What Challenges Has Keurig Green Mountain Been Facing?

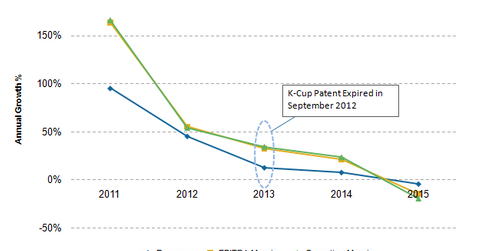

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012.

Dec. 16 2015, Updated 7:06 p.m. ET

Keurig’s challenges

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012. The patent expiration led to an opening for competitors to sell pods. K-Cup pods accounted for approximately 75% of Keurig’s revenue last year.

Instead of coming up with competing generic pods, Keurig came up with Keurig 2.0, which is compatible only with Keurig pods. The launch of 2.0, which was considered strategically fundamental to Keurig’s growth, was aimed at protecting the K-Cup business.

Keurig launched 2.0 just before the holiday season, or the first quarter of 2015, with great promotional activity. However, the launch could not attract sales for Keurig, as it reported a 16% decline in its brewer sales volume in fiscal 2015.

Coca-Cola to collaborate with JAB

Keurig has been mainly into hot brewing systems. However, the company launched Keurig KOLD, a cold brewing system in September 2015. Keurig KOLD also allows users to prepare cold sparkling and still beverages including products from beverage giants Coca-Cola Company (KO) and Dr Pepper Snapple Group (DPS).

However, the launch of KOLD may not quite fulfill high expectations for several reasons. First of all, the cost is relatively expensive. It cost ~$370 at the time of launch not including the cost of the pods to create the actual beverages. Consumers may prefer to simply purchase the beverage from the market.

Despite this, Keurig’s largest shareholder, Coca-Cola, is positive about the company and expects to continue its collaboration with JAB to grab opportunities in the single-serve, pod-based segment of the cold beverage soft drinks industry. However, Coca-Cola will be selling off its 17.4% stake in Keurig as a result of the JAB transaction.