Rockwell Collins Inc

Latest Rockwell Collins Inc News and Updates

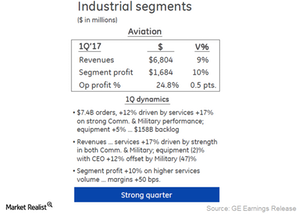

Why General Electric’s Aviation Segment Revenue Rose in 1Q17

Revenue for General Electric’s (GE) Aviation segment was $6.8 billion in 1Q17, a 9.0% rise from $6.2 billion in 1Q16.

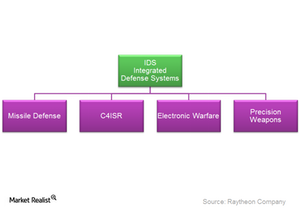

Raytheon Company’s Integrated Defense Systems

Raytheon’s Integrated Defense Systems segment saw marginally lower sales during the year due to lower sales across most of its major programs such as the Patriot program.

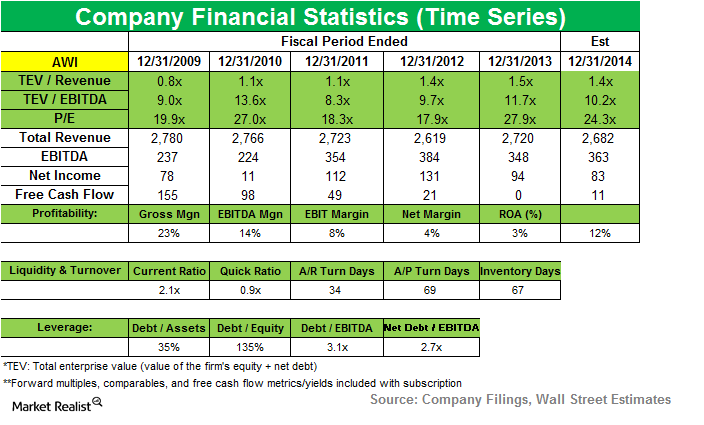

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.Industrials Consider these key risks facing Lockheed Martin

The U.S. government is Lockheed Martin’s (LMT) major customer. With almost 82% of its revenues from the U.S. government, LMT highly depends on the government.Industrials An overview of Lockheed Martin’s business segments

Lockheed Martin (LMT) operates in five business segments—Aeronautics, Information Systems & Global Solutions, Mission and Fire Controls, Mission Systems & Trainings, and Space Systems.

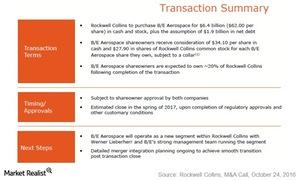

Rockwell Collins Acquires B/E Aerospace in a Deal-Making Weekend

On October 23, Rockwell Collins (COL) announced that it intends to acquire B/E Aerospace (BEAV) for a total consideration of $8.3 billion. Within Rockwell Collins, B/E Aerospace will operate as its new Aircraft Interior Systems segment.

ValueAct Capital Lowers Stake in Rockwell Collins

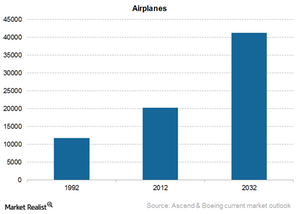

Rockwell Collins is a leader in the design, production, and support of communications and aviation electronics for commercial and military customers worldwide.

SWOT analysis of Rockwell Collins

Rockwell Collins expects its Airborne Solutions/Avionics division to see good growth in the future due to the rising demand in Unmanned Air Vehicles (or UAVs).Earnings Report Analyzing General Dynamics’ business segments

General Dynamics has four major business segments. In this article, we’ll analyze General Dynamics’ business segments.