Home Improvement Retail: A Two-Horse Race for Supremacy

The home improvement industry is highly concentrated, particularly in the consumer market. The degree of concentration is growing.

March 25 2015, Updated 11:06 a.m. ET

Industry analysis

Home Depot (HD) is a part of the home improvement industry. The industry’s market size in the US was estimated at ~$303 billion in 2014.[1. Home Improvement Research Institute, IHS Global Insight] Of this, ~$221 billion can be attributed to the consumer market and the remainder to the professional market. The former includes sales to private homeowners, and the latter category includes builders and contractors, among others.

The industry is expected to grow by ~5.7% in 2015 and at a CAGR (compound annual growth rate) of 4.5% between 2016 and 2019.

Market share and concentration

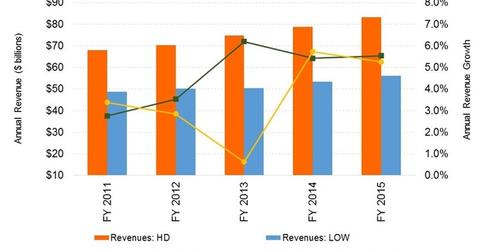

The home improvement industry is highly concentrated, particularly in the consumer market. The degree of concentration is growing. Big-box retailers dominate. Of these, Home Depot (HD) and Lowe’s (LOW) are the largest, with market shares of 27.2% and 18.4%, respectively.[3. Home Improvement Research Institute, Forbes]

There are a number of smaller players such as Menards in the US and Rona (RON.TO) in Canada. But these lack the national presence and retail footprint of their larger counterparts. With such high levels of market concentration, both HD and LOW have a lot of bargaining power with suppliers of goods, as you’ll learn in Part 3 of our series.

Competitive strengths

Competition is fierce between HD and LOW. Room for product differentiation is limited, however, in terms of building materials and electrical and plumbing components. Factors including pricing, exclusivity agreements with national brands, and customer service are critical to sales growth. While HD has concentrated on customer service as a driver to grow customer traffic and sales, LOW has competed primarily on the basis of lower prices.

Certain products including appliances, furniture, and lighting are also offered by mass merchandisers such as Walmart (WMT), department stores like Sears (SHLD), and other specialty retailers such as Restoration Hardware (RH) and Williams-Sonoma (WSM). HD also competes with hardware stores such as Ace Hardware.

The big-box home improvement chains’ one-stop shop gives them an advantage.

Home Depot leads

HD’s efforts to offer omni-channel options using both store and online channels, a broader product selection, and product customization, has secured its market leadership. We’ll discuss these aspects in greater detail later on in the series.

HD and LOW together constitute 6.6% of the portfolio holdings of the SPDR S&P Homebuilders ETF (XHB). They’re also among the top ten holdings in the iShares U.S. Home Construction ETF (ITB), representing 8.4% weight of this ETF.