Lowe's Companies Inc

Latest Lowe's Companies Inc News and Updates

Lowe's CEO Marvin Ellison Is One of Only Six Black Fortune 500 CEOs Currently

Lowe's CEO Marvin Ellison is one of only six Black Fortune 500 company CEOs, though he doesn't own Lowe's. Is Lowe's a Black-owned company?

Lowe's Owns and Sells Kobalt Tools, Products Are Made in China

Kobalt, one of Lowe's biggest tool brands, makes products such as drills and saws. Who makes Kobalt tools for Lowe's? Kobalt isn't made in the U.S.

Lowe's CEO Marvin Ellison Has a Multi-Million-Dollar Net Worth

Lowe's CEO Marvin Ellison has a multi-million-dollar net worth. How did Ellison make his millions?

Retail Stocks During Inflation—How to Tweak Your Portfolio

Inflation impacts retail stocks in a unique way. Here's what to expect, so you can tweak your portfolio as needed.

The Hurricane Factor: Stocks That Spike During Hurricane Season

Hurricanes aren't just a sign of climate change and natural disasters. For some investors, hurricanes are an opportunity to build wealth.

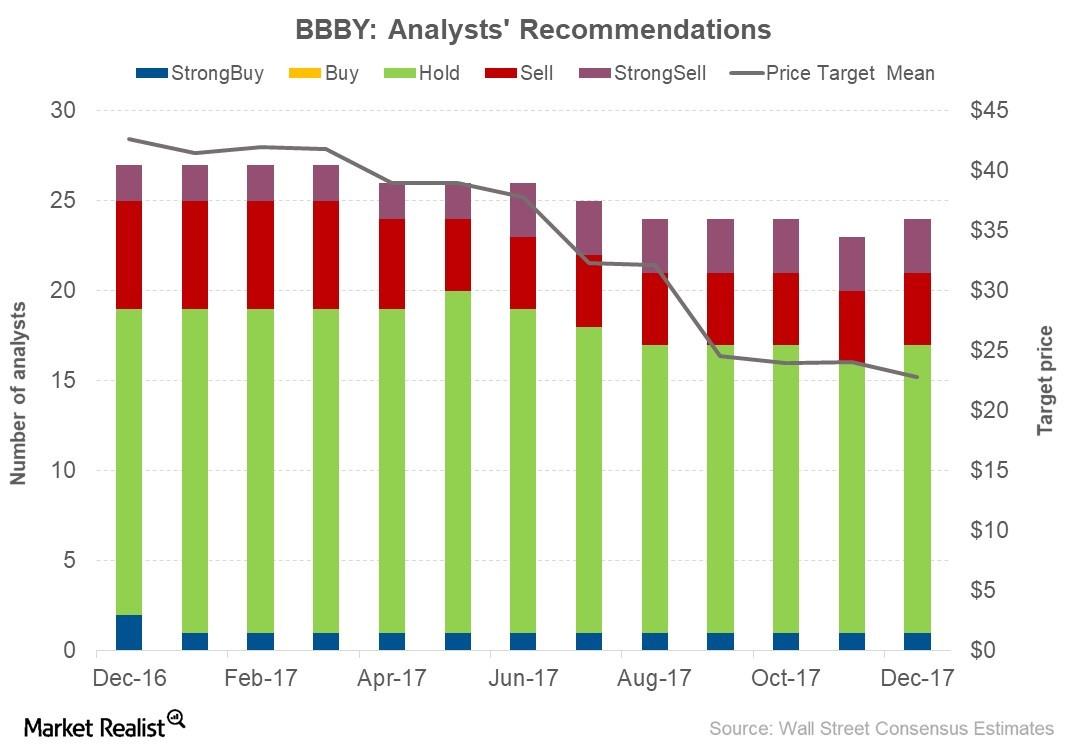

How Analysts Rate Bed Bath & Beyond after 3Q17 Earnings

As of December 21, 2017, Bed Bath & Beyond (BBBY) stock was trading at $21.50. That same day, analysts were expecting the stock to reach $22.78 in the next 12 months.

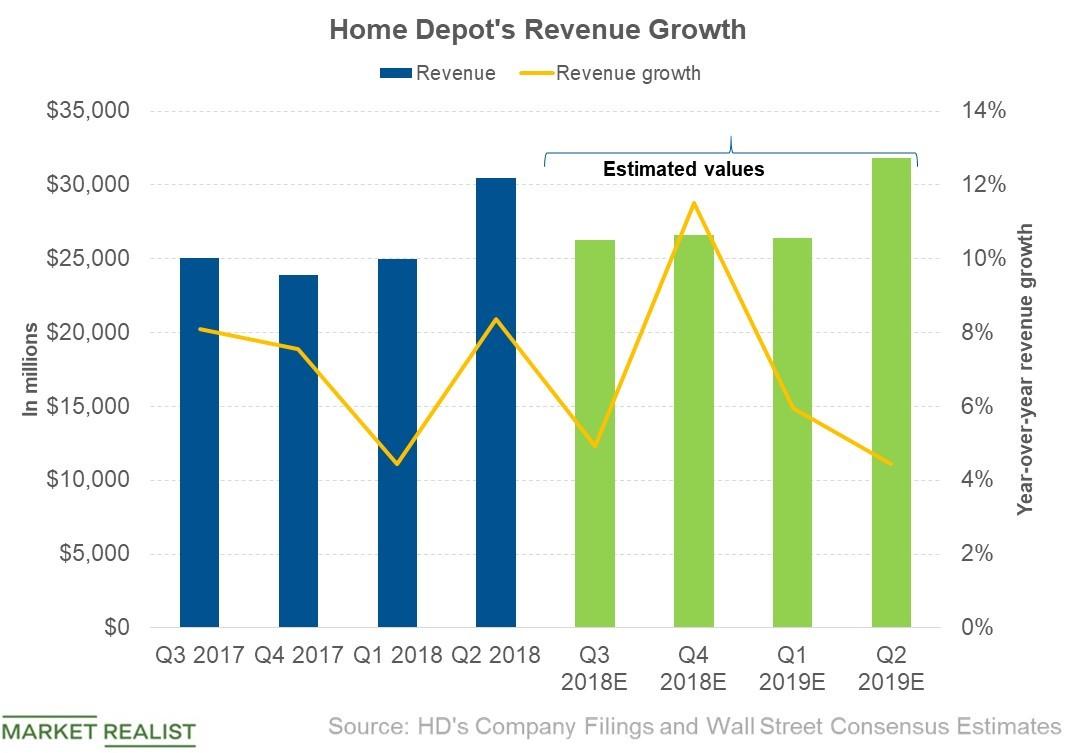

Why Analysts Expect Home Depot’s Revenue to Rise in Q3

Analysts expect Home Depot (HD) to post third-quarter revenue of $26.3 billion, a rise of 4.9% year-over-year.

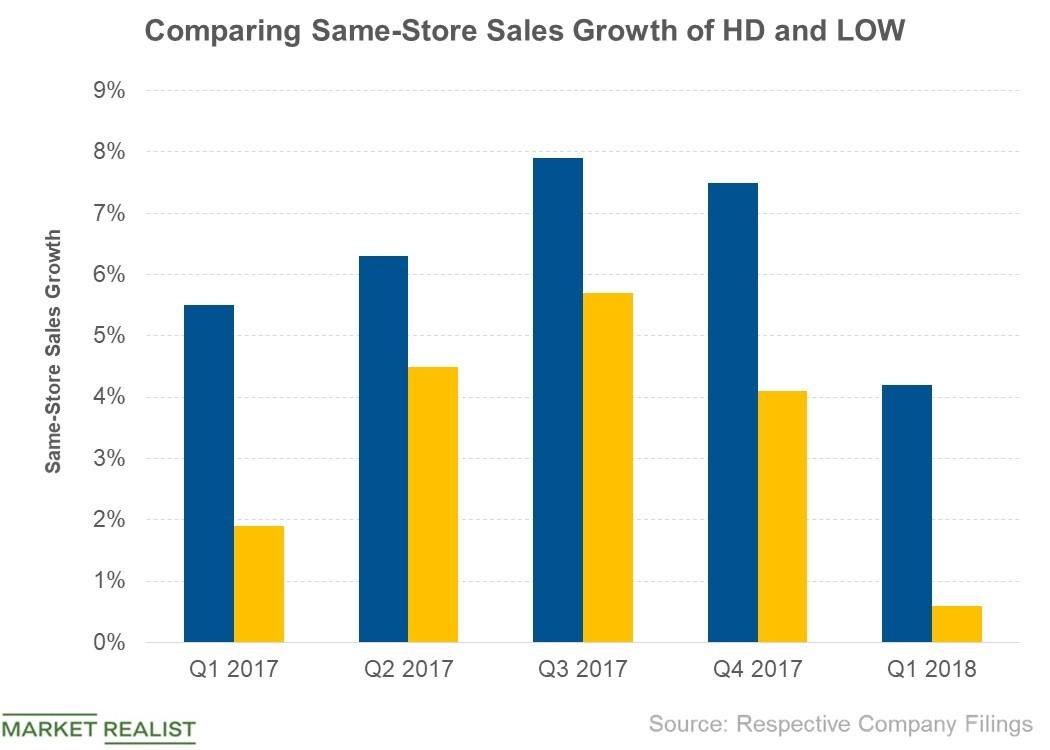

Why Both HD and LOW Failed to Meet Growth Estimates in Q1 2018

In the first quarter, Home Depot (HD) posted SSSG (same-store sales growth) of 4.2%, lower than analysts’ consensus expectation of 5.4%.

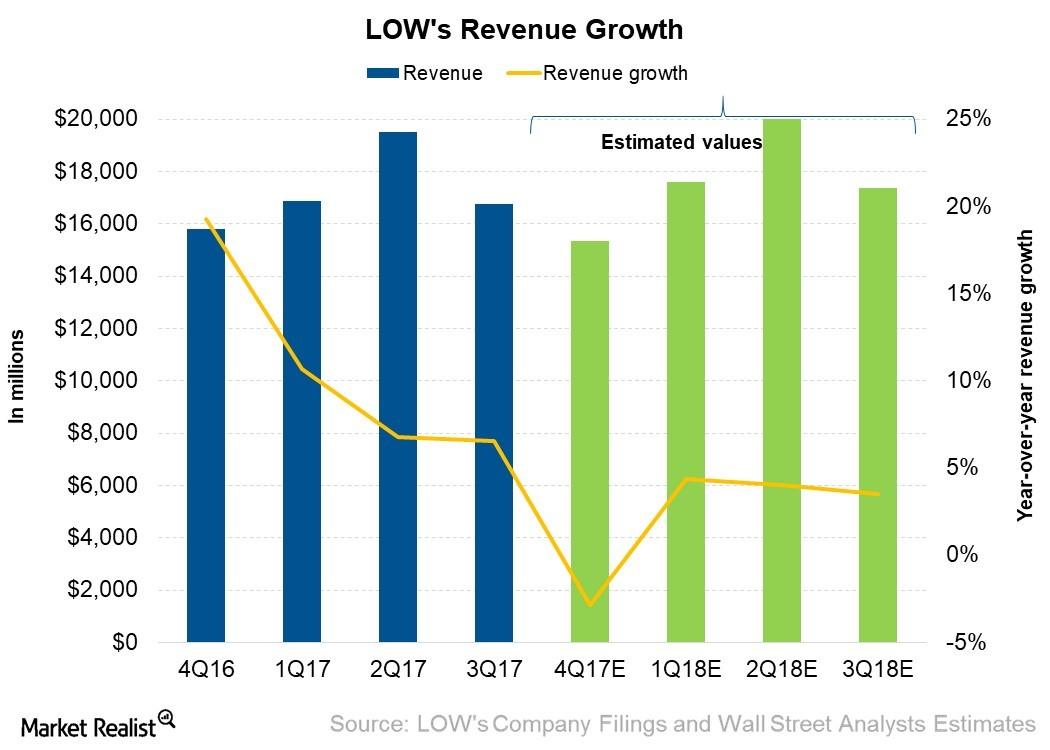

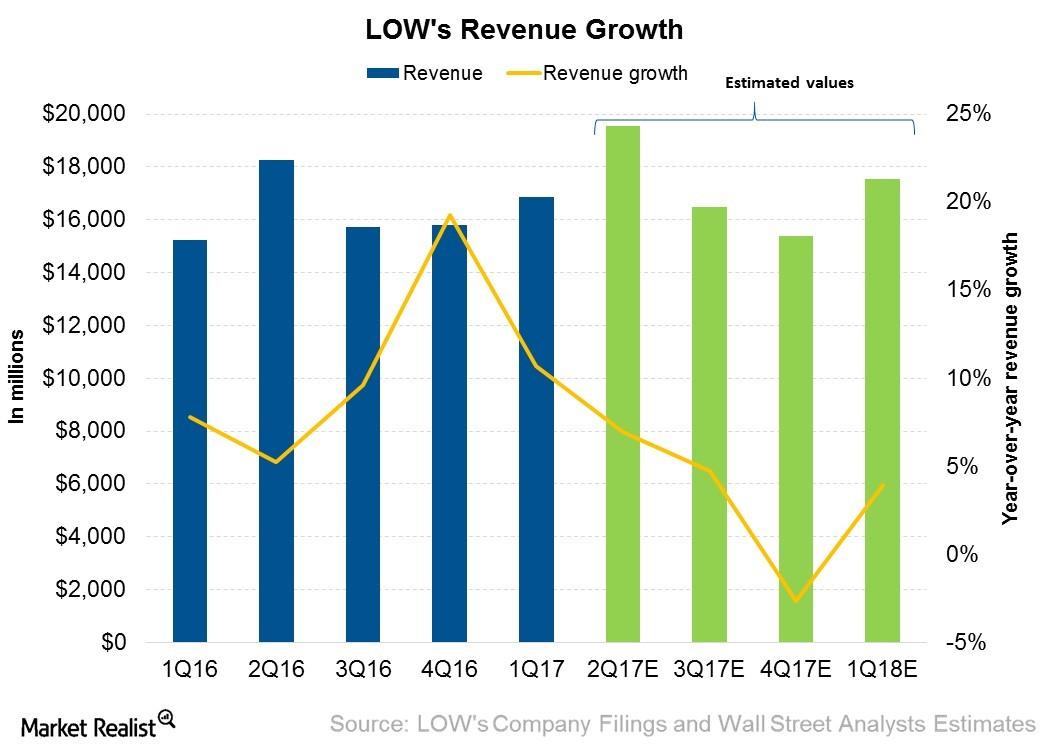

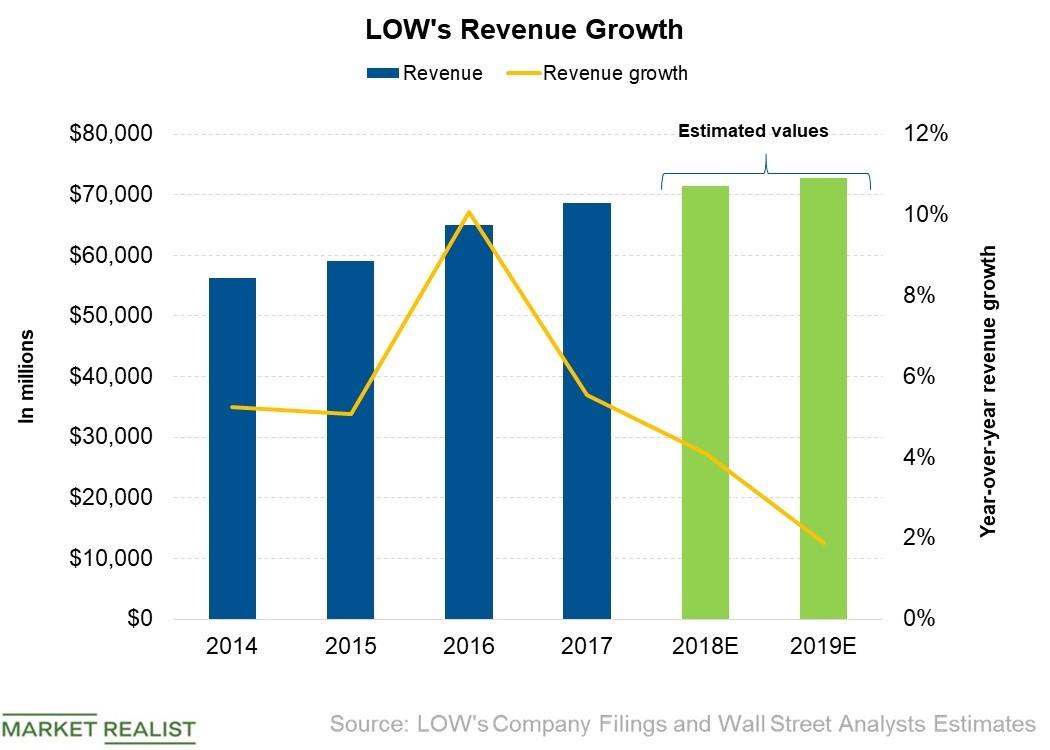

What Wall Street Expects for Lowe’s 4Q17 Revenue

Analysts expect Lowe’s (LOW) to post revenue of $15.33 billion in 4Q17, which represents a fall of 2.9% from $15.78 billion in 4Q16.

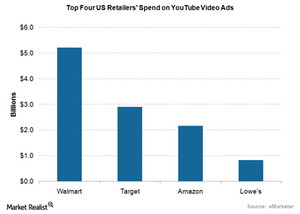

Why Retailers Are Increasing Their Ad Spending on YouTube

Walmart, Target, Amazon, and Lowe’s were the four retailers in the United States that spent the most on YouTube video ads last year.

Inside Lowe’s Analyst Expectations for Revenue over the Next Four Quarters

For the next four quarters, analysts are expecting Lowe’s to post revenue of $68.9 billion—a growth of 3.4% over its ~$66.6 billion from the last four quarters.

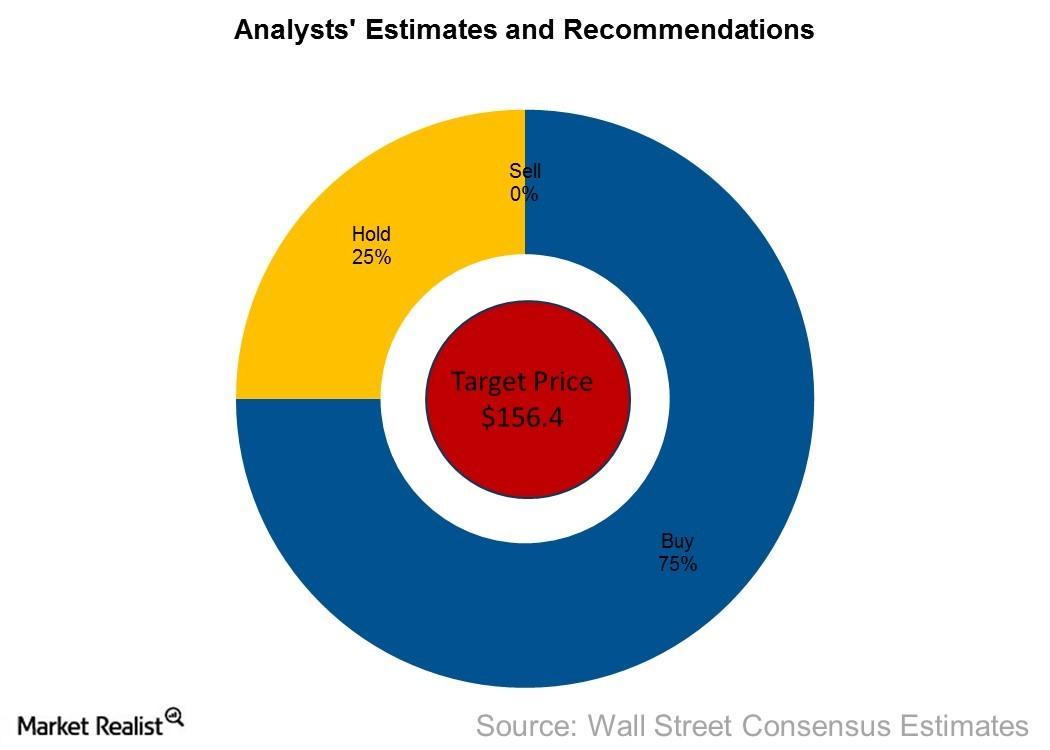

Home Depot on the Street: How the Analysts Are Leaning

As of April 27, 2017, analysts are expecting Home Depot’s stock price to touch $156.4 in the next 12 months, which represents a return potential of 0.2%.

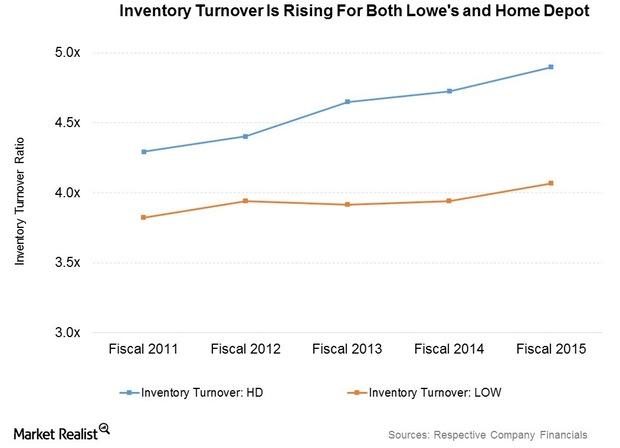

What Are Lowe’s Supply Chain and Inventory Management Policies?

Lowe’s inventory turnover came in at 4.1x in fiscal 2015 compared to 4.9x for Home Depot (HD).

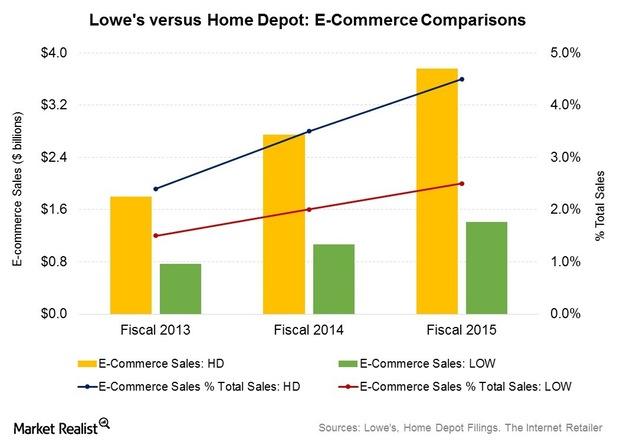

How Does Lowe’s E-Commerce Performance Compare to Rivals?

Lowe’s (LOW) derived about 2.5% of its sales from the e-commerce channel, or an estimated $1.4 billion, in fiscal 2015.

Why Lowe’s Is Trying Hard to Woo Professional Customers

A professional customer is one who’s looking for products to complete projects for other customers.

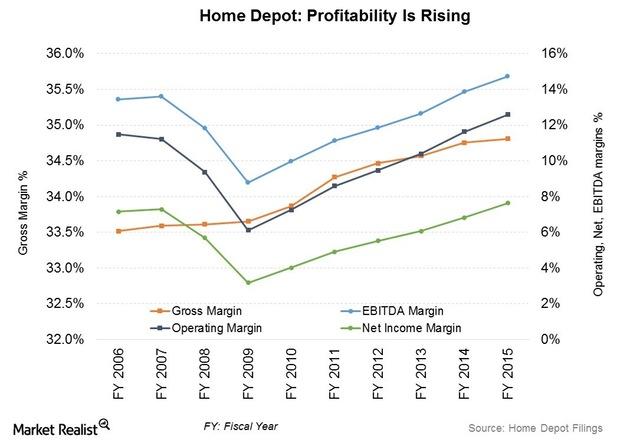

Home Depot: Margins Up on Higher Sales, Lower Expenses

Home Depot’s margins are ahead of those reported by the number-two home improvement (XHB) (ITB) retailer, Lowe’s (LOW), over the past twelve months.

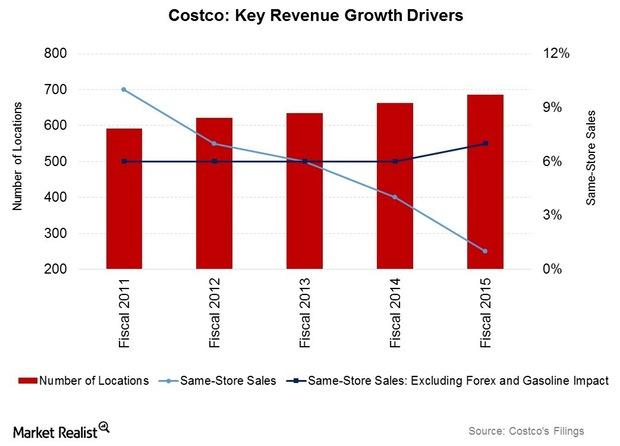

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

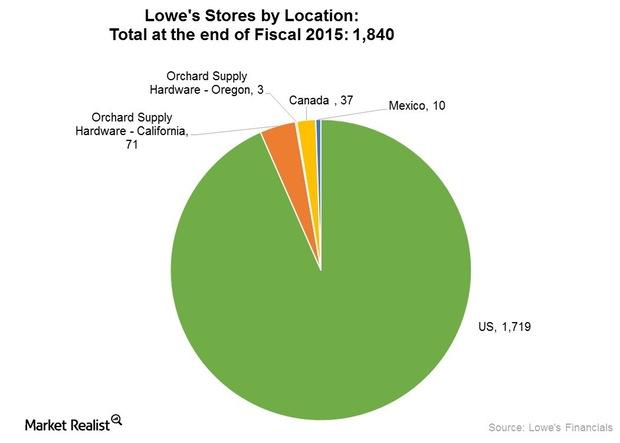

Why Lowe’s Bought Orchard Supply and Is Eyeing Smaller Stores

Lowe’s is also experimenting with the idea of rolling out other smaller format stores like City Center stores in other under-penetrated and high-density urban areas in the US.

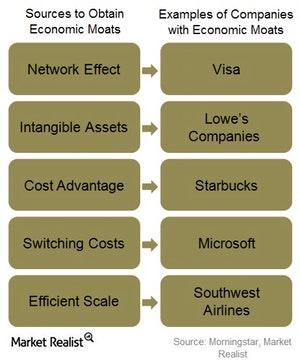

The Idea behind Economic Moats

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. she

Lowe’s Retail and Pro Customers: Who Accounts for More Sales?

The retail customer accounts for about 70% of Lowe’s sales. However, retail customers account for about two-thirds of Home Depot’s (HD) customer base.

Which International Opportunities Is Lowe’s Betting On?

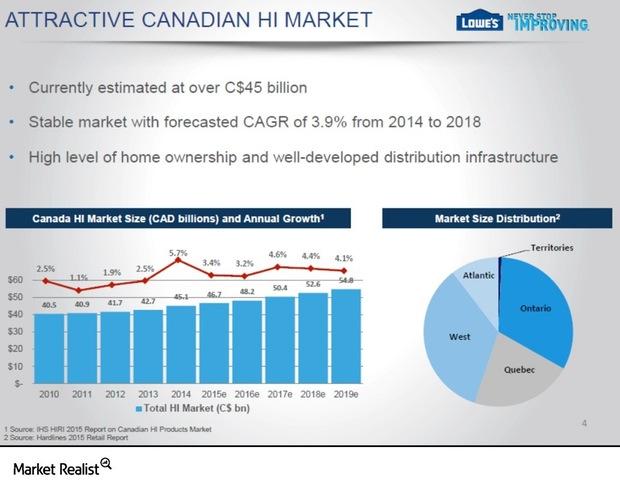

Lowe’s (LOW) operates stores in the select international markets of Canada and Mexico.

The Lowe’s-Rona Transaction: Sizing Up the Potential Synergies

Lowe’s (LOW) expects the Rona (RON.TO) transaction to be accretive to its earnings per share or EPS from the very first year after the acquisition.

Will Lowe’s Outperform Home Depot in 2020?

So far this year, Home Depot and Lowe’s have outperformed the broader equity markets. They have returned 16.7% and 9.4% YTD.

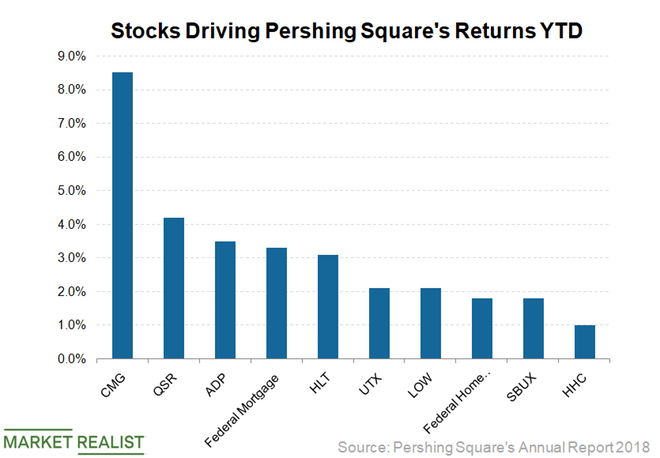

Are Bill Ackman’s Investment Strategies Successful?

In the first quarter of 2020, activist hedge fund manager Bill Ackman made a windfall profit of $2 billion. He was short on the market in March 2020.

Lowe’s Stock Rises after Impressive Q1 Performance

Today, Lowe’s reported its first-quarter earnings, which ended on May 1. The company reported an adjusted EPS of $1.77 on revenues of $19.68 billion.

Q1 13F: How Bill Ackman Played the US Stock Market Crash

So far in 2020, Bill Ackman’s timing has been impeccable. He made over $2 billion by shorting stocks as US stock markets crashed in the first quarter.

Will Home Depot Meet Analysts’ Expectations in Q1?

Amid the financial turmoil due to COVID-19, Home Depot (NYSE:HD) continues to stand tall. The company stayed open since it sells essential products.

Should You Buy Home Depot after Its Recent Pullback?

As of April 9, Home Depot was trading at 20.1x analysts’ 2020 EPS estimate of $10.04 and at 18.3x analysts’ 2021 EPS estimate of $11.02.

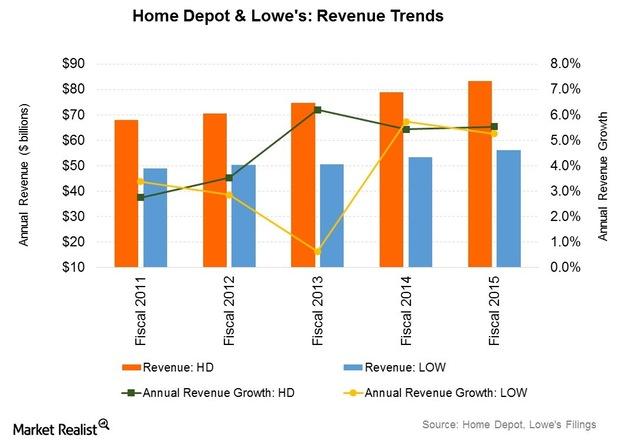

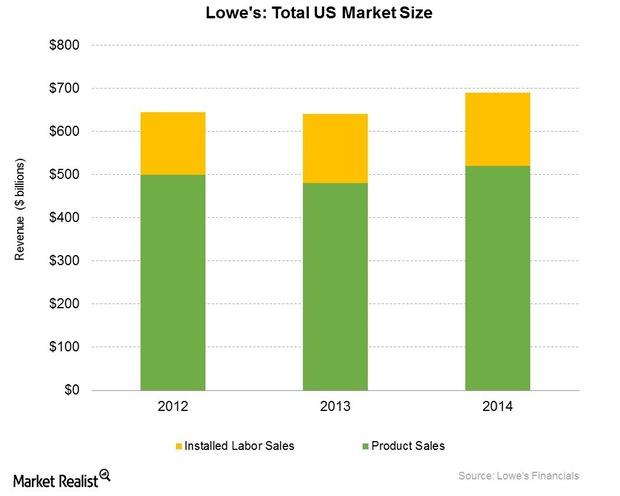

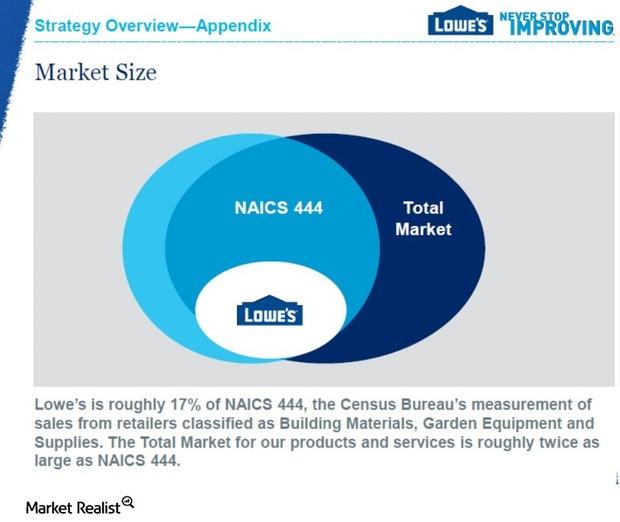

Why Home Depot and Lowe’s Are Leaders in Home Improvement Retail

Lowe’s (LOW) operates in the home improvement retail industry. The company competes with a number of retail and wholesale players.

Porter’s 5 Forces: Lowe’s Position in a Competitive Industry

Lowe’s (LOW) operates in the home improvement industry where most products, especially building materials, are largely standardized and undifferentiated.

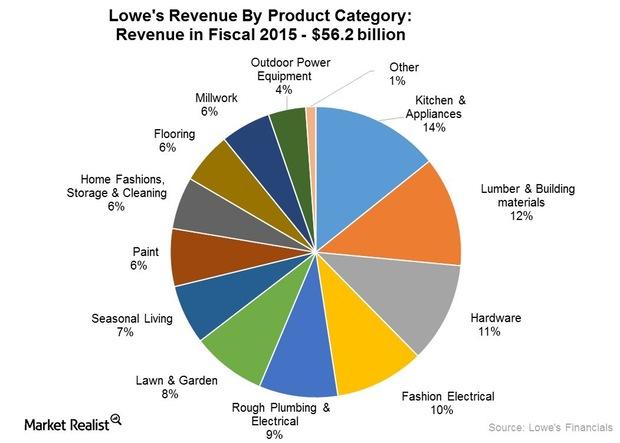

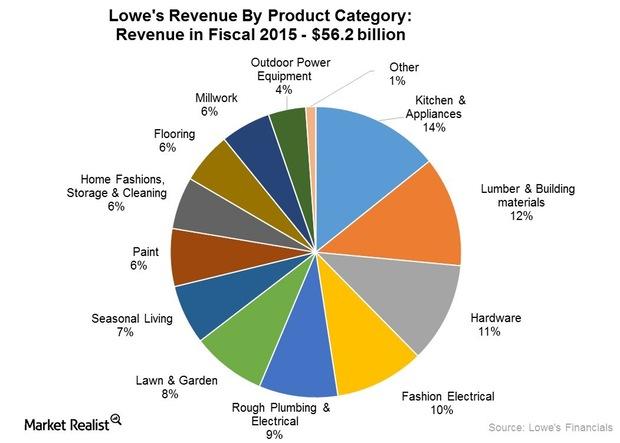

Analyzing Lowe’s Merchandise and Services Assortment

Lowe’s sources its merchandise from over 7,000 suppliers with no supplier accounting for more than 6% of sales.

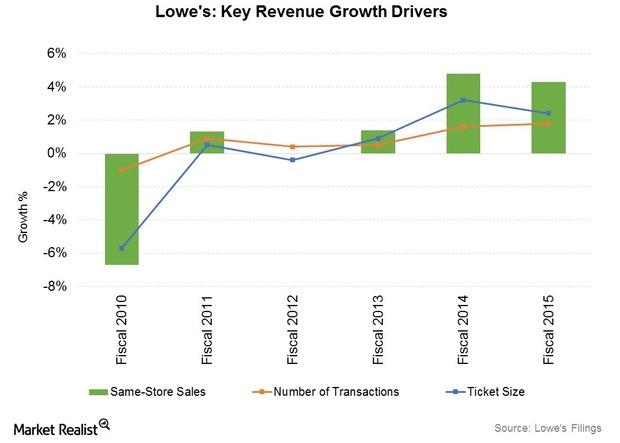

What’s Driving Sequential Same-Store Sales Growth for Lowe’s?

Lowe’s (LOW) has reported a positive trend in comparable store sales (XRT) for the past ten quarters.

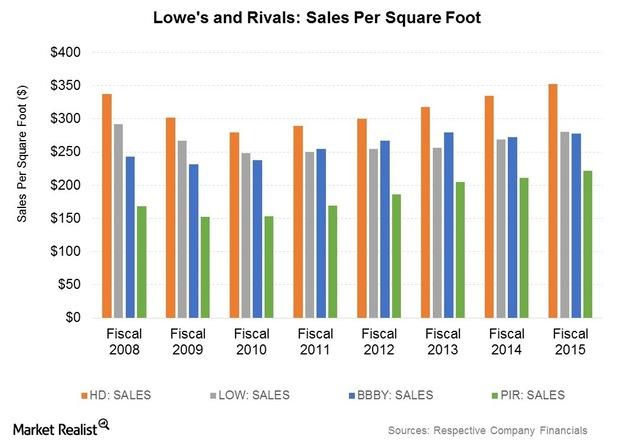

Why Lowe’s Store Productivity Is Growing Faster than Home Depot’s

One of the ways retailers can track their store performance is via productivity measures like sales and profitability per retail square foot.

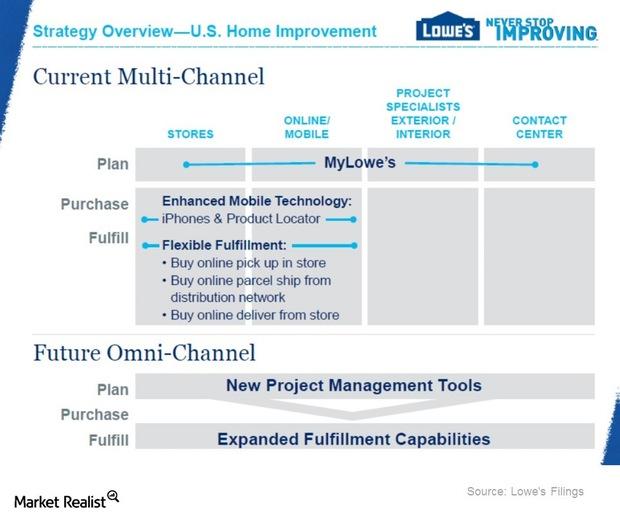

How Lowe’s Is Leveraging Its Omni-Channel Opportunity

Going omni-channel makes natural sense for both Lowe’s and Home Depot. Both retailers have a massive store network in the US, which can double as strategic fulfillment centers.

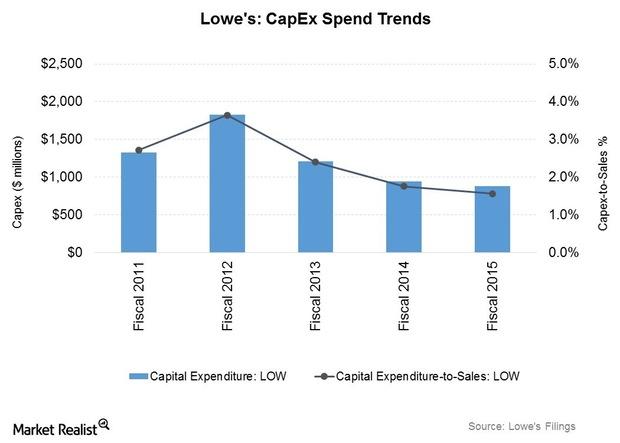

How Lowe’s Is Allocating Its Capital Expenditure Budget

Historically, a large percentage of Lowe’s (LOW) capital expenditure (or capex) has been spent on new store rollouts.

How Home Depot Is Leveraging the Pro Customer Opportunity

Driving growth from sales to pro customers is a key growth opportunity for the world’s largest home improvement retailer.

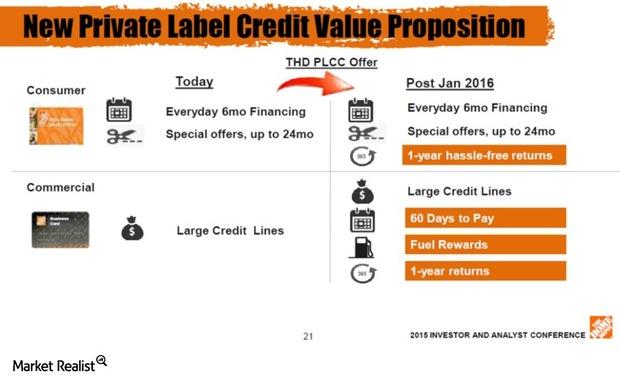

How Home Depot Drives Membership Loyalty With Pro Customers

The Home Depot’s (HD) focus on the pro customer allows the retailer to compete in the installations market and the product demand the services create.

Market Share Play: Lowe’s Bid to Gain Scale in Canada with Rona

The Rona (RON.TO) acquisition should give Lowe’s (LOW) a market-leading position in Canada’s home improvement market, estimated at over $45 billion Canadian.

Analyzing Lowe’s YTD Sales Performance in Fiscal 2016

Lowe’s sales performance and growth in fiscal 2016 have been robust so far, with net sales rising by 4.9% and same-store sales rising by 4.6%.

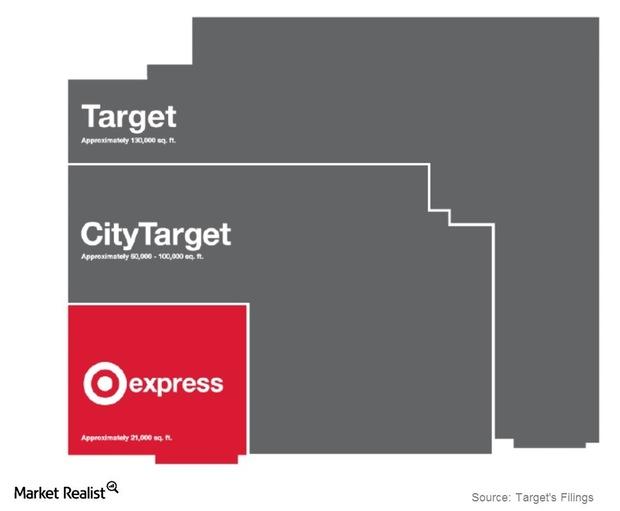

Why Target Is Looking at Flexible Format Stores in the US Market

Target operates 1,792 stores in the United States under multiple store formats. Its merchandise assortment differs by store, store location, and store size.

Home Depot: Why Did Guggenheim Downgrade the Stock?

On Tuesday, Guggenheim lowered its outlook on Home Depot (HD) stock. Notably, Guggenheim downgraded the stock to “neutral.”

How the Stock Market Is Being Supported by Consumption

Despite the trade war and the inverted yield curve, the S&P 500 Index is down 1.8% this month. Its resiliency reflects the US consumer sector’s strength.

Lowe’s Revenues: What to Expect in 2019?

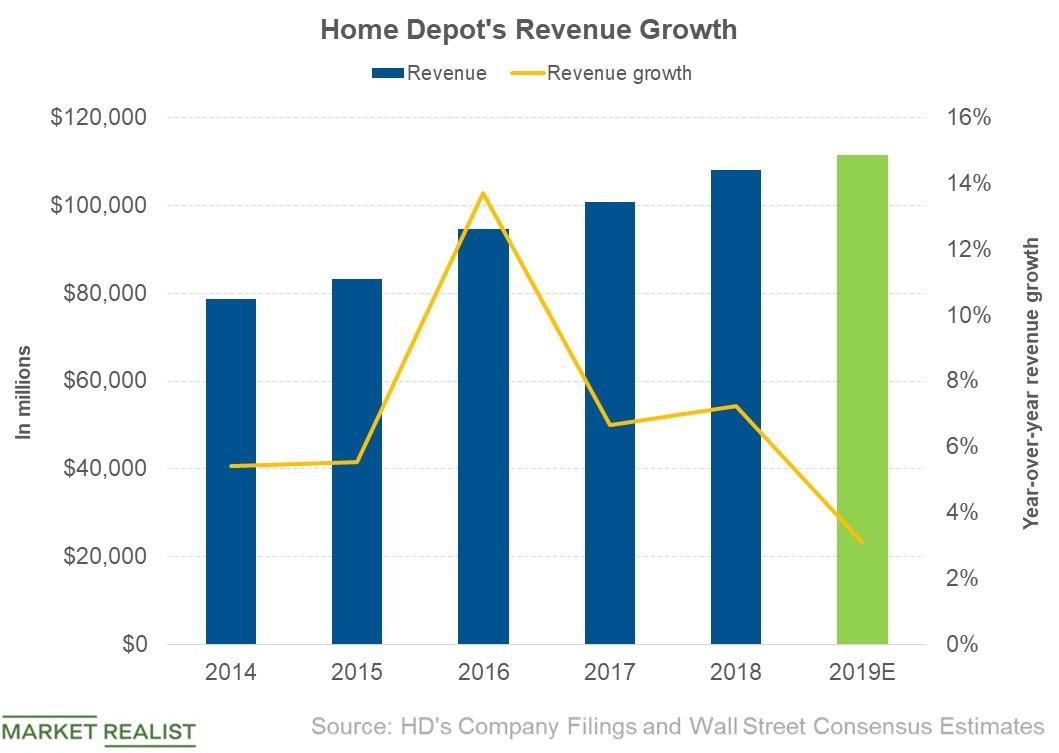

For 2019, analysts expect Home Depot (HD) to report revenues of $111.4 billion in 2019—a rise of 2.9% from $108.2 billion in 2018.

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

What to Expect of Home Depot’s Revenue in 2019

Home Depot’s (HD) management team expects its revenue to rise 3.3% this year, which also accounts for an extra week of operations in 2018.

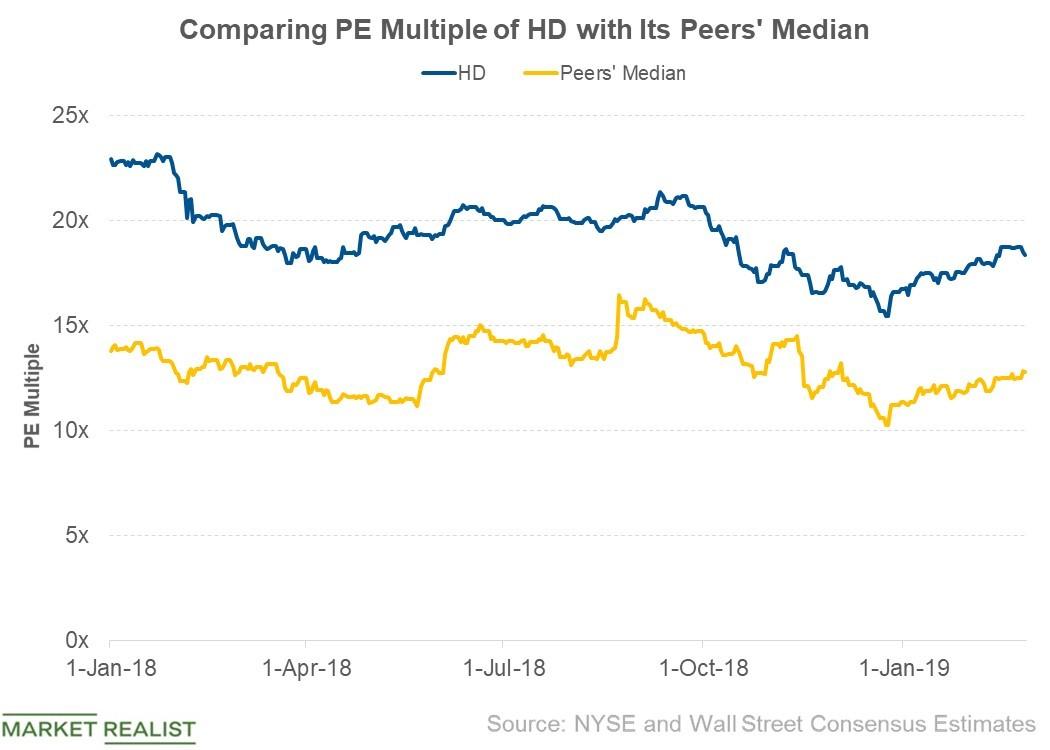

Home Depot’s Valuation Compared to Its Peers

Among the 33 analysts that follow Home Depot, 72.7% recommended a “buy,” while 27.3% recommended a “hold.”

Digging Deeper into Lowe’s Strategies

After streamlining its business, Lowe’s is focusing on four key areas to drive its sales.

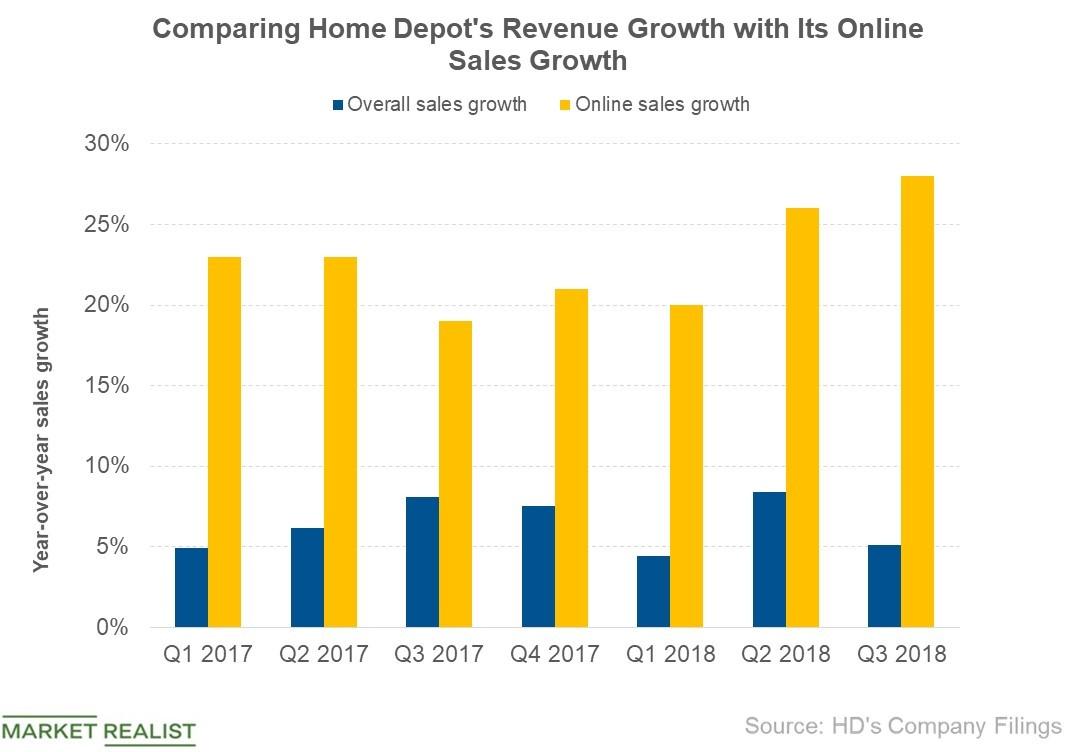

How Home Depot Aims to Drive Its Sales

Home Depot’s integrated retail strategy To counter Amazon (AMZN), Home Depot (HD) has been focusing on its integrated retail strategy, One Home Depot. The strategy integrates its offline and online channels to enhance customers’ experience, which could be hard for Amazon to replicate. In last year’s third quarter, the company’s online sales grew 28%, and […]

Home Depot Has Outperformed Lowe’s Revenue Growth in 2018

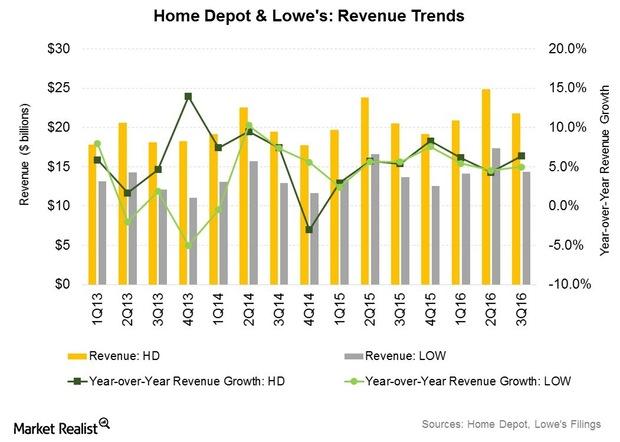

In the first three quarters of 2018, Home Depot posted revenues of $81.71 billion—6.1% growth from $77.02 billion in the first three quarters of 2017.

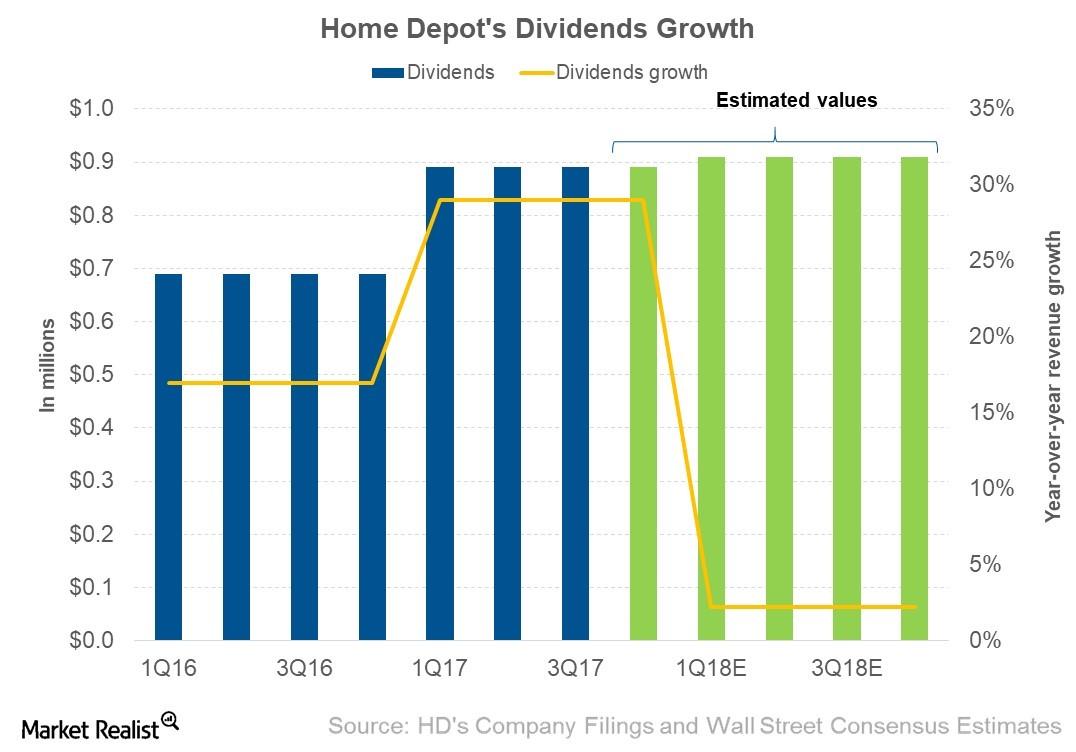

Understanding Home Depot’s Dividend Policy

In the first three quarters of 2017, Home Depot (HD) paid dividends of $0.89 per share. In 3Q17, it paid dividends at a payout ratio of 48.2%.