Home Depot: Margins Up on Higher Sales, Lower Expenses

Home Depot’s margins are ahead of those reported by the number-two home improvement (XHB) (ITB) retailer, Lowe’s (LOW), over the past twelve months.

Nov. 20 2020, Updated 3:26 p.m. ET

Analyzing Home Depot’s margins and cost structure

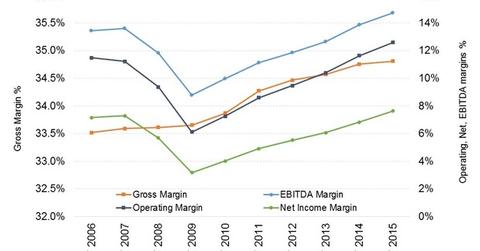

Home Depot’s margins (HD) and profitability are on the rise. Since fiscal 2009, which ended January 31, 2009, gross margins, operating margins, net income margins, and EBITDA (earnings before interest, taxes, depreciation, and amortization) margins, have expanded each year. The world’s number-one home improvement retailer’s margins have also surpassed its pre-recession performance.

Peer group comparison

Home Depot’s margins are ahead of those reported by the number-two home improvement (XHB) (ITB) retailer, Lowe’s (LOW), over the past twelve months. They also exceed those of the broader consumer discretionary sector (XLY). And while margins earned by other peers Bed Bath and Beyond (BBBY), Michael’s (MIK), and Williams-Sonoma (WSM) appear to better HD’s on some levels, these firms have a slightly different retail model and product mix.

Why are margins rising?

In 2013, Home Depot announced an operating margin target of 13% over the long term. It’s getting nearer to its goal. HD reported an operating margin of 12.6% in fiscal 2015 and expects to achieve its 13% target this year.

Margin expansion has been driven by higher same-store sales growth over the past few years, as noted in Part 8 of this series. HD is also increasing its proprietary product selection, which typically earns higher margins than comparable brands.

Meanwhile, gross margin have deleveraged due to a slight shift in the sales mix to lower-margin appliance products. It has added more appliance products online. HD expanded market share in this category, to the detriment of department stores.

On the expenses side, HD’s operating expenses have grown at a slower pace than sales have. Last year, expenses grew at about a quarter of the pace of sales. The company’s performance has also been boosted by better inventory management, supply chain improvements—refer to Part 6—and lower energy prices. HD has improved shrinkage levels in inventories, which has improved its gross margin.

HD’s net income has, however, been affected by the data breach expenses incurred in the last two fiscal years. In fiscal 2015, data breach expenses impacted the bottom line by ~$33 million, net of insurance recovery. The legal liability arising from data breach claims may also affect the company’s results in the coming quarters.