Dr Pepper Snapple Group Inc

Latest Dr Pepper Snapple Group Inc News and Updates

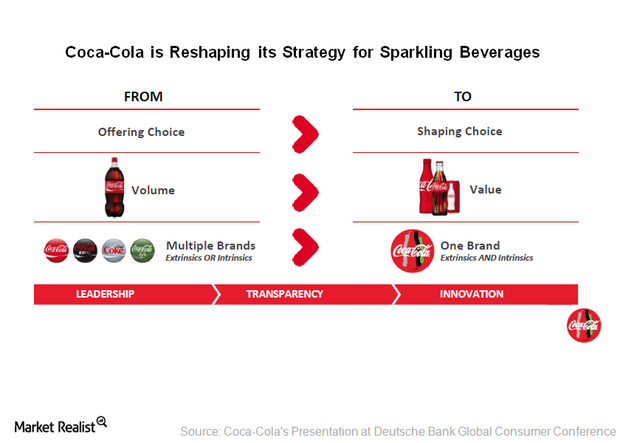

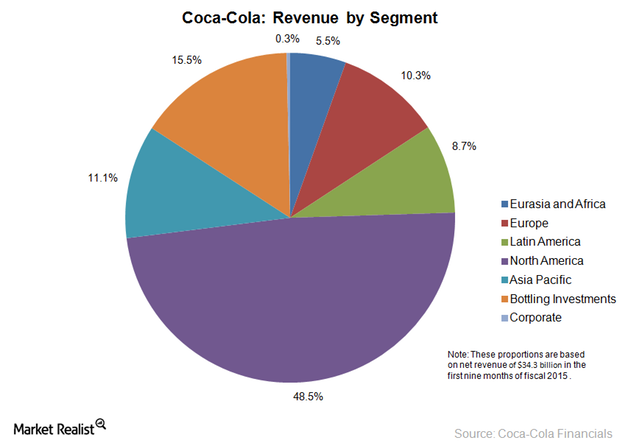

How Coca-Cola Is Reshaping Its Strategy for Sparkling Beverages

Coca-Cola is now changing its approach from offering beverage choices to consumers to shaping their choices.

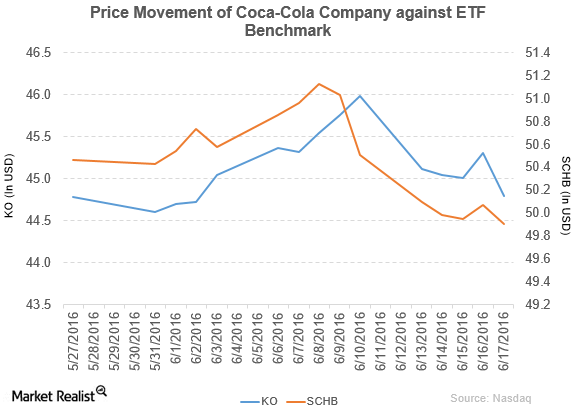

Why Did The Coca-Cola Company Fall on June 17?

The Coca-Cola Company (KO) has a market cap of $192.8 billion. It fell by 1.2% to close at $44.79 per share on June 17, 2016.

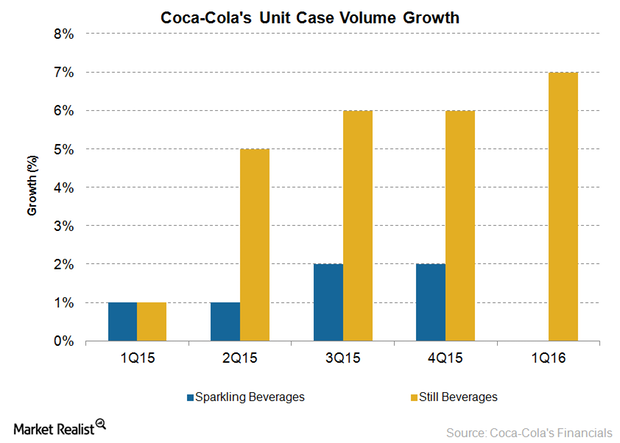

Why Coca-Cola Is Focusing on Still Beverages

In January 2016, Coca-Cola announced the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

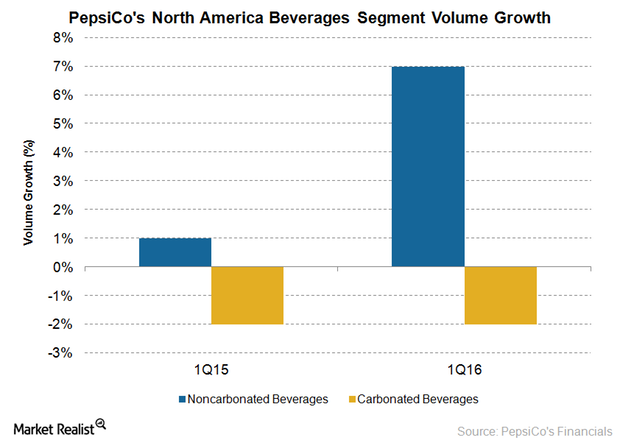

PepsiCo’s Non-Carbonated Beverages Sparkle in 1Q16

In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit.

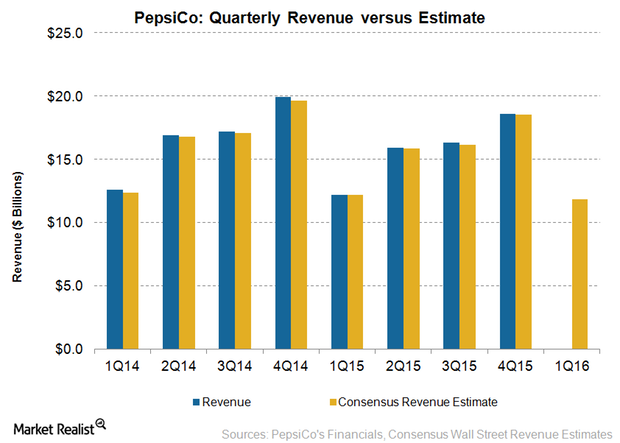

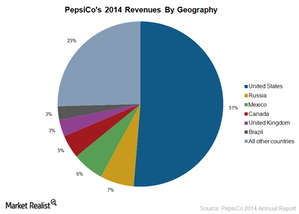

Why Analysts Expect PepsiCo’s Revenue to Decline in Fiscal 1Q16

On April 18, PepsiCo is scheduled to announce its results for fiscal 1Q16. PepsiCo’s revenue has declined in each of the past five consecutive quarters.

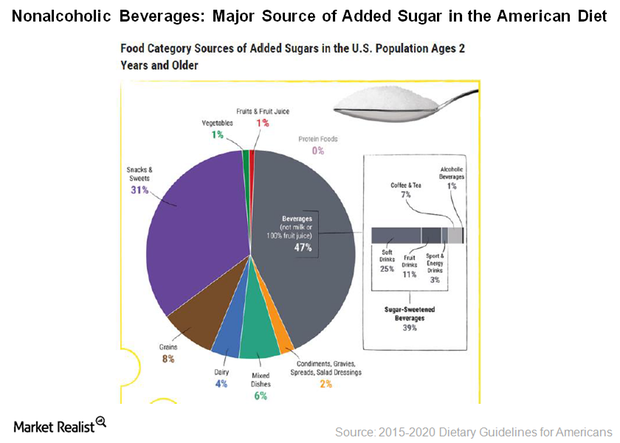

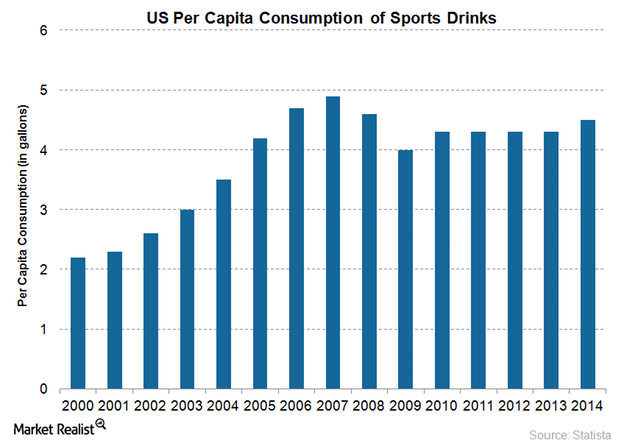

An Insight into Sport Drinks’ Positioning in the US Beverage Market

Sports drinks are considered a healthier choice than traditional soda beverages, and they contain less sugar than traditional soda beverages.

Coca-Cola Strengthened Presence in Africa with Stake in Chi

Beverage giant Coca-Cola (KO) has expanded its presence in Africa with the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

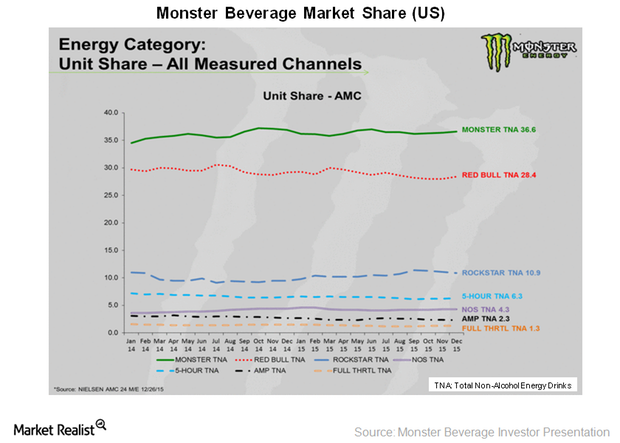

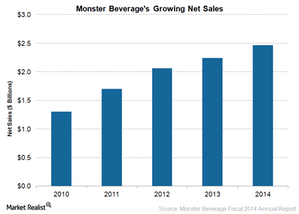

Are Strategic Brands Boosting Monster Beverage’s Sales?

According to Nielsen’s data, for the period ending December 26, 2015, the Monster Beverage brand held a 36.6% share of the US energy drink market in terms of unit sales.

Monster Beverage Increases Its Advertising Efforts

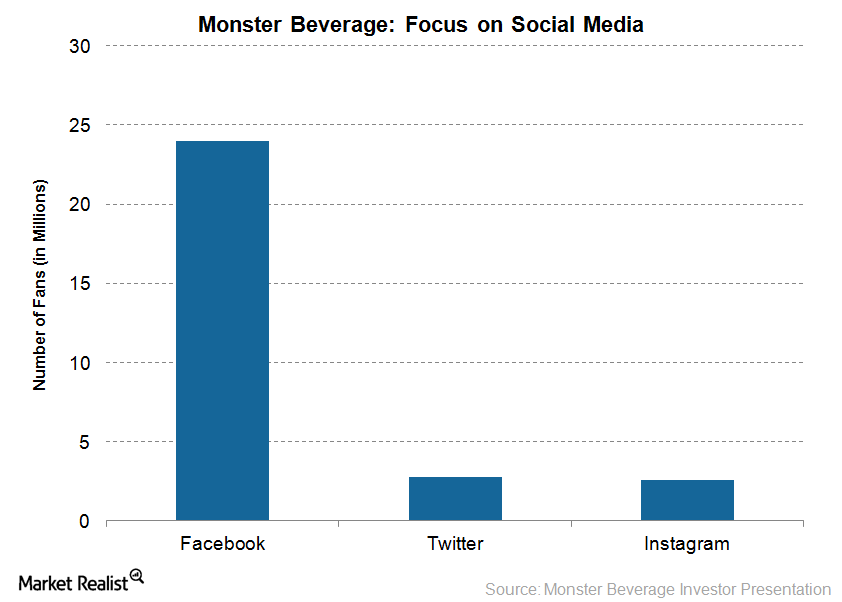

Monster Beverage enjoys huge popularity on social media. It has 24 million fans on Facebook (FB), 2.8 million fans on Twitter (TWTR), and 2.6 million fans on Instagram.

Monster Beverage Provides an Update on Distribution Transition

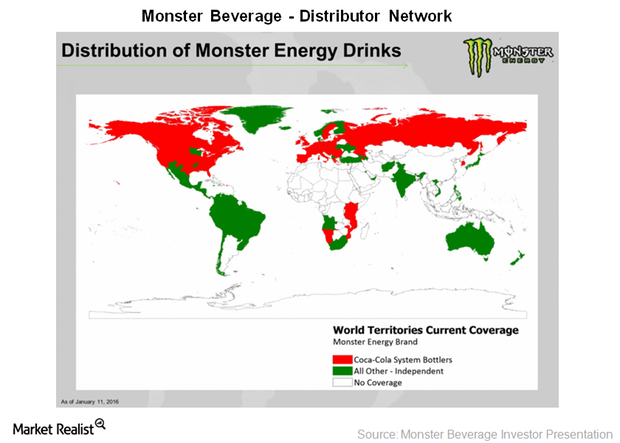

In its 3Q15 conference call, Monster Beverage disclosed an agreement with Coca-Cola HBC (Hellenic Bottling Company) that will apply across 28 countries.

What Challenges Has Keurig Green Mountain Been Facing?

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012.

Understanding Coca-Cola’s New Marketing Efforts

Coca-Cola (KO) is using its productivity savings to ramp up its media investments.

Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

PepsiCo’s Strategy for Its UK Business

PepsiCo’s strategy for its UK business involves continued investment in its core brands across snacks and beverages, including Walkers, Tropicana, Naked, Quaker, and Pepsi.

Dr Pepper Reaches for Sports Drinks with BodyArmor

On August 12, 2015, Dr Pepper Snapple announced that it purchased an 11.7% stake in BA Sports Nutrition, the company that owns BodyArmor.

Are Parents Driving Energy Drink Sales in the US?

As shocking as it may sound, a higher proportion of US households with children are consuming more energy drinks—compared to those without children.

Energy Drinks Continue to Thrive despite Controversies

Two-thirds of energy drink consumers are concerned about the negative effects of energy drinks and shots, but this doesn’t stop them from consuming the drinks.

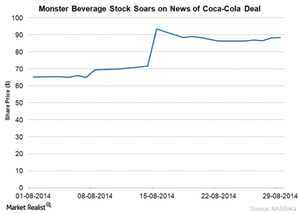

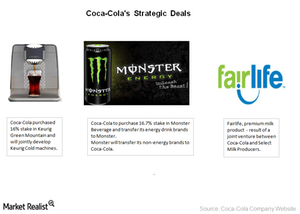

Monster Gets More Energy in Strategic Partnership with Coca-Cola

On June 12, Coca-Cola and Monster Beverage completed a strategic partnership. Coca-Cola purchased 16.7% in Monster for $2.2 billion. That day, Monster Beverage shares rose 1.0%, and Coca-Cola’s fell 0.3%.

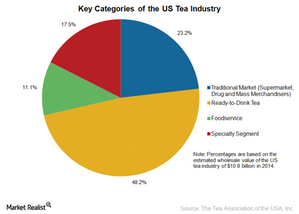

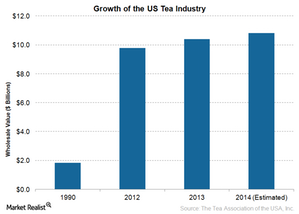

What Are the Key Categories in the US Tea Industry?

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014.

The Growing Demand for Tea in the US

Though the per capita consumption of tea in the US is low compared to other countries, the growth in tea consumption in recent years has been impressive.

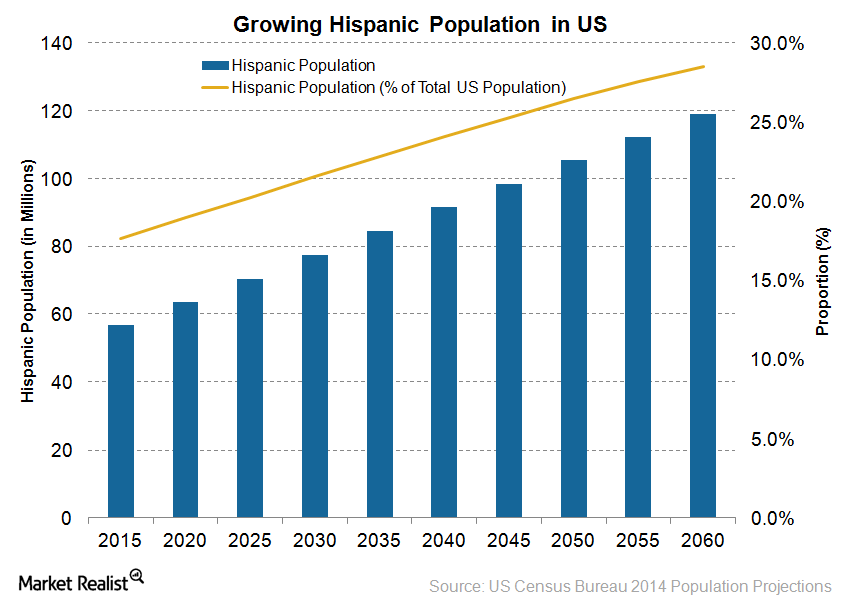

Why PepsiCo and Its Peers Are Focusing on Hispanics in 2015

PepsiCo (PEP) and peers like Coca-Cola and Dr Pepper Snapple have been developing several products based on the tastes and preferences of Hispanics.

Gatorade by PepsiCo: Still Athletic at 50

Gatorade is celebrating its 50th anniversary this year. It’s one of PepsiCo’s $22-billion brands, generating more than $1.0 billion in annual retail sales.

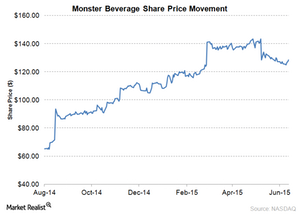

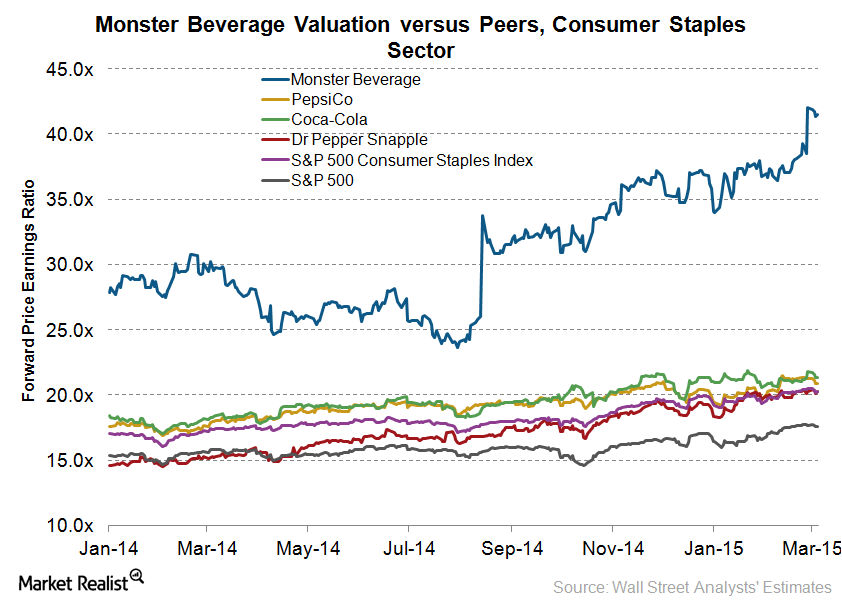

Monster Beverage’s stock outperforms peers

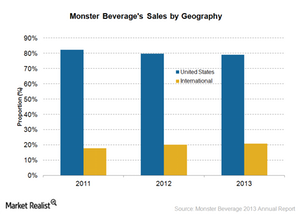

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.

Monster Beverage and Coca-Cola: A landmark partnership

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

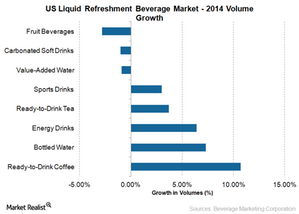

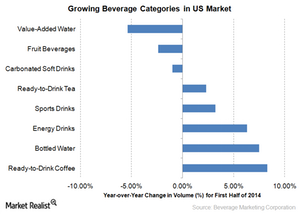

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

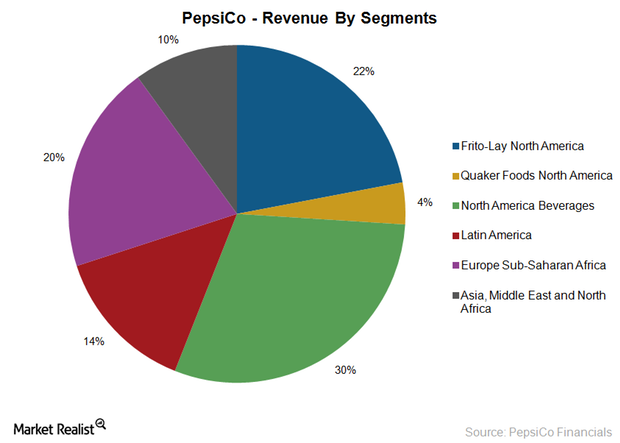

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

How PepsiCo’s focus on innovation is reaping rewards

PepsiCo’s focus on innovation includes Pepsi Spire 5.0 equipment, which allows consumers to create about 1,000 beverage combinations using a 32-inch touchscreen.

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.

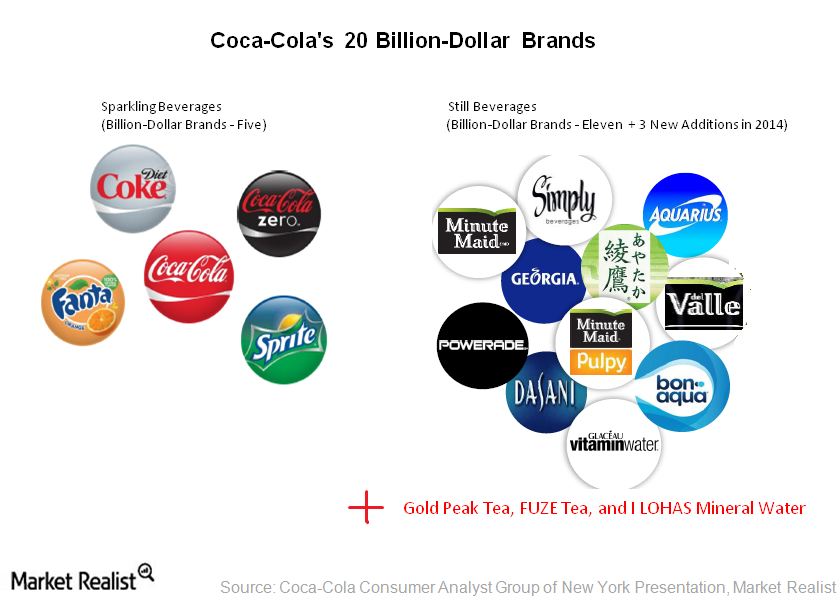

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

Why Monster Beverage’s international business is growing

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

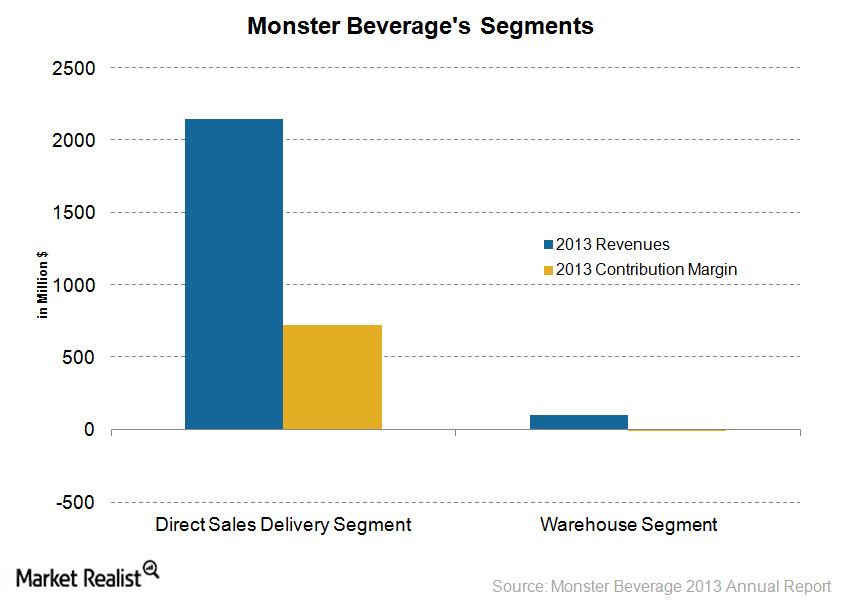

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

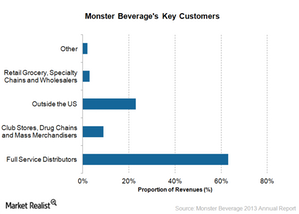

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.

An overview of Monster Beverage Corporation

Monster Beverage Corporation (MNST) is based in California. It manufactures alternative beverages. It sold over 10 billion energy drinks in the past 12 years.

What are Dr Pepper Snapple’s growth strategies?

Dr Pepper Snapple plans to grow into new categories by leveraging its distribution agreements for third-party brands such as Vita Coco coconut water.

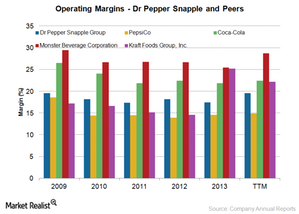

Dr Pepper Snapple makes efforts to improve profitability

Dr Pepper Snapple implemented its rapid continuous improvement (or RCI) in 2011 to simplify processes and address distribution and the availability gap.

What are Dr Pepper Snapple’s major risks?

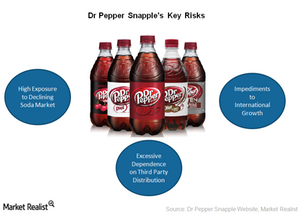

Dr Pepper Snapple faces major risks like significant reliance on carbonated soft drinks, limited international growth, and excessive reliance on third-party distribution.

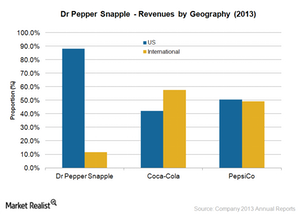

Why international expansion is vital for Dr Pepper Snapple

The carbonated soft drink volumes in North America have been continually declining. This makes it important for Dr Pepper Snapple to grow beyond its US operations.

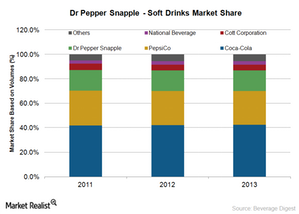

Dr Pepper Snapple is pitted against the soda behemoths

In 2013, Coca-Cola had 42.4% of the market share in the US carbonated soft drink category. PepsiCo had 27.7% and Dr Pepper Snapple 16.9% of the market share.

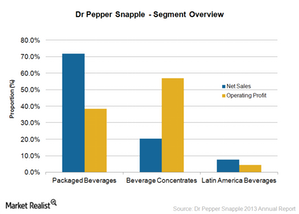

Understanding Dr Pepper Snapple’s revenue streams

Dr Pepper Snapple derives its revenues from the sale of carbonated soft drinks and noncarbonated beverages like ready-to-drink tea, juices, and mixers.

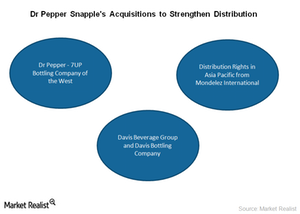

Dr Pepper Snapple strengthens its distribution network

Dr Pepper Snapple is continually strengthening its position as a major beverage company by acquiring regional bottling companies and distribution rights.

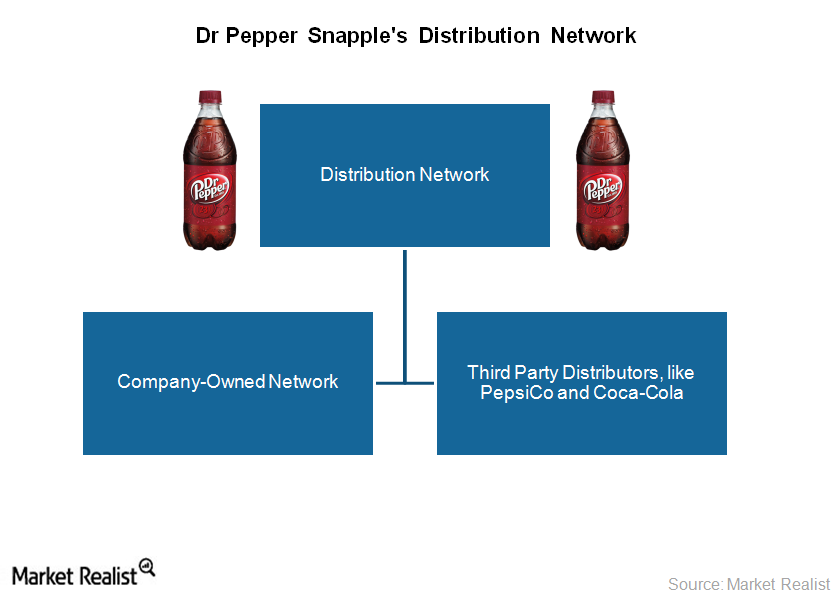

Understanding Dr Pepper Snapple’s route to market

Dr Pepper Snapple’ beverages reach consumers through the company’s own distribution network, third-party distributors, and direct delivery to customers’ warehouses.

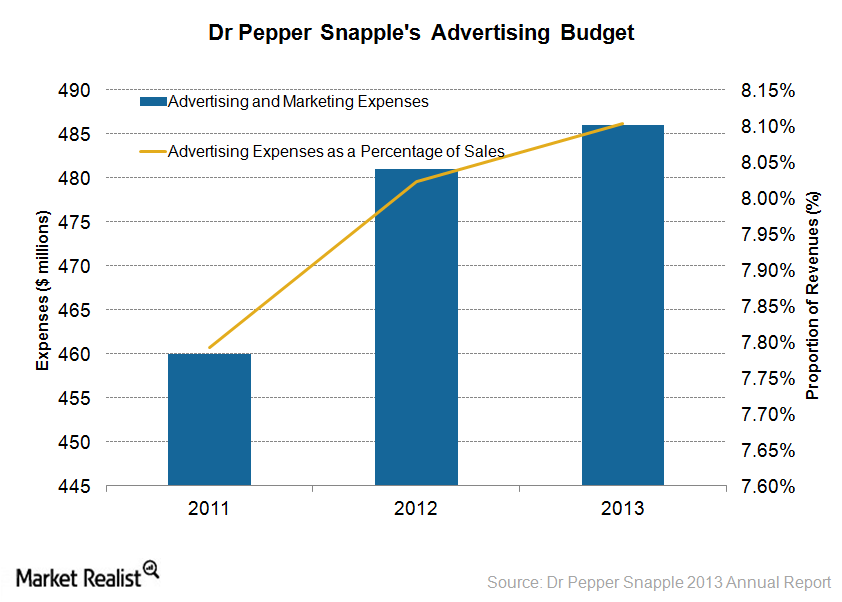

Dr Pepper Snapple targets key demographics in advertising campaigns

Dr Pepper Snapple is targeting Hispanics and Millennials in its advertising. By 2020, Hispanics will make up 19% of the US population. Millenials represents 24%.

An overview of Dr Pepper Snapple’s key brands

Canada Dry, 7UP, A&W, and Sunkist are Dr Pepper Snapple’s Core 4 brands. Noncarbonated beverages include ready-to-drink tea, juice, juice drinks, and mixers.

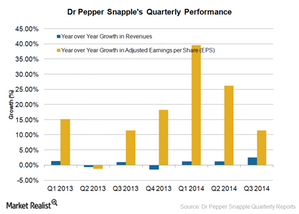

Dr Pepper Snapple’s recent performance and the road ahead

Dr Pepper Snapple expects its fiscal 2014 revenues to increase by 1%. Investors should be cautious since the company expects an impact from higher transportation and marketing costs.

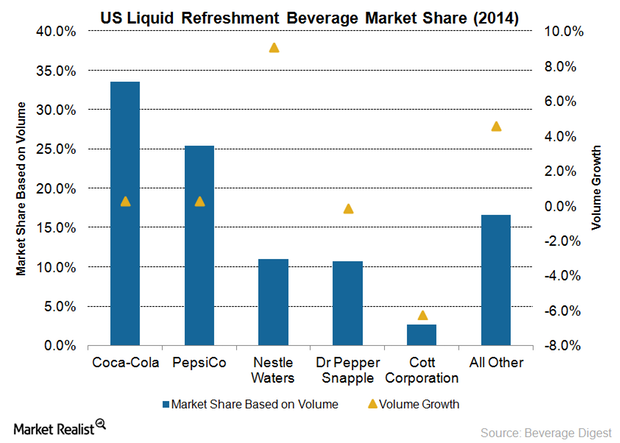

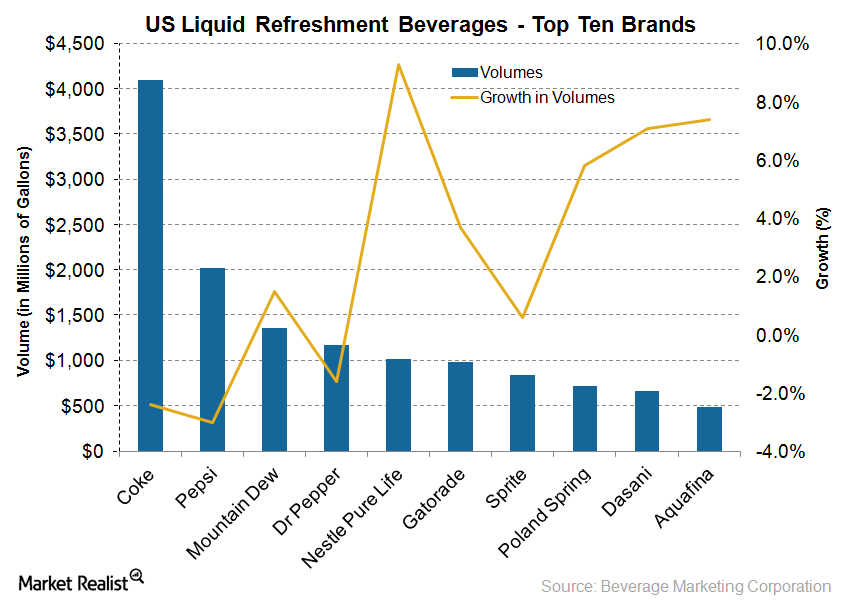

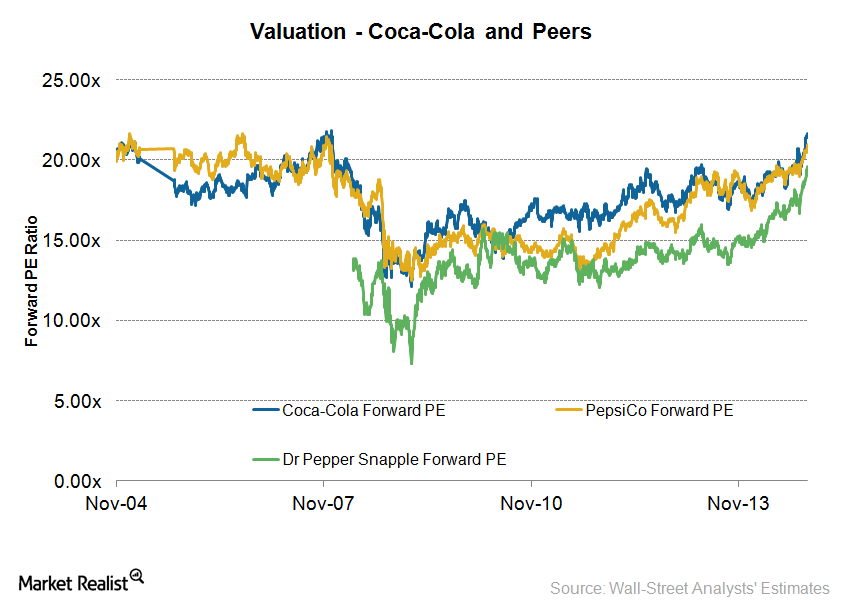

The Coca-Cola Company versus PepsiCo: A battle of giants

The Coca-Cola Company (KO) and Pepsico, Inc. (PEP), are dominant players in the soft drinks market. Both companies own a strong portfolio of liquid refreshments and several brands.

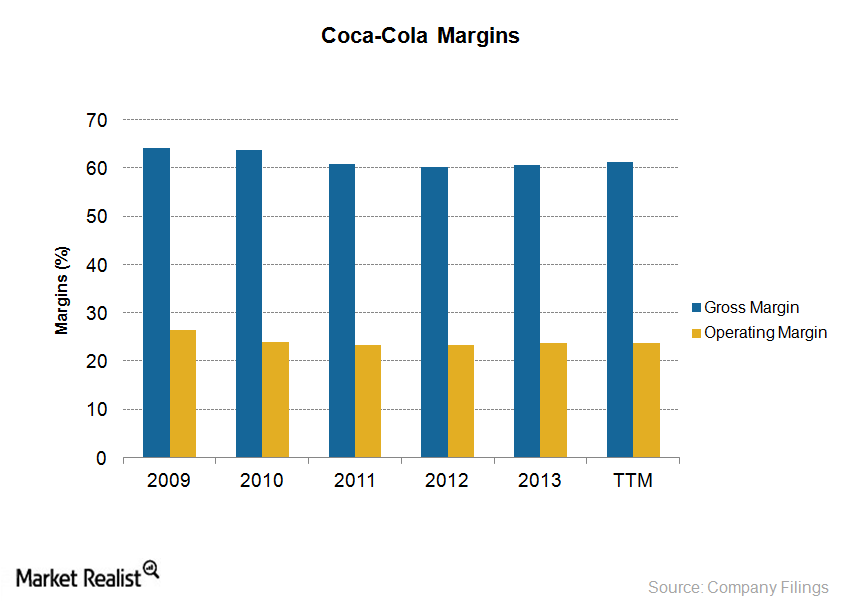

Coca-Cola fights declining margins with productivity measures

The Coca-Cola Company (KO) has been implementing several efficiency initiatives to offset the impact of adverse market conditions and declining demand for carbonated soft drinks.

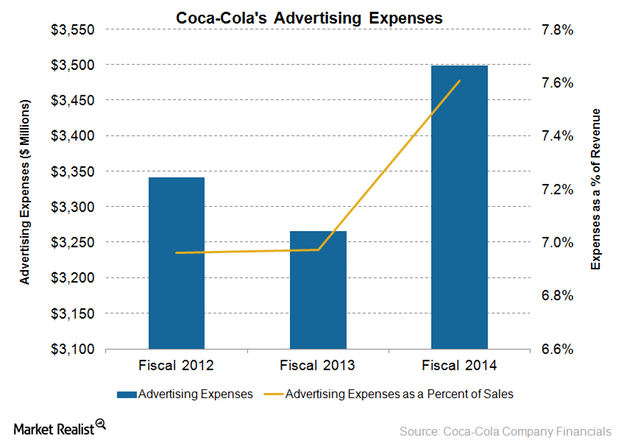

Advertising is a key strategy for Coca-Cola’s growth

In 2013, Coca-Cola spent $3.37 billion, or 7.0% of it’s 2013 revenues, on advertising—including in-store activations, loyalty points programs, and point-of-sale marketing.Company & Industry Overviews The importance of Coca-Cola’s iconic brand name

Coca-Cola enjoys huge popularity across the world. The company ranked third in Interbrand’s 2014 world’s most valuable brands list, with an estimated brand value of $81.6 billion.