Carrefour SA

Latest Carrefour SA News and Updates

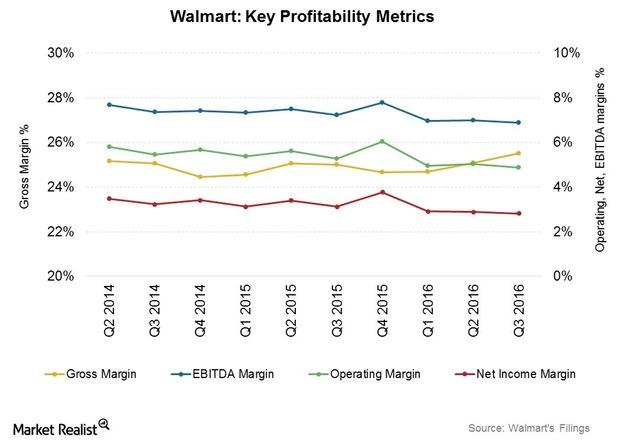

When Can You Expect Walmart’s Profitability Margins to Stabilize?

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016.

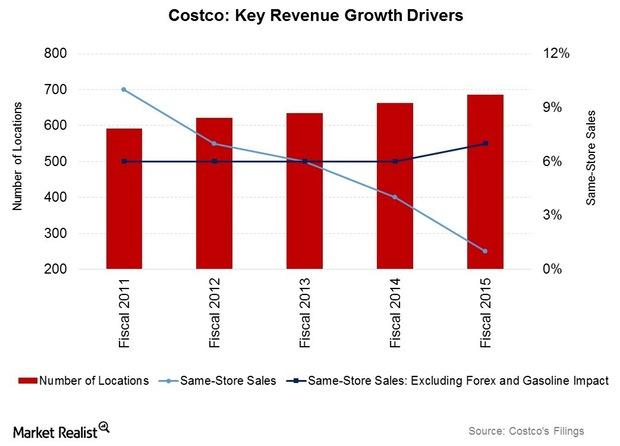

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

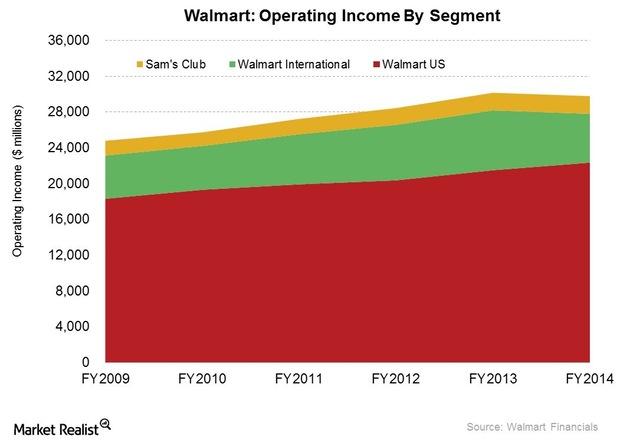

Walmart Is Looking For Growth In International Markets

Walmart (WMT) is the world’s largest retailer. The company reported 6,189 stores in its International segment—compared to 4,987 in the US in 3Q15.

Who’s The Greatest Retailer Of Them All? – Walmart

Walmart is among a select group of global retailers (XRT) (RTH) competing in a variety of store formats. However, Walmart dwarfs all of the other companies.