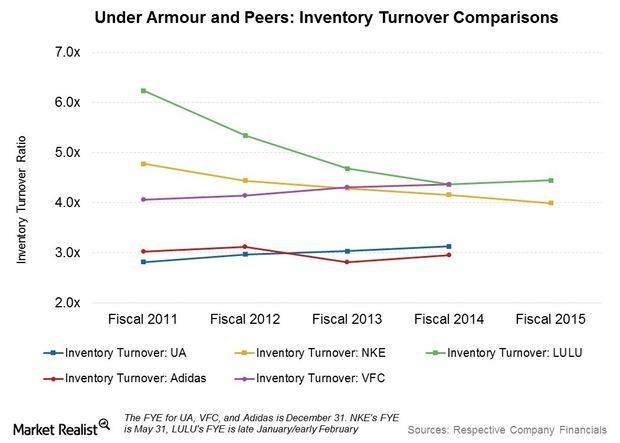

What’s Different about Under Armour’s Inventory Management?

Under Armour (UA) anticipates higher inventory growth over the next few quarters. It has made a number of changes on the inventory and supply chain side.

Under Armour Projects a ~26% Revenue Growth Rate for 2015

Under Armour is scheduled to declare its earnings for 4Q15 and full-year 2015 on January 28, 2016. It has projected revenue of $3.9 billion for 2015.