Micron Technology Inc

Latest Micron Technology Inc News and Updates

Intel’s New CEO Accelerates Its 10 nm Product Launches

Intel has provided an update on its long-delayed 10 nm process node, which was originally planned to launch at the end of 2016.

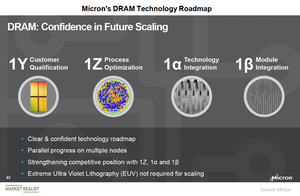

Micron’s DRAM Technology Focus

Micron Technology (MU) is currently ramping production of 1Y DRAM. It’s also filling the gap in its DRAM portfolio by adding new products.

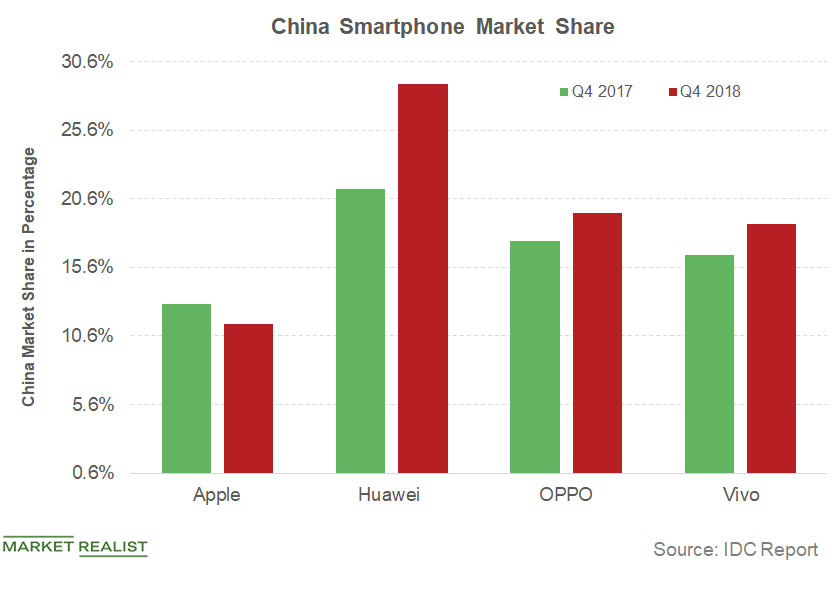

Will Samsung Galaxy Fold Eat up Apple iPhone Market Share?

Despite the rivalry between the two companies, Samsung is still one of the prominent component suppliers to Apple.

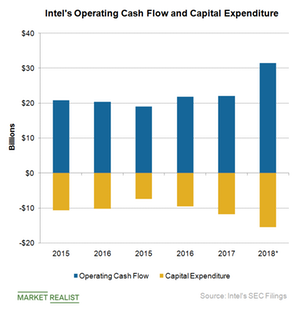

What Factors Could Influence Intel’s Capex in 2019?

Intel (INTC) is spending big on stock buybacks in 2018 driven by large cash flows coming from high PC and data center revenue.

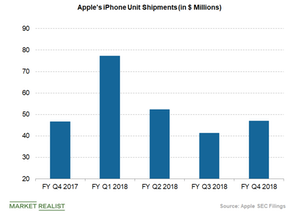

How Sluggish Demand for iPhones Is Hurting Apple’s Revenue

In the fourth quarter of fiscal 2018, Apple’s (AAPL) iPhone sales rose 29% YoY (year-over-year) to $37.2 billion.

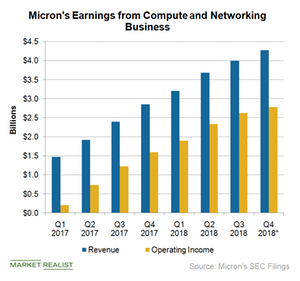

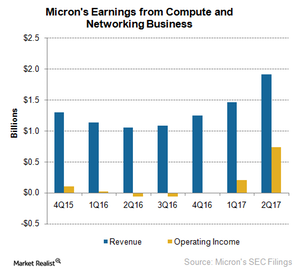

A Look at Micron’s Compute and Networking Business

Micron Technology (MU) has braced itself to withstand the challenge of falling memory prices by improving its cost competitiveness.

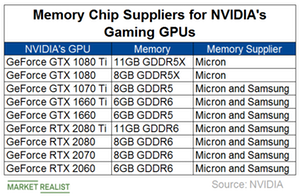

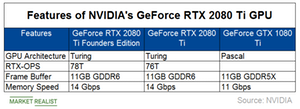

Micron to Benefit from Nvidia’s GeForce RTX 20 Series GPUs

In a recent blog, Micron stated that it has become Nvidia’s launch partner for Nvidia’s upcoming GeForce RTX 20-Series GPUs.

Seagate Is Banking on Enterprise Data Growth for Long-Term Sales

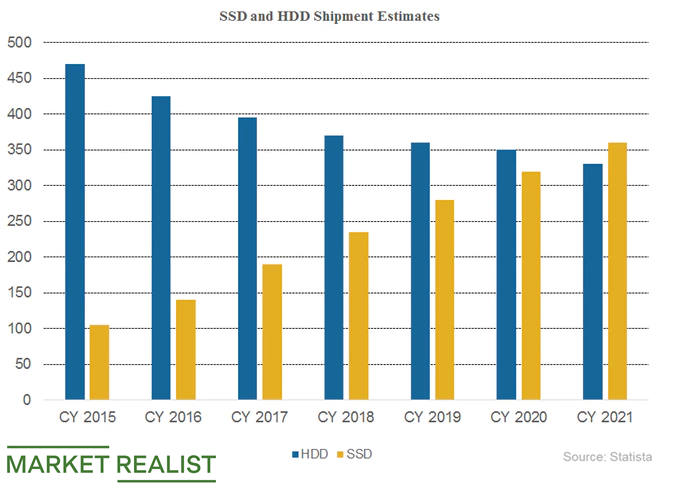

There has been an industry-wide transition in the storage space over the last few years.

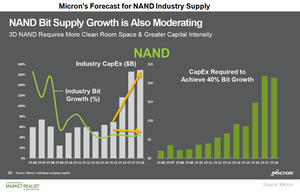

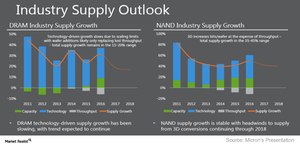

Micron Expects Stable Growth in NAND Industry Supply

Micron expects NAND industry supply to grow at an average annual rate of 40% beyond 2018.

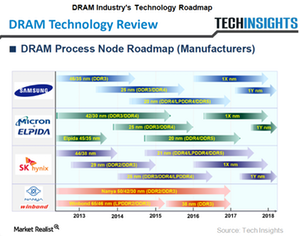

Micron’s Plan to Scale Down on DRAM Technology

Micron is investing in advanced nodes, as they provide the best return on investment opportunity by offering cost competitiveness.

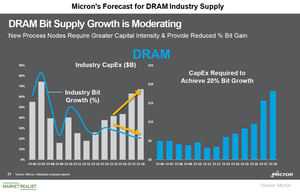

Micron Expects Limited Growth in DRAM Industry Supply

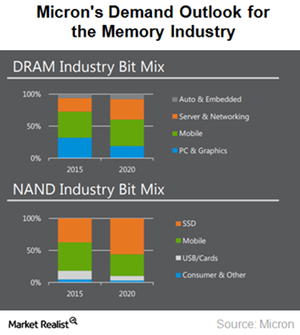

Micron expects its diversified customer base to increase DRAM (dynamic random-access memory) demand in the double-digits over the next four years.

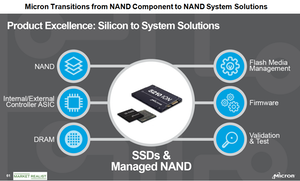

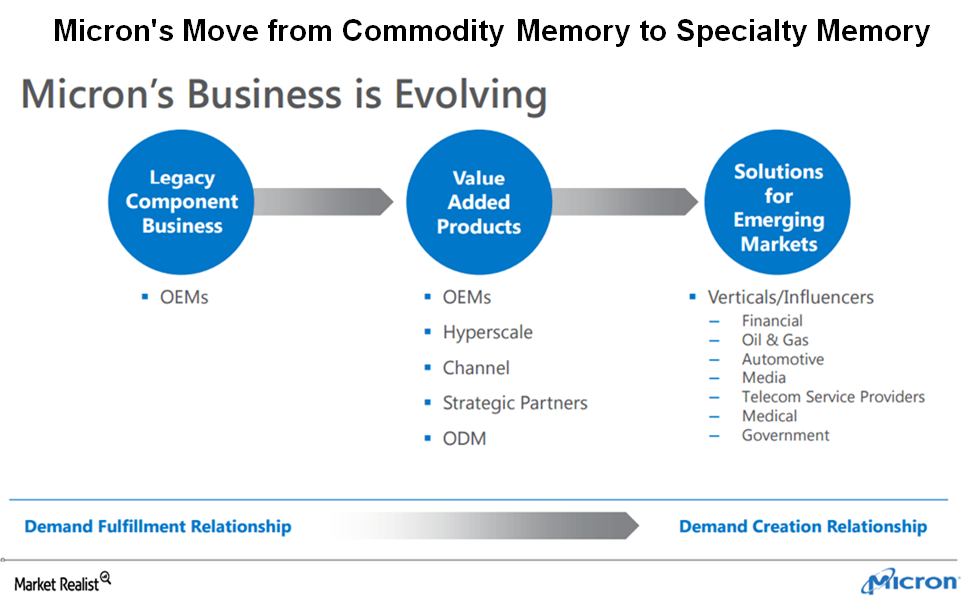

Micron Focuses on High-Value Memory System Solutions

Micron Technology (MU) is using vertical integration to achieve cost competitiveness in both the DRAM and NAND spaces.

Execution Excellence Is Micron’s Path to Technology Leadership

Micron Technology (MU) has been executing well on its technology road map.

How Does Micron Look to Tap Secular Memory Demand Trends?

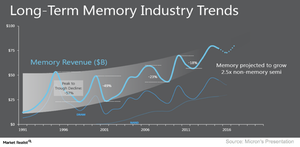

Memory demand is becoming more secular, growing beyond PCs and into the data center, autonomous cars, IoT, and AI spaces.

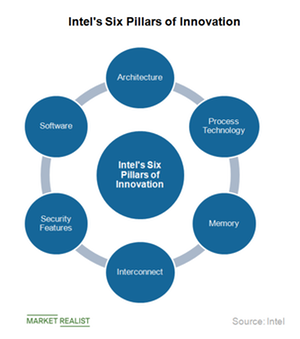

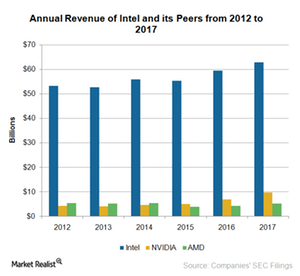

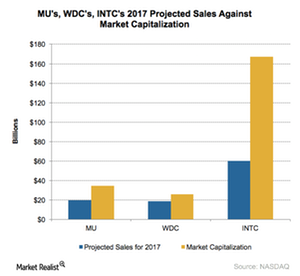

Intel in the Semiconductor Industry: Key Revenue Drivers

In fiscal 2017, Intel’s revenue rose 9% YoY (year-over-year) to $62.8 billion, driven by 16% YoY growth in its data-centric business.

The Cloud Server Market—Micron Technology’s Next Big Opportunity

On the DRAM front, Sanjay Mehrotra stated that average capacity per server increased to ~145 GB in 2017, and it is expected to increase to ~350 GB by 2021.

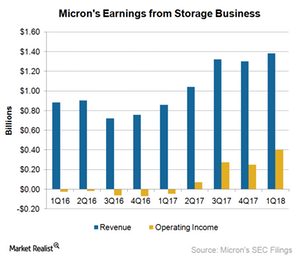

Micron Technology’s CEO Focuses on the Storage Business

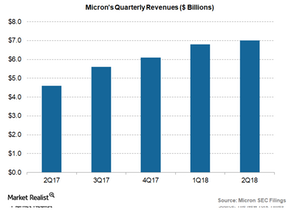

Micron Technology’s (MU) fiscal 1Q18 revenues were driven by strong demand for server, mobile, and SSD (solid-state drive) memory solutions.

What Is Micron’s NAND Strategy for Fiscal 2018?

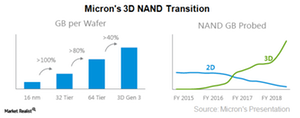

At the end of fiscal 1Q18, 3D NAND accounted for 80% of Micron’s total NAND output. The company expects to increase this mix to 95% by the end of fiscal 2018.

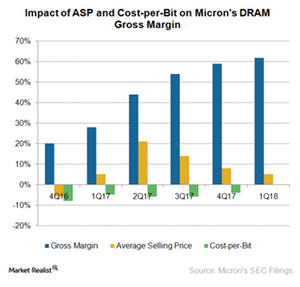

Micron’s Strategy to Improve Its DRAM Gross Margin in 2018

According to its latest earnings report, Micron’s (MU) DRAM (dynamic random-access memory) revenue rose 88% YoY (year-over-year) in fiscal 1Q18.

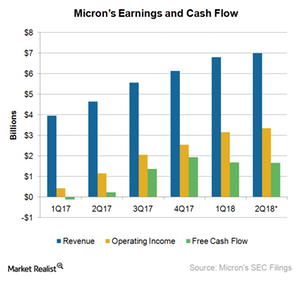

The State of Micron’s Cash Flow in Fiscal 2018

To become cost-competitive, Micron is increasing its capex from $5.0 billion in fiscal 2017 to $7.5 billion in fiscal 2018.

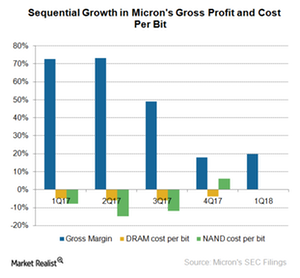

How Micron Plans to Improve Its Gross Margin in Fiscal 2018

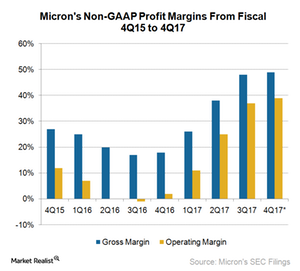

For fiscal 2Q18, Micron expects to improve its gross margin to 56.0% at the midpoint.

Why Did Micron Sue Chinese Companies over DRAM Technology?

The DRAM market is dominated by three suppliers—Samsung (SSNLF), SK Hynix, and Micron Technologies—commanding more than 90% of the market share.

Micron’s Product Strategy for Fiscal 2018

In the DRAM market, Micron expects to achieve bit crossover on 1X DRAM by the end of 2018.

Micron’s Strategy to Survive a Memory Downturn

In fiscal 1Q18, Micron introduced its 32 GB NVDIMMN (nonvolatile dual in-line memory module), which is a combination of its DRAM and NAND products.

How Tax Reform Could Impact Semiconductor Companies

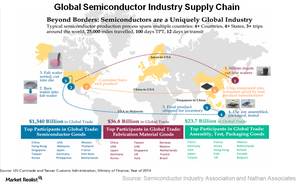

There could be a favorable business environment for the US semiconductor industry in 2018 in the wake of tax reform at the end of 2017.

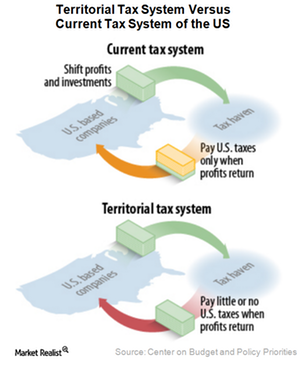

Territorial Tax System: Important for US Semiconductor Companies?

The semiconductor industry welcomed the Tax Cuts and Jobs Act that President Trump signed into law on December 22, 2017.

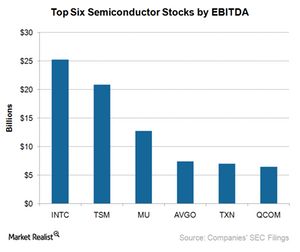

Reading the Most Profitable Semiconductor Companies

In calendar 3Q17, Intel (INTC) was the most profitable semiconductor company, with a last-12-month EBITDA of $25.3 billion.

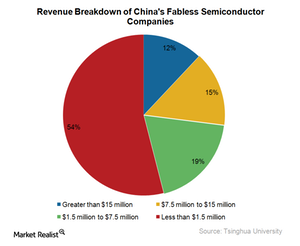

A Look at China’s Progress in Semiconductor Manufacturing

China manufactures only 13% of the world’s ICs. The nation imports more than $200 billion in chips annually, which created an estimated annual trade deficit of $150 billion in 2014.

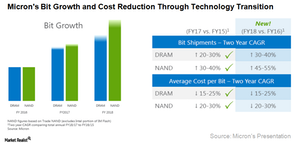

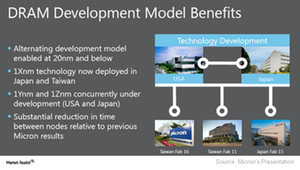

Micron’s Technology Roadmap Aimed at Improving Cost Competitiveness

Micron (MU) has expanded its manufacturing capabilities by acquiring small companies like Inotera Memories and Tidal Systems.

Changing Memory Industry Dynamics to Positively Impact Micron’s Growth

Micron expects the SSD (solid-state drive) attach rate to increase to ~50% in 2018 and 75% in 2020.

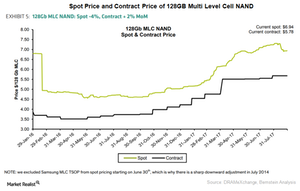

Micron’s Strategy in the NAND Market

Micron expects the NAND industry supply to grow 30%–40%, with its NAND supply expected to grow at the higher end of the industry supply range.

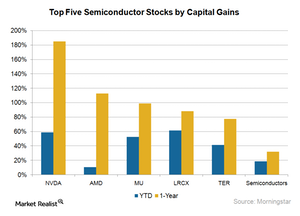

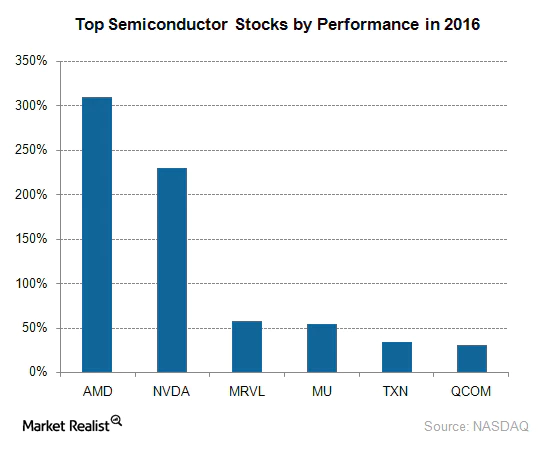

Two Newcomers in the Top 5 Fastest-Growing Semiconductor Stocks

As of September 12, 2017, Nvidia (NVDA) was the fastest-growing stock, rising 185% over the past year, compared to the industry’s 32% growth.

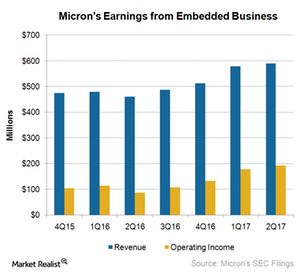

What’s the Role of Embedded Business in Micron’s Future Growth?

Micron’s EBU revenue rose 19% sequentially to $700 million in fiscal 3Q17 driven by high demand for its products across consumer, industrial, and automotive markets.

How Micron Is Benefitting from the Favorable DRAM Market Environment

Micron Technology (MU) is the third-largest DRAM (dynamic random access memory) manufacturer in the world, after Samsung (SSNLF) and SK Hynix.

Where Micron’s Profit Growth Stands next to Revenue Growth

Micron is thriving in a strong memory environment, wherein increasing DRAM (dynamic random access memory) and NAND prices are driving earnings.

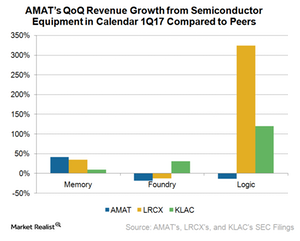

Is AMAT Losing Market Share to Lam Research and KLA-Tencor?

The emergence of the IoT (Internet of Things), self-driving cars, AR/VR (augmented/virtual reality), and AI (artificial intelligence) is driving demand for logic and memory chips.

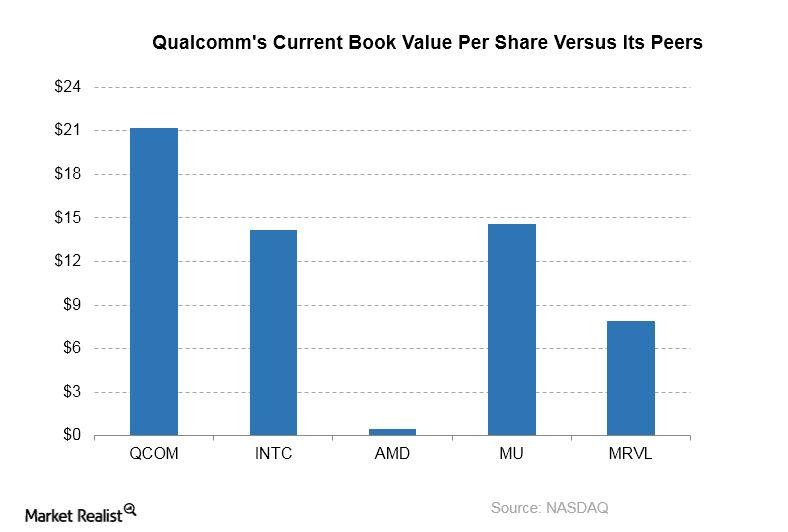

A Look at Qualcomm’s Valuation

Inside Qualcomm’s price and valuation multiples Qualcomm’s (QCOM) book value per share in 2016 was ~$21.20, compared with the expected book value per share of ~$20.60 in 2017. Qualcomm shares are trading at price-to-book value of ~2.7x. In comparison, Intel’s (INTC), Advanced Micro Devices’ (AMD), Micron Technology’s (MU), and Marvell Technology’s (MRVL) book values per […]

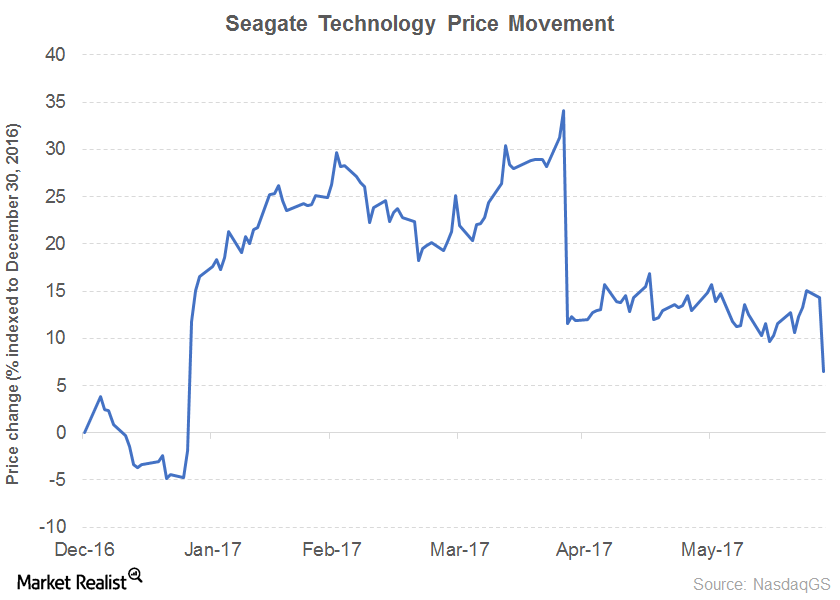

Dividend Growth of Seagate Technology and Garmin

Garmin (GRMN) recorded three-year annualized growth of 5.3%, and its five-year annualized growth fell ~1%. Its growth dipped ~24% in 2016.

Micron Doubts That China Could Sustain in the Memory Market

According to Micron’s Ernest Maddock, even if China succeeds in securing legitimate IP, it would still fail in the memory market.

Micron’s Strategy to Become Cost-Competitive

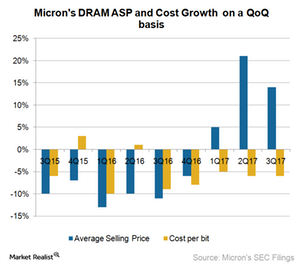

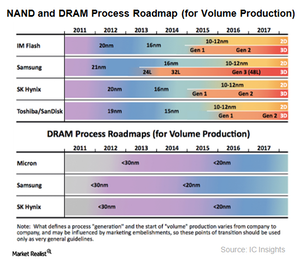

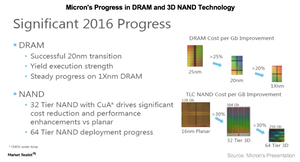

For the last two years, Micron reduced its DRAM production cost 15.0%–25.0% by transitioning to a 20 nm node and starting mass production of the 1X node.

What Institutional Investors Think about Micron Technology

Currently, institutional investors own 81.1% and insiders own 0.69% of the total outstanding shares of Micron.

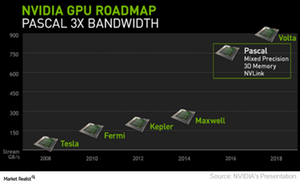

Speculation about NVIDIA’s Volta Gaming Graphic Processing Unit

NVIDIA’s product strategy NVIDIA (NVDA) has officially unveiled its next-generation Volta architecture. Whenever the company develops a new architecture, it first launches it on the Tesla GPU (graphic processing unit) platform for data centers because it commands a higher price than other platforms. Then it launches the architecture on the GeForce gaming platform, as its […]

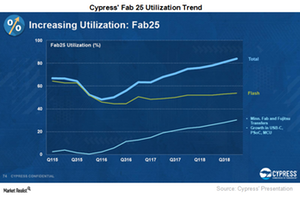

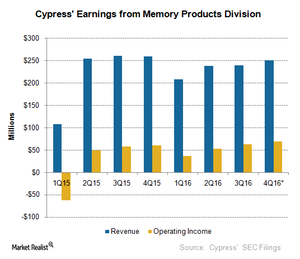

Cypress Semiconductor’s Strategy to Improve Gross Margin

Cypress Semiconductor (CY) aims to increase its gross margin from 40.0% currently to 43.0% by fiscal 4Q17 and 47.9% by fiscal 4Q18.

Inside Micron’s CNBU: Key Growth Drivers

The emergence of the data economy is creating new growth drivers for Micron Technology (MU) in every end market.

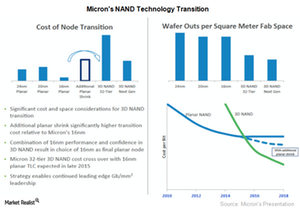

How Micron Technology Could Benefit from an Early Transition to 3D NAND

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

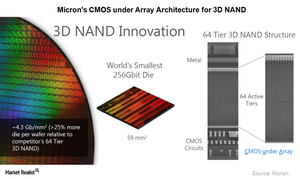

Micron Technology’s 3D NAND Roadmap for 2017

Micron Technology (MU) plans to spend ~$1.8 billion in capex on ramping up the 64-tier 3D NAND and developing the third-generation 3D NAND.

Micron Technology’s Competitive Position in the DRAM Market

Micron Technology (MU) has achieved a 25% cost reduction by transitioning from 25nm to 20nm.

Micron’s Strategy to Improve Operational Efficiencies

Micron Technology (MU) entered the 3D NAND market earlier than its competitors, as its planar NAND did not deliver good returns.

Cypress Depends on Memory Business to Improve Profits

Cypress Semiconductor (CY) is becoming a complete embedded solutions provider.

AMD Stock Continues to Fall in 2017

Advanced Micro Devices (AMD) stock fell 9.4% in the week ended January 20, 2017. Shares of the firm have fallen 14% since the start of 2017 after an incredible run last year.