Lowe's Companies Inc

Latest Lowe's Companies Inc News and Updates

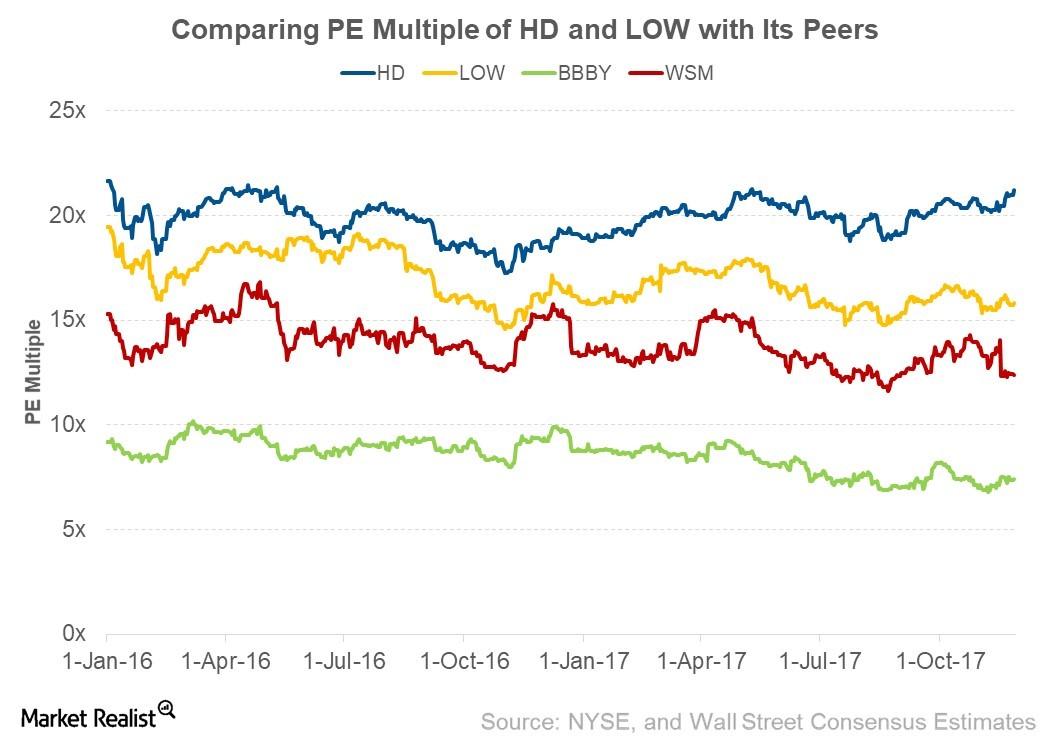

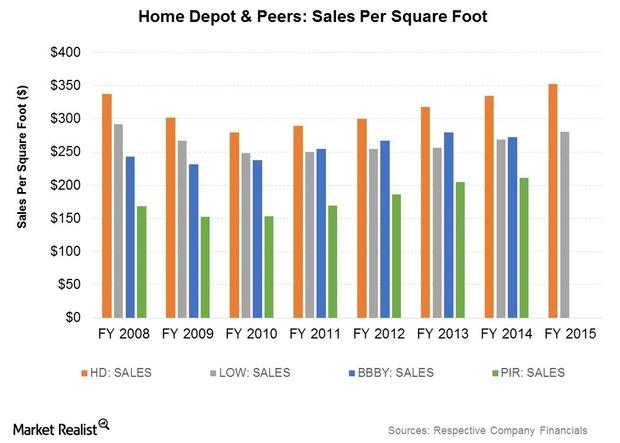

Valuation Multiples: Comparing Home Depot, Lowe’s, and Peers

Valuation multiples help investors determine market values for comparable companies. For our analysis, we consider forward PE (price-to-earnings) multiples due to high visibility in Home Depot (HD) and Lowe’s Companies’ (LOW) earnings.

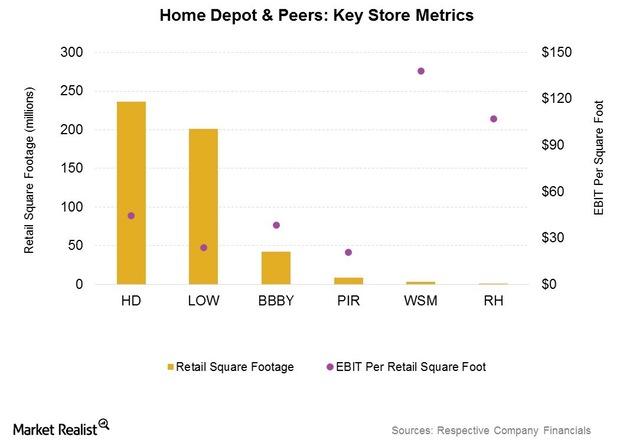

Efficient Scale Offers a Narrow Moat

Across the five moat sources (network effect, intangible assets, cost advantage, switching costs, and efficient scale), efficient scale is the most likely to drive a “narrow moat” rating from Morningstar.

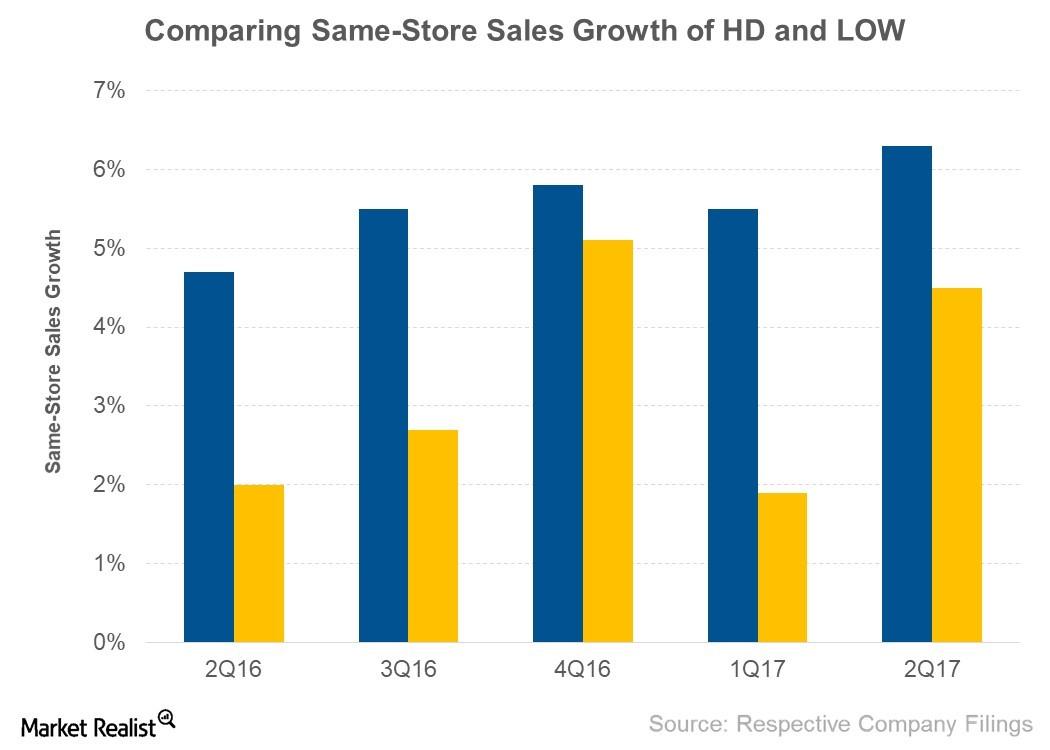

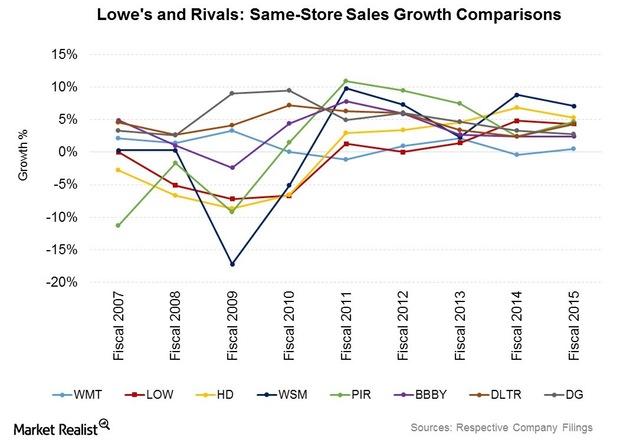

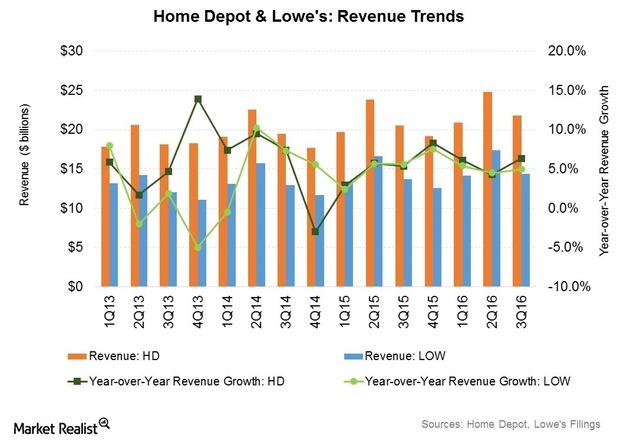

Home Depot’s Same-Store Sales Growth Was Higher than Lowe’s

Home Depot (HD) posted SSSG of 6.3%, while its US stores posted SSSG of 6.6%. Its stores in Mexico and Canada also posted positive SSSG.

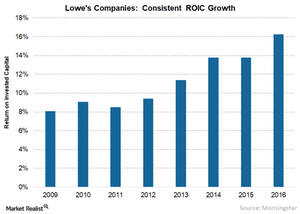

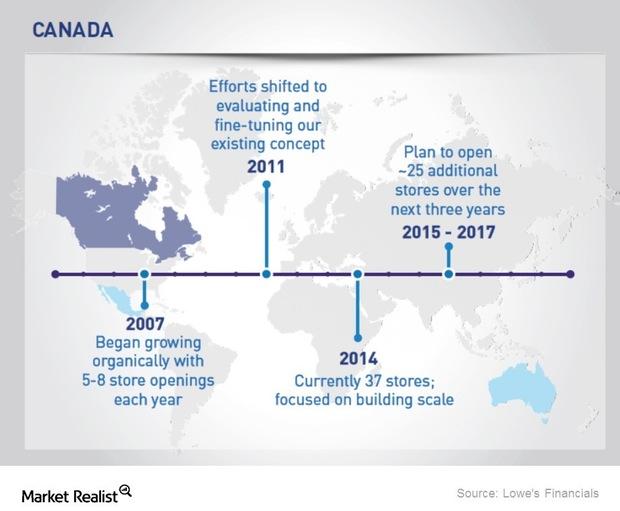

Lowe’s: Great Business Built on Logistics Strength

Lowe’s Companies (LOW) operates 2,129 home improvement and hardware stores in the United States, Canada, and Mexico.

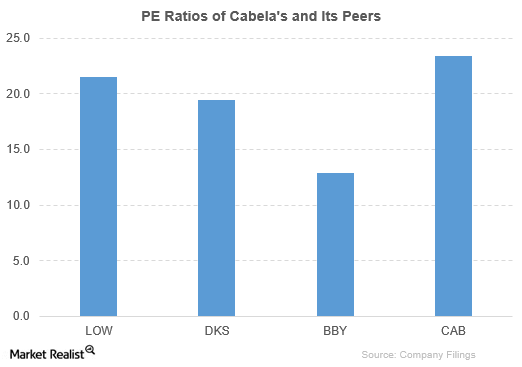

How Does Cabela’s Compare to Its Peers?

Cabela’s peers have outperformed the company based on PBV. However, Cabela’s has outperformed its peers based on PE and PS.

How This Emerson Sales Strategy Is Reeling in Big Box Retailers

Emerson Electric’s (EMR) omnichannel sales strategy is a multichannel approach that provides an integrated shopping experience.

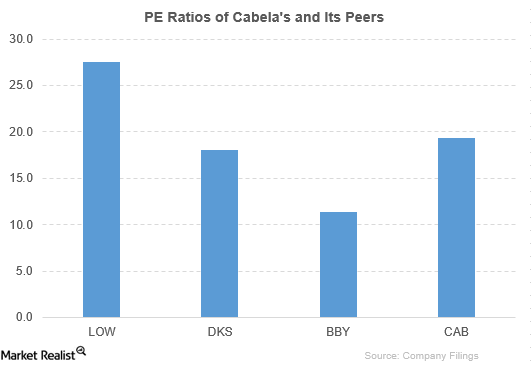

How Does Cabela’s Compare to Its Peers after 2Q16 Earnings?

Cabela’s (CAB) has been outperformed by its peers based on PBV (price-to-book value) ratio. However, Cabela’s has mostly outperformed its peers based on PE (price-to-earnings) and price-to-sales ratios.

What Are Lowe’s Opportunities and Key Threats?

The greatest opportunity for Lowe’s (LOW) perhaps lies in fully leveraging the omni-channel (XLY) model.

What Are Lowe’s Strengths and Weaknesses?

Lowe’s (LOW) is one of the largest and oldest big box retailers around. It’s been publicly listed since 1961.

Why Same-Store Sales Surged for Home Depot and Lowe’s

Home Depot’s same-store sales grew 5.1% overall, marking the 18th straight quarter of positive comps for the retailer.

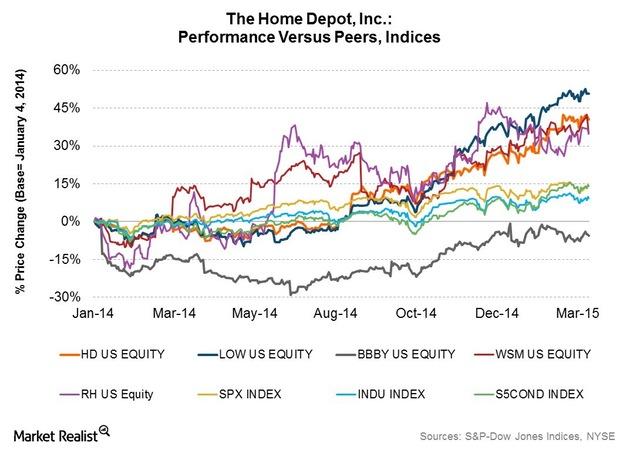

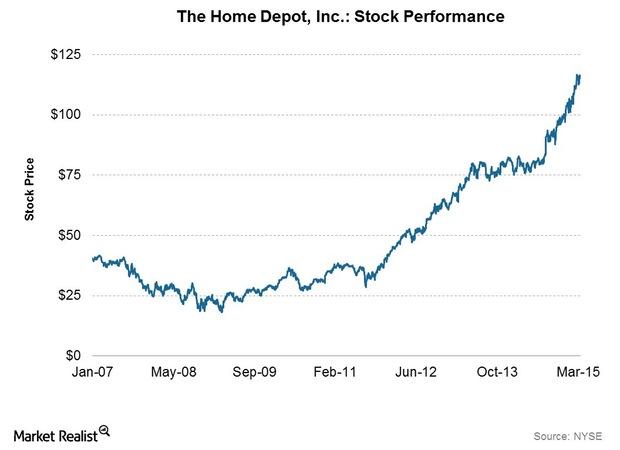

Home Depot Stock Outperforms Peer Group

Home Depot’s (HD) stock has performed well over the past five years. In fact, it’s been the best-performing stock in its peer group.

Home Depot Profits from Sound Supply Chain Management

Home Depot’s (HD) supply chain is getting more productive, resulting in better gross margins. Each store stocks about 30,000 to 40,000 different products.

Marketing at Home Depot Designed for Customer Base

Marketing initiatives at Home Depot include Pro Xtra. This program exclusively targets professional customers.

Home Depot’s Target Market and Customer Base

Home Depot invests considerable sums in providing a superior customer experience. Its co-founders say “the customer has a bill of rights at The Home Depot.”

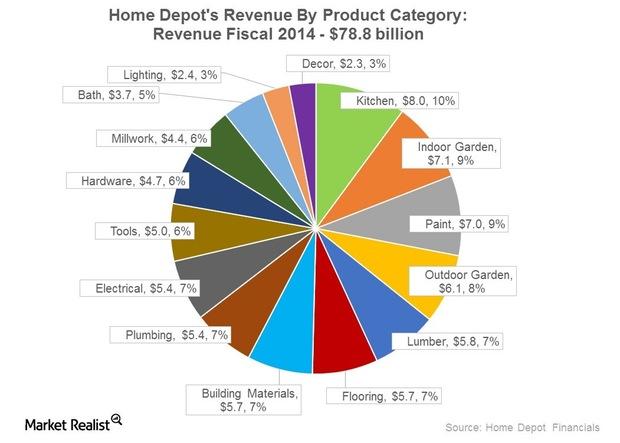

Home Depot’s Product Portfolio and Supplier Relationships

Kitchen and garden products are the best-grossing product categories. These accounted for nearly 27% of revenues in fiscal 2014.

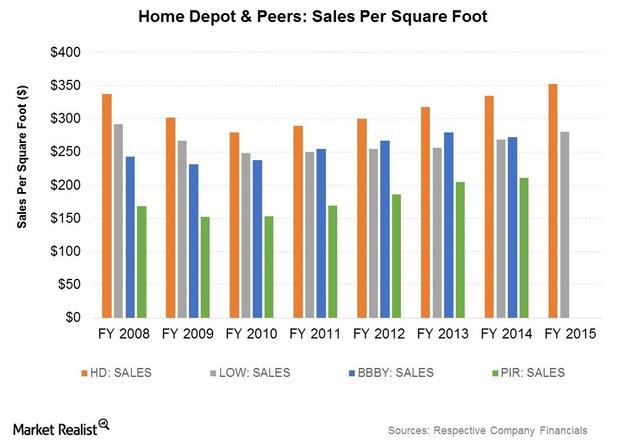

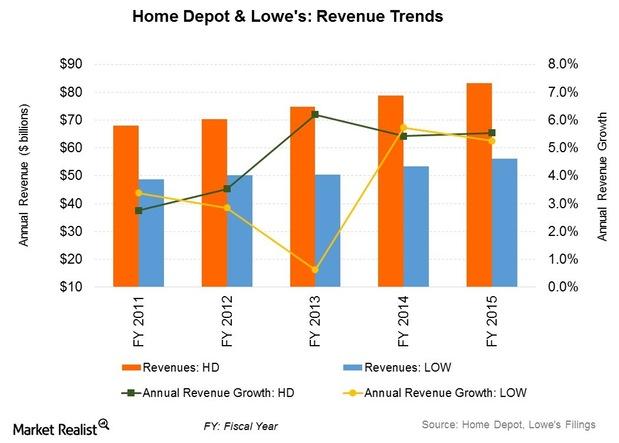

Home Improvement Retail: A Two-Horse Race for Supremacy

The home improvement industry is highly concentrated, particularly in the consumer market. The degree of concentration is growing.

Home Depot (HD): Built of Strong Stuff

Fiscal 2015 was a record year for Home Depot. The stock has returned over 47% over the past year and over 10% year-to-date.