How Analysts Rate Bed Bath & Beyond after 3Q17 Earnings

As of December 21, 2017, Bed Bath & Beyond (BBBY) stock was trading at $21.50. That same day, analysts were expecting the stock to reach $22.78 in the next 12 months.

Dec. 4 2020, Updated 10:53 a.m. ET

Target price

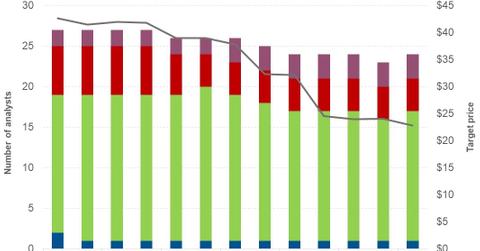

As of December 21, 2017, Bed Bath & Beyond (BBBY) stock was trading at $21.50. That same day, analysts were expecting the stock to reach $22.78 in the next 12 months, which represents a return potential of 5.9%.

Before BBBY announced its 3Q17 earnings, analysts had forecast a target price of $23.88. The decline in BBBY’s margins and the rise in advertising expenses could have compelled analysts to lower their target prices. After the 3Q17 earnings release, Wedbush cut its target price from $25 to $23 and maintained its “neutral” rating. Barclays also lowered its target price from $30 to $25, and Morgan Stanley cut its target price from $23 to $22.

Below are the target prices and return potentials of BBBY’s peers:

Analyst ratings

Of the 24 analysts following BBBY, 4.2% are recommending a “buy,” 66.7% are recommending a “hold,” and 29.2% are recommending a “sell” for the stock. BBBY stock typically moves in tandem with analyst ratings. When analysts raise their target prices, the stock usually rises, and vice versa.

Currently, BBBY is trading below analysts’ target price. However, that doesn’t mean an automatic “buy.” Investors should analyze all the various parameters we’ve covered in this series before making any investment decisions.