Evaluating Kraft Heinz’s Financials against Its Biggest Competitors

Kraft Heinz had a coverage ratio of 0.87x at the end of 3Q15, whereas McCormick & Company and Mondelēz had coverage ratios of 10.2x and 56.1x, respectively.

Jan. 9 2016, Updated 7:05 a.m. ET

Kraft Heinz’s financials

The Kraft Heinz Company (KHC) is an investment-grade company with a sustainable capital structure for the long-term. Let’s consider the following key company figures:

- The company refinanced Heinz’s $9.5 billion of existing secured debt issued at a high-interest rate with new investment grade debt, at the close of the merger transaction.

- Kraft Heinz also plans to refinance Heinz’s remaining existing secured debt issued at a higher rate with new investment-grade debt.

- The company aims to refinance $8 billion of preferred equity when it becomes callable in June 2016 with new investment grade debt. The company thereby expects to save $450 million to $500 million annually.

- The company targets to pay down $2 billion of debt within two years.

- Over the medium term, Kraft Heinz aims to achieve the net leverage ratio of below 3.0x of adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

At the end of 3Q15, which for Kraft Heinz ended on September 27, the company had a gross debt of $25.3 billion, at an average annual rate of interest of approximately 4%.

Peer group comparisons

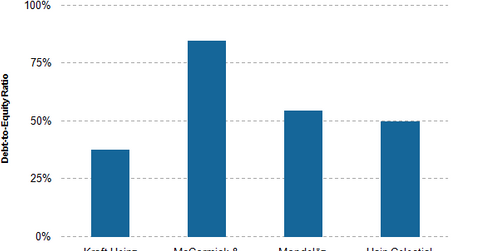

In comparison, its peers in the food industry (XLP) had the following leverage ratios:

- McCormick & Company (MKC)—84.7% at the end of 3Q15, ended August 31, 2016

- Mondelēz International (MDLZ)—54.6% at the end of 3Q15, ended September 30, 2015

- Hain Celestial Group (HAIN)—49.8% at the end of 1Q16, ended September 30, 2015

Kraft Heinz had a coverage ratio or EBIT-to-interest expense ratio of 0.87x at the end of 3Q15. McCormick & Company and Mondelēz had coverage ratios of 10.2x and 56.1x, respectively.

The Kraft Heinz Company makes up 1.6% of the PowerShares ETF (QQQ). Consumer staples firms, including the Kraft Heinz Company, make up 7.2% of the holdings of QQQ.

But what was behind Kraft Heinz’s troubling performance in 3Q15? Continue to the next part to find out.