Key Takeaways from ValueAct Capital’s 4Q14 Holdings

ValueAct opts for long-term positions in companies that it believes are undervalued. With its significant stake, the fund works with the company to improve shareholder returns.

Nov. 20 2020, Updated 2:37 p.m. ET

Highlights of ValueAct Capital’s 4Q14 positions

Jeffrey Ubben founded ValueAct Capital in 2000. The fund manages a small portfolio with a significant stake in a limited number of companies. ValueAct opts for long-term positions in companies that the fund believes to be undervalued. With its significant stake, the fund works constructively with the management and the board of the company to implement strategies that will improve shareholder returns.

ValueAct’s 4Q14 portfolio

The fund’s fourth quarter 2014 portfolio increased 7% to $15.96 billion from $14.91 billion in 3Q14. The 4Q14 portfolio includes investments in 14 companies. In this series, we’ll discuss key positions that ValueAct Capital traded during 4Q14. The fourth quarter ended in December 2014.

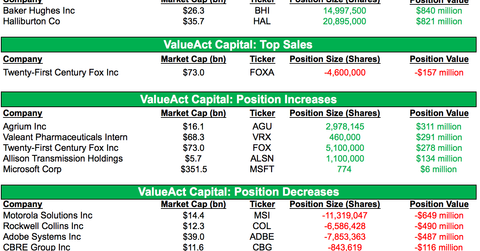

Notable positions that ValueAct traded in 4Q14

During the fourth quarter, the fund initiated positions in Baker Hughes (BHI) and Halliburton (HAL). The fund sold its position in Twenty-First Century Fox-A (FOXA). The fund raised positions in Agrium (AGU), Valeant Pharmaceuticals International (VRX), Twenty-First Century Fox-B (FOX), Allison Transmission Holding (ALSN), and Microsoft (MSFT). The fund reduced its positions in Motorola Solutions (MSI), Rockwell Collins (COL), Adobe Systems (ADBE), and CBRE Group-A (CBG).

BHI and HAL are components of the VanEck Vectors Oil Services ETF (OIH).

Other than this, the remaining positions the fund held are Willis Group Holdings (WSH), Armstrong World Industries (AWI), and MSCI (MSCI).

The above chart shows the top ten positions that ValueAct held in 4Q14.

To find out more about ValueAct’s 13D filing during the fourth quarter, read Market Realist’s Overview of ValueAct Capital’s filings.

In the next part of the series, we’ll discuss ValueAct’s position change in Baker Hughes.