Breaking down Kraft Heinz: A Segmental and Geographical Overview

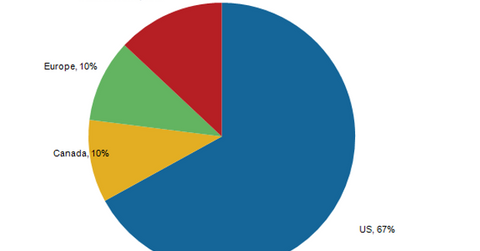

The US accounted for 67% of Kraft Heinz’s fiscal 2014 pro forma sales, with Canada and Europe each contributing 10% of total sales.

Jan. 1 2016, Updated 10:06 a.m. ET

Overview of Kraft Heinz’s segments

In July 2015, H. J. Heinz Company acquired the Kraft Foods Group to form the Kraft Heinz Company (KHC). The company’s priority is to integrate the operations of two businesses and establish a new organizational structure.

The company operates mainly in the following four segments:

- the US

- Canada

- Europe

- the Asia-Pacific region, Latin America, and RIMEA (Russia, India, the Middle East, and Africa)

The segmental nitty-gritty on Kraft Heinz

The US accounted for 67% of Kraft Heinz’s fiscal 2014 pro forma sales, with Canada and Europe each contributing 10% of total sales. Fiscal 3Q15, which ended September 27, 2015, was the first reporting quarter for the Kraft Heinz Company after the merger. Below are a few key takeaways from that fiscal quarter:

- In 3Q15, the merged company’s US segment accounted for 70.2% of total revenues, with an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) margin of 24.7%.

- The merged company’s Canada segment represented 8.8% of total sales, with an adjusted EBITDA margin of 20.4%.

- Europe accounted for 9.8% of total sales, with an adjusted EBITDA margin of 37.1%.

- The Asia-Pacific region, Latin America, and RIMEA contributed 11.2% of total 3Q15 revenues, with an adjusted EBITDA margin of 18.3%.

Peer group comparisons

Kraft Heinz’s biggest peer in the food industry (XLP) Nestlé (NSRGY) has well-balanced revenue distribution across geographies, with the Americas accounting for its highest total revenues at 29% in fiscal 2014, which ended December 31, 2014. By comparison, Mondelēz International (MDLZ) generated 40.6% of its fiscal 2014 revenues from its Europe segment.

The Kraft Heinz Company makes up 1.6% of the PowerShares ETF (QQQ). Consumer staples firms, including the Kraft Heinz Company, make up 7.2% of the holdings of QQQ.

Now that we’ve taken a geographical look at Kraft Heinz, we should take a look at the company’s goals in the international arena. Continue to the next part of this series for the analysis.