Motorola Solutions Inc

Latest Motorola Solutions Inc News and Updates

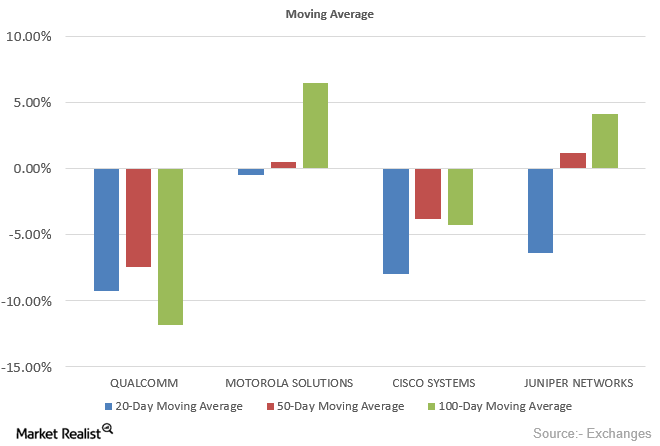

What Are Analyst Recommendations for Qualcomm?

Of the 35 analysts covering Qualcomm (QCOM), 18 have given it a “buy” recommendation, two a “sell” recommendation, and 15 a “hold” recommendation.

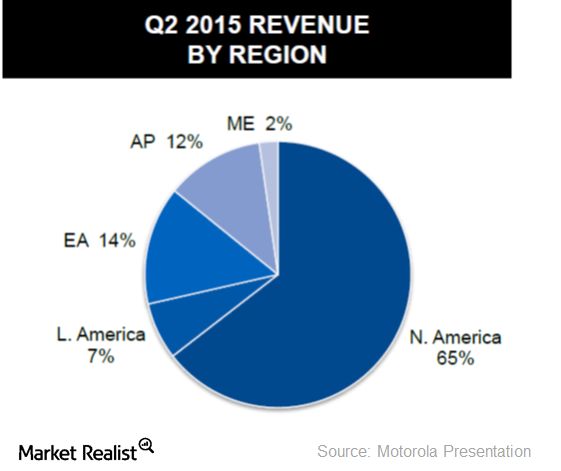

Overview of Motorola Solutions

Motorola Solutions has a market capitalization of $14.21 billion, and competitors Harris Corporation and Cisco have market capitalizations of $9.37 billion and $131.29 billion, respectively.

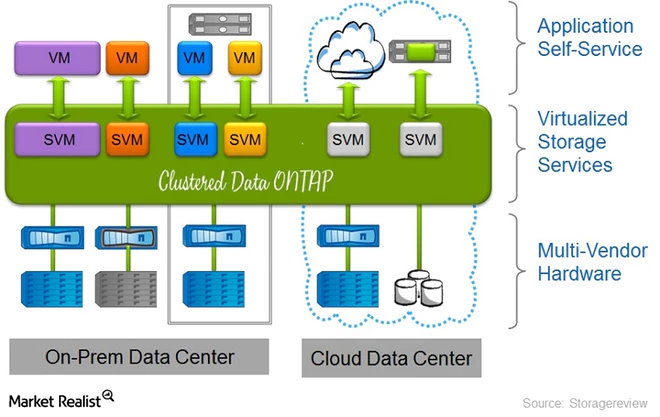

NetApp’s Key Driver: Clustered Data ONTAP

In 2013, NetApp (NTAP) introduced its own scale-out storage solution, Clustered Data ONTAP.

Qualcomm to Expand 5G Chip Tech Next Year

Qualcomm (QCOM) will expand its 5G chip technology next year. Qualcomm will soon power the mid-priced smartphones with its 5G wireless data networks.

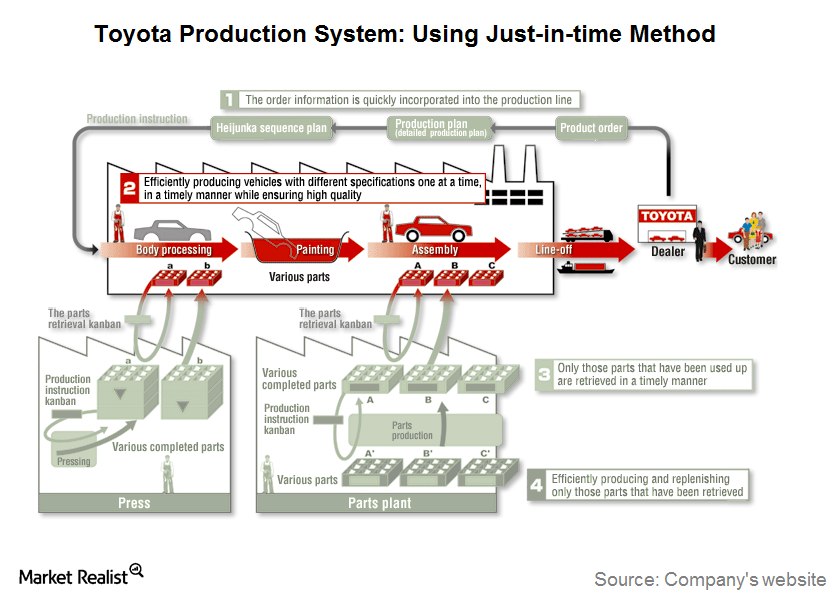

Why Toyota’s Just-in-Time Method Is Critical to Its Success

Toyota began using the Just-in-Time method in 1938. However, the true potential of this strategy was realized when it integrated this strategy with TPS.

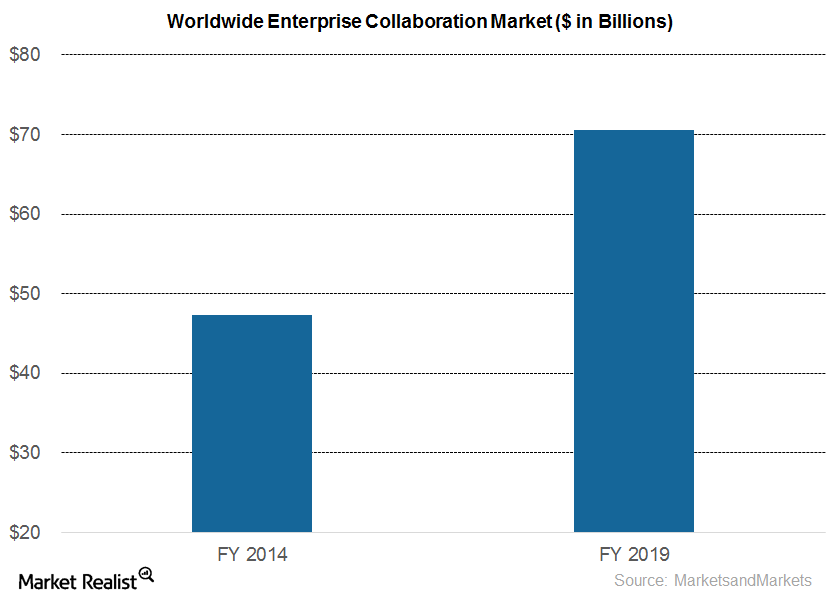

Understanding the Key Growth Drivers in the Collaboration Business

With businesses growing at a rapid pace, companies have begun to adopt new and innovative collaboration solutions to keep up in the competitive environment.

Southern Company Is a Diversified Utility Company

Southern Telecom is a telecommunications subsidiary of Southern Company. It provides dark fiber optic solutions to various businesses.