Williams-Sonoma Inc

Latest Williams-Sonoma Inc News and Updates

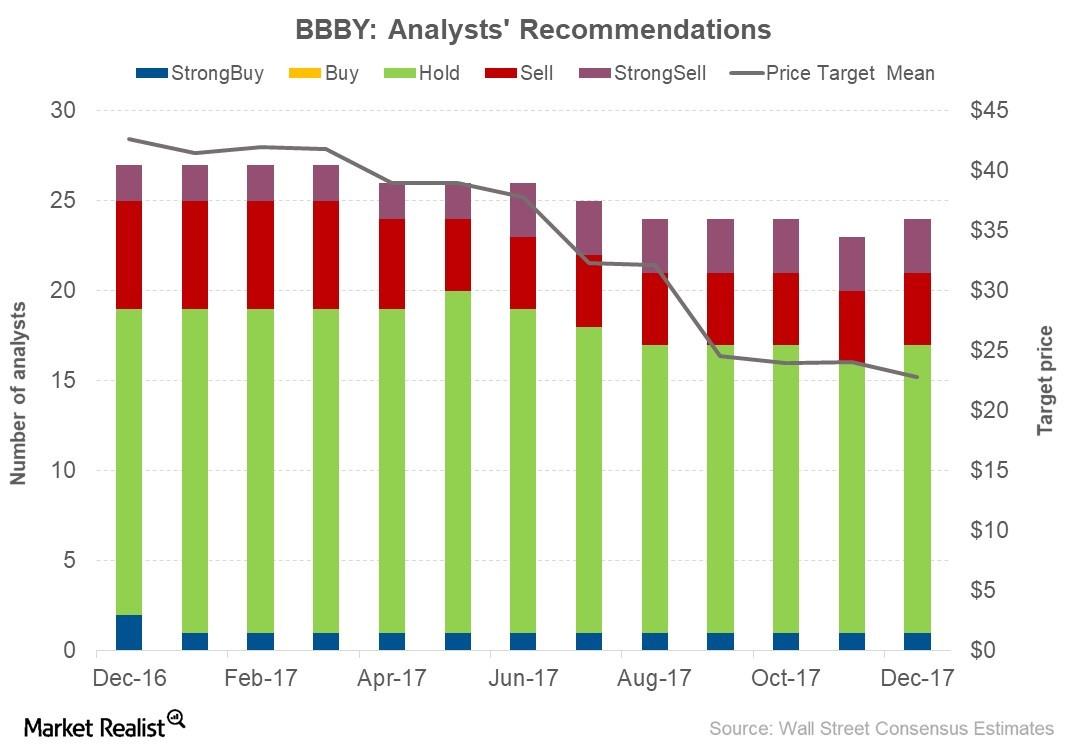

How Analysts Rate Bed Bath & Beyond after 3Q17 Earnings

As of December 21, 2017, Bed Bath & Beyond (BBBY) stock was trading at $21.50. That same day, analysts were expecting the stock to reach $22.78 in the next 12 months.

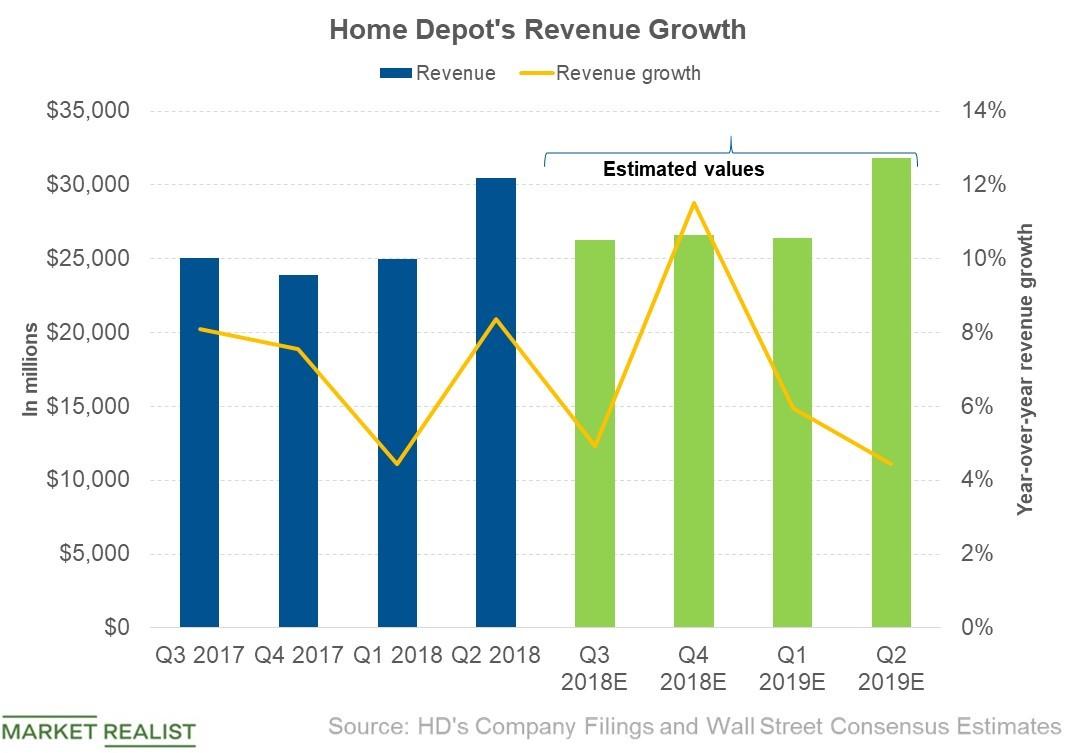

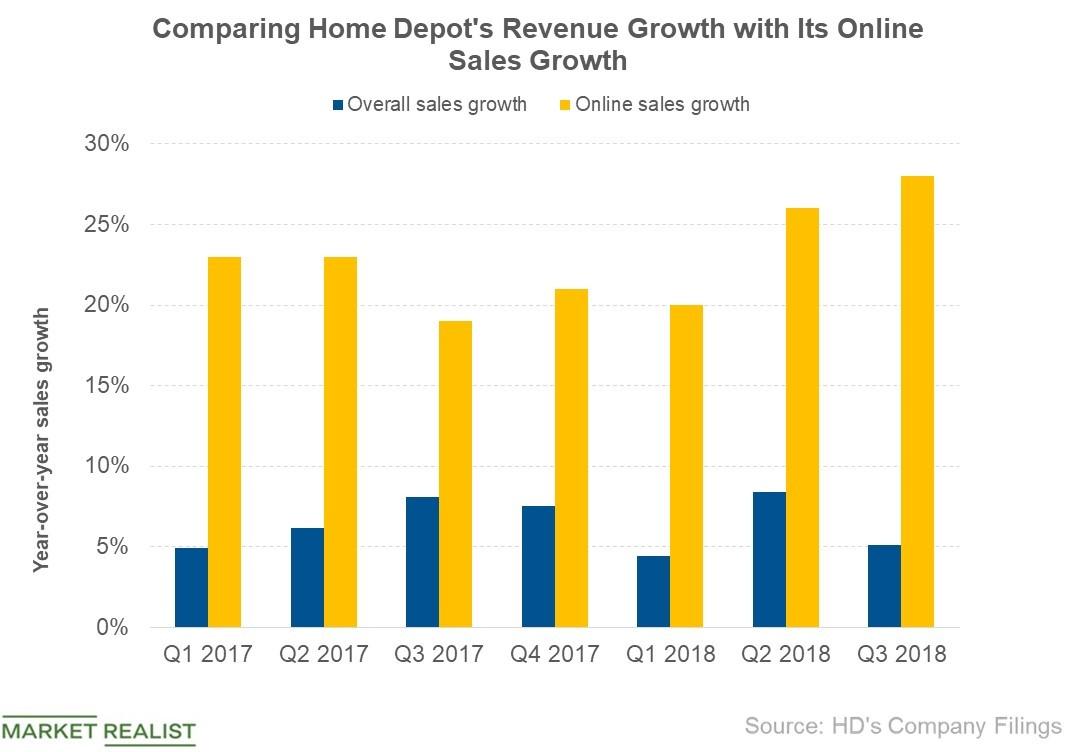

Why Analysts Expect Home Depot’s Revenue to Rise in Q3

Analysts expect Home Depot (HD) to post third-quarter revenue of $26.3 billion, a rise of 4.9% year-over-year.

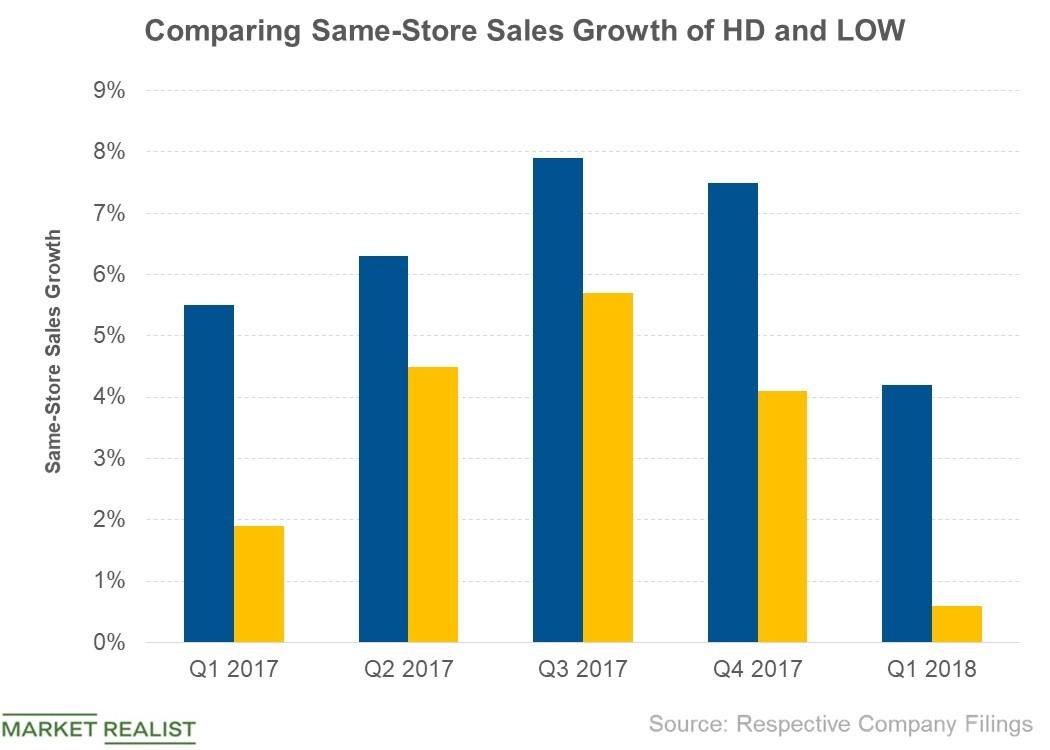

Why Both HD and LOW Failed to Meet Growth Estimates in Q1 2018

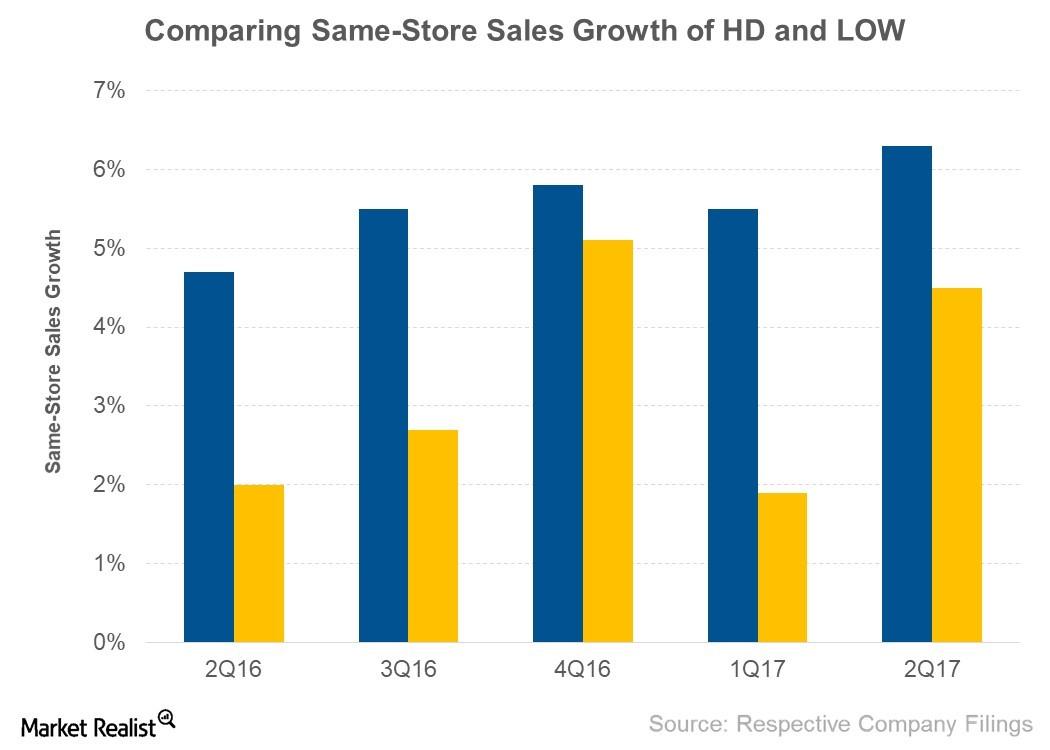

In the first quarter, Home Depot (HD) posted SSSG (same-store sales growth) of 4.2%, lower than analysts’ consensus expectation of 5.4%.

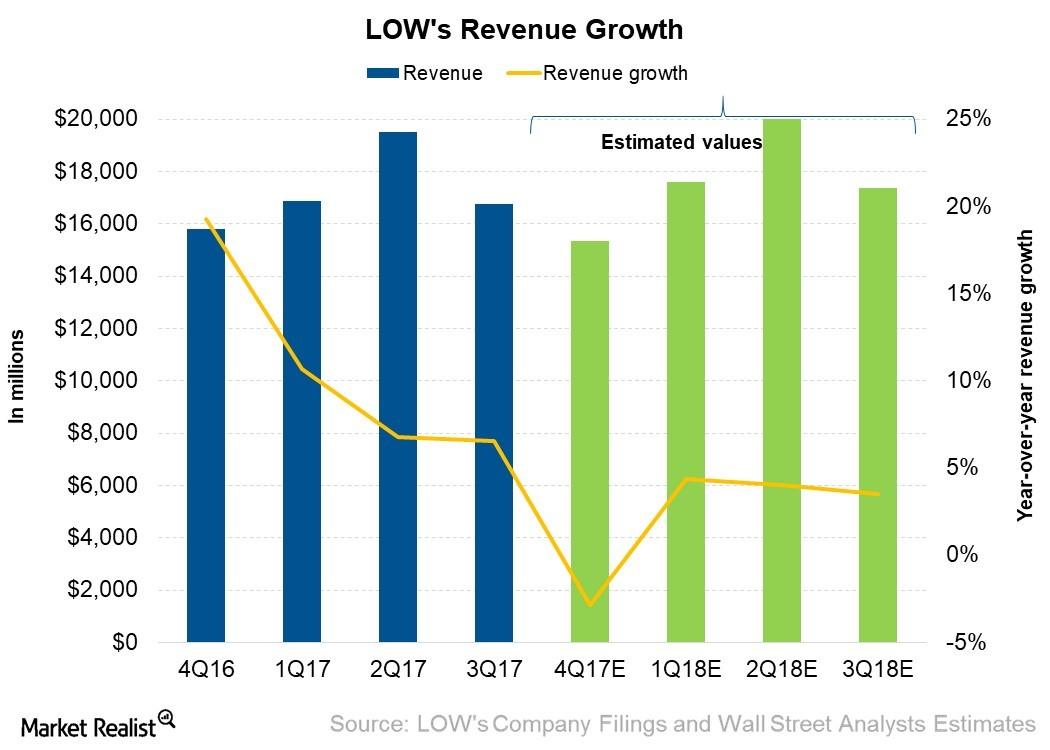

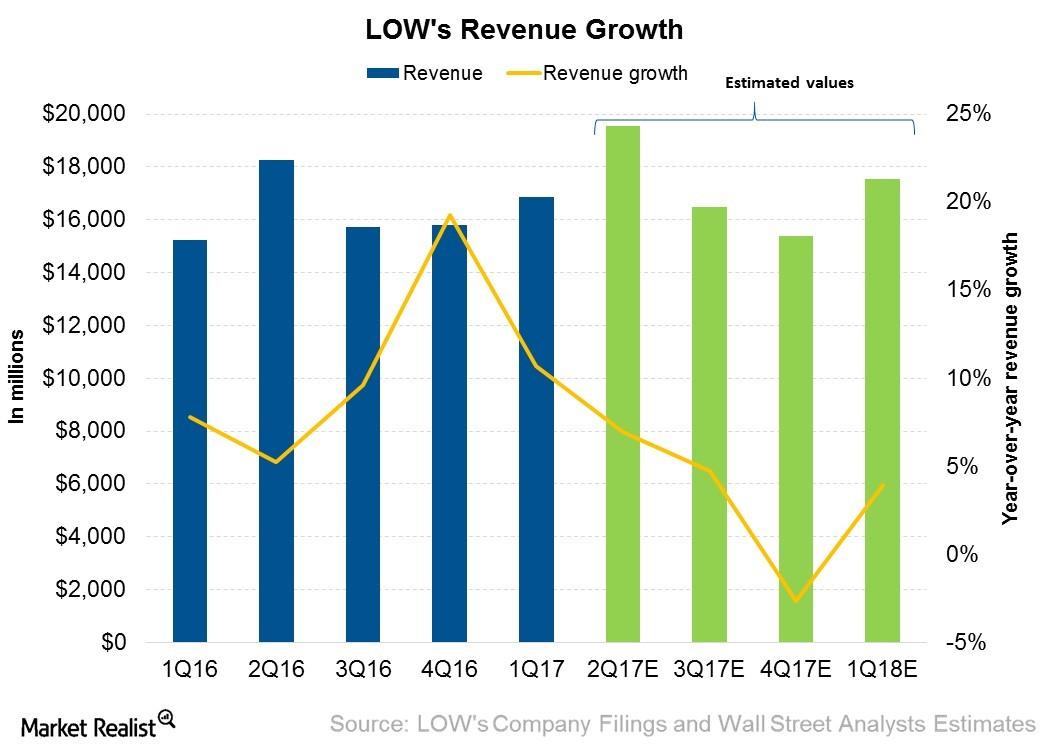

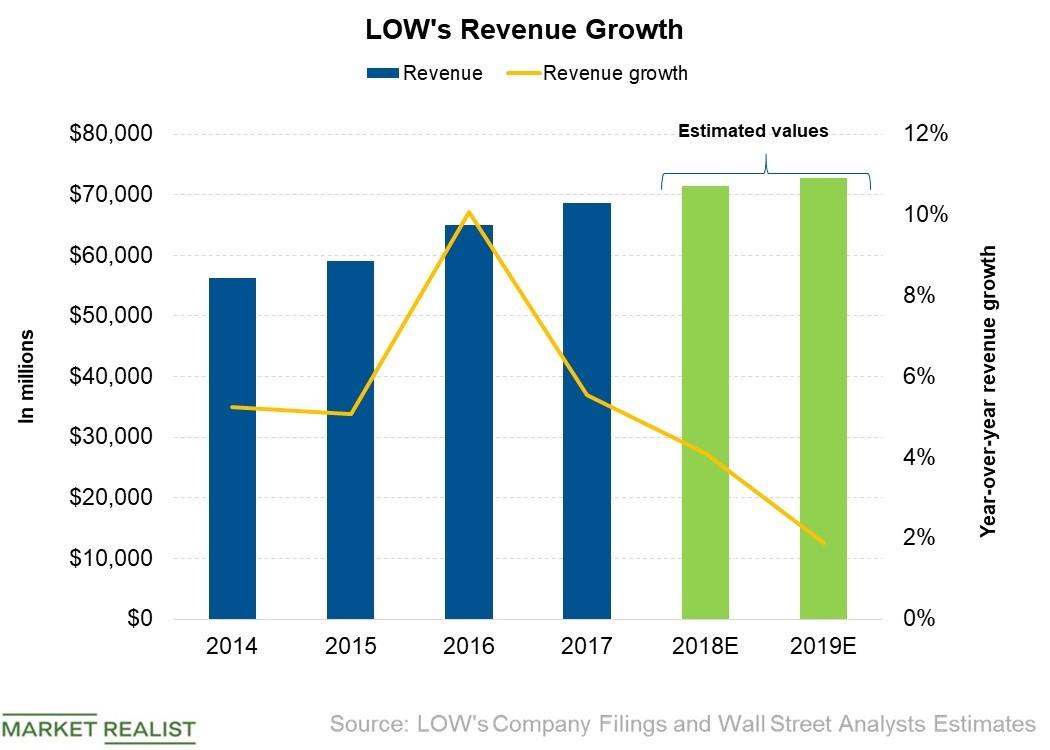

What Wall Street Expects for Lowe’s 4Q17 Revenue

Analysts expect Lowe’s (LOW) to post revenue of $15.33 billion in 4Q17, which represents a fall of 2.9% from $15.78 billion in 4Q16.

Inside Lowe’s Analyst Expectations for Revenue over the Next Four Quarters

For the next four quarters, analysts are expecting Lowe’s to post revenue of $68.9 billion—a growth of 3.4% over its ~$66.6 billion from the last four quarters.

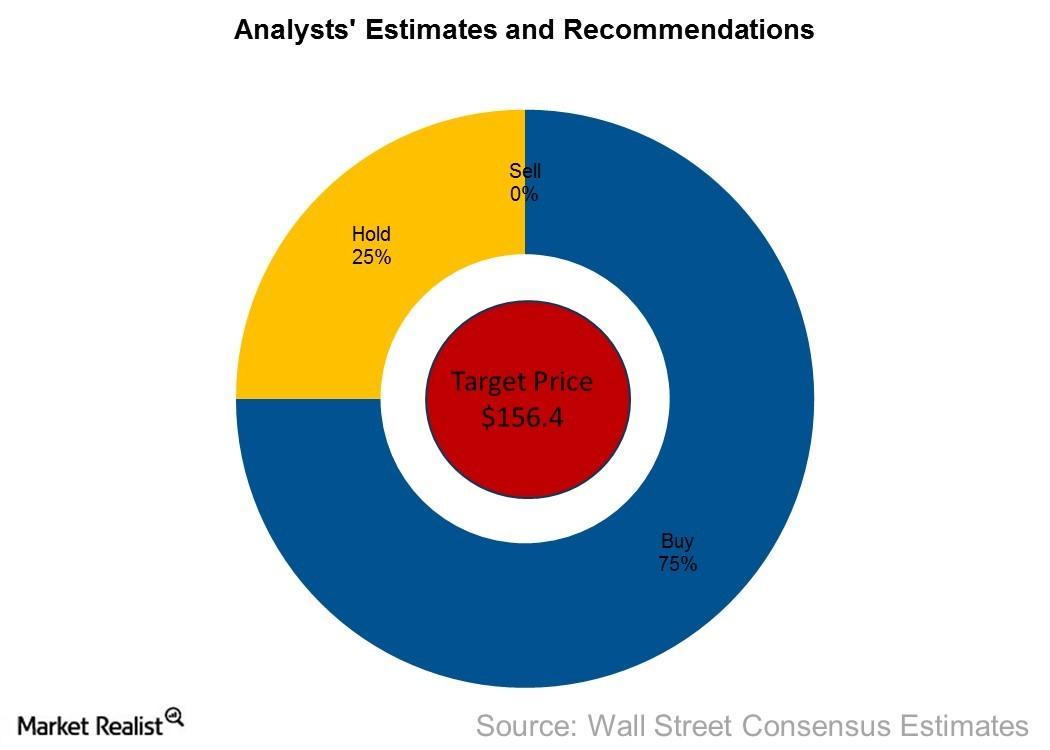

Home Depot on the Street: How the Analysts Are Leaning

As of April 27, 2017, analysts are expecting Home Depot’s stock price to touch $156.4 in the next 12 months, which represents a return potential of 0.2%.

Why Lowe’s Is Trying Hard to Woo Professional Customers

A professional customer is one who’s looking for products to complete projects for other customers.

Lowe’s Stock Rises after Impressive Q1 Performance

Today, Lowe’s reported its first-quarter earnings, which ended on May 1. The company reported an adjusted EPS of $1.77 on revenues of $19.68 billion.

Will Home Depot Meet Analysts’ Expectations in Q1?

Amid the financial turmoil due to COVID-19, Home Depot (NYSE:HD) continues to stand tall. The company stayed open since it sells essential products.

Should You Buy Home Depot after Its Recent Pullback?

As of April 9, Home Depot was trading at 20.1x analysts’ 2020 EPS estimate of $10.04 and at 18.3x analysts’ 2021 EPS estimate of $11.02.

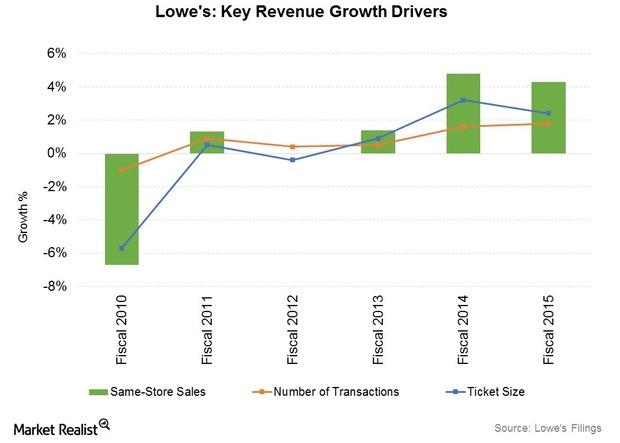

What’s Driving Sequential Same-Store Sales Growth for Lowe’s?

Lowe’s (LOW) has reported a positive trend in comparable store sales (XRT) for the past ten quarters.

How Home Depot Is Leveraging the Pro Customer Opportunity

Driving growth from sales to pro customers is a key growth opportunity for the world’s largest home improvement retailer.

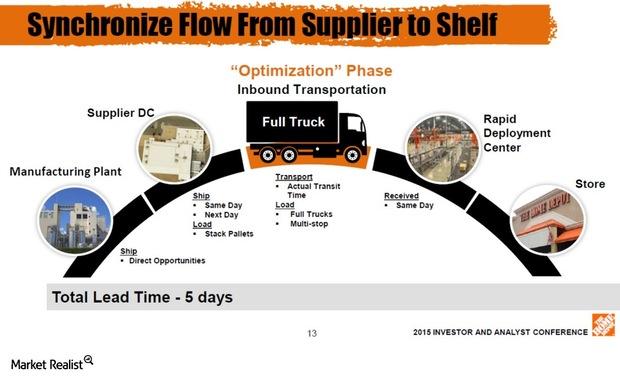

Supply Chain Sync: HD’s New Tool to Optimize Inventory Flow

Supply chain sync aims to optimize the logistics of moving products along the supply chain in the shortest and most cost-effective manner.

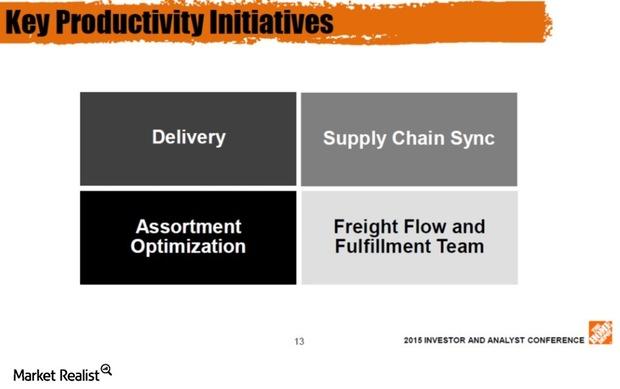

Productivity Enhancements: How Home Depot Is Trimming the Fat

Productivity enhancements resulted in improved profitability margins for the world’s number one retailer.

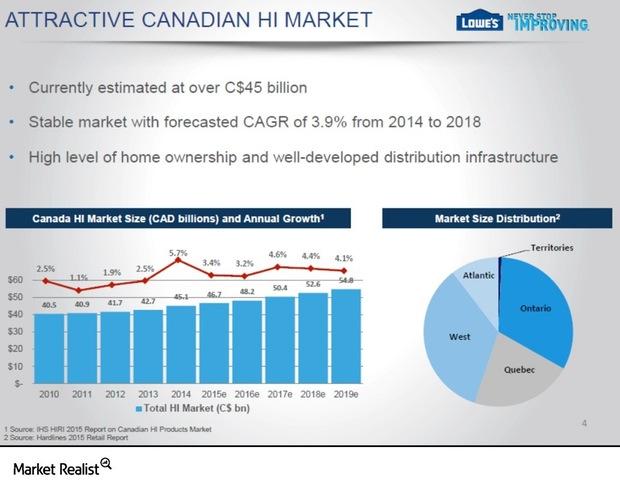

Market Share Play: Lowe’s Bid to Gain Scale in Canada with Rona

The Rona (RON.TO) acquisition should give Lowe’s (LOW) a market-leading position in Canada’s home improvement market, estimated at over $45 billion Canadian.

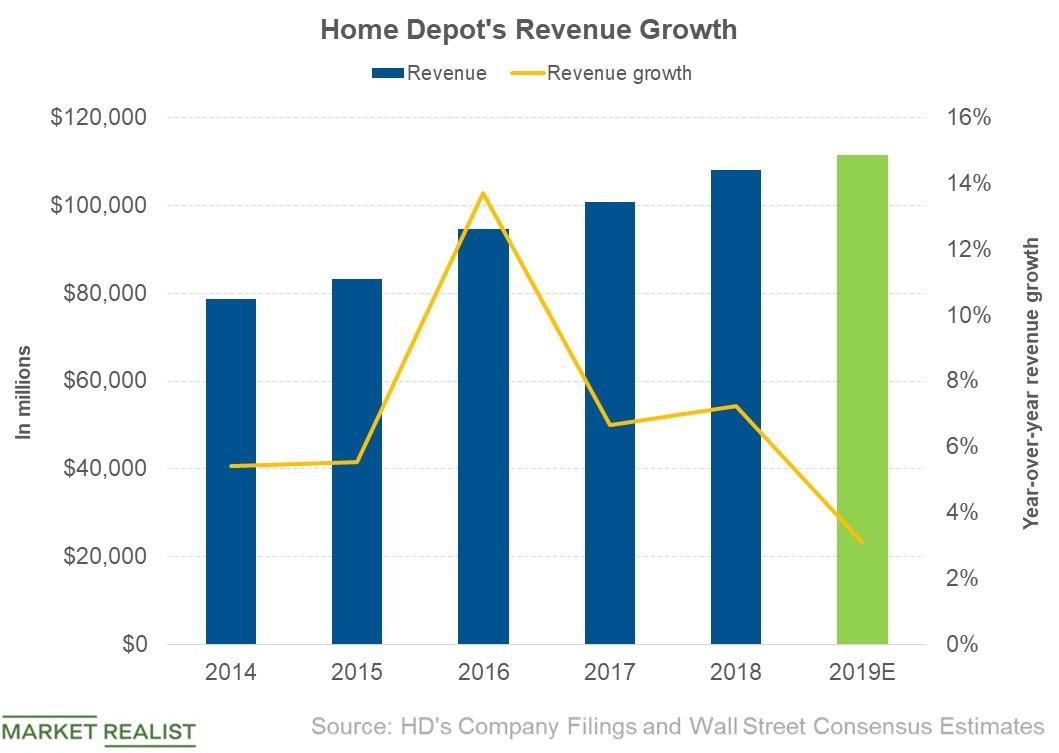

What to Expect of Home Depot’s Revenue in 2019

Home Depot’s (HD) management team expects its revenue to rise 3.3% this year, which also accounts for an extra week of operations in 2018.

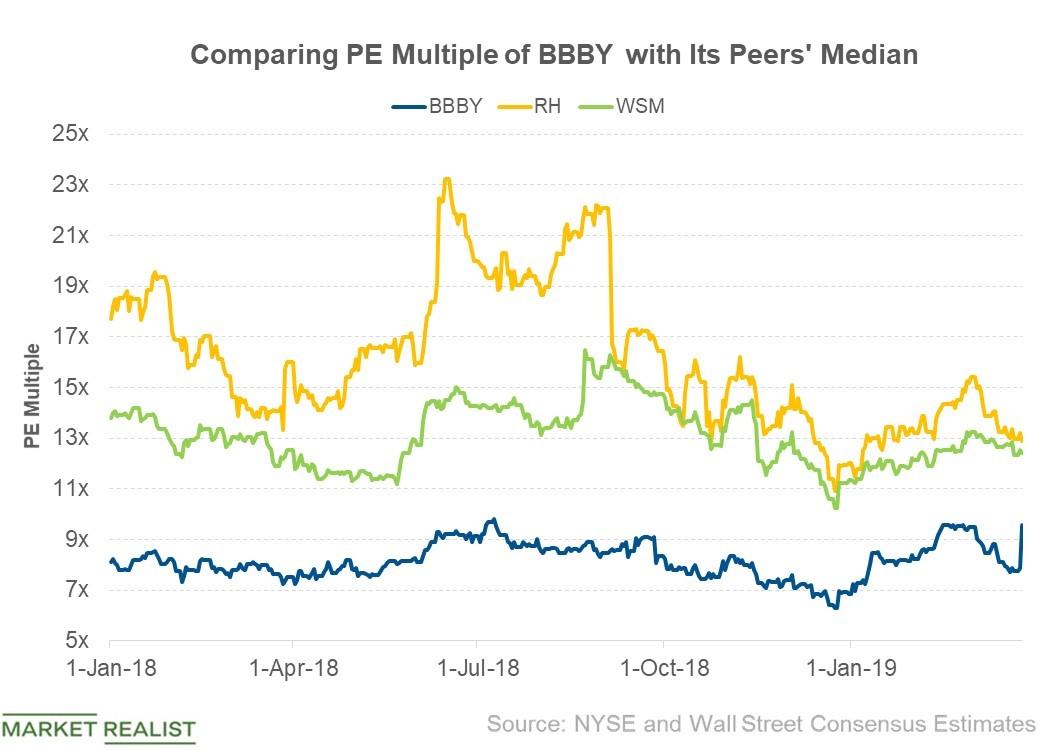

How Bed Bath & Beyond’s Valuation Stacks Up with Peers

Bed Bath & Beyond (BBBY) posted its third-quarter earnings on January 9, 2019.

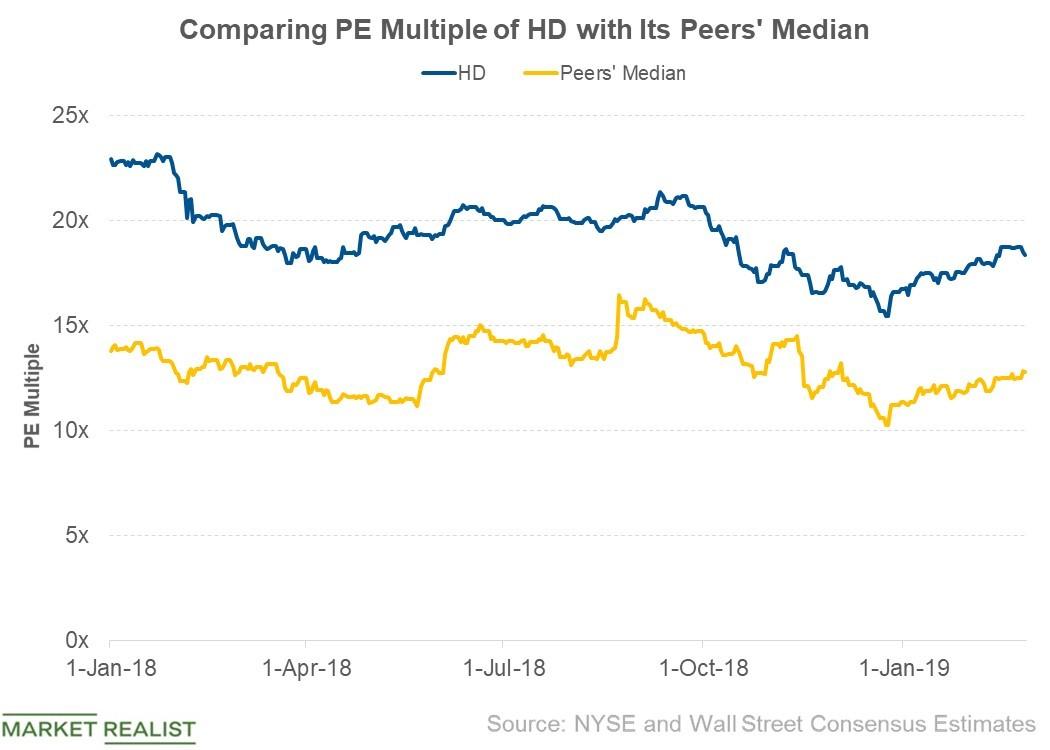

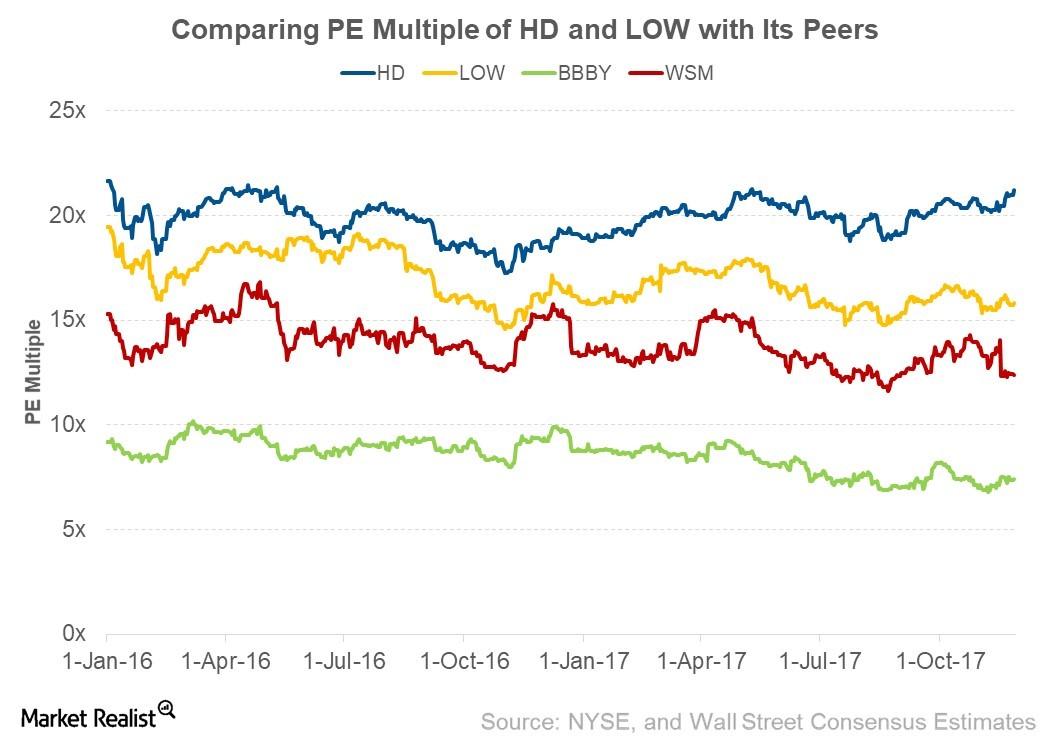

Home Depot’s Valuation Compared to Its Peers

Among the 33 analysts that follow Home Depot, 72.7% recommended a “buy,” while 27.3% recommended a “hold.”

Digging Deeper into Lowe’s Strategies

After streamlining its business, Lowe’s is focusing on four key areas to drive its sales.

How Home Depot Aims to Drive Its Sales

Home Depot’s integrated retail strategy To counter Amazon (AMZN), Home Depot (HD) has been focusing on its integrated retail strategy, One Home Depot. The strategy integrates its offline and online channels to enhance customers’ experience, which could be hard for Amazon to replicate. In last year’s third quarter, the company’s online sales grew 28%, and […]

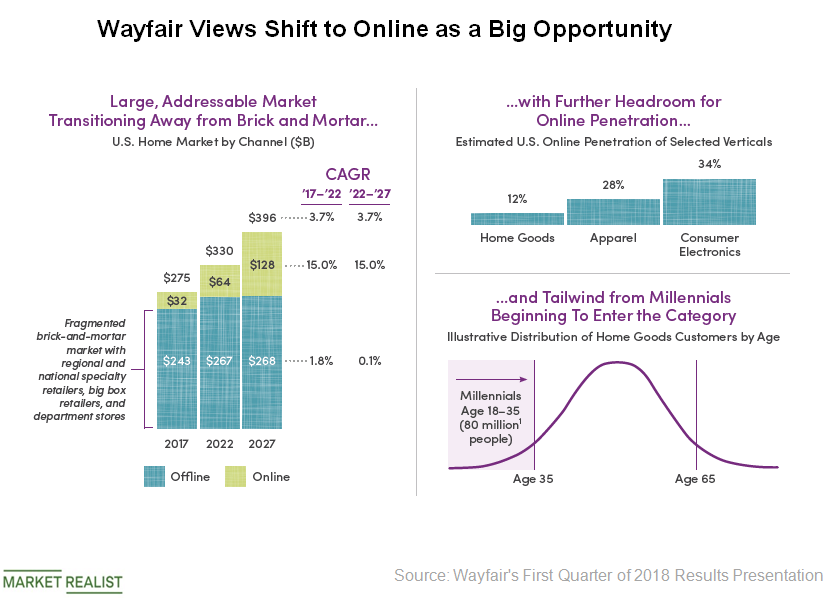

Why Most Analysts Rate Wayfair Stock a ‘Hold’

The majority of Wall Street analysts covering Wayfair (W) have maintained a “hold” rating on the stock. Here’s what you need to know.

What Are Wayfair’s Long-Term Growth Strategies?

Wayfair (W) is aggressively investing in its business to enhance long-term growth prospects.

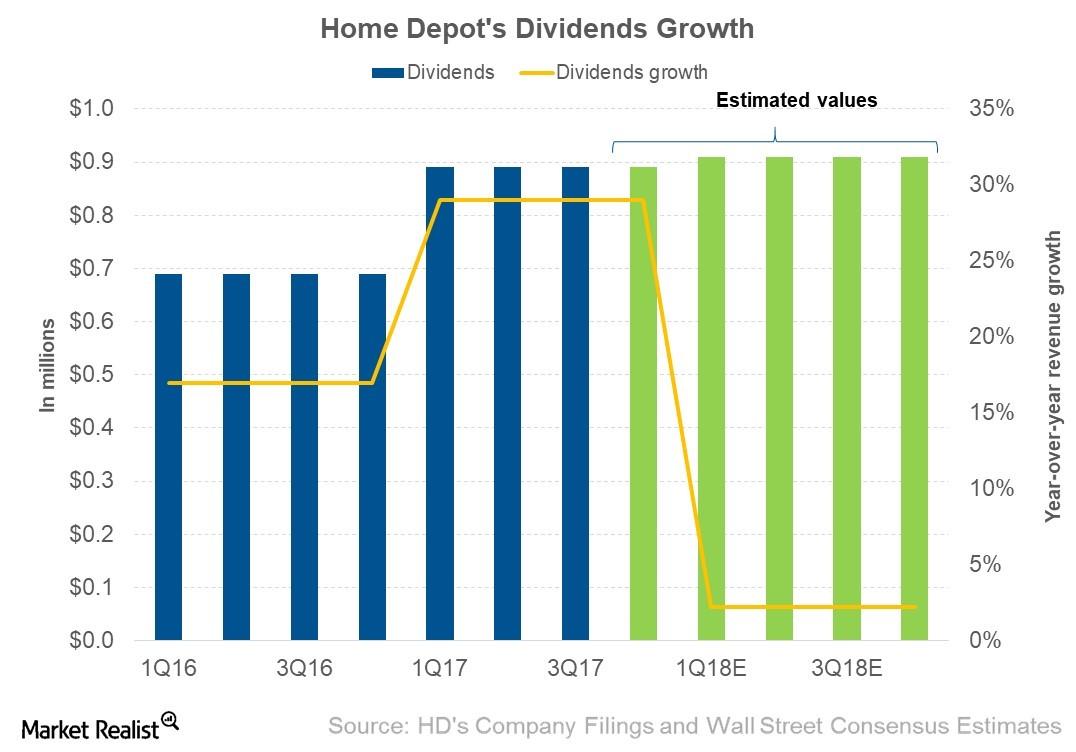

Understanding Home Depot’s Dividend Policy

In the first three quarters of 2017, Home Depot (HD) paid dividends of $0.89 per share. In 3Q17, it paid dividends at a payout ratio of 48.2%.

Valuation Multiples: Comparing Home Depot, Lowe’s, and Peers

Valuation multiples help investors determine market values for comparable companies. For our analysis, we consider forward PE (price-to-earnings) multiples due to high visibility in Home Depot (HD) and Lowe’s Companies’ (LOW) earnings.

Home Depot’s Same-Store Sales Growth Was Higher than Lowe’s

Home Depot (HD) posted SSSG of 6.3%, while its US stores posted SSSG of 6.6%. Its stores in Mexico and Canada also posted positive SSSG.

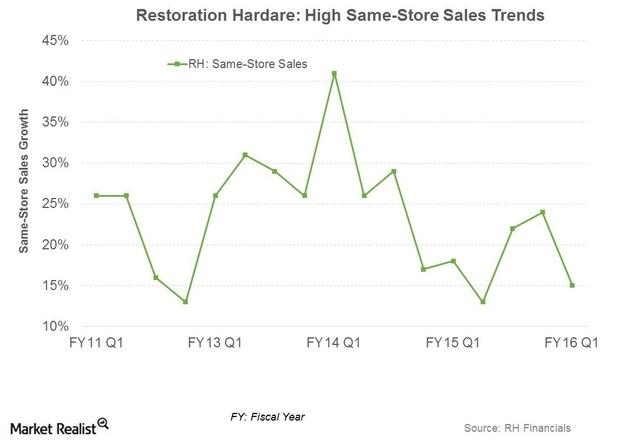

Will RH’s 2Q17 Earnings Boost Its Stock Price?

Luxury home furnishings retailer RH (RH) will announce its 2Q17 earnings after the market closes on September 6, 2017.

Multichannel Retailing Drives Growth for Restoration Hardware

Restoration Hardware, the luxury furniture retailer, is one of the most successful adapters of omnichannel retailing in the industry. It uses its stores as brand showrooms.

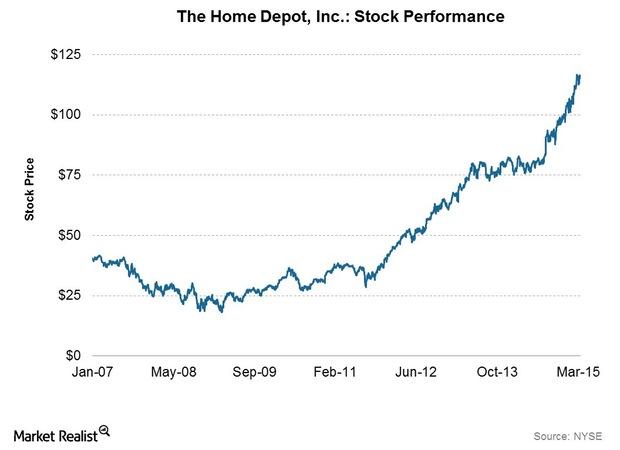

Home Depot (HD): Built of Strong Stuff

Fiscal 2015 was a record year for Home Depot. The stock has returned over 47% over the past year and over 10% year-to-date.