Diana Key

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Diana Key

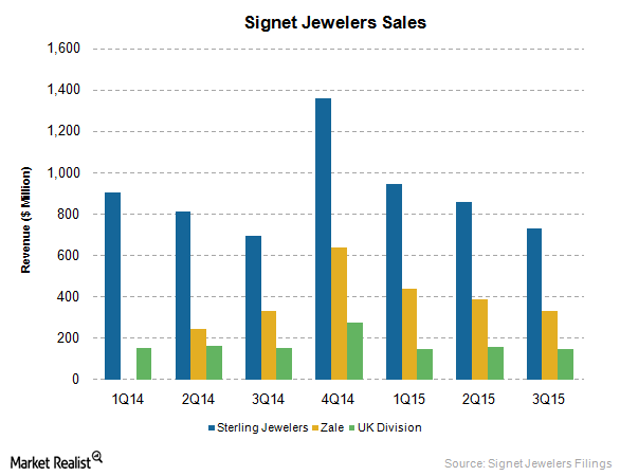

It Was a Festive Holiday Season for Signet Jewelers

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season with revenue of $1.9 billion.

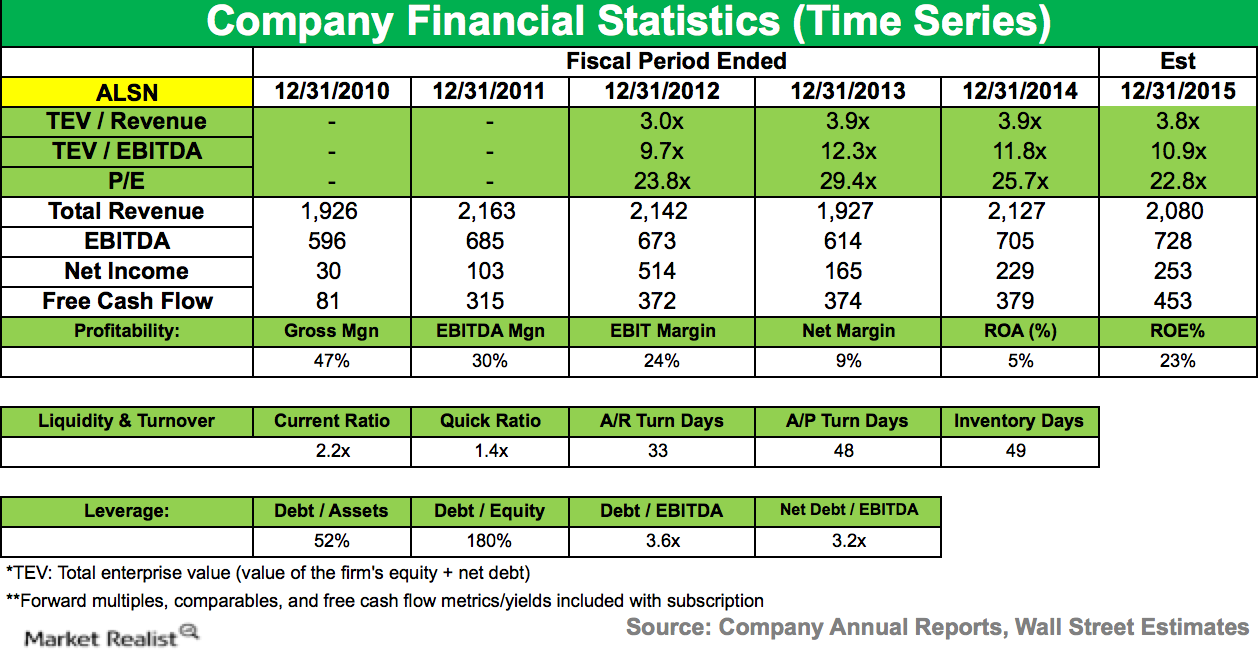

ValueAct Capital Ups Its Stake in Allison Transmission Holding

Allison Transmission Holding and its subsidiaries design and manufacture commercial and defense fully automatic transmissions.

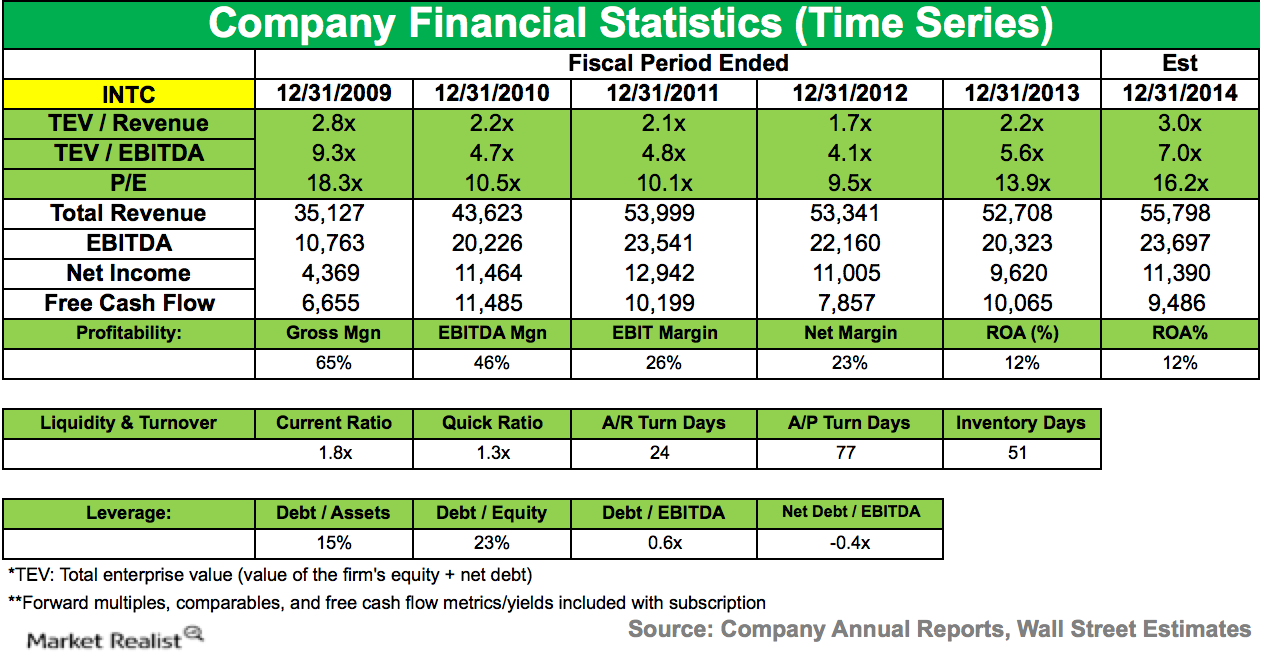

AQR Capital increases stake in Intel

Intel generated ~$5.7 billion in cash from operations. The company paid quarterly dividends of $1.1 billion and repurchased 122 million shares for $4.2 billion.

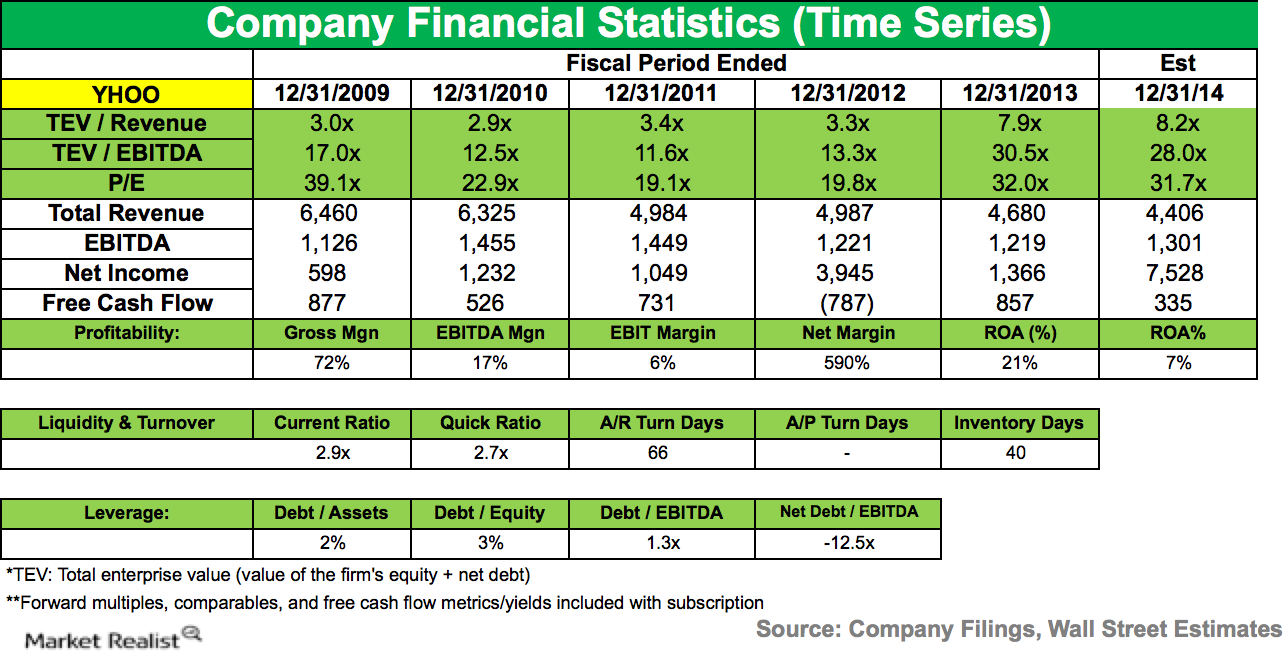

Farallon Capital sells stake in Yahoo!

Farallon Capital Management sold its position in Yahoo! Inc. (YHOO) during the third quarter. The stock accounted for 3.39% of the fund’s total 2Q14 portfolio.

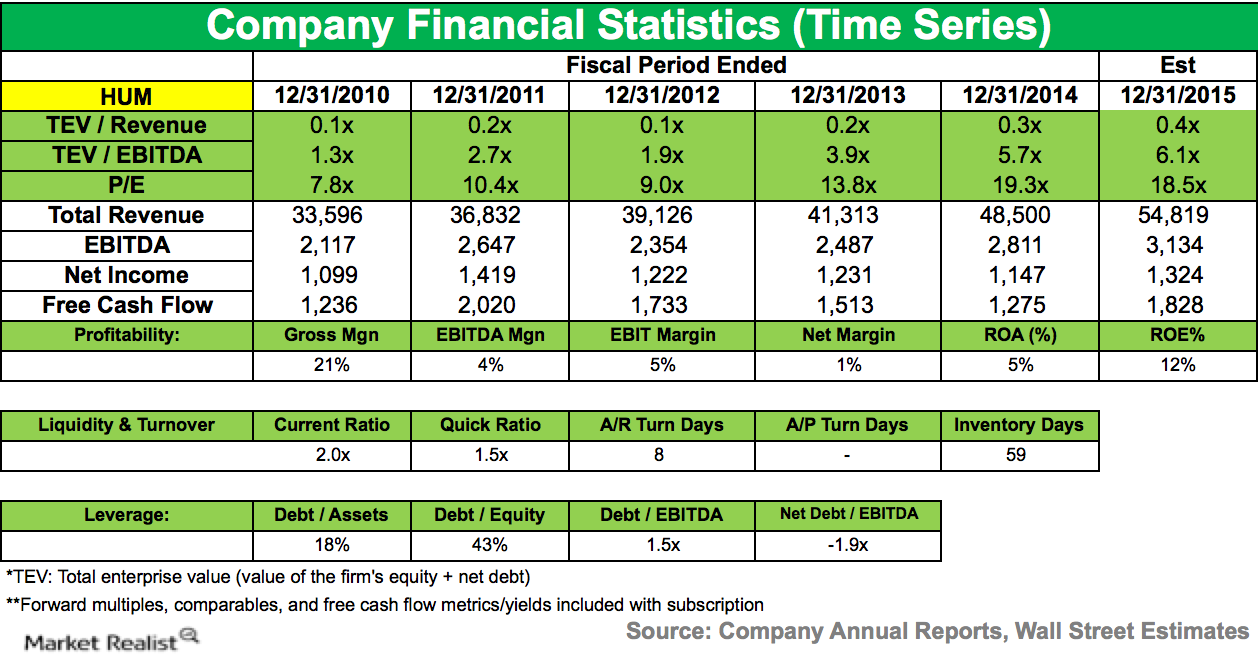

Eminence Capital Reduces Position in Humana

During the fourth quarter of 2014, Eminence Capital lowered its stake in Humana (HUM). The company accounted for 1.33% of the fund’s 4Q14 portfolio.

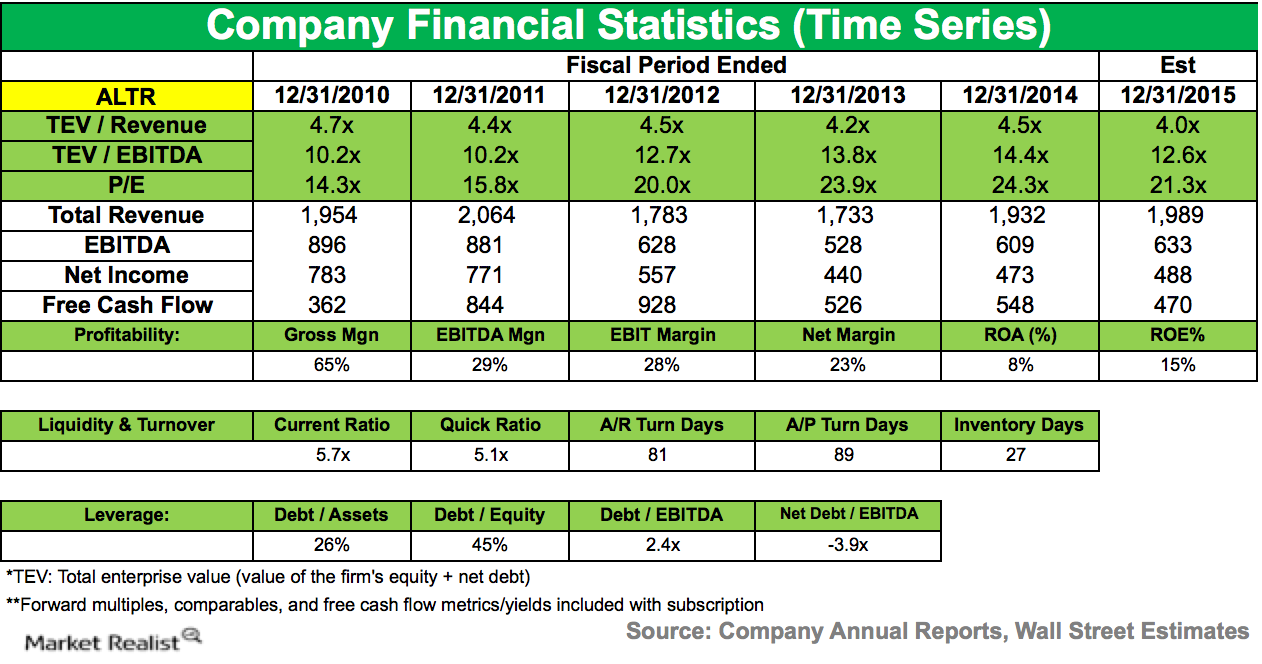

Citadel Advisors Starts a New Position in Altera Corporation

During 4Q14, Citadel Advisors started a new position in Altera Corporation (ALTR).

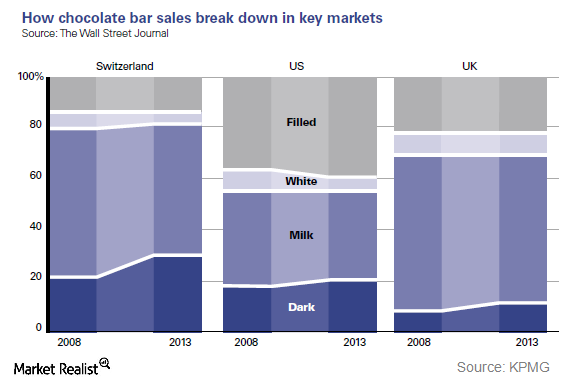

Analyzing Hershey’s Emphasis on Product Innovation

Hershey plans to position dark chocolate as a lifestyle choice in the US. It has thus begun promoting its dark chocolate brands for specific consumption.

Mead Johnson Plans to Focus on R&D to Support Innovations

Mead Johnson follows a strategy of investments in innovation, having expanded its liquids portfolio and rolled out its key specialty formulas across Asia.

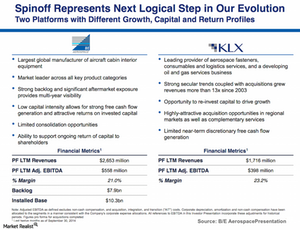

B/E Aerospace spun off KLX business on activist push

On December 17, 2014, B/E Aerospace completed its spin-off of KLX, Inc., from B/E Aerospace, and KLX started trading on NASDAQ under the ticker symbol KLXI.

Weighing Kraft Heinz’s Strengths and Opportunities

Kraft Heinz has a wide network of processing facilities and distribution centers, which allow it to supply fresh and high-quality products to customers.

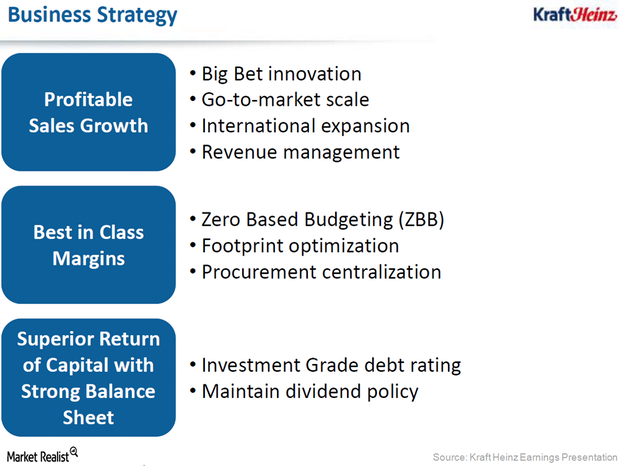

Evaluating Kraft Heinz’s Core Business Strategies

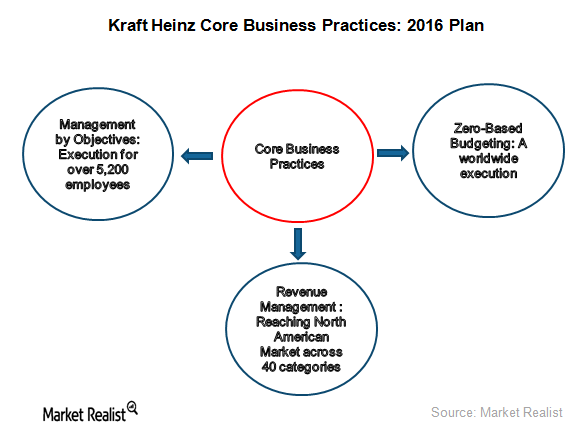

Kraft Heinz is focusing on core business practices, including ZBB (zero-based budgeting), revenue management, and MBO (management by objectives).

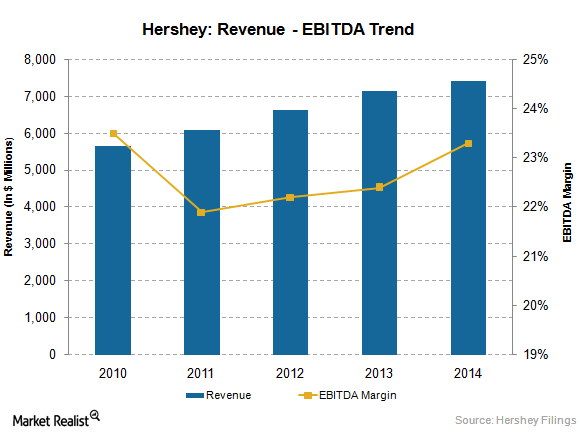

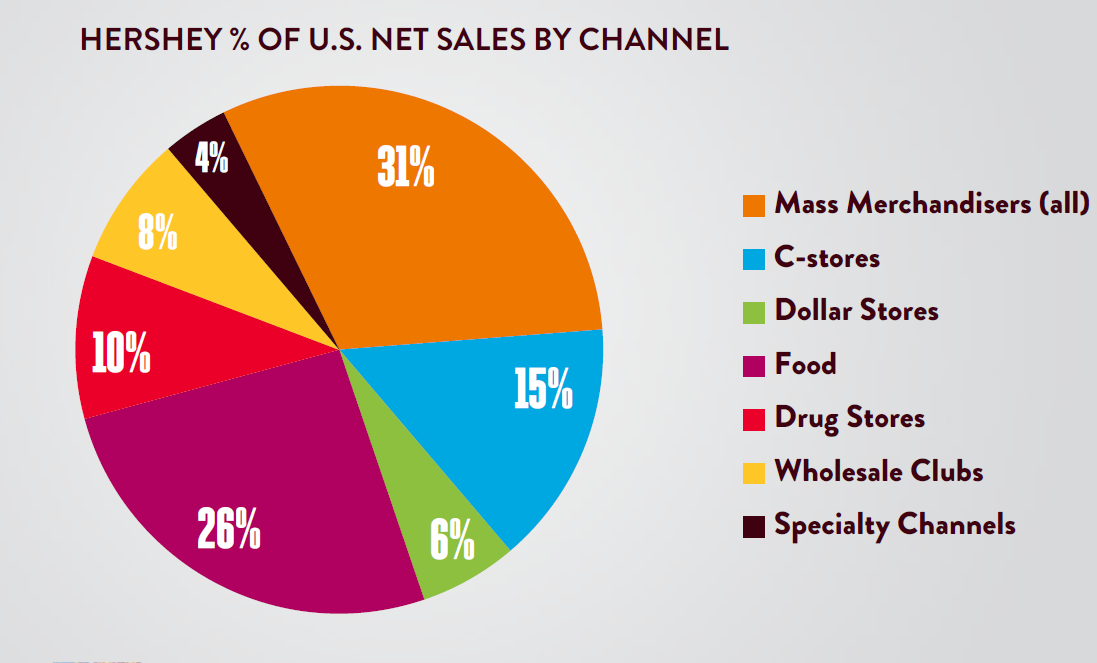

An Overview of Hershey, America’s Largest Chocolatier

Hershey is the largest producer of chocolate in North America. It is a global leader in chocolate, sugar confectionery, and chocolate-related products.

State of the Jewelry Industry in 2015: Growth and Challenges

Trends shaping the jewelry industry include Increasing demand for branded jewelry and an increased focus on e-commerce sales.

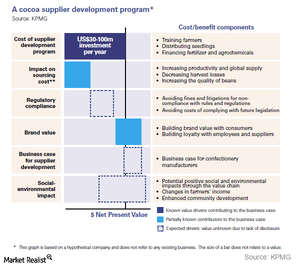

Hershey’s Steps to Improve Suppliers Productivity and Conscious Sourcing

Hershey has set a goal of sourcing 100% cocoa from certified cocoa farms. In fiscal 2014, it sourced 30% certified cocoa.

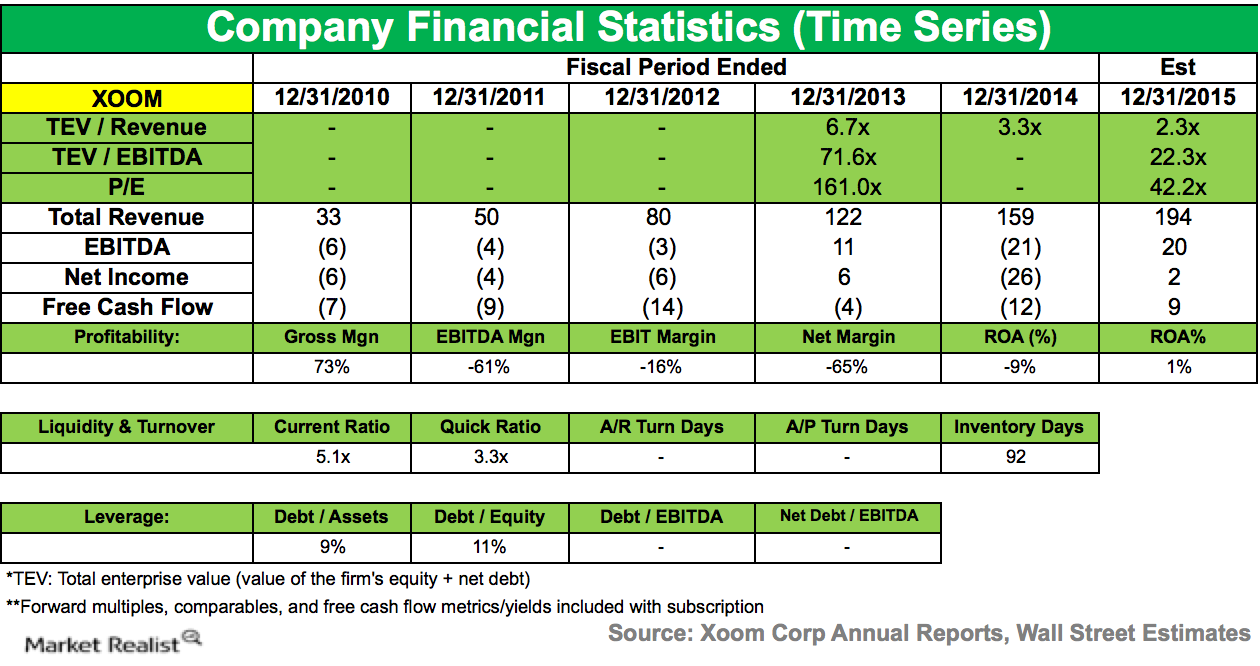

Eminence Capital raises its position in Xoom

Increased mobile adoption of Xoom’s mobile products led Latin America revenue, which rose 48% YoY. Gross sending volume increased 29% YoY.

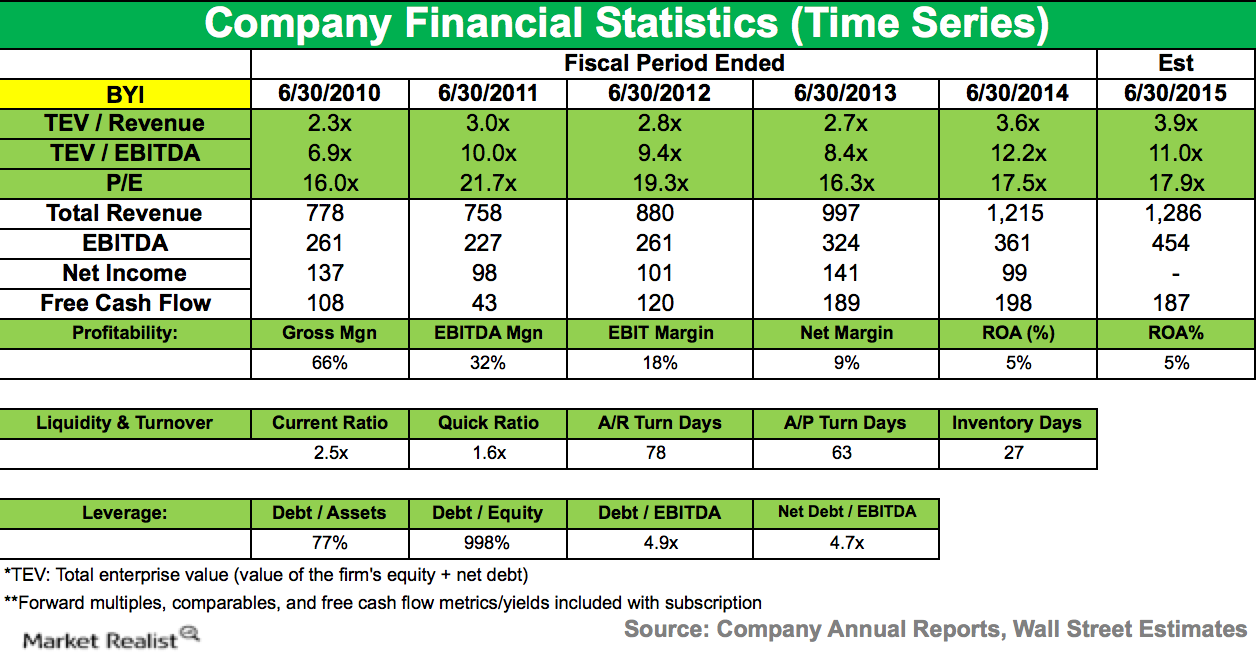

AQR Capital initiated position in Bally Technologies Inc.

AQR Capital initiated a position in Bally Technologies during the third quarter of 2014 that accounts for 0.22% of the fund’s 3Q14 portfolio.

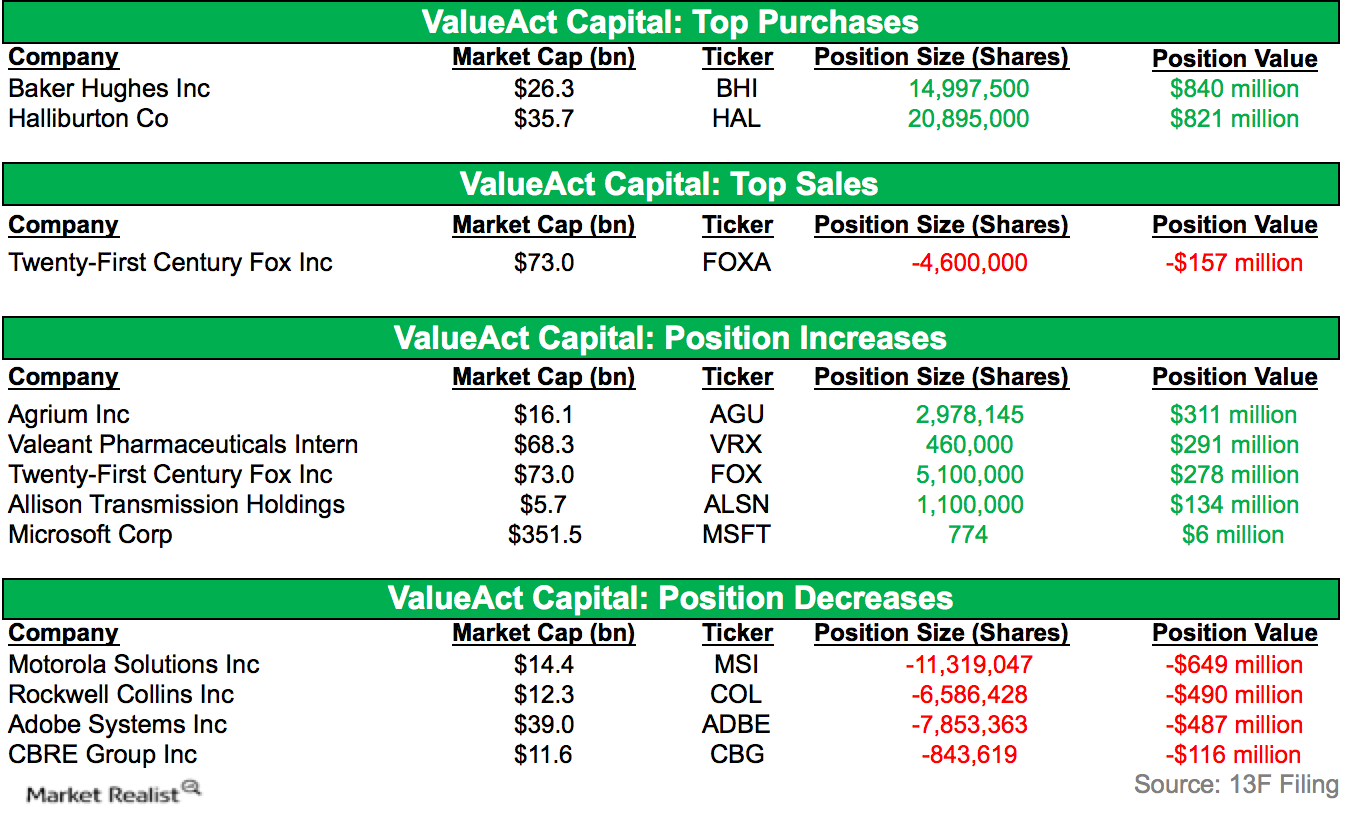

Key Takeaways from ValueAct Capital’s 4Q14 Holdings

ValueAct opts for long-term positions in companies that it believes are undervalued. With its significant stake, the fund works with the company to improve shareholder returns.

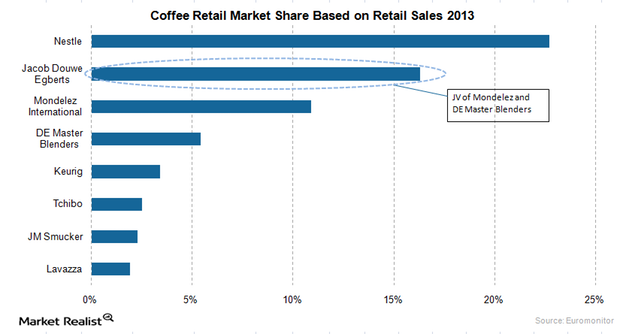

JAB to Challenge Nestle, Global Leader of Portioned Coffee Market

JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

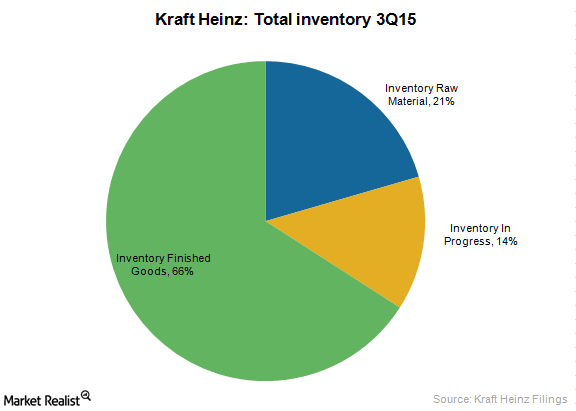

Sizing up Kraft Heinz’s SKU Rationalization Technique to Manage Inventory

Heinz has been using an inventory management technique, SKU rationalization to focus on profitable growth, which helps improve sales and profitability.

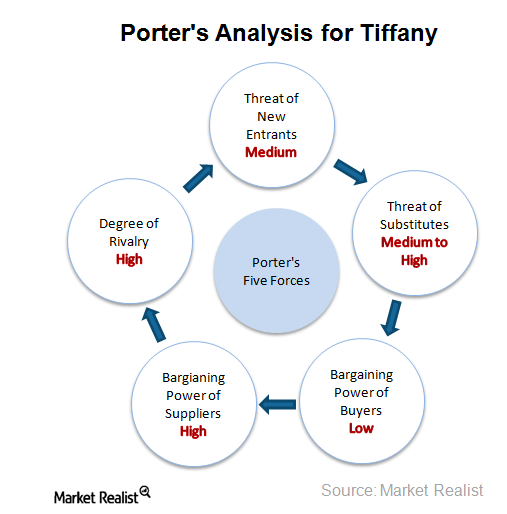

Tiffany’s Competitive Position: Porter’s Five Forces Analysis

Porter’s Five Forces model suggests that there are five forces that determine the attractiveness and long-term profitability of an industry or a sector.

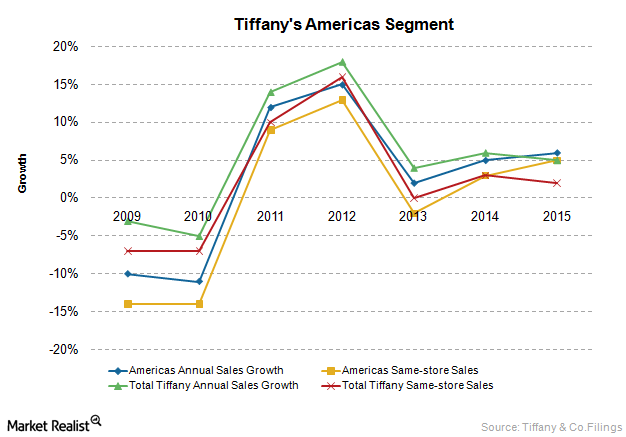

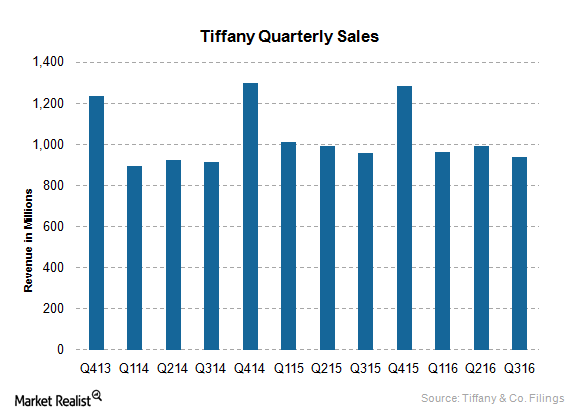

Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

Assessing Hershey’s Customer Relationships and Initiatives

Hershey is planning to stop using GMO sugar, milk from cows treated with growth hormones, artificial colors and flavors, and high fructose corn syrup.

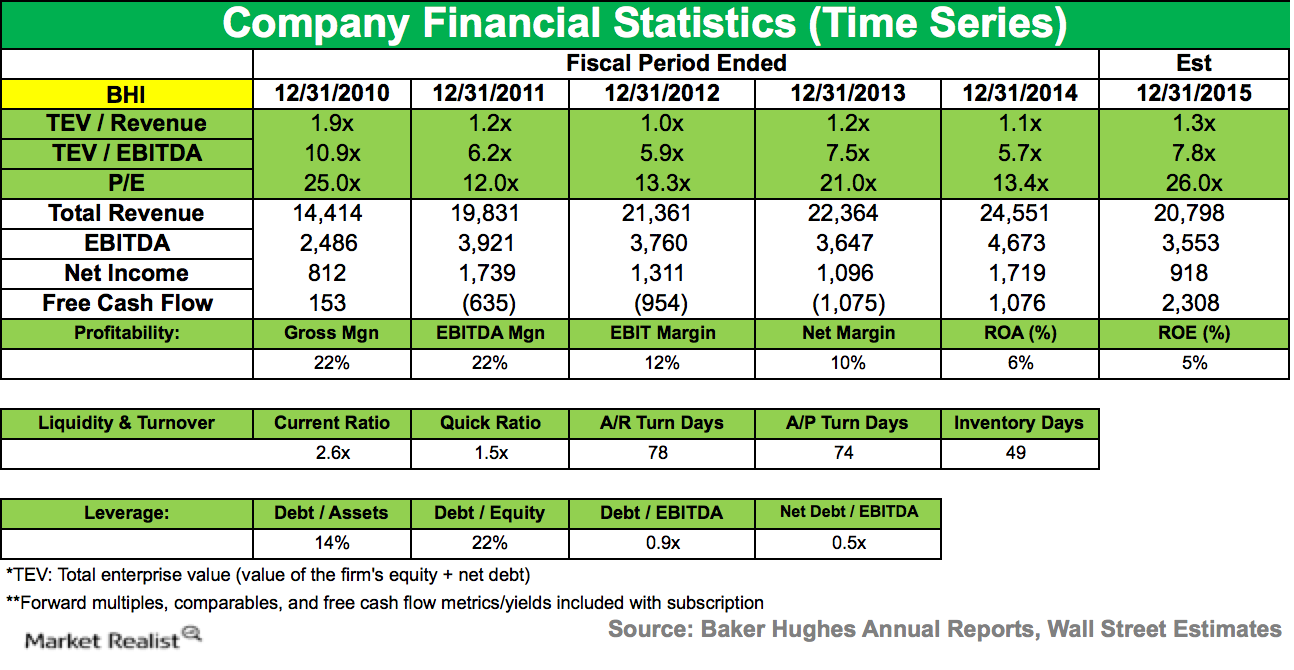

ValueAct Capital discloses activist stake in Baker Hughes

Activist hedge fund ValueAct Capital declared a 5.1% stake in Baker Hughes in its 13D filing on January 15, 2015.

Hurdles in Tiffany’s Growth: Weaknesses and Threats

Since it’s a luxury brand, Tiffany & Co.’s products are priced high, with no promotions. Thus, Tiffany products may be out of reach for many customers.

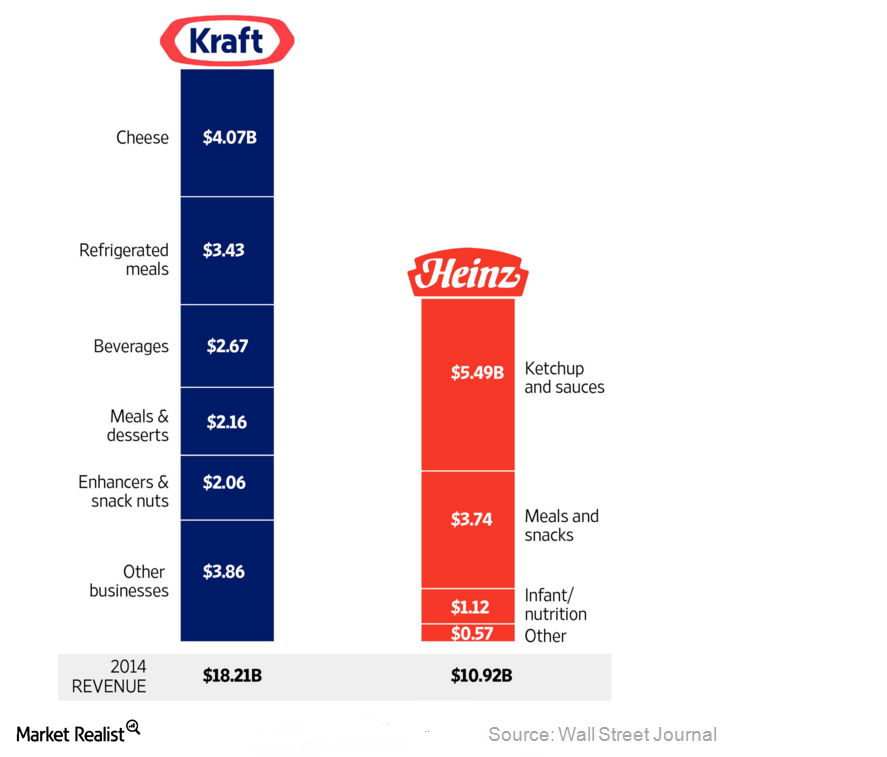

What Every Investor Needs to Know about Kraft Heinz: A Series Overview

The Kraft Heinz Company is the third-largest food and beverage company in North America and the fifth-largest food and beverage company in the world.

Why China Is Such an Important Market for Hershey in 2015

Hershey is the fastest-growing confectionery company in China, and Hershey expects China to become its second-largest market behind the US by 2017.

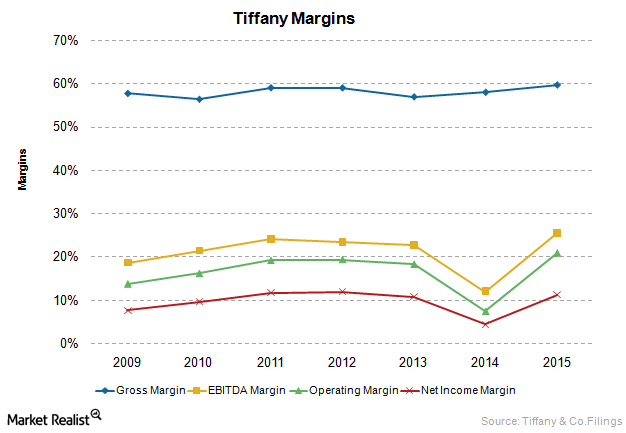

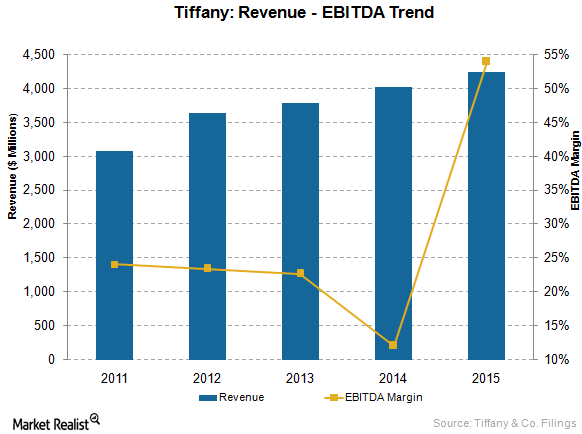

Why Tiffany & Co. Is More Profitable than Its Competitors

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers and Fossil, in the retail jewelry industry.

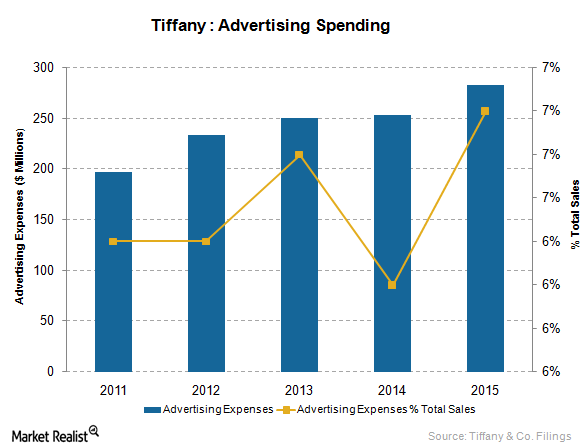

Why Tiffany Is Spending More on Marketing

Tiffany has been increasing its advertising expenses. In fiscal 2015, it spent $284 million on advertising, marketing, and public and media relations.

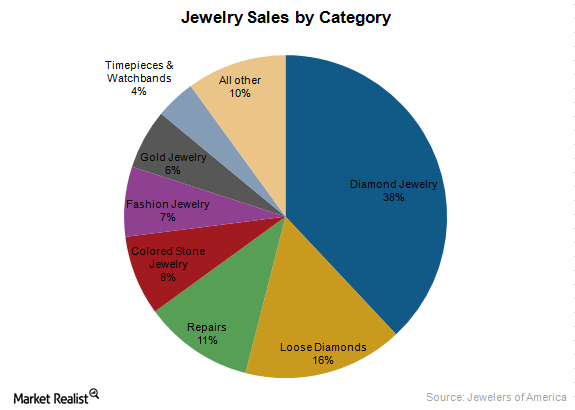

Signet Jeweler’s Market Positioning in the Retail Jewelry Industry

Total retail jewelry sales in the US grew at a CAGR of 4.4%, reaching $74.7 billion in 2014. Fine jewelry sales grew at a CAGR of 5%, reaching ~$69 billion.

JANA’s Track Record As an Activist Investor

Activist investor JANA Partners sold a 20% stake in the firm to Neuberger Berman’s Dyal Capital Partners. Dyal holds a passive interest in JANA Partners.

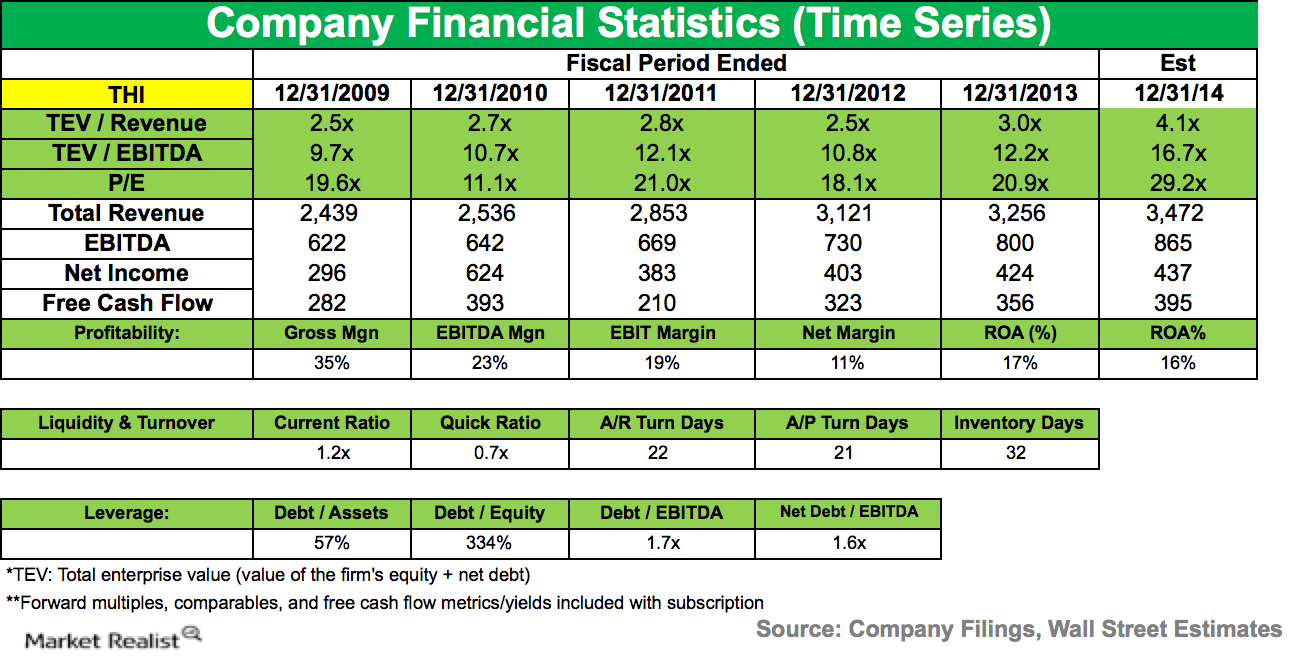

Farallon Capital initiates position in Tim Hortons

Farallon Capital Management started a new position in Tim Hortons Inc. (THI) during the third quarter of 2014. The position accounted for 2.62% of the fund’s 3Q14 portfolio.

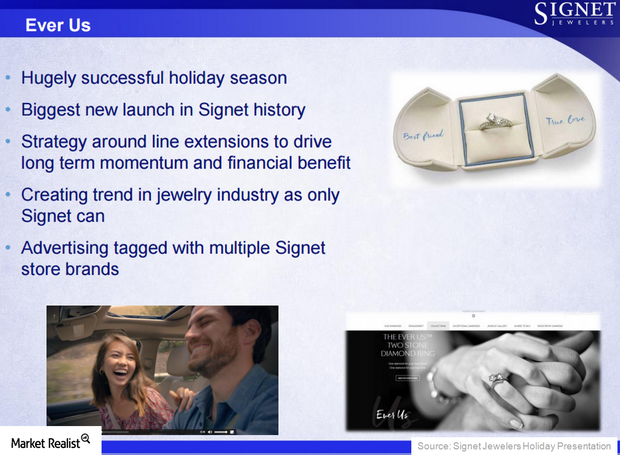

Signet Jewelers’ Ever Us Is Setting Trend for Jewelry Industry

Signet launched a new collection called Ever Us in October 2015. It’s meant to meet the need for jewelry that represents the bond between two people.

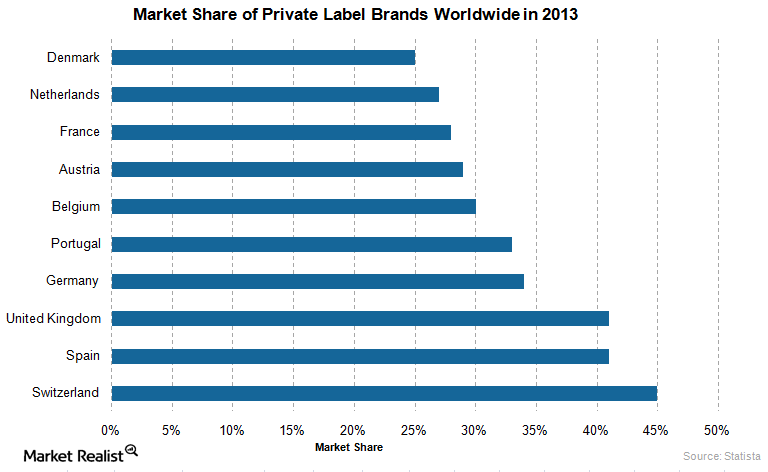

Hurdles in Kraft Heinz’s Growth: Weaknesses and Threats

Frequent recalls not only affect the consumer satisfaction and brand image of Kraft Heinz’s products but also increases the cost factor.

Kraft Heinz Implements Zero-Based Budgeting to Reduce Costs

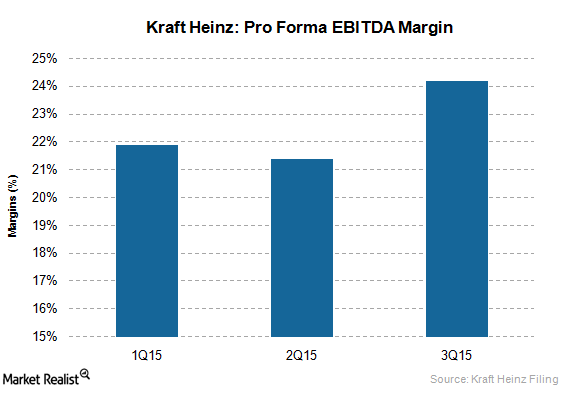

3G Capital applied a ZBB approach, which starts from zero-base and analyzes every functional area for cost, to Heinz, after it acquired the firm in 2013.

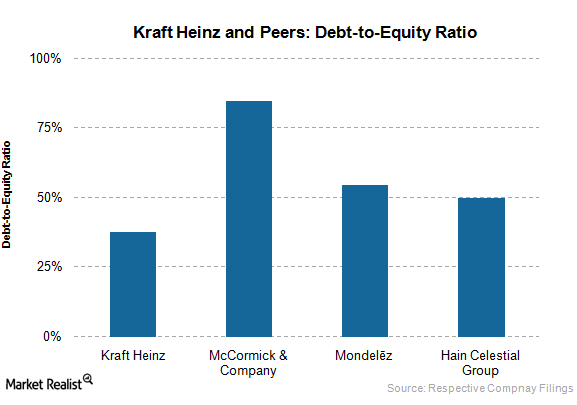

Evaluating Kraft Heinz’s Financials against Its Biggest Competitors

Kraft Heinz had a coverage ratio of 0.87x at the end of 3Q15, whereas McCormick & Company and Mondelēz had coverage ratios of 10.2x and 56.1x, respectively.

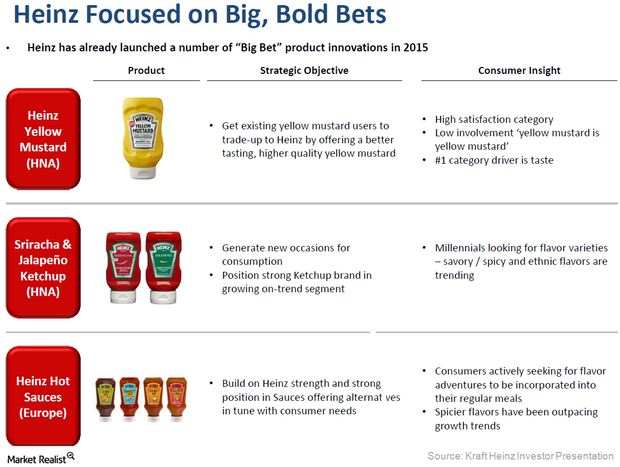

Analyzing Kraft Heinz’s Great Brands Strategy

Kraft Heinz is shifting its focus on advertising spending from non-working media to working media.

Analyzing Kraft Heinz’s Objective of Profitable Sales Growth

Kraft Heinz plans to reinvest savings from cost initiatives into its brands and to refocus its strategic vision on innovation.

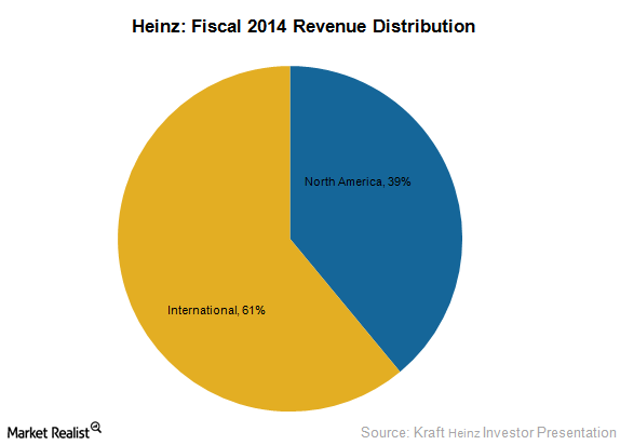

Kraft Heinz Aims to Become an International Heavy Hitter

Kraft Heinz could have the opportunity to improve its revenues by expanding into the untapped international market through the Heinz platform.

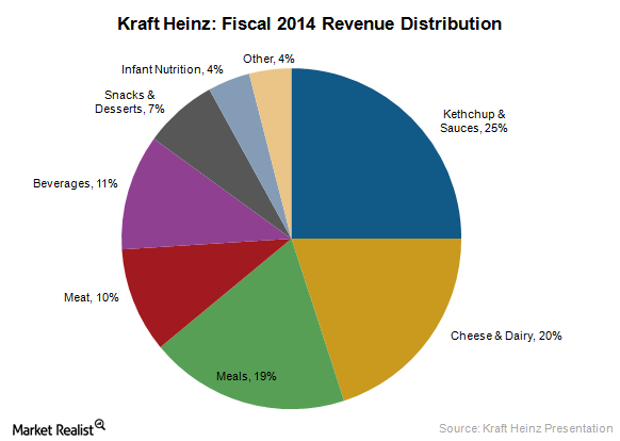

What’s on the Table with Kraft Heinz? Getting to Know the Company’s Product Offerings

Kraft Heinz operates more than 200 brands in nearly 200 countries. Its eight iconic brands contribute more than $1 billion in sales apiece to total revenue.

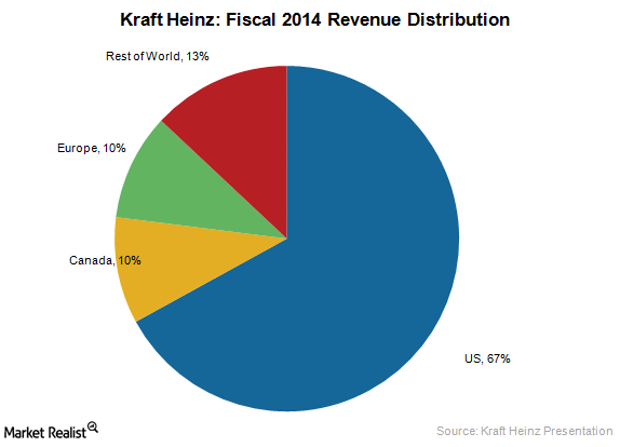

Breaking down Kraft Heinz: A Segmental and Geographical Overview

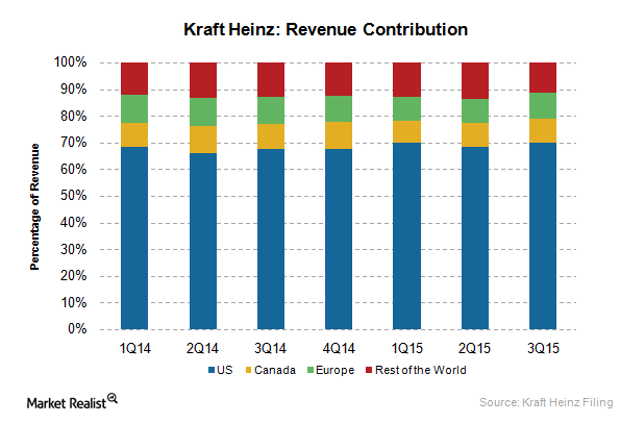

The US accounted for 67% of Kraft Heinz’s fiscal 2014 pro forma sales, with Canada and Europe each contributing 10% of total sales.

A Key Analysis of the Kraft-Heinz Merger

In early 2015, Berkshire Hathaway and 3G Capital designed the Kraft-Heinz merger by pairing the Kraft Foods Group with H. J. Heinz Company.

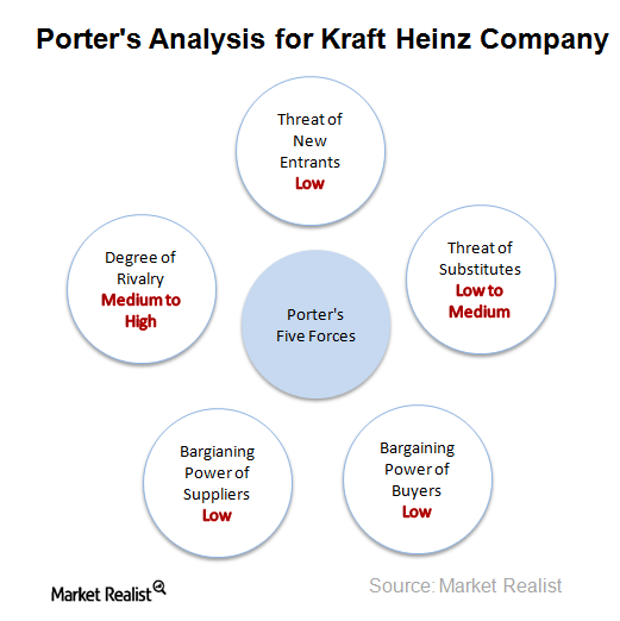

A Porter’s Five Forces Analysis of Kraft Heinz Company

Kraft Heinz faces competition from a huge number of players in the food market, but product differentiation is low between its competitors.

What Challenges Has Keurig Green Mountain Been Facing?

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012.

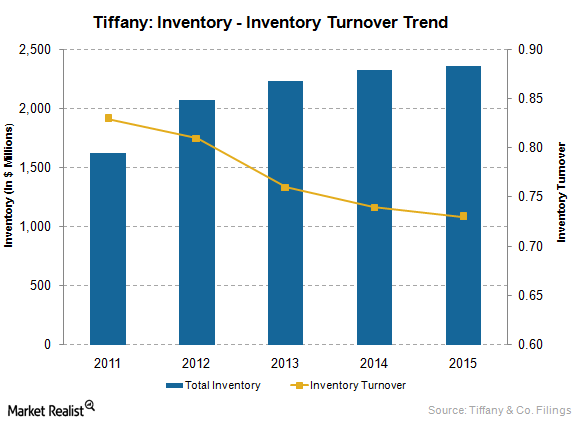

Low Inventory Turnover Is a Concern at Tiffany & Co.

At the end of fiscal 2015, Tiffany had a total inventory of $2.4 billion and inventory turnover of 0.73x, implying potential low sales and excess inventory.

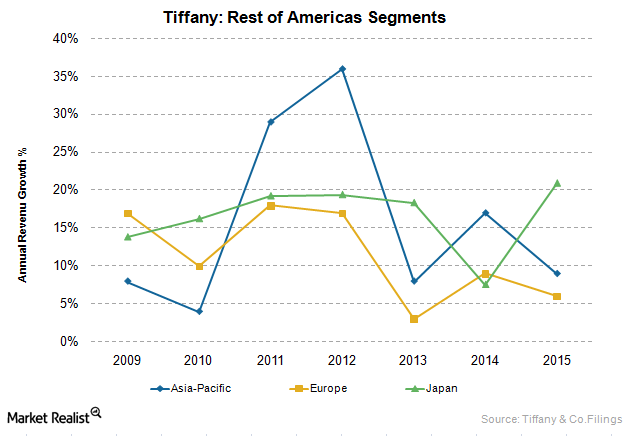

Analyzing Tiffany & Co.’s International Segments

Tiffany & Co. has presences to differing degrees in the Asia-Pacific, Japan, Europe, and Other regions.

Analyzing Tiffany’s Key Strategic Objectives

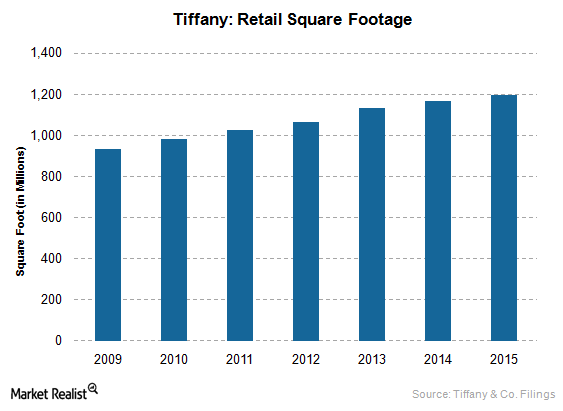

Tiffany’s key strategic objectives for growth include expanding marketing communications, opening stores in key markets, and enhancing in-store experience.

A Must-Know Business Overview of Tiffany & Co.

Tiffany & Co. is a holding company that operates through its subsidiary companies. The most notable is Tiffany & Company, a jeweler and specialty retailer.

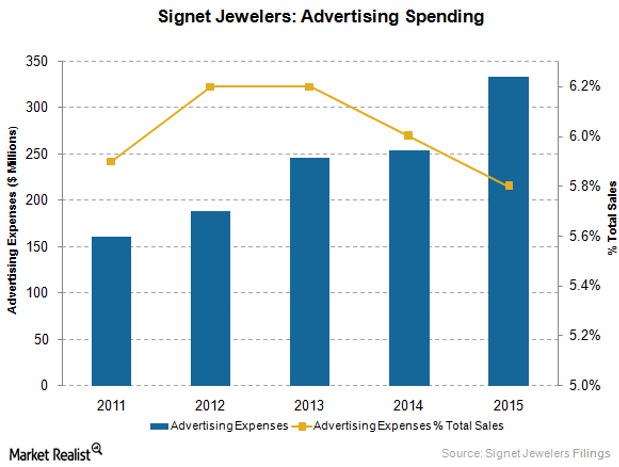

Evaluating Signet Jeweler’s Marketing Strategies and Initiatives

Signet Jewelers’ well-known, exclusive brands aim to influence consumers in their buying decisions. Sterling Jewelers thus provides 32% branded assortments.

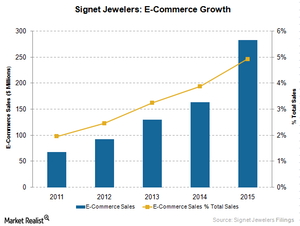

Why Signet Jewelers Prioritizes E-Commerce as a Growth Driver

Signet acknowledges the value of e-commerce growth and its ability to maximize in-store experiences. Signet has thus integrated its website with its stores.

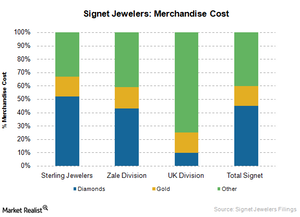

Signet Jewelers’ Aim to Improve Vertical Integration and Supply Chain

Signet aims to advance its vertical integration, including the sourcing and manufacturing of rough diamonds, which should help improve its supply chain.