Hain Celestial Group Inc

Latest Hain Celestial Group Inc News and Updates

Hain Celestial Pursues an Accretive Acquisition Strategy

Hain Celestial (HAIN) has solidified its position over the years by making numerous acquisitions in both US and overseas markets.

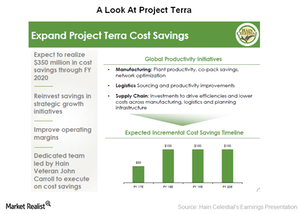

Hain Celestial’s SKU Optimization and Project Terra Efforts

Hain Celestial has undertaken a massive SKU optimization program. In fiscal 4Q17, the company stated that it had streamlined 20% of its US inventory.

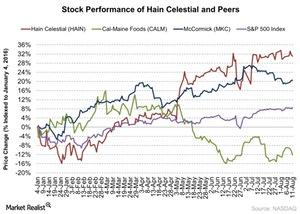

How Has Hain Celestial’s Stock Fared ahead of Fiscal 4Q16 Results?

So far, Hain Celestial’s stock has shown tremendous growth of 31% in 2016, led by an exceptional performance each quarter. The stock has gained 16% since its last quarterly earnings release on May 4.

How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

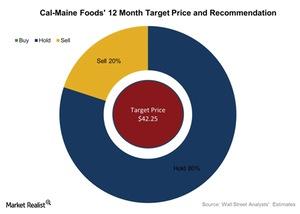

What Do Analysts Recommend for Cal-Maine Foods after 4Q16?

The average broker target price for Cal-Maine Foods rose slightly to $42.25 from $41.5—4.5% lower than the closing price of $44.18 on July 18, 2016.

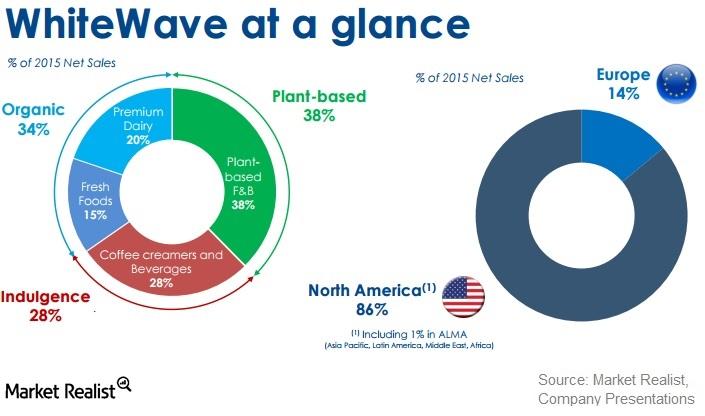

How Can WhiteWave Foods Add to Danone’s Business?

WhiteWave Foods (WWAV) currently generates around 80%–85% of its total revenue and operating profit from North America alone.

What Are the Benefits of Danone’s WhiteWave Acquisition?

Danone will be acquiring WhiteWave Foods for $56.25 per share in an all-cash transaction. This makes WWAV’s total enterprise value ~$12.5 billion.

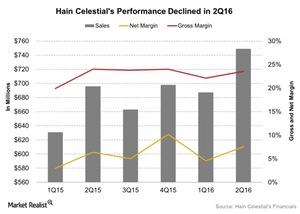

How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

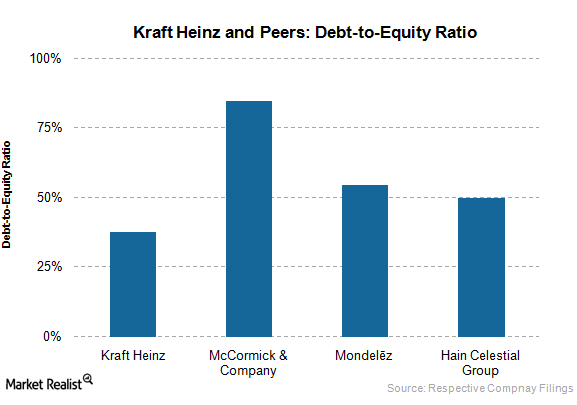

Evaluating Kraft Heinz’s Financials against Its Biggest Competitors

Kraft Heinz had a coverage ratio of 0.87x at the end of 3Q15, whereas McCormick & Company and Mondelēz had coverage ratios of 10.2x and 56.1x, respectively.

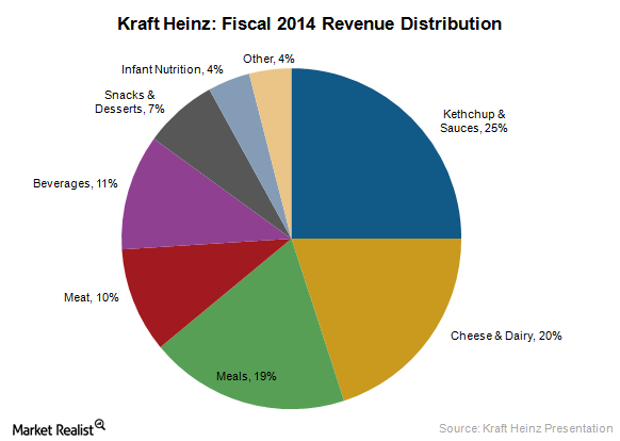

What’s on the Table with Kraft Heinz? Getting to Know the Company’s Product Offerings

Kraft Heinz operates more than 200 brands in nearly 200 countries. Its eight iconic brands contribute more than $1 billion in sales apiece to total revenue.

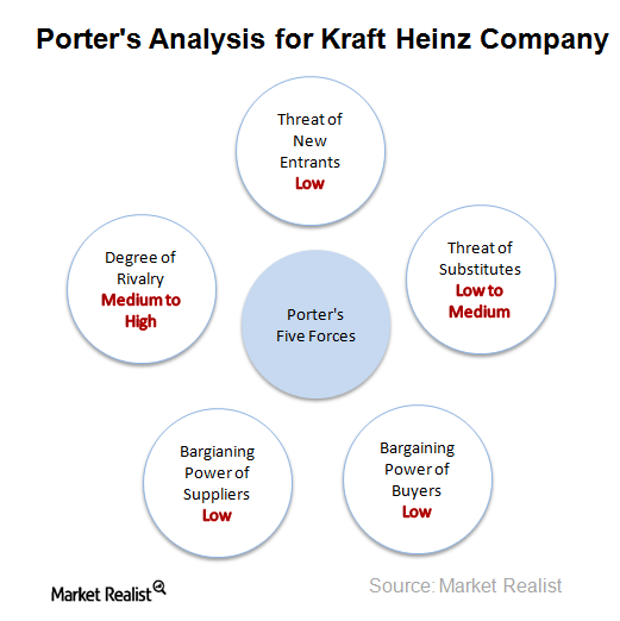

A Porter’s Five Forces Analysis of Kraft Heinz Company

Kraft Heinz faces competition from a huge number of players in the food market, but product differentiation is low between its competitors.