CBRE Group Inc

Latest CBRE Group Inc News and Updates

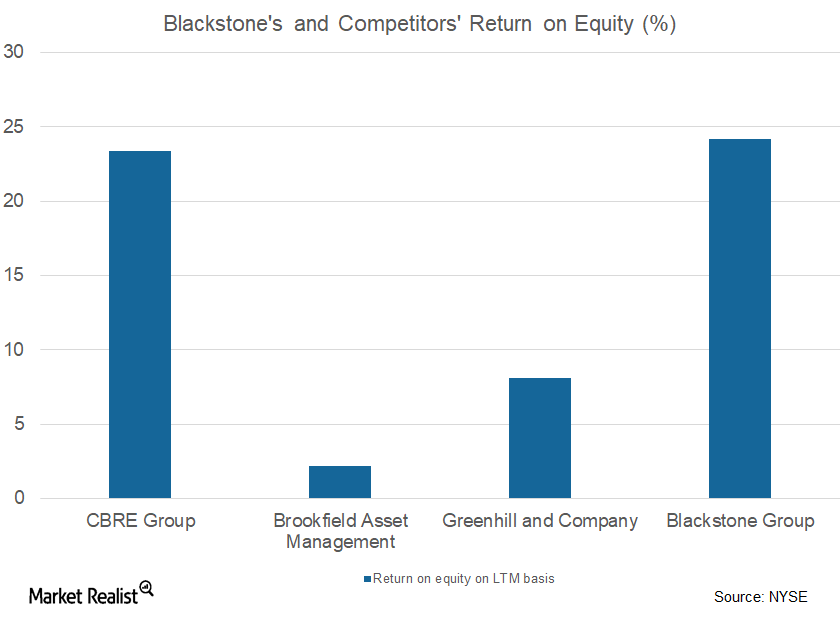

Blackstone’s Private Equity Division Saw a Strong Performance

The Blackstone Group’s (BX) private equity division posted total revenue of $1.4 billion in the first nine months of 2017, compared to $895.3 million in the first nine months of 2016.

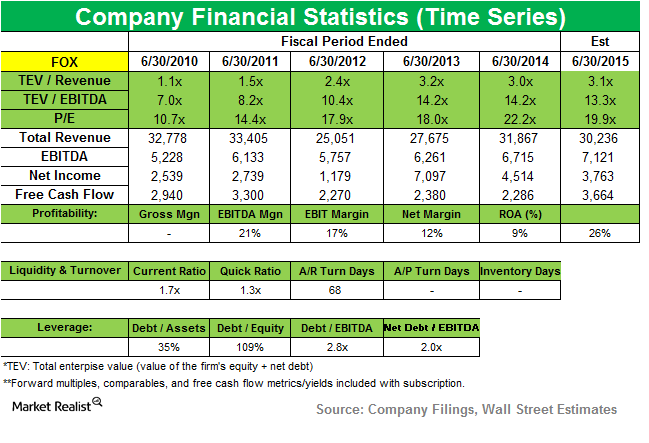

Why ValueAct Capital starts new position in 21st Century Fox

ValueAct Capital initiated a new position in 21st Century Fox (FOX). It’s a diversified global media and entertainment company. FOX accounts for 0.67% of the fund’s first quarter portfolio. 21st Century Fox is home to a global portfolio of cable and broadcasting networks and properties.