When Can You Expect Walmart’s Profitability Margins to Stabilize?

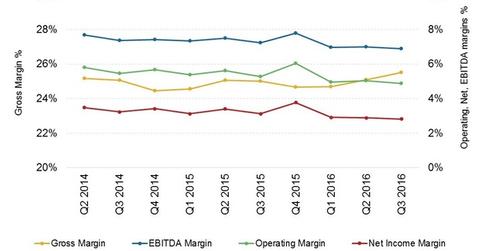

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016.

Nov. 20 2020, Updated 1:52 p.m. ET

Walmart’s gross profit margins have expanded

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016[1. Fiscal year ended January 31, 2016]. Margin improvements occurred in Walmart’s International and Sam’s Club segments while Walmart US’s gross profit margin declined. Margins were largely affected by merchandise mix changes. Sam’s Club margins also benefited from lower fuel sales, which retail at lower-than-average margins.

Operating income declines

Despite the improvement in merchandise margins, Walmart’s operating profit fell 9% to $17.5 billion in the first three quarters of fiscal 2016. Operating profit margins also fell. Operating profit margin fell 0.5 percentage points year-over-year to 5%.

All three segments reported lower operating income. Adverse forex movements affected Walmart International’s sales performance, as we discussed in Part 2 of this series. In Walmart’s International segment, operating income fell 10.6% in reported terms to $3.7 billion but rose 2.4% in constant currency terms. Operating income also fell in the Walmart US and Sam’s Club segments due to higher wage costs, more hours put in by store associates to improve customer experience, and investments in digital technology to drive higher e-commerce and omnichannel sales.

How do peers stack up?

Still, Walmart’s margins are healthier than the margins of its international peers. Tesco (TSCDY) (TSCO.L), Metro (MEO.DE), and Carrefour (CRRFY) (CRERF) (CA.PA) reported operating margins of -9.8%, 1.2%, and 2.7% for the trailing 12 months. In contrast, Walmart reported a margin of 5.3%.

Tesco has been attempting a turnaround as it struggles with declining market share in its home market and rationalizes its international portfolio.

Outlook

In fiscal 4Q16, forex and operating cost headwinds are expected to persist for Walmart. Walmart expects to spend $1.2 billion in incremental wage costs in fiscal 2016 as a result of announced wage hikes. The company plans to continue investing in pricing, improving store ambience, associates, and omnichannel initiatives in the near term. Profitability margins should stabilize by fiscal 2019.

Walmart makes up 0.62% of the iShares Core S&P 500 ETF (IVV) and 0.98% of the iShares S&P 100 ETF (OEF).