Diana Key

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Diana Key

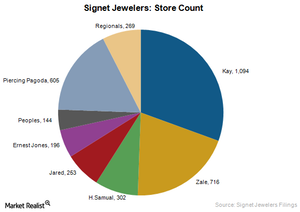

A Snapshot of Signet Jewelers’ Divisions and Product Offerings

Signet Jewelers operates under three divisions: the Sterling Jewelers division, the Zale division, and the UK Jewelry division.

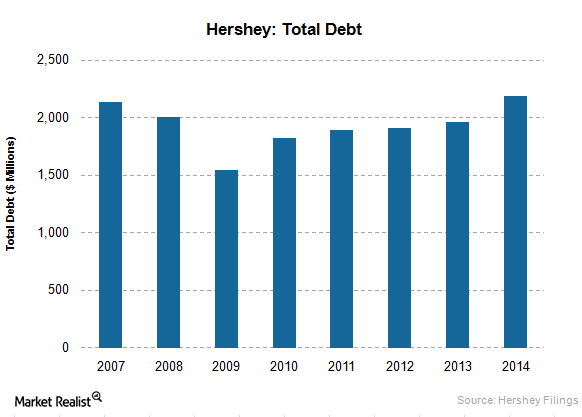

Evaluating Hershey’s Financials Against Its Competitors

Hershey had a total debt of $2.4 billion on its balance sheet in 2014. It had a total debt-to-equity ratio of 195% during the same period.

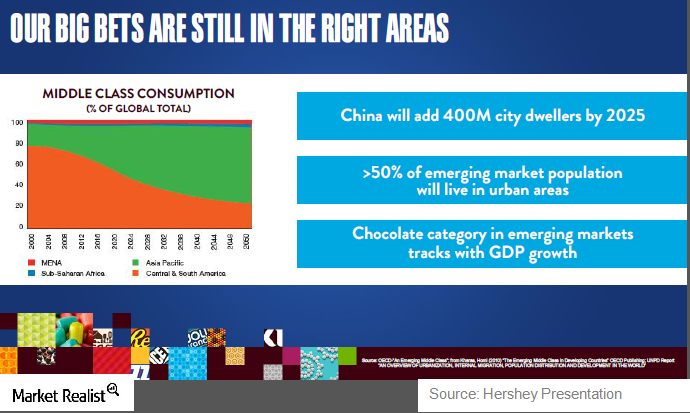

Hershey’s New Focus on International Growth Opportunities in 2015

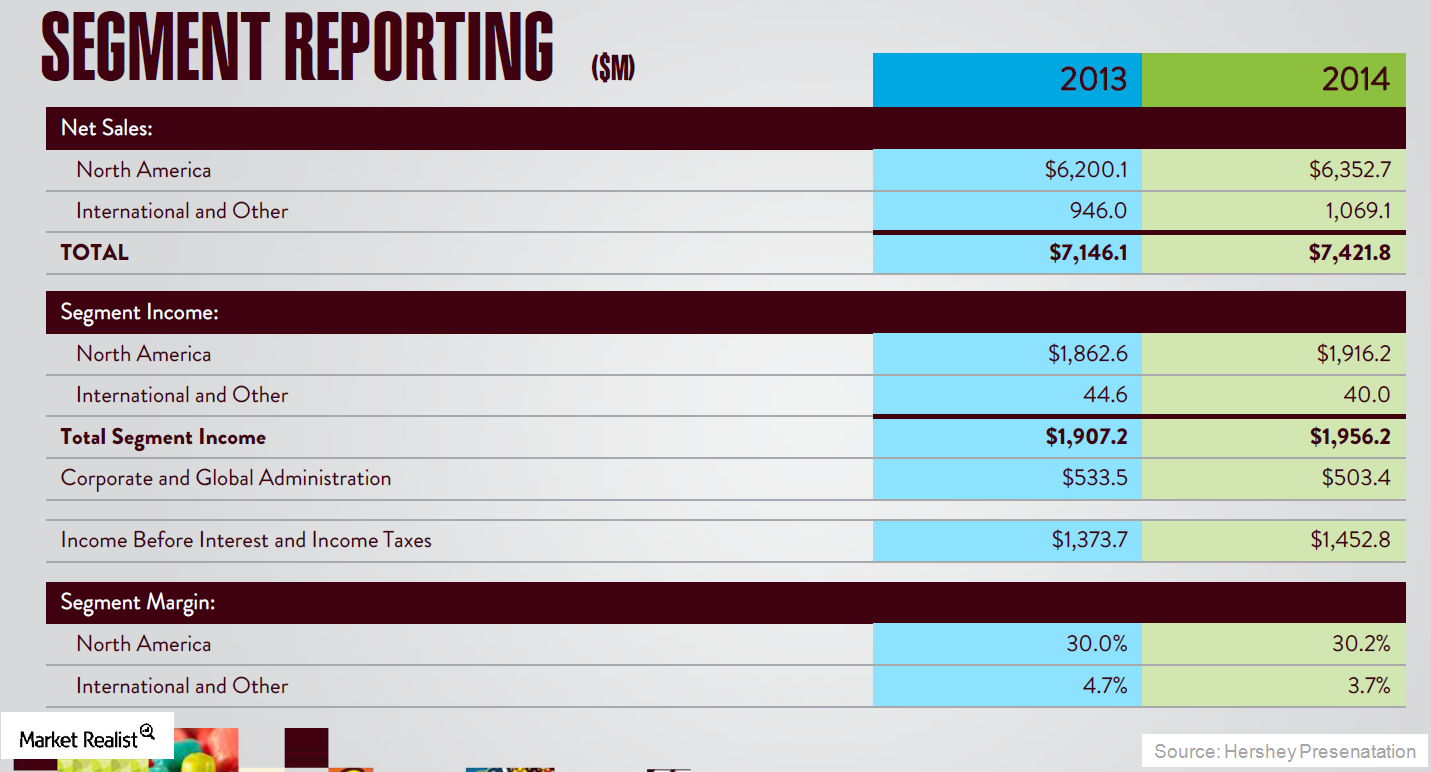

Hershey’s international segment contributes only ~30% of total revenues. Its goal is to increase international revenues to ~50% of total revenues by 2018.

Hershey’s Competitive Strategies for North America in 2015

Along with advertising, Hershey is focusing on cross-merchandising complimentary products like beverages and snacks, which should help expand consumption.

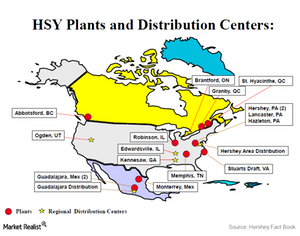

How Hershey Gained from Improving Its Supply Chain

In 2010, Hershey announced Project Next Century, which aims to streamline its global supply chain operations and create a more competitive cost structure.

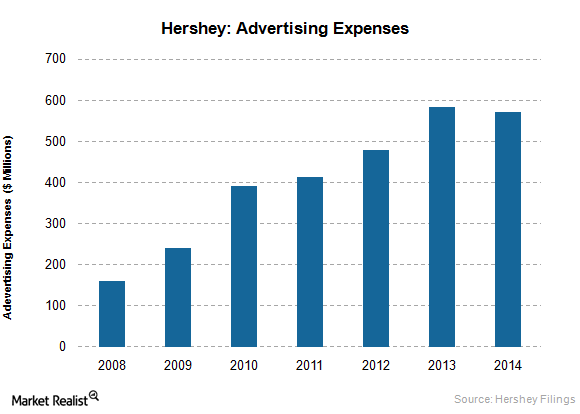

Evaluating Hershey’s Marketing Strategies and Initiatives

Hershey applies a micro-marketing concept to its businesses, which means that it markets certain products to small target audiences.

Analyzing Hershey’s Segments and Product Offerings

In its international business, Hershey is mainly focusing in emerging markets of Mexico, Brazil, India, and China.

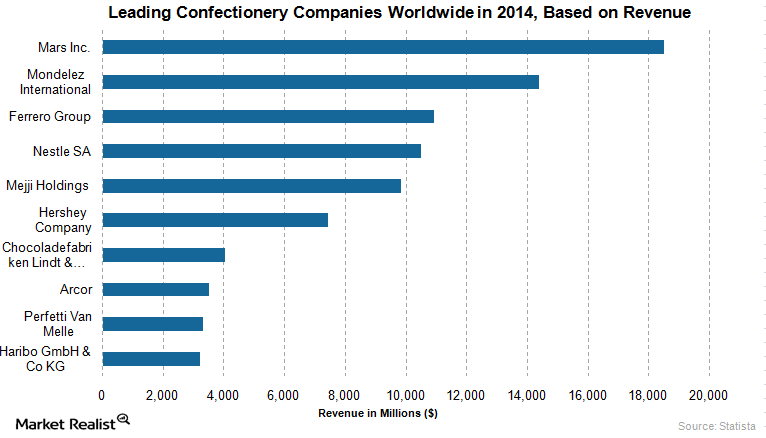

A Glance at Hershey’s Leadership in the US Confectionery Industry

Hershey is a leading player in the confectionery industry, which grew globally at a CAGR of 4.9% from 2009–2014, reaching $198.4 billion in 2014.

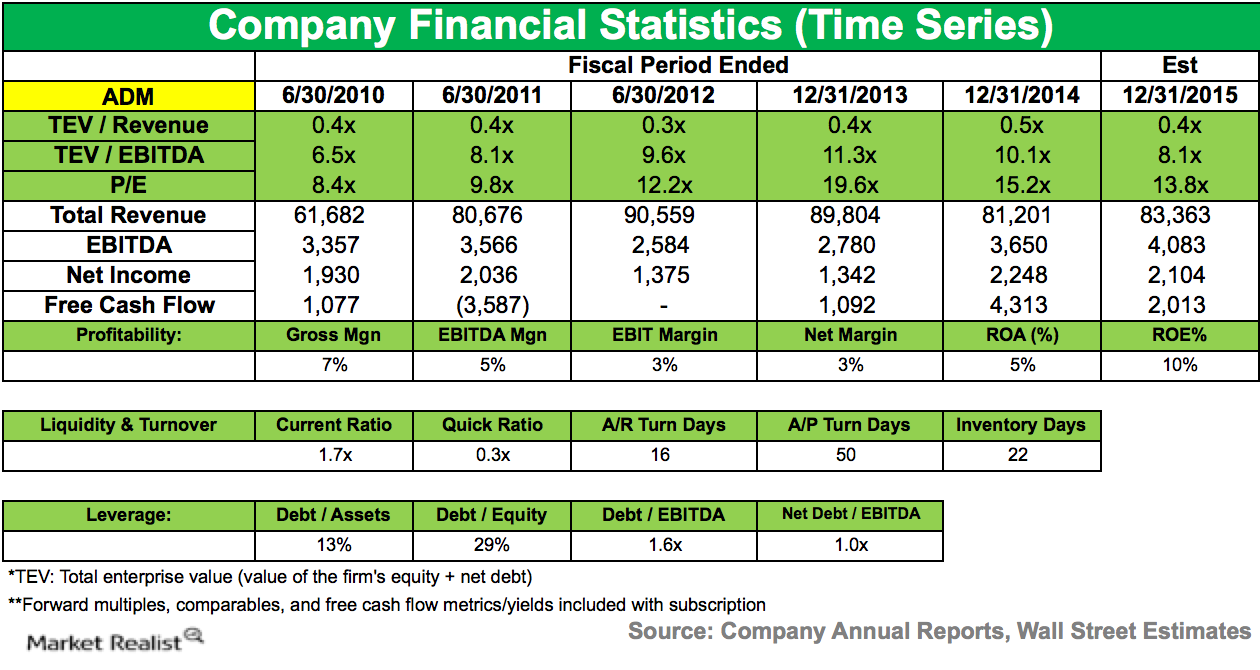

Citadel Advisors Reduces Position in Archer Daniels Midland

The Archer Daniels Midland Company is a processor of oilseeds, corn, wheat, cocoa, and other agricultural commodities.

Highlights of Citadel Advisors’ 4Q14 Portfolio

Citadel Advisors’ 4Q14 portfolio increased by 3.63% to $82.66 billion from $76.77 billion in 3Q14.

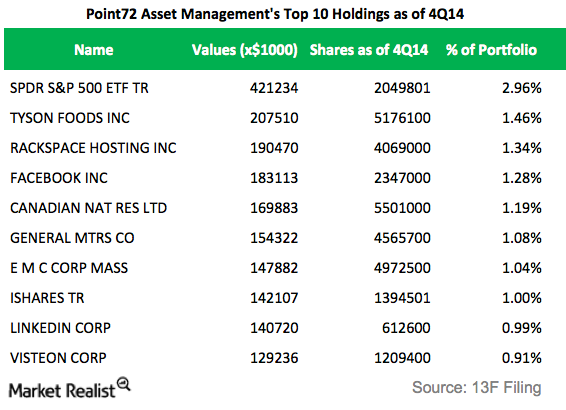

Steven Cohen and Point72 Asset Management’s 4Q14 Positions

Steven Cohen’s Point72 Asset Management disclosed new positions in its 13F filing last month. The fund’s portfolio increased by 7.25% to $14.25 billion in 4Q14.

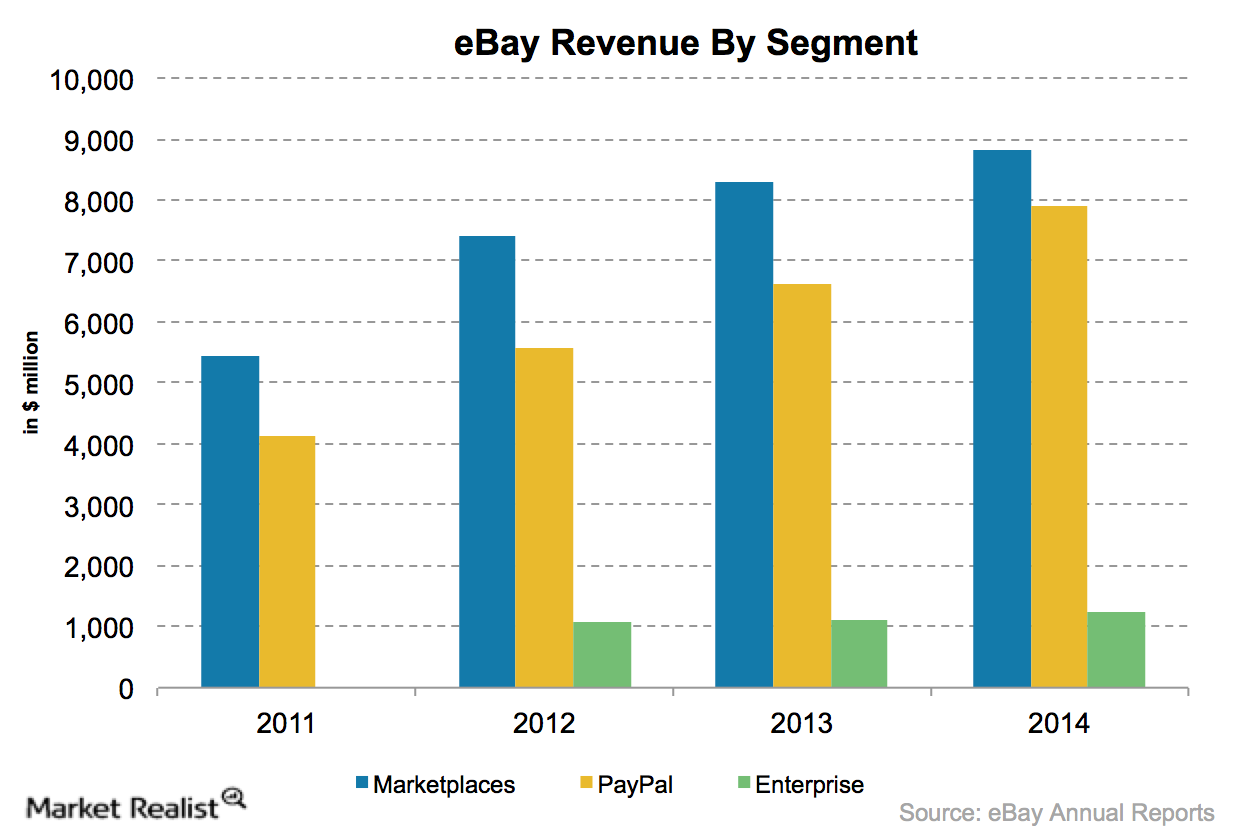

Eminence Capital Reduces Position in eBay

During the fourth quarter of 2014, Eminence Capital lowered its stake in eBay (EBAY). The company accounted for 2.55% of the fund’s 4Q14 portfolio.

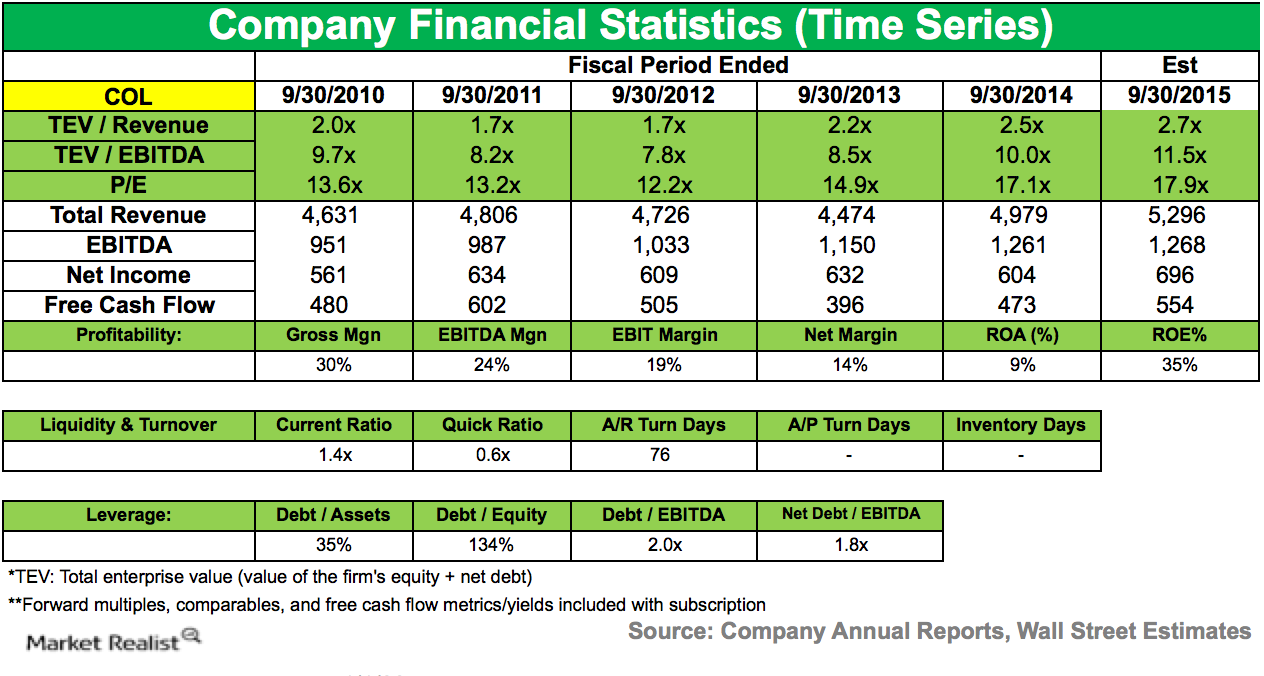

ValueAct Capital Lowers Stake in Rockwell Collins

Rockwell Collins is a leader in the design, production, and support of communications and aviation electronics for commercial and military customers worldwide.

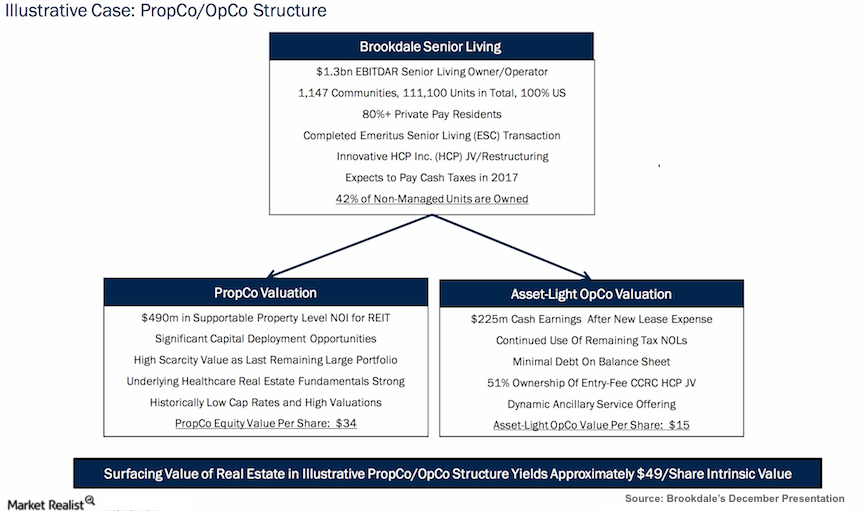

Why Sandell wants a spin-off of Brookdale’s real estate assets

Sandell has proposed a spin-off of Brookdale’s real estate assets into an REIT. It’s a tax-free spin-off that avoids double taxation on income distribution.

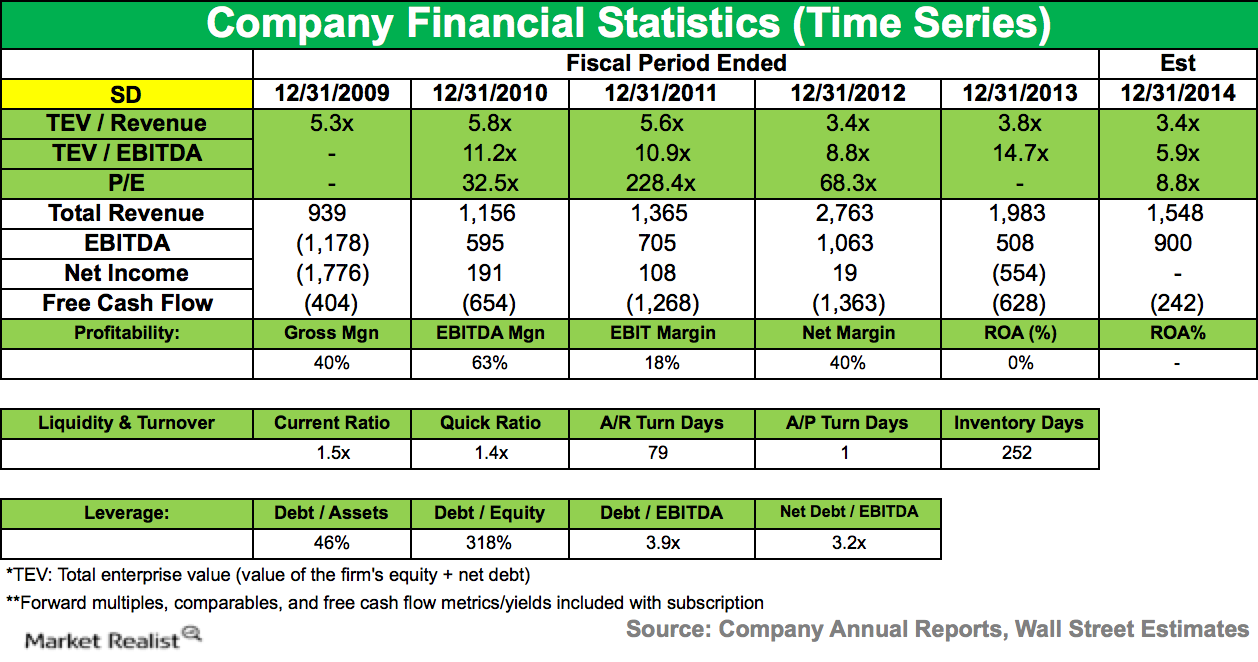

Overview of SandRidge Energy

SandRidge is expanding its low-cost multilateral program and is successfully extending its mid-continent resource base with Chester and Woodford production.

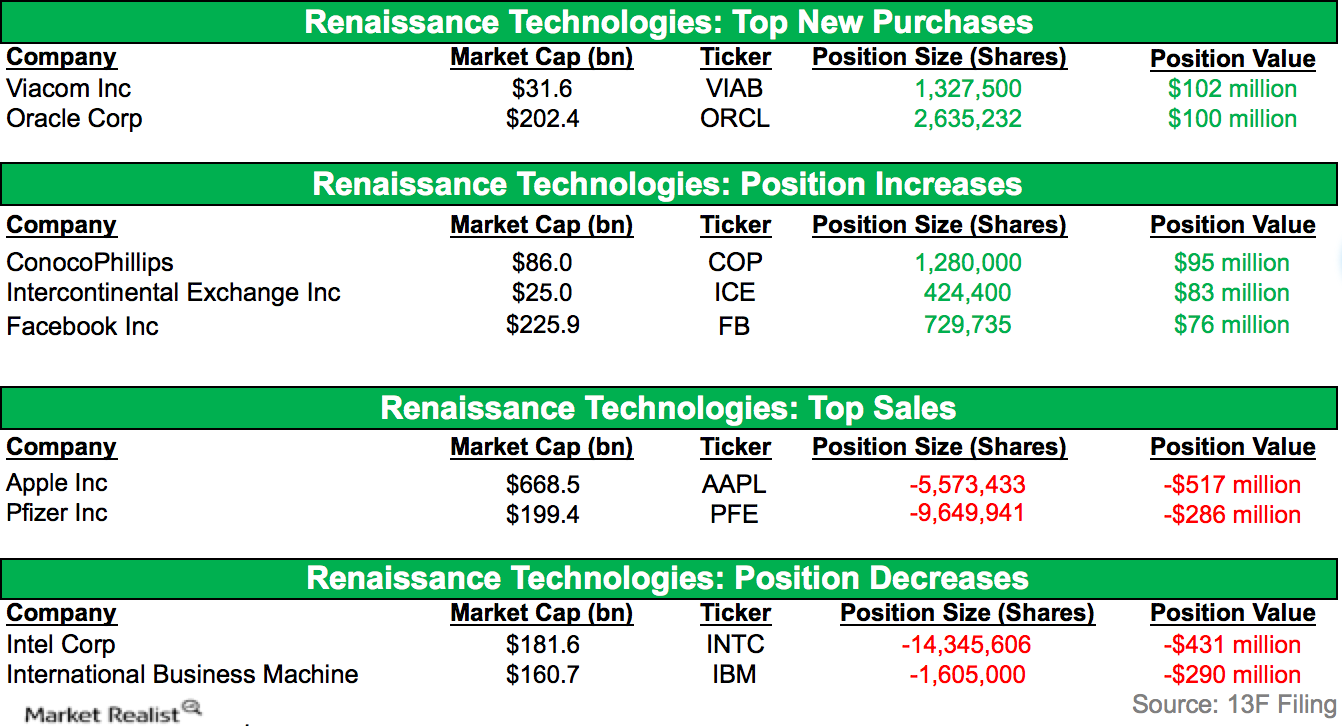

Highlights of Renaissance Technologies’ key positions in 3Q14

Renaissance Technologies is an investment management firm. The fund’s portfolio decreased to $36.52 billion in the third quarter—compared to $42.89 billion in the second quarter.