MSCI Inc

Latest MSCI Inc News and Updates

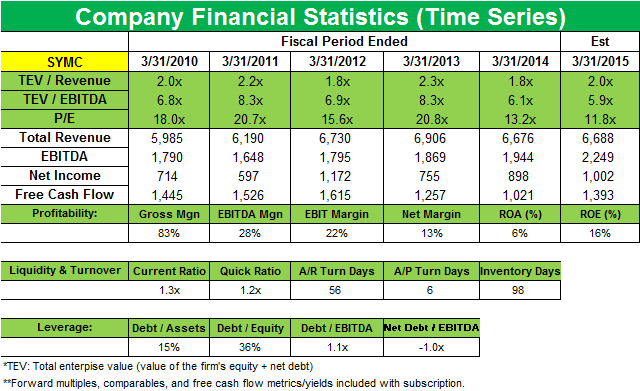

Jeffrey Ubben’s ValueAct Capital buys a new stake in Symantec

ValueAct Capital initiated a new position in Symantec Corp. (SYMC) that accounts for 1.14% of the fund’s first quarter portfolio.

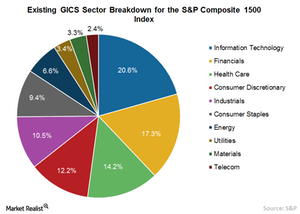

How REIT Classification Benefits Preferred Securities

S&P Dow Jones Indices and MSCI (MSCI) have decided to shift stock exchange-listed equity REITs and other listed real estate companies from the financial sector (XLF) to a new real estate sector.

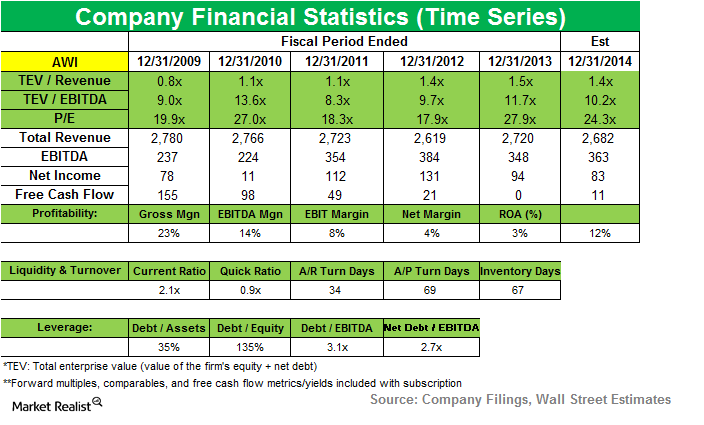

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.